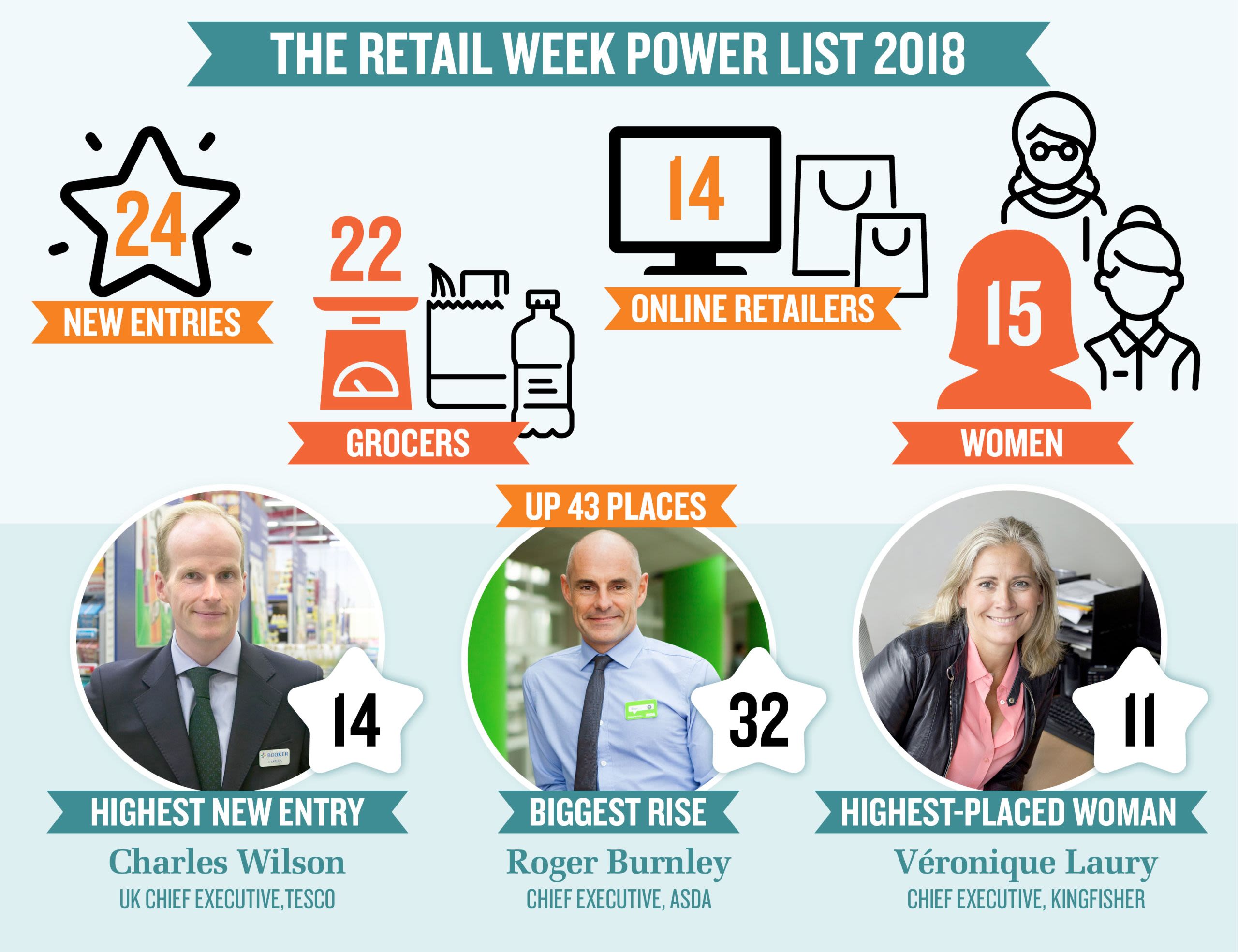

The Power List 2018

The Retail Week Power List 2018 reveals the 100 most influential people in retail

Customers are “divinely discontent”, Amazon founder Jeff Bezos wrote in his letter to shareholders this year.

“Their expectations are never static – they go up… People have a voracious appetite for a better way, and yesterday’s ‘wow’ quickly becomes today’s ‘ordinary’.”

The retailers at the top of this year’s Power List are working hard to provide customers with ‘wow’ experiences.

Be it the ability to take a photo of a dress you like, find it on Asos and have it delivered to your home the very same day, or go into John Lewis’ new Westfield store to have a beauty treatment, or learn how to transform your house into a smart home – these experiences all have the ‘wow’ factor.

"The retailers at the top of this year’s Power List are working hard to provide customers with ‘wow’ experiences"

Retail has delivered many extraordinary customer experiences over the past year, and there have been plenty of ‘wow’ moments for the business community too. None more so than the unveiling of the jaw-dropping merger between Sainsbury’s and Asda.

If it goes ahead, the new grocery supergroup will eclipse Tesco to become the UK’s largest retailer and Sainsbury’s boss Mike Coupe promises prices will be 10% lower across both businesses.

The market is tough for retail, that goes without saying, but the retailers that strive to deliver that ‘wow’ – for consumers and investors – will not just survive but thrive.

We congratulate all of this year’s Power List and their efforts to surprise and delight the “divinely discontent” consumer.

Highest risers in the Retail Week Power List 2018

| Name | Job title and company | Rise | This year | Last year |

|---|---|---|---|---|

| Roger Burnley | Chief executive, Asda | 43 | 32 | 75 |

| Richard Pennycook |

Chairman, British Retail Consortium,

The Hut Group, Fenwick, Howdens Joinery |

21 | 30 | 51 |

| Business rates | 19 | 25 | 44 | |

|

Mahmud Kamani

and Carole Kane |

Joint chief executives, Boohoo | 17 | 31 | 48 |

| Jill McDonald |

Managing director for clothing, home and beauty,

Marks & Spencer |

13 | 71 | 84 |

| The administrators | 11 | 60 | 71 | |

| Rowan Gormley | Chief executive, Majestic Wine | 11 | 85 | 96 |

| Nick Beighton | Chief executive, Asos | 10 | 4 | 14 |

| Paul McGowan |

Chairman, HMV, and executive chairman,

Hilco Capital |

10 | 49 | 59 |

| Michael Ward | Managing director, Harrods | 10 | 45 | 55 |

Biggest fallers in the Retail Week Power List 2018

| Name | Job title and company | Fall | This year | Last year |

|---|---|---|---|---|

| Seb James |

Incoming senior vice president, Walgreens Boots Alliance,

and president and managing director, Boots |

17 | 19 | 2 |

| Ian Filby | Outgoing chief executive, DFS, and incoming chairman, Joules | 15 | 64 | 49 |

| Andy Bond | Chief executive, Pepkor Europe | 11 | 40 | 29 |

| Rob Collins | Managing director, Waitrose | 8 | 36 | 28 |

| Sir Philip Green | Owner, Arcadia Group | 7 | 37 | 30 |

| Lord Rose | Chairman, Ocado and Fat Face | 6 | 56 | 50 |

| David Tyler | Chair, Sainsbury’s, and chairman, Hammerson | 6 | 72 | 66 |

| Wilf Walsh | Chief executive, Carpetright | 6 | 95 | 89 |

Retail Week ones to watch

| Name | Job title and company |

|---|---|

| Richard Walker | Managing director, The Food Warehouse |

| Clare Askem | Managing director, Habitat |

| Henry Birch | Chief executive, Shop Direct |

| Tracey Clements | Managing director, convenience, and chief executive, One Stop, Tesco |

| Ben Francis | Founder, Gymshark |

| Stuart Machin | Food managing director, M&S |

| Tarak Ramzan | Chief executive, Quiz |

| Daniela Rinaldi and Manju Malhotra | Joint chief operating officers, Harvey Nichols |

| Liam Rowley | Head of strategic investments, Sports Direct |

| Susan Saideman | Head of fashion, Amazon Europe |

| Richard Walker | Managing director, The Food Warehouse |

1-10

1. Jeff Bezos

- Chief executive, Amazon

- Last year: 1

Amazon’s legendary leader, Jeff Bezos, holds the top spot as the most powerful person in UK retail.

From the etail powerhouse’s Seattle headquarters, Bezos has wielded unparalleled influence over UK and global retail though dramatic initiatives such Amazon’s $13.7bn (£10.7bn) acquisition of Whole Foods in June last year.

Amazon has long been heralded as the business that would kill offline retail. The Whole Foods deal – and the hefty price tag that came with it – demonstrated the scale of Bezos’ ambitions in bricks and mortar as well as online retail.

The acquisition has led to Whole Foods’ prices of daily essentials being cut dramatically, as well as its stores – including in the UK – doubling as a collection point for Amazon orders.

While the tie-up is still in its early days, there can be no doubt that it signals Bezos’ hunger to further disrupt grocery. Landmark retail deals that have followed, such as Sainsbury’s proposed merger with Asda, are in part defensive as Amazon’s power grows.

Bezos’ ambitions for the UK have not diminished. Last July, the online Goliath opened a new 600,000 sq ft London headquarters in Shoreditch. It has also increased the number of tech roles in its development centres in Cambridge, Edinburgh and London to 1,500, with a specific focus on developing voice-recognition and drone capabilities.

In-store tech

Amazon is also expanding its innovative Go store format in the US. Go allows shoppers to pick up items and leave without physically paying in store – customers are tracked and their Amazon account is charged.

While Go has yet to land on UK shores, it has clearly had an impact on the domestic grocery players. Retailers ranging from Tesco to Sainsbury’s and Waitrose are among those that have been experimenting with mobile-based scanning and checkout tech in the past year.

In his annual letter to shareholders in April, Bezos said that Amazon customers and shoppers in general are “divinely discontent” and that he thrived on trying to meet and exceed their expectations.

That tireless hunger for customer-focused innovation means Bezos keeps the top spot on this year’s list.

"The Whole Foods deal demonstrated the scale of Bezos’ ambitions in bricks and mortar as well as online retail"

2. Dave Lewis

- Chief executive, Tesco

- Last year: 3

Tesco chief executive Dave Lewis moves up the list after overseeing a stellar year at Britain’s biggest retailer.

The supermarket giant registered a 28.4% increase in full-year operating profit to £1.64bn – and stretched its run of sales growth in its core UK market to 10 consecutive quarters.

Having successfully stabilised Tesco during four impressive years at the helm, Lewis’ turnaround plan has entered a crucial new phase as the retailer is firmly on the front foot once again.

In the past year Tesco has innovated in product by introducing further exclusive lines such as the Wicked Kitchen vegan range, rolled out same-day deliveries nationwide, brought in its Tesco Pay+ payment app and piloted shop-in-shop tie-ups with new partners including Next.

Perhaps most crucially, though, Lewis and his senior team have convinced Tesco shareholders to vote in favour of the £3.7bn Booker acquisition, despite dissension among some investors.

The deal was only completed in March, but the enlarged business is already piloting professional catering fascia Chef Central in larger Tesco stores and selling bigger pack sizes to more traditional Tesco shoppers.

Lewis faces another crucial 12 months as he attempts to further integrate the two businesses, but the shrewd appointment of Booker boss Charles Wilson as the group’s UK and Ireland supremo will bolster those efforts.

"Lewis’ turnaround plan has entered a crucial new phase"

3. Mike Coupe

- Chief executive, Sainsbury’s

- Last year: 4

It is not just the proposed merger with Asda that Sainsbury’s boss Mike Coupe has to sing about after moving up the list this year.

The deal, assuming it goes ahead, will reshape UK retail and create a grocery business bigger than Tesco that could potentially take on Amazon.

Coupe has consistently applied a bold and forward-thinking approach in his time at the helm of Sainsbury’s, as previously evidenced by the acquisition of Argos.

During a fruitful 12 months Sainsbury’s has also tested checkout-free payments, piloted a 30-minute click-and-collect service, invested heavily in price and acquired its long-term loyalty partner Nectar – later revamping the scheme in a bid to “redefine loyalty”.

It hasn’t all been plain sailing, though. Coupe has been forced into some tough decisions, axing 2,000 jobs last October and putting thousands more shopfloor roles at risk earlier this year amid a store “reset” programme.

He has found time to speak up on behalf of the industry too, urging the government to provide greater clarity on Britain’s exit from the EU.

That is bound to create further challenges but, if the past year is anything to go by, Sainsbury’s is in safe hands to overcome them.

"Coupe has consistently applied a bold and forward-thinking approach"

4. Nick Beighton

- Chief executive, Asos

- Last year: 14

Asos boss Nick Beighton shoots up the list this year, climbing 10 places to take the highest spot of any fashion retailer.

Beighton, who took over as chief executive from Asos founder Nick Robertson in 2015 following a stint as chief financial officer, has managed to supercharge Asos’ growth and give the already pre-eminent business a new direction.

His work on making Asos a digital superpower led to him being named Clarity Retail Leader of the Year at the Retail Week Awards this year.

The etailer is investing heavily in technologies such as artificial intelligence (AI), augmented reality (AR) and virtual reality (VR), and its efforts are being rewarded – interim pre-tax profits rose 10% with sales ahead by 27%.

Beighton has also played a prominent role in arguing the case for ethically responsible business and is a member of the Government’s new Retail Sector Council.

"Beighton has managed to supercharge Asos’ growth and give the already pre-eminent business a new direction"

5. Paul Marchant

- Chief executive, Primark

- Last year: 7

Primark chief executive Paul Marchant moves up the list as the value fashion giant continues to turn in an impressive performance.

While Asos’s Nick Beighton rises up the list thanks to digital prowess, at the opposite end of the scale Marchant has managed to take the resolutely offline Primark to ever greater heights.

Primark is trying to crack the US and appears to be achieving some success – it told Retail Week that like-for-like sales in the country rose 20% in the past year – in a market where many UK retailers have had to quit and return to Britain with their tails between their legs.

In other international markets Primark is also going from strength to strength and in the UK the retailer has boasted positive like-for-likes – an outstanding achievement at a time when bricks-and-mortar sales are falling and many are vying to ditch stores via CVAs.

"Marchant has managed to take the resolutely offline Primark to ever greater heights"

6. David Potts

- Chief executive, Morrisons

- Last year: 11

In his own words, David Potts has got Morrisons “firing on all cylinders” once again and after another impressive year few would argue with him.

The Bradford-based grocer has continued sales momentum at its core supermarket business, with its The Best premium, Wonky fruit and vegetables, and Savers entry-level ranges all gaining traction among shoppers.

And Morrisons has rapidly grown its burgeoning wholesale arm, adding supply deals with McColl’s and Sandpiper to its existing agreement with Amazon as it pursues “capital-light” revenue streams.

The grocer’s Nutmeg clothing brand – which it launched online this year – is also growing at pace as Potts continues to transform Morrisons into an increasingly competent competitor versus its big-four rivals.

"David Potts has got Morrisons ‘firing on all cylinders’ once again"

7. Brexit

- Last year: 5

Although the profound consequences of the UK’s divorce from the EU are yet to be truly known, Brexit’s formidable force has already reverberated throughout the retail sector.

The pain of a weaker sterling has, as most hedging agreements expire, hit many retailers and driven a rise in sourcing costs.

However, the Armageddon many were expecting has failed to materialise and the UK has not plunged into recession as some expected.

Wages rose at an annual rate of 2.9% during the first quarter of the year, while the UK’s unemployment rate remained at its joint lowest level since 1975.

As much as the weak pound has knocked retailers such as Wilko and Poundworld, others such as B&M, The Range and discount grocers Aldi and Lidl have reaped the benefits of catering for more cautious consumers.

Brexit will bring winners and losers. For now it remains, for many, a source of uncertainty and the catalyst for transformation.

"Brexit’s formidable force has already reverberated through the retail sector"

8. Peter Cowgill

- Executive chairman, JD Sports

- Last year: 12

JD Sports boss Peter Cowgill climbs the ranks into the top 10 this year as the sports fashion retailer posted another year of exceptional sales and profit growth.

Cowgill has used a combination of canny acquisitions in local markets – such as Finish Line in the US and Hot-T in South Korea – and an openness to the benefits of mobile technology to drive JD Sports’ brand recognition and sales.

The retailer launches an app for every country in which it operates, with localised deals and offers. Its prowess is such that its UK app was the most downloaded retail app during Black Friday last year.

In a sector rife with disruption, Cowgill has established himself as a safe pair of hands for some of the world’s most in-demand brands – and demanding customers.

"Cowgill has established himself as a safe pair of hands for some of the world’s most in-demand brands"

9. Alex Baldock

- Chief executive, Dixons Carphone

- Last year: 9

Alex Baldock took on one of retail’s biggest jobs this year, when he left Shop Direct for Dixons Carphone.

Baldock was credited with rescuing Shop Direct and transforming it into an ecommerce pioneer.

He exited in October after delivering the etailer’s fifth consecutive year of rising sales and profits – but the etailer’s failure to find a buyer did dull the shine of this victory somewhat.

However, his turnaround caught the eye of the Dixons Carphone board, which hired him to lead the business as it battles a stagnant mobile market.

It’s early days in his new role but Baldock has already made his mark with a radical restructure of the electricals retailer’s top team, his scathing critique of its previous management and decision to close almost 100 Carphone Warehouse shops.

"Baldock was credited with rescuing Shop Direct and transforming it into an ecommerce pioneer"

10. Sir Charlie Mayfield

- Chairman, John Lewis Partnership

- Last year: 8

John Lewis Partnership chairman Sir Charlie Mayfield has slipped down this year’s list.

The retail veteran is as respected as ever among those in the industry but has not had a vintage year.

John Lewis Partnership awarded partners the lowest bonus since 1954 as its full-year profits tanked, dropping 77% thanks to margin pressure at grocery arm Waitrose, along with the need to make vital investments to futureproof the business.

However, Mayfield, who has been John Lewis chairman since 2007, is extremely well-placed to guide the partnership through its troubles, having already helped it weather the financial crisis.

At the partnership’s full-year results in March, Mayfield thundered that the current climate was “absolutely no time for a defensive crouch” and that this year would bring an increased pace of innovation. History has shown that he’s not a man to bet against.

"The retail veteran is as respected as ever among those in the industry but has not had a vintage year"

11-30

11. Véronique Laury

- Chief executive, Kingfisher

- Last year: 13

Véronique Laury, chief executive of DIY powerhouse Kingfisher, rises up the list this year.

The five-year transformation plan that Laury implemented almost three years ago – One Kingfisher – still has its critics and some think that Kingfisher seems to be in a never-ending state of transformation.

However, Laury has a clear eye on the future. Thinking outside the (big) box, she has begun to share her vision for the future of DIY shops.

As urbanisation continues and DIY migrates online, shops will shrink and be located in city centre locations, also becoming hubs for advice and services such as rentals, she predicts.

12. Lord Wolfson

- Chief executive, Next

- Last year: 10

It has been an up-and-down year for Next chief executive Lord Wolfson, who has nevertheless navigated some of the retailer’s difficulties with success.

At its results in January, Wolfson said 2017 had been “in many ways the most challenging year we have faced for 25 years” but that the “uncomfortable” period had “prompted us to take a fresh look at almost everything we do”.

Next has brought renewed focus to its product, is improving the retail experience in stores with the introduction of complementary concessions and has made improvements to its website, which had fallen behind best-in-class rivals.

The strategy seems to be working. Wolfson upped Next’s full-year profit forecast after a stellar first quarter when full-price sales climbed 6% and online sales surged 18.1%.

13. Steve Rowe

- Chief executive, Marks & Spencer

- Last year: 15

Marks & Spencer chief executive Steve Rowe has shown grit in his efforts to turn around the venerable retail name.

Rowe aims to fully haul M&S into the 21st century by creating a ‘digital first’ organisation, complemented by strengthened retail basics such as lower prices and better availability.

To do that he has restructured his top team – former marketing supremo Patrick Bousquet-Chavanne is among the departures, and ex-Target Australia and Steinhoff boss Stuart Machin has joined to run the food arm.

M&S’ once-outperforming food business has slowed down and restoring its fortunes is now another item on Rowe’s to-do list under the formidable scrutiny of M&S chairman Archie Norman.

Norman is thought to be taking a highly hands-on approach to his role, but he and Rowe apparently hold each other in high regard.

At last year’s interim results Norman said: “One of the things that has been important is that I have figured out somebody has been going around this business grasping a few nettles and slaughtering a few sacred cows, and that has been Steve.”

There is still a lot of work to do. M&S pre-tax profits nosedived 62% in its year to March 31 as costs associated with its store-closure programme hit the bottom line.

14. Charles Wilson

- UK chief executive, Tesco

- NEW ENTRY

New Tesco UK boss Charles Wilson catapults into the rankings following the grocer’s tie-up with Booker.

Wilson, who was chief executive of the wholesaler, has long been admired in UK retail and bringing his expertise to the grocer was viewed by many as a significant coup of Tesco’s £3.7bn deal to buy Booker.

Wilson, a former M&S and Arcadia executive, took the helm at Booker in 2005 when it was in dire straits after its merger with Iceland turned sour.

He transformed the business. He demerged it from Iceland, listed on the Stock Exchange, purchased rival Makro’s UK cash-and-carry operations and snapped up the Londis and Budgens convenience chains.

All of that caught the eye of Tesco. The merger between the two – the UK’s biggest grocer and the UK’s biggest wholesaler – completed earlier this year and Wilson was appointed Matt Davies’ successor as Tesco UK and Ireland boss.

He is now widely regarded as the heir apparent to Tesco boss Dave Lewis whenever he chooses to leave the grocer.

15. John Rogers

- Chief executive, Sainsbury’s Argos

- Last year: 16

John Rogers’ empire has changed beyond recognition since the melding of Sainsbury’s and Argos in late 2016.

The market-leading general merchandise giant has more than 800 stores, 191 of which are now in Sainsbury’s branches.

But that is just the beginning of Argos’ life within supermarket walls. If the proposed merger of Sainsbury’s and Asda goes ahead, Argos could go into 250 Asda stores too, representing a huge growth opportunity.

Sainsbury’s believes that £500m synergies will be created each year through buying benefits and the opening of new Argos branches inside Asda stores.

The expanded presence should work well for Argos. Rogers said at Retail Week Live that, while 60% of its sales are generated online, 81% of all Argos sales continue to be fulfilled via store as click-and-collect becomes ever more popular.

Some retail watchers argue that Asda may even be a better match for Argos, given its complementary customer base.

As the store roll-out continues apace – and shoppers become more accustomed to seeing Argos in their supermarkets – the general merchandise giant looks set to conquer UK retail.

16. Paula Nickolds

- Managing director, John Lewis

- Last year: 17

Paula Nickolds became one of the most powerful individuals in UK retail when she took the reins at John Lewis last year.

But Nickolds – who worked her way up from graduate trainee at the department store – has taken over during a difficult time for John Lewis and the high street as a whole.

She has managed the challenging environment well and John Lewis like-for-likes inched up 0.4% in its last financial year, while operating profit before exceptionals rose 4.5% to £254.2m.

Nickolds has helped spearhead innovation and investment at John Lewis this year. That investment is ploughed into initiatives such as two-hour delivery slots and online order tracking, which should help maintain John Lewis’ position as the leader in omnichannel retail – 45% of its sales are generated online, which is among the highest in UK retail.

Her other major focus is “creating experiences” and many retailers are looking to John Lewis to define great in-store experience.

Its Oxford and Westfield London stores – both of which opened over the past year – are designed to be places to “shop, do and learn”, with concierge desks that promote a range of in-store services such as beauty bars, personal styling and a tech training room.

17. Steve Murrells

- Chief executive, The Co-operative Group

- Last year: 20

The Co-op boss Steve Murrells continues to power up the list as the mutual’s revival marches on under his leadership.

The former Tesco executive, who led The Co-op’s food business for almost five years, became group chief executive last year and has helped the business return to profit.

Pre-tax profit recovered to £72m in the 12 months to March 31, compared with a £132m loss the previous year.

The food business drove growth as the grocer refocused on its traditional values, such as involvement in local communities and ethical foundations.

In an acquisitive grocery market The Co-op has been no slouch, snapping up Nisa earlier this year. It has also struck a deal to supply Costcutter’s 2,200 c-stores.

Expect more action in this area. Murrells plans to get Co-op products and services to more homes through “smart partnering and acquisitions” going forward. Watch this space.

18. Tim Steiner

- Chief executive, Ocado

- Last year: 21

Ocado boss Tim Steiner jumps up the list after he made good on his promise to turn the business into a major technology platform.

Until 12 months ago, Ocado’s tech tie-ups with both an unnamed “European retailer” and Dobbies Garden Centres had left investors underwhelmed – but it’s a different story this year.

Deals with big names such as French grocer Casino, Canada’s second-largest supermarket Sobeys and Sweden’s ICA have quietened the critics, but its landmark tie-up with US giant Kroger has really made the industry sit up and take notice.

Ocado’s share price surged 80% after it signed the deal, which will involve it opening 20 warehouses for Kroger across the US over the next three years.

Ocado’s technology nous may be the future growth driver of the business, but ongoing investments are taking a toll on profits.

After posting flat full-year profits last year, it warned 2018 earnings would be hampered by these investments.

But, with promises that EBITDA would “improve significantly” in 2019 through growth in its own retail business as well as licence fees from its new international partners, the future is looking bright for Ocado and its determined boss.

19. Seb James

- Incoming senior vice-president, Walgreens Boots Alliance, and president and managing director, Boots

- Last year: 2

It’s quite a plummet down the Power List for Seb James, who jumped ship from Dixons Carphone to Boots this year.

James exited Dixons Carphone at a low ebb in what had generally been a triumphant six years at the helm.

The pinnacle of his time in charge was the £3.8bn merger of Dixons and Carphone Warehouse in 2014, but the retailer has found life tougher of late.

New Dixons Carphone boss Alex Baldock has slammed his predecessor for an underinvestment in colleagues and customer service, and an “uneven” execution of the Dixons and Carphone merger.

However, the indefatigable James remains highly thought of and is moving to one of retail’s most venerable names.

He joins at a difficult time for the health and beauty stalwart. Like-for-likes fell last quarter in what Boots called a “challenging marketplace”.

The effervescent James’ energy and ideas are likely to help Boots navigate the stormy waters.

20. Christian Hartnagel

- UK chief executive, Lidl

- Last year: 22

Christian Hartnagel, one of the youngest chief executives in UK retail at just 35 years old, rises up the list this year as Lidl’s phenomenal growth story in the UK continues.

Over the past year the discounter overtook Waitrose to become the country’s seventh-biggest grocer and now holds a 5.4% market share.

Hartnagel, who took over from Lidl lifer Ronny Gottschlich in 2016, said last July that he intended to double the retailer’s UK store openings to between 50 and 60 a year.

This is the “fastest ever” opening rate in the UK and the retailer is devoting £1.5bn to the cause.

However, this investment is taking its toll on Lidl’s bottom line and Hartnagel warned that profits would be lower this year.

It could be short-term pain for long-term gain as the German discounter has the big four in its sights.

21. Doug Gurr

- UK country manager, Amazon

- Last year: 26

Doug Gurr once again climbs the list as Amazon’s UK business continues to expand.

The might of Amazon looms large over everyone in UK retail. Rivals are increasingly focusing on doing what they think Amazon can’t rather than trying to beat the online juggernaut at its own game.

Under Gurr’s leadership, Amazon’s relentless expansion has continued. It opened a new London headquarters in trendy Shoreditch last year and doubled the number of research and development roles there to 900.

The scale of its growth is evident in how much warehouse space it is taking. According to research from Savills, the etailer snapped up 4 million sq ft of distribution centre space across the UK last year – five times as much as Lidl, the next retailer on the list.

The centres will help the etailer expand its product selection and supercharge growth.

Gurr is also a member of the Government’s new Retail Sector Council.

22. Simon Arora

- Chief executive, B&M

- Last year: 24

During a volatile time for the UK value sector, B&M – the business that Simon Arora bought back in 2004 – goes from strength to strength.

B&M profits surged 25% to £229.3m in the 53 weeks to March 31 as sales advanced 22%.

Consumer appetite for B&M seems insatiable at the moment and Arora is determined to satisfy it.

At a time when rivals such as Poundworld are seeking to shut stores, B&M is opening them at a rate of knots. It opened 39 new shops last year and will add at least 45 to its portfolio in its current financial year.

A major growth driver for B&M has been food. Arora cannily snapped up value grocer Heron Foods last year for £152m and the food chain delivered an “excellent” performance, generating £11.7m EBITDA in the eight months B&M has owned it.

Arora has also introduced frozen and chilled foods into 72 B&M stores so far and is plotting expansion in the Southeast for Heron.

Aldi and Lidl aren’t the only value grocers the big four need to worry about.

23. Mike Ashley

- Chief executive, Sports Direct

- Last year: 23

Mike Ashley stays static at 23 after a mixed year for the king of value sportswear.

Controversy seems to follow Ashley around and this year was no different as his working practices were aired in a high court battle with former advisor Jeff Blue.

On the financial front, Sports Direct had a poor year. Profits plummeted nearly 60% and the bad run continued into its current year as pre-tax profits slumped 67.3% in the half year to October 29.

However, Ashley continues to roll the dice and gamble on other retail business.

Over the year, he upped his stake in Debenhams to 29.7% – just below the threshold that would trigger a formal takeover bid – snapped up a 27% stake in French Connection and a 26% holding in Game.

He also still holds an 11.1% stake in House of Fraser.

Ashley is on his way to owning a fair chunk of the UK high street.

24. Ray Kelvin

- Chief executive, Ted Baker

- Last year: 25

Ted Baker boss Ray Kelvin can seemingly do no wrong. The charismatic chief executive continues to smash expectations both home and abroad.

In its last financial year, Ted Baker posted a 12.3% rise in pre-tax profit to £68.8m, as sales continue to rocket.

Ted Baker is now a poster boy for UK retail overseas and is as popular in Shanghai as San Francisco.

Kelvin knows brand is everything and is rigorous in maintaining Ted Baker’s unique aesthetic and tone of voice.

In fact, he makes sure everything is done in the way that Ted – the fictional character around whom the brand is built – desires.

25. Business rates

- Last year: 44

The burden of business rates is not going anywhere soon.

For some retailers the rates bill outweighs rent and critics believe that creates an unfair playing field, giving online retailers an unjust boost.

As many retailers seek to offload stores as costs climb, calls for the Government to take definitive action on business rates are growing louder.

Debenhams chairman Ian Cheshire is part of the chorus. He warned earlier this year that town centre property costs are “killing more and more retailers” and urged reform of rates.

As the cross-party Housing, Communities and Local Government Committee undertakes another inquiry into the future of the high street, retailers will be lobbying to make sure rates reform is considered.

26. Giles Hurley

- UK and Ireland chief executive, Aldi

- NEW ENTRY

Giles Hurley replaced Aldi UK boss Matthew Barnes in May this year and his new role catapults him into this year’s list.

Despite only being in his early forties, Hurley is an Aldi veteran, with 18 years under his belt at the discounter.

Hurley worked his way up from the shopfloor and his experience should put him in good stead as he seeks to continue Aldi’s growth in the UK.

Hurley previously ran Aldi’s Irish business but has taken on a far bigger beast as UK boss. Aldi already has more than 760 UK stores and aims to have 1,000 by 2022.

All eyes will be on Hurley to see if he can continue Aldi’s good run.

27. Archie Norman

- Chairman, Marks & Spencer

- NEW ENTRY

When he took to the stage for the first time at Marks & Spencer’s interim results late last year, Archie Norman made it clear that he would not be a passive observer of M&S’ turnaround.

Norman, famous for the rescue of Asda, described how he had been “opening cupboards and looking under the carpets” and discovered a business that had failed to change with customers.

He said recognition of “the unvarnished truth” about where M&S found itself would be the starting point for its turnaround and paid tribute to the efforts made by chief executive Steve Rowe.

Norman is so ubiquitous and can be so unsettling in his challenges that he is nicknamed Snape, after the wizard in the Harry Potter series. The hope is that he will work some magic at M&S.

28. The CVA

- NEW ENTRY

This has been the year of the company voluntary arrangement (CVA). Just six months in and already House of Fraser, New Look, Carpetright, Poundworld, Mothercare and Select have turned to the restructuring process to rid themselves of stores and reduce rental payments.

However, landlords and retailers alike are becoming frustrated with the restructuring tool, which some feel is open to abuse.

British Property Federation director of real estate policy Ian Fletcher said last month that “a CVA allows retailers to rip up contracts freely entered into”.

“It is an insolvency process where pensioners’ savings, invested in property, are at risk and therefore it is not victimless,” he continued.

With times tough on the high street, we can expect more retailers to resort to CVAs in the year ahead.

29. Sir Malcolm Walker

- Chief executive, Iceland

- Last year: 35

Sir Malcolm surges up the Power List after a stellar year in which he was awarded Outstanding Contribution to Retail at the Retail Week Awards.

The assault of discounters Aldi and Lidl on the UK grocery market could have frozen sales at Iceland, but instead the retailer goes from strength to strength.

Rather than simply resorting to price cuts to take on the German discounters – as the big four did – the straight-talking Walker set about changing customer preconceptions of frozen foods with the Power of Frozen campaign.

And it’s worked. Sales climbed 8% to £3.02bn in its year to March 30, with like-for-likes up 2.3%. However, adjusted EBITDA dipped 1.8% to £157.1m after it invested in costs, marketing and price, and suffered from availability problems in the run-up to Christmas.

Walker has also made an impact on the eco agenda when Iceland became the first major retailer to vow to eliminate all plastic packaging from its range by 2023, tapping into the consumer demand for less plastic waste.

It also pledged to stop using palm oil as an ingredient in own-brand food by the end of this year, warning that it drives the destruction of rainforests.

Sir Malcolm’s Iceland is leading by example.

30. Richard Pennycook

- Chairman, British Retail Consortium (BRC), The Hut Group, Fenwick, Howdens Joinery

- Last year: 51

Richard Pennycook shoots up the list after taking on the role of chairman of the BRC in February.

He has taken to his responsibilities as a spokesman for the retail industry like a duck to water.

In May this year he called for reform of the apprenticeship levy, which is hammering many retailers, and urged the Government to take action.

Pennycook is determined to make this happen. He has taken on the role of co-chair of the newly set up Retail Sector Council, which supports collaboration between Government and the retail industry.

Pennycook has also been kept busy by the many businesses that he chairs. At Fenwick, the department store he joined last year, he appointed the first chief executive outside the owning family; and the etailer he chairs, The Hut Group, continues to grow and snap up more businesses.

Pennycook has proven to be a worthy statesman on behalf of the businesses he represents and the industry as a whole.

31-50

31. Mahmud Kamani and Carol Kane

- Joint chief executives, Boohoo

- Last year: 48

Boohoo bosses Mahmud Kamani and Carol Kane leap up the list as the etailer’s dramatic ascent continues.

Boohoo has become a shining star of UK retail. Sales almost doubled in its last financial year to £580m while pre-tax profits jumped 40% to £43m.

Kamani and Kane are building a suite of brands. The business now consists of Boohoo, BoohooMan, PrettyLittleThing and Nasty Gal.

In fact, it is young fashion etailer PrettyLittleThing – the business set up by Kamani’s sons Umar and Adam, which Boohoo acquired just over a year ago – that was the star performer last year with sales up 228% to £181m.

Kamani and Kane are thinking big and building warehouse capabilities large enough to handle £3bn sales globally. Asos watch out.

32. Roger Burnley

- Chief executive, Asda

- Last year: 75

It’s a steep rise up the list for Roger Burnley, who took the top job at Asda at the beginning of 2018.

And what a time to come to the helm. The planned merger between Asda and Sainsbury’s – two businesses Burnley knows well having worked as director at both – will create the UK’s largest supermarket group, eclipsing Tesco.

Burnley will still run Asda from Leeds but will also take a seat on the operating board of the combined business.

The merger of the two grocery titans will not be an easy task and Burnley’s experience at both will be vital to Mike Coupe.

33. Sir Ian Cheshire

- Chairman, Debenhams

- Last year: 32

Sir Ian Cheshire still has a lot to do at Debenhams – underlying pre-tax profits plummeted more than 50% in its last half year – but he is certainly trying new things to revamp the department store business.

His hiring of former Amazon exec Sergio Bucher in October 2016 was viewed as a curveball by some but it has brought with it fresh ideas, from ‘social shopping’ to bringing in partners such as gym operator Sweat! and furniture retailer Maison du Monde, which Cheshire also chairs.

However, as the numbers show, there is lots to be done and it’s no wonder that Cheshire has decided to “accelerate” its turnaround plan.

Outside Debenhams, former Kingfisher boss Cheshire has been as vocal as ever on retail’s big issues, speaking out on Brexit and pensions over the past year.

He remains one of retail’s great ambassadors.

34. Philip Day

- Chief executive, Edinburgh Woollen Mill Group

- Last year: 38

Aggressively acquiring struggling clothing retailers has reaped rewards for Edinburgh Woollen Mill under the stewardship of chief executive Philip Day, who climbs four places to 34.

In keeping with his tried-and-tested strategy of buying distressed brands, Day added men’s tailoring supplier Berwin & Berwin to the Edinburgh Woollen Mill stable this year.

Berwin & Berwin joins Peacocks, Jaeger, Country Casuals, Austin Reed, Jane Norman and Ponden Home in Day’s growing retail empire.

In fact, whenever a retailer hoists up a ‘For Sale’ sign, Day’s name is in the mix to snap it up.

He is using his stable of brands to help build his new Days department store business.

The first such store opened in Carmarthen in May 2017 and Day plans to open 50 UK stores, with branches in Crawley and Bedford planned this summer.

35. Theo Paphitis

- Chief executive, Theo Paphitis Retail Group

- Last year: 34

Charismatic entrepreneur Theo Paphitis owns a sizeable chunk of the UK high street, with hardware specialist Robert Dyas, stationer Ryman and lingerie specialist Boux Avenue under his control.

It has been a mixed year for his businesses. Robert Dyas was the standout star as EBITDA jumped 60% to £2.4m, but Boux Avenue recorded a £2.2m EBITDA loss despite like-for-likes spiking 7% over the year to April 1, 2017.

Paphitis is more than just a retail boss. He campaigns and supports the industry, from urging all business leaders to make sure their employees have a workplace pension to his vocal backing of apprenticeships in the sector.

Paphitis is more hero than dragon.

36. Rob Collins

- Managing director, Waitrose

- Last year: 28

Rob Collins tumbles down the list after Waitrose took the lion’s share of the blame for the 77% pre-tax profit plunge at John Lewis Partnership.

While Waitrose’s sales were up 1.8%, operating profit tumbled 41.9%, which it said was down to its decision not to pass on price inflation to customers. The margin pressure is likely to continue at the grocer in its current year.

German discounter Lidl also overtook Waitrose to become the UK’s seventh largest grocer by market share this year.

Collins – who like his counterpart at John Lewis, Paula Nickolds, joined the partnership as a graduate trainee – is focusing on making Waitrose even more “Waitrose”.

He has ploughed investment into customer experience, including the introduction of 49 new in-store sushi counters.

Will service and sashimi be enough to restore the shine of Waitrose?

37. Sir Philip Green

- Owner, Arcadia Group

- Last year: 30

Sir Philip Green’s fall down the Power List continues.

Arcadia’s operating profits sank 42% to £124.1m in its year to August 26, 2017 as sales fell 5.6%.

In a sluggish fashion market, Arcadia brands such as Topshop and Miss Selfridge have lost ground to the likes of Boohoo and Missguided.

Meanwhile, Sir Philip’s personal brand continues to take the biggest battering. He may have put his hand in his pocket and given £363m to the BHS pension pot last year but the damage to his reputation lingers on.

So does Sir Philip have the fight to turn Arcadia’s fortunes around? While reports that he has held talks with Chinese textile giant Shandong Ruyi over a possible sale of the business continue to circulate, the mercurial Green may well decide to prove the critics wrong and rebuild both his fashion empire and his good name.

38. Angela Spindler

- Chief executive, N Brown

- Last year: 40

Angela Spindler’s overhaul of N Brown appears to be bearing fruit as adjusted pre-tax profits edged up 1.3% in the year to March 3.

Hearteningly for Spindler, who is transforming catalogue group N Brown into a nimble, digital retailer, online sales were up 10% and the power brands that she is ploughing most investment into – Simply Be, Jacamo and JD Williams – surged 17%.

However, tough trading conditions have hit the group with product sales dipping slightly in the first quarter of its current year. Spindler also took the tough decision to close its 20 high street stores and focus on becoming a global online retailer.

All is set for N Brown to enter the growth stage of Spindler’s transformation plan.

Leading FTSE 250 business N Brown makes Spindler one of the most powerful women in retail.

She is keen to use her power for good and is an active ambassador of Retail Week’s Be Inspired campaign, which encourages and supports future female leaders.

39. Matt Brittin

- President, EMEA, business and operations, Google, non-independent director, Sainsbury’s

- Last year: 45

In 2017 the words “OK, Google” entered the retail lexicon. AI-powered voice search may be its shiny new offering, but Google has had an undeniable hold on the retail industry for years and this continues to tighten.

Few people mentioned in this list could claim to have a better understanding of how people shop online than Brittin, who climbs up six places in this year’s list.

Google is no stranger to controversy and is currently appealing a €2.4bn (£2.1bn) fine issued by the EU for abusing its online dominance by manipulating consumer search results to promote its price comparison tool Google Shopping.

But Google is a fundamental part of how people shop online and retailers are compelled to use its tools and advertising services to grab both attention and spend.

40. Andy Bond

- Chief executive, Pepkor Europe

- Last year: 29

It’s a steep fall for Andy Bond, who was Steinhoff’s most senior representative in the UK.

Last year, we were expecting Bond to lead more retail acquisitions. However, trouble at Pepkor parent company Steinhoff following an accounting scandal, which wiped 90% off the conglomerate’s value, meant he spent much of his year firefighting.

Bond was quick to sever financial ties between Poundland and Steinhoff through a £180m loan to protect the value retailer. That was a smart move at a time when credit insurers were reducing Poundland’s cover.

Now as private equity firms circle Poundland, it is understood that former Asda boss Bond has been talking to would-be backers, including Alteri, about a management buyout. Watch this space.

41. Federico Marchetti

- Chief executive, Yoox Net-a-Porter

- Last year: 39

It’s been a busy year for Federico Marchetti as Richemont, the luxury group that once owned Net-a-Porter, acquired Yoox Net-a-Porter (YNAP).

Richemont, which owns brands including Cartier and Dunhill London, already had a 49% stake in YNAP but in January made an offer to buy the rest, in a bid that valued the business at €5.3bn (£4.6bn).

It is clear to see why Richemont wanted to take control. YNAP dominates luxury ecommerce and as more and more customers shop online for upmarket purchases the group stands to benefit.

Despite Marchetti, the founder of Yoox who masterminded the merging of the two luxury etailers in 2015, personally making around €200m (£175m) from the deal he intends to stay and lead YNAP.

With his sights set on strengthening YNAP’s foothold in the world’s largest luxury market, China, the etailer’s growth story looks far from over.

42. John Allan

- Chairman, Tesco

- Last year: 47

If Sainsbury’s chairman David Tyler is looking for some advice on the Asda merger, then perhaps he should speak to John Allan, who steered Tesco clear of shareholder and regulatory ire in the £3.7bn acquisition of Booker, the UK’s largest wholesaler.

Snapping up Booker gives Tesco a stronghold over the food industry supply chain – a feat many feared would fall flat at the regulator.

Allan, up five places, can be equally pleased by the ring of Tesco’s tills – operating profit before exceptionals surged 28.4% to £1.64bn in its last financial year.

For Allan, it’s a job well done in the aftermath of the disastrous tenure of his predecessor, Sir Richard Broadbent.

43. Jacqueline Gold

- Chief executive, Ann Summers

- Last year: 46

Jacqueline Gold, one of retail’s biggest personalities, has returned Ann Summers to growth over the past year.

Full-year profits more than doubled to £2.9m as her store refurbishment plan bore fruit.

A new-concept store performed a whopping 20% up on the rest of the sex toy and lingerie retailer’s estate over the year.

Gold, who takes an active role in Retail Week’s Be Inspired campaign, is now gunning for growth and is determined to take Ann Summers global.

“We believe the international opportunity for us as a business is huge, through licensing, joint ventures, standalone stores, all of which is part of our strategy for the future,” she said earlier this year.

Gold is a tour de force and if anyone can take on this impressive expansion it’s her.

44. Jo Whitfield

- Chief executive, The Co-op Food

- NEW ENTRY

Jo Whitfield succeeded Steve Murrells as chief executive of Co-op Food in July last year.

Former Asda executive Whitfield clearly impressed in her interim stint leading the business last year and has continued to do so in her permanent role.

Over the past year, The Co-op has swooped on Nisa, paying £137.5m for the symbol group, and signed a deal to become the exclusive supplier to 2,200 Costcutter stores.

Whitfield has not taken her eye off the ball with the retailer’s core estate. She unveiled plans to invest £160m this year in 100 new food stores and “major makeovers” at 150 existing shops.

Her work so far has paid off as food like-for-likes rose 3.4% at the grocer in its last financial year. So far so good for Whitfield.

45. Michael Ward

- Managing director, Harrods

- Last year: 55

“Cracking China” is a regular topic at both conferences and retail board meetings considering life after Brexit.

But rather than taking UK brands to the Land of the Red Dragon, retailers might want to take a leaf out of Harrods boss Michael Ward’s book and look closer to home – the department store takes £1 in every £5 spent by Chinese tourists in London.

Of course it could have been very different for Harrods.

The revival in the retailer’s fortunes owes much to Yorkshireman Ward – who jumps 10 places in this year’s Power List – after he reversed a decision to leave the world’s most famous department store in 2016 and steer it through the uncertainty that followed the Brexit vote.

Ward has since embarked on a £200m revamp of the Knightsbridge store and overseen continued investment in wellness, food, and even a smoking room and keep for cigar aficionados.

In combining tradition, heritage and innovation, Ward appears to have found the perfect blend for luxury retail.

46. Andrew Harrison

- Chairman, Carphone Warehouse

- Last year: 53

Andrew Harrison was parachuted into the Carphone Warehouse role – stepping down from his position as deputy chief executive of parent company Dixons Carphone – last year to lead a shake-up of the struggling mobile phone specialist in tough market conditions.

Consumer behaviour is changing when it comes to mobiles. People are holding on to their handsets for longer amid a lack of radical innovation by phone manufacturers.

Seb James, who at the time led Dixons Carphone, said that there was “nobody better qualified” to get the mobile specialist back on track and it’s clear to see why.

Harrison, a Carphone Warehouse lifer, led the business until its £3.8bn merger with Dixons in 2014.

All eyes will be on him as he tries to navigate a challenging market.

47. Elizabeth Fagan

- Outgoing UK managing director and incoming non-executive chairman, Boots

- Last year: 42

Just two years into her reign as Boots UK boss, Elizabeth Fagan is stepping down.

However, she is not leaving the retailer – owner Walgreens Boots Alliance has created a new role of non-executive chairman for her, which she will begin when Seb James officially takes the helm at Boots in September.

Fagan, who was previously marketing director for Boots where she launched the retailer’s famous ‘Here Come the Girls’ ad, has presided over a difficult period in an increasingly competitive health and beauty market.

Walgreen Boots’ international retail like-for-likes dipped 2.8% on a constant currency basis, which it said was mainly due to Boots’ UK business.

Fagan has also had to weather several media storms, such as the backlash Boots faced when it refused to cut the price of its emergency morning-after pill – it has since bowed to pressure – and claims made on BBC’s Inside Out by a number of its pharmacists that understaffing in its outlets could pose a risk to patients.

48. Jack Ma

- Executive chairman, Alibaba

- NEW ENTRY

If this were a global power list then Jack Ma would surely be jostling for the top spot with Jeff Bezos. However, because Alibaba does not trade in the UK Ma falls short.

That’s not to say he is not having any impact on the UK. Alibaba’s Tmall platform has become the chosen point of entry to China for many retailers.

Sainsbury’s, Asos, Waitrose and Burberry are just some of the brands that have opted to sell via the platform – and it’s easy to see why.

On Singles’ Day – Alibaba’s homegrown Sales festival – revenue hit £19bn in just 24 hours.

UK retailers are not looking to Alibaba for just sales, they are looking at Ma for direction on the future of retail and technology.

From payment to AI to what the store of the future will be, Alibaba is leading the way and is the reason UK retailers are increasingly looking East for strategic direction.

49. Paul McGowan

- Chairman, HMV, and executive chairman, Hilco Capital

- Last year: 59

It had been a relatively quiet year for Paul McGowan until last month when Hilco, the restructuring specialist that he chairs, snapped up Homebase from Bunnings.

Just a few years ago, when Hilco bought a retailer many would predict the end was nigh for the business in question. The restructuring specialist had a reputation as an asset stripper.

However, its revival of HMV – a chain many thought did not have a future when Hilco bought it five years ago – has changed many people’s views. The restructuring firm won “Turnaround of the Decade” at the Turnaround, Restructuring and Insolvency Awards last year for its work at HMV.

Transforming Homebase, though, will be a tough task. Its stores have been left looking like a jumble sale with a mismatched product mix after Bunnings stripped out its home furnishings and put in harder DIY lines.

But it looks like McGowan is giving it a good go. Retail Week understands that Hilco intends to invest up to £75m in turning around Homebase. If McGowan succeeds more accolades – not to mention a leap up the power list – will likely follow.

50. Steve Clarke

- Chief executive, WHSmith

- Last year: 57

Steve Clarke’s WHSmith suffered a slight dip in pre-tax profits in the half year to February 28 as its underperforming high street stores offset gains made by its growing travel arm.

Clarke blamed a lack of bestsellers in the book department over Christmas.

As ever, he has taken to the trusty WHSmith axe to cut costs. The retailer has already achieved £7m of cost savings in the first half and Clarke has identified a further £5m in its second half.

However, it’s not all about cutting costs, Clarke has also been innovating with WHSmith’s technology-focused travel format Tech Express.

Since some observers fear that the retailer’s cost cutting can’t go on forever, this innovation is welcome.

51-75

51. Angela Ahrendts

- Senior vice-president of retail, Apple

- Last year: 52

At a time when retail is increasingly focused on experience rather than simply selling ‘stuff’, Angela Ahrendts is turning the dial at Apple.

In September, Ahrendts unveiled Apple’s new retail concept, dubbed the ‘town square’.

Town squares are public spaces found in the heart of towns and cities and used for community gatherings – exactly the purpose Ahrendts wants Apple’s stores to serve.

Apple’s town squares will be places for people to come together, relax and enjoy music performances from local artists and collaborate with each other. The stores will feature boardrooms for meetings and learning sessions using Apple’s iconic genius bars.

This format is being rolled out across Apple’s global flagship stores.

In this new world of retail where people crave experiences, Ahrendts is delivering.

52. Paul Kelly

- Managing director, Selfridges Group

- Last year: 60

The department store sector has being hammered of late but Selfridges has bucked the trend. The group posted double-digit sales and profit growth in its last set of results published in October 2017.

Kelly jumps eight places this year as Selfridges and its experience-laden stores benefited from a surge of overseas shoppers looking to capitalise on the weak pound.

While ‘experiential’ is the buzzword in retail right now, Selfridges continues to define what that word means.

Features ranging from an in-store boxing ring to a gig venue as part of its Music Matters campaign last summer are a part of the store’s everyday life and shoppers have come to expect this.

The retailer is also investing in making sure it looks its best with a £300m facelift of its flagship London store and digital offering kick-started last year.

Times may be tough but Kelly has found the successful recipe to maintain the appeal of the famous yellow bag.

53. Max Nutz

- UK and Ireland managing director, Inditex

- NEW ENTRY

Zara owner Inditex’s new UK and Ireland boss, Max Nutz, makes his power list debut after replacing Iñigo de Llano in March this year.

As usual, Inditex has promoted from within and Nutz, who joined the fashion supergroup in 1999, has held senior international positions across its European business.

Little is known of Nutz – secretive Inditex refuses to even send a photo of him to Retail Week – but he has hit the ground running.

Flagship brand Zara has kicked off a new tech-heavy approach to its stores in the UK and opened a digitally integrated store at Westfield Stratford, the first of its kind in the world, featuring a self-checkout area and click-and-collect function serviced by in-store automated warehouses.

54. Carlos Duarte

- UK and Ireland country manager, H&M

- Last year: 58

Low-profile Duarte climbs up this year’s list. While H&M’s commercial performance has been so-so, under his leadership the retail group has reinvigorated the UK high street.

Its various brands, from H&M to upmarket Cos and more feminine brand & Other Stories, are taking over the UK high street and last summer it chose the UK – the retailer’s third largest market after Germany and the US – to launch Scandinavian chic brand Arket.

The rapid introduction of the Arket fascia – it now has five stores in the UK – provides Duarte with a slightly more upmarket brand to drive growth, complementing the existing H&M stores.

Known for its high ethical standards, H&M appears to have found a sweet spot in the UK for its brand of fast fashion and quirky homewares.

While the introduction of new stores is a welcome good-news story for the UK’s retail scene, Duarte’s next challenge is to transform optimism into profit.

55. Euan Sutherland

- Chief executive, Superdry

- Last year: 56

To borrow the famous football cliché, Superdry had a year of two halves.

In July last year things were looking rosy as Sutherland steered Superdry to record a 27.4% rise in pre-tax revenue to £752m.

Fast-forward to April 2018 and ‘The Beast from the East’ cooled new season sales and weaker margins sent a chill through Superdry’s investors.

Sutherland revealed in May that price cutting had taken a bite out of margins, which declined approximately 200 basis points over the past year, and trimmed the sales forecast for 2019.

Nonetheless, Superdry did manage to notch up double-digit profit growth over the year. Of that, Sutherland can be proud.

56. Lord Rose

- Chairman, Ocado and Fat Face

- Last year: 50

The businesses chaired by former Marks & Spencer boss Lord Rose have fared well this year.

Fashion retailer Fat Face’s EBITDA jumped 8% to £14.9m in the half-year to December 2, 2017, while Ocado has impressed investors by signing up a raft of international retailers to its tech platform.

The guidance of Lord Rose, one of retail’s most respected leaders, has paid off.

However, it has been a relatively quiet year for Rose, whose influence is often felt across the industry as a whole. For example, in the past he has led campaigns such as Britain Stronger in Europe in an attempt to keep Britain in the EU.

Perhaps he has been sidetracked by his attempts to crack the world of media.

Lord Rose launched a podcast called Breakfast with the Boss, during which he and his co-host – businesswoman and broadcaster Natalie Campbell – interview business people about their careers, successes and failures. Chris Evans watch out.

57. Kevin O’Byrne

- Chief financial officer, Sainsbury’s

- RE-ENTRY

When plans for the Sainsbury’s–Asda merger were unveiled earlier this year, chief financial officer Kevin O’Byrne was there with Sainsbury’s boss Mike Coupe, taking questions from the press and analysts, and selling the merits of the deal.

O’Byrne will play a crucial role in the year ahead, helping Coupe to lead the grocery supergroup and manage its integration if the mega-merger gets the green light.

Former chief executive of both B&Q and Poundland, O’Byrne has solid leadership credentials and will be pivotal to the deal’s success.

58. The weather

- Last year: 61

The Great British weather has been as volatile as ever this year, with a warm autumn followed by snowstorms in March when fashion retailers hoped to sell their spring/summer lines.

Although many retailers have found ways to respond to volatile weather patterns by shortening lead times, reducing range sizes and moving away from weather-dependent clothing such as heavy winter coats, many have still been hampered.

Superdry, H&M and Debenhams blamed the weather for dampening sales this year.

However, there were sunny spots. In May Next raised its full-year profit forecast after a recent warm spell led to better-than-expected sales.

59. Judith McKenna

- Chief executive, Walmart International

- NEW ENTRY

Former Asda finance boss Judith McKenna took on one of the biggest roles in global retail this year as she was promoted to chief executive of Walmart’s international division – and she has already played a key role in what is likely to be a landmark deal in the UK.

McKenna, along with Mike Coupe, masterminded the Sainsbury’s–Asda merger, the biggest M&A deal in UK grocery history.

She has already influenced the UK market by sanctioning Asda’s investment in price and own label, which is helping the grocer gain momentum in its fightback.

Expect her to have a greater hold on the UK market when the Sainsbury’s–Asda deal completes.

Her global hold is only likely to grow as her new role makes her heir apparent to the Walmart throne. Current boss Doug McMillon and his predecessor Mike Duke both ran the international division before their ascent.

60. The administrators

- Last year: 71

When times are tough on the troubled high street an increasing amount of power falls into the hands of the administrators.

Already this year Toys R Us, Maplin, Bargain Booze-owner Conviviality and furniture retailer Warren Evans have hit the buffers – and more administrations are expected as difficult trading conditions bite.

Businesses such as PwC, KPMG and AlixPartners will determine whether these embattled companies have a future and in whose hands they are most likely to survive.

61. Matt Moulding

- Chief executive, The Hut Group

- Last year: 69

It has been another stellar year for The Hut Group, the business founded and run by Matt Moulding.

Gross profit rocketed 51% to £318m and sales shot up 47% to £736m in 2017.

It’s difficult to keep track of the businesses The Hut Group owns, such is the pace of its rampant acquisition strategy.

Over the past year, the etail group has snapped up cosmetic brand Eyeko, cult cosmetics brand Illamasqua, skincare brand Espa, subscription beauty box business Glossybox and Australian beauty etailer RY.

And there’s more to come. Chief executive Matt Moulding secured a £600m revolving credit facility in May for the group in order to supercharge acquisitions and bolster its tech capabilities. That followed the £515m secured last October.

As his acquisition strategy shows, Moulding is ambitious. His goal is to be the global number one in online health and beauty, and the solid own-brand offer he is building is helping him achieve that aim.

62. Nitin Passi

- Chief executive, Missguided

- Last year: 62

Missguided founder Nitin Passi holds steady in this year’s power list.

The popularity of the brand continues to grow – sales soared 75.6% to £205.8m in its financial year to March 26, 2017 – however, the etailer fell into the red last year as costs mounted.

Passi took action to cut costs earlier this year when a redundancy programme was launched, with 50 job cuts expected as the retailer strives to become “leaner”.

Missguided might be cutting some jobs but it is also adding others and has bolstered its leadership team this year.

Passi has turned to Shop Direct alumni to help guide his business to the next stage of growth, hiring Gareth Jones as chief executive of online – an appointment that turned out to be short-lived as he left in May after just eight months – Jonathan Wall as chief digital officer and Kenyatte Nelson as chief customer officer.

Passi seemingly has plans to build Missguided into an ecommerce giant the size of Shop Direct.

63. Steve Caunce

- Chief executive, AO.com

- Last year: 64

It has been just over a year since Steve Caunce took over from AO.com founder John Roberts as chief executive of the electricals retailer.

Caunce, who has been with the business for 13 years, deemed the last year one of “good progress” despite the business sliding further into the red in its year to March 31.

It did notch up double-digit sales growth over the year and Caunce insisted that AO.com remained on track to become profitable in three years.

64. Ian Filby

- Outgoing chief executive, DFS, and incoming chairman, Joules

- Last year: 49

Ian Filby has been a stalwart of the Retail Week Power List after eight years at the helm of furniture specialist DFS.

However, he falls down the list this year following the news he plans to depart the business this autumn.

Mild-mannered Filby has helped drive phenomenal growth at DFS, broadening its appeal through store expansion, multichannel development and range enhancement, and led its stock market float in March 2015.

Filby will stay on at DFS on a part-time basis for a year to help guide the business through a difficult market for big-ticket retailers. He will also chair Sofology, the business that DFS acquired last year.

Filby, who chairs the BRC’s Policy Board, also takes over as chairman of premium fashion retailer Joules in August. His influence on retail remains strong.

65. Alistair McGeorge

- Executive chairman, New Look

- RE-ENTRY

When times are hard at New Look who does it turn to? Alistair McGeorge.

Once again the embattled fashion retailer has drafted in turnaround specialist McGeorge to reverse its fortunes after a particularly poor patch – New Look suffered an underlying operating loss of £74.3m in its last financial year, when sales slid 7.3% to £1.35bn.

McGeorge has worked his magic at New Look before. He first arrived in 2011 when the retailer was at a low ebb and got it firing on all cylinders again.

He has hit the ground running as he strives to repeat this feat.

McGeorge aims to revamp product – he feels it has become too young and edgy for New Look’s customers – improve supply chain efficiencies and he has gained approval for a CVA to close 60 stores and reduce rent on a tranche of its shops.

Will these initiatives help McGeorge work his magic at New Look once again?

66. José Neves

- Chief executive, Farfetch

- Last year: 73

José Neves’ Farfetch started out as a platform for small luxury boutiques to sell online. Now it is becoming a place where luxury powerhouses need to have a presence in order to supercharge online sales.

This year, Harvey Nichols and Burberry have launched on Neves’ platform to build their appeal with Farfetch’s global audience.

Like many fast-growing online businesses, Farfetch is still loss-making. Despite sales jumping from £87.1m to £151.3m in 2016, pre-tax losses swelled from £28.6m to £34m.

However, that’s not putting off would-be investors. Farfetch is reportedly working with JPMorgan and Goldman Sachs on an IPO on the New York Stock Exchange that is expected to value the firm at around £4bn. Yoox Net a Porter has competition on its hands.

67. Chris Dawson

- Founder, The Range

- Last year: 74

Devon’s self-styled Del Boy rises up this year’s list. There is speculation that Chris Dawson could be lining up a £2bn float of The Range in the second half of this year.

Just like Derek Trotter, it has been a rags-to-riches story for Dawson who began his career as a market trader selling perfume and watches.

The Range, dubbed “the poor man’s John Lewis” by Dawson, has thrived as budget-conscious customers helped the discount furniture and homewares retailer to make profits of nearly £55m in the year to January 2017.

Profits are expected to have topped £100m for the year to January 2018.

Dawson is clearly no plonker, achieving a healthy balance sheet at a time when furniture stores are feeling the pinch and discounters are reporting mixed results.

If Dawson can secure the float, this time next year he could be catapulted up the list.

68. Mike Logue

- Chief executive, Dreams

- Last year: 77

Mike Logue has had a dream tenure at beds retailer Dreams. He took the helm back in 2013 after the retailer was rescued from administration by private equity firm Sun European.

Logue has notched up four consecutive years of profit and sales growth, despite the tough market conditions in big-ticket retailing.

In its last financial year pre-tax profits advanced 7.2% to £29.2m.

Former Asda man Logue puts the growth down to efficiency gains, customer service and producing better quality products.

For the phenomenal turnaround of Dreams, Logue should be applauded.

69. Sergio Bucher

- Chief executive, Debenhams

- Last year: 68

It’s early days for former Amazon executive Sergio Bucher at Debenhams but it’s fair to say he hasn’t had the best of starts.

Underlying profit before tax and exceptionals plunged 51.9% in the period to March 3. Bucher was also forced to warn on profits after a gruelling Christmas period when Debenhams resorted to discounting to coax festive sales.

All of that has forced Bucher to accelerate his turnaround plan, designed to make Debenhams a destination, digital and different.

Bucher wants shopping to be social and is adding new products, services and experiences – he has even snapped up a stake in beauty bar business Blow and brought its concessions in store.

There have been some bright spots for Bucher. Beauty and food delivered positive sales and its new-look store in Stevenage – which won Best New Store at the Retail Week Awards 2018 – is performing well. However, the City will be demanding results from this strategy – and fast.

70. Ian Grabiner

- Chief executive, Arcadia

- Last year: 67

It has been another tough year for Arcadia.

Operating profits crashed 42%, sinking from £215.2m to £124.1m as sales fell across the group in what Ian Grabiner admitted was a “disappointing” year.

Grabiner, as ever, has remained under the radar. However, he has demanded a 2% discount on all current and future orders from suppliers, citing the “significant costs in technology, distribution and people” Arcadia has made.

The business is also understood to have hired consultant McKinsey to help turn around Arcadia’s fortunes.

Grabiner has his work cut out.

71. Jill McDonald

- Managing director for clothing, home and beauty, Marks & Spencer

- Last year: 84

Jill McDonald took on the most challenging job in fashion last October, leading Marks & Spencer’s long-suffering clothing arm.

Many have tried and failed to turn around M&S’ clothing sales and eyebrows were raised when McDonald, who has no previous experience in fashion, was hired.

What McDonald does have is an unwavering focus on the customer. She has spent some 30 years working in consumer brands, most recently as chief executive of Halfords and before that as UK chief executive of McDonald’s.

Her former chairman at Halfords, Dennis Millard, said last year: “Jill looks at things through the prism of the customer and what we needed to do for the customer. We’re now much more highly engaged with customers.”

If she can do the same for M&S, McDonald might just find the retailer’s much-needed secret sauce.

72. David Tyler

- Chairman, Sainsbury’s and Hammerson

- Last year: 66

David Tyler’s imminent departure as chair of Sainsbury’s isn’t going to be a quiet exit via the back door as he attempts to secure the rubber stamp for the Sainsbury’s–Asda mega-merger.

Tyler will want his Sainsbury’s swansong after failing in his role as chairman of retail property firm Hammerson to secure a merger with Intu – the reason why Tyler drops six places down this year’s list.

This time around, if Tyler can win over shareholders and the CMA, he will end his Sainsbury’s tenure by securing a deal few people saw coming and leave the grocer in rude health to do battle at the tills with arch-rival Tesco.

73. Karen Hubbard

- Chief executive, Card Factory

- Last year: 76

Card Factory’s pre-tax profits fell 12% to £72.6m in the year ended January 31, as increased sourcing costs and a higher wage bill took their toll.

Nonetheless, boss Karen Hubbard climbs three places as the company continues to invest in online – ecommerce sales were up 67% – and a bold store-opening programme.

Despite the profit fall, Card Factory sold more cards last year than in 2016 and served a record number of customers.

Under Hubbard’s stewardship, Card Factory has strengthened its position as the market leader in greetings cards.

74. Peter Macnab

- Chief executive, AS Watson UK

- Last year: 83

While health and beauty rival Boots has struggled of late, Superdrug has thrived under the leadership of Peter Macnab.

The retailer posted a 2.4% jump in like-for-likes in the all-important Christmas period as online sales soared by 30%.

Superdrug says its performance has been bolstered by “the selfie generation” who snapped up items such as highlighters and brow products.

The selfie generation is just who Superdrug appeals to. It has cultivated a younger, cooler brand than rival Boots and capitalises on the latest health and wellness trends.

The retailer launched its first beauty studio at its Fosse Park store in Leicester earlier this year, offering services such as waxing, a nail bar and a hair salon.

In March, it opened a vegan beauty pop-up shop. The store, in London’s Boxpark, is designed to tap into the growing trend for ethical products.

Initiatives such as these, along with Macnab’s continued focus on price, promotions and exclusive products, will intensify the pressure on Boots.

75. Ben Barnett

- Chief executive, The Foschini Group

- NEW ENTRY

New in at 75, Ben Barnett has quietly built a premium fashion empire in the UK for The Foschini Group (TFG).

Barnett, previously the long-serving boss of Phase Eight, became chief executive of TFG London after the retailer was bought by the acquisitive South African conglomerate.

He has since boosted TFG’s position in the UK by acquiring premium clothing retailers Whistles in 2016, then Hobbs and Damsel in a Dress last year.

Barnett also reportedly eyed up acquisitions of Coast, Oasis and Warehouse, as well as Jigsaw over the past year.

Clearly Barnett and his backers see a growth opportunity in upscale womenswear – don’t be surprised to see more additions to this premium powerhouse over the next 12 months.

76-100

76. Graham Bell

- Chief executive, Screwfix

- NEW ENTRY

Graham Bell was promoted to chief executive of Screwfix in July last year following Andrew Livingston’s move to Howdens Joinery.

Bell has been integral to Screwfix’s rapid growth. In his previous role as operations and property director he oversaw dramatic store expansion.

The DIY retailer opened almost 250 stores over the four years to 2017/18 and 90% of the population now live within 20 minutes of a branch.

Ease and convenience continue to power Screwfix’s growth. Its store estate and seamless multichannel integration – customers can collect items ordered online in just one minute – keep its trade customers coming back.

It has bolstered its multichannel credentials this year by introducing digital click-and-collect kiosks in some stores, which have reduced waiting times – a pet hate of busy tradespeople.

Under Bell’s stewardship, Screwfix continues to be the star of the Kingfisher business. Sales surged 16.7%, up 10% on a like-for-like basis, to £1.5bn in its last financial year.

Its multichannel prowess helped it win Retail Week’s Best Retailer Over £250m and Digital Pioneer awards this year.

77. Gary Grant

- Co-founder, The Entertainer

- NEW ENTRY

The Entertainer founder Gary Grant oversaw a 37% lift in pre-tax profits to £11.5m in the 12 months to February 1.

The results were boosted by a 30% rise in sales at The Entertainer’s online operation, TheToyShop.com.

The Entertainer’s resilience and strong omnichannel performance catapults Grant into the list for the first time.

As famous toy retailer Toys R Us closed its doors for the final time, a bullish Grant unveiled “an ambitious growth agenda”, including plans to invest in UK and European acquisitions and a new web platform. “To infinity and beyond,” as Toy Story’s Buzz Lightyear would say…

78. Luke Jensen

- Chief executive, Ocado Solutions, and executive director, Ocado

- NEW ENTRY

Luke Jensen has made a dramatic impact since he joined Ocado in February last year as the boss of its technology arm.

The division has long been heralded as the growth engine of the Ocado group, but investors had been waiting for some time for the etailer to sign up international partners for its tech services.