SUPPLY CHAIN 2025

Supply Chain 2025

Building resilience today, future-proofing tomorrow

Building resilience today, future-proofing tomorrow

Intelligent, resilient, supported by AI, cost-efficient, sustainable, driven by people, constantly adapting...

A lot is expected of today’s retail supply chains, and getting the dynamics right is crucial to future performance.

With analysis of how retailers in the UK and internationally are transforming their supply chains, Retail Week’s Supply Chain 2025 report – produced in partnership with Acopia, Alcumus SafeContractor and nShift – provides a blueprint for businesses looking to sustain growth and achieve success.

In this report, our latest annual instalment since launching in 2019, we unpick the key priorities and areas of investment for retail supply chains over the coming year – and the role technology and people must play.

We also explore how retailers can balance ethics and profits in the changing retail landscape and how to maximise partnerships to support supply chain evolution. Supply chain strategies are only getting smarter – read on to find out how you can keep up with the pack.

Our Supply Chain 2024 report, published in May 2023, advised retailers to set up their supply chains to prepare for ongoing disruption.

After almost a decade of turbulence caused by external factors such as Brexit, the global pandemic, mounting geopolitical unrest, and rising inflation, uncertainty and change have emerged as the only constants. This means building resilience and mitigating risk are now priorities.

As 2024 got underway, this was all too clear to see.

Supply chains from Southeast Asia to Europe faced disruption because of unrest in the Red Sea that began in October 2023. Shipping firms have been forced to find alternative routes as armed Houthis, a political and military movement in Yemen, attacked vessels in this key international cargo corridor, which they claim is a response to Israel’s war against Hamas in Palestine.

Sainsbury’s spent January 2024 in regular communication with the UK government – seeking information to mitigate the risk these longer journeys posed to lead times for its general merchandise goods. PepCo and Matalan were among the retailers voicing concern about stock hold-ups.

UK and US governments have responded to the Red Sea attacks with military action of their own – but no matter how quickly the situation is resolved, retail supply chains will feel the impact well into 2024.

Closer to home, rising costs continue to impact retailers’ operations – and the surprise UK annual rate of inflation increase to 4% in December 2023, after several months of declines, suggests the economy is still some way from shaking its volatility.

Simply put, the cost of doing business in the UK today is significantly higher than it was in the two decades before the pandemic, when UK inflation, which is calculated using the Consumer Price Index, averaged just 2%.

But retail is resilient – and inventive

While the backdrop to retailing in 2024 is challenging, it is not all doom and gloom for the industry. There are significant opportunities ahead for retailers investing to mitigate risk and putting the right strategies in place.

Technology and people are key to unlocking growth

A combination of new strategies in these areas have culminated in retailers driving efficiency from first to last mile, adding robustness and speed to their distribution capabilities in the process.

Next and Marks & Spencer (M&S) are among the retailers that have strengthened their omnichannel supply chains with impressive results in the last 12 months.

In January, Next increased its full-year profit before tax guidance by £20m to £905m, up 4% versus last year, with better management of stock stated as a key contributor. The retailer has increased its use of automation in warehouses, including at its 500,000 sq. ft Rotherham site, which the company says is driving efficiency for the online business.

M&S said in November that its half-year profit was up by 75% year on year. Supply chain modernisation is highlighted as supporting the retailer’s success, with early cost savings and improvements reported from the 2022 acquisition of former third-party food distribution partner Gist. The clothing business is in the process of changing to focus on “fewer, more strategic suppliers, systems upgrades to increase visibility and connectivity, and the creation of an omnichannel logistics network”.

Despite continued Brexit-related red tape and cost burdens, including the new health checks required before chilled and frozen foods can enter the UK, which were introduced on January 31 2024, retailers are starting to find their way again after supply chain problems caused by the UK’s departure from the European Union (EU).

As of October 2023, Fortnum & Mason is back selling in the EU after pausing trading following Brexit. The retailer’s opening of a dedicated EU website and fulfilment centre, which has helped the department store navigate customs challenges, displays innovative thinking and paves the way for others to follow.

Fortnum & Mason created a new website to navigate selling to the EU after Brexit

Fortnum & Mason created a new website to navigate selling to the EU after Brexit

Elsewhere, Ikea, Aldi and Sainsbury’s are investing in staff pay throughout their supply chains to help drive productivity and reward and recognise workers. Staff retention is a key target, and retailers such as The Very Group, Asda and M&S are building in flexibility for their workforces across departments – be it experiments with four-day working weeks or generally building in opportunities to work their hours in a way that better suits their lifestyles.

One other trend gaining momentum in retail in 2024 is the continued push towards sustainability – and there is significant work being undertaken by retailers and their suppliers to foster more collaborative ways to make progress in this area.

Indeed, the evolution of third-party partnerships is a broader trend in the retail supply chain as retailers continue to hone their propositions in 2024 and 2025.

Supply chain challenges and opportunities abound in retail. We look at it all in detail across the following four chapters, helping to point the way forward for the industry throughout this year and further ahead into 2025.

Introducing automation in the first mile of the supply chain to smooth out and speed up operations in an increasingly complex retail world is a common goal for retailers. And the rise of artificial intelligence in the last 18 months, alongside other technologies, is also opening retailers’ eyes to the art of the possible when it comes to efficiency in the supply chain.

And the results of such endeavours are regularly made public by the industry’s leaders.

“Incredibly dynamic” and “twice as efficient” compared with older and previous warehouses – these were some of the comments made by Ocado CEO Hannah Gibson as she unveiled the retailer’s newest customer fulfilment centre (CFC) in Luton in December 2023.

At 346,000 sq. ft, the warehouse carries 50,000 SKUs and operates with Ocado Solutions’ 550-series automated robots, enabling a 50-item customer order to be picked from the site in just 10 minutes. Additionally, Luton is the first of the retailer’s CFCs to be fitted with its proprietary robotic arms, which will be able to pick more than half of the Ocado range from the site.

Being part technology company and part retailer, Ocado leads the way in UK retail with warehouse and robotics innovation – it provides a vision of the future for wider supply chain innovation.

For Ocado, it is a commercial necessity to be groundbreaking – and the work at Luton is viewed as a testbed for its tech arm, which sells solutions to global third parties such as Casino and Kroger. But, for other retailers, tech investment is all about supporting their own operations.

Automation acceleration

JD Sports and Frasers Group are retailers identifying the efficiencies that automation brings. JD Sports has its new ecommerce warehouse in Derby, which became fully operational in 2023 after it signed a 20-year lease agreement with developer Panattoni. Similarly, Frasers Group invested £200m in automation at its Shirebrook distribution centre (DC) in the 2021-22 financial year and continues to upgrade facilities.

For JD, it is a case of continual improvement. Having upgraded to a cloud-based warehouse management system in 2022 as part of plans to open new international DCs and refresh an ageing tech stack, the retailer is embracing automation.

Automated packaging technology in its Derby site has enabled the sportswear retailer to box 1,100 single or multiple-item orders per hour, according to Paul Stokes, head of automation and engineering at JD. He says “right-size boxing technology is a key capability for the future – offering major benefits in fulfilling ecommerce orders in a cost-efficient and sustainable way”.

Automation is not just for the bigger retailers. In January 2023, The Perfume Shop announced what it described as its largest-ever outlay on warehouse automation, unveiling packaging automation tech to support ecommerce operations.

“Investment into warehouse automation will ensure we’re keeping up with the increasing demands of our online business,” managing director Gill Smith said of the £2.5m investment, which is also viewed as a way of minimising packaging.

Across the pond, Walmart is a stand-out example of automation in the supply chain.

On October 12 2023, the American multinational retailer announced it was opening a fifth “next generation fulfilment centre” in 2026. At present, three of the other four promised sites are in operation – in Joliet, Illinois; McCordsville, Indiana; and Lancaster, Texas – with Greencastle, Pennsylvania to come. The fifth, in Stockton, California, will, matching the others, use “a powerful combination of people, robotics and machine learning (ML) to set an entirely new precedent”.

The tech in these sites streamlines a manual, 12-step process into just five steps, and – according to Walmart – it provides “more comfort for associates, double the storage capacity and double the number of customer orders we’re able to fulfil in a day”.

In April 2023, Walmart said it wants circa 55% of packages processed through its fulfilment centres to be handled by automation by 2026. The US’ largest private sector employer said that the move is estimated to improve unit cost averages by about 20%.

Walmart is doubling down on AI deployment too, which is expected to play a greater role in supply chain tech innovation more universally.

Walmart uses AI and ML systems to monitor its inventory at peak season

Walmart uses AI and ML systems to monitor its inventory at peak season

BP wants to have 3,400 convenience stores by 2030

BP wants to have 3,400 convenience stores by 2030

AI bolstering final-mile efficiency

Walmart

There is no busier time at Walmart than the final quarter of the calendar year. In October 2023, Parvez Musani, SVP for end-to-end fulfilment at the retailer, felt it was a good moment to explain how AI is helping to give Walmart’s supply chain an edge over its rivals.

He said the company’s AI and ML-driven inventory management systems are “essential for supplying customers with what they need, when they need it, and at the low costs they expect from Walmart”. The systems leverage historical data and pair it with predictive analytics, enabling the retailer to optimise inventory positioning for the peak period.

Musani said the system integrates insights from all the channels Walmart uses to serve customers. The systems combine decades of customer service and peak period inventory management insights, with AI helping the retailer crunch the numbers quickly.

Talking ahead of 2023’s peak trading, he said: “Our AI/ML engines are primed to offer even deeper insights, and we expect our performance will be stronger than ever.

“When building AI/ML frameworks for holidays, we start with a foundation of data and business constraints to create a possible universe of ML models. During model training, we fine-tune ML models using historical data like past sales, as well as online searches and page views.”

He added: “We also consider ‘future data’, such as macro-weather patterns, macroeconomic trends, and local demographics, to anticipate demand and potential fulfilment disruptions.”

Musani said the system can ‘forget’ anomalies – for example, “a once-in-a-lifetime snowstorm in Florida” – so Walmart does not carry over one-time deviations into future inventory management practices. This capability was new for 2023.

BP

BP’s UK convenience retail business is now being supported by AI.

It was announced in November 2023 that BP was upgrading its forecasting and replenishment capabilities using a platform that leverages AI to anticipate and meet fluctuations in customer demand. The supply chain planning upgrade was deemed necessary by BP, which said more than half of customers to its UK retail stores now visit on a food-only mission, rather than for fuel-only or food and fuel.

By 2030, BP wants to double its convenience gross margin from a 2022 base of around $1.5bn (£1.12bn) – and double the number of shops where it believes it provides a differentiated offer from its competitors to more than 3,400. This target is a key reason for the AI investment, as higher stock availability and customer service levels are required.

The new planning tools are also viewed as a way of helping BP reduce food waste.

Balancing tech with people power

From finding warehouse space to automating sites, through to achieving smarter stock management, retailers have their work cut out in the first mile of the supply chain.

Aside from automation and AI investments, other technologies such as RFID (Radio Frequency Identification), computer vision and warehouse robots are becoming more popular.

John Lewis operations director Naomi Simcock said in March 2023 there are several supply chain changes the retailer is making to help its drive for profitability. Speaking as interim executive director at the time, she explained there were opportunities in “changing our sourcing strategy, in particular on own brand, looking at some of the places we source from to take out some of the risk around freight costs, so bringing some sourcing back to nearer shore”; but she also talked up tech’s potential to boost efficiency.

“The other big area where we’ll see investment is around technology to improve areas like stock loss,” she noted.

“We’re pushing out the rollout of RFID, so we’ve got visibility of stock and where some of the risks are in the system.”

Elsewhere, Boots continues to use warehouse robots in its Burton DC. From robotic arms for picking small items to cube-shaped automated storage and retrieval systems” – which managing director Seb James said on Black Friday week can “handle four orders a second” – there is an array of tech filling the health and beauty business’ warehouse.

Back in November 2019, Boots introduced ‘cobots’: robots that carry items between warehouse picking stations to cut down the distance staff must travel. As of 2024, this machinery has become a permanent part of the retailer’s armoury – particularly at peak. The tech is driving results, as Boots reported its online business experienced the “biggest-ever month of sales” in November 2023, as well as its “biggest-ever day of sales” on Black Friday 2023, helping sales in the three months to November 30 rise by 9.8% year on year.

Tech titan Amazon, meanwhile, introduced AI imaging stations in two fulfilment centres in the US in May 2023. The aim of the tech is to screen orders to detect and remove damaged items, and to speed up picking and packing.

The role of the imaging stations is typically the responsibility of warehouse workers, but Amazon’s own research says the tech is three times more effective than people in identifying damaged goods. Anything the tech picks is analysed by workers themselves, and – like the Boots cobots – it is another example of man working alongside machine.

Retailers are aware of the need for people and tech to work in harmony, but there is no denying more automation does reduce the need for warehouse jobs. For example, Walmart reportedly reduced its fulfilment centre workforce headcount by 2,000 last year.

Retailers will continue to assess staff numbers as reliance on technology increases. But many are increasing remuneration for workers because of the increasingly important role they play in the supply chain and considering the inflationary environment.

Aldi and Lidl stand out for their pay policy. In December 2023, Aldi committed to paying all store and warehouse staff at least £12 an hour from February 1 2024 – £13.55 for those in south-east England – and Lidl announced in January 2024 that its workers will receive the “highest hourly pay rates in the sector” of up to £13.85 an hour.

Described as a £37m investment in staff, the Lidl pay rises also included new bank holiday and nightshift premiums.

It is a sensitive issue, though. Industrial action that took place around the world in 2023, most notably at Amazon over the Black Friday period when 150 strikes and actions took place at warehouses globally, with staff asking for better working conditions and more commitment to sustainability, shows retailers need to continue to look after workers.

JD Sports group supply chain director Justin Cox summed up getting the balance right at a supply chain conference in October 2023.

As well as modernising its Rochdale stores warehouse and opening the Derby DC, JD is expanding internationally; it opened its DC in Heerlen in the Netherlands in December 2023 and is set to unveil another in Australia this year. These are being run utilising an array of new tech and automation, but – for Cox – supply chain is a people business.

“People, people, people – it’s all very well having great automation and systems, but without the right people to run it, [you’ve] got no chance,” he said at the event.

Reflecting on making a success of a tech-enabled supply chain department, comprising long-term staff and multiple new solution provider partners, he added: “It’s all about changing the culture and building that one-team methodology.”

He spoke about the importance of making the environment a positive and comfortable one to operate in – saying even the design and food supply in the staff canteen is crucial today where such factors are important in a competitive jobs market.

The importance of innovation in retail fulfilment cannot be understated.

In fact, research conducted in October 2023 by Retail Week and nShift in partnership with YouGov, which surveyed 1,000 UK shoppers, found 43% of consumers had declined to make a purchase in the previous 12 months due to a lack of delivery options.

It is why both multichannel retailers and online pure-plays across the globe are continuing to experiment and invest in new methods of fulfilment and improve their customer propositions.

Delivery innovations

Drones

Although it is a tech that not every retailer can afford to invest in, drone delivery is the latest battleground between global retail giants Amazon and Walmart. Both businesses are already using this technology in the US.

Walmart said in January it now delivers by drone from stores in seven states (Arizona, Arkansas, Florida, North Carolina, Texas, Utah and Virginia) and it was “reaching new heights” by expanding the service in Dallas-Fort Worth to make it available to 75% of the population there. With 20,000 safe drone deliveries already completed by Walmart across the US, Prathibha Rajashekhar, SVP, innovation and automation, said: “Drone delivery is not just a concept of the future.”

Walmart customers ordering by drone can get items, such as cooking ingredients, last-minute gifts and snacks, in 30 minutes or less. Some deliveries can happen as fast as 10 minutes, supplementing other speedy delivery methods such as ‘Express Delivery’ within three hours and late-night delivery until 10pm.

Amazon, meanwhile, currently delivers by drone in California and Texas but is looking to launch Amazon Prime Air in a third, as-yet undisclosed, US state and in Italy. A UK move is expected in 2024, albeit at a non-specified date, with Amazon working with the Civil Aviation Authority to ensure it meets UK regulations.

In the UK, Boots has been experimenting with drone delivery. It sent prescription medicine over the Solent from Portsmouth to the Isle of Wight in 2022, where goods were gathered by the retailer and transported to pharmacies as part of a proof of concept.

Last-mile logistics – social media, rapid delivery and ‘blended’ retail

Investment and experimentation in last-mile logistics has been ongoing over the past decade, including in the last 12 months an increase in focus on same-day delivery.

Last August, TikTok Shop launched Fulfilled by TikTok (FBT), a new programme designed to make it easier for retailers and brands to sell on the platform in the UK.

FBT is designed to provide merchants with easier and quicker logistics, offering same-day, automated fulfilment for all orders made by 7pm Monday to Friday, as well as a ‘next working day’ premium delivery service. Such a service could further fuel the direct-to-consumer trend, helping start-up brands launch into ecommerce with an instantly sophisticated fulfilment proposition.

In keeping with this trend, department store chain John Lewis launched its same-day delivery service outside of London for the first time in July last year, charging customers in Birmingham, Leeds and Manchester £9.95 per order and promising the product delivery that day if ordered by 10am.

John Lewis head of customer fulfilment operations Eva Cullen said: “We always want to improve the service for our customers and there has been a real appetite for same-day deliveries. With customers using it for purchases of everything from bed sheets to toothbrushes, we are confident this service could have even more potential in the future.”

The UK’s largest retailer, Tesco, is also doubling down on expanding its rapid online delivery arm, Whoosh, which it first launched in May 2021.

Peak period 2023 online sales at Tesco jumped by 11.5% year on year, supported by “strong execution, with orders, volumes, pick rates and availability all up”, and circa half a million pre-Christmas orders were fulfilled by Whoosh.

Whoosh is now available in more than 1,000 Tesco Express stores, and take-up from customers shows there is room in the market for within-the-hour delivery that comes with a £2.99 charge (an additional £2 is placed on orders under £15).

Away from the grocery market, on-demand delivery through third-party providers is now also being offered by several retailers, including Boots, and will soon be offered by Screwfix. Both have partnered with Deliveroo – the latter’s imminent arrival on Deliveroo follows the marketplace’s decision to launch a “shopping” section collating a growing number of non-food partners it delivers for.

Eric French, Deliveroo’s chief operating officer, said in November 2023: “Just as Deliveroo transformed the way people eat, we’re set to do the same to how people shop, bringing more of the local neighbourhood to people’s doors.” This expansion shows Deliveroo’s ambitions to become a one-stop shop for consumer goods and is prompting grocers such as Tesco to keep innovating themselves to maintain pace.

Lars Pedersen, CEO of global delivery management software leader nShift, adds: “We are seeing many exciting innovations in last-mile deliveries, reflecting how important deliveries are to customers. Offering delivery options that chime with customers can increase conversion rates by as much as 20%.

“These are good for customers. The challenge for retailers lies in how easily they support all these delivery capabilities, even at the busiest times. Ensuring customers get the best delivery experience depends on automating the process as far as possible, to provide a range of connected services that boost the overall performance.”

New distribution models are emerging all the time in retail, too.

Getting closer to customers

As part of a decision to get closer to its customers and build in more flexibility, Ikea launched collection points in Tesco car parks in September 2023, and plans to have 70 of these sites in place by autumn 2024. It is also rolling out ‘Plan & Order’ stores across the UK and the US, including in Austin and Los Angeles later in 2024, having launched its first stores in this format in the first quarter of 2023.

The store expansion strategy at Ikea is focused on providing smaller, more easily accessible locations – and these new sites provide access to expert advice as well as a place to pick up online purchases and place online orders. Such a blend of the physical and digital in the pre-purchase phase allows customers to make informed choices and build an affinity with a brand across channels.

Meanwhile, Polish convenience chain Zabka is another example of a retailer looking to offer a blended customer experience. Its second ‘Drive’ shop opened in January, allowing shoppers to order products digitally via its website or app and then pick them up at the shop without leaving their car, with staff bringing the order directly out to the customer – an extension of the drive-thru concept, bringing ultra-convenience to shoppers.

nShift’s Pedersen says: “In all forms of online retail, deliveries are the beating heart of the business. Deliveries that run smoothly can build long-term loyalty. But things can break down quickly if the system seizes up.

“The right mix of delivery choices depends on book-and-print tools, which connect to the widest possible range of carriers and delivery methods, including same-day, zero-emissions and delivery lockers.”

Returns – a problem that keeps coming back

Returns continue to plague retail, particularly the fashion industry. Asos and Boohoo publicly bemoaned the cost of returns on their margins last year, and there is still huge work to do to eliminate them.

One lever retailers pulled in 2023 was to start charging customers for online returns. Any items that can be returned to a store tend to be free to do so, but fashion retailer H&M started to charge customers £1.99 for online product returns in September 2023, citing a rise in delivery and processing costs, as well a rise in returns in general.

New Look started trialling a charge for returns in February 2023 at a fee of £1.99, following in the footsteps of Boohoo and Zara, which began imposing a fee of £1.99 and £1.95 respectively on shoppers in 2022. The likes of Next and Uniqlo have charged for online returns for years with a fee of £2.95 per order.

The British Fashion Council (BFC)’s Institute of Positive Fashion published a report in March 2023 that suggested the UK fashion industry lost at least £7bn in 2022 due to returns. It also estimated UK returns generated 750,000 tonnes of CO2 emissions.

According to the report’s consumer research, incorrect sizing or fit (93%) and product quality not meeting expectations (81%) were the top reasons for returning goods. Some 56% of shoppers said a fee is the measure most likely to prevent returns, though.

Economic consultancy Roland Berger predicts that retailers with circa 70% of sales coming from their website could reduce the cost of returns handling by 20-40% – by using sizing calculators and virtual avatars – and argues that technology investment online is essential to tackling returns.

Indeed, fashion retailer Bershka launched a virtual fitting room online in November 2023. The tech takes a front and side photo of the customer, and the 3D mapping system then recommends appropriate sizing and shows consumers mock-ups of how they will look.

In July 2023, Zalando co-CEO Robert Gentz described “a step-change solution in the industry that will help customers find the perfect fit before delivery”. He was talking about the launch of the marketplace’s AI-powered tool that enables shoppers in Germany, Austria and Switzerland to receive size recommendations for garments based on predicted measurements garnered from photographs of them wearing tight clothing.

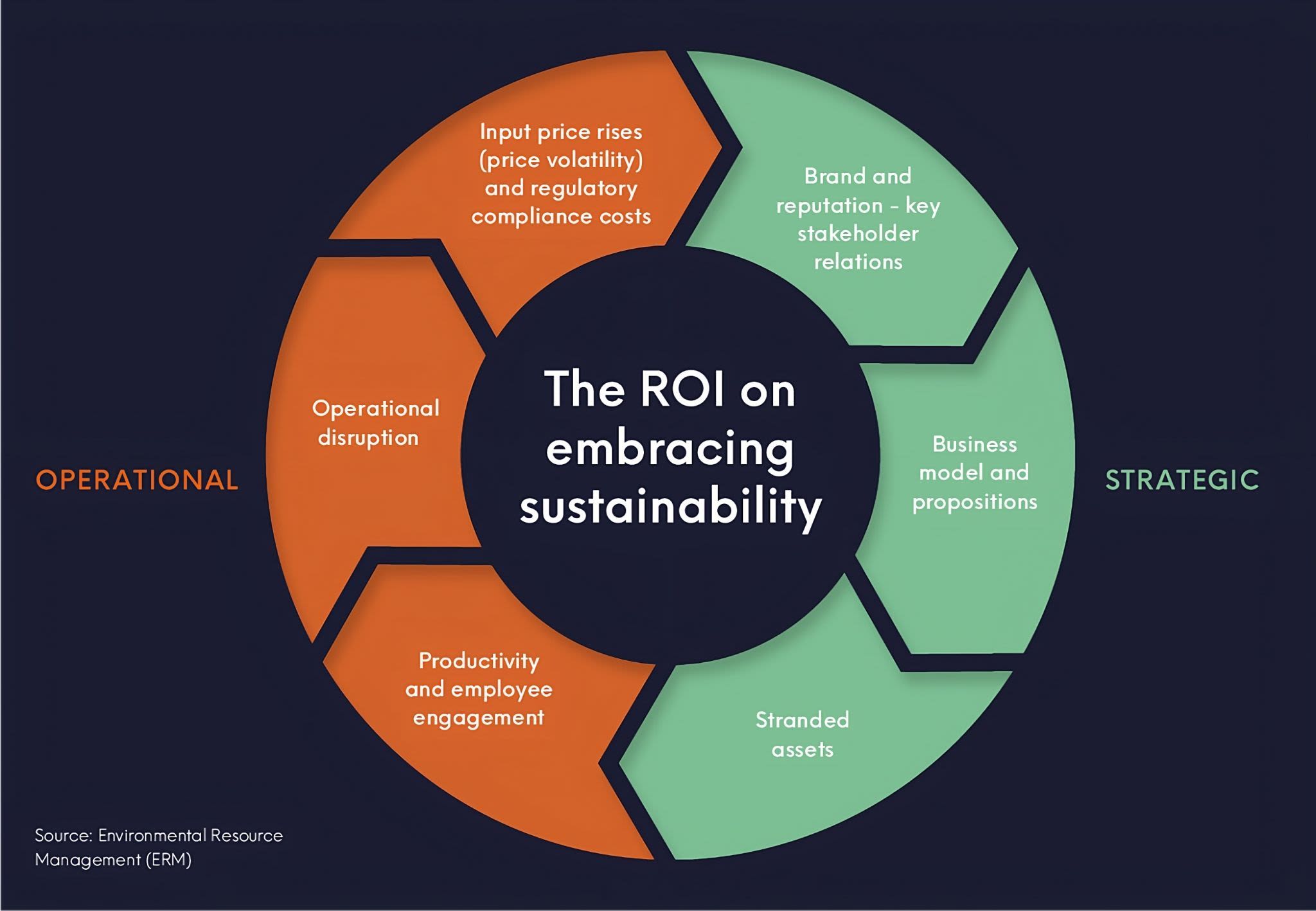

Supply chain sustainability has reached a tipping point, and retailers are being called on by investors, consumers and employees to take action in reducing their environmental impact.

And they need to act now: a January 2024 report from the National Oceanic and Atmospheric Administration in the US revealed that the Earth’s average land and ocean surface temperature in 2023 was the highest since records began.

Antarctic sea ice coverage also reportedly dropped to a record low in 2023, which is another alarming sign that human activity is significantly damaging the planet beyond repair.

Systemic change is needed to address the root causes of the climate crisis, and at the heart of that is a shift towards a low-carbon economy. But individual action is crucial because it moves the dial on important matters, creates demand for more sustainable products and services and builds momentum towards transformation.

Terry Gardner, retail director of Acopia Group – a specialist in providing sustainable packaging solutions to industry – notes that it is imperative for retailers to be proactive. “If your customers, competitors and moral conscience all point toward change, then doing nothing costs more than doing something”, he says.

To that end, many retailers have had their environmental awakening and set bold climate-friendly targets. The biggest impact they can have – and where the most progress can be made – is in addressing energy consumption and in working closely with suppliers in the supply chain.

Measuring for success

Stefanie Sahmel, a consultant and former head of sustainability at online grocer Abel and Cole (she left in 2023), says any business’ environmental improvement strategy starts with measuring the current situation they are in.

“You can’t manage what you don’t measure, so the first thing is, you have to get the insight into your supply chain,” she notes.

Acopia Group’s Gardner agrees: “So many carbon emissions sit outside of your control, around 80%, either up or downstream in your supply chain. By measuring what you can internally, it’s a great way to get started on your sustainability journey.”

Sahmel adds that consumers used to just be happy that their order turned up, but increasingly they want to know about product provenance. This is contributing to a transparency drive across retail.

Rebecca Sperti, SVP sales at supply chain compliance specialist Alcumus SafeContractor, emphasises the importance of understanding your supply chain thoroughly by going back to basics. In retail, the network of goods not for resale (GNFR) suppliers plays a vital role. She says: “Retailers must ensure these suppliers not only meet safety and quality standards but also align with sustainability objectives. By meticulously mapping out GNFR suppliers, retailers can establish a foundation for measuring sustainability and other critical compliance data. Collaboration with supply chain partners becomes essential, allowing retailers to collectively work towards sustainability goals.

“At Alcumus SafeContractor, we have partnered with four out of the five largest global facility management providers who serve prominent retailers. These partnerships involve auditing, reporting and establishing a baseline for onsite contractor data, providing visibility across a portion of the supply chain.”

Retailers are combing through their supply chain networks to gather a picture of their suppliers’ working practices and gaining a greater understanding of – for instance – who supplies their suppliers. It is not just consumers demanding it either, as regulation is mounting up. From October 2025, for instance, the Extended Producer Responsibility (EPR) Scheme will mean the cost of managing packaging waste will be shifted from councils to businesses. This will prompt a need for retailers to improve material efficiencies to reduce costs. Businesses are increasingly being asked to prove their operations are ecologically and socially sound end to end.

Retailers should not delay in taking a considered review of their packaging processes, according to Acopia Group’s Gardner. He says: “Any retailer that can start to look at reducing their impact on consumer waste now, rather than waiting until October 2025 when the EPR scheme launches, is a good thing.”

There is some significant work taking place in the fashion industry. New Look, for instance, announced a new partnership in November 2023 to gain greater visibility across its supply chain. Its tie-up with data collection specialist TrusTrace will assist in identifying responsible sourcing and business continuity risks.

Berghaus parent company Pentland Brands is also putting traceability at the heart of its current strategy. For Sara Brennan, positive business director at Pentland Brands, data insights are essential. “Our supply chain is complex, and data holds the key to unlocking progress towards our sustainability goals, which will likely be a trend for all retail businesses in 2024.

“Having the right traceability data enables businesses to join certified sustainability schemes, which consumers trust. In the future, we also plan to share traceability data directly with consumers to support their purchasing decisions.”

The legislative landscape is complex and ever-changing, she notes, and “can only be addressed with actions supported by reliable data.”

Unlocking supply chain data is crucial as retailers look to set targets. Once retailers have set goals for improvement, they then have a roadmap for making positive change.

The Science Based Targets initiative (SBTi) has become the de facto standard for approving organisations’ sustainability targets and net zero ambitions. Dunelm, John Lewis Partnership (JLP) and Tesco are among the retailers to have their goals verified by SBTi, which gives them the green light required to work towards these ambitions.

JLP, for example, was the first retail organisation globally to set forest, land and agriculture (FLAG) science-based targets. The chart, below, shows the SBTi-approved ambitions.

In January, after extensive work with its suppliers over three years, Pandora Group was able to announce it is no longer sourcing silver and gold directly from mines – it is only using recycled precious metals.

This change was scheduled for 2025, but the company reached its target a year early. Extracting raw materials from the ground is a contributing factor to climate change, so Pandora’s latest landmark move is deemed to be a step in the right direction by the business.

Reputations are at stake when it comes to sustainability strategy, as Boohoo has found out in the last four years. Having consolidated its UK supply chain following a two-year review in 2020-22 into alleged UK warehouse malpractice, a BBC Panorama investigation in January then claimed that the company put ‘Made in UK’ labels on non-UK items.

Boohoo said this was down to a misinterpretation of labelling rules, but the retailer is a case study in reputational damage because of supply chain practice.

Renewables and the transition from fossil fuels

Retailers can set themselves up for cheaper fuel bills – and enhance their reputations – in the long run by focusing on renewables and playing an active role in greening the energy grid.

Co-op Group, for example, signed a corporate power purchase agreement with renewable energy provider Voltalia in November 2023, which unlocks the investment required for the development of a solar farm in North Yorkshire, due for completion in 2025. The retailer has committed to sourcing its electricity from the site for 15 years, and when all solar panels there are operating at maximum capacity, they could provide electricity to supply 7.5% of Co-op’s total electricity needs annually, making it a mutually beneficial sustainability partnership.

Shirine Khoury-Haq, group CEO at Co-op, said at the time of the deal: “Not only will this agreement unlock more green energy, it will also enable energy security, drive economic growth and move us closer to net zero.”

Elsewhere, Inditex, parent company of fashion brands such as Zara and Massimo Dutti, is aiming to reduce its global greenhouse gas (GHG) footprint from seaborne logistics by incorporating alternative fuels in all its inbound routes.

Inditex is working with a third-party supplier to replace fossil fuels on its ships with green methanol or second-generation biodiesel based on waste feedstocks.

It is an example of companies working together to drive change. The more organisations follow a sustainable route and invest in renewable energy – or greener products and services – the more momentum there is for systemic change in the market.

But smaller changes can be made to start cutting the cost of energy bills straight away, too.

A £200,000 investment from Southern Co-op to retrofit thermal night blinds on chillers in 46 of its stores is expected to result in energy savings of up to 9%. The work, which took place in 2023, is projected to reduce 73 tonnes of CO2e (carbon dioxide equivalent) per annum – the equivalent of the average annual electricity used by two retail stores.

Waitrose, meanwhile, started a trial on its Hampshire farm in October 2023 in which it captures methane gas from cow manure and uses it to fuel tractors on the site. Over time, this should result in the retailer no longer needing to use fossil fuels in the farming process, helping it move towards its net zero goals and save money.

Waitrose fuels its tractors with biomethane on its Hampshire farm

Waitrose fuels its tractors with biomethane on its Hampshire farm

Part of its work with several agricultural tech companies, Waitrose wants to prove the case for methane capture so that other farms in its supply chain follow suit. These farms would not only get a new biofuel for their sites, but they could also convert it into electricity to power other elements of their premises, or generate additional revenue from it – selling it to fleet managers, for example.

Reduce, recycle, redistribute

For the grocers, food waste prevention is viewed as a strategy with multiple benefits.

Disposing of food waste costs retailers money, but a growing number are teaming up with partners to redistribute would-be waste to consumers who need it. In the case of Too Good to Go, a food waste prevention company that helps find buyers for near-use-by-date items for Morrisons, Aldi and others, retailers can maximise revenue from goods otherwise destined for the bin.

Aldi is one retailer making solid ground in this space, with the company revealing in January that it has reduced food waste in its operations by 57% since 2017. It said it was exceeding its targets – and has now committed to reduce food waste by 90% by 2030.

The grocer also works with food redistribution business Company Shop Group and charity Neighbourly, which helped Aldi pass on one million meals over the most recent festive season that otherwise would have been wasted.

And consumers are going for this type of service. In an inflationary environment, the availability of food sold at a fraction of the original cost is attractive to shoppers seeking bargains, with Too Good to Go, for example, now boasting 83 million active app users globally and 275 million meals not going to waste across 17 countries.

Alongside this, the circular economy is impacting supply chains too.

WHSmith, Ikea, musicMagpie and Currys all are all retailers offering financial rewards to consumers who opt to trade in products they no longer want instead of throwing them away. These retailers understand there is value in would-be waste, and they are leveraging it as an additional revenue stream. For instance, in November 2023, WHSmith introduced its BookCycle buy-back scheme whereby customers register online and scan unwanted books for a valuation. Books can then be dropped off in-store and customers receive a gift voucher in exchange.

Staying with the circularity theme, in November 2023, Primark, M&S, Frasers Group and Dunelm signed up to charity Wrap’s ‘Textiles 2030’ initiative to “reduce carbon emissions, improve water stewardship and make the clothing and textiles sector more circular”.

Wrap said last year that retailers signed up to the agreement have reduced the carbon impact of the textiles they produce by 12%, as well as reducing water use by 4%, on a per tonne basis between 2019 and 2022. The charity is calling on more retailers and brands to make these commitments and to embrace preloved markets in order to help increase the longevity of products brought to market.

Winning hearts and minds

Retailers need to bring their staff on the sustainability journey, and there are examples of how they are encouraging greener behaviours across the workforce.

Iceland Foods in the UK is using vehicle telematics (tech that records and transmits vehicle data) and gamification in its fleets to reward its teams for more efficient driving. The telematics tech is paired with a rewards app, and drivers can win weekly tech and cash prizes, or £4,000 in an overall ‘Elite Driver Championship’, for the points they pick up for driving more safely and efficiently.

Spanish fashion retailer Mango announced in January that it is teaming up with a Madrid university to provide ongoing sustainability training to its design, buying and quality assessment teams. This is recognition that sustainability is a driver of business success going forward.

However, Pentland Brands’ Brennan warns that a sustainability strategy is a complex journey. She says that often retailers will make one change they deem to be environmentally or socially positive, but it has “unintended consequences”.

For example, electric vehicles are widely viewed as a move in the right direction for the environment, but retailers looking to bring these into their fleets should be considering whether the precious metals used in batteries were mined ethically.

“Everything has a positive and negative impact – it’s all about understanding it,” she explains.

“There can be fear in doing something, but retailers have to do their due diligence. You have to look at everything from environmental impact to factory conditions. You cannot just focus on one element when rolling out a sustainability strategy.”

Tie-ups with third parties are a central part of the modern retail supply chain, and they are only becoming more strategic.

First-mile friendships

Outsourced distribution and logistics are a notable direction of travel for several long-established UK retailers, with both Currys and WHSmith choosing this route in the past few years.

Most recently, in January 2024, Retail Week exclusively revealed WHSmith had teamed up with GXO in the name of efficiency and effectiveness. Ownership of all three of its in-house distribution centres and their 440 staff – in Swindon, Birmingham and Dunstable – are transferring across. Transport operations have also been outsourced to the same logistics provider, with WHSmith keen to optimise its network and leverage shared transport facilities.

WHSmith supply chain director Sean Feeney said this would help create “a modern and efficient supply chain which delivers for our UK businesses and customers”, acknowledging it needs a structure to keep pace with its growing travel retail operation.

The expertise that comes with a dedicated logistics provider is one thing that drew Currys towards launching an outsourced partnership back in 2021. Simon Boss, director of home delivery at Currys, says working with a third-party distribution company allows the electricals retailer to tap into its knowledge of automation and tech innovation.

Another factor impacting partnerships in first-mile logistics is near-shoring (outsourcing logistics to suppliers in neighbouring countries) and on-shoring (domestic outsourcing).

As supply chain disruption has become more common, businesses, including retailers and consumer goods firms, are realising that the cost advantages of a “buy-centric and/or offshore-focused supply chain” are decreasing, according to consultancy AlixPartners, which has tracked a move away from reliance on China.

Asos and Boohoo have turned to near-shoring to mitigate disruption from the Red Sea shipping crisis

Asos and Boohoo have turned to near-shoring to mitigate disruption from the Red Sea shipping crisis

AlixPartners said in December 2023 that it is no longer a given that China is the cheapest for labour, and costs related to environmental, social and governance (ESG) and growing automation in warehouses globally mean manufacturing in the Far East does not always bring the savings it once did.

AlixPartners said it surveyed 115 Europe-based executives across industries and nearly all respondents have developed actions to reduce dependency on China. A quarter said they had already reduced exposure by 10%, while an additional one-third said they will hit that threshold in 2024.

While the intent exists to accelerate near-shoring, it does not happen overnight; but there are signs of an evolution. Since the pandemic, for example, Inditex is purchasing more goods from “local” markets in Spain, Portugal, Turkey and Morocco, and Dr Martens, Marc O’Polo and Mango are among a cohort of retailers less reliant on China for sourcing.

Elsewhere, in February 2024, it was revealed that Boohoo and Asos had turned to near-shoring to mitigate disruption from the Red Sea crisis. The fashion retailers have begun ramping up the sourcing of products from countries such as Turkey and Morocco, as well as domestically in the UK, to avoid the longer lead times and inflated prices associated with shipping from Asia.

As the shift to near-shoring develops, new partnerships will emerge. And as AlixPartners suggested in August 2023, new development centres, material supply chains, manufacturing methods and machinery will be required.

Alcumus SafeContractor’s Sperti adds: “The evolving trend of near-shoring presents an opportunity for retailers to enhance their supply chain management processes. Relocating operations to the UK and Europe offers advantages in streamlining adherence to regulations and standards, and transitioning from global to regional requirements. This alignment simplifies the measurement, baselining and benchmarking of health, safety and ESG data. Near-shoring also facilitates the development of new supply chain relationships to enhance resilience and continuity, which is essential in a landscape marked by numerous ongoing disruptions.”

Last-mile linkups

In January 2024, THG announced Holland & Barrett would be using its Ingenuity Commerce platform to run direct-to-consumer services, as part of a wider shake-up of distribution at the health food and supplements retailer.

Holland & Barrett chief operating officer Anthony Houghton said the retailer’s digital sales operations were at 95% capacity. “We need to invest now in a new digital outbound system to meet the future demands of our customers,” he added.

A three-year outsourcing deal will allow the business to “continue to grow at pace with a partner who are industry experts in direct-to-consumer fulfilment”, Houghton continued.

Holland & Barrett is now undergoing a multimillion-pound redevelopment of its Burton distribution centre, too, as it seeks “a new state-of-the-art fulfilment system”.

Holland & Barrett is partnering with THG Ingenuity to revamp its distribution operation

Holland & Barrett is partnering with THG Ingenuity to revamp its distribution operation

Other notable new partnerships in the last mile include Co-op’s burgeoning collaboration with autonomous robot company Starship Technologies, and Amazon’s work with several e-cargo bike manufacturers as it continues to open “micromobility hubs” in urban areas.

Co-op rolled out delivery via Starship’s robots to a total of four districts in Leeds in 2023. The grocer had already brought the technology, which delivers groceries to consumers in under an hour, tracked via an interactive map, to the streets of Wakefield, Trafford, Milton Keynes, Northampton, Bedford and Cambridge.

Amazon, meanwhile, is opening hubs from which it and its partners will fulfil parcels to people’s homes by foot or cargo bike. It is targeting these hubs for circa 40 European cities by the end of 2025, viewing them as a means to take vans off the road and reduce urban pollution.

With modern retail a blended landscape of online and physical sales, there is a demand for sophisticated behind-the-scenes systems to orchestrate a seamless service. It is why so much investment is being directed in warehouses and factories by the most forward-thinking retailers, which want to lead the way in this more complex era of commerce.

And thanks to the likes of Amazon, Tesco Whoosh and Walmart providing rapid delivery options, shoppers’ fulfilment expectations are sky high – and that dictates the need for ongoing logistical improvements and innovation from the wider retail world.

Supply chains are where retailers can make the most ground in reducing their CO2 emissions and driving positive change as they strive to become better businesses, defined by their policies for people and planet as much as their profitability.

Against this backdrop, Retail Week and our partners have compiled five essential guidelines for retailers to pursue over the coming 12 months to build resilience into their supply chains and future-proof trading:

1. Think efficiency

Retailing is more expensive than it was pre-pandemic, and the economy continues to be unpredictable and turbulent. Therefore, investing in efficiency such as automation and AI-enabled systems that speed up production and processes, reduce the cost of business and improve service is becoming increasingly essential for all retailers.

2. Reduce risk

As the Red Sea conflict highlights – just as Brexit, the pandemic and ongoing geopolitical tension did before it – retailers need to diversify their supply chains to ensure continuity. Risk does not stop there, though; there is an ever-evolving regulatory landscape and growing pressure to ensure supply chains are ethically and environmentally sound to consider. Strategic tie-ups can help de-risk supply chains.

3. Invest in people power

For all the tech investment, people power is at the heart of a successful retail supply chain. As tech capability enhances, so too does the need to find skilled people to oversee, maintain and optimise it for the good of the wider business. Corporate reputations are at stake, too – retailers will be held to account for people policy.

4. Care for the planet

From considering the conditions in which goods are made and where they are sourced, to driving energy efficiency and transitioning from fossil fuels, there are so many environmental factors involved in running a successful modern retail supply chain. Retailers operating with the most transparency are already one step ahead.

5. Find the right partnerships

It is impossible to fulfil any of the above alone. As supply chains continue to evolve, customer expectations increase, stricter rules on ESG arrive and the need for more innovative technology grows, retailers will need to find specialist partners to support their strategies and keep them on track for growth and prosperity.

Expert insights

Terry Gardner, retail director, Acopia Group

Sustainability pays

When it comes to creating a sustainable business, there is a fine balance between investing in the future, protecting operational stability and the bottom line.

As the Supply Chain 2025 report shows, building strong relationships inside and outside of your organisation that align with your brand ethics and values is key to delivering on your vision of sustainability and, ultimately, long-term success.

The path to sustainable business is just one of the many challenges facing retailers such as yours over the next 12 months into 2025, but arguably one of the most important.

Since 1988, 100 companies have been the source of more than 70% of the world’s greenhouse gas emissions according to the Climate Accountability Institute. The impact of this is beginning to affect how people buy from you.

It’s not just consumers who want retailers to become more sustainable, your staff and prospective staff do too. It is no longer about the products you sell that staff and consumers are interested in, but it’s also about what goes on behind the scenes with sourcing, packaging and distribution – indeed, the whole supply chain.

Brands that are serious about innovation and setting sustainable standards throughout their supply chain could see operating profits increase by as much as 60%, research from McKinsey & Company found.

Investing in strategic partnerships can help you rethink processes that have the power to be transformative; building rigour and resilience into your supply chain that mitigates risk.

Opportunities for GNFR (goods not for resale) consolidation with free stockholding and call-off, to shared logistics that minimise delivery impact, to procurement platforms that provide a complete insight on spend, all create smarter ways of doing business sustainably.

Rebecca Sperti, SVP sales, Alcumus SafeContractor

Mitigate supply chain risks

In the UK retail sector, there are challenges abound, but for retailers ready to embrace change, numerous benefits await, from business growth to operational improvements. However, maintaining a positive brand image while embracing this dynamic market is no easy task. With investor scrutiny and consumer expectations soaring, safeguarding business reputation is essential.

Navigating this landscape requires adaptability to evolving risk domains, especially in managing GNFR suppliers. In addition to traditional health and safety and insurance concerns, retailers must address emerging challenges such as ethical labour practices, including compliance with the Modern Slavery Act 2015 and stringent right-to-work checks.

Balancing compliance with critical regulations while ensuring safety, reputation and service continuity across a vast network of stores and distribution centres poses its own challenges. Meeting ESG requirements adds another layer of complexity. To compound these issues, even the largest retailers often lack in-house resources and expertise to manage their extensive supplier networks.

At Alcumus SafeContractor, we understand these challenges and have been operating in this space for over 20 years, supporting some of retail's biggest names. We help retailers of all sizes to mitigate supply chain risks and ensure they only work with safe and compliant contractors and suppliers.

Lars Pedersen, chief executive, nShift

Last-mile deliveries drive growth

Retailers increasingly see the last mile as a driver of revenue growth. Get deliveries right and retailers can stand out, customers will shop again and they will spread the word.

The key is to think differently about deliveries. Rather than relying on one or a handful of carriers, forward-thinking retailers are putting together delivery capabilities that reflect their brand and fit around their customers.

Providing a range of joined-up delivery-related services, built around a core 'book and print' service, can transform order fulfilment for retailers. Integrating all these services through one market-leading provider will deliver a broader service, with less risk.

The right choice of delivery options alone could increase shopping basket conversions by as much as 20%.

All along the delivery experience, there are opportunities to add extra value for customers, generate additional sales and retention opportunities, and build brand preference.

One example is to market new sales to customers through the tracking communications they get while they await their deliveries. These catch customers when they are at their most receptive – helping increase sales.

Returns is another: digitising this process makes it easier for retailers to offer exchanges rather than refunds and helps get returned items back on sale quickly. The right returns solution can deflect 30% of refunds to exchanges.

Retailers cannot achieve these benefits if they outsource their deliveries to just one or two carriers. Taking tighter control over deliveries needn’t be a big, disruptive process.

Supply Chain 2025, produced by:

Megan Dunsby

Senior commercial content editor and report project manager

Ben Silitoe

Report writer

Sam Millard

Designer