THE UK'S

TOP 30

most productive

retailers

Productivity is a complex term at the best of times —it can be effected by anything, from a retailer’s historical use of technology to the shape and structure of its workforce, and the most relevant metrics to measure it can change from business to business.

Throw in the still-evolving after effects of the pandemic and the picture becomes even more complicated. Even before Covid hit in 2020, retail was operating within an economy with broader productivity challenges. ONS data shows that UK productivity growth across all industries halved following the 2008 global financial crisis, and by 2019 was 20% below the level it would have reached if it had continued on its pre-crisis path.

Huw Pill, Bank of England chief economist, said in 2021 that wave after wave of uncertainty — the 2008 financial crash, Brexit and the pandemic to name three of the major ones — had knocked business confidence over the past 20 years, denting appetite for risk and stalling investment, innovation and research and development.

Further complications are coming from the current inflationary environment. The past two years have brought an upward pressure on wages which has contributed further to staff costs. But while this presents an obvious challenge for productivity, it could also herald a change of approach, prompting retailers to invest in labour-saving technologies and even improving employee engagement in a sector that is notoriously poor for job satisfaction ratings, and employee engagement and retention has long been an issue.

What this report reveals

While retailers have responded to the cost-of-living crisis with a broad range of support measures for staff — from free food to wage increases and interest-free loans — staff want more than just decent wages when it comes to improving true engagement (as we discuss in chapter 4).

This report analyses how retailers are deploying a combination of sales-increasing tactics and cost-refining strategies. We have analysed staff cost to sales ratios and sales value per employee, and explore how the top 30 achieved their high productivity.

It should be noted that while these 30 retailers are handling a challenging environment with high levels of staff productivity, it does not necessarily mean they are all enjoying high sales and profit growth.

Productivity is complex, but building a clear understanding of what is impacting it in each business shines a unique light on the varied factors impacting a company’s performance — and is a critical part of charting a path towards improvement. This report will highlight the companies with the UK’s highest levels of productivity and unearth lessons from their operations, technology and workforce strategies that are applicable to all retailers.

Methodology

RWRC, together with ServiceNow, has analysed retailers’ group staff costs to sales ratios and the value of sales per employee to identify the UK’s 30 most productive retailers. Data from 180 UK retailers has been evaluated, using the latest available annual reports or accounts at Companies House (2021/22). Retail group sales, staff costs and employee numbers were analysed to calculate the ratio, with retailers then ranked accordingly.

Who we spoke to

Jon Bell

Productivity director, Morrisons

Beth Bloomfield

Senior analyst, Retail Week Prospect

Chris Connon

Senior principal, Slalom

Hanna Hua

Analyst, Retail Week Prospect

Stephnie Judge

Managing director, Victorian Plumbing

Richard Lim

Chief executive, Retail Economics

Silvia Rindone

UK&I retail lead, EY

Martin Schofield

Founder, Retail247

Alastair Woods

Pay and employment partner, PwC

Chapter 1

The top 30: which retailers made the list

Our Top 30 list, using sales and staff cost figures from 2021/22, reflects businesses’ positions a year to 18 months ago — the market has experienced significant changes since then and it will be interesting to see how their future rankings are affected by the current situation

Some retailers that are well known for their efficiency, such as Amazon and Aldi, do not appear on the ranking because they do not split out staff costs in their financial reports. For others, such as Ocado, their reliance on expensive staff with technology expertise means their staff costs to sales ratio is lower than those in our top 30. However, their use of that technology is likely to bring significant future productivity gains.

The ranking also highlights some interesting broader trends that continue to play out in 2023.

Etailers are strongly represented, for instance, with 13 out of 30 entrants being pureplays.

“Etailers have the advantage of having lower overheads, with no shop floor employees. This improves their productivity ratio when compared to those with stores,” says Retail Week Prospect analyst Hanna Hua.

Even a few of our best performing multichannel retailers, such as homeware retailer Loaf (11th) and fashion retailer End Clothing (13th), are online-led businesses with a few carefully selected stores supporting digital sales. This makes for a more likely productive model than retailers with large legacy store estates, which may be in the process of closing stores and right-sizing their estates in a bid to cut costs and focus on the most profitable and productive stores.

Mixed fortunes for etailers

The top 10 etailers include several names that have had a rollercoaster couple of years.

Ranked fifth, In the Style, for instance, is currently conducting a strategic review after reporting a loss before tax of more than £3.1m for the six months ending September 30, 2022. But this followed a 39% surge in revenue to £29.8m over the same period. Direct-to-consumer sales grew 24% to £23m and wholesale revenue rocketed 139% to £6.9m as third-party retailer partnerships bore fruit.

With similar conditions affecting many of our etailers – namely higher return rates as shoppers returned to occasion wear where fit is harder to achieve buying online than the leisurewear years of the lockdowns, as well as supply chain problems – several of our top ranked businesses have achieved high productivity even as profits falter.

Pureplays versus multichannel retailers

Our highest ranked multichannel retailers include several big names, from Tesco (seventh) to Currys (16th) to Frasers Group (23rd), which have been careful to keep a close eye on their store estates over the past decade. Each has followed a constant process of right-sizing the estate, allowing them to achieve similar levels of productivity to smaller, often more agile operators.

While etailers outperformed in this year’s ranking following a strong 2021 for the channel, multichannel retailers put in a strong showing over Christmas 2022. At Sainsbury's Argos, for example, general merchandise sales grew 7.4% over the festive period, with Argos' sales up 7.1%. While some of this was down to Royal Mail strikes making click-and-collect more attractive to customers, people have well and truly returned to stores in their droves in 2022. Given these shifts, next year’s ranking may feature more multichannel names.

In addition, multichannel retailers are continuing to change the shape and size of their businesses, adapting in ways that may boost their staff productivity in future years. Sainsbury’s Argos, for instance, is in the process of ending its operations in Ireland, and is also closing standalone Argos stores in favour of adding more counters to Sainsbury’s supermarkets.

Other major multichannel players, such as Next (which didn’t make the ranking this year), are in the process of making significant —and often expensive — changes to their business models.

Next launched its Total Platform service in 2020, which allows third-party retailers to sell online using its ecommerce infrastructure. The return on its investment could start to have more of an impact on productivity in 2023 and into 2024, when, as chief executive Lord Wolfson has predicted, acceleration of the platform will become more dramatic.

Concurrently, Next is following an acquisitive strategy, with its most recent purchase being Joules in December 2022. Further acquisitions could see headcount and staff costs rise further — and it’s clearly a strategic priority, with the appointment of Jeremy Stakol as executive director and lead group investments, acquisitions and third-party brands director.

These large-scale business transformations don’t come cheap and many big-name multichannel retailers are in the middle of medium-to-long term change.

Marks & Spencer (also not in this years's top 30) is another brand undergoing change, following its ‘reshape for growth’ strategy that will see it reduce the number of full-line stores by 67 (from 247 to 180) by 2028. The aim is to shrink the estate to focus on the most productive stores.

Fashion’s productivity advantage

Fashion retailers are well represented this year — seven of the top 10 are fashion retailers, and they make up 19 of the top 30.

While productivity relies on different things for different fashion businesses — Asos (first) will be more reliant on volume of sales for a strong ranking than luxury brand Watches of Switzerland (15th), for instance, where a lower number of high value sales and highly trained staff produces good results — fashion does lend itself to a number of productivity-encouraging initiatives.

Online third-party sales model, such as Brand Alley, can boost productivity outcome for retailers owing to lower-cost transactions and wide market reach

Online third-party sales model, such as Brand Alley, can boost productivity outcome for retailers owing to lower-cost transactions and wide market reach

Many of these involve selling stock sourced from third parties. Marketplaces are common for fashion retailers, with Asos an obvious example, allowing it to sell stock made by others. BrandAlley, fourth on the list, sells items from other brands and retailers, which work with the site to sell slow-moving or excess stock. MandM Direct, eighth, operates a ‘wholesale clearance’ model, through which it acquires excess and end-of-line stock holdings from established brands.

For fashion retailers that do stock their own items, new initiatives are helping to increase sales without increasing the associated need for warehouse space or logistics costs.

Very Group, ninth, launched a stockless fulfilment model, known as dropship, with key brands such as Adidas and Reebok in October 2021, where customers receive stock directly from the brand partner. It has since expanded the model to other brands which allows it to increase range without additional stock investment.

Majestic's subscription service WineClub was launched in 2021

Majestic's subscription service WineClub was launched in 2021

Influence of pandemic behaviours

It is possible to see evidence of pandemic shopping behaviours in this year’s ranking.

Majestic Wine (17th), which already has a relatively high average transaction value owing to the nature of its product and business model, was further boosted in 2021 by customers continuing to drink more wine at home rather than going out.

Etailers across the board benefitted from the spike in online sales as customers took their time to return to stores, even after they started reopening.

Fashion retailers — from Asos to Gymshark (sixth) to Sweaty Betty (28th) — managed to take advantage of shoppers’ desire to buy more loungewear and leisurewear as they stayed at home more, and embraced comfort when they did go out.

And throughout, evidence of these retailers’ adaptability in the face of unprecedented uncertainty shone through — something we explore further in the next chapter.

Staff engagement matters

Employee engagement and retention is one key aspect of productivity retailers have long grappled with, and which the pandemic intensified.

Throughout 2020 and 2021, staff struggled with being on the so-called frontline and dealing with stressed customers.

In 2022 the crises kept coming, with the cost of living rising and with many retail staff struggling to make ends meet.

As a result, skills shortages continue to plague many parts of retail — and recruitment, on-boarding and training new employees is expensive.

Businesses with highly engaged employees tend to perform better. In its most recent (2020) meta-analysis of ongoing research into employee engagement and productivity, Gallup (which surveys 276 organisations in 54 industries, across 96 countries) found that businesses with higher engagement saw an 18% increase in sales productivity, a 10% boost in customer loyalty and a 23% increase in profitability.

Chapter 2

Case studies: how they did it

Whether they are boldly focusing on growth in a bid to amplify profits or analysing operations to see where roles can be created or cut, these are the UK’s most productive retailers.

1st Asos

Launched: 2000

Employees: 3,017 Group sales: £3.94bn (2022) +0.7% 2021/22 group staff costs to sales ratio: 4.1

There is no avoiding that Asos has had a difficult time of late — swinging into the red in 2022, forcing the launch of a turnaround strategy — but noted in the introduction to this report, growth and productivity do not always head in the same direction.

Despite its challenges, Asos has also enjoyed some significant wins over the past 12 to 18 months. For a start, its acquisition of collapsed Arcadia brands Topshop, Topman and Miss Selfridge in February 2021 has proven something of a masterstroke. Sales across the Topshop brands surged 105% in 2022 (full year), which helped to boost growth in a difficult year. Sales also grew more than 200% in the US, supported by Asos’ successful wholesale partnership with American department store chain Nordstrom.

Just 300 staff (of many thousands) transferred to Asos as part of the £330m deal, suggesting this growth came at relatively low cost and potentially helping to boost Asos’ productivity performance.

Asos has also invested in technology to help reduce costs surrounding the trickiest parts of the online fashion purchasing journey, such as returns, focusing on fit technology in an attempt to lower the volume of items sent back.

Zeekit's tool helps customers decide whether a purchase it right for them by displaying outfits on 16 different body shapes

Zeekit's tool helps customers decide whether a purchase it right for them by displaying outfits on 16 different body shapes

It uses augmented reality from Israeli firm Zeekit to provide customers with an image of their choice of product on 16 virtual models of varying body types. It has also used AR technology from HoloMe in its mobile app, offering a virtual catwalk experience for 200 of its own-brand products, also aimed at helping to reduce returns.

While Asos’ productivity performance is clearly strong, the measures it is taking to tackle its current problems could boost it further. Hit by the shift back to in-store shopping, and further impacted by supply chain issues, high return rates and the cost-of-living crisis, Asos swung into the red in the year to August 2022, with profits plummeting 105% — it posted an operating loss of £9.8m on group revenues that edged up 0.7% to £3.94bn.

In response, chief executive Jose Antonio Ramos outlined a plan that included tighter stock management and reduction of costs. The business is removing 35 unprofitable brands from the platform by the end of the first half of 2023, rationalising office space and reducing staff costs by 10% through staff cuts.

2nd Victorian Plumbing

Launched: 1999

Employees: 532 Group sales: £269.4m (2022) +0.2% 2021/22 group staff costs to sales ratio: 4.6

Online bathroom retailer Victorian Plumbing ranks at number two for the second time, with its strong performance this year echoing its 2020 ranking.

It floated in mid-2021 on London Stock Exchange’s Alternative Investment Market, with a market capitalisation of around £850m, and its turnover inched up 0.2% to £269.4m in the year ending 30 September 2022.

When it comes to productivity, its success is down to two core areas of focus.

The first is marketing and marketing technology — the business has invested significantly in search engine optimisation and TV advertising over the past few years, and this has paid off as brand awareness, traffic and sales have grown.

'Boss your bathroom' TV advertising from Victorian Plumbing's current campaign

'Boss your bathroom' TV advertising from Victorian Plumbing's current campaign

The brand is continuing to develop this space, with current projects and future goals including improved data segmentation and customer targeting. It is working with Google to use automation and machine learning to further improve SEO, and a number of in-house projects are under way that include an AR app and AI chat bot.

Second is a strategic approach to people development. Managing director Stephnie Judge says one of the retailer’s core values is “we develop and grow” with the business prioritising personal development, people management and hiring from within.

In addition, the retailer has developed higher margin own-brand lines — in the 2021 financial year, its 20-plus own brands generated around three-quarters of the total revenue at significantly higher margin than third-party brands.

Logistics is also an area of focus. In January 2023 Victorian Plumbing announced plans to open a new purpose-built distribution centre in Lancashire, a £50m investment that would enable consolidation of existing sites when it opens in autumn 2023. In the longer term, it expects the site to be “broadly neutral” when compared to current property costs.

3rd Zalando

Launched: 2008

Employees: 17,043 Group sales: £8.9bn (2021) +29.7% 2021/22 group staff costs to sales ratio: 4.9

German fashion retailer Zalando has pursued a technology-driven strategy for several years now, and the results are paying off.

Having built an efficient customer-focused platform, it is using its tech prowess to bring on more third-party brands and offering marketing, fulfilment and sales tools to others. As this develops, it is able to expand its range and boost revenue without significant investment in stock.

In addition, it is generating multichannel efficiencies via its Connected Retail division, which allows bricks and mortar retailers to ship products directly to customers from their stores.

Zalando’s Connected Retail tool aims to digitalise physical stores

Zalando’s Connected Retail tool aims to digitalise physical stores

The platform grew significantly through the pandemic and as of full-year 2021 had almost 7,000 stores trading on the Zalando marketplace.

Like Asos, it is focused on the sticking point of returns, which can significantly dent productivity at fashion retailers, exploring virtual fitting rooms, other fit tools and 360-degree product views in a bid to reduce them. In 2020 Zalando acquired Swiss mobile body scanning developer Fision for an undisclosed sum.

Looking ahead, it is offsetting price increases by focusing on profitability and reducing marketing expenditure. In mid-2022 co-founder and co-CEO Robert Gentz said the retailer was planning to reduce marketing spend rather than cut jobs, with the intention of keeping employment steady. However, in February 2023 he announced the "removal of several hundred overhead roles", but added that frontline operations roles in logistics centres, customer care and outlet stores, as well as operational roles in its Zalando Studios, would not be affected.

Top 30 highlights

- Ranked: 7th

- Launched: 1919

- Employees: 354,744

- Group sales: £61.3bn (2021) +6%

- 2021/22 group staff cost to sales ratio: 8.2

Tesco is the only supermarket inside the top 10. Its employee cost-to-sales ratio has improved significantly from 2020 following the divestment of its international operations in Thailand, Malaysia and Poland.

It has also made several rounds of cuts at head office and in middle management positions. In January 2023 it announced further cuts, with plans to reduce the number of team and lead managers in its superstores, impacting 1,750 roles. In addition it's closing its counter and deli services, which could impact a further 350 people.

The supermarket highlighted streamlining costs and improving productivity as one of its key strategic goals in its April 2022 preliminary results, with a three-year savings plan targeting £1bn of savings through four streams – goods and services not for resale, property, store and distribution operations, and central overheads.

- Ranked: 9th

- Launched: 2005

- Employees: 3,591

- Group sales: £2.15bn (2021) -7.3%

- 2021/22 group staff cost to sales ratio: 8.2

Ranked ninth, the Very Group is a good example of a business that has continued to invest cannily in strategic areas, keeping a close eye on costs and productivity while it does it.

Employee numbers have fallen overall over the past few years – in 2020, for instance, the retailer cut 141 jobs in order to create 100 new technology roles.

It is also rationalising its property costs, closing its customer care site in Aintree in 2021 with the 500 staff moving to work from the retailer’s Speke headquarters or from home. Very’s finance team, however, has grown in size as the group expands its credit offering to help customers deal with the cost of living crisis.

- Ranked: 23rd

- Launched: 1982

- Employees: 30,353

- Group sales: £4.8bn (2021) +32.5%

- 2021/22 group staff cost to sales ratio: 11.1

Frasers Group has a sprawling store estate — around 1,600 shops — and more than 40 brands to its name, which is often a recipe for higher staff costs and lower productivity. But the business also operates in a highly efficient manner, enabling it to rank 23rd in our top 30.

It is not always clear if Frasers Group’s acquisitions involve taking on all the staff in the businesses it buys — around 80 staff were let go when Missguided was purchased in June 2022, while press surrounding Studio Retail’s acquisition in February 2022 focused on 1,400 jobs being saved — but it’s safe to say the group is unlikely to take on more staff than it needs.

The business has also, in the past, been found to be in breach of minimum wage requirements. In 2016 a Guardian newspaper investigation found Sports Direct, as the business was then known, was in breach of minimum wage law. It led to workers being paid £1m in back pay and owner Mike Ashley being hauled in front of a parliamentary select committee.

In response, Sports Direct reviewed its policies and practices and implemented a string of improvements, but in 2020 the newspaper levied fresh allegations at the retailer after it found minimum wage warehouse staff were unable to leave the building during unpaid breaks..

The retailer has a reputation for keeping a close eye on costs. Beth Bloomfield, senior analyst at Retail Week Prospect, says Frasers Group constantly works to keep costs in check.

“Frasers is closing stores that don’t have a purpose – having just removed themselves from London, for instance, with the House of Fraser brand. It is right sizing the estate, which increases productivity. It is also acquiring a lot of online-only brands such as Missguided and homewares retailer Amara, which means fewer overheads.”

Plus, Frasers is finding ways to make their stores work harder by combining two brands under one roof — Missguided will soon have a presence in Sports Direct stores, for instance. The business has even built a 5% stake in Asos, making it the fourth largest investor in the business.

Chapter 3

Shaking things up: how they are investing

Retail is an industry that is always in flux, but the pressure to adapt has been particularly acute over the past three years as almost constant waves of uncertainty and wider economic change have hit the sector.

In response, retailers are investing and reshaping their businesses in a variety of ways.

Tipping point of a tech transformation

Richard Lim, chief executive of consultancy Retail Economics, believes the sector is “on the cusp of a massive technological leap, driven by AI” which could boost productivity significantly in the coming years.

Productivity improvements in retail have been slow over the past decade, he says, with the sector failing to benefit to the same extent as others — such as manufacturing — from technological advancements. This comes down to the fact that it remains cheaper to employ people to undertake low-skilled work than it is to invest in AI and robots to do it.

“There is a trade-off between the cost of technology and the efficiency it provides, versus whether it’s commercially viable,” Lim says. But over the past few years, technology has become more affordable and wages are on the increase, helping to drive a broad shift towards technology.

“Margins are under pressure, labour costs and input costs are rising,” he says. “Retailers have to find more efficient ways of operating and technology is helping to find ways of doing that.”

Moving in this direction, Sainsbury's (ranked 29th) announced in February that it was to close two of its general merchandise depots by 2026 (Basildon and Heywood) affecting 1,400 jobs, as it rolled out a £90m investment in automation to modernise its logistics network at Daventry.

Sainbury's Daventry warehouse is due to be upgraded with a £90m proposed investment for further automation

Sainbury's Daventry warehouse is due to be upgraded with a £90m proposed investment for further automation

Chief executive Simon Roberts said that transforming the Sainsbury's/Argos network would "make our business simpler, more efficient and more effective for customers" and would "reduce costs, so we can invest where it will make the most impact for our customers".

Data advancements

There are myriad technologies that retailers are turning to, but for many in 2023, it means better use of data and, increasingly, investing in AI.

Chris Connon, senior principal at Slalom, a technology and digital transformation consultancy — clients of which include eBay, Microsoft and Travis Perkins — says better data visibility can be game changing when it comes to making the right decisions, and choosing the areas to focus on that are most likely to increase sales or boost efficiencies.

Getting better data visibility can be a game-changer and can help identify the right course of action — the tech they need, how to support staff better, where to focus efforts

“Retailers have a lot of data but it is generally in silos. Getting better visibility can be a game-changer and can help identify the right course of action — the tech they need, how to support staff better, where to focus efforts. It also helps them identify which channels work and why.”

This tallies with the investment plans of some of the retailers included in our rankings.

Jon Bell, productivity director at Morrisons (24th in the top 30) says data is “exceptionally important” to the business. “We have worked really hard over the past two to three years to improve our data, and it will be informing a lot more of our decision making. It also enables us to think about things differently.”

Morrisons relaunched its loyalty programme in July 2022, after a customer review to find out what shoppers valued the most

Morrisons relaunched its loyalty programme in July 2022, after a customer review to find out what shoppers valued the most

However, the business is careful to combine data with what store teams are saying. “The art is how you marry that data with retail experience, customer insight, what colleagues are telling us, and then bringing it all together. It will become more important over the next 24 to 36 months.”

This use of data can manifest in a variety of different ways, from improving scheduling tools so the business has the right people in the right place, to helping inform on product range decisions, such as where products get sent, how often, and in what volumes.

As part of this shift Morrison's productivity team now sits alongside technology and supplier development, following a business reorganisation at the end of 2022.

“There are huge synergies between how we use technologies and data, how we order stock, how we flow stock, and how productive we are as a business so it made perfect sense to bring those teams together,” Bell says.

The Very Group is another retailer (9th in the rankings) to have invested early in AI. A chatbot was added to the website in the 2020 and this is now its largest customer care channel, handling 268,000 queries a month.

The bot has the ability to recognise if a customer is getting frustrated and will recommend they speak to a person instead if this is the case, meaning staff time is saved for more complex queries while simple problems are solved without human input.

Helen Watt, senior enterprise retail specialist at ServiceNow, adds: “E-tailers have the advantage of lower overheads and no shopfloor employees – their productivity levels are naturally higher. While technology is an important consideration for e-tailers looking to gain or maintain efficiency, it's especially important that stores with physical spaces and multichannel capabilities look to how technology can help mitigate the impact of naturally lower productivity levels. Harnessing technology to fill in the gaps in this way can make a very real contribution to a more efficient process overall.”

Reinventing retail careers

With wage inflation putting margins under pressure, and with shortages making it hard to fill certain roles, the age-old problem of keeping staff engaged in what are often seen as transient jobs has become more acute.

Boosting engagement is no mean feat. A survey by digital platform WorkL in November 2022 found that retail employees are some of the most unhappy and least engaged: just 58% said they were happy at work (compared with 64% on average) the lowest percentage of the industries surveyed.

Alastair Woods, a pay and employment partner at PwC, says the pandemic has not helped. “There is definitely some workforce fatigue following the two years of the pandemic with staff in all sectors feeling overworked and burned out. Retail workers along with those in hospitality and other frontline areas have perhaps felt this more acutely.”

Lim says a shift in mindset is needed. “Retail is still a low-paid sector in many areas. That is changing, but it’s something that has to be addressed by leadership teams because an unhappy workforce is an unproductive workforce.”

Colleagues help us identify and solve business problems — getting rich feedback from colleagues is really powerful because they are closer to the customer

At Morrisons, Bell says employee engagement is seen as an opportunity and there is a focus on connecting staff with the business’s wider purpose. “We’ve just gone through a programme asking every colleague to think about what we could stop, start or continue. The way we think about that is working with purpose — colleagues help us identify and solve business problems. Getting rich feedback from colleagues is really powerful because they are closer to the customer and best placed to say that a system works really well or they need a new tool.”

Martin Schofield — a former technology and logistics director at Harvey Nichols who has also worked at Burberry and Debenhams, and who now runs consultancy firm Retail247 — says a mindset shift can help when it comes to staff engagement and productivity. “There can be an overemphasis on reducing costs, rather than selling more. I’ve sat in board meetings where we talk about how important customer service is to us, and then the next agenda item is whether we can afford to pay more than minimum wage. A good sales person will sell more and needs to be paid more.”

Incentivising people in the right way can help to turn retail from a job to a career, he adds — in luxury retail, increasing commission percentages for any sales made beyond targets can significantly boost sales.

Look at how the most productive retailers, the continental discounters, are consistently improving their store colleague effectiveness through an ongoing improvement programme. The result is that staff are seen as an operational advantage

Silvia Rindone, UK&I retail lead at EY, says this shift in mindset can be adapted to different forms of retail. “Retailers could look at how the most productive retailers, the continental discounters, are consistently improving their store colleague effectiveness through an ongoing improvement programme. The result is that staff are seen as an operational advantage for their business. While a low-cost model isn’t right for many retailers, understanding all colleague activities and exactly which drive customer benefits is critical.”

One continental discounter, Aldi ( which does not feature in our ranking because it does not split out staff costs) announced in February 2023 that it plans to hire 6,000 new store staff in the UK in 2023. The supermarket has 990 stores and about 40,000 staff across the UK, with store staff now paid a starting salary of £11 an hour across the UK and £12.75 within the M25 Greater London area.

ServiceNow enterprise retail specialist Charlotte Barnett concludes: “There’s no understating the importance of a positive employee experience. We can see businesses with higher engagement levels saw an 18% increase in sales productivity, a 10% boost in customer loyalty and a 23% increase in profitability. Investing in technology to boost staff engagement will have positive repercussions across all aspects of the retail organisation.”

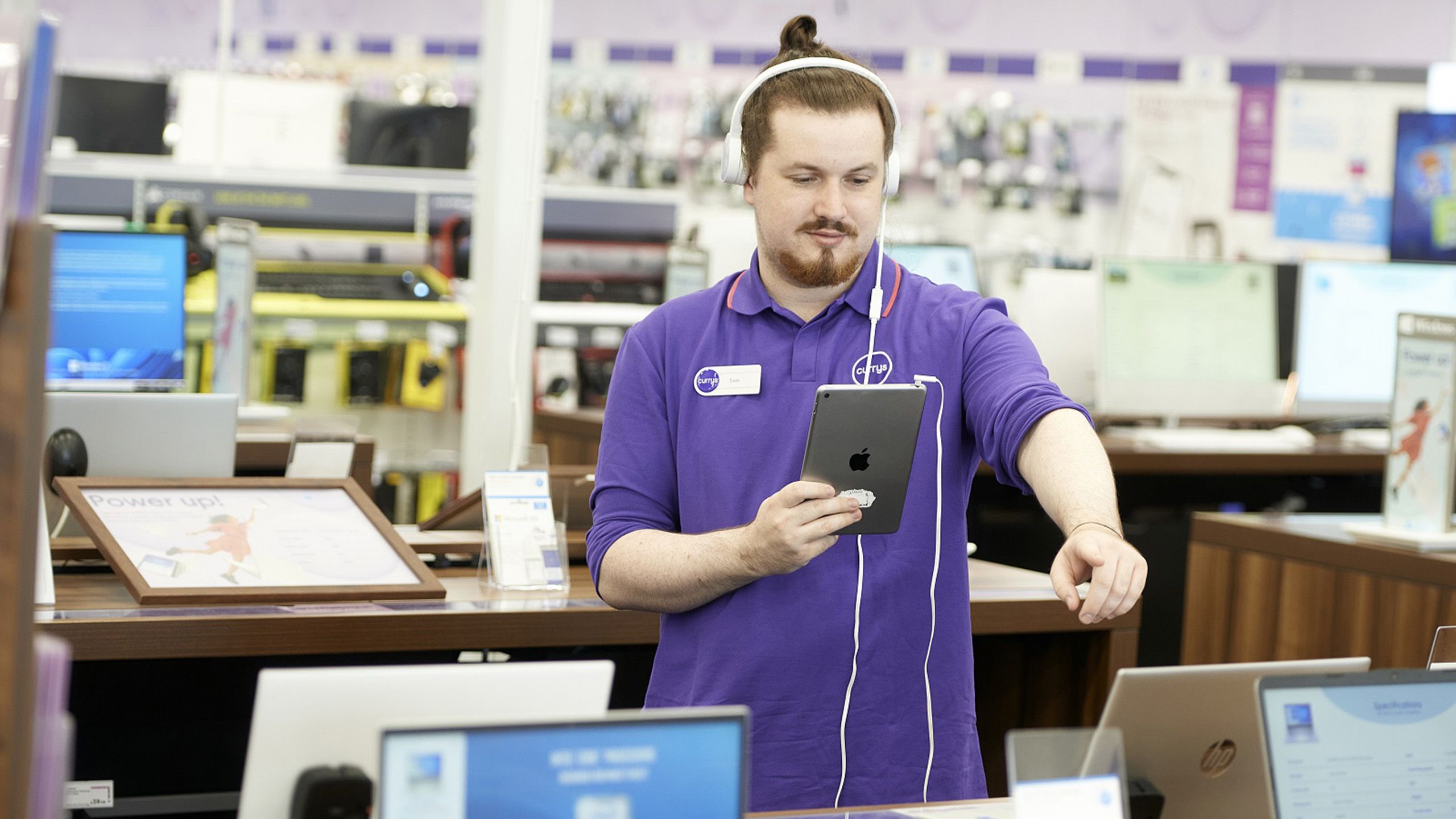

Spotlight on Currys

Currys (16th in this year's top 30) recognises the importance of employee engagement and is prioritising it in a range of ways. During the pandemic it moved away from annual colleague surveys to real-time pulse surveys using LinkedIn platform Glint.

Quick to react to feedback

The goal was to create a continuous cycling of listening and dialogue, enabling managers to take quick action on things that mattered most to colleagues.

As a result of the insight it generated, Curry's invested heavily in colleague wellbeing, increased training and access to learning programmes, and boosted momentum on improving the customer experience.

Its headline measure of engagement — the statement 'I am happy working at Currys' — increased by nine points between October 2020 and October 2021.

Tech tools

Other technology used by the business aims to connect staff even when they work in different places. It uses video streaming and chat services from Workplace, Meta’s business platform, to help colleagues connect and share best practice.

Staff providing its ShopLive service, for example — which connects customers via video with in-store staff — can share ideas, tips and expertise with each other via a specific channel. This means colleagues can support each other while offering a remote service, as well as sharing useful tips to pass on to customers.

Perks of the job

In 2022, meanwhile, the business introduced a hybrid working model for head office employees, and raised wages of hourly staff multiple times. In September 2022, hourly rates increased to £10.35 per hour and £11.43 in London — the third raise in 13 months, totalling a 15.6% increase during the period.

Chapter 4

How to crack productivity: what’s next

As the retailers in our ranking have shown, productivity is a multi-layered concept that requires a multi-pronged approach. While every business has a different history and is on a different journey, there are several themes that emerge among those leading the way

4 steps to boost productivity

1. Focus on data

Data and AI are increasingly becoming the backbone of many retail businesses. For many, the first job is to tackle the silos, firstly by joining up different data sets, and secondly to enable different teams to communicate more effectively and use consistent tools and processes.

With all employees singing from the same hymn sheet, this will improve efficiency and have an immediate effect on productivity.

2. Use tech to solve specific issues

Every business has its own set of problems to solve, and those on our top 30 ranking tend to invest in the areas that matter.

For example, in fashion high returns rates is a sticking point. At the Very Group, ranked ninth, AI and RFID are being used to speed up the returns process. When it opened its Skygate fulfilment centre in 2020, it introduced an automated pocket sorting system. A returned item is manually inspected, then its RFID label is scanned and dropped into a pocket where it is automatically categorised for repacking. The returns process now takes less than 24 hours and most items are resold in 72 hours. Customers are refunded more quickly and product availability is improved.

3. Drive the transformation

Looking beyond the immediate tasks of improving the way data is used, retailers should be thinking creatively about how technologies such as blockchain, machine learning, %G and AI could boost efficiency or sales. The ongoing digital transformation in retail still has some way to run, with everything from accurate demand forecasting to a single customer view yet to be fully cracked.

Those able to achieve these things earlier will likely make significant productivity gains. While smaller projects can feel more achievable, business leaders will also need to keep a keen eye on the big picture to ensure the company evolves at pace.

4. Invest in employee engagement

Recruiting in retail has always been a costly endeavour, with high churn meaning training and onboarding costs are high. But with skills shortages biting, it has never been more important to take care of staff.

At Victorian Plumbing, second on our ranking, good people management is a core value. Managing director Stephnie Judge says a focus on personal development, training opportunities and effective communication creates a faster, more collaborative culture.

Promoting from within is another key priority. “We’ve seen many successes with this strategy by providing growth and new opportunities to our colleagues who already embody the values and culture of Victorian Plumbing,” Judge says.

The business is also constantly gathering insight on employee productivity and feedback via surveys. “This strategy is further enforced by more informal engagement opportunities and events as we believe employee engagement is key to productivity,” Judge adds.

While technology will play an ever-growing role in retail in the future, there is no substitute for good people. Retailers that prioritise good people management and career development will be rewarded with a faster, more efficient business.

Love this report?

Why not book one of our experts to present the findings to your team, examining what they mean for you and your business? Contact Nicola Harrison at Nicola.Harrison@retail-week.com

As the retailers in our ranking have shown, productivity is a multi-layered concept that requires a multi-pronged approach. While every business has a different history and is on a different journey, there are several themes that emerge among those leading the way

4 steps to boost productivity

1. Focus on data

Data and AI are increasingly becoming the backbone of many retail businesses. For many, the first job is to tackle the silos, firstly by joining up different data sets, and secondly to enable different teams to communicate more effectively and use consistent tools and processes.

With all employees singing from the same hymn sheet, this will improve efficiency and have an immediate effect on productivity.

2. Use tech to solve specific issues

Every business has its own set of problems to solve, and those on our top 30 ranking tend to invest in the areas that matter.

For example, in fashion high returns rates is a sticking point. At the Very Group, ranked ninth, AI and RFID are being used to speed up the returns process. When it opened its Skygate fulfilment centre in 2020, it introduced an automated pocket sorting system. A returned item is manually inspected, then its RFID label is scanned and dropped into a pocket where it is automatically categorised for repacking. The returns process now takes less than 24 hours and most items are resold in 72 hours. Customers are refunded more quickly and product availability is improved.

3. Drive the transformation

Looking beyond the immediate tasks of improving the way data is used, retailers should be thinking creatively about how technologies such as blockchain, machine learning, %G and AI could boost efficiency or sales. The ongoing digital transformation in retail still has some way to run, with everything from accurate demand forecasting to a single customer view yet to be fully cracked.

Those able to achieve these things earlier will likely make significant productivity gains. While smaller projects can feel more achievable, business leaders will also need to keep a keen eye on the big picture to ensure the company evolves at pace.

4. Invest in employee engagement

Recruiting in retail has always been a costly endeavour, with high churn meaning training and onboarding costs are high. But with skills shortages biting, it has never been more important to take care of staff.

At Victorian Plumbing, second on our ranking, good people management is a core value. Managing director Stephnie Judge says a focus on personal development, training opportunities and effective communication creates a faster, more collaborative culture.

Promoting from within is another key priority. “We’ve seen many successes with this strategy by providing growth and new opportunities to our colleagues who already embody the values and culture of Victorian Plumbing,” Judge says.

The business is also constantly gathering insight on employee productivity and feedback via surveys. “This strategy is further enforced by more informal engagement opportunities and events as we believe employee engagement is key to productivity,” Judge adds.

While technology will play an ever-growing role in retail in the future, there is no substitute for good people. Retailers that prioritise good people management and career development will be rewarded with a faster, more efficient business.

Love this report?

Why not book one of our experts to present the findings to your team, examining what they mean for you and your business? Contact Nicola Harrison at Nicola.Harrison@retail-week.com

Partner viewpoint

Dave Sayers, UK and Ireland director of retail, ServiceNow

The retail industry is no stranger to disruption. In fact, it’s often among the first sectors to be impacted by macroeconomic factors, the likes of which we’ve seen in abundance recently. In the face of these challenges, it’s natural for business leaders to want to focus the bulk of their time, resources and budgets on customer operations to increase sales or drive loyalty. This approach, however, makes it easy to overlook a fundamental business priority – the employee experience.

Organisations that fail to foster a standout total experience – one that benefits both employees and customers alike – risk impacting not just business efficiency and productivity levels, but also customer relationships. Unhappy and unproductive employees cannot create satisfactory outcomes for customers.

Retail organisations must drive a positive employee experience but doing so requires the right supporting technology. The pandemic showed first-hand how leaders can harness modern technology in order to improve joiner, mover and leaver processes, as well as overall employee experience, reduce unnecessary silos, speed up processes and boost collaboration within an organisation, all without the need for a total system overhaul.

The impact of this can be truly transformational for the retail sector. A more streamlined experience sparks benefits for employees, who will realise tighter handoffs and efficient processes, and customers, who will benefit from faster outcomes and smoother service. Ultimately, it’s about leveraging cross-functional workflows. In doing so, you’re enabling supporting roles to get closer to customer needs, while simultaneously allowing staff to do their very best work.

Report produced by:

James Knowles

Report editor and head of content innovation, Retail Week

Rebecca Thomson

Writer

Stephen Eddie

Managing editor, Retail Week

Rachel Horner

Sub editor/designer

Sam Millard

Designer

Imogen Jones

Commercial partnerships director, Retail Week