The Power List 2016

The Retail Week Power List 2016 unveils the 100 most influential people in retail

Strong leaders are more important than ever in this tumultuous retail industry…

Competition is getting fiercer, customers are becoming more demanding and, as the demise of BHS and Austin Reed this year has proven, retailers must move with the times or face extinction.

Retail leaders now need more than just good shopkeeping skills. They need to be inspirational – rallying the troops to face this unprecedented change. They need to be warriors – battling a growing number of competitors prepared to slash prices to steal share. They need to be visionaries – identifying and shaping future shopping trends.

It is this calibre of leader that the Retail Week Power List marks out and applauds.

Mark Fagan, chief executive of Power List partner eCommera, Linked by Isobar, says: “It is those who innovate and disrupt the market that are succeeding in an increasingly challenging business environment.

“To survive and stand out from the competition, brands and retailers must not only meet customers’ existing needs, but also identify and address needs that consumers are not even yet aware of themselves.”

This is what sets apart the leaders in this year’s Power List. They are not licking their wounds, lamenting tough times on the high street, they’re innovating and reinventing their businesses.

“The visionaries on the Power List show the rest of the industry how to keep ahead of customer trends and shifting challenges. In fact, it is predicted we will see more change in the next seven years than in the entire 20th century,” says Jess Stephens, chief marketing officer at Power List partner SmartFocus.

Power List partner Olswang highlights that many of this year’s top 100 are already embracing and investing in technological innovation. “For some this means updating their legacy systems, for others it means joining forces with innovators through acquisition or joint venture, for others it means differentiating their offering through the use of in-store technology, and for most it means delivering a seamless customer view across all channels,” says Sarah Wright, partner and head of trade marks at Olswang.

The unprecedented rate of change in the industry will be a daunting prospect for many, but for our smartest, bravest leaders it signals new opportunities to be exploited.

We congratulate all on this year’s Power List and their bold steps into this brave new world of retail.

For more comment from our partners, click on partner messages.

Highest risers in the Retail Week Power List 2016

| Name | Job title | Rise | This year | Last year |

|---|---|---|---|---|

| Steve Rowe | Chief executive, Marks & Spencer | 37 | 19 | 56 |

| The weather | 29 | 44 | 73 | |

| Steve Murrells | Chief executive, retail, The Co-operative Food | 21 | 65 | 86 |

| David Potts | Chief executive, Morrisons | 14 | 16 | 30 |

| Allan Leighton | Chairman, Co-op | 11 | 87 | 98 |

| Mike Coupe | Chief executive, Sainsbury’s | 10 | 3 | 13 |

| Peter Cowgill | Executive chairman, JD Sports | 10 | 18 | 28 |

| Ray Kelvin | Founder and chief executive, Ted Baker | 10 | 36 | 46 |

| Gillian Drakeford | UK country retail manager, Ikea | 10 | 47 | 57 |

| Alex Baldock | Group chief executive, Shop Direct | 8 | 13 | 21 |

Biggest fallers in the Retail Week Power List 2016

| Name | Job title | Fall | This year | Last year |

|---|---|---|---|---|

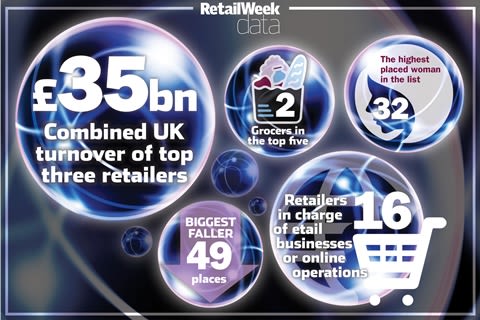

| Black Friday | 49 | 91 | 42 | |

| Angela Ahrendts | Senior vice-president of retail and online stores, Apple | 13 | 32 | 19 |

| Mike Ashley | Founder and deputy chairman, Sports Direct | 12 | 21 | 9 |

| Laura Wade-Gery | Executive director of multichannel, Marks & Spencer | 12 | 67 | 55 |

| Sir Philip Green | Founder, Arcadia | 11 | 23 | 12 |

| Richard Baker | Chairman, DFS, and operating partner, Advent | 9 | 78 | 69 |

| Ian Grabiner | Chief executive, Arcadia | 8 | 56 | 48 |

| John Walden | Outgoing chief executive, Home Retail Group | 7 | 33 | 26 |

| Andrew Moore | Chief merchandising officer, Asda | 7 | 70 | 63 |

| Christopher Bailey | Chief executive and chief creative officer, Burberry | 7 | 94 | 87 |

Retail Week Be Inspired ones to watch

Retail Week is creating a campaign to inspire and promote the careers of successful female retail leaders. As part of the Be Inspired campaign, Retail Week has dedicated this year’s Power List ‘ones to watch’ list to female talent in the industry.

| Name | Job title |

|---|---|

| Amee Chande | Managing director UK, Alibaba |

| Helen Connolly | Incoming chief executive, Bonmarché |

| Jo Jenkins | Director of womenswear, lingerie and beauty, Marks & Spencer |

| Suzanne Harlow | Group trading director, Debenhams |

| Tracey Clements | Managing director for convenience, Tesco and chief executive of One Stop |

| Maria Hollis | Executive director of buying and design, House of Fraser |

| Paula Nickolds | Commercial director, John Lewis |

| Gracia Amico | Chief executive, PetsPyjamas |

| Mary Turner | Chief executive, Koovs |

| Fiona Lambert | Former vice-president of own-label development, Asda |

1-10

1. Jeff Bezos

- Founder, Amazon

- Last year: 2

Jeff Bezos is crowned king of Retail Week’s Power List. Amazon has long been the company that most in the industry fear but its recent push into fashion and food put it on every retailer’s radar.

Unbeatable range, low prices, speedy delivery and constant innovation make Amazon fearsome competition.

Shoppers can’t seem to get enough of the etailer. Globally, it clocked up more than $100bn in sales in the 12 months to January, up 26% versus the previous year, as the Amazon train raced ahead at full steam. It’s now making money too. The etail giant had its most profitable quarter ever at the beginning of the year.

In the UK, Amazon now accounts for around 20% of general merchandise sales and it took home 25% of all non-food growth in 2015 on a gross merchandise basis, according to investment bank UBS.

Bezos remains the driver of strategy for the company and keeps a watchful eye on goings-on across the globe.

He has put innovation at the heart of Amazon and is committed to ploughing its immense turnover back into the business to make sure its product, service and prices are the best in the market.

Its expansion in the UK continues apace. The retailer is seeking to crack two of the most challenging markets in retail – food and fashion.

In food, it finally launched Amazon Fresh, its fresh grocery proposition, ending months of industry speculation, and began selling Morrisons products on its Amazon Pantry platform in May.

Meanwhile, in fashion, the etailer opened a studio in London’s trend-setting Shoreditch at the beginning of this year and has hired former Marks & Spencer womenswear boss Frances Russell, who is thought to be working on developing Amazon private labels.

The retailer has also furthered its credentials as the leader in fulfilment this year. Bezos has an obsession with improving customer service and the etail powerhouse has expanded its Prime Now hourly delivery service to the UK. It has been rolled out in cities including London, Birmingham, Newcastle and, most recently, Portsmouth.

While Amazon has had plenty to celebrate over the past year, controversy is never far away from the etailer. Bezos has come under fire for running a “dystopian” workplace where staff are stressed, paranoid about being fired and often reduced to tears.

Bezos has denied the claims and says his workers are more “paid volunteers”. “I have a team of people that I love. And we get to work in the future,” he says.

2. Sebastian James

- Group chief executive, Dixons Carphone

- Last year: 1

Sebastian James may have lost the top spot in the Power List but he continues to prove retailers can take on Amazon and not just survive but thrive.

While others in the electricals sector – one of Amazon’s strongest categories – are crumbling, James is building an empire.

The £10bn super merger between Dixons and Carphone Warehouse in 2014 had its critics, but James has silenced them by exceeding all expectations. The electricals powerhouse raised its full-year profits forecast in January following a stellar Christmas.

James has moved rapidly since the merger and has started opening three-in-one Carphone, Currys and PC World stores. The retailer believes it can reduce its estate by 134 stores and deliver at least the same, or even better, sales.

Stores are where James believes Dixons Carphone has an advantage over Amazon. Service and in-depth product advice on the new wave of technology entering the market is better delivered in store than by online technical specifications, according to James.

The merger may be delivering in the here and now but James has an eye on the future.

The tie-up was propelled by the convergence of technology driven by mobile devices. Over the past year the average number of connected devices per household has risen from nine to 17. Dixons Carphone not only sells connected devices, it also offers shoppers installation, repair and technical support through its Geek Squad and Knowhow divisions, and provides similar services for businesses through its Connected World Services arm. The services side of its business should thrive with the proliferation of connected devices.

“There will be real demand for services for making the damned things work,” says James.

In March this year, Dixons Carphone also acquired TV and telecoms price-comparison site Simplifydigital as part of its ambition to make choosing and switching products less bewildering for its customers.

Not content with building his empire in Europe, James has also sought expansion further afield. Dixons Carphone launched a US joint venture with telecoms company Sprint, which it plans to build into a 500-store chain.

It seems the world is Dixons Carphone’s oyster as James – in the year that the company was named Retailer of the Year at the Retail Week Awards with Oracle – proves there’s still global demand for service-oriented retail stores.

3. Mike Coupe

- Chief executive, Sainsbury’s

- Last year: 13

Sainsbury’s boss Mike Coupe leaps into the upper rankings of the Power List after a remarkable year.

Despite turbulence in the grocery market, Coupe has led from the front with conviction and calm – traits he had to utilise in a very different manner when helping the supermarket escape a bizarre brush with the Egyptian authorities over an historical embezzlement case last June.

That was an unusual feather in his cap. Day to day, Coupe has helped Sainsbury’s weather the grocery storm and the retailer has consistently outperformed its big four rivals over the past year.

However, it is his bold move to bid for Argos that has propelled Coupe up the Power List. The £1.4bn acquisition will create a cross-retail, multichannel supergroup that it is hoped will be capable of taking on Amazon and John Lewis. The deal is expected to go through in the third quarter.

The Argos bid has not diverted Coupe’s attention away from his day job. Sainsbury’s has delivered solid results this year, bouncing back from the impact of the prior year’s property writedowns to return to a statutory pre-tax profit of £548m.

Coupe has made some big decisions over the past year. He’s launched a tie-up with Alibaba to sell goods in China, tested a new easy-to-shop format designed to woo customers to its big-box stores and has confidently ditched the Brand Match scheme. He is also phasing out multi-buy offers as Sainsbury’s increasingly focuses on delivering everyday low prices.

All in all, Coupe’s proven himself a worthy successor to Justin King. However, with the task of merging two of the UK’s largest retailers looming large, he could face his most challenging year to date.

4. George Osborne

- Chancellor of the Exchequer

- RE-ENTRY

George Osborne’s impact on the retail sector over the past 12 months – and not necessarily in a helpful way – cannot be overstated.

The Chancellor introduced a compulsory national living wage for workers over the age of 25 as part of the 2015 Budget. Some retailers, notably Ikea, Aldi and Oliver Bonas, have pledged to pay above the living wage, however others are facing major headaches over how they will cover the rising wage bill.

Some tough decisions are being made and both Tesco and B&Q have cut staff bonuses, benefits and overtime pay to protect the bottom line.

Osborne’s other big impact on retail has been his long-awaited review of the much-hated business rates system.

In this year’s Budget he vowed to base rate increases on the Consumer Price Index, rather than the higher, and largely discredited, Retail Price Index.

Good news for retailers, however the reform will not come into effect until 2020.

5. Dave Lewis

- Group chief executive, Tesco

- Last year: 6

Dave Lewis faced one of the toughest jobs in retail when he was parachuted into Tesco almost two years ago, but an impressive 12 months has transformed the mood at the grocer from rattled to recovering.

The former Unilever executive has made progress on each of his three strategic priorities – regaining competitiveness in the core UK business, building trust and transparency, and protecting and strengthening the balance sheet.

Following Tesco’s whopping £6.4bn loss for the year ended February 2015, Lewis has hired 9,000 extra customer-facing staff, invested heavily in price, reviewed ranges and closed unprofitable stores to return the group to a full-year statutory profit of £162m.

The £6.2bn disposal of the Homeplus business in Korea and the shelving of 49 planned store developments helped shore up its battered balance sheet, while it also regained freehold ownership of 70 stores to reduce its exposure to future rent rises.

Simplifying relationships with suppliers and decreasing promotional activity has helped rebuild faith in the Tesco brand as Britain’s largest retailer demonstrates signs that it is flexing its muscles again.

But Lewis has warned that “we don’t at all think that the job is done” as he faces what he believes will be a “very challenging, very uncertain” year at the helm.

6. Lord Wolfson

- Chief executive, Next

- Last year: 5

Lord Wolfson has slipped one place in the Power List as he faces a tough year at Next.

Wolfson has always managed to deliver during times of adversity. However, he has already lowered profit expectations for the year following a dip in sales over the first quarter.

Wolfson warned that 2016/17 could be Next’s toughest year since the 2008 financial crisis – a statement that caused its share price to tumble.

Next, along with Wolfson, has been a perennial overachiever – last year pre-tax profits jumped 5% despite a tough Christmas.

However, many analysts believe that others are catching up on Next’s multichannel lead. Directory sales rose 7.7% last year, a modest amount for the retailer that is accustomed to double-digit growth.

Despite all this Lord Wolfson is still incredibly influential and is regarded as retail’s cerebral figurehead. His market forecasts are seen as being as reliable as any economist’s.

His prediction that 2016 will be a difficult year where retailers once again “feel like walking up the down escalator, with a great deal of effort required to stand still” will have given many in the industry pause for thought.

Wolfson rarely sticks his head above the parapet but the Tory peer made some bold statements over the year, revealing that he would hike up prices to combat the effects of the living wage and throwing his weight behind Brexit.

On the latter he memorably said: “Britain’s anti-growth sentiment boils down to a deeply pessimistic view of what our generation can achieve: that we cannot build better than our forefathers; that we cannot compete in an open global economy. But a nation that wants to stand still is a nation in decline.”

7. Sir Charlie Mayfield

- Chairman, John Lewis Partnership

- Last year: 3

It’s the first year since 2011 that Sir Charlie Mayfield hasn’t made it into the Power List top five, but that says more about the changing shape of the industry than his leadership of the John Lewis Partnership.

No one can question Mayfield’s retail prowess. He has demonstrated the ability to hold firm, invest wisely – notably in multichannel and IT – and deliver solid sales at a time when high streets, and department stores in particular, are feeling the heat.

In challenging times, and with continuing food price deflation hitting the Partnership’s Waitrose grocery business, the lauded retail group still delivered profits and sales in line with expectations.

The partnership’s pre-tax profits may have declined 10.9% to £305.5m in its last financial year, but that was attributed to higher pension charges and lower property profits. Excluding those, profits would have climbed 7% in the 52 weeks to January 30.

Mayfield, who started his career in the army where he rose to lieutenant and served in Northern Ireland during the Troubles, commands respect in the industry and has built a reputation on speaking out on thorny issues such as the Scottish referendum debate last year.

He was one of the first retailers to confront the consequences of Brexit, holding a debate at JLP with Lord Stuart Rose and JML owner John Mills to understand the consequences. However, unlike previous years Mayfield decided to keep his findings to himself rather than share with his peers.

8. Richard Pennycook

- Chief executive, The Co-operative Group

- Last year: 14

Co-operative Group chief executive Richard Pennycook has had an impressive year as his efforts to restore the landmark retailer’s fortunes bear fruit.

Pennycook was named Clarity Retail Leader of the Year at this year’s Retail Week Awards with Oracle in recognition of his efforts so far. He has moved the business from what he termed a “rescue” phase to “rebuild”.

Convenience retail is at the heart of the group’s momentum – Kantar data has shown impressive gains – and the self-effacing Pennycook has displayed one of the key characteristics of modern leadership: the ability to surround himself with strong management team members.

Pennycook has also demonstrated a shrewd understanding of the Co-op’s unique position in national life, and his business improvements have been accompanied by organisational change designed to ensure its distinctive ethos and values are maintained.

Pennycook made headlines for his decision to request a 60% pay-cut package because the business is now back “in calmer waters” and his role is therefore less demanding. As executive pay continues to provoke public debate, it was a striking gesture.

Earlier this year Pennycook told Retail Week: “One of the fantastic things about retail is that when you’ve got everything lined up like that and it’s working, then success builds on success because the heads are up, there’s a spring in the step, people are confident, and therefore they are out there delivering and selling. When you can ride that wave, it’s a good feeling.”

This year he has ensured the feelgood factor has been felt at the Co-op.

9. Paul Marchant

- Chief executive, Primark

- Last year: 4

Primark’s chief executive Paul Marchant slipped five places this year following a rare blip in form and the impact made by peers.

The stellar growth expected from Primark was not in evidence as both profits and like-for-likes took a slight dip in its first half.

The retailer was hit by currency headwinds because of its growing overseas business and the unseasonable weather over peak.

However, Primark remained upbeat about growth and said there was plenty of room for expansion both at home and abroad.

As ever, Marchant kept a low profile but quietly shepherded Primark towards launching three stores in Italy. However, his greatest success this year was the much-talked about US launch.

While the value retailer has yet to release sales figures for its US enterprise, it has opened nine stores there over the past year.

And despite the continued rise of ecommerce, Primark has stuck to its guns and refused to trade online. The fact that shoppers still flock to its stores despite dwindling footfall across the high street demonstrates the power of Primark and the unique quality of its proposition.

10. Andy Street

- Managing director, John Lewis

- Last year: 7

It hasn’t been a vintage year for John Lewis. Although like-for-likes rose 3.1%, profits remained flat at the nation’s favourite department store.

However, Street has been busy toiling to make sure John Lewis keeps ahead of the competition.

The multichannel leader is investing £500m in omnichannel, which Street believes will make up the bulk of its sales by 2019, a year ahead of expectations. In its last financial year, online accounted for a third of total sales.

The £500m war chest will go towards state-of-the-art warehousing and new IT to improve systems, forward planning and customer analysis.

Street also plans to keep store sales motoring as much as possible. He oversaw the opening of John Lewis’ impressive new flagship in Birmingham’s Grand Central shopping centre and has laid plans for a new 115,000 sq ft store in Cheltenham, which will open in early 2017.

He’s also constantly seeking to improve the store environment. In March, he unveiled plans to open an IT hub in Birmingham that will test in-store technology in real time.

Street’s shrewd investment in clicks and bricks continues to make John Lewis the one to watch in multichannel retail.

11-30

11. Ronny Gottschlich

- Managing director UK, Lidl

- Last year: 17

Lidl has powered ahead in the war with discount rival Aldi this year, propelling its boss Ronny Gottschlich to the brink of the top 10.

According to Kantar Worldpanel, the grocer has consistently outperformed Aldi over the past 12 months to steal its German rival’s crown as the UK’s fastest growing grocer by sales.

Last July it unveiled plans to cement that position with a new head office in Tolworth and became the first UK supermarket to pay a ‘real’ living wage of £8.20 an hour in October. Lidl has also launched its more upmarket ‘store of the future’ format as it cranks up further heat on the big four.

12. Matthew Barnes

- UK chief executive, Aldi

- Last year: 10

After eating the free lunch provided by the big four in recent years, Aldi and boss Matthew Barnes have found the going tougher during the past 12 months.

Data suggests its sales growth has slowed below that of rival Lidl, while its bid to counteract Morrisons’ Price Crunch initiative by comparing its private-label goods with branded products was dubbed “a sign of desperation” by analysts.

However, Aldi’s launch of wine and non-food time-limited offers online has got off to a solid start and its store expansion within the M25 continues at pace. The discounter continues to challenge grocery’s established order.

13. Alex Baldock

- Group chief executive, Shop Direct

- Last year: 21

Baldock had another exceptional year at Shop Direct, which has grown at pace since his arrival four years ago.

Baldock made some big decisions over the past year, including culling the last of its remaining catalogues to become completely digital, as well as dropping its smaller brands including Isme and Woolworths.

The decisions have paid off as profits surged 78% to £71.7m in its most recent year.

The former banker has made shrewd investments at Shop Direct, which now leads the market in terms of big data and personalisation. He has helped transform Shop Direct from a past-its-prime catalogue retailer to a true digital leader.

14. Sean Clarke

- Incoming chief executive, Asda

- NEW ENTRY

Walmart China boss Sean Clarke has been parachuted in to help turn around struggling Asda and will take the reins next month.

Clarke, deemed by Walmart International boss Dave Cheesewright to be one of the global grocery giant’s most experienced executives, started his retail career at Asda in 1996. He served as commercial finance director at the supermarket for six years. He has since travelled the globe with Walmart and was chief financial officer in Japan, Germany and Canada, before moving to China.

Clarke has impressed in China where he has helped Walmart become the country’s second largest grocer. He faces a tough task ahead to stop the rot at Asda amid a turbulent UK grocery market.

Asda has suffered the most from the growth of the discounters and has posted seven consecutive quarters of falling like-for-like sales.

The gauntlet has been laid for Clarke to reposition Asda. All eyes will be on the Walmart veteran to see if he can make the same impact in Leeds that he did in Shenzhen.

15. Tim Steiner

- Chief executive, Ocado

- Last year: 15

The chief executive of Ocado holds steady this year as the grocery etailer delivered its second consecutive year of profit.

However, the international technology and logistics partnership it promised in 2015 has failed to materialise. The overseas opportunity is what many believe will propel Ocado’s growth so the lack of action will concern some shareholders.

Steiner has admitted he was over-ambitious with his original target but says there will be a deal struck by the end of 2016.

The pressure will be on Steiner to make sure he keeps that promise.

16. David Potts

- Chief executive, Morrisons

- Last year: 30

David Potts has soared up the Power List after a successful first year at the helm.

Potts faces a tough job turning around Morrisons but already performance is improving. Like-for-like sales have grown in the past two quarters as his initiatives have begun to bear fruit.

Potts, who started his career stacking shelves at Tesco, has set about re-establishing Morrisons’ bond with shoppers and focused on what previously made it great – good quality product at good value prices with good service.

He has also secured a potentially game-changing tie-up with Amazon Pantry. Morrisons supplies hundreds of fresh, frozen and ambient products to the etailer, which launched on the site in May.

Initiatives like this could help drive growth to Morrisons as Potts focuses on getting its own proposition right.

17. Christo Wiese

- Investor

- NEW ENTRY

South African billionaire Christo Wiese has significantly upped his interest in UK retail over the past 12 months to crash land on to our list.

Wiese, a former lawyer, acquired fashion chain New Look last year for £780m through his investment group Brait. The group also raised its stake in frozen food chain Iceland to 57%.

Wiese has bankrolled new value fashion chain Pep&Co, which opened 50 stores in as many days under the management of former Asda boss Andy Bond. On top of that, he is also backing Bond’s new venture, discount variety chain Guess How Much!

With a considerable war chest, it’s a fair bet Wiese has his eyes on further prizes.

18. Peter Cowgill

- Executive chairman, JD Sports Fashion

- Last year: 28

Under Cowgill, JD Sports has more than held its own among retail’s premier league. Latest full-year profits jumped 57% to £157m off the back of a 20% sales increase driven by a strong performance in Europe.

The group’s revenues have been further boosted by converting its Oxford Street, Glasgow and Newcastle shops to a new superstore format. Cowgill has also managed to cut losses at the firm’s outdoors division, which comprises Blacks and Millets.

Outside the UK, the group has been on the acquisition trail, snapping up Dutch chains Perry Sport and Aktiesport.

JD’s upsurge has been in sharp contrast to its rival Sports Direct, which will no doubt doubly please Cowgill as Mike Ashley once promised to “finish off” JD Sports.

19. Steve Rowe

- Chief executive, Marks & Spencer

- Last year: 56

In July last year Marks & Spencer veteran Steve Rowe swapped responsibility for food for fashion as he succeeded John Dixon at the head of the crucial, but embattled, general merchandise division.

Within months he had moved again to replace Marc Bolland as chief executive, but his challenge remains the same – to restore M&S’s fashion fortunes.

Rowe, an M&S ‘lifer’, has hit the ground running. He has vowed to “cherish and celebrate” its core 50-plus female shopper, whom he has dubbed “Mrs M&S”, and give her the quality wardrobe essentials that she craves.

He has also retained management control over the apparel business as he drives change.

The former M&S Saturday boy has not been helped by poor weather, which has hit performance at many fashion retailers, but will hope to make his own weather at the famous high-street name.

20. Stefano Pessina

- Executive vice-chairman and chief executive, Walgreens Boots Alliance

- Last year: 20

Italian-born billionaire Stefano Pessina’s enthusiasm for retail shows no sign of waning. Despite originally taking himself out the running for the Walgreens Boots Alliance top job, the 75 year old had a change of heart after a successful stint as interim boss at the health and beauty giant.

Since his permanent appointment last July, Pessina has overseen the launch of a five-year digital transformation plan and is rumoured to be eyeing up an Australian expansion.

In the UK, Boots continues to dominate the high street’s health and beauty market but it has made staff cuts in a bid to slash costs.

In the past year 700 back-office roles and up to 350 assistant store manager roles have been shelved at the retailer, and it has recently come under scrutiny for staff practices in its pharmacy division.

21. Mike Ashley

- Founder and deputy chairman, Sports Direct

- Last year: 9

Retail maverick Ashley has suffered what can only be described as an annus horribilis that has seen him relegated from retail’s top 20.

On both trading and reputational fronts, Ashley and his beloved Sports Direct have suffered. Sports Direct issued a profit warning earlier this year that led to its share price halving.

Meanwhile, media organisations probed the retailer’s working conditions at its Shirebrook warehouse and highlighted a number of concerning practices. It even led Parliament’s Business, Innovation and Skills Committee to set up an inquiry into the revelations.

Ashley admitted to MPs that Sports Direct had outgrown him but vowed to improve working conditions and create a workplace that he would be happy for his children to work in.

The troubles at Sports Direct have not thwarted Ashley’s attempt to expand his retail empire. He led failed bids for collapsed chains BHS and Austin Reed this year. He remains an indomitable force in UK retail.

22. Matt Davies

- UK chief executive, Tesco

- Last year: 27

Former Halfords boss Matt Davies has emerged from Dave Lewis’ shadow at Tesco this year as the grocer’s core UK business shows signs of revival.

Davies took on more of a leading role at the retailer’s full-year press briefing as Lewis entrusted his executive team to field questions from the press.

Davies has been central to Tesco’s revival efforts, playing a key role in the introduction of its Brand Guarantee initiative and the launch of its seven entry-level Farms brands, designed to better compete with the discounters on price. By Davies’ own admission, there is more work to do and he faces another important 12 months ahead.

23. Sir Philip Green

- Owner, Arcadia

- Last year: 12

Sir Philip Green has been embroiled in controversy since BHS fell into administration. Questions have been asked of his decision to sell the troubled business to a little-known consortium with a dubious track record and the £580m in dividends his family took out of the troubled retailer during his ownership.

Green has attracted the ire of MPs, who have spoken of him “ratting” on his commitment to BHS staff and pensioners. He appeared before a select committee to answer questions on his role in the demise of the department store chain in June.

Elsewhere, Green showed his usual business prowess in a much-hyped collaboration with pop star Beyoncé, with whom he launched a line of ‘athleisure’ wear, Ivy Park. The line manages to both tap into the stellar rise of athleisure as a concept and collaborate with one of the world’s biggest stars.

He may be under pressure right now, but never underestimate Green.

24. Simon Arora

- Chief executive, B&M Bargains

- Last year: 23

Value retailer B&M, led by Simon Arora, has enjoyed another strong year and cemented its position as one of the UK’s fastest-growing retailers. Arora, who studied law at Cambridge, is helping drive B&M towards its target of 850 stores with a record 79 shops opened over the year. Full-year profits jumped 19.5% this year as sales surged 23.6% to break through the £2bn barrier.

B&M also entered the FTSE 250 after first listing in 2014. Arora has been keen to distance himself from single price point rival Poundland, although the ante has been upped with the launch of multi-price format Poundland & More. Fiercely intelligent Arora will no doubt enjoy the challenge of keeping up with his rivals.

25. Robin Terrell

- Chief customer officer, Tesco

- Last year: 25

Robin Terrell has played a central role in Tesco’s turnaround. He helped launch Tesco’s Brand Guarantee last October, which replaced its voucher-based Price Promise with instant discounts if a customer’s branded shop is more expensive than its big four rivals.

His initiatives to woo back customers are paying off. The grocer reported its first rise in quarterly UK like-for-likes in three years in April.

Tesco has a way to go to return to its retail heyday and Terrell is focused on regaining shoppers’ trust.

“There won’t be one silver bullet. There are lots of smaller things that add up, so we are back to ‘every little helps’ in its true sense,” he said.

26. Rob Collins

- Managing director, Waitrose

- NEW ENTRY

A new entry into this year’s Power List, Rob Collins has big shoes to fill as Mark Price’s successor as Waitrose managing director. Collins, who has been with the John Lewis Partnership for 22 years, only took the reins in March but has quietly carved out a promising start to his tenure.

The upmarket grocer lifted the lid on plans to open its first cashless store in broadcaster Sky’s Osterley offices and in April unveiled a new premium brand, Waitrose 1, to bring together existing luxury ranges. Details of a partnership to sell goods through Alibaba in China emerged just weeks later, helping Collins lay down an early marker.

27. John Roberts

- Founder and chief executive, Ao.com

- Last year: 24

John Roberts has delivered strong sales growth at Ao.com over the year, however his efforts to build an overseas electricals empire have taken a toll on the bottom line.

Operating losses widened from £2.2m to £10.6m as Roberts invested in Ao.com’s fledgling German operation and launched in the Netherlands.

Roberts is committed to widening Ao.com’s reach and plans to expand into “every country touching the German border”.

Roberts is relentlessly focused on providing an exceptional experience for customers, from browsing online to delivery, and Ao.com regularly comes top of various shopper satisfaction polls.

Despite this solid sales performance and positive sentiment, Ao.com has failed to live up to its IPO debut and its share price is still half the value of its float price.

28. Nick Beighton

- Chief executive, Asos

- NEW ENTRY

Nick Beighton has proven more than a safe pair of hands since taking over from founder Nick Robertson as chief executive of Asos last September. He steered the fashion etailer to an impressive 18% jump in its half-year pre-tax profits in April.

Beighton knows Asos inside out. In his previous roles as chief financial officer and chief operating officer, he was Robertson’s right-hand man. However, he has not simply followed Robertson’s blueprint. He has made his own bold decisions, including cutting his losses in China and shutting down the standalone website there.

But as overseas shoppers respond well to Asos’ investment in price, the etailer’s international business remains a jewel in its crown.

The Chinese site might not have worked, but Beighton is sure to have some takeaways for the rest of his international empire.

29. John Rogers

- Chief financial officer, Sainsbury’s, and incoming chief executive, Home Retail Group

- NEW ENTRY

Sainsbury’s John Rogers has stormed into the Power List after playing a pivotal role in what has been a landmark year for the grocer.

As chief financial officer, he was a key architect in Sainsbury’s successful £1.4bn bid for Argos-owner Home Retail and will become chief executive of its new acquisition when the deal completes in the third quarter.

Rogers will have a big year ahead as he begins the hefty task of combining Sainsbury’s non-food business with Argos.

30. Theo Paphitis

- Chairman and owner, Ryman, Robert Dyas and Boux Avenue

- Last year: 31

Theo Paphitis is one of the most famous businessmen in the UK with a retail empire that includes Ryman, Robert Dyas and fast-growing lingerie chain Boux Avenue, however his Twitter profile still simply reads “shopkeeper”.

It was a good year for the shopkeeper as Ryman and Robert Dyas profits rose over the year and Boux Avenue cut its losses.

Boux Avenue, which celebrated its fifth birthday this year, is going from strength to strength with UK turnover rocketing 36% to £36.5m over the past year. It also has a fledgling international business and the ever-ambitious Paphitis has plans for 100 stores globally over the next two years.

The former Dragon clearly still has fire in his belly.

31-50

31-50

31. Andy Higginson

- Chairman, Morrisons and N Brown

- Last year: 33

Just over a year ago, Andy Higginson was thrust front of stage as Morrisons finalised its search for Dalton Philips’ successor, taking a more central role in results presentations. Now that chief executive David Potts has his feet firmly under the table, Higginson has taken a less hands-on but equally vital role as chairman at both the grocer and fashion retailer N Brown.

Higginson’s expertise and calming influence in the boardroom have provided the perfect sounding board as Morrisons begins its recovery and N Brown accelerates its growth plan.

32. Angela Ahrendts

- Senior vice-president of retail and online stores, Apple

- Last year: 19

Angela Ahrendts has been in post for two years at Apple, however so far her impact on the store has been modest to the outside eye.

Her major initiative has been to make Apple stores “sleeker and smarter”. She introduced personal appointments for shoppers to buy Apple Watches and has begun showcasing high-end Apple products not made by Apple, such as Phantom wireless speakers, in stores.

She also stopped encouraging shoppers to camp outside Apple stores to get their hands on the Apple Watch when it launched, insisting instead they try it out in store and order it online.

It comes at a time when Apple’s star may be on the wane. Sales of iPhones, which account for two thirds of the company’s revenue, are expected to fall in 2016 for the first time since it launched in 2007.

All eyes remain on Ahrendts – the highest paid female executive in the US– to see if she can replicate her Burberry success at Apple.

33. John Walden

- Outgoing chief executive, Home Retail Group

- Last year: 26

If there was an award for dealmaker of the year, Walden would be a shoo-in. He ably oversaw the bidding war for Argos between Sainsbury’s and Steinhoff, and secured the £340m sale of Homebase to Australian retail giants Wesfarmers.

However, he moves down the list as he will leave Home Retail when the sale to Sainsbury’s completes later this year.

The £1.4bn sale is largely down to him. He has revitalised Argos and turned it into a multichannel leader, which caught the eye of Sainsbury’s. He should be applauded for the phenomenal turnaround that he has orchestrated.

34. Anders Kristiansen

- Chief executive, New Look

- Last year: 36

New Look might have a new owner but it is business as usual for its charismatic boss Anders Kristiansen.

Profits are rising consistently and Kristiansen is making wise investments to ensure that continues. Many may be talking about China but Kristiansen is a man of action. Since 2015, New Look has opened more than 85 stores in China and another 50 are planned in its current financial year.

It’s not just overseas where Kristiansen is gunning for growth; he’s also targeting the menswear market. The retailer has opened six standalone New Look Men branches and another 20 are in the offing this year.

35. Doug Gurr

- UK managing director, Amazon

- NEW ENTRY

Amazon’s new UK boss storms into the Power List following his appointment in May.

Gurr, who has led the etail giant’s Chinese business for the past two years, is a veteran of UK ecommerce and his appointment will strike fear into many retail leaders, particularly grocers.

Gurr, who prior to joining Amazon spent five years heading up multichannel and fulfilment at Asda, takes the helm as the etailer begins its assault on the grocery market. It launched fresh food proposition Amazon Fresh in the UK in June, building on its Amazon Pantry UK debut last November.

If anyone can make a success of food online it’s Gurr and the big four will be nervously watching his progress.

36. Ray Kelvin

- Founder and chief executive, Ted Baker

- Last year: 46

Ted Baker boss Ray Kelvin shoots up 10 places after another great year for the retailer. Pre-tax profits surged 18.6% to £58.66m as the brand thrived, despite tough conditions in the fashion sector.

The inimitable Kelvin has built a brand recognised the world over from a single shop in Glasgow where his mother worked on the tills. The retailer now trades in 37 countries.

Kelvin has created a unique brand and the Ted Baker spirit is present in everything it does, from the stores it runs to the product it makes. As Kelvin said in in his Retail Week Live speech this year: “People can copy our clothes but they can’t copy the way we think or do things.”

37. Sir Charles Dunstone

- Chairman, Dixons Carphone

- Last year: 37

Sir Charles Dunstone has had another cracking year since merging his Carphone Warehouse – the company he co-founded from his Marylebone flat – with Dixons in 2014 in a deal worth £3.6bn.

The newly formed Dixons Carphone raised its full-year profits forecast earlier this year after bumper Christmas trading.

The retailer is seeking to harness the synergies of the merger and has started opening three-in-one Carphone, Currys and PC World stores. It will cut store numbers by 134 this year and deliver the same sales.

Mega-mergers can often be a painful process, but Dunstone’s Dixons Carphone has been plain sailing so far.

38. Angela Spindler

- Chief executive, N Brown

- Last year: 35

N Brown chief executive Angela Spindler’s dip down the Power List has more to do with the strong performance of others than any failure on her part.

Spindler has been hard at work transforming plus-size specialist N Brown. Profits have taken a hit following increased investment to turn N Brown into a digitally led business. However, her strategy is beginning to bear fruit.

Profits in the second half jumped 11% and the retailer’s online penetration jumped six percentage points to 65% over the year that Spindler described as a “milestone in our transformation”.

39. Véronique Laury

- Chief executive, Kingfisher

- Last year: 38

It’s been a busy first year in charge of Kingfisher for new chief executive Véronique Laury. Full-year profits dipped by more than a fifth as she launched her turnaround plan for the business.

The ‘One’ Kingfisher plan is designed to unify the business by streamlining products, improving the digital offer and harnessing operational efficiencies. The retailer will close 60 B&Q stores in the UK and Ireland as part of the plan. Laury believes ‘One’ will boost Kingfisher’s bottom line by £500m. However, it will take five years and an £800m investment to reap the rewards.

There is good news for Laury on the trading front. She unveiled a 3.6% uplift in like-for-likes during its first quarter, driven by a stellar performance in the UK.

However, it hasn’t been smooth sailing for Laury throughout the year. She faced a staff backlash when the company removed time-and-a-half pay for Sunday working, double pay for bank holidays and seasonal staff bonuses, while increasing its basic minimum pay to above the living wage.

Almost 150,000 people signed an online petition against the changes and Kingfisher was forced to extend compensation from one to two years for those impacted.

40. Malcolm Walker

- Chief executive, Iceland

- Last year: 34

The enigmatic Iceland founder has fallen down the list this year as the frozen food specialist continues to face stiff competition from the discounters. Both sales and profits were flat at Iceland over its last financial year, although the decline in like-for-likes moved from 4.4% to 2.7%.

South African billionaire Christo Wiese’s investment vehicle, Brait, has increased its shareholding in Iceland to 57% – a move that could add firepower to the grocer’s Power of Frozen campaign. Despite another relatively quiet 12 months, Walker still managed to produce one of the quotes of the year, memorably dubbing the Which? super-complaint into supermarket pricing tactics as “bollocks”.

41. Katie Bickerstaffe

- Chief executive, UK and Ireland, Dixons Carphone

- Last year: 41

Katie Bickerstaffe has delivered another stunning set of results for Dixons Carphone’s UK and Irish business, which includes a 6% like-for-like sales jump across the year, record customer satisfaction levels and a 31% rise in half-year earnings.

Bickerstaffe has ably managed the integration of Dixons and Carphone Warehouse and has pushed the button on a full roll-out of its three-in-one stores, which bring together Currys, PC World and Carphone Warehouse under one roof.

Bickerstaffe, who was a management trainee at Unilever before moving up through PepsiCo, Dyson, Somerfield and Kwik Save, is also an ambassador of Retail Week’s Be Inspired campaign, encouraging the progress of the next generation of female retail leaders.

42. Sir Ian Cheshire

- Chairman, Debenhams

- RE-ENTRY

A familiar name on previous Power Lists, Sir Ian Cheshire’s appointment as Debenhams chairman has led to him re-entering this year at number 42.

The former Kingfisher boss, who was formally appointed at Debenhams in April, has said he wants to be a “fully involved” chairman, and described the department store business as “underappreciated”.

His first task was to find a replacement for departing chief executive Michael Sharp. After a long and thorough search, Cheshire hired Amazon’s European fashion boss, Sergio Bucher, who will help progress Debenhams’ international and online expansion.

Cheshire can also be expected to be a prominent ambassador for the retail sector generally. The former BRC chairman is a vocal spokesman on behalf of the industry.

43. John Allan

- Chairman, Tesco

- Last year: 43

Former Dixons Carphone chairman John Allan has been a huge influence at Tesco since taking on the chairmanship last year. The grocer’s board was often criticised for having a lack of retail veterans, a box that Allan’s experience instantly ticked.

His knowledge and expertise will have provided a guiding light for boss Dave Lewis, helping him settle into his first retail chief executive position.

Allan’s expert handling of a fiery AGM last year demonstrated his calm head, which will prove invaluable again this year as the grocery sector continues to face turbulent times.

44. The weather

- Last year: 73

If weather is for wimps then there were lots of namby-pambies in the fashion sector this year. A mild autumn and winter hit sales of warm clothing while snow in April dampened the popularity of spring/summer ranges.

High street stalwarts including Next, H&M and Primark have all blamed the weather for poor sales over the year.

The increasingly unpredictable weather has led to many retailers abandoning the traditional seasonal approach to building ranges. Marks & Spencer, for instance, has experimented with ‘seasonless’ products that can be layered up or down and worn all year round.

45. Elizabeth Fagan

- Incoming senior vice-president and managing director, UK and Ireland, Walgreens Boots Alliance

- NEW ENTRY

Boots international boss Elizabeth Fagan will take charge of the retailer’s UK and Irish business in July, following the departure of Simon Roberts.

Fagan is a Boots lifer and joined the business 16 years ago as a buyer. She was previously marketing director and managing director of Boots Opticians before taking charge of the Walgreens Boots Alliance business in Latin America, Asia, continental Europe and the Middle East in 2015.

Taking control of the UK business is certainly a major undertaking. The retailer has gone through two major rounds of redundancies in the space of a year. That aside, Boots UK revealed a 1.8% rise in second-quarter retail like-for-likes in April, driven by a “good performance” over Christmas and strong results for its ‘Order & Collect’ service.

46. Jacqueline Gold

- Chief executive, Ann Summers

- Last year: 47

Ann Summers boss Jacqueline Gold has brought the lingerie and sex-toy retailer back into the black over the past year and has launched an interesting new venture, a dating app for customers itching to put her products into practice.

Gold, who was awarded a CBE in the new year for services to entrepreneurship, women in business and social enterprise, is increasingly recognised as a spokeswoman for the retail industry and has weighed in on issues ranging from Sunday trading to the lack of women in senior roles in the sector.

Whether she’s tackling issues in the boardroom or the bedroom, Gold will continue to make her voice heard across the industry.

47. Gillian Drakeford

- UK country retail manager, Ikea

- Last year: 57

Gillian Drakeford shoots up the Power List following a barnstorming performance by Ikea over the past year. UK profits nearly tripled to £116m in the year to August 2015.

Drakeford, an Ikea lifer, has spurred innovation and expansion at the retailer, which is opening a raft of smaller-format stores in Norwich, Westfield Stratford, Aberdeen and Birmingham. If successful, the order-and-collection stores could help power expansion at Ikea, which has faced difficulty in obtaining planning permission for its big-box stores in the UK.

48. Federico Marchetti

- Chief executive, Yoox Net-a-Porter Group

- NEW ENTRY

Federico Marchetti was relatively unknown in the UK this time last year, despite founding Italian luxury etail giant Yoox Group. However, Yoox’s acquisition of Net-a-Porter in October 2015 thrust him into the spotlight. The merger has created a luxury etail powerhouse currently valued at €2.8bn.

It has also brought a fair bit of upheaval, including the departure of Net-a-Porter founder Natalie Massenet, Mr Porter boss Ian Tansley and Stephanie Phair, president of Net’s discount etailer TheOutnet.

Marchetti made sure those changes did not impact performance as revenues jumped 30% in 2015. The former investment banker has also found additional synergies from the merger, which exceeded the Group’s expectations. The Group raised its target from €60m to €85m in November 2015. It could be the start of a beautiful relationship for the luxury pairing.

49. Andy Bond

- Co-founder, Pepkor UK

- RE-ENTRY

Former Asda boss Andy Bond has had a busy year. Through his investment vehicle Pepkor UK, last July he launched discount fashion retailer Pep&Co, backed by South African billionaire Christo Wiese, and opened a whopping 50 stores in two months.

Not content with that, he’s bringing another new retail format to the high street. Guess How Much!, a discount variety retailer poised to rival Poundstretcher, made its debut in June.

Bond has established himself as Wiese’s right-hand man in the UK and is understood to have advised Steinhoff, in which Wiese is an investor, on its potential bid for Home Retail. All in retail will be watching to see what the pair’s next move will be.

50. Lord Rose

- Chairman, Ocado, Fat Face and the Britain Stronger in Europe campaign

- Last year: 52

He may be chairman of Ocado and Fat Face but it’s Lord Rose’s extracurricular activities that have taken centre stage this year.

As leader of the Britain Stronger in Europe campaign, Rose has been at the centre of the thorniest issue not just in retail, but in politics.

Rose may be an influential, powerful orator, but the campaign has had a lukewarm response. The business community that was vocal in the Scottish Referendum has remained relatively neutral during this debate. However, Rose has persevered and we’ll see whether his efforts have paid off at the polling station this month.

51-75

51. Carlos Duarte

- Country manager, UK and Ireland, H&M

- Last year: 45

H&M is one of many fashion retailers that has suffered at the hands of the weather this year. The mild winter across Europe hit the sales of seasonal lines and forced H&M to slash prices to shift stock.

Duarte, the dapper Portuguese who heads H&M’s UK and Irish business, has been busy pushing new growth initiatives.

Over the past year he has revamped H&M’s beauty offer, introduced make-up concessions into stores including Oxford Circus, Nottingham and Southampton, and launched its first homeware concessions in Selfridges.

With the weather offering no respite in 2016, Duarte will be hoping these initiatives help boost the bottom line.

52. Paul McGowan

- Chief executive, Hilco, and chairman, HMV

- Last year: 53

When collapsed music and DVD retailer HMV ended up in the hands of Hilco three years ago, few believed it would have a long-term future. However, the retailer is going great guns. It is snatching share from Amazon in the physical entertainment market and is even expanding overseas.

HMV is launching across Europe via its website and has opened stores in the Middle East in partnership with Al Mana Group. It is also in talks with potential Australian and Indian franchise partners.

McGowan is clearly embracing the challenge at HMV, however, he’s still hard at work at Hilco too. McGowan led an unsuccessful bid to buy BHS but Hilco has since been hired to trade the department store’s 164 shops until its liquidation.

53. Ian Filby

- Chief executive, DFS

- Last year: 54

DFS has thrived since it floated in March last year. Profits and sales have surged and its share price has rallied following a weak debut on the stock market.

Filby has kept sales motoring with a range of growth initiatives. He is targeting a more aspirational customer by selling exclusive French Connection products and has opened smaller-format stores to expand in urban centres.

Now he is seeking to replicate DFS’s success overseas. It has launched a successful fledgling Dutch business and is mulling a move into Germany and Belgium. He has also acquired a Spanish furniture store and secured the DFS Spain trading name to target the expat community.

As a member of the BRC board and chair of its policy board, Filby also plays an important role representing the industry more widely.

54. Andrew Harrison

- Deputy chief executive, Dixons Carphone

- Last year: 59

Andrew Harrison has been laying the foundations of Dixons Carphone’s US expansion this year. He was involved in the deal with US telecoms network Sprint to open up to 500 Sprint-branded stores.

Harrison, nicknamed ‘Statto’ because of his ability with figures, played an important role in Carphone Warehouse’s successful US mobile phone shop venture with American retailer Best Buy, from which it was bought out for £838m in 2012.

Harrison’s international expertise should come in useful in his latest role as independent non-executive director of Ocado, a position he took up in March. The online grocer is plotting a technology tie-up with an overseas retailer, with the US thought to be a likely target.

55. Michael Ward

- Outgoing managing director, Harrods

- Last year: 51

Michael Ward’s 10-year spell at Harrods is set to come to an end in January next year, and the retail veteran leaves the department store in fine shape. Profits rose 4.2% to £146.3m in its last financial year.

It’s been an eventful decade for Ward, who has navigated Harrods through the financial crisis and its sale from Mohamed Al Fayed to the Qatari Investment Authority in 2010. The department store has thrived under his leadership and is the leader in luxury retail.

Ward, who is also chairman of luxury trade body Walpole, has been a prominent campaigner in support of the relaxation of visa rules for Chinese visitors to the UK – they are important luxury customers – as well as for airport expansion in the Southeast of England.

No one knows well-heeled shoppers better than Ward and he leaves big shoes to fill at Harrods.

56. Ian Grabiner

- Chief executive, Arcadia

- Last year: 48

The BHS collapse has left a dark cloud over all surrounding Sir Philip Green this year, including his faithful lieutenant Ian Grabiner, who has been asked to give evidence to the select committee’s inquiry into the pensions and sale of the department store business.

Arcadia, the ship that Grabiner steers, turned a healthy profit last year; however, like-for-likes took a tumble at the start of its current financial year.

Grabiner also found himself unpopular with suppliers by imposing tougher payment terms on its partners.

However, the jewel in Arcadia’s crown, Topshop, continued to thrive over the year, particularly overseas. It also inked a high-profile collaboration with superstar Beyoncé, which launched to great fanfare this spring.

57. David Tyler

- Chairman, Sainsbury’s

- NEW ENTRY

It’s been a landmark year for Sainsbury’s and long-term chairman David Tyler has provided guidance and leadership throughout.

Tyler, a former finance director of one-time Argos owner GUS, was one of the key figures involved in Sainsbury’s successful bid for the general merchandise retailer.

Tyler’s knowledge of Argos will be invaluable when Sainsbury’s tackles the mammoth task of integrating the two businesses when the merger completes later this year.

58. Steve Clarke

- Chief executive, WHSmith

- Last year: 60

There’s more to WHSmith’s success than the trend for adult colouring books. Chief executive Steve Clarke’s shrewd management and smart investments helped boost profits by 11% in its latest half-year.

Clarke has sharply managed space in stores, invested in its core stationery lines and embraced the convenience trend with concessions in post offices and the roll-out of WHSmith franchise stores. He’ll be hoping these initiatives, and the colouring book trend, will brighten up WHSmith’s profits in the year ahead.

59. Iñigo de Llano

- UK managing director, Inditex

- Last year: 58

In true Inditex form, Inigo de Llano has quietly got on with business since he took the reins as UK boss of Zara’s parent company in 2015. De Llano, who was previously Inditex’s Australian boss, has focused on sales growth and tight control of operating expenses in his new role.

Little is known about Zara-owner Inditex’s UK performance, but on a global stage the fashion group is soaring. While rival H&M suffered at the hands of unseasonable weather this year, Inditex’s fast-fashion model has come into its own and like-for-likes surged 8.5% globally.

De Llano has continued Zara’s mission to take over London. During the year, the retailer opened a fifth store on Oxford Street, a 48,000 sq ft glass and concrete flagship on the eastern half of the road.

60. Paul Kelly

- Group managing director, Selfridges

- Last year: 64

Paul Kelly has helped maintain Selfridges’ position as the bastion of experiential retail. The department store is famous for an ever-changing array of events, restaurants, concessions and exclusive products that make it a destination for shoppers.

Selfridges is a shining example of retail theatre not just in the UK, but globally. It was named best department store in the world for a record third consecutive time at the biennial Global Department Store Summit awards in 2014 and will hope to keep hold of the crown this year.

Kelly, who posted record profits for Selfridges over the past year, is investing to keep the department store on top of the pile. It is ploughing £300m into an overhaul of its Oxford Street flagship.

61. Ian Kellett

- Chief executive, Pets at Home

- NEW ENTRY

Ian Kellett replaced Nick Wood as Pets at Home chief executive earlier this year. Kellett is a safe pair of hands to run the Pets business, having played an important role in its phenomenal growth over the past 10 years. He served as chief financial officer since 2006 before becoming chief executive of its retail arm last year.

Kellett has a lot to get his claws into. The retailer is expanding its veterinary services and piloting new formats including dog-only store Barkers and convenience concept Whiskers n Paws. If he can get these formats right, he’ll keep Pets’ investors purring.

62. Philip Day

- Owner and chief executive, Edinburgh Woollen Mill Group

- RE-ENTRY

Philip Day is building an empire through snapping up collapsed businesses. This year he bought the Austin Reed and Country Casuals brands along with five concessions.

Day, who made his fortune through Edinburgh Woollen Mill, previously bought Peacocks and Jane Norman out of administration.

The strategy is bearing fruit as Edinburgh Woollen Mill Group profits surged 28% in its most recent year. Peacocks was the star performer with sales up 8%.

Day, who also owns Ponden Home, is constantly looking for new opportunities and is rumoured to be in the running to buy Tesco-owned business Dobbies Garden Centres.

63. Nigel Oddy

- Chief executive, House of Fraser

- Last year: 61

Nigel Oddy’s first year in charge of House of Fraser has been a mixed bag. Although the retailer posted its first pre-tax profit in a decade, it has lost some good staff over the course of the year.

There’s been a revolving door at House of Fraser’s Baker Street head office with highly regarded chief customer office Andy Harding, clothing boss Jackie Hay and home, food and beauty aficionado Ysanne Jenkins among those exiting.

There’s clearly a lot of reasons for former HoF chief operating officer Oddy to be positive. Online and own-brand are firing on all cylinders, it has investment for much-needed store refurbishments and will open its first Chinese shop this year. However, Oddy needs to bring some stability to the business if it is to reap the rewards.

64. Euan Sutherland

- Chief executive, SuperGroup

- Last year: 66

Former Co-op boss Euan Sutherland has brought stability, consistency and professionalism to SuperGroup since his appointment in October 2014.

The Superdry owner had a rocky couple of years prior to his appointment. Blighted by IT glitches and accountancy errors, profit warnings were becoming a common occurrence at the retailer and, regardless of the brand’s popularity, investors began to lose faith.

Big-hitter Sutherland has changed all that and has delivered sparkling results over the past year. Sutherland has invested in infrastructure, grown its overseas business and extended the Superdry brand beyond fashion into lifestyle.

His appointment has allowed founder Julian Dunkerton to concentrate on where his skills lie – product – and the range improvement has been noticeable. Together, Sutherland and Dunkerton have created a dream team that has SuperGroup investors sleeping soundly at night.

65. Steve Murrells

- Chief executive – retail, The Co-operative Group

- Last year: 86

The Co-op comeback has been one of the success stories of the year and, while Richard Pennycook has rebuilt the group, Steve Murrells has driven growth at its food business.

The Co-op Food was the star performer across the food-to-funerals mutual, notching up a 3.3% uplift in operating profit to £250m on £7bn sales.

Murrells has capitalised on the trend towards convenience, a part of the business that has grown for 12 consecutive quarters. He has offloaded larger stores in order to focus on convenience and plans to open 100 new branches in 2016.

66. Mark Lewis

- Retail director, John Lewis

- NEW ENTRY

John Lewis’ omnichannel business is the blueprint that many in the industry are working to and Mark Lewis is the man in charge of it.

Lewis was promoted from online to retail director over the year with the remit of accelerating the full integration of shopping channels at the department store.

Online now makes up a third of John Lewis’ sales and its success comes from the seamless experience across bricks and clicks. In fact, more than half of online shoppers collect their orders in either John Lewis or Waitrose stores.

On that front, Lewis took the brave decision to introduce a charge for click-and-collect to ensure the profitability of its fast-growing omnichannel business. It’s a move many across the high street will be watching and hoping to replicate.

67. Laura Wade-Gery

- Executive director for multichannel, Marks & Spencer

- Last year: 55

It’s been an understandably quiet year for Marks & Spencer’s multichannel supremo, who has been on maternity leave since January.

Web sales have finally recovered after the retailer’s notoriously difficult 2014 relaunch that failed to click with customers. In its latest quarter, online sales rose 8.2% and the retailer said customer satisfaction was growing.

Wade-Gery returns to a markedly different M&S. Marc Bolland has departed and former general merchandising boss Steve Rowe is at the helm. Rowe reshuffled the management team in May but will not update on Wade-Gery’s responsibilities until she returns from maternity leave.

68. Roger Burnley

- Incoming deputy chief executive, Asda

- NEW ENTRY

When Roger Burnley was poached by Asda from Sainsbury’s many touted him as a successor for chief executive Andy Clarke – including Clarke himself.

The appointment of Sean Clarke as the new Asda boss may have ended this speculation, however it’s clear that Burnley, who finishes his gardening leave in October, is going places at the grocer.

He was elevated to deputy chief executive on Sean Clarke’s appointment and Dave Cheesewright, international boss at Asda owner Walmart, declared Burnley “a top talent and a future CEO”.

Burnley was wooed from Sainsbury’s, where staff are understood to be disappointed that the Yorkshireman has opted to return to Leeds-based Asda.

Burnley had six successful years at the grocer earlier in his career. He served under Archie Norman and Allan Leighton, the duo that turned around Asda in the 1990s.

He will be hoping to invoke some of Norman and Leighton’s spirit to help lift Asda out of the doldrums.

69. Darren Shapland

- Chairman, Maplin, Poundland, Topps Tiles and NotOnTheHighStreet

- Last year: 67

It’s been a busy year for chairman extraordinaire Darren Shapland, who holds four retail chairmanships.

Notable achievements over the year include hiring former B&Q boss Kevin O’Byrne as a replacement for Poundland stalwart Jim McCarthy and helping his latest company NotOnTheHighStreet navigate a potential capital-raising.

Shapland, a former Sainsbury’s director, is a retail veteran with more than 25 years’ experience. That experience is being put to good use in the companies that he is guiding to growth.

70. Andrew Moore

- Chief merchandising officer, Asda

- Last year: 63

Andrew Moore faced a steep learning curve after taking on responsibility for food last year. Moore, who made his name driving impressive growth at George, took charge during a tumultuous time in the grocery market, where discounters are battering the big four.

Asda has been the biggest victim. Like-for-likes have plummeted at the grocer and show little sign of improvement. Moore must prove his mettle to get Asda back into growth.

71. Kevin O’Byrne

- Chief executive, Poundland

- RE-ENTRY

Jim McCarthy leaves big shoes to fill at Poundland but Kevin O’Byrne is an impressive replacement. O’Byrne was most recently chief executive of B&Q and has headed DIY giant Kingfisher’s businesses in China, Turkey, Germany and the UK and Ireland. That international experience will come in handy at Poundland, which in recent years has rolled out its Dealz fascia to Ireland and Spain.

O’Byrne only started in April but already has a challenge on his hands. Poundland’s latest half-year results showed profits dropped by a quarter, which sent its share price tumbling. He also has to manage the integration of the 99p Stores acquisition. He’ll need to put his DIY and ‘fix it’ experience to good use at Poundland.

72. Stacey Cartwright

- Chief executive, Harvey Nichols

- Last year: 70

Stacey Cartwright has had a challenging year at Harvey Nichols. Operating profits fell 30% to £13.9m in its year to March 28 and Cartwright warned that the trading climate for luxury retail will remain uncertain.

Cartwright knows luxury well. She joined Harvey Nichols two years ago from Burberry where she was chief financial officer. The former finance boss is not being tight-fisted in her new role and has invested in both stores and technology. The retailer has introduced an impressive loyalty card app, overhauled its Birmingham flagship and relaunched its website over the past 18 months.

However, there has been some embarrassment over the year. The retailer withdrew from its new seven-floor Azerbaijan department store just months after its high-profile launch after a split with its licence partner.

73. Peter Davis

- Managing director, Homebase, and chief operating officer, Bunnings

- NEW ENTRY

Peter Davis comes storming into not just the Power List but the UK at large. Australian DIY powerhouse Bunnings snapped up Homebase for £340m in a move that sent shockwaves throughout the home improvement sector.

Bunnings is a tour de force in Australia and its price, range and service are difficult to beat. The retailer has been clear that the Homebase acquisition is a store grab and it plans to rebrand the business as Bunnings and introduce its offer, which will put it in direct competition with B&Q and Wickes.

Amiable Davis, or PJ as he’s known throughout the business, is a Bunnings lifer with more than 30 years served. He is unafraid to make bold moves. One of his first actions when taking over Homebase was to axe its senior management team, a daring decision given his lack of UK experience. All eyes will be on Davis to see if he can replicate Bunnings’ success in the UK and his daring pays off.

74. John Browett

- Chief executive, Dunelm

- RE-ENTRY

John Browett has become a man of mystery in retail – you never know where he’s going to turn up next. From Dixons to Apple to Monsoon and now Dunelm, his career moves continue to surprise.

Browett, who has been in post at Dunelm since January, has some ambitious targets to meet at the homewares retailer. Deputy chairman Will Adderley, who handed over the reins to Browett after a successful stint as interim boss, believes Dunelm’s sales can grow by 50% in the medium term.

Browett knows exactly how he is going to achieve that growth and has pushed the button on expansion within London and the M25.

75. Matt Moulding

- Chief executive, The Hut Group

- Last year: 74

With shareholders including retail dignitaries Sir Terry Leahy and Sir Stuart Rose, pressure is heaped on The Hut Group to deliver, and founder Matt Moulding has yet to disappoint.

In its last financial year, The Hut Group’s profits rose by 33% and sales jumped 35% to £334m. The Cheshire-based retail group, which operates more than 20 websites including Zavvi, MyProtein and The Hut, is fast turning into an international powerhouse, with more than half of sales coming from overseas.

Moulding, a protégé of Phones4U tycoon John Caudwell, says his aim is to build a “major British export success”. If he can deliver on this he’ll make his heavyweight shareholders very happy.

76-100

76. Mark Newton-Jones

- Chief executive, Mothercare

- Last year: 78

Mark Newton-Jones has had a dramatic impact since taking the helm at Mothercare in 2014. He has accelerated the turnaround of the struggling mother and baby retailer and is gaining traction. The retailer posted its first statutory pre-tax profit in five years in its last financial year and losses narrowed at its core UK arm.

Newton-Jones wants to transform the global brand into a digitally led business that is supported by fresh, modern, multichannel stores.

He has closed unprofitable stores, ploughed money into IT and is integrating the online and offline business. However, according to those who work there, the biggest change he has brought about is improving morale.

Newton-Jones is a team-builder that can enthuse people around his vision – a vision that is becoming clearer by the day.

77. Catriona Marshall

- Chief executive, Hobbycraft

- Last year: 75

Catriona Marshall moves down the list owing to the stellar performance of others, although Hobbycraft also has plenty to celebrate. The retailer continues to thrive under her leadership and EBITDA rose 25.9% to £6.8m over the year.

Marshall has laid the foundations to scale the business over the next five years. She has invested in ecommerce, which grew a whopping 142% in the last financial year, supply chain and in keeping prices down.

Now Hobbycraft is focused on accelerating its expansion. Marshall believes the arts and crafts retailer can grow to 150 stores and has started opening smaller-format shops to reach her target quicker.

78. Richard Baker

- Chairman, DFS, and operating partner, Advent

- Last year: 69

Richard Baker falls down the list because his role has relaxed slightly after he oversaw DFS’ float last year.

DFS’ stock market debut may have disappointed in terms of valuation, but an impressive performance has helped its share price rally. Baker has helped ensure the furniture retailer has stayed on course and delivered rising sales and profits.

The retailer is also gunning for new growth opportunities such as overseas expansion and opening smaller stores in city centres.

79. Simon King

- Managing director, Wickes

- Last year: 76

Simon King edges down the list despite a cracking year at Wickes. The DIY retailer has gained market share as like-for-likes jumped 5.3% over its last financial year.

King has made smart investments in speedy click-and-collect that will help woo trade customers. It has also benefited from significant range reviews and brought customers more clearly defined value, good quality and premium ranges.

However, pressure could mount on King in the year ahead following Bunnings’ UK entry. The Australian retailer carries hard lines of DIY and is aiming to service trade customers by opening earlier. King will need to keep his eye on the ball to protect his market share gains.

80. Darren Blackhurst

- Group commercial director, Morrisons

- Last year: 77

Darren Blackhurst has kept a low profile since joining supermarket Morrisons last year.

The former B&Q commercial director and Matalan chief executive has bundles of grocery experience, including an 18-year stint at Tesco. His experience has been beneficial as he helps chief executive David Potts tackle Morrisons’ turnaround during a time of turmoil for the grocery sector.

Morrisons’ performance has already shown signs of improvement and like-for-likes sales grew over the past two quarters. Blackhurst will be part of Potts’ crack team tasked with keeping this good run going.

81. Tanya Lawler

- Vice-president, eBay UK

- Last year: 79

In a world where online retailers can often be seen as the enemy, Tanya Lawler has made eBay a key ally for many bricks-and-mortar players.

The marketplace connects its 18 million buyers to a wealth of retailers across the high street including Argos, SuperGroup and Debenhams.

It is particularly potent for small retailers. More than 50% of eBay’s Black Friday deals were from its SME sellers.

The etailer’s relationship with the retail community also extends into fulfilment. Over the past year, eBay has extended its tie-up with Argos that allows customers to pick up their eBay purchases at Argos stores nationwide. More than 3 million parcels have been processed this way since the service’s pilot in 2013.

82. Andrew Livingston

- Chief executive, Screwfix

- Last year: 85