The World’s Best

Ecommerce Retailers 2025

Who they are. How they’re winning

At a glance

As consumer confidence is beginning to rise and online discounts play into shoppers’ cost-conscious mindsets, retailers have been elevating their digital strategies.

Whether it’s a hyperfixation on personalisation, driving engagement through immersive experiences such as augmented reality, seamless omnichannel integration, leveraging social commerce or employing AI to enhance productivity and drive cost-savings, 2025 is the year of ecommerce innovation.

In this report, we turn the spotlight on 10 global ecommerce trailblazers to discover which innovations and investments are making a difference and understand what it really takes to win online in today’s fiercely competitive climate.

Read on to discover:

- The state of the ecommerce landscape today and where you should be investing to see growth

- How getting online payments right can drive loyalty and boost basket spend

- Which digital innovations are all hype, and which are really contributing to conversions

- A peak behind the curtain at the strategies of the world’s best ecommerce retailers

The ecommerce landscape

In 2025, global ecommerce sales are expected to rise to $6.56trn (£5.21trn) – a 7.8% increase from 2024. By 2028, Shopify forecast that this figure will rocket to $8.09trn (£6.42trn).

Globally, 20% of all sales were made online in 2024, according to McKinsey. In the UK this figure was even higher; ecommerce made up 27.2% of total retail sales in the last year – up slightly from 26.7% seen in 2023, according to the Office for National Statistics.

If we use the UK’s online retail market as a looking glass on the global market, ecommerce looks to be on the up.

Indeed, while bricks and mortar stores face challenges – in the UK, for example, The BRC reported that footfall was down 2.2% year on year in 2024 – UK consumers spent a record £26bn online this golden quarter alone, according to Adobe Analytics.

UK online sales (excluding food) increased by 2.2% year on year in January 2025, bolstered by deep discounts on furniture, bedding and other home accessories, according to the BRC. This was significantly above the 12-month average growth of 0.1% and the three-month average growth of 1.8%.

Discounts drove much of this spending, with Adobe reporting that heightened price sensitivity generated around £220m in sales from November to December.

So, what’s driving this rapid growth?

The Covid-19 pandemic is believed to have accelerated the global shift to online shopping by up to five years, while an increase in mobile commerce is boosting these numbers further.

Meanwhile, exciting new tech and AI-powered tools mean ecommerce retailers can do more with less and have ever-more ways to grab consumers’ attention.

In 2025, there’s no question that those who don’t adapt face being left behind. Read on to explore how the most innovative retailers are making online pay.

UK online sales increased by 2.2% in January, bolstered by deep discounts

UK online sales increased by 2.2% in January, bolstered by deep discounts

The pandemic is believed to have accelerated the shift to online shopping by up to five years

The pandemic is believed to have accelerated the shift to online shopping by up to five years

Meet the ecommerce powerhouses

Here we uncover the innovations and ecommerce strategies of 10 global ecommerce powerhouses, as chosen by Retail Week’s expert team of editors and journalists.

Alibaba

In 2024, multinational tech conglomerate Alibaba was ranked the third most valuable company in China according to Kantar, with a value of $68.48bn (£54.29bn). The company also boasted the seventh most downloaded retail app in the world in Sensor Tower’s State of Mobile 2025 report.

AliExpress – the brand’s global marketplace – enjoyed an outstanding Black Friday, with an increase in visits of over 140% year on year – the highest change of all retailers. Similarweb research revealed the super-low-cost retailer attracted 2.8 million visits over Cyber Weekend, with an aggressive 90% discount strategy no doubt playing a large part.

AliExpress is incredibly successful at attracting users year-round, but its challenge is converting these visitors.

Indeed, the marketplace saw a 134.6% rise in web visits from December 2023 (10.6 million) to December 2024 (24.8 million), while its trailing ‘12-month change’ – described by Similarweb as a company’s operating performance over the last year – stood at 70.8%. The sheer volume of visitors appeared to counterbalance a relatively low conversion rate of 3.79%, allowing the brand to flourish.

So, how is Alibaba driving this popularity rise?

Alibaba’s innovations put empowering small to medium-sized enterprises (SMEs), a significant portion of its customer base, front and centre.

In November 2024, the retail and tech powerhouse launched an AI-powered B2B product sourcing search engine, dubbed Accio.

This “intuitive and conversational” engine uses natural language processing to help SMEs find products. As well as empowering users to make quicker and more informed purchasing decisions, Accio simplifies inquiries, payments and after-sales support.

By mid-January 2025, the AI-powered search engine had reached 500,000 SME users, while the Accio Inspiration feature had seen a significant increase of almost 30% in conversion rates for suppliers.

In addition, Alibaba has unveiled several programmes to support SMEs. In August, the brand announced it had joined the Athlete365 business accelerator programme to help sports people become business owners. This followed the launch of Alibaba’s Academy for Women Entrepreneurs in Europe in April 2024.

Amazon

In the past year, marketplace titan Amazon has pushed ahead with exciting innovations surrounding AI and last mile, as it strives to enhance its already world-leading shopping experience.

It’s been another stellar year for the retailer. Although its web visits were slightly down as of December according to Similarweb, with a 12-month change of -3.9%, it achieved an impressive conversion rate of 10.75% in 2024. Amazon also saw the most web traffic of all UK retailers on Black Friday 2024.

Ahead of analyst expectations, the marketplace announced revenues of $187.8bn (£150.9bn) in the final quarter of 2024, a 10% increase from 2023. Online store sales grew 7% year on year, accounting for 40.3% of total revenue.

Amazon has always understood the value of accelerating the last mile. In February 2024, it expanded its same-day delivery service to more than 80 towns and cities in the UK. It also achieved its fastest-ever global delivery speed for Prime members, with over 1 billion items arriving the same or next day. In January, it announced preparations to bring its much-hyped Prime Air drone deliveries to the UK, starting with flights from its Darlington warehouse. Electric-powered drone delivery has been available in certain states in the US since 2022, for items weighing up to five pounds.

The company also recently ordered the UK’s largest ever fleet of electrical heavy goods vehicles, with over 140 new electric Mercedes-Benz trucks and eight Volvo FM Battery Electric trucks to be added to the retailer’s transport network over the next 18 months. The fleet is forecast to transport over 300 million packages each year in the UK.

However, one of Amazon’s most game-changing innovations is its futuristic ‘vision-assisted’ package retrieval (VAPR) tech, which it plans to install in 1,000 electric delivery vans by early 2025.

This AI-powered solution identifies the correct package to deliver at each stop by lighting it up with a green ‘O’ upon arrival and highlighting other packages with a red ‘X’.

Early testing showed a 67% drop in perceived physical and mental effort for drivers, and more than 30 minutes saved per route.

Boots

The biggest pharmacy chain in the UK, Boots is also growing its presence abroad. Its principal retail brands comprise of Boots in the UK, Thailand and the Republic of Ireland, Benavides in Mexico, and Boots franchise operations in the Middle East and Indonesia.

Since 2024, Boots has strengthened its grip on the beauty market, launched rapid delivery and stormed Black Friday with an “exceptional” performance that saw its biggest-ever day of sales.

Results for the first quarter, announced January 2025, have seen total comparable retail sales up 8.1% year on year for the three months ending 30 November 2024. Boots.com specifically saw digital sales up 23% year on year, accounting for 22% of total retail sales.

Similarweb data found Boots to have a very respectable average conversion rate of 5.27% in 2024, demonstrating that not only can it attract visitors to its website, but effectively turn them into paying customers.

In 2024, Boots brought in 25 beauty brands – including Prada Beauty, Tree Hut and Coats – and launched its beauty campaign, titled ‘Make More Room for Beauty’. The campaign targeted under-35s and incorporated TV, out of home advertising, print, radio, digital display, paid and owned social, PR, email, and in-store marketing. Boots’ beauty sales increased 11% year on year in Q4.

The brand also partnered with JustEat in September 2024, launching a rapid delivery service across 50 UK stores, including London, Birmingham, Manchester, Leeds, Glasgow and Edinburgh.

Over 1,000 items can be purchased through the speedy service – “for times when you need something urgently but can’t leave the house” – including meal deals, skincare and children’s medicines. Delivery can be as quick as 30 minutes.

The brand plans to offer the service in another 100 stores by spring 2025.

Speaking at Live: Retail Week x The Grocer in February 2025, chief digital officer Paula Bobbett said the next step for Boots is to leverage its growing data pool to evolve healthcare services.

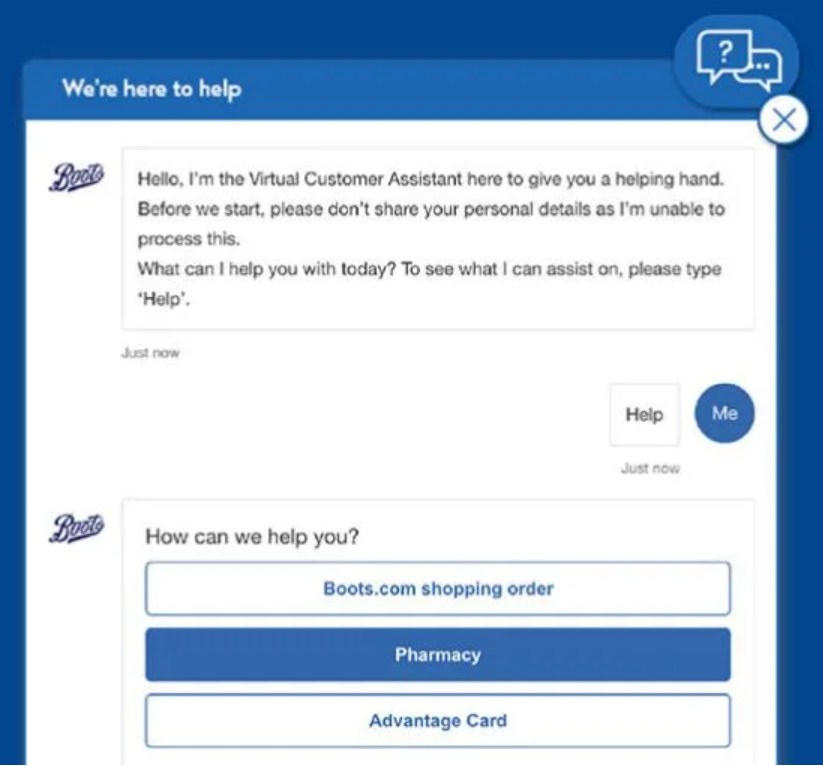

The success of its Boots advantage card app, implementation of an AI chatbot and its multimillion investment in its digital platform has left the retailer in an excellent position when it comes to data shared with consent for use. Bobbett discussed the brand tackling this “next frontier”, using the data to drive better healthcare outcomes.

Coupang

Online marketplace Coupang has harnessed the power of ultra-fast delivery and streamlined customer experience to become the largest online marketplace and ecommerce platform in South Korea, with many saying it has ‘out-Amazoned’ Amazon itself.

Launched in 2010 as a Groupon-style business selling a wide product range including clothing, groceries and electronics, by the fourth quarter of 2021, one out of every two online shoppers in South Korea were choosing to spend their cash with Coupang. When it launched on the New York Stock Exchange in March 2021, it had the largest valuation of any Asian company in the US that year – $102.2bn (£81.01bn).

In 2024, Coupang was named among the businesses driving Forbes’ Midas List in Europe thanks to its “aggressive investments in logistics, rapid delivery capabilities and diverse business segments”.

Speed has always been at the heart of Coupang’s success. The company harnessed a combination of AI and localised fulfilment to patch up South Korea’s historically fragmented network. Now, 70% of all South Koreans live within seven miles of a warehouse. Meanwhile, proprietary algorithms are used to calculate everything from driver delivery routes to how to stack packages.

Coupang offers ‘Rocket Delivery’, which ensures next-day delivery for most orders, and ‘Dawn Delivery’, which guarantees early morning delivery for purchases made before midnight. These innovations have enabled Coupang to achieve 99.3% on-time deliveries within 24 hours.

However, it was Coupang’s acquisition of Farfetch, a global online luxury company, that grabbed headlines in 2024. During its takeover, in a deal valued at $500m (£396.8m), Coupang said it was aiming to “streamline the business” and increase “financial strength,” with an aim to cut up to 30% of Farfetch’s total workforce. Coupang’s sudden entry into luxury ecommerce appears to be going well so far. In the first two quarters since the takeover, Farfetch brought in $748m (£593.6m), as reported by Forbes in August 2024.

Currys

A leading UK omnichannel technology retailer, Currys operates online and through 727 stores across six countries. In the UK&I, it trades under the Currys brand, and in the Nordics it’s under the Elkjøp brand. Group operations are supported by a sourcing office in Hong Kong.

One of retail’s top innovators, the electricals giant doubled down on its digital transformation in 2024, tapping into AI and tech innovations to power staff productivity and elevate the customer experience across all channels.

Speaking at Live in February 2025, chief executive Alex Baldock said he expects AI to be the “single biggest tech trend since the tablet”.

“Currys has got 75% market share of the AI products – we intend to be the standout beneficiaries of it,” he explained.

Currys CEO Alex Baldock speaking at LIVE: Retail Week x The Grocer 2025

Currys CEO Alex Baldock speaking at LIVE: Retail Week x The Grocer 2025

In the run up to Christmas, Currys switched from paper product pricing to digital labelling or ‘electronic shelf edge labelling’ (ESEL) in around 60 stores, and added a digital queuing system across all outlets, fronted by ‘sales floor leaders’.

Elsewhere, Currys announced in May 2024 that it had partnered with consultancy firm Accenture and tech giant Microsoft to help deliver its core cloud technology infrastructure and leverage cutting-edge AI tech. The goal is to “modernise, secure and simplify” its technology estate as it strives to accelerate AI adoption.

This latest stage of Currys’ ongoing digital transformation has centred around organising customer data to improve the customer experience.

So far, Curry’s digital transformation appears to be having a positive impact.

Indeed, after a successful Christmas with “strong peak trading”, the electricals giant raised its profit outlook for the year. Omnichannel sales outperformed during the festive season and web traffic grew 5.3% from 28.6 million in December 2023 to 30.1 million in Dec 2024. However, average conversion rate in 2024 was low, according to Similarweb, at 2.29%, which could reflect a desire from shoppers to make big ticket purchases in store.

With Budget headwinds and economic uncertainty to tackle, Baldock explained there would be more automation and offshoring. The retailer already has around 1,000 colleagues in India, and forecasts this will expand as labour costs of UK employees inflate.

Next

Operating in over 70 countries worldwide with franchise stores across Europe, Asia and the Middle East, Next also leverages its infrastructure by offering a complete suite of online services to third-party brands under ‘Total Platform’.

It’s been a landmark year for Next. The clothing retailer hit the £1bn profit milestone last year and is forecast to repeat this performance in 2025. It also enjoyed a bumper Christmas performance in 2024, posting an increase in full-price sales by 6% against the same period last year.

In addition, Next saw some festive gains in its web traffic, which grew 24.3% from November to December according to Similarweb. While web traffic declined -7.2% from December 2023 (42.5 million) to December 2024 (39.4 million), the brand boasted a strong average conversion rate of 7.13% in 2024.

The impact of rising costs, however, hasn’t been ignored. In January 2025, Next announced its intention to offset increased wage costs following the Budget with “unwelcome” price rises. It is implementing an increase of around 1% in selling prices on like-for-like clothing over and above any factory gate price increases, which it said has “fortunately” seen 0% inflation so far. It expected price rises to remain below the Bank of England’s target for inflation of 2%.

When it comes to Next’s strategy, the past year has been all about breaking into new markets, both at home and abroad.

After highlighting overseas ambitions as a key growth strategy, in April 2024, the brand struck a franchise deal with Indian marketplace Myntra.

Partnering with a well-established retailer in the country is a savvy way for Next to enter the Indian market, which has a huge appetite for clothing and footwear.

The deal will see between eight and 10 Next-branded stores launched in Indian cities including Delhi, Mumbai and Bengaluru within the next few years. Next will also have “an extensive presence” online with Myntra.

Additionally, Next expanded into the UK’s luxury market last year.

In October 2024, it launched a new online premium fashion platform called Seasons, in a bid to serve “overlooked” customers seeking “investment-worthy pieces” to build an “elegant and timelessly fashionable wardrobe”.

The high-quality, curated fashion offering encompasses products from luxury brands including Marc Jacobs, Paul Smith and Coach.

Next said Seasons will offer an “unmatched” level of service including next-day delivery and 500 national collection and return points.

It plans to expand the ecommerce platform internationally towards the end of 2025.

Ocado Retail

The joint venture between Marks & Spencer and Ocado Group, operates solely in the UK, with ambitions to “be the biggest online grocer” in the country. Parent company Ocado Group facilitates the retailer's tech infrastructure with leading logistics software. Ocado Group operates in the UK and at least 10 other countries including the US. It also partners with grocery retailers globally including Morrisons, Coles and Panda Retail.

Ocado Retail delivered a strong performance in 2024, spending several consecutive months as the fastest-growing retailer in the Kantar UK grocery market share charts. It also enjoyed another record-breaking Christmas, hitting a new peak of 500,000 orders per week.

Much of the growth seen in 2024 was driven by new customer acquisition, which jumped 12.1% year on year. The retailer achieved this by working hard to shake off perceptions the brand was “too pricey,” and convince consumers it delivers “reassuringly good value”.

This was achieved through an attractive promotion for new customers – 25% off new customers’ first shops and a three-month free smart pass – and six ‘Big Price Drops’ between June 2023 and August 2024. These measures sit alongside Ocado’s Price promise, introduced in March 2023, which matches customers’ shop to Tesco.com on more than 10,000 products, including Clubcard prices.

Ocado Group is a global leader in automation and robotics. Its fully automated Luton customer fulfilment centre is now home to 40 proprietary robotic arms, which “pick a fair proportion of the range,” in addition to 550-series robots, which enable a 50-item order to be picked from the site in just 10 minutes.

In addition, Ocado retail is working on delivering “unbeatable choice” to customers, with recent partnerships including Holland & Barrett and Virgin Wines. Over 300 Holland & Barrett products were added to the Ocado ecommerce site in January 2025, aiming to cater to a wide variety of more health-conscious shopper missions. A range of 50 wines from Virgin’s assortment was added to the site in October 2024, marking the first time Virgin Wines had been available as individual bottles, rather than multi-bottle cases.

Tesco

According to the World Economic Forum, Tesco is the third-largest retailer in the world by gross revenues, and the ninth largest by revenues. This isn’t surprising based on its global reach; it has stores in seven countries across Asia and Europe, and is the market leader in the UK, Ireland, Hungary and Thailand.

Tesco has long been a leader in customer experience (CX), thanks to its trailblazing loyalty scheme that operates in multiple countries including the UK, Ireland, the Czech Republic, Slovakia and Hungary. The scheme gives the grocer access to valuable customer data, allowing the brand to better serve shoppers.

In January, Tesco boss Ken Murphy hailed the supermarket’s “biggest ever Christmas” trading period, citing investments in value, quality and service.

Investments included “improving quality across all ranges” and “providing the best experience for [their] customers in-store and online,” which was supported by an extra 28,000 colleagues over the Christmas period.

Tesco CEO Ken Murphy

Tesco CEO Ken Murphy

As Tesco’s Clubcard celebrates its 30th birthday in 2025, the brand is piloting an exciting change to its loyalty scheme. ‘Your Clubcard Prices’ will offer customers bespoke discounts based on their shopping behaviour.

Every Wednesday, participating customers will receive new offers, which will be valid for seven days, and they will be able to buy their discounted products more than once.

Reflecting the ongoing popularity of its Clubcard, the Tesco app was the fourth most downloaded app in the UK in 2024 – the highest of any grocer.

Meanwhile, in June, Tesco launched the ‘one-stop-shop’ online marketplace, which displays third-party goods alongside the grocer’s own range after data insights revealed customers were searching for products the supermarket didn’t sell.

The platform launched with around 9,000 products across DIY, garden, home, pet care and toys, but by August, more than 20,000 products were on its virtual shelves.

While goods from external sellers are listed next to Tesco groceries, deliveries are fulfilled directly by suppliers.

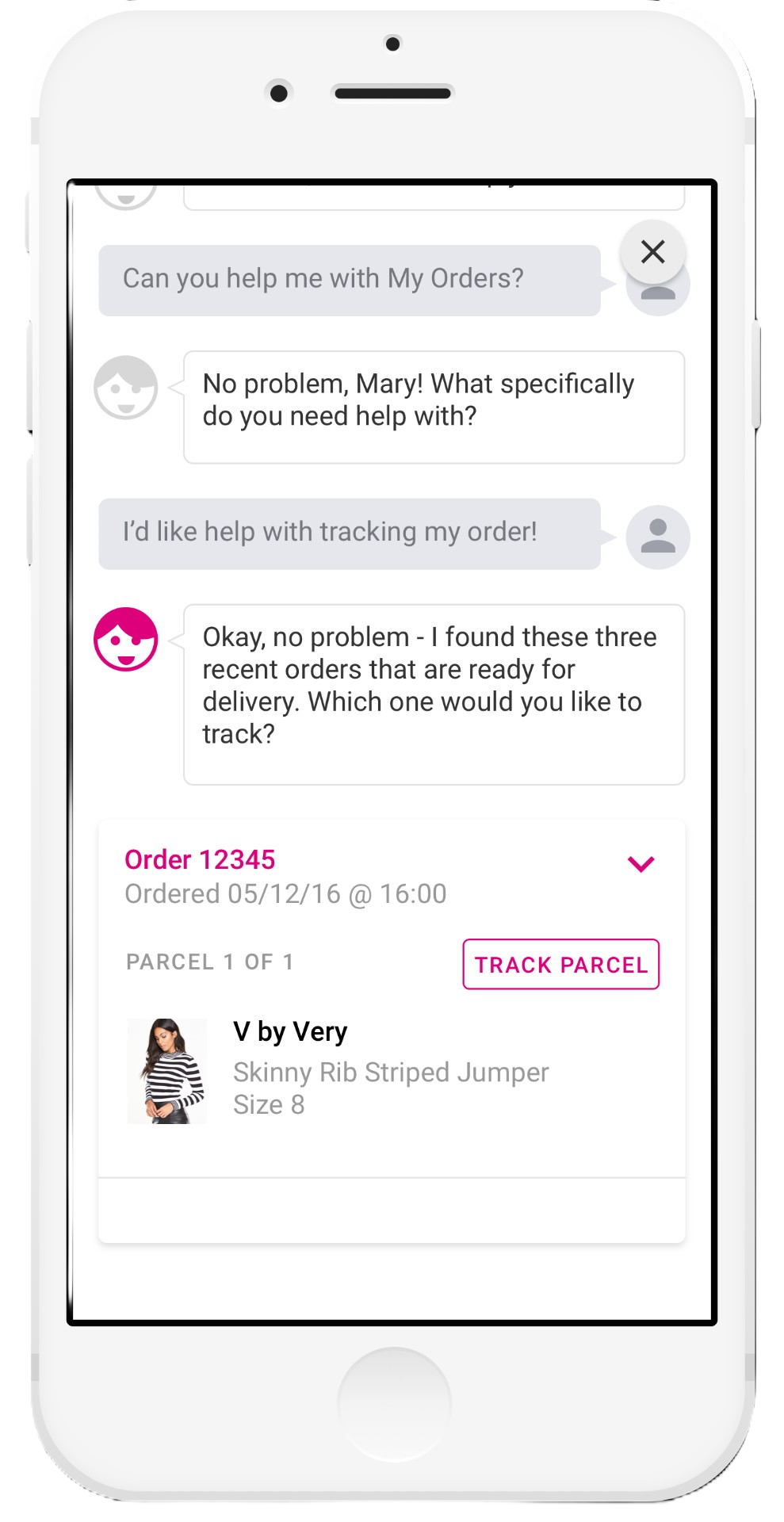

The Very Group

The Very Group aims to be a world-class digital leader and boasts over 2,000 brands across home, fashion and electricals. Its focus on fully digital experiences, deep understanding of customer data and commitment to offering flexible ways for customers to pay, earns it a place on our list.

The Very Group enjoyed a strong golden quarter in 2024, delivering 2.3% growth in year-on-year UK retail sales in the seven weeks to December 27. This followed a “resilient” full-year performance reported in October.

While its web traffic for the last year has been challenged by tumultuous market conditions (traffic dropped -9.6% year on year in December 2024 and -12.3% month on month), the retailer maintains a strong conversion rate, with average conversion at 4.43% in 2024. The Very Group said in October that “careful cost management” coupled with a “loyal and growing customer base” are driving resilience.

Forward-thinking Very has truly embraced the ecommerce opportunities of AI and data, with this tech embedded across many elements of the business.

Through a partnership with Amazon Web Services, the brand uses AI-driven time series modelling and seasonality profiling to improve stock level predictions, ensuring better product availability – particularly during peak trading periods like Black Friday and Christmas.

Its generative AI Innovation Lab was developed to “deliver interactive and personalised digital shopping experiences to millions of customers”. It has trialled new generative AI-powered retail solutions to revolutionise how customers shop through its platform. Speaking on the launch in November 2023, chief information officer Matt Grest said: “We want to be recognised as one of the UK’s leading AI-powered retailers,” emphasising their drive in this space.

Recognising the evolving nature of AI, The Very Group is prioritising upskilling its workforce. In September 2024, it partnered with Multiverse to launch a new data academy to develop 11 of its data professionals who will enrol onto a 39-month degree-level Advanced Data Fellowship course.

In September 2024, The Very Group announced its ambitions to “become the choice retail media network for brands”, on the launch of its retail media proposition dubbed ‘Very Media Group’. Working alongside retail media operator SMG and advertising company Criteo, the brand aims to create the right campaigns for the right customers, driving sales for brand partners.

The Very Group claims 1.4 million daily site visits, with a strong 4.4 million customer base, so it has a lot to offer its potential clients.

Its media proposition is said to also integrate above-the-line, experiential and influencer marketing, collaborating with brands on bespoke campaigns targeting specific audiences online.

Walmart

The world’s biggest retailer by revenue according to the NRF, last year saw Walmart increase its investments in tech-driven innovations across its over 10,500 stores in 19 countries. Not only did the retailer expand its AI capabilities – implementing generative AI-powered search on iOS – and increase its drone delivery capabilities, but it introduced two key innovations targeting younger shoppers.

In April 2024, Walmart partnered with online game platform Roblox to launch a new shoppable experience in the metaverse called ‘Walmart Discovered’. Through the platform, customers can purchase real products, such as bags, water bottles or wireless headphones.

After clicking ‘buy’ users complete the transaction with payment and shipping details on a webpage, while also receiving a digital version of the item for their avatar.

For the initial test, Roblox did not earn any revenue, instead gaining valuable insights into demand and consumer reactions.

Walmart is also targeting younger consumers through its ‘Shop with Friends’ social platform, which it developed after a company leader witnessed their daughter sending photos of different outfits in a store to friends.

Users can choose from a series of models to find the closest likeness and create a virtual fitting room of outfits they like. They are then shown how the outfits look on their chosen model and can share a link to their fitting room with friends, who can virtually like their favourite picks.

Vitally, there’s no way to give negative votes or more detailed feedback – this is the company’s way of avoiding ‘negative trolling’. Users are also not required to install any apps or create an account to vote, allowing potential shoppers to browse without barriers.

This follows similar online shopping initiatives from Walmart, including virtual glasses try-ons, launched January 2024, and an AR view-in-your-home feature for furniture, launched June 2022.

Walmart’s groundbreaking omnichannel efforts are reaping rewards. Its 2024 full-year performance figures revealed 6% revenue growth, which the brand put down to its omnichannel model continuing to “resonate” with customers.

Driving digital experiences

In 2025, technological development is advancing at lightning speed and customer expectations are evolving just as quickly.

Keeping up with cutting-edge ecommerce means harnessing the latest tech to develop cohesive, seamless and personalised experiences, both on- and offline.

But what tactics are the most forward-thinking ecommerce retailers deploying in 2025? And how are they balancing customer expectations with operational realities?

Blending bricks and mortar with ecommerce

In the past year, retailers have invested heavily in omnichannels, recognising that today’s shopping experiences often begin in one channel and end in another. Many pureplay retailers have ventured into bricks and mortar, while traditional high-street brands have been busy upgrading their tech in-store and online.

“Advanced video technologies are driving revenue and strategic evolution in omnichannel retail,” says Simon Hayward, VP international at video platform Vimeo. “Tools like Vimeo’s interactive video empower brands to create built-in calls to action within product showcases. This integration is proving effective for retailers of all sizes.”

“Non-stop dogwear, a leader in performance dog gear, achieved a 34% increase in conversion rates while simultaneously reducing returns by using interactive video to address customer sizing issues. This directly translates to improved customer satisfaction and lower operational costs.”

“Additionally, LG Electronics, also powered by Vimeo, capitalised on viewer interest by embedding direct links to their purchase website within product overview videos,” continues Hayward.

As Bomin Kim from LG Electronics notes, “We’ve added hotspots to our product overview videos. These hotspots link directly to LG Electronics’ consumables purchase website.”

“These results demonstrate how Vimeo’s interactive video, by directly connecting customer interest to purchase, enhances the omnichannel experience and drives measurable business outcomes,” says Hayward.

THG-owned, former pureplay beauty brand Lookfantastic ships to over 200 countries carrying over 22,000 products. It opened its first permanent store in Altrincham, UK in September, building on the success of a pop-up, and stocks 90 brands from its portfolio.

The new store aims to “educate customers about the brands and products through the in-real-life experience,” and allows customers to personalise beauty boxes, bringing the brand’s beauty box subscription service into a physical space.

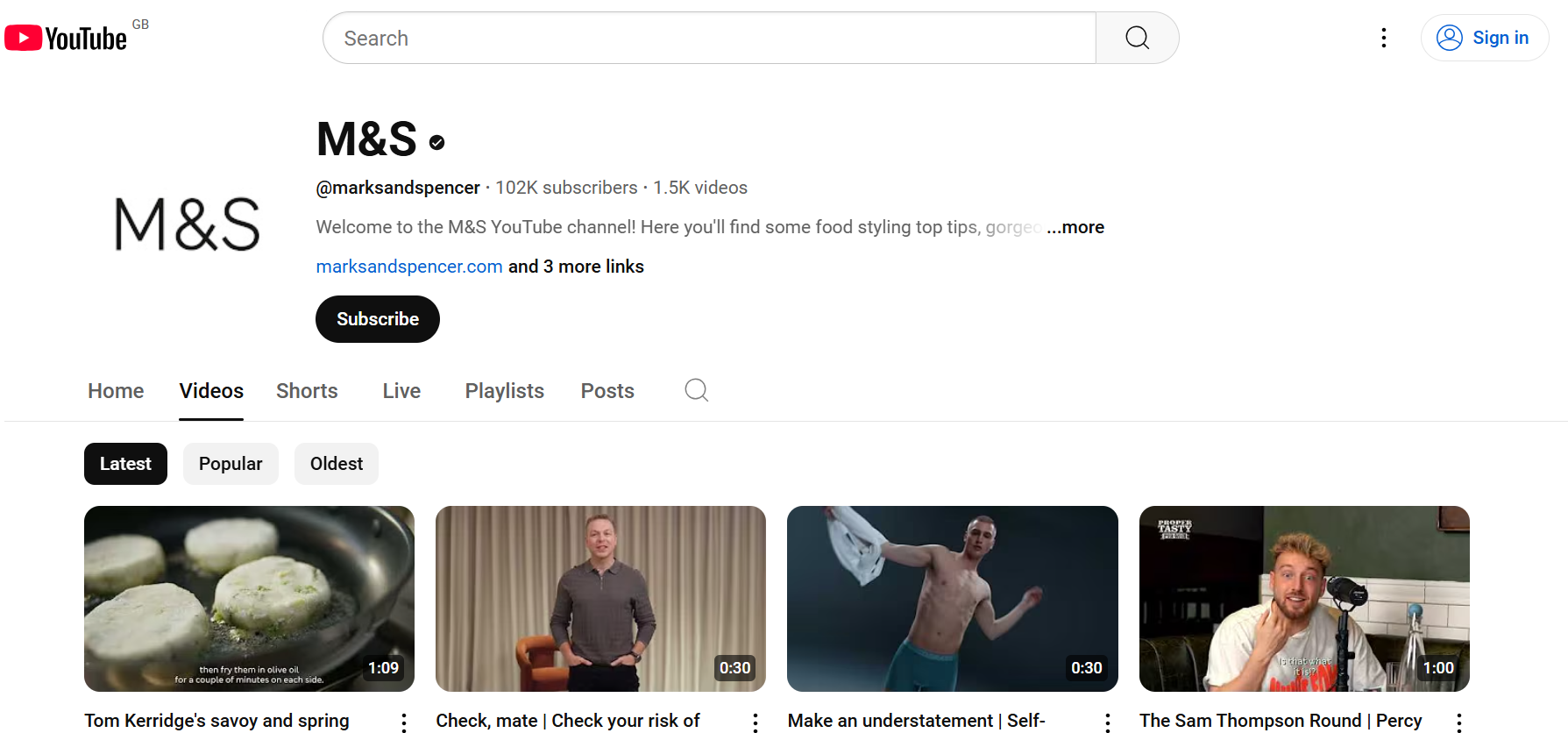

Meanwhile, British legacy brand Marks & Spencer is accelerating its omnichannel strategy with significant investments in AI, social media and personalisation. While well known as a UK retailer, the international arm of the business serves customers across 70 markets globally through strong local partners and online channels.

M&S now allocates as much budget to TikTok and YouTube as to its iconic TV ads, with social spend up 79% year on year, as of September 2024.

AI is used to enhance content creation, customer recommendations and live shopping, while personalised homepages and style quizzes improve user experience.

With 9.4 million active online customers and the M&S app accounting for 44% of online orders, M&S is reshaping its digital presence for sustained growth. In the UK, interactive in-store screens have been a major area of omnichannel investment in 2024, as retailers aim to marry the convenience of digital shopping with the experience of visiting bricks and mortar stores.

Swedish fashion giant H&M, for instance, has also installed interactive fitting rooms at its new omnichannel store concept at London’s Westfield shopping centre, Stratford, which opened its doors on November 21. It first trialled interactive fitting room experiences in Germany in 2021, in a partnership with NeXR Technologies alongside the launch of a new collection.

The fitting rooms incorporate screens that recognise the size and colour of products, offer tailored styling tips, allow customers to request alternative options and order online via the H&M website.

Luxury department store Selfridges, which ships to 130 countries, frequently hosts first-time in-store experiences for digital-native brands like SOJO, Tala and Gymshark, has taken this concept a step further.

It collaborated with Snapchat to create an AR locker room in its Oxford Street store, where customers can virtually try on sports kits. This blend of digital innovation with in-store engagement aims to cultivate a more interactive and immersive shopping experience.

Delighting customers with personalised experiences

In November 2024, 81% of customers surveyed admitted to preferring companies that offer a personalised experience in the State of Customer Service and CX study by Shep Hyken.

It’s unsurprising, then, that the majority of retailers have prioritised personalisation. From unique adverts and dynamic pricing to customised landing pages and product recommendations.

So, how are retailers continually improving personalisation?

While many brands make use of customer data to personalise customer experiences, fashion retailer Levi’s – which sells its products in over 110 countries – is actively surveying customers to ensure they have the best experience possible.

Buying jeans online is a pain point for many customers who need to ensure the right fit. To overcome this obstacle to purchase, Levi’s launched a jeans fit guide in November 2024 on Amazon’s Alexa device in Germany.

After commanding: ‘Alexa, start the Levi’s fit guide,’ customers are guided through questions that determine their gender, style and fit preferences, before the tool recommends the best fit.

Leveraging AI to transform CX

When it comes to gathering customer data, well-executed loyalty programmes are hard to beat, and AI is playing a vital role in progressing their efficiencies.

Just as Tesco is looking to further personalise its loyalty scheme, Boots – another brand with a well-established membership scheme – is harnessing its big data and adaptive AI to personalise its search function.

When a shopper enters a search, the engine processes up-to-date data to ensure the results are as relevant as possible. It also ensures products it suggests are in stock, and will recommend trending products popular with other customers.

The Very Group is another company delving into personalised search. It employs AI designed by US-based Constructor to make search results more personalised and relevant.

This pioneering tech learns user intent in real time, dynamically re-merchandising products across search, browse and recommendation areas to enhance discoverability and drive sales.

Of course, retailers must find the right balance between customer expectations and the operational realities of developing world-class ecommerce experiences. From the challenges of managing inventory and fulfilment through to staffing and tech investments.

Fortunately, the development of adaptive, generative and traditional AI tools has empowered retailers to do much more with less, across the whole customer journey.

Of course, developing cutting-edge AI tools, whether in-house or through partnerships, requires significant investment, but many leading retailers clearly believe developing the ultimate CX is worth the money.

Next has revealed it now employs more people developing technology than in its product teams. The brand uses AI for forecasting, gathering sales data and learning what it needs to re-stock, when and where.

Boots, meanwhile, is using AI to enhance its warehouse capabilities, and trialling a generative AI conversation chatbot.

For the Very Group, stock forecasting and customer search are the biggest AI investment areas, while AI-powered robots and machines are integral to Ocado’s warehouse operations.

Richard Lim, chief executive of consultancy Retail Economics, warned that “a big gulf” has emerged between retailers with a firm grip on AI and the retail opportunities it offers, and those without.

“The next wave of digital acceleration is coming from AI technologies, and I can only see that gulf widening between those that are really embracing it and those that are not,” he said.

All change at the checkout

Getting online payments right

Today’s customers want fulfilment to be convenient, inexpensive and reliable – and optimising online payments upstream, throughout supply chains and downstream at the customer end, are major components to achieve this.

Upstream

Getting digital payments right upstream means developing end-to-end supply chains with seamless payments, as well as gaining full financial visibility and control, enabling enhanced strategic decision making.

“Maintaining positive cash flow, managing international payments and streamlining financial operations are all common challenges for ecommerce businesses today,” says James Simcox, group chief product officer & managing director international at global payments provider Equals Money.

“It’s vital retailers address these pain points by offering seamless payment tools and a central view of business spend,” Simcox continues. “By adopting the right digital payment solutions, ecommerce businesses can streamline operations and drive sustainable growth.”

In recent years, digital payment innovations have transformed the upstream supply chain, from sourcing raw materials and procurement to supplier payments.

By thoughtfully selecting the right digital payment provider for their requirements, retailers can enjoy faster transactions, lower costs, greater transparency, enhanced security and better supplier relationships.

So, which features should retailers look for when considering modern payment solutions?

1. Real-time payments and instant settlements

As every retailer knows, delays in supplier payments can cause stock shortages and disrupt operations, leading to missed sales opportunities.

Choosing digital solutions with real-time payments and instant settlements allows for faster, more efficient transactions, which reduces delays in supplier payments. This allows businesses to maintain strong supplier relationships and negotiate better terms.

2. Automated reconciliation

Manual reconciliation of payments, supplier invoices and operational expenses can be time-consuming and prone to errors.

“Automated reconciliation tools help reduce the time spent on manual processes: improving accuracy, detecting fraud more effectively and providing businesses with real-time financial insights,” adds Simcox. “This enables ecommerce sellers to stay on top of cash flow and make quicker, more informed decisions.”

3. International payments

For retailers working internationally, cross-border digital payment solutions can streamline overseas transactions, lowering traditionally steep fees and speeding up settlement times.

“With multi-currency accounts, online retailers can send, receive, and manage payments in multiple currencies from a single account – eliminating the need to juggle between different accounts and enabling customer preference of paying in local currencies,” says Simcox.

4. Virtual bank accounts and BNPL

Suppliers and manufacturers can also use e-wallets or virtual bank accounts, allowing for seamless transactions and lower processing costs.

Buy now pay later (BNPL) solutions are not only for customers. Digital lending platforms help small suppliers access credit faster and improve cash flow.

5. Forward contracts and FX hedging

For large ecommerce businesses trading in high volumes of different currencies, there are potential financial gains to be made from forward contracts and foreign exchange (FX) hedging too.

Simcox adds: “Forward contracts and FX hedging enable businesses to lock in exchange rates for future payments. This can protect budgets from volatile market shifts and safeguard margins, making financial planning more predictable and secure.”

Amazon partnered with Barclays in August 2024 to launch a co-branded credit card in the UK

Amazon partnered with Barclays in August 2024 to launch a co-branded credit card in the UK

In November 2024, John Lewis partnered with Klarna to introduce a BNPL option

In November 2024, John Lewis partnered with Klarna to introduce a BNPL option

Currys introduced flexpay in partnership with BNP Paribas Personal Finance

Currys introduced flexpay in partnership with BNP Paribas Personal Finance

Downstream

While quirky CX and strong product ranges drive discovery and boost basket spend, long-term loyalty stems from getting the foundations for taking and making payments right, every time.

According to a February 2024 report by PYMNTS Intelligence and Adobe, 70% of shoppers consider the availability of their preferred payment methods to be ‘very’ or ‘extremely’ influential when choosing an online store. Interestingly, 53% of the US consumers surveyed felt it’s online marketplaces that best meet their payment method preferences, with only 22% holding the same view about brand websites.

However, on top of limited payment options, complex checkout processes, unexpected fees and lengthy account creation can all also lead to basket abandonment.

So, how are leading retailers tackling these issues to improve CX?

In October 2024, Currys introduced flexpay in partnership with BNP Paribas Personal Finance – a refreshed credit option designed to offer more flexible payment solutions.

Customers can choose fixed monthly payments or a BNPL option, with access to low-rate and interest-free promotional credit on selected products.

Flexpay aims to simplify credit usage with a dedicated mobile app, improved application process and enhanced visibility of credit balances.

94% of shoppers believe it is important to have multiple payment methods to choose from

Currently, over 20% of eligible purchases at Currys are made using credit, making it the retailer’s most-used payment option.

Meanwhile, Amazon partnered with Barclays in August 2024 to launch a co-branded credit card in the UK – The Amazon Barclaycard – allowing customers to earn rewards on their spending.

Rewards can be redeemed for Amazon.co.uk gift cards via the Barclaycard app, with no annual fee.

Customers earn 1% rewards on Amazon purchases, 0.5% on everyday spending (dropping to 0.25% after 12 months), and 2% back on Amazon purchases during events like Prime Day. The card also includes Barclaycard entertainment perks and a £20 Amazon gift voucher.

Retailers including Walmart, Amazon, Gucci and Target are using Affirm’s BNPL service to offer shoppers a ‘transparent’, ‘flexible’ and ‘fair’ payment option. One of the leading choices of BNPL service provision in North America, Affirm launched in the UK in November 2024.

“With a mission to build honest financial products, Affirm offers consumers flexible and longer-term pay-over-time options – up to 24 months – and never charges any late or hidden fees,” says Ruth Spratt, VP and UK country manager, Affirm.

“Affirm is helping UK merchants large and small – including those on Adyen and soon those on Shopify – grow their business through a consumer-first payment experience,” she continues.

Elsewhere, in November 2024, John Lewis partnered with Klarna to introduce a BNPL option for online shoppers.

Customers can split payments into three instalments over 60 days, making budgeting easier.

Klarna’s popular BNPL service is already used by retailers like Argos, Boots and WHSmith, offering flexible and interest-free payments.

BNPL is a smart move for retailers, with UK BNPL spending hitting a record in 2024, with 13.9% of payments processed through such providers, and 66% of shoppers saying they would be open to using it in future.

The future of digital shopping

Retailers are continually experimenting with novel innovations, but are they merely headline-grabbing gimmicks or worthy of long-term investment?

Retail media

Retail media has been a hot topic over the past few years, with retailers from Co-op and Currys to The Perfume Shop and Selfridges investing big. In fact, UK retail media spend was forecast to total $4.9bn (£3.87bn) in 2024, equating to 10% of total media spend in the UK.

So, how are retailers using retail media to supercharge customer experiences?

Ocado Retail is expanding its retail media capabilities through Audience+, which enables advertisers to leverage Ocado’s first-party shopper data for precise targeting, campaign execution and performance measurement across multiple ad platforms.

The goal is to boost transparency and efficiency, and further personalise the customer experience.

In January 2025, Currys announced the expansion of its retail media network, Currys Connected Media, by integrating in-store advertising across its UK and Ireland stores.

With over 100 screens in some locations and an expected 40 million annual impressions, the initiative provides new engagement opportunities for both in-store brands and external advertisers.

This expansion enhances omnichannel marketing, combining digital and physical touchpoints to offer data-driven, impactful consumer interactions, reinforcing Currys’ position as a leader in tech retail media and shopper engagement.

Tesco is also rapidly expanding its retail media business, with store advertising at up to 50 locations and video advertising on its website and app for more engaging brand storytelling.

In addition, the grocer has formed a landmark partnership with GroupM, the world’s largest media-buying business, to enhance data-led solutions across on-site, off-site and in-store media.

By harnessing Clubcard data, Tesco delivers precise audience targeting and immersive omnichannel brand activations.

With retail media becoming a key focus for grocers, Tesco is positioning itself as a market leader, using its vast customer reach and insights to drive advertiser success and business growth.

Metaverse shopping

When shopping in the metaverse, customers experience browsing, purchasing, and interacting with products in virtual, immersive environments via virtual reality (VR), augmented reality (AR) and 3D technology.

This pioneering tech merges ecommerce, gaming and social experiences, offering personalised and immersive retail journeys.

The metaverse concept has faced challenges like user experience, technology accessibility and consumer readiness, but there is still customer appetite for the tech. In Feburary 2025, YouGov surveyed 1,000 US adults. It found 26% have used the metaverse in the past 12 months, with this rising to 80% for those owning a VR headset. In fact, 22% had shopped for physical products and 14% purchased virtual products. 37% said they’d be more likely to use the metaverse in the next year if there were more opportunities for virtual shopping or exclusive deals.

So, who’s trying it out?

Ikea launched on game platform Roblox in June 2024, opening a virtual UK store and recruiting 10 real-life employees to work in-game for £13.15 per hour.

The Co-Worker Game allows players to experience retail roles, serving meatballs, assisting customers and managing virtual showrooms. The initiative aims to engage a new demographic, showcasing retail careers in an interactive, innovative way.

Meanwhile, Benefit is enhancing its omnichannel strategy with its first virtual 3D shopping experience. The Benemart launched in partnership with Obsess in August 2024.

Available in the UK, US, Germany and France, the immersive platform allows users to shop as avatars, customise makeup looks and interact with friends via voice chat and games, tapping into Gen Z’s preference for social commerce.

This complements Benefit’s physical pop-ups, like its latest in November, in London’s Carnaby Street, creating a seamless blend of digital and in-person experiences.

What’s next for metaverse shopping?

Advancements in AR, VR and blockchain technologies are expected to make virtual shopping more immersive and accessible.

As these technologies evolve and consumer interest increases, metaverse shopping could become a more integrated part of the retail landscape, offering personalised and interactive shopping experiences.

Augmented and virtual realities

AR and VR have been around for a while, but when it comes to retail their potential to capture shoppers’ attention is only just starting to be realised.

In July 2024, US footwear retailer Foot Locker developed an immersive AR experience to engage with customers and visitors to the Olympic Games in Paris.

The brand’s interactive map allowed customers to identify loyalty points and unlock exclusive rewards by scanning QR codes, which were close to Foot Locker stores in the city.

Elsewhere, urban-lux retailer Løci incorporated AR tech into its first immersive store on London’s Oxford Street, allowing shoppers to virtually try on footwear and apparel using full-length AR mirrors.

This combination of in-store interaction, digital convenience and personalised experiences exemplifies Løci’s ‘i-tail’ concept – merging the best of physical and online shopping to engage customers in a dynamic, tech-driven environment.

While such experiences may primarily be targeting Gen Z and Gen Alpha audiences, AR and VR are relatively accessible technologies. This means brands with comparatively older audiences could harness them to engage customers and drive spend.

Social commerce

Social commerce is a hugely effective tool in removing friction from customer experience. After all, it allows users to find, purchase and review products, without ever leaving TikTok, Instagram, Facebook, Snapchat or other social media apps.

In 2024, social commerce made up nearly 20% of all ecommerce sales, up from just 5.5% in 2018. Social commerce revenue is forecast to reach $6.2trn (£5.06trn) worldwide by 2030.

In an increasingly digital marketplace where consumers rely on social media for product discovery and purchasing decisions, retailers must prioritise their social commerce strategies to drive sales.

Next is one example of a retailer harnessing the power of social commerce via integration with Facebook and Instagram. Customers can now browse and purchase products directly through Next’s social media pages.

Similarly, fashion retailer Asos is aiming to engage its tech-savvy Gen Z audience with its dynamic social commerce strategy.

The brand shares interactive video content on TikTok, offering product highlights and styling tips to inspire, and then converting shoppers’ interest into sales through TikTok’s seamless shopping capabilities.

Live shopping

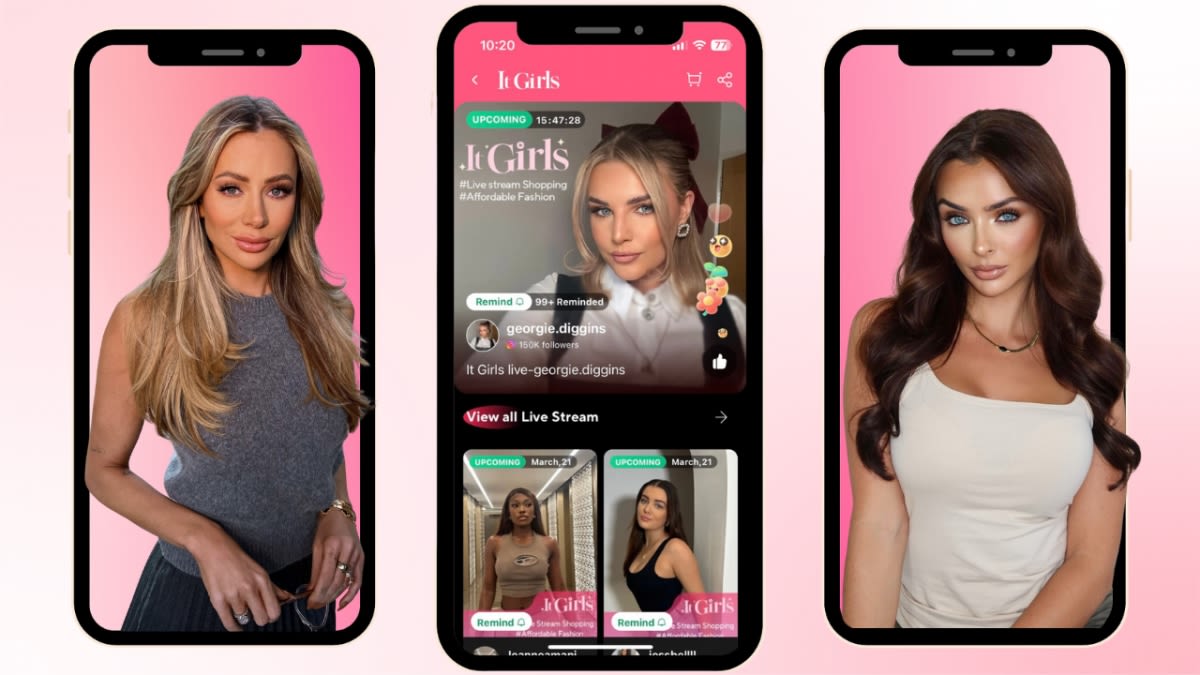

Originating in China, live shopping has now grown into a $512bn (£418bn) market and is expected to account for up to 20% of all ecommerce sales in the UK by 2026.

Livestream shopping is intended to help consumers make smarter shopping choices through more curation and by bringing them “closer to the products”.

Globally, retail brands are taking note, with eBay, Poshmark, Zara, Shein and Amazon all experimenting with the format.

AliExpress also made its livestream shopping debut in the UK in 2024, in a partnership with Vogue Business. It claimed that the concept is “one of the most effective ways of engaging with consumers directly”.

The livestream debut was launched with an ‘It Girls’ influencer campaign starring Love Island alumnus Olivia Attwood.

Before investing in livestream shopping, brands should ensure they have an engaged social following, strong visual products and the resources and ability to create interactive, high-quality content.

As for when to invest in this promising retail channel – peak shopping seasons and product launches are both effective places to start.

How to strengthen your ecommerce offering

Drawing on learnings from across the report, here we explore five ways you can boost your ecommerce offering to increase dwell time, win spend and enhance customer experiences.

Invest in AI across the value chain

AI tools can elevate and streamline every stage of the ecommerce value chain, from data insights, personalisation and marketing to inventory management and fraud detection.

By leveraging AI, brands can improve customer experiences, optimise operations and boost sales, increasing efficiency while also saving time and resources.

With AI becoming increasingly commonplace among ecommerce leaders, from Amazon and Walmart to The Very Group and Currys, this tech is no longer merely a ‘nice to have’.

Indeed, retailers who fail to embrace the AI revolution will likely struggle to remain competitive, with slower and clunkier processes than their rivals.

Future-proof with smart digital payments innovation

The digital payments landscape is evolving rapidly, and businesses that fail to adapt risk falling behind.

Real-time payments, AI-driven forecasting and open banking solutions offer ecommerce businesses greater agility and data-driven decision-making, both upstream and downstream.

Retailers that invest in pioneering fintech like AI-powered financial tools, predictive FX management and automated cash flow forecasting can scale efficiently while minimising financial risks and improving overall profitability.

Leverage loyalty, data and insights

Tesco and Boots are two prime examples of retailers maximising the opportunities of their ultra-popular loyalty programmes to become ecommerce leaders.

When it comes to gathering data, personalising customer journeys and encouraging app adoption, it’s hard to beat a world-class membership scheme.

And the value of this first party data shouldn’t be overlooked, especially as Retail Media offerings continue to make waves as an additional revenue stream.

Maintain focus on rapid delivery

Fast delivery is quickly becoming the norm, with pioneering ecommerce retailers aiming for 60-minute delivery over same day.

To achieve this, they’re launching AI-powered distribution centres with high-tech robots, creating proprietary logistical algorithms and even flying in drones.

Convenience is king when it comes to winning at ecommerce, so retailers must continue striving towards even faster delivery.

And if the budget isn’t there to create the infrastructure in-house, why not consider a partnership with a rapid delivery company?

Delight customers with immersive online experiences

From virtual 3D shopping experiences like The Benemart and AR-powered fitting rooms like those at Selfridges, to virtual metaverse stores and live shopping streams hosted by popular celebrities, there has never been as many ways to delight and excite customers online.

With retailers vying for consumers’ attention and Finternet users at risk of ad fatigue, it’s vital to use the tech at your fingertips to deliver creative stand-out experiences that will drive true engagement.

Partner viewpoint

Ruth Spratt, VP and UK country manager, Affirm

Consumers are increasingly demanding personalised payment options that provide greater choice and flexibility at checkout. As merchants look to reach more customers and boost sales, Affirm, a pay-over-time market leader, has launched in the UK to help businesses and consumers.

Founded in 2012, Affirm’s mission is to build honest financial products that improve lives. Affirm enables approved consumers to split the total cost of purchases into budget-friendly payments. Every transaction is underwritten individually and Affirm’s success is aligned with consumers and merchants since it does not have any late fees, hidden charges or profit off consumer data.

Unlike other BNPL products that specialise in short-term loans, Affirm provides financing options up to 24 months.

This consumer-centric experience is why 90% of Affirm transactions come from repeat users and more value for consumers means more growth for retailers.

Affirm’s partners report a 70% lift in average cart sizes and nearly 30% fewer abandoned carts than other BNPL products.

We’re proud that hundreds of thousands of merchants – including 90% of the top US ecommerce brands – trust Affirm. Learn more about how merchants can grow their business and drive customer loyalty offering Affirm’s more flexible pay-over-time options.”

James Simcox, Group chief product officer & managing director international, Equals Money

Ecommerce retailers face a range of financial challenges, from managing cash flow to handling international vendor payments and fluctuating currencies. Equals Money provides a suite of solutions that offer greater control over these variables.

Our virtual cards make it easier to manage platform spend and subscriptions, providing better tracking and improving financial transparency. By integrating open banking at checkout, ecommerce businesses can offer customers a secure, smoother payment experience, which can boost conversion rates and foster customer loyalty.

For businesses with global operations, multi-currency accounts simplify managing funds across different currencies, reducing the complexities of cross-border payments and removing unnecessary conversion.

We also offer expert support in navigating vendor payments and managing currency fluctuations through forward contracts and hedging strategies. By leveraging these solutions, ecommerce businesses can enhance their financial oversight, optimise cash flow, and mitigate risk to their bottom lines.

This enables online retailers to make more informed decisions, solidify supplier relationships and ultimately drive profitability – supporting their long-term growth and success.

Simon Hayward, VP international, Vimeo

Looking at the current e-commerce landscape, the surge in video consumption is undeniable, and its influence on purchasing decisions is profound – a staggering 90% of shoppers utilise video to inform their buying choices, and websites featuring videos experience an 88% increase in time spent on page. This isn’t just about passive viewing; it’s about active engagement that translates into tangible results.

Platforms like Vimeo have evolved beyond simple video hosting, becoming comprehensive solutions tailored for retail and ecommerce. The integration of shoppable videos and interactive content creates immersive experiences that captivate customers and drive conversions.

The global reach facilitated by video is another critical advantage. Tools like Vimeo’s AI translation, which preserves the original voice while removing language barriers, enabling e-commerce businesses to expand into new markets with ease. This global scalability, coupled with detailed video analytics, positions video as a strategic imperative.

The adoption of Vimeo by industry giants like Zalando, Adidas, and IKEA, and recent recognition as a top innovator in the Fast Company's Most Innovative Companies, reinforces our commitment to providing cutting-edge video solutions that empower e-commerce businesses to engage with their customers, ultimately driving significant sales growth and solidifying their online presence. Learn more at vimeo.com/solutions/retail

The World’s Best Ecommerce Retailers is produced by:

Rebecca Taylor

Commercial content editor and report editor

Caroline Howley

Report writer

Vanessa Kintu

Production editor

Alban Bizet

Designer

Stephen Eddie

Managing editor

Sophie Nevin

Account director