The top 30 UK multichannel retailers

The big hitters mastering seamless cross-channel retail

In 2017, there aren’t many retailers that don’t operate an ecommerce site, but being a successful multichannel retailer is so much more than simply opening an online store.

It entails offering a great online customer experience and should enable shoppers to effortlessly switch between channels, providing a smooth and seamless purchasing journey.

Retail Week Prospect has devised its own methodology to determine the multichannel trailblazers that have created the perfect integration between physical and digital retail worlds.

The list is topped by Argos, which has certainly raised the bar by allowing customers to view and reserve store stock and with the launch of its in-house Fast Track same-day delivery service.

Argos generates half of its sales online, many of which are fulfilled by its Fast Track same-day delivery service

Argos generates half of its sales online, many of which are fulfilled by its Fast Track same-day delivery service

The statistics say it all: Argos generates half of its sales online, but three quarters of those online orders are collected within its stores, underlining the strength of its multichannel business model. It is of course this know-how that caught the eye of Sainsbury’s when it acquired the business last year.

And while the sharp end of the top 30 includes names that are widely considered to be multichannel leaders – John Lewis, Dixons Carphone and House of Fraser come to mind – it is testament to the strength of this research that smaller retailers such as Schuh, Evans Cycles and Jessops also ranked highly.

All are retailers that have advanced multichannel capabilities, be that in fulfilment, visibility of stock or the ability to offer a seamless customer experience.

The top 30 multichannel retailers share three key attributes:

1. Flexibility

If there is one overarching theme it is that retailers should remain adaptable in their approach as there is no single recipe for success.

Camera specialist Jessops, for example, was relaunched as a digitally led multichannel business by Dragons’ Den star Peter Jones after it collapsed into administration in 2013.

This involves trading through a much smaller store network based in large urban areas around the country, but also by differentiating itself from online competitors through a speedy 30-minute click-and-collect service.

But while having an extensive store network might be seen as a disadvantage in the current multichannel world, retailers including Screwfix and The Entertainer beg to differ. Both have realised the potential for stores to act as fulfilment centres and are continuing to pursue physical expansion.

Meanwhile, Argos is a prime example of having leveraged its sizeable estate as the backbone for its industry-leading Fast Track delivery service.

"Stores provide a level of immediacy that the online channel will struggle to rival, but the gap is narrowing thanks to quicker delivery times"

2. Speed

Stores provide a level of immediacy that the online channel will struggle to rival, but the gap is narrowing thanks to quicker delivery times.

While only about a third of the top 30 currently provide a same-day delivery service, this proportion is expected to increase as it becomes a fierce battleground in online retail.

Ninety-minute deliveries are less prevalent, with only four retailers – Maplin, Matchesfashion, Schuh and The Entertainer – offering this.

The Entertainer is one of only four stores in the top 30 to offer 90-minute deliveries

The Entertainer is one of only four stores in the top 30 to offer 90-minute deliveries

Nevertheless, with consumer expectations around speed and flexibility of fulfilment continuing to gather pace, retailers ignore investment in this area at their peril.

There is also a real opportunity for multichannel retailers to excel in this area as they benefit from their existing store networks.

Pureplay behemoth Amazon may have distribution centres scattered around the country in strategic locations but the majority of etailers will have more limited distribution capabilities and are less well-placed to offer fast deliveries.

A bricks-and-mortar presence provides what should be a bulletproof foundation for advancements in fulfilment.

"While only about a third of the top 30 currently provide a same-day delivery service, this proportion is expected to increase as it becomes a fierce battleground in online retail"

3. Tech investment

With online continuing to take a greater slice of overall sales, multichannel retailers are finding that their stores are becoming less productive.

However, this does not mean retailers should radically reduce their footprint – rather they should aim for a perfect synergy between online and offline through considered investment in new technologies.

Click-and-collect is an ideal way to drive online shoppers into store. It’s convenient for shoppers and productive for retailers – often leading to additional purchases.

It also gives the chance to enhance brand reputation by offering an engaging and pleasurable in-store experience – an opportunity that should further prompt investment in new in-store innovations.

Smart retailers are also those that have gone one step further and have achieved a single view of stock. By allowing shoppers to see if a store has a particular item in stock, they may decide to visit a store that they wouldn’t have otherwise.

This capability can be tied into a speedy click-and-collect service, with both Jessops and The Entertainer, for example, offering click-and-collect within 30 minutes.

How retailers were scored

The analysis within this report has been compiled by Retail Week Prospect, an intelligence service offering insight and analysis on the UK retail scene.

Retail Week Prospect has developed a scoring system to determine the UK’s top multichannel retailers. Retailers that are included must trade through physical stores in the UK and an online store front. The UK’s top 200 retailers were under consideration.

Our calculations take into account the proportion of sales generated through the online channel, as well as a range of multichannel factors including click-and-collect, speed of fulfilment, single stock view and the ability for shoppers to switch seamlessly between channels.

TOP 30 UK MULTICHANNEL RETAILERS

The UK’s top 30 multichannel retailers, determined using Retail Week Prospect’s scoring system.

| Rank | Retailer | RWP multichannel score | % of sales generated online |

|---|---|---|---|

| 1 | Argos | 1,960 | 53% |

| 2 | John Lewis | 1,815 | 42% |

| 3 | Dixons Carphone | 1,743 | 25%* |

| 4 | Schuh | 1,701 | 16% |

| 5 | Evans Cycles | 1,657 | 33% |

| 6 | Jessops | 1,652 | 50%* |

| 7 | House of Fraser | 1,646 | 22% |

| 8 | Mothercare | 1,625 | 41% |

| 9 | The Entertainer | 1,453 | 18%* |

| 10 | Screwfix | 1,447 | 60%* |

| 11 | Hobbs | 1,392 | 25%* |

| 12 | Better Bathrooms | 1,387 | 50%* |

| 13 | Mamas & Papas | 1,380 | 26%* |

| 14 | Matchesfashion.com | 1,379 | 66% |

| 15 | The White Company | 1,354 | 41%* |

| 16 | Maplin | 1,316 | 13% |

| 17 | Kurt Geiger | 1,305 | 25%* |

| 18 | Reiss | 1,295 | 23%* |

| 19 = | Crew Clothing | 1,288 | 30%* |

|

19 =

|

Mint Velvet | 1,288 | 35% |

| 21 | Next | 1,286 | 38%* |

| 22 | Bravissimo | 1,273 | 40%* |

| 23 | All Saints | 1,253 | 21% |

| 24 | Superdry | 1,241 | 17% |

| 25 | Halfords | 1,227 | 15% |

| 26 | Urban Outfitters | 1,221 | 20%* |

| 27 | Dune | 1,218 | 18%* |

| 28 | Lakeland | 1,211 | 23%* |

| 29 | Ted Baker | 1,209 | 22% |

| 30 | Office | 1,186 | 24% |

* Retail Week Prospect estimates for % of online sales

TECH ADOPTION

From online stock visibility to achieving a single view of the customer, a seamless online retail offer has never been more vital.

As the end of the last millennium approached it was assumed that retail’s future lay online and online only.

Almost 20 years on, it is clear that the successful retailer gives as much time and effort to its physical offline presence as it does to its online offer. The importance of this is underlined by a number of online retailers turning to bricks-and-mortar in recent years.

This trend highlights the synergy between the online and offline channels, and the importance of a seamless integration between the two in a multichannel environment.

Ultimately this needs to be supported by data that can be shared quickly and easily across the business, and technology advancements to facilitate this have become a major priority for many of the top 30 UK multichannel retailers in recent years.

"Every single retailer featuring in the top 30 allows customers to view stock availability online and half of the retailers provide shoppers with the ability to see stock availability in a specific store"

Stock visibility

Improving stock visibility has been a key focus. Every single retailer featuring in the top 30 allows customers to view stock availability online and half of the retailers provide shoppers with the ability to see stock availability in a specific store.

Screwfix is a prime example of this. While originally founded as a mail-order operation, it now has a rapidly expanding store network.

Screwfix was originally founded as a mail-order business and now has a network of stores

Screwfix was originally founded as a mail-order business and now has a network of stores

The trade retailer believes that for multichannel to work seamlessly it must offer the same experience across all channels – including stock accuracy.

To do this, the retailer partnered with Oracle to gain a single view of stock across the business, integrating Oracle’s ecommerce and warehouse platform. Stock visibility across the business allows Screwfix customers to check availability in local stores and collect within one minute.

Single view of customer

The platform also provides Screwfix with a single view of its customer – an area on which many of the top 30 are currently working on.

By gathering customer data across channels, a multichannel retailer can begin to understand how its customers are shopping online and offline, and better manage their expectations between the two to provide a seamless experience.

However, retailers need to build the right foundations to support this.

Halfords shows how this works in practice. Its Moving up a Gear strategy involves leveraging customer data and analytics throughout the business to develop a single view of its customer.

It upgraded its core operating platform to an SAP-based solution in 2014 but is still not quite there yet, which only highlights the scale of such projects.

Back-end focus

Another example of the importance of fundamental back-end changes brings us to Matchesfashion, which is perhaps the most remarkable of the top 30 when it comes to business transformation.

Matchesfashion has metamorphosed from its bricks-and-mortar roots into a leading multichannel player over the past five years by responding to its customers’ needs and investing accordingly, including in a new ecommerce platform.

Back-end changes, including the implementation of a Microsoft Dynamics NAV ERP system in 2016, have allowed it to scale its multichannel offer, while its partnership with Proximity Insight’s Dynamic Clienteling on in-store transactional iPads provides it with real-time data across its channels.

As a result, Matchesfashion now generates two thirds of its UK sales online, although as much as 50% of its business in store is done via the in-shop iPads.

While retailers in the top 30 have generally made strong headway with back-end technology investments, it is as much about organisational structure and culture as it is technical capability.

Many businesses are being held back by information not being shared across the organisation, while also misunderstanding the true value of the IT function in each department of the business.

As in-house skillsets continue to develop, it is becoming more fashionable for retailers to increase their in-house operations to ensure an agile model.

However, the experiences of many of the top-ranked retailers in this report show that there is still much value in collaborating with technology suppliers that can help them achieve a seamless integration between channels.

Key takeaways

- Customers need to have total visibility of stock, down to specific store level

- Get ahead by investing in technology that helps develop a single view of the customer

- A collaborative company culture and invested stakeholders are key to successful back-end development

"While retailers in the top 30 have generally made strong headway with back-end technology investments, it is as much about organisational structure and culture as it is technical capability"

Retailers offering online stock availability

| Retailer | Stock availability viewable online |

Stock availability viewable online for a specific store |

|---|---|---|

| All Saints | ✓ | |

| Argos | ✓ | ✓ |

| Better Bathrooms | ✓ | |

| Bravissimo | ✓ | |

| Crew Clothing | ✓ | |

| Dixons Carphone | ✓ | ✓ |

| Dune | ✓ | ✓ |

| Evans Cycles | ✓ | ✓ |

| Halfords | ✓ | ✓ |

| Hobbs | ✓ | ✓ |

| House of Fraser | ✓ | ✓ |

| Jessops | ✓ | ✓ |

| John Lewis | ✓ | |

| Kurt Geiger | ✓ | ✓ |

| Lakeland | ✓ | |

| Mamas & Papas | ✓ | ✓ |

| Maplin | ✓ | ✓ |

| Matchesfashion | ✓ | |

| Mint Velvet | ✓ | |

| Mothercare | ✓ | |

| Next | ✓ | |

| Office | ✓ | |

| Reiss | ✓ | |

| Schuh | ✓ | ✓ |

| Screwfix | ✓ | ✓ |

| Superdry | ✓ | |

| Ted Baker | ✓ | ✓ |

| The Entertainer | ✓ | ✓ |

| The White Company | ✓ | |

| Urban Outfitters | ✓ | ✓ |

Partner viewpoint: tech adoption

Today’s customers expect a seamless multichannel experience where they enjoy the same quality and tone of communication, brand feel and availability of products or services whether they’re online, on the phone or in store, writes Brother UK general sales manager Greig Millar.

Some will want to start transactions online and complete them in store, or view items in store before ordering them for home delivery.

This puts IT systems on the front line in terms of giving retailers an edge over their competition.

Many retailers are putting in place single integrated platforms that can connect every part of the business – online, mail order, phone and in store, so that nothing can fall through the cracks.

IN-STORE INNOVATION

Why in-store advancements and productivity are integral to generating sales in the modern-day physical retail environment.

Driving growth through ecommerce has remained a key focus for retailers in recent years – whether that’s introducing new delivery services or investing greatly in the online customer experience.

However, after years of rapid sales growth, the online channel is swiftly maturing, making it even more important for retailers to connect their offline and online channels.

Speak to any retailer and they’ll tell you how imperative the store is to their business. Even for the top 30 multichannel retailers identified in our ranking, online sales account for a third of total sales on average – meaning that the remaining chunk of sales needs to be driven through greater productivity in store.

Although like-for-like sales offer a good indication of the performance of a retailer’s stores, and online sales show the efficiency of its ecommerce operations, a multichannel business isn’t only online, it has stores too, making connectivity between all channels key for good performance.

Get connected

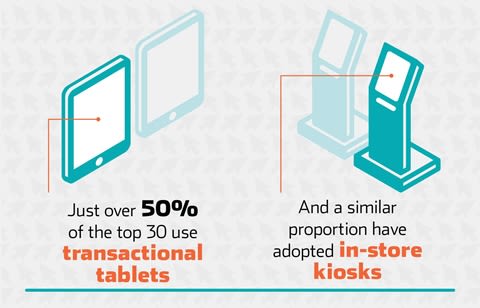

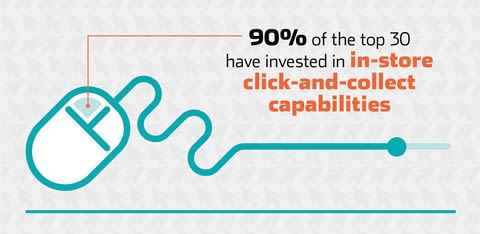

Many retailers are currently modernising their retail estate to support and connect their physical presence with their digital business. A key example is click-and-collect from stores, in which 90% of the top 30 have invested. It’s crucial for retailers to understand how they can use this to their advantage to drive additional spend and loyalty.

Evans Cycles – number five in our ranking – has put the store at the heart of its multichannel proposition. The retailer offers a click-and-collect service and in-store expert staff members, meaning that staff are able to drive additional purchases through knowledgeable advice at the point of collection.

The specialist cycle retailer was also an early adopter of using mobile technology in stores, rolling out iPads across its estate in 2013.

"Tablets enable customers to get their hands on products that are out of stock, as well as driving higher basket values by giving access to the entire online range – thus providing a crucial link between online and offline"

Tablets enable customers to get their hands on products that are out of stock, as well as driving higher basket values by giving access to the entire online range – thus providing a crucial link between online and offline.

About 50% of retailers in our top 30 use transactional tablets in stores, while 40% have in-store kiosks and terminals. Parent and baby specialist Mothercare proves this strategy can help boost productivity as more than 40% of its online sales were placed in store during its last financial year.

Innovation in this area has proven so popular with customers that Mothercare has taken things a step further by introducing a new consumer-finance package that can only be created on the devices – an approach that has helped to increase the average order value in stores.

Location, location, location

Investment in location technology such as beacons and geofencing (which uses GPS technology) shows that mobility is front of mind for many retailers.

In-store beacons can be used to detect customers’ smartphones and through the retailer’s app send them media such as exclusive offers and supplementary product information – an approach that Mothercare started trialling in 2016.

Beacon technology not only enhances a customer’s in-store experience but also allows retailers to collect information on those shoppers, including how they move through the store. This can then be used to improve productivity via clever merchandising and product placement.

Beacon technology can be used in store to connect with shoppers via the retailer’s app

Beacon technology can be used in store to connect with shoppers via the retailer’s app

John Lewis has this year rolled out its Partner app for store staff and increasing productivity is undoubtedly one of the main motivations behind it.

The app allows staff to check stock on their mobile devices without having to leave the customer.

The initiative helps the department store to deliver better customer service by responding instantly and accurately to customer queries – a similar experience to browsing online.

Dixons Carphone has reserved itself a front-row seat at the new tech table with the piloting of smartwatches that allow staff to check on stock, promotions and care plans.

A collaboration with Samsung Gear and TBS Mobility, the forward-thinking retailer says that it helps to bring products to life.

While our ranking proves that it’s crucial for any multichannel business to connect its online and offline operations, investment doesn’t come cheap.

B&Q has admitted that usage on its kiosks in smaller stores was low, while Schuh’s transactional kiosks are operated only by staff.

Dixons Carphone has partnered with Samsung Gear to pilot smartwatches for staff to check stock

Dixons Carphone has partnered with Samsung Gear to pilot smartwatches for staff to check stock

Despite our research finding that nearly half of the top 30 have installed in-store kiosks, there is undoubtedly still value in an assisted selling approach.

Instead of retailers just playing catch-up with the competition to remain relevant and drive productivity in a digital era, it is important for each to carefully consider the needs of their customer base to ensure the best return on investment.

Not only does the cost of implementation need to be considered, but store staff will also need to be trained to use the technology.

Key takeaways

- Bringing online customers into store by offering click-and-collect services can drive sales

- In-store technology can boost productivity

- Retailers must keep customer needs at the centre of any investment decisions – tech adoption should not be for the sake of it

How retailers are connecting the digital and physical

| Retailer | In-store kiosks | Transactional tablets |

Shop in store, delivery to home |

|---|---|---|---|

| All Saints | ✓ | ✓ | ✓ |

| Argos | ✓ | ✓ | |

| Better Bathrooms | ✓ | ||

| Bravissimo | |||

| Crew Clothing | ✓ | ||

| Dixons Carphone | ✓ | ✓ | ✓ |

| Dune | ✓ | ✓ | |

| Evans Cycles | ✓ | ✓ | |

| Halfords | ✓ | ✓ | |

| Hobbs | ✓ | ||

| House of Fraser | ✓ | ✓ | ✓ |

| Jessops | ✓ | ✓ | |

| John Lewis | ✓ | ✓ | ✓ |

| Kurt Geiger | |||

| Lakeland | ✓ | ||

| Mamas & Papas | |||

| Maplin | |||

| Matchesfashion | ✓ | ||

| Mint Velvet | ✓ | ||

| Mothercare | ✓ | ✓ | ✓ |

| Next | |||

| Office | ✓ | ✓ | |

| Reiss | ✓ | ✓ | |

| Schuh | ✓ | ✓ | |

| Screwfix | ✓ | ✓ | |

| Superdry | ✓ | ✓ | ✓ |

| Ted Baker | |||

| The Entertainer | ✓ | ✓ | |

| The White Company | ✓ | ||

| Urban Outfitters | ✓ |

Partner viewpoint: in-store advancements

Why do people visit retail stores? At one time, the answer was simple – to buy things, writes Brother UK senior client manager for sales Richard Titmuss.

But, in a world where it’s easy to order virtually anything you can find in the shops online and have it delivered to your door, often for the most competitive price available, what incentive remains to visit physical outlets? The answer is the experience.

Online shopping doesn’t yet have an equivalent to trying on a piece of clothing, playing with the user interface of a device or tasting a sample of food before deciding to make a purchase – no matter how immersive the online marketing, it can never really replicate these experiences.

TURBO-CHARGED FULFILMENT

From 90-minute and same-day deliveries, to time slots and click-and-collect, an attractive – and speedy – fulfilment proposition will keep customers loyal.

A strong fulfilment offer is integral for any multichannel retailer. However, consumers’ rising demand for convenience, along with depleted sales in the challenging trading conditions, has narrowed margins and retailers need to be realistic about the fulfilment features that prove cost efficient and those that can be ignored.

For retailers without a single view of stock and a deep understanding of their supply chain network, offering fundamental fulfilment services such as click-and-collect, order tracking and time-slot delivery services can become a logistical and financial nightmare.

Argos – this year’s top-ranked multichannel retailer – has led the way in fulfilment, supported by early investment in its stocking and digital systems.

Argos was an early adopter of innovation in stocking and digital systems, leading the way in multichannel retailing

Argos was an early adopter of innovation in stocking and digital systems, leading the way in multichannel retailing

It developed a ‘hub-and-spoke’ distribution model, where smaller stores are replenished twice a day from nearby larger ‘hub’ stores – effectively creating a network of mini fulfilment centres.

This infrastructure also formed the basis for the launch of its in-house Fast Track delivery service in 2015, which allows it to make same-day deliveries.

Managing the supply chain

While there are few others that have gone to the extent of setting up their own delivery network, retailers are continuing to invest in technology and infrastructure that helps them better manage and support their supply chain and extend their fulfilment options.

Leading the way, multichannel footwear retailer Schuh was one of the first in the sector to develop its own warehouse management system – Shark.

This gives it a single view of stock and allows it to easily move stock to whichever store is having the most success with a particular line. Shark also enables Schuh to fulfil online orders from its stores – a key capability when compiling our ranking.

Toy specialist The Entertainer is another example of a smaller retailer that invested in its multichannel capabilities at an early stage.

It spent time integrating its online business, physical stores and supply chain ahead of the launch of a 90-minute delivery service in partnership with Shutl in 2013. Four years later, this remains a leading proposition in the toy sector.

"For retailers without a single view of stock and a deep understanding of their supply chain network, offering fundamental fulfilment services such as click-and-collect, order tracking and time-slot delivery services can become a logistical and financial nightmare"

The need for speed

Our research shows that 90-minute deliveries are only offered by four of the top 30 multichannel retailers – The Entertainer, Maplin, Schuh and Matchesfashion.

However, this is becoming a major battleground, with grocers such as Tesco and Sainsbury’s currently trialling speedy delivery services in the London area.

Same-day deliveries are offered by just under a third of the top 30 retailers, while a similar number of retailers offer click-and-collect through third-party fulfilment providers such as Collect+ and Doddle.

Third-party fulfilment provider Doddle is popular with retailers that do not have an extensive nationwide presence

Third-party fulfilment provider Doddle is popular with retailers that do not have an extensive nationwide presence

Doddle is of particular interest to retailers that don’t have an extensive nationwide presence, such as Evans Cycles, Lakeland and Mamas & Papas.

Additionally, in an era where the role of physical stores has shifted from transactional to experiential, click-and-collect serves another function by drawing shoppers into stores, which provides the opportunity to boost impulse buys.

This shift makes it clear why so few retailers offer locker services and would rather provide in-store collection (although a lack of third-party providers currently offering lockers to retailers is also a factor).

Of the top 30, only Superdry offers collections via lockers, but some 90% offer a click-and-collect service from store.

This isn’t to say that click-and-collect is the holy grail of enhanced fulfilment and increased productivity, for some retailers have become victims of their success with this approach.

John Lewis’ click-and-collect orders are fulfilled from its distribution centres rather than store stock and in order to reduce costs it began charging £2 for click-and-collect orders under £30 from 2015.

While the charge did not have a significant negative impact on demand for the service – click-and-collect accounted for just over 50% of all online sales at John Lewis last year – it is notable that not many retailers have been brave enough to follow in its footsteps.

Consumer expectations regarding fulfilment are constantly on the rise and speed and efficiency are more important than ever to ensure that shoppers have a positive customer experience.

Many of the UK’s leading multichannel retailers have realised that fulfilment capabilities have the ability to powerfully drive brand loyalty.

By investing in new technologies and partnering with the right third-party suppliers, retailers will not only open up new avenues for growth, but also make the business more margin-efficient.

Key takeaways

- Fundamental fulfilment services rely on a single view of stock and deep understanding of the supply chain network

- Consumer expectations continue to rise as delivery times fall; same-day delivery is good but 90-minute delivery should be the aim

- Both in-house warehouse management systems and third-party suppliers can significantly enhance fulfilment capabilities

"Many of the UK’s leading multichannel retailers have realised that fulfilment capabilities have the ability to powerfully drive brand loyalty"

The top 30 multichannel retailers leading the pack in fulfilment

| Retailer |

Delivery in 90

minutes or less |

Same-day

delivery |

Next-day

delivery |

Time-slot

deliveries |

Click-and-collect

via third party |

Click-and-collect

lockers |

|---|---|---|---|---|---|---|

| All Saints | ✓ | |||||

| Argos | ✓ | ✓ | ✓ | |||

| Better Bathrooms | ✓ | |||||

| Bravissimo | ✓ | |||||

| Crew Clothing | ✓ | |||||

| Dixons Carphone | ✓ | ✓ | ✓ | |||

| Dune | ✓ | ✓ | ||||

| Evans Cycles | ✓ | ✓ | ||||

| Halfords | ✓ | ✓ | ||||

| Hobbs | ✓ | ✓ | ||||

| House of Fraser | ✓ | ✓ | ✓ | |||

| Jessops | ✓ | |||||

| John Lewis | ✓ | ✓ | ✓ | |||

| Kurt Geiger | ✓ | |||||

| Lakeland | ✓ | ✓ | ||||

| Mamas & Papas | ✓ | ✓ | ||||

| Maplin | ✓ | ✓ | ✓ | ✓ | ||

| Matchesfashion | ✓ | ✓ | ✓ | ✓ | ||

| Mint Velvet | ✓ | |||||

| Mothercare | ✓ | |||||

| Next | ✓ | ✓ | ||||

| Office | ✓ | |||||

| Reiss | ✓ | ✓ | ||||

| Schuh | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Screwfix | ✓ | |||||

| Superdry | ✓ | ✓ | ✓ | |||

| Ted Baker | ✓ | |||||

| The Entertainer | ✓ | ✓ | ✓ | |||

| The White Company | ✓ | ✓ | ||||

| Urban Outfitters | ✓ |

PARTNER MESSAGE

This report provides a fascinating insight into the evolution of multichannel retail, and the key battlegrounds in the fight for wallet spend.

Phil Jones, managing director, Brother UK

"By being agile and keeping customer need as the primary justification for any tech adoption, retailers in all sectors are forging ahead and driving cross-channel revenue"

We’re in the midst of an arms race in which the immediacy of bricks-and-mortar stores being made available to online shoppers has taken centre stage.

A significant proportion of retailers now offer same-day delivery and some even provide limited 90-minute delivery services.

Simultaneously, the in-store experience is evolving to offer shoppers services previously only available online, such as instant stock availability checks, product reviews and other in-store location-based services.

The fuel driving retailers to go toe-to-toe on all of these fronts is the same as it always has been – the need and desire to give the customer what they want.

Retailers nailing this challenge are doing so by analysing the latest technologies, identifying those that best support their customers and joining forces with the right partners to deliver seamless integration.

By being agile and keeping customer need as the primary justification for any tech adoption, retailers in all sectors are forging ahead and driving cross-channel revenue.

Establishing a foothold and then gaining ground in what is already a fierce multichannel landscape relies on the ability to remain flexible and keep up with rapidly increasing consumer expectation.

Failure to do so leaves retailers at risk of becoming irrelevant and sets a path toward unprofitability.

We at Brother thank Retail Week for its help in uncovering the secrets of the UK’s top multichannel retailers and look forward in excitement to further innovations on the journey to true cross-channel shopping.

The top 30 multichannel retailers

The big hitters mastering seamless cross-channel retail

Written by Philip Wiggenraad, Rebecca Marks,

Nick Found and Ryan Doherty

Powered by Retail Week Prospect

Produced by Dan Harder and Emily Kearns

In partnership with Brother