Disruption to shipping routes due to geopolitical instability is just one of the challenges facing retailers in 2024

Disruption to shipping routes due to geopolitical instability is just one of the challenges facing retailers in 2024

At a glance

Ecommerce today isn’t easy.

Supply chain disruptions, global political instability and soaring inflation are just a handful of the challenges piling on the pressure.

And as we enter a third year of high living costs in the UK, cash-strapped consumers are set to remain conservative with their spending, pushing retailers to work harder than ever to win digital spend.

What's becoming clear is that traditional ecommerce strategies no longer cut it when it comes to attracting, converting and keeping shoppers' attention online.

And the retailers winning are having to rapidly adapt and innovate to keep ahead of the curve.

The UK’s Top 30 Ecommerce Retailers report, produced in association with Ecommpay, Rithum and Zendesk, delves into these winning strategies, showcasing the country’s most successful ecommerce retailers by forecast online sales.

In the following chapters, you’ll discover where future-forward retailers are investing money, time and resources to see the greatest returns online while maximising customer loyalty, and how you can follow their lead.

Methodology

The primary ranking of The UK’s Top 30 Ecommerce Retailers is based on forecast UK online sales for financial year 2023, compiled by Retail Navigator by Lumina Intelligence in January 2024.

The additional ranking cited in this report includes Retail Navigator data of total UK online sales for FY2022 and comparisons for forecast UK online sales in five years' time FY2027 (five-year CAGR). Please note some figures may be estimated.

Analyst team: Beth Bloomfield, Lisa Byfield-Green, Kate Doherty, Hanna Hua, Wendy Massey

Online retail did not have it easy in 2023. From ongoing supply chain issues resulting from the Russia-Ukraine conflict to sky-high inflation that increased operational costs and triggered the greatest cost-of-living crisis in three decades, retailers faced yet another year of challenges.

Take Farfetch, for example. Macroeconomic conditions significantly impacted its revenue and profit over the last year. Acquired in December 2023 by global ecommerce retailer Coupang, it took an injection of $500m (£394.8m) in emergency funding to save the embattled brand, as the luxury retailers’ market value plummeted from $24bn in 2021 to $220m by the end of 2023.

And with the IMRG Online Retail index forecasting 0% year-on-year growth for ecommerce as a channel in 2024, following a sharp sales dip in January, it’s never been more imperative for retailers to get their strategies right to capture consumer spend.

But despite the tough trading landscape, many retailers are winning in the ecommerce space, remaining resilient thanks to rapid adaptation and innovation within the sector.

The world’s largest retailer, Amazon, had a record-breaking Christmas with sales of $170bn (£1.33.3bn) in the three months to December 31, 2023, up 14% year on year.

January 2024 saw the largest monthly sales rise for retail since April 2021, as retail value sales grew 3.9%, according to the latest Office for National Statistics (ONS) retail sales data. Online spending values fell by 4.1% over the month to January but grew by 1% over the year.

Heading deeper into 2024, can retailers remain cautiously optimistic?

Broadly speaking, the answer is yes. Consumer confidence is on the up - in January 2024, it rose to its “best headline score in two years”, according to the GfK Consumer Confidence Index. The score is calculated by five measures, with the consumers' ‘view on their personal financial situation for the next 12 months’ question broadly considered the best single indicator as to how the nation’s households feel. This measure increased by two points in January to zero and held in February, ending 24 consecutive months of negative scores.

Inflation is expected to gradually ease its grip despite the Bank of England holding out on its 2% UK annual rate target. Sitting at 4% in January 2024, down from 11% in the autumn of 2022, it’s certainly moving in the right direction.

As a result, Retail Navigator analysts anticipate retail could see an uptick in the second half of 2024, as inflation gradually brings prices down, which should filter back into increased consumer spending.

However, with new EU food import border checks having begun in January, disruption continuing in the Red Sea and political change on the horizon with a UK general election later this year – all likely to further impact prices – there are still significant challenges for retailers to overcome in the year ahead.

While some online players will struggle, what is clear is that those set to triumph online are the ones keeping in touch with their customers’ needs, wants and values, transforming and evolving, leveraging data, prioritising UX, and investing in tech to increase efficiencies and capture consumer spend.

With the help of our analysts, we have compiled here The UK’s Top 30 Ecommerce Retailers report, comprising two exclusive rankings that celebrate the notable retailers succeeding and turning the tide online.

The first is the predictive Top 30 Retailers by Forecasted UK Online Sales in 2023/24; the second is the Ones to Watch: Top 30 Retailers by UK Online Sales Growth YoY% in 2022/23, based on past performance year-on-year growth.

The UK’s Top 30 Ecommerce Retailers report delves into the winning strategies of retailers from both lists, pulling out vital learnings to provide a toolkit that you can learn from and be inspired by in 2024.

So, let’s meet the ecommerce power players of tomorrow.

As might be expected, well-established retailers populate the FY2023/24 list of the top 30 retailers by UK online sales. Amazon, Sainsbury’s, Tesco, Asda and Currys make up the top five, holding onto their enviable, unchanged rankings from the previous year.

The fact that the ranking is dominated by big-name, established brands suggests retailers don’t have to be ‘disruptors’ in the online space to innovate, adapt and evolve to keep meeting customers’ needs. But there are digital transformation strategies they can adopt.

Here we take a look at six retailers among the top 30 forecast to thrive online in the tough trading landscape of 2023/24.

They are numbered below according to their place in the ranking.

1. Amazon

- FY2023 forecast UK online sales: £26.4bn

(+8% on 2022) - FY2022 total UK online sales: £24.4bn

(+5.1% on 2021)

Amazon sits comfortably at the top of the sales ranking once more, following a year of rapid-fire strategy shifts to adapt to the changing market. And, with a forecasted five-year compound annual growth rate (CAGR) of 9.2% – the second highest in our top ten – the marketplace titan doesn’t look set to lose its crown any time soon.

Amazon.co.uk was the most visited retail website in the four weeks to Christmas 2023, amassing close to 90 million visits to its UK site, and a further 6.7 million British visitors to its US site, according to data from Similarweb.

Unsurprisingly, marketplaces dominated the most visited list, likely due to their wide product range and speedy delivery options, with ebay.co.uk and etsy.com also featuring in the top 10 most visited.

In 2023, Amazon adopted a “maniacal focus” on customer experience, while also striving to lower its cost to drive future growth. As such, it began to source directly from brand owners, bumped up fees for its European sellers and actioned a global workforce reduction of over 25,000 employees.

Warehouse wins and losses

In addition to plans to shutter three of its older UK warehouses – in Doncaster, Hemel Hempstead, and Gourock in western Scotland – Amazon opened two new state-of-the-art fulfilment centres in 2023. A £500m energy-efficient Sutton Coldfield site was launched in October, adding 547,000 sq ft to Amazon’s capacity, along with a £450m, 464,000 sq ft distribution centre, complete with three floors of Amazon Robotics technology, which opened in Stockton on Tees.

However, the new sites haven’t been without their issues. In January 2024, members of the GMB union announced a strike over pay and working conditions at the Birmingham Sutton Coldfield site. And Amazon Coventry staff have held 28 days of industrial action since January 2023.

An Amazon spokesperson told Retail Week in July 2023 that the retailer has so far invested £125m in pay rises for UK hourly paid workers in less than a year and regularly reviews hourly employee wages. Nevertheless, further strike action at Amazon Coventry was announced in January 2024.

A leader in robotics implementation for over a decade, Amazon unveiled a headline-grabbing robot named Digit in October 2023. The 5ft 9in humanoid is currently being trialled in US warehouses, working alongside employees to grab, move and handle items. Not forgetting Amazon’s much-hyped 60-minute drone deliveries set to take flight in the UK from late 2024.

Powerful partnerships

Elsewhere, new partnerships with Meta and Snap, debuted in November 2023, are enabling shoppers to buy Amazon items directly from apps. The social media-style ‘consult a friend’ functionality empowers customers to share, comment and react to products.

This year, Amazon is also branching into a surprising new market – a strategic partnership with Hyundai to sell cars online in the US. After purchasing a car online, customers can pick it up or have it delivered from their local dealership.

With less than half (42.8%) of Amazon’s revenue generated by online stores, the marketplace will continue to bolster additional revenue streams, such as third-party seller services, advertising, subscription services and AWS (Amazon Web Services). AWS is expected to profit from erupting interest in Generative AI – since January it has been testing a customer-facing Gen-AI-powered tool that answers customers’ product questions.

4. Asda

- FY2023 forecast UK online sales: £3bn

(+6.6% on 2022) - FY2022 total UK online sales: £2.8bn

(+8.3% on 2021)

Asda is at fourth place in the ranking as it rounded out a productive year underpinned by digital transformation, acquisitions, quick commerce (or q-commerce) development and the rapid expansion of its value-led convenience store chain. The grocer also landed 15th on our ones to watch growth ranking with 8.3% year-on-year growth for FY2022/23, indicating its commitment to meeting the challenges of online retail.

It has bold ambitions too. In November, the supermarket unveiled its long-term plan to overtake Sainsbury’s and become the UK’s second-largest grocer.

According to Kantar data published in November 2023, Asda currently sits at 13.4% market share, just above Aldi (9.6%) and behind Sainsbury’s (15.6%) and Tesco (27.5%). Our analysts forecast YoY growth for Asda of 6.6% in FY2023/24 and a five-year CAGR of 5.5%. Sainsbury’s, in comparison, is forecast at 3% YoY growth in FY2023/24, with a five-year CARG of 4% – so it will be interesting to see the outcomes of Asda’s growth strategy in the coming months.

Merging q-commerce with ecommerce

Following its separation from Walmart in 2021, the grocer is transitioning its ecommerce business onto a state-of-the-art platform designed around customer experience and agility, as it strives to achieve a unified commercial environment. A brand-new digital core will streamline the grocer’s supply chain, forecasting, buying and merchandising, HR, warehouse management and ecommerce processes.

Meanwhile, its transformation into a “new value-led consumer champion” is fast progressing with the £2bn acquisition of EG Group UK in 2023, on the back of 132 former Co-op sites gained in 2022. The grocer aims to convert 470 c-store sites to Asda Express before the end of Q1 2024 to further bolster its q-commerce offering.

Improving its online fulfilment is also in the spotlight for Asda this year. Amid its “aggressive” q-commerce strategy rollout, Asda put the focus firmly on upping delivery speed, expanding the range available, and improving substitutions. Rapid delivery options now include UberEats, Just Eat and Deliveroo, while Asda’s Express delivery service transports products to doors in as little as one hour.

In April 2023, Asda expanded its q-commerce offering, opening its first Deliveroo Hop site in Tottenham Hale. The service offers consumers groceries in as little as 10 minutes and is facilitated through a dedicated picking space within stores.

Knockout pricing

Asda has continued to reinforce its value-led credentials over the past year as the cost of living continued to bite. At the beginning of 2024, the grocer became the first UK supermarket to price-match both Aldi and Lidl, slashing prices by an average of 17% across more than 280 products. The supermarket invested £130m in lowering prices across 600 products in 2023, resulting in a 14.7% jump in year-on-year, own-brand sales.

In January, the grocer appointed Matt Kelleher, its first chief digital officer, who will be responsible for the supermarket’s data and ecommerce functions. Kelleher joins Asda from Morrisons where he was chief information officer.

10. Screwfix

- FY2023 forecast UK online sales: £1.6bn (+10.9% on 2022)

- FY2022 total UK online sales: £1.4bn

(-9% on 2021)

Screwfix’s skilful evolution from catalogue business to wildly successful omnichannel retailer is one of the most captivating stories of retail’s digital era.

The trade tool retailer placed 10th in our forecasted online sales ranking, with anticipated year-on-year growth of 10.9% in FY2023/24 and an estimated five-year CAGR of 11%.

Screwfix casts a laser-sharp focus on continuously strengthening its omnichannel operation. Ecommerce accounted for around 60% of total sales in FY2022, according to our analyst calculations, compared with just 33% in pre-pandemic FY2019. Screwfix says app and mobile now account for over 65% of digital sales, while more than 80% of orders are picked up via click and collect, which takes as little as 60 seconds.

Speed, speed, speed

Lightspeed delivery continues to be a top priority for the brand, with the expansion of its Screwfix Sprint fast-fulfilment option to more than 320 stores and covering 45% of UK postcodes in 2023. A ‘Don’t walk, Sprint’ campaign, launched in May 2023 to highlight its 60-minute delivery proposition, was supported by a social media influencer campaign – a first for the brand. Meanwhile, its Deliveroo partnership, launched in November 2023, has made up to 500 products available on the app.

And the pace is only ramping up. A re-platform with Google Cloud, announced in November 2022 as part of parent company Kingfisher’s five-year plan, is set to make the Screwfix website “100 times faster”, enhancing the brand’s ability to deliver as the fastest non-food delivery service worldwide.

Looking ahead, Kingfisher plans to bolster all its ecommerce sales with the launch of a new retail media network. Announced in December 2023, the group will expand its retail media opportunities to third-party brands across its banners, beginning with Screwfix’s sister company B&Q. “Over time” the business predicts revenue from advertisers will reach up to 3% of group ecommerce sales.

12. M&S.com

- FY2023 forecast UK online sales: £1.5bn (+12.4% on 2022)

- FY2022 total UK online sales: £1.4bn

(+4.8% on 2021)

Following Marks & Spencer’s colossal comeback under its landmark ‘reshaping for growth’ agenda, M&S.com (the online fashion, home, gifting and beauty arm of the business) continues to soar as the brand leans into loyalty, value and partnerships.

Online sales are forecast to jump 12.4% year on year in FY2023, placing the brand 12th in our ranking, while its five-year CAGR forecast is the second highest of the top 30, at 13.9%. Notably, M&S.com also features 22nd on our ones to watch list, indicating the legacy brand has the legs to take on digital-first disruptors.

Marks & Spencer continues to develop its portfolio of partnerships, with more than 70 third-party clothing and footwear brands now available on M&S.com. It aims to scale this aspect of its business through dropshipping capabilities enabling fulfilment from partner stock and reducing the volume of split shipments, thereby lowering costs.

Tailored personalisation

The Sparks app is a major focus in Marks & Spencer’s ecommerce growth. In its full-year results for 2022/23, the retailer quoted that average active app users totalled 4.3 million – although its target is 10 million. It aims to reach this goal by improving the shopping journey, increasing Sparks card scan rates and harnessing customer data to boost personalisation. Currently, just 20% of Sparks users enjoy personalisation, but having invested significantly in digital data IP, the retailer hopes to accelerate this reach to more shoppers.

Marks & Spencer is also making good on its ‘value you can trust’ stance with its commitment to freezing apparel prices in 2024 and focusing instead on volume growth and delivering value by innovating alongside suppliers.

And the retailer appears to be going from strength to strength. M&S.com enjoyed a spectacular Christmas: in the 13 weeks to December 30, like-for-like clothing and home sales grew 10.9% online, compared with growth of 2% in store.

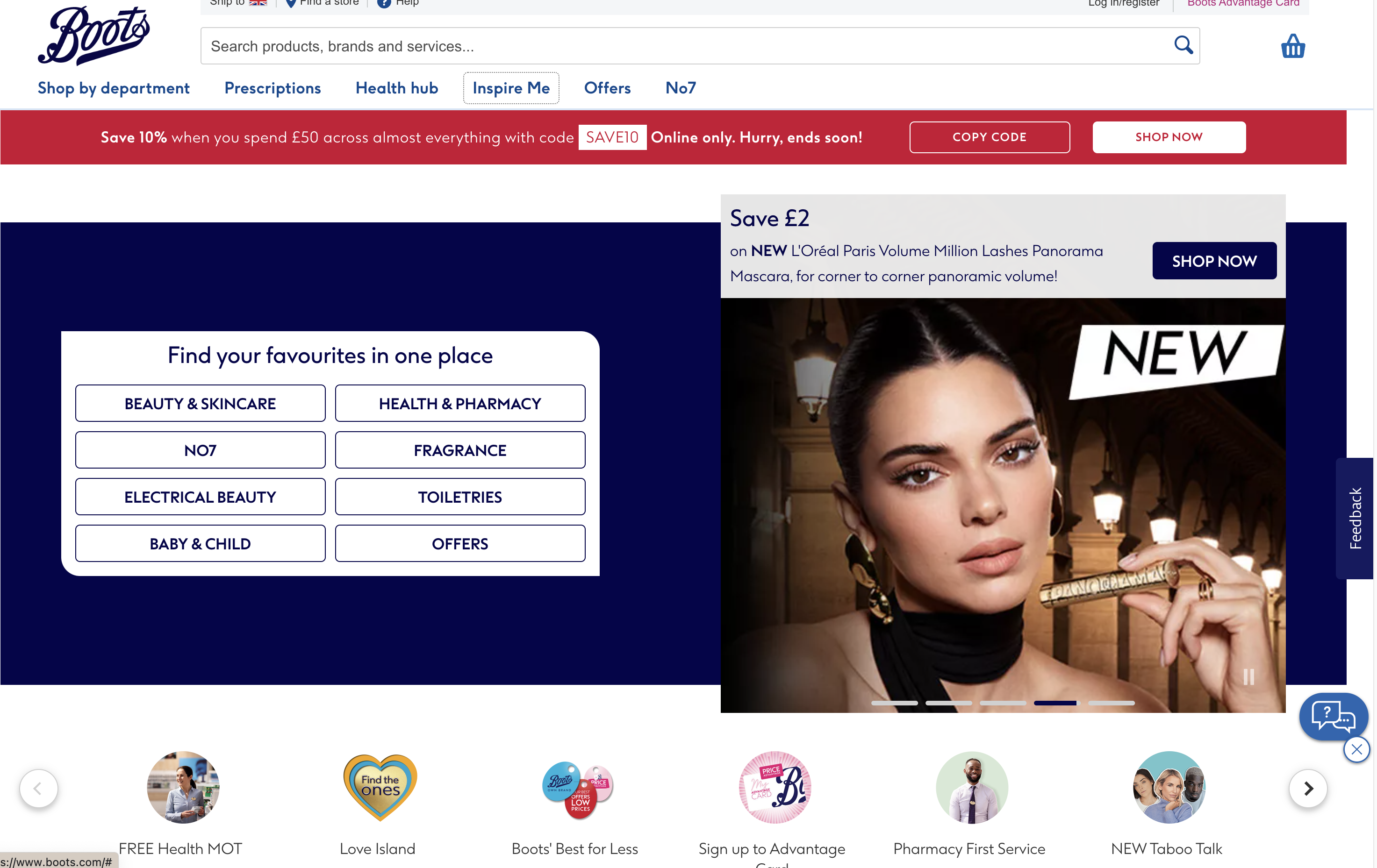

16. Boots

- FY2023 forecast UK online sales: £1.3bn

(+20% on 2022) - FY2022 total UK online sales: £1bn

(-10.4% on 2021)

Boots’ digital strategy is in a strong position. Coming off a year which saw its biggest-ever Black Friday and a record-breaking month of sales in November, boots.com sales grew 17.5% YoY across the final quarter of 2023 alone.

The healthcare brand placed 16th in our online sales ranking, with the second-highest ecommerce growth of the top 30 (20% forecast YoY for 23/24). Digital sales were up significantly, contributing 19.2% of total sales in the three months ending November 2023, while app growth has rocketed by 60%, with 7.2 million active users. The future looks bright too, with an enviable estimated five-year CAGR of 12.5%.

Its competitor, Superdrug, joins the online sales ranking list for the first time this year placing 30th, with forecast growth of 9.4% – this heralds a good year ahead for the online health and beauty space.

Re-platform opportunities

Chief digital officer Paula Bobbett is spearheading a campaign to re-platform operations with a dynamic, digital overhaul. The brand has invested in over 25 major technical upgrades relating to efficiency, stability and customer experience in the past three years.

Its digital ecosystem is content-rich, with money-saving deals, Inspire Me suggestions, Boots Online Doctor and the Taboo Talk podcast. Meanwhile, its Health Hub offers access to Boots’ healthcare services, as well as doctors, therapists and dermatologists.

Boots has historically thrived in the loyalty space. As rivals race to catch up, the brand’s loyalty programme boasts over 17 million active users, including 45% of women in the UK. And it continues to incentivise sign-ups: in 2023, the retailer cut prices on 2,000 products for Advantage Card customers.

While plans to launch a marketplace have been shelved, Boots has rolled the idea into ongoing initiatives, such as its dropship programme through which third-party brands can deliver directly to its customers.

With Boots owner Walgreens mulling a £7bn London IPO, change could be afoot at the retailer, but with positive results thus far, it’s vital it keeps a sharp eye on delivering on its digital transformation.

23. Dunelm

- FY2023 forecast UK online sales: £632m

(+7.1% on 2022) - FY2022 total UK online sales: £590m

(+6.5% on 2021)

“Extending and digitalising the total retail system” is a key pillar of value-led furnishing specialist Dunelm’s plan for sustainable growth, and the company is making headway, holding steady on its place in the top 30 ranking at 23rd, with a forecast of 7.1% growth for FY2023 and a comfortable five-year CARG of 6.8%.

Through this ongoing strategy, Dunelm aims to “combine the benefits of physical stores with the convenience of online shopping, and the reach of its marketing ecosystem”. As a result, digital sales (which include home delivery, click and collect and tablet-based sales in-store) rose to 35% of total sales in FY2022, compared with 46% FY2021, and around 20% of sales before the pandemic.

Over the next 12 months, the retailer intends to improve user experience through its website with “new search tools”, a “faster site architecture” and increased options for furniture delivery. The online product range is set to expand too, including made-to-measure categories, surpassing its current offer of more than 50,000 lines across 30 sub-categories.

Fulfilment is also getting a boost and ‘efficiency’ is a key word of the year, with “new tools for forecasting and replenishment” across its warehouses aimed to increase availability for its customers.

Customised web experience

Its third strategy pillar surrounds evolving its “marketing ecosystem” with investment planned for increased personalisation over the next year. Following “comprehensive” research into consumer attitudes, Dunelm found that as a brand it comes top of mind (first, second or third mentioned) in around 50% of its product categories and it now aims to up this statistic.

As well as targeted and personalised marketing emails, sent out at optimised times with customer-specific product recommendations, the retailer is testing a more customised website experience. Paid search will lead shoppers to land on personalised dunelm.com landing pages with greater ranges of options beyond the original search term. As of September 2023, this activity was described by the brand as in an “early stage” with positive outlooks on the horizon for customer experience moving forward.

Towering retail giants sit comfortably at the top of the UK online sales ranking – for now. But will they manage to retain their positions in a retail landscape that demands agility? Our ones to watch list details the fast-growing ecommerce brands threatening their positions.

Perhaps surprisingly, department store chain Fenwick placed top on the ones to watch growth ranking, with a staggering year-on-year growth of 50.7% in FY2022, while Sosandar and Selfridges followed, with 44.1% and 33.3%, respectively. In comparison, the fastest-growing brand on the top 30 forecast sales is Ikea, with growth for 2023/2024 set at 20.1%.

So, what strategies and tools power such rapid acceleration? And what can the UK’s ecommerce sales behemoths learn from these growth retailers' success?

They are numbered below according to their place in the ones to watch online sales growth YoY% 2022/23 ranking.

2. Sosandar

Featured for a second year, online womenswear retailer Sosandar has been growing at a phenomenal rate, with a 44.1% increase in sales in FY2022 placing it firmly in second place.

Following its “milestone” first year of profitability in 2022, the young brand is fast becoming a major player, with a record golden quarter in 2023, where it saw a 23% increase in revenue year on year to £14.3m, up from £11.6m in the previous year. It has an estimated five-year CAGR of 17.5%.

Mobile first

Sosandar’s website is at the heart of its success, but it also sells through third-party partners including John Lewis, Marks & Spencer, Sainsbury’s, Next, The Very Group and JD Williams.

In an interview with Retail Week in June 2023, co-chief executives Ali Hall and Julie Lavington said: “Our partners are very important, but our own site is as well. Our own site is the hub of where we start and that will always be the absolute hub of what we do.”

While a lot of retailers may have legacy infrastructure to contend with, there is a lot they can learn from Sosandar. In 2016, the brand constructed its modern, mobile-first site with a “seamless customer experience” that could cope with high levels of traffic. Its success lies in its content-rich design, merging ecommerce with editorial, including fashion ideas, trend advice and styling tips.

Investment in personalisation and segmentation tools and the launch of the Sosandar app in 2023 is set to reinforce the customer experience going forward, as the brand gears up to open its first UK stores and looks to international expansion with launches in Australia and Canada in the coming months.

3. Selfridges

Selfridges was among the 13 triple-ranked retailers that placed in the top 30 for online sales for FY2023 and FY2022, as well as the ones to watch list.

It placed 25th in terms of online sales forecast for FY2023 but was third when it came to YoY% growth for FY2022. With 33.3% growth year on year (2022/23), and a five-year CAGR forecast of 15.4%, it appears to be on the ascendancy.

Selfridges ecommerce platforms, including its website and mobile app, now draw over 30 million online visitors per month, and the retailer ships to more than 130 countries. It is fusing investments in omnichannel and loyalty to get the most from its customers.

Selfridges unlocked

In July 2023, the luxury department store launched its Selfridges Unlocked membership scheme, which is wrapped in an omnichannel experience. The Selfridges ‘key’ is a QR code that can be used both online and in-store, and ‘keyholders’ gain access to “the best product launches, events, news and free shipping on orders of over £150.”

Rather than attempting to replicate the experience of its iconic stores online, it aims to complement the Selfridges “spirit” through online advice and interaction. Editorial content and personalisation efforts, such as individualised homepages, play key roles, while its ‘shop by Instagram’ feature allows customers to make purchases via the social media app.

New owner Central Group, which completed its purchase of the brand in August 2022, has underlined its omnichannel ambitions for the business. It will be interesting to see how it plans to steer Selfridges to the top.

4. The Co-operative Food

Its emphasis on convenience, loyalty and delivery innovation has secured fourth place for The Co-operative Food on the ones to watch ranking. With online sales jumping 24% in FY2022 and an estimated five-year CAGR forecast of 19.5%, Co-op Food is fast becoming a serious ecommerce contender.

The Co-op has been working steadily towards its goal of grabbing a 30% share of the quick convenience market (rapid delivery from store to door) by 2027.

Its ‘member prices’ initiative replaced The Co-op’s traditional ‘2p for every £1 spent’ reward scheme in January 2024. It ploughed £70m into the extension of its member-only prices across 200 everyday essentials and lowered prices on over 600 lines to bring them to the same cost or lower than other national convenience stores. This, it says, is a “financially more rewarding” deal for customers.

It hopes these measures, alongside an extra £240m of investment by 2028, will help boost its active membership numbers from around five million to eight million by 2030. Early signs are encouraging, with active membership numbers up 15% from 2022.

First retail media network for convenience

Building upon the wealth of data its membership scheme provides, the retailer became the first in the UK convenience sector to launch a retail media network. Introduced at the beginning of the year, the network, which offers brands the opportunity to target prospective customers across Co-op's 2,500 convenience locations and boost visibility across the grocer’s ads, was described as a “momentous move” by Co-op chief membership and customer officer Kenyatte Nelson.

Co-op Food remains a UK industry outlier in its use of autonomous robot delivery. The 2023 expansion of Starship Technologies’ rapid delivery option has enabled it to offer fulfilment to Leeds, Greater Manchester, Milton Keynes, Northampton, Bedford, Cambourne and Cambridge. Shoppers order through the Starship food delivery app and groceries are picked fresh from local Co-op stores, further strengthening the retailer’s omnichannel presence.

It also capitalises on the existing networks and online platforms of various delivery partners, including Just Eat, Deliveroo, Amazon and Uber Eats to rapidly accelerate its ecommerce strategy. In July 2023, its reward scheme was extended to Uber Eats customers who could add their Co-op membership number at checkout to earn rewards when purchasing selected groceries online.

14. Superdrug

Coming in at 14th on our ones to watch ranking, with sales growing 9.9% in FY2022, beauty retailer Superdrug also climbed into 30th place in the top 30 ranking by total forecast online sales for FY2023/24. And, with an estimated five-year CAGR of 9.6%, this is clearly no fluke.

Matt Walburn, ecommerce director at Superdrug, told Retail Week that Superdrug.com is a “central pillar” to the health and beauty retailer’s ‘O + O’ (online and offline) strategy, following an intensive digital development programme. This included a website re-platforming, the launch of its online doctor service, inclusive new accessibility features on the website and the relaunch of its mobile app with improved navigation.

It was a huge year for loyalty at Superdrug, as the brand unveiled its new VIP reward scheme in October 2023. Health & Beautycard members who had already spent £300 with the retailer were automatically promoted to VIP membership, unlocking access to 12 months of offers including “always on” 10% off on own-brand products. The VIP scheme is app-only in a bid to boost customer adoption of its digital card.

Democratising own-brand products

Elsewhere, the retailer’s own-brand make-up line Studio London significantly exceeded expectations. The range revolves around a low-price, high-quality proposition facilitated by a deliberately low marketing budget that is intended to “democratise” products and retain customers. This line has driven 20% year-on-year growth in the cosmetics category, giving Superdrug a 40% market share of mass-market cosmetics – its highest in a decade.

Last March, the brand launched its new digital marketplace to smooth the way for potentially hundreds of new vendor partners. Walburn says this is “a huge opportunity to get the newest and most trending products into our customers’ hands” while helping to “profile diverse creators who would never have been able to secure a national retail listing before.”

Superdrug has responded to the cost-of-living crisis with price cuts, including 50% off more than 150 own-brand everyday items, limited-period price freezes on more than 5,000 favourites, and its “earliest ever” reductions on a range of Christmas gifts.

17. AllSaints

In 2023, omnichannel fashion retailer AllSaints strengthened its ecommerce proposition, placed an “intense focus” on product development and continued to expand internationally. These tactics saw it reach number 17 on the ones to watch list, with 7% year-on-year online sales growth in FY2022, and a projected five-year CAGR of 4.3%.

Last year, AllSaints re-platformed on to a modern, scalable ecommerce solution, triggering a more personalised and flexible approach to meeting customer needs.

The fashion retailer also enabled customer experimentation on its website to identify new areas of opportunity, focused on video content to show off its “beautiful collections”, and employed AI for website merchandising and customer service.

James Reid, chief innovation officer at AllSaints, told Retail Week: “We’ve had some great early success with the use of AI in our customer service functions, using the technology to provide a faster and more efficient service; more than 30% of the contact we receive from our customers now being handled through the use of AI.”

Shrinking store footprint

AllSaints has also been investing in merging online and offline. In-store pods give customers access to the full online offering from the store, allowing the brand to reduce its store footprint from 10,000 sq ft to around 3,000 sq ft – significantly benefitting overheads. Meanwhile, app users can scan in-store barcodes to explore further product information and curate wish lists of their favourite styles.

After an unrelenting battle against the soaring cost of living, inflation is easing somewhat, if slowly, and consumer confidence is on the up. Yet the trading landscape remains tough.

Sentiment is divided for the year ahead: while 24% of consumers expect to have more money to spend in 2024, 31% of shoppers are predicting they will have less to spend, research conducted by Retail Week in October 2023 found.

It's more important than ever that retailers put customer needs at the very core of their proposition. To win, retailers must develop an intelligent blend of personalisation, supply chain and flexible payment solutions alongside seamless, integrated customer experiences.

In this chapter, we highlight the core pillars of customer-centicity to prioritise in 2024.

Personalisation:

No longer a ‘nice to have’

Personalisation is the transformation all retailers want to get right – 76% of consumers say they’re more likely to purchase from brands that provide personalised experiences, with 78% being more likely to recommend them to others, according to consultancy firm McKinsey's research, published in November 2021.

Similarly, 71% of customers expect brands and businesses to deliver personalised interactions, and 76% become “frustrated” when this expectation is not met.

This is why, with retailers now able to collect more detailed data than ever before and the explosion of AI tools unlocking productivity wins, retailers must leverage customer data to personalise touchpoints throughout the customer journey across multiple devices and channels. Think powerful recommendation engines and completely individualised homepages.

For example, eBay, which features 14th on our forecast FY2023 UK online sales ranking, and 29th for FY2022/23 year-on-year growth, uses AI and structured data to deliver highly personalised offers designed to incentivise social media-style ‘snacking’ behaviour among customers. The marketplace has also invested in generating more relevant search results and personalising the mobile experience.

Meanwhile, Ocado, forecast sixth in our FY2023 UK online sales ranking, up one place from last year, has integrated personalisation into shopper journeys using AI. Customers see favourite items and previously purchased items first in searches, and reminders are sent out for their most-purchased items.

Fashion retailer Asos, 11th on the forecasted FY2023/24 online sales ranking and 13th for ones to watch FY2022/23 growth, has also innovated in the personalisation space in recent years. It has put a personalised twist on its ‘new in’ recommendations and has partnered with ecommerce tech platform Rokt since August 2023, to serve customers better personalised post-purchase offers. The partnership draws upon Rokt’s “machine learning and artificial intelligence optimisation” to offer more personalised ads in a bid to drive the engagement of its shoppers and boost brand loyalty.

Customers at the heart of the supply chain

Retailers are now deploying myriad fulfilment options, ranging from Screwfix’s 60-second click and collect to Amazon’s Prime Air drone delivery – make no mistake, failure to deliver swift, convenient and cheap fulfilment can turn off even the most loyal customers.

But what delivery options do consumers actually want? Retail Week research conducted in October 2023 found that price is a sticking point, with 69% of respondents preferring free delivery, even if it takes longer. Thirty per cent said they want the flexibility of being able to choose from different delivery options, and 24% put the ability to choose a specific time and date among their top three delivery preferences.

Amazon was named by consumers as offering the best shopping experience of all the retailers – it is no coincidence that the brand that conquered fulfilment also crowns the list of our top 30 retailers by sales.

The online marketplace boasts a vast range of convenient delivery options, including free standard, scheduled, one-day four-hour, same-day and overnight. Not content to sit on its laurels, its much-hyped 60-minute drone deliveries are set to launch in the UK and Italy in late 2024.

Elsewhere, Ikea UK, 20th in our top retailers by forecast sales ranking and 30th for 2022/23 growth, invested €3bn (£2.6bn) in 2023 in doubling up its out-of-town big-box stores as distribution centres. The aim? Faster and cheaper deliveries for customers and lower carbon emissions. In April 2023, the homewares brand announced it would invest £4.5m in last-mile electric vehicles across the UK in a bid to hit its goal of 100% zero-emission deliveries by 2025.

Lululemon – placed in sixth position in our ones to watch growth ranking for FY2022 with a five-year forecast CAGR of 13.9% – is achieving customer-centricity within the supply chain by boosting transparency, which is upping efficiencies, and enhancing the customer experience for those ordering through the website.

The athletic apparel retailer utilises RFID technology in its stores to support staff efficiency and keep track of inventory levels, as well fulfilment options such as buy online and pick up in-store. This tech enables store staff to leverage “real-time, accurate data” when serving customers. The brand also employs product lifecycle management software to ensure the journey every product takes, from ideation stage to development, is tracked in one centralised location.

Tesco is the UK’s biggest grocer with an established supply chain strategy and it has come in a steady third in our forecast sales ranking. It employs advanced analytics systems to help predict what customers are buying, coupled with modelling tools that simulate the performance of distribution depots. In ‘final mile’ terms, Tesco’s rapid-online delivery service Whoosh, created in partnership with Uber, can deliver in as little as 30 minutes and is now available from half of Tesco’s Express chain – representing 55% of UK households.

Flexible payment solutions:

What’s worth the investment?

As retailers work to ease the pressure of the cost of living on shoppers with price cuts, loyalty schemes and value-led own-brand ranges, flexible payment solutions provide another avenue to win attention from money-conscious consumers online.

Frasers Group, which is up one place on last year to 13th in the forecast total sales ranking and fifth for FY2022 YoY% growth, has taken flexible payments into its own hands. In April 2023, the retailer unveiled Frasers Plus, a membership scheme and flexible payments solution rolled into one that unifies all customer data in one place. Shoppers receive bespoke access to offers, points and payment plans of up to 36 months across all the group’s brands.

Similarly, The Very Group, which is ninth on our top 30 for forecast UK online sales 2023/24 up one from last year, offers a range of flexible payment options, including buying outright, splitting purchases into three payments and Buy Now Pay Later (BNPL) through its self-serve Very Pay platform.

Very takes an even more mindful approach to payments, offering advice through its website. Customers can log concerns on a range of topics from mental health to finance difficulties and access tips on how to save money. In 2023, Very launched a pilot to provide unsecured personal loans to help families with their finances. Existing Very Pay customers could apply online and receive a quick decision. They could then self-serve through their Very Pay account, accessing flexible options to repay a regular instalment, make a full payment or repay any amount in between.

Such initiatives are well in line with the retailer's core strategy of supporting families to “get more out of life”, targeting the retailer's three main pillars of ease, choice and understanding.

Brand partnerships are also big in this space. Retailers such as Asos, H&M and River Island have partnered with BNPL firm Klarna, leveraging its AI-powered in-app shopping lens to compare prices and retailers, and read reviews of more than 10 million items. THG partnered with FLA-regulated Newpay in March 2023, to allow shoppers the ability to split purchases into flexible monthly payments across multiple retailers.

“In the face of rising inflation, BNPL can be a useful payment option for shoppers to better manage their cash flow. However, when offering flexible payment options such as BNPL, it will become increasingly important to stay on the right side of regulators while providing a fair and transparent product for consumers,” says Moshe Winegarten, chief revenue officer at payments service provider Ecommpay.

“According to research conducted by Ecommpay, 33% of British consumers would remove items at checkout if BNPL wasn’t offered. Additionally, 73% of businesses that offer a flexible payment option say they have experienced more of their customers using it as inflation has increased,” he says, emphasising the value of flexible payment options for shoppers and retailers alike.

Seamless, integrated user experiences

Smooth user experiences are a must for any retailer in 2024, since even the slightest friction can lead to abandoned baskets.

Marks & Spencer has placed digital-led customer experience firmly in the spotlight as it develops an astute omnichannel offering with heavy personalisation.

Innovations smoothing the path to purchase include an AI-powered ‘style finder’ visual search feature, which allows customers to upload a photo of an outfit and find similar products available at M&S. On the M&S Sparks app, customers will find an uber-personalised digital shopfront, while the ‘scan & shop’ facility allows customers to cut queues in-store.

Marks & Spencer’s Chester-based customer contact centre deals with five million queries per year via live chat, email, social media, phone and post. Its CX platform streamlines the capture of customer feedback and analysis, empowering leaders to make more customer-driven strategic decisions.

Chief executive Stuart Machin has commented that while the retailer is “pretty confident that in the medium term, in the longer term, online sales still have the opportunity to grow faster than stores” there is “more to do to drive online growth and improve returns on data, digital and technology investment.”

Areas the retailer is set to invest in over the coming year include the modernisation of legacy technology systems, driving conversion through improving its in-app shopping experience, and providing more personalised experiences by leveraging customers’ data.

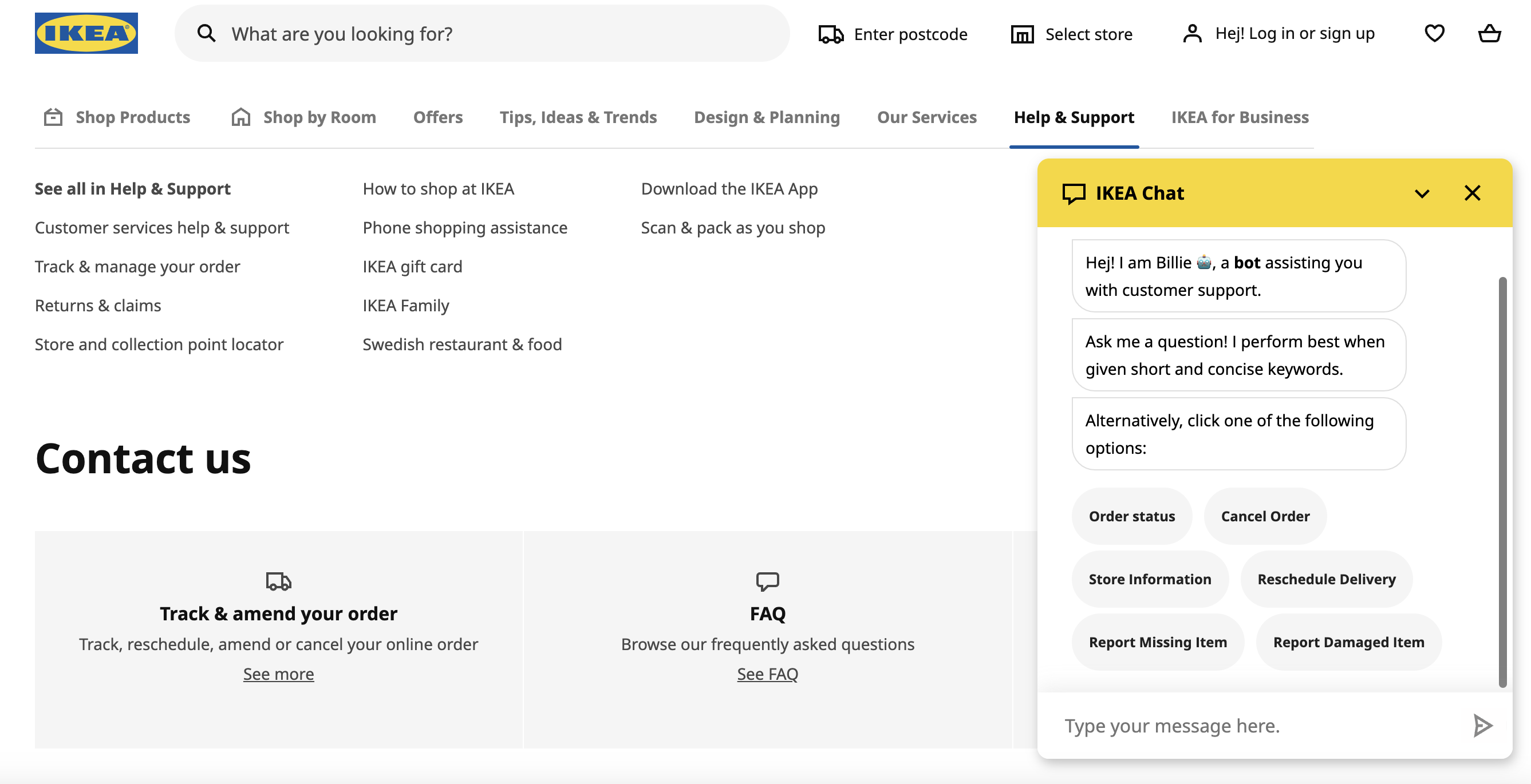

Ikea's chatbot Billie answered over 3 million queries in two years

Ikea's chatbot Billie answered over 3 million queries in two years

Ocado has made extensive investment into AI-driven robotic picking and autonomous deliveries

Ocado has made extensive investment into AI-driven robotic picking and autonomous deliveries

Amazon introduced AI imaging stations to screen orders and speed up picking and packing

Amazon introduced AI imaging stations to screen orders and speed up picking and packing

Creator Studio enables customers to create one-off, on-demand designs

Creator Studio enables customers to create one-off, on-demand designs

Boots is trialling a Gen-AI product-finder tool on its website

Boots is trialling a Gen-AI product-finder tool on its website

Generative AI burst into the mainstream in 2023, leaving retailers scrambling to work out how best to harness this game-changing tech.

Retail Week research published in November revealed that 49% of retailers are already investing in AI or looking to do so in 2024. Another 24% are interested in the new tech but adopting a ‘wait and see’ approach.

Yet consulting firm McKinsey & Company’s August 2023 survey revealed that compared with other industries, retail has the highest “no exposure” rate to AI, suggesting there’s a huge amount of potential just waiting to be tapped.

Of course, the success of AI in retail depends on the integrity of the data it is fed. And with the final demise of third-party cookies coming in 2024, first-party data is going to become even more crucial for retailers.

Success also hinges on colleague buy-in and training. "Although the majority of customer experience leaders believe that generative AI tools must be embedded directly into existing tools, only 45% of CX agents working in customer experience say they have received any AI training," says Eric Jorgensen, VP EMEA enterprise at Zendesk. "Moving forward, the provision of adequate AI training will be essential in helping colleagues truly reap the benefits of the technology."

Here we take a closer look at some of the best use cases for AI in the retail industry as well as the retailers that have already taken the leap.

Customer-facing chatbots

Currently one of the most widely used Gen-AI tools, chatbots have revolutionised customer service to make it more efficient, personalised and engaging.

Unlike human employees, chatbots are available 24/7, never get tired, and are not subject to emotions that affect how they interact with customers. These smart assistants learn from every interaction, can recall past conversations, understand context and deliver personalised responses.

Indeed, 62% of UK leaders believe this always-on tool will drive large benefits, including cost savings and freeing up human workers’ time for more complex tasks.

The Very Group, one of 13 retailers to feature on both Retail Week rankings at ninth for FY2023 sales and 27th for ones to watch FY2022 growth, launched its chatbot in 2016, and five years later it became the group’s most popular customer service channel. Handling 268,000 queries per month, the chatbots help to drive a 23% reduction in inbound customer contact while also improving the group’s net promoter score.

Meanwhile, AI bot Billie is handling queries at Ikea. During Billie’s rollout between 2021 and 2023, the bot dealt with around 47% of customer enquiries. This equates to 3.2 million interactions solved by the chatbot and almost £11.2m in savings.

Waitrose tested Tastewise’s new AI chatbot TasteGPT to curate recipes and menus in 2023. Martyn Lee, chief executive at Waitrose, commented in September on how he could see the potential to develop products quicker than the current 12-month average, using AI and people collaboratively. He said that the tool enabled him to “get recipes and photographs tailored to food trends that I can then test with customers before any of my team put ingredients to pan.” The end result is happier shoppers presented with new product lines more quickly.

However, it’s imperative AI is deployed using human insight and retailers undertake an extensive test-and-learn phase. In January 2024, delivery firm DPD had to disable part of its AI-powered online chatbot after a disappointed customer was able to make the bot swear and criticise the company, before posting its responses to social media.

While AI may be the future copilot of quick and reliable customer service, there’s certainly still work to be done to perfect it.

Intelligent, transparent supply chains

Baking AI solutions into the supply chain is another use case that multiple retailers have already adopted.

By sourcing data from across the business and creating a 360-degree view of operations, AI identifies where retailers need to focus their resources. This can help them optimise online inventory levels and minimise wasteful unsold goods, track the movement of products throughout their lifecycle, and boost transparency.

The results? Improved efficiency, data-driven decision-making, increased customer trust, and crucial cost reduction.

Ocado employs AI-enabled forecasting to cut stock waste levels – claiming they are now as low as 50% below industry norms. On the other hand, predictions of future stock levels result in higher availability and fewer substitutions for customers. The group has also committed extensive investment into AI-driven robotic picking solutions and autonomous deliveries.

Ikea announced in March 2023 that 100 autonomous drones are now in use across its supply chain for stock inventory at a number of its warehouses in mainland Europe. The drones work during non-operational hours to boost stock accuracy and secure availability of products for online or physical retailing.

In May 2023, Amazon introduced AI imaging stations in two US fulfilment centres to screen orders and speed up picking and packing. These imaging stations, based on visual data processing tech, can efficiently detect damaged items and remove them, as well as automating fulfilment operations and enhancing operational efficiency.

Deep personalisation

Deep personalisation hinges on the ability to accurately process data and appropriately translate its findings into personalised touchpoints for consumers. Retailers are using AI for personalisation across the board.

Brands, including Marks & Spencer, Mac Cosmetics and John Lewis, are already pioneering the virtual try-on, increasing consumers' confidence in online purchasing and reducing return rates. John Lewis has trialled the technology on its circular clothing rental market. Customers input their height, dress size, and bra size and upload a headshot to generate a virtual version of themselves.

Product innovations

In addition to boosting back-end operations, retailers have unveiled some eye-catching AI-powered product innovations over the past few years.

In October 2023, H&M Group launched an AI design tool through its on-demand print merchandise service Creator Studio. The Gen-AI, text-to-artwork tool helps customers create one-off designs, enabling them to express their individuality while enhancing the shopping experience.

Data insights and trend forecasting

AI can extract valuable insights by analysing large data sets, from quantitative data and customer reviews to social media mentions and discussions. Retail leaders are then able to conduct real-time trend spotting, leading to data-driven decisions and innovations.

Retailers can even leverage AI tools to analyse rivals and markets to keep their business strategy competitive.

For instance, as discussed, Waitrose has used its own data for food innovation. Beyond AI platform Tastewise's chatbot technology, the retailer leveraged its ability to analyse large and complex data sets. The grocer drew analytics and insights from across the food and drinks industry, including search trends and discussions on social media, to develop food that consumers really want. This included the development of its new own-brand, Japanese-inspired food range Japan Menyū.

Lush has been working with customer service solutions provider Zendesk to leverage data to enhance colleague productivity. "Through implementing intuitive reporting tools and real-time customer data, managers have optimised customer experiences and streamlined workflows effectively, leading to manager productivity surging by 50%," says Eric Jorgensen, VP EMEA enterprise at Zendesk. "This improvement has led to annual cost-efficiency savings of around $208,000 for Lush, through reducing the need to hire additional manager-level colleagues."

Fraud prevention

AI models are being implemented across retail as a financial fraud protection tool, with machine learning models able to identify subtle patterns and anomalies from historic transaction data to more quickly and accurately identify risks.

“According to accounting firm BDO, UK fraud reached £2.3bn in 2023, marking it the second-biggest year for scams in the last two decades,” says Moshe Winegarten, chief revenue officer at Ecommpay.

“The biggest challenge for online retailers is reducing fraud without decreasing conversion. From a payment processing perspective, the growth of AI will undoubtedly help with fraud monitoring, offering real-time optimisation with immediate or even pre-emptive reaction times to thwart attacks.

“Retailers working with us at Ecommpay are tackling the problem head-on, employing anti-fraud solutions that include a range of in-house risk control measures, with technologies like graph analysis to identify multiple chains of fraudsters, even if they’re currently inactive.”

Product-finding tools

Not just for warehouses, visual data processing is a subset of AI that has a wide variety of applications across the entire retail value chain. It can be used to detect defects during manufacturing, track footfall, implement checkout-free stores, and power product-finding tools.

Paula Bobbett, chief digital officer at Boots, told Retail Week that the retailer is trialling this functionality as part of the customer journey. “We are currently trialling a product-finding tool on boots.com with a very small proportion of visitors to the site. The tool is powered by Gen-AI and we are looking to understand how customers use and interact with this technology before rolling it out more widely.”

In 2024, the message is clear: whether pureplay or omnichannel, digital is irrevocably intertwined with almost every part of the shopping experience.

The store of the future operates a unified commerce environment that empowers customers to shop where, when, and how they want to, combining all the potential touchpoints to better personalise the customer experience.

As bricks-and-mortar brands innovate to leverage digital efficiencies in store, pureplay retailers are increasingly branching out into pop-up stores to introduce a physical element into their customer journey.

Pureplays investing in pop-ups

Pop-up shops serve an important role in reaching new customers, but their success hinges on whether the retailer manages to retain those customers after the temporary store is shuttered.

eBay, LookFantastic and Depop all opened digital-focused pop-ups during Christmas 2023, while pureplay fashion giant Asos made its first solo foray into physical retail on Black Friday weekend. Its Oxford Street pop-up was “shoppable both physically and digitally” and the retailer partnered with Snapchat on a feature that allowed customers to generate a digital avatar of themselves wearing a range of Asos apparel they could purchase in store or online.

Meanwhile, pureplay jewellery retailer Abbott Lyon opened the doors to its pop-up store in Westfield White City in November, with personalisation and interactivity at the heart of its first concept store. In-store tablets were available to help shoppers design custom pieces, while a pick ’n’ mix style wall added yet another interactive element.

Mobile apps enhancing the store experience

Sitting in 11th place for UK ones to watch online sales growth in FY22/23, Lush has been a true innovator in the app space, employing tech to create an enhanced in-store experience for customers while also staying true to its eco credentials.

The brand has increasingly disposed of packaging over the past few years, instead selling products ‘naked’. To overcome the obstacle of missing product information, it added a clever feature called ‘lush lens’ to its app, which was relaunched in 2021 alongside its new website. Customers can snap a photo of any ‘naked’ item in-store and be taken to the relevant product information online. In 2023, the retailer shared its aims to bring the lush lens “to peak form and usage” as it focuses on bringing its digital operations to “top of class” through investment in omnichannel across stores and ecommerce.

Boots, John Lewis, and Ikea have also deployed a product scanner feature on their apps, with the latter two also providing a customer-facing stock checker.

QR codes: Connecting physical and virtual

After a faltering start, QR codes are now recognised by retailers as one of the simplest ways to link physical stores with the virtual world.

Boots, for example, has deployed more in-store QR codes that make it easier for shoppers to quickly order items online if they prefer home delivery.

Marks & Spencer deployed QR codes for the launch of its beauty packaging take-back scheme in June. Customers who recycled their packaging were able to scan a QR code on the in-store recycling box to receive 10% off Beauty at M&S products to buy online or in-store.

In September, fashion brand Nobody’s Child launched digital product passports in the form of QR codes. Customers can now scan clothing labels to check the garment’s eco credentials and download a unique NFT as a receipt.

Unified commerce is the ultimate aim

The natural step after omnichannel, unified commerce means putting all data and platforming in one place to leverage it across the whole of the business. It brings all sales channels together to deliver streamlined data for retailers and a truly seamless customer journey no matter how shoppers want to access the brand.

Asda is on the path to building a unified commerce environment with a full technology re-platform – “the largest scale project of its type in Europe”. By the end of 2024, it aims to have fully replaced its core systems, browsing experience, app, routing, order management, picking, single sign-on, contact centre systems and mobile check-in proposition.

Simon Gregg, senior vice-president for ecommerce at Asda, said: “[It] has allowed us to deep dive on our customer opportunities and build upon our mission to unify our ecommerce portfolio, providing a long-term omnichannel proposition for the business.”

Fashion retailer AllSaints is another brand striving for a more unified ecommerce approach. Chief innovation officer James Reid has explained that his team “is working hard to unify the multiple ways through which we provide an unrivalled service to our customers across retail, ecommerce and wholesale.”

One of its strategy innovations that has been a “huge success” has been the adoption of a ‘single pool of stock’ that is available to all, regardless of the channel the customer chooses to shop with.

After diving into the strategies of some of 2023’s most successful ecommerce players,

what are the key action points for retailers looking to strengthen

their ecommerce offering in 2024 and beyond?

1. Digitise your loyalty scheme

With first-party data now crucial for customer insights and personalisation, every retailer needs a loyalty scheme – as well as strong campaigns to incentivise sign-up. The traditional physical card isn’t going to cut it any more though. Instead, develop an app-based loyalty programme that slots seamlessly into your omnichannel strategy.

2. Link your stores and ecommerce offering

The lines are blurring between shopping channels for consumers, and the retailers poised to win over the next year are the ones listening to where customers want them to be. Allow your consumers to move seamlessly between formats. Whether they’re ordering online to click and collect or using in-store QR codes to find further product information online, the two should be inextricably and seamlessly linked.

3. Experiment with AI

If you haven’t already invested in AI, now is the time to experiment. Data is key, so collate and clean this first and implement a clear data management strategy from the off. Identify your greatest business need and invest there to start with for the best returns, whether that’s AI to bolster inventory management and supply chain efficiencies behind-the-scenes, or customer-facing chatbots and virtual tools front of house.

4. Get your supply chain right

To become an ecommerce champion, you’ve got to get your supply chain up to scratch. Customers expect streamlined delivery and returns, transparent tracking options and a breadth of fulfilment options to choose from. Doing it in-house isn’t the best option for everyone, so it’s wise to consider partnerships that expand click and collect along with rapid delivery networks to offer more options to customers.

5. Invest in infrastructure

Unified commerce is the logical follow-on phase after omnichannel, and the retailers that achieve this will win the customer experience battle. Stores still on legacy systems may need to re-platform to acquire the agility needed to support such an operation.

6. Bolster value with quality

With the cost-of-living crisis rumbling on, retailers are making swinging price cuts and developing value-led own-brand ranges to capture online spend. When every penny counts, consumers demand value for money. This is why leading retailers are getting creative to finance value-led initiatives.

7. Expand brand partnerships

From Superdrug’s growing marketplace to Sosandar and Marks & Spencer’s third-party ecommerce brand partnerships, retailers are increasingly collaborating to expand their offering and extend their online reach. This is really a no-brainer - a quick and easy way to broaden your offering, expand into new spaces and reach new customers.

8. Maximise automation

There are so many ways to embed automation in a retail business, from low-hanging fruit such as chatbots and communication tech to landmark projects such as warehouse automation. But wherever retailers choose to use it, automation is one way to save time, cut costs and improve your customer experience.

Partner viewpoints

Moshe Winegarten, chief revenue officer, Ecommpay

2023 was another challenging year for retailers, with consumer spending continuing to be influenced by rising interest rates and stubborn inflation. Although the economic situation remains fragile, I believe that with a greater emphasis on ecommerce, there are still fantastic opportunities for businesses to thrive.

As retailers maximise their online presence to beat economic stagnation, Ecommpay has seen increased demand for alternative global and local payment methods, along with solutions such as payment links, which allow end consumers to pay from anywhere, on any device.

Ecommpay survey results show that open banking and buy now, pay later are where business leaders see the biggest growth opportunities. That’s no surprise, as our data also shows that three-quarters of consumers would abandon an online checkout if their preferred payment method were unavailable, making optionality essential.

As each customer becomes more valuable, conversion rates can significantly impact revenue and long-term success. Therefore, businesses must ensure their payment flows are streamlined, secure and aligned with customer expectations.

Despite a tricky economic backdrop, I remain optimistic about the future of retail and congratulate all the companies featured in this report. As businesses seek to reduce costs, grow efficiency and increase revenue, Ecommpay will always be there to help.

Philip Hall, managing director EMEA, Rithum

It was a challenging year for brands and retailers’ profitability with ongoing inflationary pressures, geopolitical uncertainty and changing consumer demands and expectations. Despite these factors, there are opportunities for profitable growth.

One way brands and retailers can reach new audiences and revenue streams is to take a multichannel approach. Today’s online shopper is comparison shopping – a resounding 82% now visit multiple websites throughout their buying journey, according to our 2023 Online Consumer Behaviour Global Report.

Retailers and brands need to meet consumers where they are by exploring different ecommerce models such as dropship and private or public marketplaces, collectively referred to as unowned inventory. Different models can help retailers and brands meet specific objectives, whether that's extending product assortment without taking on inventory risk, expanding internationally, reaching new audiences, or finding more cost-efficient delivery methods.

Marks & Spencer is a great example of innovation in retail. M&S adopted different selling models to support its growth strategy. It did this by expanding its product assortment with third-party brands and reaching new audiences through its unowned inventory approach. By embracing this as part of its omnichannel business, M&S is ensuring it meets shifting customer demand while providing a consistent customer experience

The lines are blurring between brands and retailers. Today’s global consumers are as comfortable shopping on marketplaces as they are on retailers and direct-to-consumer brand websites. What is clear from the leaders in this report, is that whatever approach or model you choose keeping the customer front and center and having the flexibility to adopt different variants of unowned inventory is the key to success.

Eric Jorgensen, VP EMEA enterprise, Zendesk

As the Top 30 Ecommerce Retailers report reveals, 2023 was not an easy year for retail due to macroeconomic circumstances, the cost-of-living crisis and worldwide conflicts.

Consumers are more careful when spending their money and retailers have to invest in a powerful CX strategy to keep customers happy and loyal. As Zendesk’s CX Trends 2024 Report shows, more than half of customers would switch to a competitor just after one bad experience. In the retail industry specifically, 63% of CX retail leaders are rethinking their entire customer journey due to emerging tech like generative AI.

The integration of AI powered chatbots which help service agents focus on complex issues and improve customer experiences with personalised fast responses can be the differentiating factor. However, as AI continues to develop, clarity and transparency on its usage will be essential to build trust with customers.

It is a pleasure to see that lots of retailers already deliver a sophisticated CX based on individual customer needs. We congratulate all the retailers named in the top 30 for tirelessly working on delivering the best experience for their customers even during challenging times.

The UK's Top 30 Ecommerce Retailers is produced by:

Rebecca Taylor

Commercial content manager and report editor

Caroline Howley

Report writer

Lorraine Griffiths

Production editor