In profile: A-Z

Need-to-know retail innovation from around the world

Amazon's mechatronics and sustainable packaging team have installed more than 1,000 new robotics and AI-powered innovations in just five years

Coles teamed up with Wing to launch drone deliveries to customers in Canberra

The Co-op's Starship Technology autonomous robots deliver goods to consumers in several areas of the UK

Decathlon's Second Life website offers product buy-back and resale

Retail's global innovators:

A-E

Ahold Delhaize

(Netherlands)

Dutch-Belgian grocer Ahold Delhaize is taking tech innovation seriously, illustrated in April 2024 by the launch of a new digital-focused studio in Bucharest aimed at strengthening its engineering capabilities. By accruing a 250-strong tech team, the plan is to drive innovation in areas such as ecommerce, app development, data and loyalty.

The retailer is a long-time innovator, adopting electronic shelf labels (ESL) in its European stores as early as 2019, supported by ESL specialist Hanshow Technology. It spent 2023 working with tech provider Cisco to deploy OpenRoaming – a framework to connect billions of users to millions of Wi-Fi networks globally – in its Belgian stores. This has boosted its Wi-Fi access and helped drive shopper engagement with its loyalty apps.

In May 2024, the grocer announced it expects €5bn (£4.2bn) in cumulative savings by applying AI and automation in its logistics, distribution, stores and back office. It also announced that it expects its increased efforts in driving loyalty scheme customers towards its apps will boost sales volumes. Its tech team announced in July 2024 that its data centres had migrated to Oracle Cloud VMware Solution, supported by DXC Technology, in a move presented as a cost-reduction and efficiency drive.

Ahold Delhaize is also one of five grocery giants investing in a five-year $125m (£98.9m) venture capital fund, W23 Global, alongside Tesco, Woolworths, Empire and Shoprite. Announced in April 2024, the fund is designed to “accelerate innovation” and find influential start-ups that can shake up global grocery.

Aldi

(Germany)

While it may not operate a transactional ecommerce website, Aldi’s tech investments stretch from the store to the supply chain, with most of its focus on finding efficiencies to support its low-operating-cost model.

As well as working with tech and IT consulting specialist Wipro to develop workplace services, Aldi has partnered with consultancy Genpact in the US and Australia to help it use AI to optimise its return on investment from tech platforms such as SAP, Blackline and ServiceNow. The grocer continues to explore the most innovative tech around.

Following significant volatility in the retail global supply chain in recent years, Aldi’s Asian unit said in January 2024 that it was migrating to an automated supply chain platform One Network Enterprise. The tie-up enables it to manage its global freight and distribution partners on one AI-powered solution.

Meanwhile, in-store, Aldi Nord’s partnership with computer vision company Trigo – which began in 2022 – continues to educate the business on how checkout-free stores might be deployed more widely across its network. The trial in Utrecht, the Netherlands, requires visitors to check in via the app, select their items and check out digitally.

It continues to teach Aldi about optimal product assortment and checkout processes and appears to be a direction of travel for the grocer, which deployed Grabango tech in a Chicago store in April 2024, to bring queue-free transactions to its US operations.

Alibaba

(China)

Alibaba’s influence on retail knows no bounds. Its online retail platforms, such as Taobao and Tmall, and its tech-driven grocery stores, have revolutionised the way consumers shop both domestically and internationally. Many international third parties opt to join Alibaba’s ecosystem rather than go direct to consumers in China.

Alibaba’s ‘New Retail’ ambition – the target of creating a shopping experience that seamlessly merges online and store-based shopping as if there are no channel boundaries – has had global influence since it was introduced in 2017. Western retailers have looked at Alibaba’s visionary stores – which consumers navigate with their mobiles while overhead distribution systems prepare local online orders for rapid delivery – as the potential future of grocery.

However, a challenging post-Covid economy in China means Alibaba’s innovation agenda is taking a different direction. The retail titan has denied it is selling swathes of its physical estate but it is certainly focusing on its core online and cloud businesses – and exploring how to capitalise on the AI revolution.

For example, its brand Taobao announced in March 2024 a ¥10bn (£1.07bn) subsidy for boosting content creation, with innovation in live streaming and short video content viewed as a way of driving consumer engagement. This is particularly relevant as competition ramps up among emerging players such as rival Temu owner Pinduoduo.

Amazon

(US)

Like its Chinese counterpart Alibaba, Amazon continues to be a beacon of innovation at the cross-section where retail and technology meet.

In August 2024, Amazon UK launched a co-branded credit card with British bank Barclays that allows customers to earn rewards when they spend. Over in the US, Amazon launched several AI-powered features for customers, including, in February, a new shopping assistant named Rufus for mobile customers; and, in April, a new playlist generator for Amazon Music.

Amazon continues to be a beacon of innovation at the cross-section where retail and technology meet

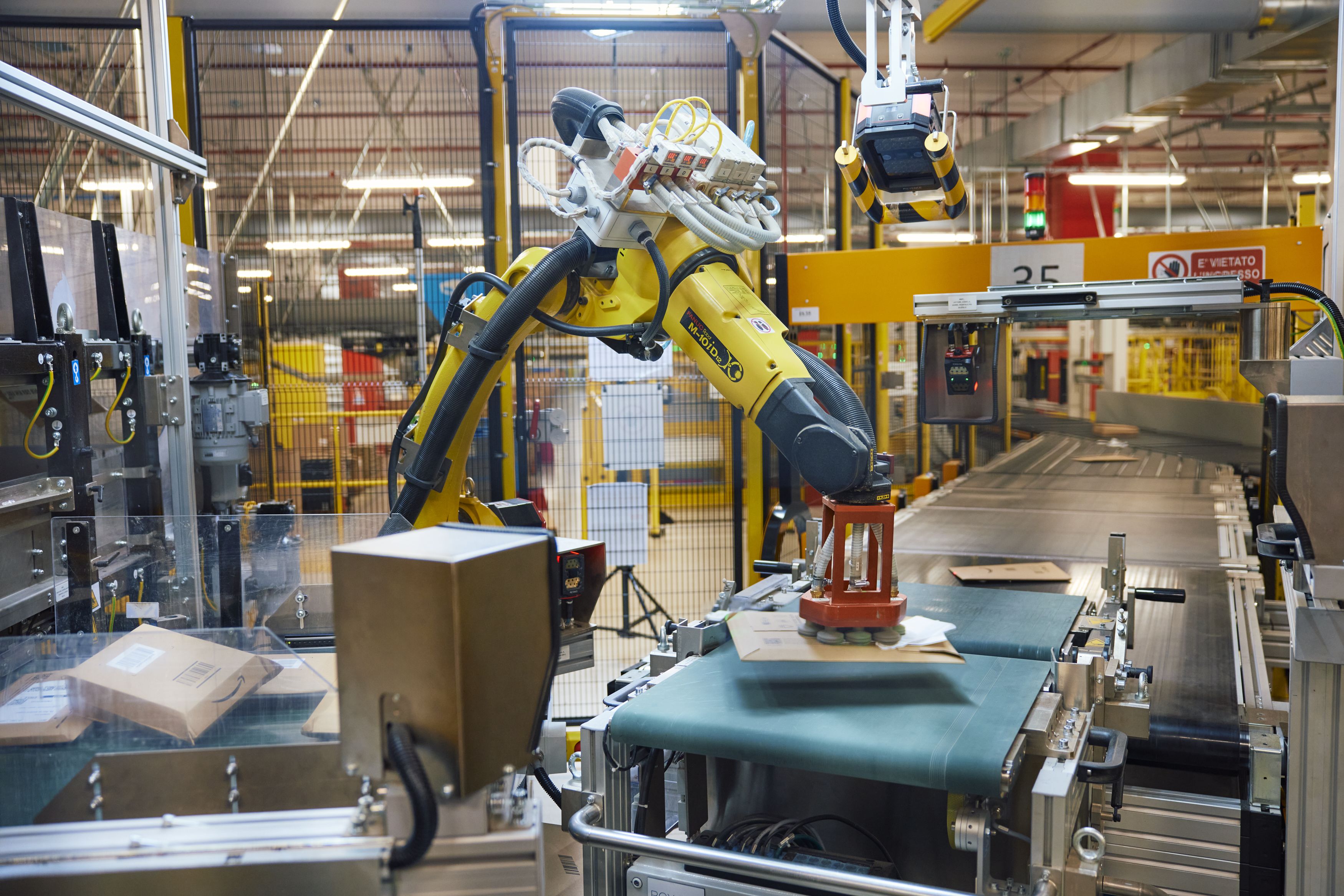

From these consumer-facing innovations to the company’s wider supply chain operations, the deployment of AI runs deep at Amazon. For example, by the end of 2024, it is estimated its mechatronics and sustainable packaging team, formed in 2019, will have been responsible for the installation of over 1,000 new robotics and AI-powered innovations, such as pallet movers and automated guide vehicles, throughout Amazon’s European fulfilment centre network alone.

Amazon continues to build outward and grow sales in its AWS cloud utility division, which now accounts for circa 17% of overall revenue, as third-party businesses continue to seek its expertise in IT infrastructure hosting as part of their digital modernisation projects.

Elsewhere, checkoutless Amazon Fresh stores in the US have evolved from a focus on Just Walk Out technology to the use of smart carts – where consumers take a trolley, log into their account via a built-in device and are charged for their goods as they exit via a dedicated lane.

Carrefour

(France)

While much of the global retail market continues to introduce behind-closed-doors generative AI proof of concepts, Carrefour is more than a year down the line with ChatGPT usage at a customer-facing level.

The France-based grocery giant was one of the first retailers to publicly announce and deploy services powered by this emerging strand of AI. In July 2023, it introduced an advice robot for shopping on its French site carrefour.fr, description sheets for Carrefour brand products on its website and support for purchasing procedures internally. All were based on ChatGPT’s creator OpenAI’s technologies, particularly GPT-4.

With group chief executive Alexandre Bompard already talking up how generative AI will “enrich the customer experience and profoundly transform our working methods”, Carrefour is keen to lead retail’s experimentation with this new tech. Indeed, in August 2024, the grocer revealed it is also using an AI-powered solution from Swedish food waste company Deligate to track inventory, monitor changes in demand and take action to avoid food waste.

Carrefour has introduced palm payments in its Paris store

Carrefour has introduced palm payments in its Paris store

Most dramatically – and underlining its innovative retailer credentials – is Carrefour’s introduction in July 2024 of a new way to pay in a Paris store. Working with French merchant services company Ingenico, it provides the capability for consumers to pay with their palms. Palm scanners alongside traditional payment terminals are being tested to reduce friction at the point of purchase.

Coles

(Australia)

In March 2022, the supermarket chain teamed up with Alphabet-owned drone company Wing to launch drone deliveries to customers in Canberra. It has paved the way for others to trial the tech – for example, Wing launched in Melbourne in July with delivery platform DoorDash a launch partner for the airborne delivery service.

Coles teamed up with Alphabet-owned drone company Wing to launch drone deliveries to customers in Canberra

In another example of delivering tech-driven customer experience improvements, in December 2023, it launched shoppable recipes by embedding tech firm Northfork’s application programming interfaces (APIs) into its online platform so that shoppers can – in one click – add all ingredients required for recipes to their shopping basket.

In March, Coles expanded its partnership with tech titan Microsoft to shift from trialling AI-powered tools to scaling them across operations and ensuring staff are using them to leverage data at every opportunity. Indeed, a tie-up with big data analytics software specialist Palantir Technologies, announced in February, is also part of Coles’ dedicated data and AI strategy – the partnership aims to improve workforce management and supply chain functions.

Coles is one of several global grocers leveraging UK retailer Ocado’s technology arm Ocado Solutions – and, from August, its shoppers in Sydney and Melbourne have been served by customer fulfilment centres built on the Ocado Smart Platform. This comprises significant robotic and automation power to speed up orders and drive productivity.

The Co-op

(UK)

The flow of new tech and digital innovation at the Co-op's food division shows no sign of slowing.

A core aim of the UK grocer’s work in this space is providing customer convenience, extending choice for its shoppers, and linking its fledgling ecommerce operation to its stores, which serve communities across the UK.

This strategy is displayed through its wide array of partnerships in the quick commerce space, including with Deliveroo, Just Eat, Starship Technologies and Uber Eats. In light of this growth, Co-op announced in July that it was implementing Walmart’s ‘Store Assist’ online fulfilment technology, which is an app to manage pick-up, third-party marketplace, ship-from-store and last-mile delivery orders all in one place – making the management process more straightforward for in-store staff.

Meanwhile, Co-op’s partnership with robotics company Starship Technologies, entailing a fleet of autonomous robots delivering goods directly to customers using GPS, is now accessible in parts of West Yorkshire and Greater Manchester, as well as Milton Keynes, Northampton, Bedford and Cambridge. Co-op now has the most extensive robot delivery arm in UK retail.

It also intends to grow the number of InPost lockers hosted at its stores, with the pick-up and drop-off points set to be in 150 Co-op stores by the end of 2024.

The Co-op intends to grow the number of InPost lockers hosted at its stores, with the pick-up and drop-off points set to be in 150 Co-op stores by the end of 2024

Currys

(UK)

Currys announced in May 2024 that it had selected consultancy firm Accenture and tech giant Microsoft to help deliver its core cloud technology infrastructure and leverage the newest AI technologies. Through the joint venture, the consumer electronics retailer will “modernise, secure and simplify” its technology estate – all part of efforts to accelerate Currys’ adoption of AI technologies.

It is the latest stage of an ongoing digital transformation at the retailer, which in the past three years has centred on organising customer data to put Currys in a better position to serve shoppers in-store and online. A key cog of this work was rolling out CRM software specialist Salesforce’s software in 2022 to enable store staff to surface relevant customer information at the point of purchase. The strategy has also involved working with Microsoft Azure to migrate data centres from on-premise to the cloud.

Currys’ adoption of AI technologies is the latest stage of an ongoing digital transformation at the retailer

Currys’ launch of Connected Media – its new retail media arm – in December 2023, is a prime example of the potential benefits of a strong data strategy. This is a new revenue driver and formalises how brands can advertise to consumers through the Currys network while putting more relevant products in front of shoppers in-store and on digital channels.

Decathlon

(France)

Much of French sports retailer Decathlon’s recent tech investment supports a more circular economy. For instance, its UK stores are linked to an online rental service that can be booked online, while its Second Life website has been established offering product buy-back and resale.

In May 2024, Decathlon announced an investment in Recyc’Elit, which specialises in recycling would-be-waste textiles. It is early days and Recyc’Elit’s first demonstrator is only set to be built in 2025, but Decathlon’s investment is evidence it is keen to address its supply chain waste – and that of others – supported by the latest technological advancements.

Other investments are related to its growing efforts in digital commerce. For instance, the retailer continues to build out its marketplace with third-party marketplace business Mirakl as it benefits from the wider assortment of products such a model brings. And in April it secured a deal with media agency Fifty to run its integrated media strategy across all channels using AI-driven audience insights.

The new ideas at Decathlon are coming thick and fast, with February 2024 seeing the launch of an immersive shopping experience app for Apple Vision Pro that allows US-based online shoppers to view its goods in 3D. In June 2024, the sports retailer unveiled Decathlon Pulse – a subsidiary focused on investing in innovative people and businesses to elevate its position in the sports and wellness market.

eBay

(US)

Online marketplace eBay has retrospectively positioned itself as a preloved pioneer, cleverly placing its brand at the heart of the accelerating circularity movement in retail.

In May 2024, a new ‘resell on eBay’ feature was added to its digital product passports, making it easier for brands and buyers to promote circularity and extend product lifecycles. Certilogo, a digital ID and authentication subsidiary acquired by eBay in July 2023, has embedded the new feature into the smart labels it manufactures for brands, so when a user scans the code they are presented with a clear route to reselling their garments.

Elsewhere, eBay’s strategic partnerships with secondhand clothing platforms Reskinned and ACS Clothing are helping brands easily launch preloved ‘stores’ on its website, encouraging further growth in the second-hand market.

Internationally, eBay is building AI-enabled features to improve the experience of its sellers. This year, in September, a redesigned dashboard for tracking and optimising ad campaigns has been launched, as have AI tools to help create ads based on real-time trends.

On the consumer side, it removed American Express as a payment method for its US shoppers in August 2024 and replaced it with Venmo’s mobile-first checkout, which its senior team has said is a tactic to appeal to Gen Z and younger demographics in general.

Esselunga

(Italy)

Italian supermarket chain Esselunga has ramped up its testing of new retail concepts, processes and technologies with the launch of EsselungaLab in March 2024. The working shop-come-experimental-lab in Milan provides the retailer with a dedicated space to try cutting-edge services, technologies, communication methods and materials, as well as new furniture, as it seeks to meet evolving customer needs.

Spread over two floors, the digital-payment-only hub includes a salad island with a robotic assistant and speedy checkout options supported by computer vision tech – in a vision of what the future of grocery shopping in Italy could be.

EsselungaLab's salad island with robotic assistant

EsselungaLab's salad island with robotic assistant

Trigo’s computer vision tech and Diebold Nixdorf’s self-service terminals feature in the space, which has been developed on the site of the Milan 2015 Expo and in a part of the city dedicated to organisations involved in innovation and developing future concepts.

Other evidence of Esselunga’s innovation strategy comes in the form of its latest website launched in November 2023, dedicated to quality wine and spirits. Enoteca Esselunga delivers throughout Italy, not just in the areas where Esselunga has stores, making it a standout operation in a market where ecommerce is still a small part of grocery retail.

Estée Lauder

(US)

More personalised interactions and speedier reaction to market trends are core goals for Estée Lauder going into 2025. In April 2024, the beauty conglomerate teamed up with Microsoft to create an AI Innovation Lab aimed at making the most of the tools available as part of the Microsoft Azure OpenAI Service.

In April 2024, the beauty conglomerate teamed up with Microsoft to create an AI Innovation Lab

Key for Estée Lauder, which has more than 20 beauty brands in its stable, is to launch products in markets with greater local relevancy. Within the new hub, Estée Lauder and Microsoft plan to build “impactful generative AI [GenAI] use cases” helping the beauty company better react to social trends and consumer demands. For instance, in April the duo announced it had built an internal-facing GenAI chatbot to enhance marketing effectiveness globally.

In addition, product innovation sits at the heart of the new strategic partnership, with GenAI tools being used in research and development teams to speed up products coming to market and build them based on the latest trends data region by region.

In a competitive beauty sector, Estée Lauder knows it needs to continue to modernise – and much of its tech investment is directed towards supply chain efficiency and inventory optimisation – with reducing obsolete and excess ranges viewed as an important profitability driver.