TALKING SHOP

What 530 store staff really think of your strategy

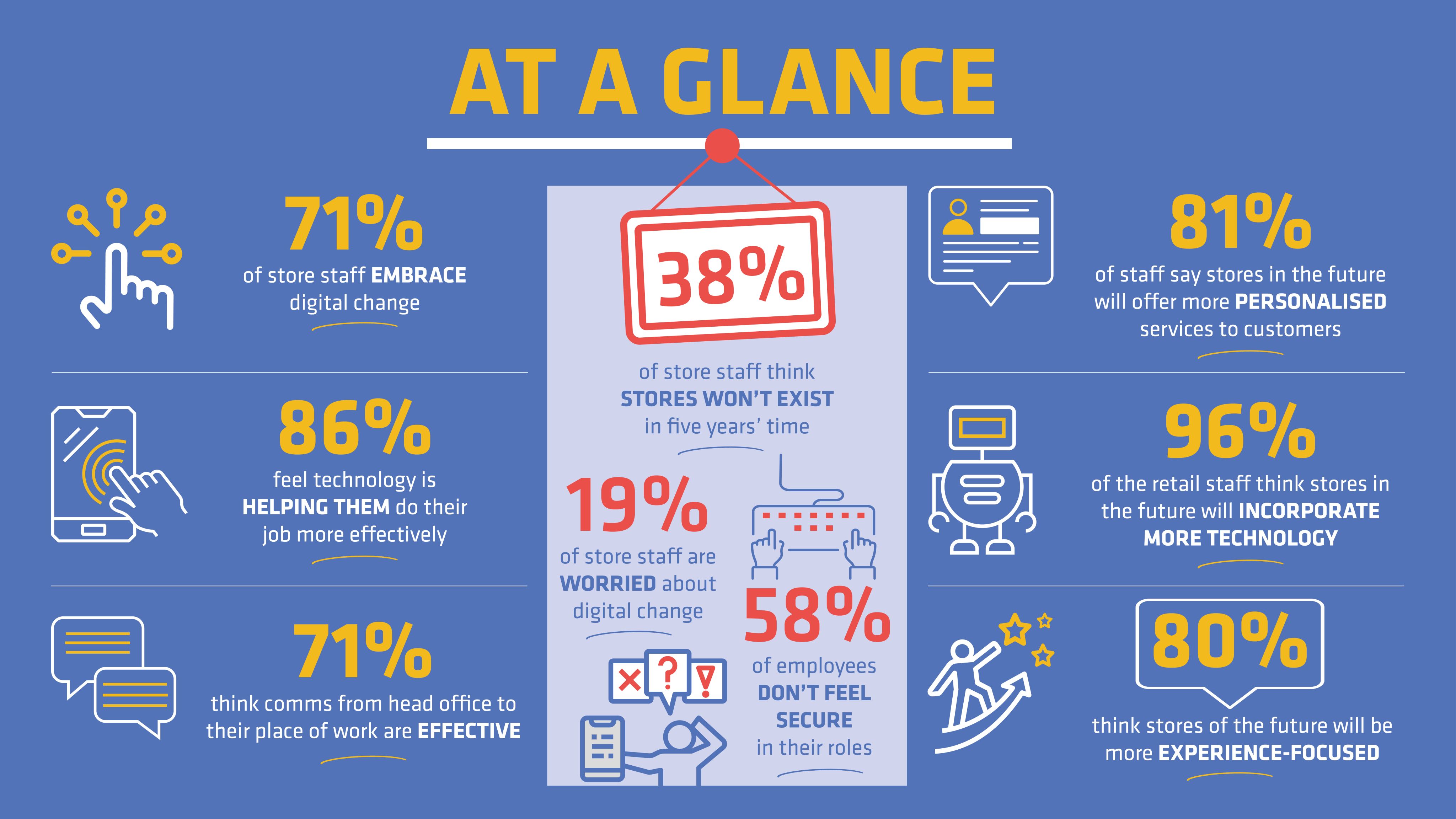

At a glance

Store-based retailers across the board are embracing digital change, driven by increasing competition from ecommerce players, evolving consumer expectations and greater accessibility of tech solutions. And rightly so. Consumers continue to want more from retailers: there is greater demand for speed, convenience, quality customer service, personalised experiences and seamless web-to-store integration.

With these demands comes growing pressure on store staff: there are new technologies and systems for frontline colleagues to learn, as well as changing priorities and the requirement for altered working hours and flexibility, and staff are needing to navigate their position in a workplace where automation and tech-driven systems are being adopted at pace.

In a survey of 530 store staff, compiled by Retail Week and Logile between March and April 2023, the findings reveal that almost half (49%) do not feel loyal to their retail business and would consider leaving for the right role. Yet the results also present green shoots of positivity:

- 71% of store staff are embracing digital change, with 86% saying technology has a positive impact on their effectiveness.

- More than two-thirds (71%) of store staff surveyed report communications from senior leadership as effective, which, while a positive result, does show a slight decrease from 2020 (76%), when we last ran this report.

So how can retailers truly maximise their greatest asset – their workforce?

Our Talking Shop report analyses the survey findings and provides a blueprint for businesses navigating digital change by shining a light on the realities of working in retail, and offering insights and actionable solutions to the biggest challenges for frontline staff. Global retailer case studies and advice from industry experts add further depth.

Read on to discover how the human side of physical retail is evolving and where real efficiencies can be made.

Methodology: Retail Week and Logile surveyed 530 UK retail store staff (anonymously) between March and April 2023 to understand their perspectives on working in retail today and the pace of digital change. Staff sentiment on the integration of in-store technology, internal workplace communications, the shape of the stores of the future and broader perspectives on retail as a career path was investigated. The survey was conducted by WorkL For Business, an employee experience survey and insight provider. Retail Week has also compared the results with its previous Talking Shop survey of 500 store staff, conducted between September and October 2020, to understand how opinions have changed in the past three years.

Introduction

Omnichannel has been the buzzword of the past decade in retail, but the pandemic accelerated the pace of change, and store-based retailers across the UK are increasingly investing in digital transformation.

In the past year alone, two of the country’s biggest retailers have overhauled their strategies: Primark now operates click-and-collect and will have rolled out the service to 57 stores, almost a third of its UK estate, by the end of the summer, having had no online presence prior to 2022; similarly, B&Q is now using more than 50 of its stores as digital hubs for fulfilling home deliveries when, prior to the pandemic, it relied solely on its warehouses for this function.

As the digital evolution continues, the best and most successful retailers will be the ones taking their store staff with them on the journey

These examples highlight the radical change taking place in the heart of the retail industry – stores – and as this evolution continues, the best and most successful retailers will be the ones taking their store staff with them on the journey: communicating and engaging them across touchpoints, investing in their careers, driving productivity and finding the best combination of human and tech power.

As we explore in this report, retailers including Marks & Spencer, Crew Clothing, Zara and One Stop are introducing technology across store networks while focusing on what it all means for their staff.

In the 2020 Talking Shop report, Retail Week questioned frontline store staff about how they were engaged as digital change unfolded. It found some were somewhat disillusioned with the digitisation of their stores. Some were fearing for their roles as stores were closed during lockdowns (24% felt insecure in their jobs), while others were unhappy with how senior staff relayed plans to them (31% of shopfloor workers said in-store communications were ineffective) and queried investments in their teams.

Now, three years on, Retail Week has once again asked 530 UK store staff about these matters to see what has changed and what positive momentum there is in their retail businesses, alongside areas retailers need to address.

Although the survey shows some of these concerns remain, store staff have cited several consistencies and improvements in communication and engagement, and there is clear appetite for technology to aid them in their roles, provided solutions are deployed in a clear and collaborative way; 71% are happy to embrace digital change and 86% say tech is helping them do their job more effectively.

Senior leadership must bolster their store staff’s brand advocacy and loyalty, guiding them through digital transformation, as this can drive sales growth in the years to come

But there is a need to keep frontline staff on side and motivated as the digitisation of bricks and mortar continues, especially against the backdrop of the current uncertain micro- and macroeconomic environment, which is creating many challenges of its own.

Senior leadership must bolster their store staff’s brand advocacy and loyalty, guiding them through digital transformation, as this can drive sales growth in the years to come. The findings indicate that stores of the future will rely upon an experienced, passionate and driven workforce, who are supported by technology.

The following chapters explore how retailers are investing in their store teams, illuminate areas where retailers have work to do and highlight tangible ways other businesses can collaborate with frontline colleagues to embrace digital change.

From the rise of in-store self-service to automated click-and-collect points and the now common deployment of mobile devices in the hands of shop staff, bricks-and-mortar stores have become digitised.

This research shows 72% of store staff feel the pace of digital change in their stores is fast, with 14% suggesting it is too fast for them to keep up. Those finding it most challenging are store staff in the sports and leisure (31%), toys and gifts (27%), and home and DIY (25%) sectors.

However, others are calling for greater digital transformation. This is particularly true among those with longer retail careers. Those who have more than 10 years’ experience are most likely to say the pace of digital change needs to be quicker (8% versus a 4% average).

The drive for digitalisation

There is evidence supporting the business case for digital investment in stores.

M&S, for example, is known for adopting technology into its store environments. In May 2023, it introduced the ‘queue-busting’ option of offering payment in fitting rooms in its new full-line store in Leeds, freeing up store staff to focus on customer service. Customer choice comes first throughout tech integration, with another addition – the 164-seat cafe – offering both table service and digital ordering by smartphone to suit customers’ preferences.

Being outpaced

While M&S is in growth mode, companies such as Debenhams and Arcadia were slow to digitise their stores and combine their physical and digital assets – and they collapsed and disappeared from high streets and shopping centres in 2020. Other factors were involved, but the lack of modernisation in stores was a key reason for their move to a purely online model.

Despite their stores vanishing from high streets, both brands do still exist online and may make a return to physical retail yet – Arcadia’s brands were split between Asos and Boohoo, and Debenhams went to Boohoo, which trialled a 7,552 sq ft beauty store in Manchester’s Arndale shopping centre in December 2021.

Who’s embracing the switch?

Positively, most store staff are excited about the digital changes the industry is going through, with 71% reporting that they embrace it.

Store staff working in the health and beauty sector (24%) are most unsure about how they feel towards digital transformation. This sector has traditionally involved store staff offering significant levels of advice to customers – whether that is related to medical conditions or beauty product routines – so the idea consumers might be able to self-serve via touchscreens or learn more about products via online content could change their roles substantially.

On the subject of job security, 42% of store staff say they feel secure or very secure in their roles, with more than half (58%) of the workforce feeling less so, more than double than in 2020 (24%), suggesting there is work for senior leadership to do to empower their frontline teams.

While an overwhelming majority of store staff (81%) are not worried about digital change, there are learnings to be had from the 19% who are – 38% of whom fear new technologies, either using them or that they could take over their roles and leave them redundant, while almost a third don’t think they help them do their job better.

With the rise of and focus on artificial intelligence (AI), none more so than the attention Open AI’s ChatGPT tool has gained since November 2022 when it was released to market, staff worry that technology might replace their roles, that they may not understand it or that they may feel pressure to use it correctly.

AI and why the human touch is still important

The tech-replaces-people fear has persisted for decades and it is starting to show up in retail. BT’s announcement in May 2023 that it expects its workforce to be reduced by around 55,000 people by the end of the decade, many of whom will be replaced by technologies including AI, shows it is a valid concern.

Yet AI has its limitations and needs to be balanced with human interaction.

For instance, retailers such as Tesco and Amazon have introduced AI-powered checkout-free stores in the UK over the past few years, but these trials have produced varied results. For Amazon, the strategy to roll out its Amazon Fresh format nationwide was put on ice in September 2022 after its impact fell short of expectations. For Tesco, the latest iteration of its futuristic GetGo stores is a ‘hybrid’ variety, where customers can choose from app-based, tracked shopping that requires no checkout, a self-checkout or a manned checkout.

Through its trials, the UK’s largest supermarket chain has effectively concluded that AI-run checkouts only work, right now, if there is an option for human interaction alongside them, which shows the value of retail workers in the store environment.

Six ways retailers are looking after store staff

Job security is not solely linked to the digital evolution in retail, of course. Retailers are navigating the fiercest UK cost-of-living crisis in generations, with the rate of inflation stuck at its highest rate for 40 years at the time of writing. Interest rates are also at their highest level for almost 15 years.

These cost concerns are both impacting staff wellbeing and the ability for retail stores to trade successfully; the Centre for Retail Research estimates 150,000 store-based jobs will disappear this year as up to 18,000 stores close down.

To fight against this downturn, retailers are taking action, and many are also embracing new policies to help employees better manage their mental and physical wellbeing and work-life balance.

1. Cost-of-living support

In November 2022, Ikea invested £12m in a pay rise and wellbeing support package to support its staff through the cost-of-living crisis. Within the scheme was an average 6% pay rise for salaried workers, to £10.90 an hour, or £11.95 in London, and a bonus equivalent to one month’s salary ahead of Christmas 2022.

Additionally, Ikea’s staff discount has doubled from 15% to 30% off and those working for the retailer can now access additional free healthy meals when in the workplace. Other benefits for staff who have been with the company for six months include a flexible ‘no questions asked’ loan of up to £1,000 or 10% of their salary, and an increase from 15% to 25% discount on a public transport season ticket.

Darren Taylor, Ikea UK and Ireland people and culture manager, said at the time: “Recognising the increasing challenges brought by the rising cost of living, we are pleased to share some of the additional measures we are taking to ensure needs are met, and hope that it will ease some of the pressures of the current climate.”

The same month, River Island started distributing care packages containing food and personal items to help staff and created a non-repayable grant scheme for staff experiencing financial difficulties.

2. Increasing pay

Aldi, Costa Coffee and Currys are among a raft of companies raising pay for store staff in retail this year, which as an industry has stepped up in the cost-of-living crisis and been quick to take relevant renumeration action.

Majestic Wine unveiled a new pay structure in April 2023, comprising an average staff salary increase of 6.7% and an additional £250 bonus rewarding their efforts over the previous year. The new structure means that, along with the base pay rate increase for staff, Majestic Wine store managers can earn up to an extra £11,700 per year. Renumeration will also recognise retail staff’s wine qualifications, which they can take as part of their employment at Majestic Wine, as well as the revenue of the store where they work – directly linking what they earn to their personal development and performance.

Lush announced a 10% pay rise for its retail staff in April 2023, in line with the real living wage set by the Living Wage Foundation. Commenting on the move, which brought hourly pay to £10.90 in the UK and £11.95 in London, Lush finance director Kim Coles said: “Lush staff making and selling our products are crucial to our success, and we continue to commit to the rate to ensure that, as the cost of living continues to rise, we can be confident that our rates of pay are fair and that our staff can afford what they need to thrive, not just to survive.”

3. Life event policies

Recognising the need to support colleagues through different life events, Toolstation has introduced a series of new policies, including now offering 10 days of additional leave during the first two years of parenthood to cover emergencies and one week’s additional paid leave for both new parents for the two years following the birth of their child.

Toolstation is also one of the latest retailers to provide more leave entitlement related to fertility challenges, with two days’ paid leave for those undergoing fertility treatment or an IVF cycle, two weeks’ paid leave for those affected by miscarriage and two days’ paid leave for affected partners.

Maternity, adoption and surrogacy entitlement have been increased to 26 weeks’ full pay followed by 13 weeks’ statutory and two weeks’ paid paternity leave.

Toolstation has also increased pay for all store, operations and entry-level employees by 9.4%, meaning entry-level colleagues will now be paid £10.60 per hour. In addition, a flexible working option is available to staff who have worked at Toolstation for more than 13 weeks.

Toolstation HR director Jag Nagra said: “These initiatives are integral to our ambition to create a workplace that supports colleagues in moments that matter and may have an impact on their working lives.”

4. Menopause support at work

A growing number of retailers have introduced or updated menopause-related staff policies in recognition of the oversight in this area previously.

In October 2021, Asos announced staff could work flexibly and take time off at short notice while going through menopause, which was part of a dedicated move to give its workforce greater options and time off when “going through health-related life events”, which also included pregnancy loss.

Holland & Barrett, meanwhile, said in October 2022 that it had trained more than 4,000 colleagues on recognising menopause symptoms and on how to advise on lifestyle and diet options. This, of course, helps customers, but also raises understanding within the workforce about the different phases of the menopause cycle, making it less taboo.

5. Flexible working

Amid a mounting mental health crisis and changing attitudes towards work post-pandemic, several retailers have trialled the concept of a four-day working week aimed at increasing flexibility and creating a better work-life balance for people.

Sainsbury’s announced in February that it was trialling flexible working for its store managers and head office and warehouse staff. Staff have been given the option to work their 37.5-hour contracts across the seven-day week, but they are not authorised to take consecutive Fridays off.

In November 2022, M&S announced that, from January 2023, more than 3,000 retail managers would be given the choice of spreading their hours over five days, a four-day compressed week or a compressed nine-day fortnight.

In October 2022, Superdry introduced a four-day week with compressed hours for all store team members on full-time contracts.

A nationwide trial of a four-day week took place last year, supported by pressure group The 4 Day Week Campaign, which generated positive results. More than 70 businesses from different industries took part in the trial, where employees worked 80% of their usual working hours for 100% of their pay, and the conclusion was that staff at these organisations were happier and healthier, and the companies themselves were more productive.

6. Investing in new stores

Although the Centre for Retail Research has made store closure projections in the tens of thousands, some retailers are opening stores in 2023 and hiring new store staff as a result, including Flannels, Seasalt, M&S, H&M, Primark and Aldi.

After a return to profitability following its collapse into administration in early 2020, womenswear retailer Monsoon announced in December 2022 plans to open 22 new UK stores over the following year, having opened 19 the year before. Its first new childrenswear boutique launched in Westfield in February 2023.

On a global scale, Urban Outfitters says it plans to grow its physical presence over the next few years, starting in April 2023 when it confirmed three new locations planned in the UK, Netherlands and Germany.

With increased investment in bricks and mortar comes job opportunities, which is good for the communities where all new stores are based.

Ikea provides free meals for staff at work

Ikea provides free meals for staff at work

Lush gave retail staff a 10% pay rise in April, in line with the Living Wage Foundation

Lush gave retail staff a 10% pay rise in April, in line with the Living Wage Foundation

Holland & Barrett has trained more than 4,000 colleagues on recognising menopause symptoms, which also helps promote understanding within the workplace

Holland & Barrett has trained more than 4,000 colleagues on recognising menopause symptoms, which also helps promote understanding within the workplace

Sainsbury’s is trialling flexible working for its store managers and head office and warehouse staff, including a four-day week

Sainsbury’s is trialling flexible working for its store managers and head office and warehouse staff, including a four-day week

The fusion of physical stores with online shopping is leading to new approaches to store formats that now include the kind of tech that has revolutionised warehouses over the past decade.

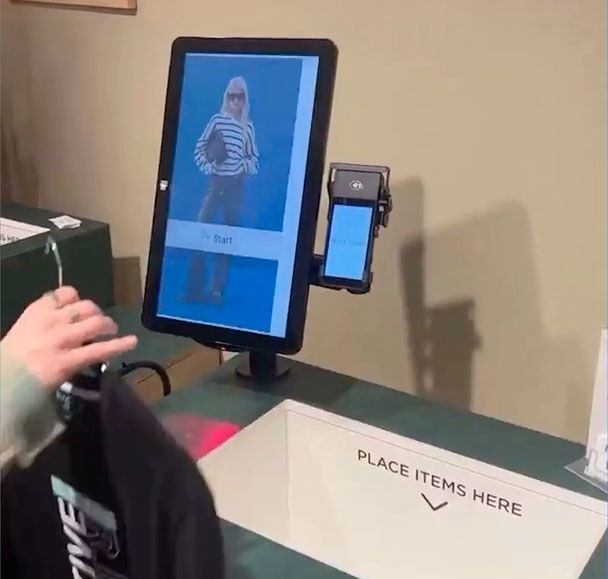

Zara’s Westfield Stratford City branch in London, which was extended and updated in May this year, includes an automated collection point operated by a robotic arm among its new features.

The idea of this tech deployment is to speed up the click-and-collect process for consumers while removing the operational burden on staff fulfilling online orders in the shop. The two online collection points and dedicated automated returns checkouts highlight the Inditex-owned retailer’s preference for its stores to use tech to drive convenience for customers and staff alike.

Broadly speaking, two tech streams have taken hold in bricks and mortar: tech to improve workforce collaboration and operational efficiencies, and tech to directly serve consumers and help frontline staff deliver exceptional customer experience (CX) – although, as with the Zara example, often the two feed into one another.

Tech for staff collaboration and efficiency

Retailers are looking to increase the productivity of their staff. For instance, Kavanagh Group, owner of grocery chain Budgens, has been cutting out time-consuming in-store labour at its internet-of-things-powered concept store in Belsize Park, London, opened in February this year.

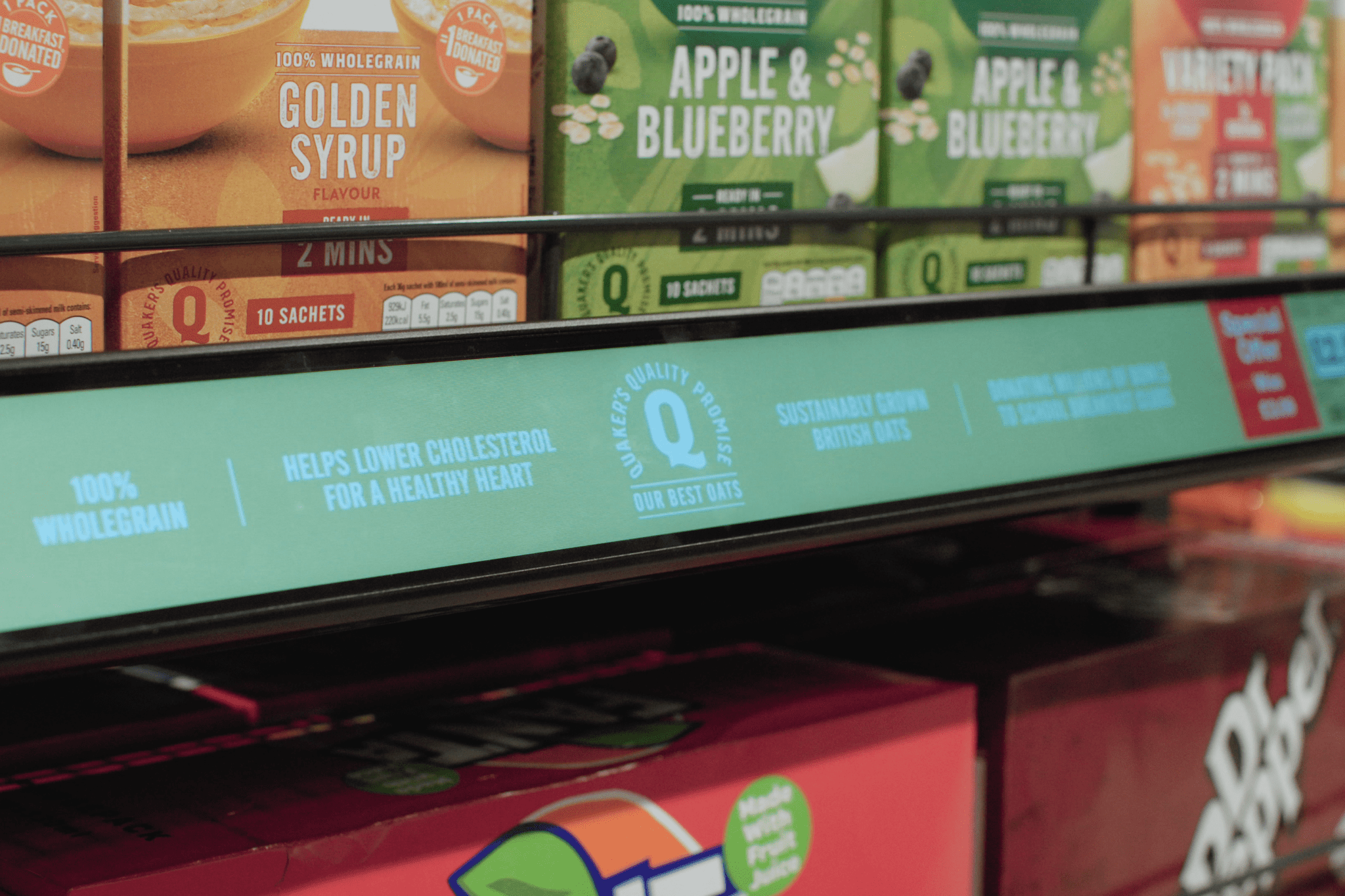

Digital shelf-edge labels are updated centrally and cameras on the shelves inform staff about inventory levels, cutting out several manual tasks. Kavanagh claims the technology means its workforce can “better utilise” at least 10 hours a week that would normally be spent focusing on shelves and changing paper tickets, as automating shelf monitoring and alerting saves time on the traditional retail function of gap scanning.

Meanwhile, one of the new operational pinch points retailers are experiencing amid increasing digitisation is how to deal with online orders that are served or fulfilled from stores.

Many retailers, such as the Co-op and Sainsbury’s, are increasingly using their stores as mini distribution hubs for online shoppers, requiring new skillsets and operational planning to ensure customer-facing supermarket workers are not distracted from their traditional roles.

Convenience chain One Stop has brought in software to help staff manage multiple delivery providers picking up items to fulfil online orders. The Deliverect technology, which began roll-out in January this year, initially in owned stores but eventually to be introduced in franchises too, provides one system to manage multiple delivery partner relationships.

Tim Josephs, head of online at Tesco-owned One Stop, which has partnerships with several quick-commerce delivery partners, says: “It allows us to manage more tasks centrally, helping to save time for our store colleagues and franchisees while improving the service we offer customers.

“Order picking will become more efficient, menu availability can be managed more effectively and we can generate menus all in one place. Deliverect will also give us greater insight into each store, allowing us to continually improve our offer and individual store performance.”

Tech to improve CX

Electricals retailer Currys is trialling new AI robots at four stores, including its Birmingham flagship. KettyBots help customers locate specific items, guiding people to products and, in doing so, freeing up store staff to spend more time with customers who need expert advice before making a purchase. The current novelty of robots in UK shopping scenarios provides a CX differentiator for Currys, too.

With slightly less novelty factor, at Crew Clothing a new mobile sales solution is in place across the store estate, replacing traditional tills with hand-held devices, allowing employees to serve customers all around the shopfloor. This is not new in retail, but for fashion retailer Crew, which has plans to remove all its traditional tills over the course of 2023, it is a fresh idea to allocate more shop space to product merchandising and greater interaction between staff and customers.

Crew head of IT Richard Surman says: “Instead of being constrained to a checkout area, our staff can roam the shopfloor, engaging with customers and offering immediate purchasing opportunities – from fitting rooms to front of house, or wherever is most convenient for the customer.”

Zara’s Westfield Stratford City branch features two online collection points and dedicated automated returns checkouts

Zara’s Westfield Stratford City branch features two online collection points and dedicated automated returns checkouts

Budgens’ Belsize Park store is powered by the internet of things. Image courtesy of Kavanagh Group/SES-imagotag

Budgens’ Belsize Park store is powered by the internet of things. Image courtesy of Kavanagh Group/SES-imagotag

Currys’ new KettyBot directs customers to products in store

Currys’ new KettyBot directs customers to products in store

The insider perspective on in-store tech

Tech is taking over tasks that, until recently, store staff had been doing and deployment can be unsettling or empowering for employees. Often the way tech is viewed can come down to how well a retailer communicates with its staff about the changes.

Broadly, store staff seem to be on board with tech being used for these purposes. A high percentage of frontline staff – 86% – say technology helps them to do their job more effectively, a statistic that remains unchanged from our 2020 survey where the same percentage of store staff reported having access to the tech needed to do their job effectively sometimes, often or all of the time.

Interestingly in 2023, the percentage of staff saying that they always have access to technology to help better their work has dropped to 12% from the 19% reported in 2020, with a higher percentage of staff choosing sometimes for this question (42% compared with 34% in 2020).

This is most prominent in the home and DIY, and music, books and stationery sectors, where 30% and 26% of respondents respectively said that they always or often have access to the tech they need to be more effective, compared with a reported average of 44%.

On the converse, charity (67%), general merchandise (53%) and toys and gifts (53%) seem to be taking the most noticeable strides in implementing technology to make store teams’ working lives easier.

It is encouraging that the significant investment retailers are putting into this area is valued by staff. The statistic comparison suggests that, in some sectors, businesses are really refining their approaches and getting better at retail tech investment, but it is also clear that in others there is still significant work to do in acquiring, implementing and training staff with the right technologies to enable them to work more effectively.

For the fourth year running, retail ranked among the worst industries for work-life balance by company review site Glassdoor at the end of 2022.

Recent investments in pay rises and wellbeing packages, experiments with investment in store space and technology, and flexible working suggest retailers recognise the need for change.

From Majestic Wine’s pay increases and relevant staff development to Ikea’s cost-of-living support package and the various experiments with four-day week models and parenthood leave, retailers are doing more, it would appear, to engage, reward and motivate their workforce.

But are these changes simply perceived as headline-drawing acts of corporate responsibility in an ongoing cost-of-living crisis or true beams of support in an industry burdened with challenges?

Speaking out

Our research shows that 47% of frontline staff think their opinion matters to leadership, but that leaves a majority who believe it doesn’t. There is clearly some work to do to ensure those at the coalface are being heard.

Retailers such as M&S and LK Bennett are working to change this, with each of these businesses’ CEOs putting in place clear avenues for staff to communicate with those leading the company and express their views about how their organisations are run. The respective initiatives, M&S’ ‘Straight to Stuart [Machin, CEO]’ and LK Bennett’s ‘Discuss with Darren [Topp, CEO]’, follow a similar model by encouraging staff to put forward their opinions and engage with wider strategy.

Machin’s scheme generated 10,000 messages in its first year (2022) and he has described the success of the initiative as “a testament to the culture and passion of our teams”.

Meanwhile, 71% think communications from head office to stores are effective. Playing into the aforementioned analysis in chapter two, this is an area of slight decline for the industry in the aftermath of the pandemic (compared with 76% in 2020) and should be prioritised by senior teams to ensure communications remain effective.

The sectors with the most work to do in this area are department stores and grocery, with 37% and 36% respectively saying communication is ineffective, while charity, fashion, and health and beauty retailers are ahead of the rest – 100%, 83% and 82% respectively say communication is effective.

One example of a retailer with a particularly happy workforce, according to WorkL, is Fat Face. In a report by Retail Trust and WorkL published in May 2022, Joanne Wilson, head of people at Fat Face, described the workplace culture as a key reason for staff contentment.

She explained that head office gives managers of different departments and individual stores the freedom to create their own culture “overarched by the wider business culture”.

Wilson said: “Empowering our teams to determine their own culture has created true accountability, which is really important to us. Every employee matters and every employee can have an impact on the culture at Fat Face.”

How supported are store staff really?

Our research highlights that 65% of frontline staff think head office either often or very often changes priorities and introduces new tasks into their daily routines. The Fat Face approach is one way to circumnavigate this management tactic.

Some 55% agree or strongly agree that they get enough advance warning to plan properly when asked to conduct new daily tasks, but there is clear room for improvement here. This is particularly evident in toys and gifts, home and DIY, and sports and leisure, the sectors where a negative response to this statement was given most frequently – 40%, 39% and 35% respectively.

The home and DIY sector, for example, has digitised more dramatically than many others in the months since the pandemic, with online fulfilment from stores now a core part of retailers’ operations, such as B&Q and Wickes, when pre-2020 that was not the case.

This new model seems to be good for business, with Kingfisher’s UK and Ireland division’s and Wickes’ like-for-like sales up by 15.3% and 22.8% respectively on a three-year basis. However, our findings serve as a warning for any business undertaking significant change that staff want more time to plan for any new tasks asked of them.

Department store staff showing signs of discord

Encouragingly, 64% of store staff feel they have a good deal of flexibility in their roles and are in control of their hours.

The sector where flexibility exists the least, according to our respondents, is department stores.

Overall, department store staff are the most likely to show disharmony compared with staff members working in other industries. As well as being most likely to highlight a lack of flexibility (44% versus an average of 35%) and inefficient communication between head office and the front line (37% versus an average of 29%), department store workers are also the most likely to report digital changes happening in their stores without them having a say on the matter (42%).

Only grocery staff (57%) feel more strongly about this latter point.

No sector of retail has been left unaffected by digital transformation, the wider economic environment and emerging consumer behaviours, but department store chains have certainly seen more disruption than most.

House of Fraser was acquired out of administration by Sports Direct – now Frasers Group – in August 2018 and is now about half the size it was at that point, although its 31 stores now in operation showed an improvement in trading last year, according to a half-year statement issued by the wider group in December 2022.

John Lewis permanently closed 16 stores during the pandemic, which represented almost a third of its estate.

Meanwhile, Debenhams and BHS no longer exist in physical store form after their rescue buyouts – so it is no wonder that staff in the department store sector feel cautious or disconnected from their respective businesses’ decision-makers.

However, recent performances by M&S and Selfridges indicate positive change is afoot. This year began with M&S – one of the UK’s largest retailers and a business that is once again in growth mode following an extensive period of digital transformation – unveiling an investment of almost £500m in stores.

The investment entails what boss Stuart Machin described as a move towards running “180 high-quality, high-productivity full-line stores while opening over 100 new food halls by April 2026”. Some 20 new M&S stores are planned for 2023/24 and they are in key city locations such as Leeds, Liverpool and Birmingham, while at the same time, poor-performing stores will be removed from its estate.

Machin says that the future of the store is in “bringing digital and physical together to create great shops that allow customers to shop the way they want to today”. He acknowledges that the company’s “historic failure” to modernise its estate means 40% of M&S stores pre-date the Second World War. And, crucially, he says that as well as making the stores fit for customers, it is crucial to modernise these working environments for staff.

At Selfridges, significant work is being undertaken in store to modernise its offering – much of it in line with a push to become more sustainable as a business. Under its ‘Project Earth’ strategy, the department store has introduced repair stations, a second-hand product resale shop and a rental service. This move to a circular business model entails engaging and developing staff in a new way of doing business as much as it involves educating consumers about greener ways to shop.

The Timpson staff recipe: Mix bottom-up management with team-spirit initiatives and a sprinkling of technology

Aside from the key-cutting and shoe-mending machines, Timpson views itself as a tech-lite retailer in terms of in-store features.

Chief executive James Timpson – like his father (the founder of Timpson) before him – is a proponent of an “upside down management” approach, where staff are given significant autonomy to run their stores as they see fit. Timpson judges a store’s success on its customer satisfaction scores and sales.

Each member of staff is linked to a bonus scheme relevant to their part of the business and the general recruitment ethos is to promote from within, meaning staff have clear opportunities for career progression. To boost morale and provide additional pastoral care, there are also cash gifts offered and time off when staff get married, and the company provides free use of holiday homes across the country.

Timpson describes itself as “a true equal opportunities employer”, with its recruitment model centred around looking for “great personalities”. Regardless of their background or history, everyone who applies will be considered for a job, including former offenders and other marginalised groups, which the company specifically aims to help into work. This approach to giving chances where other employers may not strengthens the connection between senior leaders and shop staff.

Interestingly for a self-proclaimed tech-lite chain, Timpson is starting to introduce fully automated key vending machines into its stores, highlighting that even the most people-centric of retailers can see the benefits of new tech and innovative equipment to bolster CX.

Sarah Baker became a Timpson store manager through the released-on-temporary-licence work scheme

Sarah Baker became a Timpson store manager through the released-on-temporary-licence work scheme

Timpson is introducing fully automated key vending machines into its stores

Timpson is introducing fully automated key vending machines into its stores

How do frontline staff envisage the stores of the future and their place within them? For some, there is a fear the store won’t even exist and only ecommerce will survive. In fact, the percentage of store staff that believe stores won’t be around in the future has dramatically doubled in the past three years.

In 2020, 18% of all staff surveyed said they believed stores won’t exist in five years’ time. This view was particularly prevalent among young frontline staff, with more than a third (36%) of 16- to 25-year-olds making this judgement. Three years down the line, their prediction could be read as somewhat dramatic and off-target, with many retailers adding to their real estate in 2023, as we highlighted in chapter one.

But despite the growth stories, it appears the widespread closure of retail spaces in recent years, including 13 Tile Giant shops, all of Paperchase’s 106 standalone stores and 28 concession stands, and M&Co’s entire estate of 170 shops in 2023 alone, have created a feeling of pessimism across the industry’s workforce.

Incredibly, our 2023 findings suggest that 38% of staff agree with the statement there will be no stores in five years’ time. Some existing leases on the high streets and shopping centres of the UK last longer than that, raising the possibility of exaggeration within this claim.

Even so, retail leaders shouldn’t ignore the clear call for change and the sign that stores must evolve.

Personalisation at the fore

Our research shows that the majority of store staff (81%) agree with the statement that stores in the future will offer more personalised services to customers.

Sainsbury’s provides a standout example of personalisation in use. The grocery giant launched Nectar Prices in April 2023, offering discounts to customers in the scheme across products from health and beauty, confectionery and snacking, beers, wines and spirits, household, baby, pet care and Sainsbury’s own-brand lines. Use of the mobile app SmartShop also offers customers a checkout-free option in selected stores.

At the time of launch, chief executive Simon Roberts said: “Nectar Prices will help millions of our customers save more on every trip to Sainsbury’s. There is much more to look forward to; we will keep refreshing Nectar Prices and increasing the variety of products on offer.

“It gets better – Nectar customers who shop in store with SmartShop will receive extra personalised value with Your Nectar Prices, bringing them the best prices on their favourite products. Our customers really are at the heart of every decision we make and we hope they find that Nectar Prices is an exciting way to bring them consistently great value all year round.”

Greater operational flexibility

Significantly, the majority of store staff (70%) believe the statement that stores in the future will be open longer hours to be true.

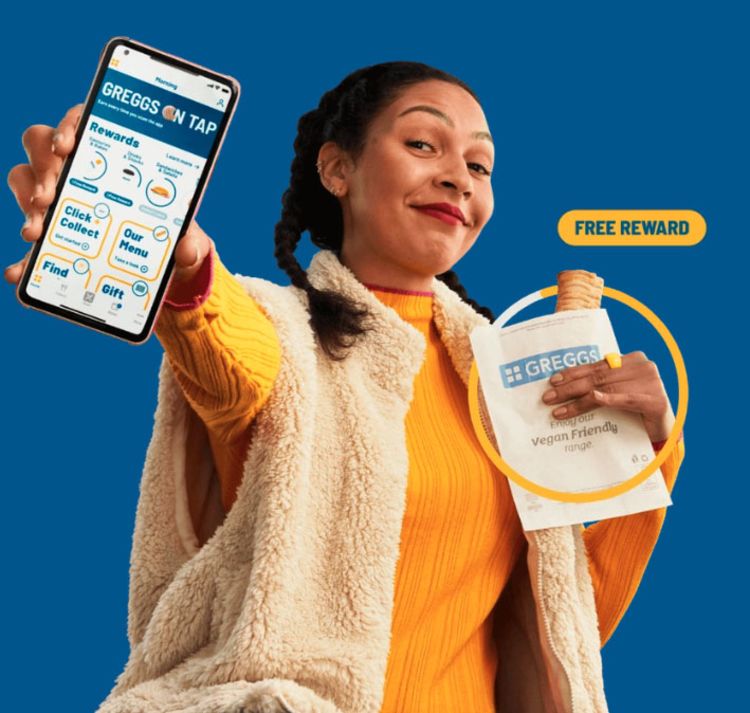

Greggs said it would trial 24-hour drive-thru stores by the end of the year, as well as extending the opening hours at 300 stores to 9pm. Some Greggs stores in motorway stations and petrol forecourts are already open to 7pm or 8pm, but a typical Greggs branch finishes trading by 6pm.

New technology underpins the modern Greggs operations, according to Tony Taylor, the company’s IT and business change director, but it is used very much in conjunction with its people. Speaking at Retail Week Live in March 2023 about the Greggs reward app, click-and-collect and delivery functions introduced in the pandemic, Taylor said: “Greggs is known for its warm, personable customer service. Technology needs to make that easier and more efficient without compromising on quality.”

New digital options introduced to customers have to be accepted by staff for them to work, and one way Greggs achieved success here was through placing its colleague discounts on the app. To access rewards, staff had to use the technology, in turn helping them to learn new systems and better help customers.

Similar tech deployments have been seen globally, helping retailers to extend trading hours. In Tokyo, confectionery chain Chateraise opened its first 24-hour unstaffed store in April 2023 containing self-checkout facilities.

More tech advancements to come

Almost all (96%) of store staff surveyed agree with the statement that stores in the future will incorporate more technology – and it is hard to think of a retailer that isn’t adopting more in-store tech.

Linked to longer opening hours, one area gaining traction is radio-frequency identification (RFID) checkout. Sports equipment retailer Decathlon has adopted the tech to speed up the checkout process, allowing shoppers to simply drop items into a box at the checkout and be served an itemised bill, without the need to scan products individually.

Fashion retailer River Island piloted RFID-enabled self-service checkouts in its Bluewater store in 2022 and has since scaled up the scheme, introducing it into its Trafford Centre store in May this year, with Staines to follow. Customers drop items into the RFID bucket and a list of goods instantly appears in a digital basket on the accompanying kiosk where the customer completes the transaction.

The RFID tech not only speeds up transactions and improves the experience for the customer, but it also gives the retailer a real-time view of inventory movement across the supply chain and store environment, therefore improving stock management.

While the company’s target was for 50% of all in-store transactions at Bluewater to be processed through self-checkout, by February 2023 that figure was already closer to 70%.

By allowing consumers to self-serve, River Island has freed up staff in participating stores to be more customer-query-focused, which Paul Cooper, director of technology operations at River Island, says makes their jobs more satisfying.

Customer experience is still key

Lastly, 80% of the store staff surveyed agree with the statement that stores in the future will be more experience-focused – and, again, there are plenty of examples of this in development.

One is London-based tech start-up Nothing, a retailer backed by GV (formerly Google Ventures), EQT Ventures and C Ventures, which opened its first bricks-and-mortar store on December 10, 2022, and “aims to make tech fun again”.

Its smartphone Phone (1) and wireless earbuds Ear (stick) are the brand’s flagship products, which are stocked alongside merchandise and limited-edition runs of other tech. In terms of in-store CX, there is a 4,000 flip-dot system wall that can be programmed on the spot to create a constantly revolving graphic story and a retro phone booth where Nothing’s Phone (1) operates as the official store helpline.

Elsewhere, in March 2023, Inditex-owned womenswear, sportswear and lingerie specialist Oysho opened the doors to its first UK store at Westfield London, White City. The store promises several dedicated CX features such as free Wi-Fi, three self-checkout stations to speed up queues and a click-and-collect service available within one hour of ordering a product via the app.

Staff at Greggs use the same app to access their rewards as customers do, helping them understand the CX better

Staff at Greggs use the same app to access their rewards as customers do, helping them understand the CX better

River Island’s RFID-powered self-service checkouts

River Island’s RFID-powered self-service checkouts

Nothing store, Soho

Nothing store, Soho

The results of our exclusive store staff surveys show that retailers are making tangible headway in engaging, rewarding and communicating with their frontline staff. And, although there are some concerns about the digitisation of stores, shop workers are keen to embrace technology where it makes a real positive difference to both CX and their roles.

Many retailers are increasing frontline pay, sometimes at record rates, and rolling out a raft of initiatives to improve staff wellbeing – Majestic Wine and Ikea are examples of retailers leading the way in this regard. Others, such as M&S, Crew and Zara, are investing in technology to help improve staff working experiences and empower them to spend more time where their skills are best leveraged.

So what do UK store staff really want from you in today’s world of retail? The key findings are summarised below.

What your store staff really want

1. STORE STAFF AREN’T AGAINST TECHNOLOGY

Although retailers need to be mindful that some store staff are concerned about the role of tech in their businesses and feel insecure about their jobs as a result, most retail staff at the coalface understand that technology can help them do their jobs properly. In fact, they are willing to embrace it, so retailers should do their due diligence without rolling out tech for tech’s sake.

2. BETTER STOCK MANAGEMENT IS WANTED

Retail shop staff are calling for tech to help with managing store inventory and stock management in particular. It’s the core area where improvements with technology can be made – and it’s an area where efficiency can result in better margins.

3. THINK CUSTOMER-FIRST BUT DON’T FORGET YOUR COLLEAGUES

A wave of shops are being set up with improved CX in mind, but they can only work if retailers have buy-in from the staff working there. New store strategy needs to be shaped with store staff’s input and insights.

4. HANDS-OFF MANAGEMENT CAN EMPOWER STORE STAFF

Some of the happiest retail store workers are those with an element of decentralised management. If retailers trust staff enough to employ them in the first place, maybe they trust them to establish the environment and culture in which they work, as exemplified by Fat Face and Timpson.

5. COMMUNICATION IS CRITICAL

This theme is repeated from our 2020 report and, while some sectors show progress in improving communications and transparency between head office and store staff since Covid, other sectors must work harder to reach that high standard.

Partner viewpoint

Matthew Lovitt, commercial director EMEA, Logile

Building a connected, hyper-personalised customer experience has emerged post-Covid as the next wave of retail transformation. The physical store is becoming the epicenter of that change, putting frontline retail colleagues under more pressure than ever to deliver.

Retailers have consistently reinforced the intent to leverage technology to shape how their stores can address customer expectations. However, they should be aware of potential strategy or execution gaps. Empowering colleagues to land change right, first time, is key to delivering a transformative customer experience in a competitive market. A strategy is just that, without the technology to support landing change at pace.

Logile partnered with Retail Week to revisit store colleagues' perspectives on the current state of technology, operations and how they are coping with new and future demands. The report provides unfiltered insight into how equipped frontline colleagues feel to deliver the operational needs of today as well as the stores of the future they’re helping to shape. These insights serve as a timely prompt for retailers to consider their colleague engagement and operational strategies, and how they can better improve colleague confidence in their jobs through technology and communication.

The report findings reveal an opportunity for retailers to seek technology solutions that inherently help them deliver a platform for digital transformation. Solutions that can facilitate informed decision making for long-term initiatives and on-the-fly operations, along with tools to empower the workforce and keep them engaged, are imperative to make a positive impact on employee expectations and customer experience.

Talking Shop

Rebecca Taylor

Commercial content manager

Ben Sillitoe

Writer

Imogen Jones

Commercial partnerships director

Stephen Eddie

Managing editor

Rachel Horner

Subeditor

Rebecca Dyer

Subeditor

Hanna Hua

Data analyst

Laura Reid

Designer