Supply chain success is the holy grail for any retailer today, but how can it tangibly be achieved? And what are the strategies to generate operational efficiency and true return on investment?

Retail Changemakers, the new report from Retail Week produced in association with Informatica and Maersk, celebrates 15 global brands buoyed by supply chain transformation and serves as the inspiration retailers need to make their businesses stronger.

Some of these brands are enjoying sales growth due to supply chain investments, while others are instead benefiting from improvements in productivity and operational performance. Then there are the lucky few that are achieving a combination of the two.

Over the following chapters expert insights from the Retail Week Prospect analyst team will be drawn upon, with exclusive global sales forecasts to understand how supply chain activity is influencing results.

Learn from the Retail Changemakers and make your supply chain work to your advantage.

Methodology

The Retail Week analyst team has identified 15 global retailers that are either enjoying sales growth due to supply chain innovation and transformation, achieving greater efficiencies, or both. The analyst team has compiled exclusive forecast sales for the current year (FY 2022/23) and five years’ time (FY 2027/28).

The Retail Week analysts Lisa Byfield-Green, Beth Bloomfield and Hanna Hua

The Retail Week analysts Lisa Byfield-Green, Beth Bloomfield and Hanna Hua

Retailers will be only too aware of the multitude of factors putting their supply chains under scrutiny and at risk on a global scale.

Leaders were forced to deal with Brexit-related red tape before riding out a global pandemic that turned supply chains on their heads and disrupted the flow of goods across borders.

Now the cost-of-living crisis and ongoing political volatility have caused inflation in goods and energy. Containers for shipping goods across borders are up in price and the cost of running transportation has accelerated, meaning doing international business is more expensive than it once was.

If the past few years have taught retailers anything it is that flexibility in the supply chain is crucial and there is no such thing as business as usual – so preparing for constant disruption is wise.

If the past few years have taught retailers anything it is that flexibility in the supply chain is crucial and there is no such thing as business as usual – so preparing for constant disruption is wise

Against this backdrop, many businesses have reassessed how to get goods from A to B. They are also rethinking which countries and territories to source from and where to sell their goods. Fortnum & Mason, for example, made the decision to stop shipping goods to many countries in the European Union in 2022 due to rising costs and administration caused by the UK’s exit from the Union.

The climate emergency is also putting pressure on retail supply chains. The threat of potential new legislation relating to carbon emissions means many organisations are looking at how they operate with a lower environmental footprint – and that has put a focus on the methods used to transport goods and ways to ship more efficiently.

Grocery retailer Lidl, for example, made a commitment in November 2022 to stop using air freight to source fresh fruit and vegetables for its Swedish and Dutch stores, which is aimed at reducing the carbon emissions associated with the transport of fresh produce. There are no plans to do this for the UK market yet, but it shows progressive thinking within the wider organisation.

The UK's Streamlined Energy and Carbon Reporting policy, which was introduced in 2018, requires organisations to share energy use and carbon emissions information in their annual reports. This has meant retailers now need to find ways to make incremental improvements across their operations.

Within first mile, retailers such as Currys, Tesco and Amazon are working on ways to reduce their reliance on fossil fuels in what the latter has called “a challenging area to decarbonise”.

And at the last mile, several of the major carriers are electrifying their fleets while retailers are developing new partnerships with greener delivery or low-carbon start-ups to get goods to people’s homes.

Changing consumer behaviour is also having a major impact. Indeed, Scott Jennings, chief strategist at supply chain software specialist Informatica, highlights that “consumer preferences have changed forever, which will continue to send shockwaves up and down the supply chain. One day it’s out-of-stocks, the next month a glut of inventory is on the books.”

He adds: “To get ahead of these supply chain shocks and manage unforeseen black swan events, complete supply chain visibility with trusted data has become a modern mandate.”

Amid this turbulent backdrop, there are retailers and brands smoothing out the kinks in their supply chains and enjoying either sales growth or improved operational efficiency or, for some of the best, both in equal measure.

Amid this turbulent backdrop, there are retailers and brands smoothing out the kinks in their supply chains and enjoying either sales growth or improved operational efficiency or both in equal measure

There are signs of a bounceback in supply chain operations too. Next chief executive Lord Wolfson commented in January 2023 that the medium-term outlook for supply chains was more positive than the short-term, explaining at the time that increasing global factory capacities and finding new sourcing markets have helped reduce costs – although the company has not specified which new markets in particular.

Some businesses have been set up for success for some time. Zara owner and Spain-based Inditex sources more than half of its products from “proximity” markets – Morocco, Portugal, Spain and some in Turkey – meaning distribution is less affected than those with more geographically spread supply chains when global trading friction occurs.

In the case of global retailers Decathlon, Kingfisher and several others, there has been a pivot towards an online marketplace model that decentralises their supply chains and opens these businesses up to working with a broader range of suppliers at a limited cost.

Indeed, despite the fragility of supply chains worldwide, there are clear examples of retailers and brands that are protecting their margins and driving efficiency through well-thought-out supply chain investment and modelling.

Enter the 15 Retail Changemakers.

Below, we profile the Retail Changemakers. Despite the uncertainty and the challenges impacting commerce in the UK and internationally, these businesses represent the companies investing to strengthen their supply chains.

How the Retail Changemakers stack up

Our analysts have compiled forecast sales data for the 15 global retailers they have identified as Retail Changemakers. This forecast data is presented below with the retailers listed in alphabetical order.

Amazon tops the chart for forecast sales in the next five years, followed by Aldi, Tesco and Nike. Read on to deep dive into the supply chain strategies of all 15 businesses and understand more about what makes the Changemakers tick.

Aldi

- Investing in new distribution centre as it expands its store network

- Rolling out click and collect to aid fulfilment

- Focused on reducing food and energy wastage in its supply chain

Aldi’s business model is based on driving down costs and creating efficiencies throughout the supply chain.

From a technology perspective, huge advancements are in the pipeline – with the grocery chain receiving approval in 2021 for a 1.3 million sq ft site in Leicestershire that will include a semi-automated distribution centre and office space just 20 miles from the company’s head office. Aldi expects to open its 1,000th store in the UK in 2023, too, so needs the supply chain capacity to support a growing bricks-and-mortar business.

Aldi is renowned for its low-tech strategy, but when it does invest in this space it does so with speed, efficiency and cost-cutting in mind. In many cases – including ecommerce, which it only entered in January 2016 – Aldi refrains from investing in tech for as long as possible, but that means it will usually pick the right systems for the business and learn from others’ work in the space.

Aldi is in growth mode and is looking to recruit 6,000 store staff – and it is investing in its people, with warehouse staff given a 20% pay rise in February 2023. Basic pay for 7,000 workers in this area of the business now sits at £13.18 an hour.

Aldi is renowned for its low-tech strategy, but when it does invest in this space it does so with speed, efficiency and cost-cutting in mind

After its initial £35m investment into ecommerce, the supermarket chain has slowly ramped up its offering online, with a focus on click and collect rather than home delivery to keep costs to a minimum and to leverage its store estate.

At the time of writing more than 200 of Aldi’s 990 UK supermarkets offer click and collect and – while in June it axed the service at 12 of its stores such as Reading and Crawley due to a lack of customer demand – the service will remain. The retailer relies on a strategic partnership with AO Logistics to deliver bulkier ‘SpecialBuys’, which ensures this part of its operations stays at a fixed cost. That tie-up has been in place since September 2019.

Aldi UK also acquired PSI Global Logistics – which provides software for strategic planning, controlling and optimisation of logistics networks – back in 2015. This acquisition gave the retailer the key data analytics and management tools to oversee its supply network, transport processes and logistics centres across the UK and Ireland.

In September 2022 the discounter overtook Morrisons to become the fourth biggest supermarket in the UK in terms of market share, according to Kantar. And from a sustainability perspective, Aldi started trialling the use of an all-electric refrigerated trailer in its UK fleet in April 2022. In August 2022 the discounter started piloting HGVs that run on compressed natural gas, which it said will reduce its carbon footprint and save operating costs.

Since February Aldi has been working with food waste prevention app Too Good to Go to help reduce the amount of end-of-life food it throws away. At the end of each day, bags of items nearing their sell-by date are packaged up for a third of their normal price and consumers can reserve these through the app. It gives Aldi a chance to drive extra revenue from would-be waste.

Predicted total sales for FY2022/23 at Aldi are £101.5bn, but the infrastructure investment being undertaken, and ongoing onboarding of new customers, is expected to help the retailer reach a five-year CAGR of 4.4% that will result in sales of £135bn by 2027/28.

Amazon

- Using partnerships to aid operational efficiency

- Cutting-edge tech is a focus, with warehouse robotics arms being implemented

- In process of overhauling transportation network with investment in electric fleets

Tech giant Amazon’s logistics and supply chain provides the bedrock to its success in retail. It offers consumers a rapid and consistent next-day delivery service, convenient pick-up lockers in third-party locations and a Prime subscription service that drives significant loyalty.

Its service in the UK is supported by 24 UK distribution centres, but it is the company’s technological innovation and investment that continues to drive efficiencies through the business.

Most recently, in August 2022, Amazon acquired Cloostermans, a Belgium-based mechatronics manufacturer that provides tech to stack heavy pallets and totes or package products together for customer delivery. The investment in fulfilment is paying off, with Amazon chief executive Andy Jassy saying in April 2023: “We expect to have our fastest Prime delivery speeds ever in 2023.”

Warehouse robotic arms to handle packages prior to the home delivery journey are an increasingly common feature of the Amazon network, with ‘Sparrow’ introduced in November 2022 to detect and move individual products using computer vision and artificial intelligence.

Amazon's Sparrow robot was introduced to warehouses in November 2022 to sort individual products

Amazon's Sparrow robot was introduced to warehouses in November 2022 to sort individual products

Around half of items sold on Amazon are from third-party sellers, via Fulfilled by Amazon (FBA), under which vendors pay Amazon to hand over picking, packing and fulfilment of items for delivery to Prime members. That so many others rely on Amazon’s infrastructure is evidence of a robust supply chain offering.

Amazon launched an initiative in April to help sellers extend their business to all its UK and European marketplaces. The European Expansion Accelerator tool will make it easier for sellers to list their products across these online stores and is free to use. All professional selling partners who already sell in at least one of Amazon’s European stores in France, Germany, Italy, Spain, the Netherlands, Poland, Sweden, Belgium and the UK can access the new technology.

But even the top supply chain networks require ongoing readjustment and are not immune from macroeconomic environment factors. Amazon said its shipping container costs more than doubled in 2022 versus pre-pandemic rates and that, combined with wage inflation, had created $2bn (£1.66bn) in additional costs. Amazon plans to optimise its fulfilment network by closing three warehouses in the UK to reduce fixed costs, while taking up excess capacity through the expansion of its FBA network.

Amazon has also come under pressure from its warehouse workers. Since the start of the year, the tech giant has faced a series of strikes, including a 14-day strike in April involving more than 600 Coventry workers – with staff demanding pay rises and better working conditions.

A bid by the GMB for union recognition was quashed in June, with Amazon telling Retail Week that it offers “competitive pay, comprehensive benefits, opportunities for career growth, all while working in a safe, modern work environment”.

Investment is being ramped up in the sustainability space, with Amazon announcing in October 2022 it will invest more than €1bn (£873m) over the next five years to decarbonise its European transportation network. The commitment includes more than £300m in the UK and involves adding to the thousands of electric and alternatively fuelled vehicles already deployed across its European operations.

Amazon also co-founded The Climate Pledge back in 2019 – an environmental initiative where signatories commit to achieving full decarbonisation of their operations by 2040 – and it has continued to gain momentum in the years since.

Some 417 companies from across the globe have now signed the pledge, including Selfridges, Sainsbury's, Unilever and Amazon itself.

Reviewing Amazon’s supply chain strategy, Maersk global head of retail Johanna Hainz says that “innovators and pioneers, such as Amazon, are feared and admired for their speed and decisiveness in taking on new ideas and rolling them out, also in the supply chain.

“Often the key to success is choosing like-minded partners who can help businesses leveraging each other's network by learning and experimenting with insource and outsource across different geographies to balance risk and capacity at the same time. This approach provides businesses (and the partners) with learnings on agile opportunities and long-term commitment that make both evolve together.”

Sales forecasts are strong, which arguably allows Amazon to commit more towards improving its supply chain sustainability than the average retailer. For 2022/23 total sales were £417bn and an expected five-year CAGR of 7.9% should result in total sales of £675.6bn by 2027/28.

Decathlon

- Reaping rewards of warehouse automation

- Marketplace launch has expanded its range to thousands of SKUs

- Creating a more circular supply chain is key with moves into rental and resale

Technological supply chain development has been a key theme in recent times at Decathlon, with the sports equipment retailer relocating to a larger UK distribution site at Rushden Lakes, Northamptonshire, in 2019. It proved well timed, with the additional capacity coming just as the pandemic created a surge in demand for the retailer’s goods.

During 2020 the company invested £473,000 in its mechanisation and infrastructure to help meet that growing demand. Decathlon started rolling out automated picking and sorting bots from robotics firm Exotec to its Canadian operations in December 2021, following deployment in Europe the year before. The idea is to better serve stores, accelerate ecommerce and build a more responsive and efficient supply chain.

It is expected that over time these solutions will roll out to further European Decathlon territories.

Elsewhere in Europe, showing Decathlon’s willingness to embrace technology where it sees a significant benefit to do so, the retailer partnered with robotics company Geek+ in January 2022 to bring hundreds of autonomous mobile robots to three DCs in France, Poland and Italy.

Decathlon started rolling out automated picking and sorting bots from robotics firm Exotec to its Canadian operations in December 2021, following deployment in Europe the year before

Alongside the investment in its own supply chain, Decathlon launched an online marketplace in June 2021 to open up new categories and hundreds of thousands of new SKUs to customers.

This is an increasingly common move among UK retailers, with Superdrug, Mountain Warehouse and Boots among those following suit in 2022. This allows businesses to increase product range while outsourcing stock management, pricing, content, storage, fulfilment and returns to third parties, saving time and money.

As part of its sustainability commitment, Decathlon has a longstanding commitment for air freight to account for just 1% of its transportation needs. Another eco-related move by the business in the UK is to ramp up its rental product range, with 46 stores now running dedicated rental services.

The implications of moving into rental include the need for a more circular supply chain model, which is supported by a centralised hub that keeps rental stock separate from the core retail product ranges. This strategy falls into the business’ wider Second Life programme, whereby it is offering a range of repair services, pre-loved products for sale and customer education initiatives to help raise awareness of more circular consumption habits that can help reduce the impact consumers and businesses have on the planet.

Estimated total sales of £12.4bn for 2022/23 are expected to grow by a 4.7% CAGR rate to £16.7bn in 2027/28, justifying the remodelling and infrastructure investments Decathlon has made in the past four years.

Fast Retailing

- Data and AI playing a key role in Uniqlo owner’s supply chain strategy

- Investing in automation and robots as part of Ariake Project

- Launch of in-store repair workshops signifies move to more circular thinking

Fast Retailing, which runs 17 Uniqlo stores in the UK and more than 1,000 stores worldwide, is focused on efficiency and positioning itself as a technology company as well as a retailer.

Much of that technological expertise is being deployed across the supply chain and a partnership with Google since 2018 means the company can use AI to optimise its inventory. In November 2021 it achieved its ambition of speeding up its supply chain and getting product to market quicker, with the aim of reducing the time from planning and manufacturing to selling in stores by 90%.

Uniqlo has also worked with Accenture since 2015 to collect actionable customer insights to support its operations in product development, merchandising, production, logistics, marketing, sales and customer service, while the retailer is a keen proponent of RFID to track inventory throughout the supply chain.

The retailer continues to invest strongly in increasing the level of automation at its warehouses to boost efficiency, and as part of this programme – the Ariake Project, (what Fast Retailing defines as ‘sweeping corporate transformation across the business’) – it has earmarked ¥54.1bn (£345m) of investment in automated warehouses and systems in FY2023.

This plan follows the move in 2018 to transform its Ariake warehouse in Tokyo, where it replaced 90% of staff there with robots that fold T-shirts, as well as inspect and sort products for shipping. The warehouse has been automated in partnership with material handling systems provider Daifuku.

Its West Japan warehouse has also been transformed to this level and Fast Retailing intends to develop this infrastructure in Mainland China, the US and Australia as it looks to drive efficiency through its own warehouse network to minimise product shortages.

Integrating stores with its online operation is a core focus for the Japan-headquartered business. Its home territory stores offer an in-store service whereby customers can order items online to be delivered to their homes the next day. This plan is set for international markets too.

Another new key feature of Uniqlo’s latest flagship stores – such as its London Regent Street and Covent Garden stores opened in April 2022 and 2023 respectively – is the inclusion of repair workshop stations that point towards more circular thinking at the business. The workshops also encourage shoppers to keep clothing items in use for longer to reduce environmental impact.

Sales for 2022/23 at Fast Retailing were £14.6bn, and with an expected 5.9% CAGR rate over the next five years total sales should hit £22.4bn by 2027/28.

Ikea

- Adapting its stores to double up as distribution centres

- Utilising autonomous drones in international markets to drive productivity

- Making major investments in green technology such as EV charging

Ikea UK is currently investing in making its out-of-town big-box stores double up as ecommerce distribution centres, as it looks to speed up its online retailing operations and scale that part of the business.

The furniture retailer is set to invest €3bn (£2.6bn) in 2023 to adapt its big-box stores to double as online distribution centres, which the business believes will give it the ability to provide customers with faster and cheaper deliveries.

Ikea currently delivers items purchased online within four to 30 days – for in-store orders, same-day deliveries can be arranged depending on the item, while London customers can pay £39 for same-day delivery via TaskRabbit. Importantly for Ikea, which is a retailer with a vocal environmental opinion, shipping from store to customers’ homes means lower emissions than when shipping from several logistics centres.

Automation in existing out-of-town warehouses is a major point of investment for the company too, which utilises autonomous drones in its supply chain to manage stock inventory and prevent staff from manually confirming each pallet of goods stored.

Ikea warehouse drones are currently operational in Switzerland, Belgium and Italy

Ikea warehouse drones are currently operational in Switzerland, Belgium and Italy

The drones are not currently operational in the UK, but they are used in several European territories such as Switzerland, where they were launched in March 2021, as well as Belgium and Italy.

In terms of supplier relationships, Ikea favours fostering long-term tie-ups that it believes help drive down its supply chain costs. All suppliers must live up to Ikea’s ‘IWAY’ code of conduct to ensure they meet mandated sustainable and socially responsible ways of working.

There is much change afoot at Ikea, with senior management acknowledging the traditional way of dictating how customers shop with modernising business needs. That has resulted in smaller, in-community stores opening in the UK and a refresh of multiple behind-the-scenes systems.

For instance, it is rolling out an employee scheduling system, which means it will be able to match staffing levels to trading patterns. This is part of a move to update internal tech systems with software as a service from some of the largest suppliers around such as Oracle, IBM and BlueYonder (previously JDA).

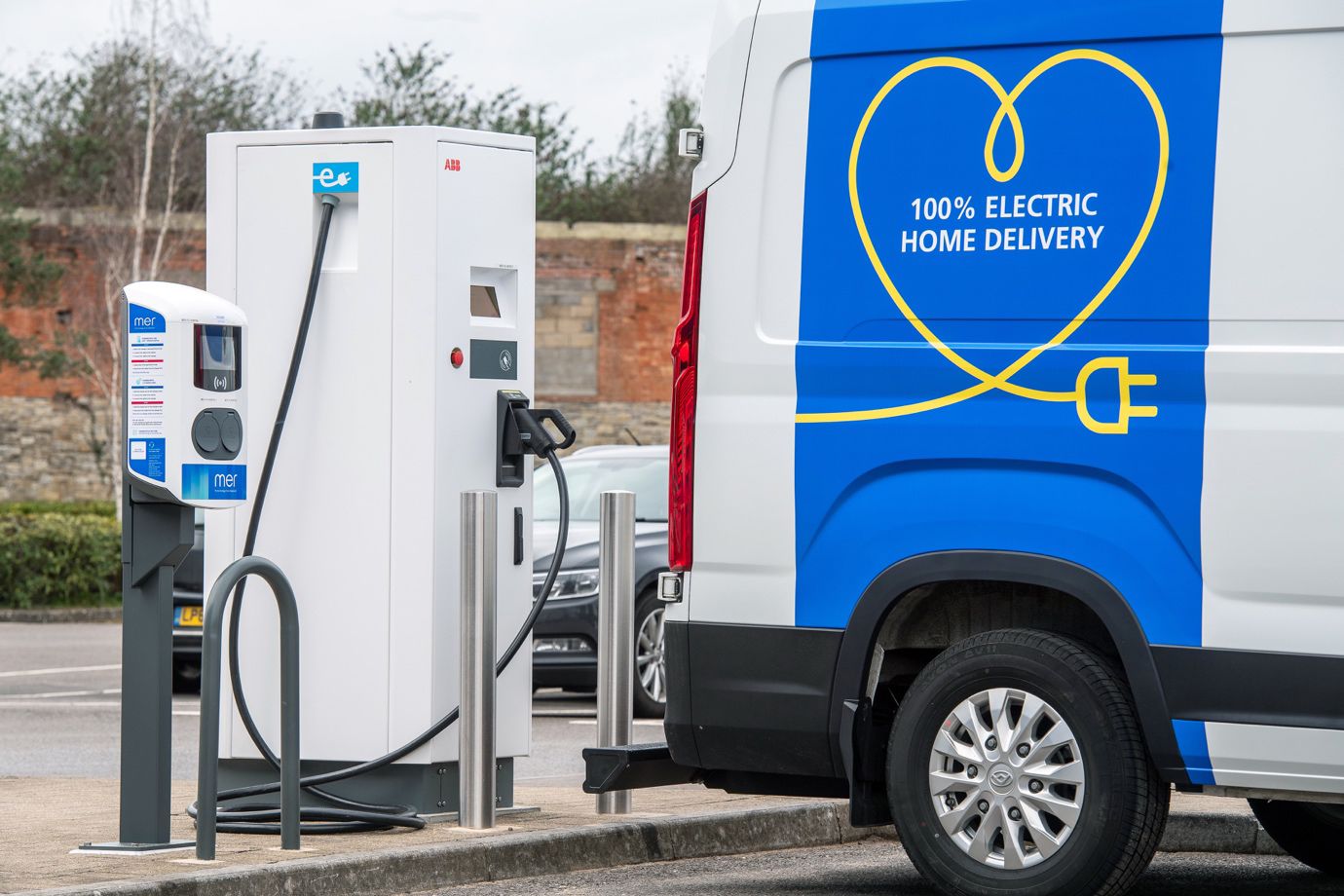

In April 2023 Ikea announced plans to invest £4.5m in last-mile electric vehicles across the UK

In April 2023 Ikea announced plans to invest £4.5m in last-mile electric vehicles across the UK

Ikea is making investments in greener strategies to back up its eco statements. In April 2023, it announced plans to invest £4.5m in one of the biggest electric vehicle infrastructure projects for last-mile fleets in the UK, aiming for 200 charging points for electric delivery vehicles across the country to support greener deliveries. Ikea has set the target of 100% zero-emission deliveries by 2025.

Ikea is also working to reduce its supply chain carbon emissions through a partnership with Maersk. Since September 2020, Ikea has worked with Maersk to shift transportation from truck to rail between Barcelona port and Tarragona terminal, which is said to be cutting the retailer’s greenhouse gasses from its long-haul transports in Spain by around 700 tonnes per year.

This solution has since been replicated in Italy with Ikea switching approximately 2,000 containers from truck to rail for the transport flow from the APM terminals in Vado to the Ikea distribution centre in Piacenza. Ikea has said the tie-up is a “needed, ambitious step to reach our goal” of becoming climate positive by 2030 and reducing emissions from every transport.

Ikea’s 2022/23 sales reached £35.6bn, but with an expected CAGR 3.2% over the next five years, the business should hit £43bn by 2027/28.

Inditex

- Made headway by producing ranges in small batches with quick manufacturing

- Building a ‘single inventory’ position with online and store stock integrated

- New Oysho store demonstrates supply chain innovation

The wider fashion retail sector has long looked to emulate the rapid speed to market achieved by Inditex. The Zara owner operates an integrated supply chain, and its sales and market share growth over the past decade have been supported by a willingness to adopt and widely deploy the latest technologies.

New designs are produced in small batches and can arrive in store within two weeks from concept, with many products sourced from manufacturers and factories owned by Inditex.

This has long been the case, with all channels neatly combined to create a global powerhouse of a retailer. This is evidenced by its store managers regularly forwarding data and customer feedback to commercial teams who can work with manufacturers to build collections based on the latest customer demand.

The idea of a ’single inventory position’ has been a key theme of the retail group’s work in the past 10 years, with Inditex working to integrate its online and store stock into the same system and using RFID tagging to keep track of inventory across its operations.

Such work helps with business as usual but, notably, it also put Inditex in a position of strength during the pandemic when much of fashion retail was brought to a halt due to enforced store closures. In April and May 2020, Inditex’s single view of stock meant it was able to fulfil “a big part” of its online order backlog by selling products located in closed stores, turning shops into microfulfilment centres overnight.

All channels neatly combine to create a global powerhouse of a retailer

All products, regardless of where they are produced, arrive at Zara’s Spanish hub before being shipped around the world, but with half the goods it sells manufactured in Europe close to the point of distribution it can quickly get items to market globally.

Informatica’s Jennings says every retailer should be putting supply chain data at the heart of its strategies to drive performance and, crucially, profitability: “According to the Deloitte Consumer Products Outlook Survey, published at the start of this year, 90% of profitable businesses were found to have shared supply chain data with consumers for applications and 76% shared data with key trading partners to coordinate and optimise logistics.”

Zara spent €1.4bn (£1bn) on process automation, store modernisation and modernising its logistics platforms in 2014. The investment in technology has continued in the decade since, with robot picking now used in stores to retrieve growing numbers of click-and-collect orders, and customers able to access real-time store stock information via the mobile app to boost inventory transparency and accuracy.

Meanwhile, in March 2023 Inditex launched its first Oysho store in the UK at Westfield in London’s White City. Inside the space are several modern supply chain solutions such as click and collect within an hour of ordering products via the Oysho app, as well as in-store delivery.

Inditex’s estimated sales of £27.9bn in 2022/23 are expected to reach £38.2bn by 2027/28 at a CAGR rate of 5.3%, reflecting its infrastructure work and modernisation in line with growing digitally influenced shopping behaviour.

Kingfisher

- Stores are now central to the B&Q and Screwfix owner’s strategy

- Notable investment in delivery, with Screwfix Sprint proposition delivering items in 47 minutes

- 2022 marketplace launch paving the way for increased inventory with minimal costs

B&Q and Screwfix owner Kingfisher is arguably the UK retailer that has made the most dramatic supply chain shift since the onset of the pandemic. Approximately 20% of B&Q stores are now used for online order picking – pre Covid-19, the retailer relied solely on distribution centres for ecommerce fulfilment.

Colleague-facing apps for in-store picking were built in the UK, with that technology now used across Kingfisher’s international retail banners. Shops are now viewed as central to B&Q’s ecommerce strategy, helping optimise and speed up online delivery and improve customer convenience.

Rapid fulfilment has been at the heart of stablemate Screwfix’s proposition for years now, with an average delivery time of 47 minutes, and the other retail chains in the group such as B&Q in the UK and Castroma in France are now catching up.

Another example of a shift in Kingfisher’s digital retailing model, beginning in March 2022, was the launch of a B&Q online marketplace that added tens of thousands more products to its inventory and created more direct-to-consumer brand relationships via its platform.

Rapid fulfilment has been at the heart of Screwfix’s proposition for years now, with an average delivery time of 47 minutes

Like Decathlon, the move is viewed by Kingfisher as a way of growing its inventory without the need to significantly increase its supply chain costs. The move also provides flexibility and agility in the event of further supply chain disruption or sourcing issues with traditional product lines.

B&Q wants to grow its online range to 1 million products and as of March 2023 there were approximately 400 carefully selected third-party sellers on its Diy.com platform, with products across 18 home improvement categories. The move has enabled B&Q to offer over 340,000 additional home improvement SKUs, compared with its previous pre-marketplace offer of around 40,000.

In November 2022, Kingfisher announced a partnership with Google Cloud that then chief digital and technology officer JJ Van Oosten said would boost its engineering excellence and underpin its technology strategy across multiple parts of the business, including back-end and customer-facing platforms.

Among other benefits, the Google tie-up is expected to enhance forecasting capability and help Kingfisher build a real-time ordering system that will improve stock accuracy across its stable of retailers.

It was also announced in November 2022 that Kingfisher will adopt order-management system provider Fluent Commerce’s technology to support its online businesses and improve inventory visibility across its organisation. A trial of the tech is currently under way at B&Q and it is expected to help build a consistent view of inventory.

ESG is intertwined in its supply chain investments. In July 2022, the group said a transition to 100% renewable electricity, significant investment in energy-efficiency measures and using alternative fuels within its delivery fleet had already significantly reduced carbon emissions. This comes as it works towards eco targets approved by climate action group the Science Based Targets initiative.

Sales of £13.1bn in 2022/23 are expected to reach £14.8bn in 2027/28 based on a five-year CAGR rate of 2.1%.

Lululemon

- RFID technology aiding improved fulfilment and staff efficiency

- Early adopter of new tech to manage product lifecycles and provide greater transparency

- Invested in Fashion Climate Fund to help cut industry’s emissions

Lululemon was previously dabbling with tech alongside its core position as an athleisure retailer, after it acquired fitness tech company Mirror for $500m (£397.4m) at the height of the pandemic fitness boom. In April 2023 the retailer started looking to offload that division, now known as Lululemon Studio.

Now, with a change of approach, tech remains a key part of its supply chain operations, particularly around stock visibility. Within its stores, Lululemon uses RFID technology, aiding store stock takes and inventory management.

According to the retailer, implementation of RFID technology allows store staff to leverage “real-time, accurate data” when serving customers, while also supporting the company’s fulfilment offerings such as buy online, pick-up in store.

Lululemon had deployed this tech strategy, which it calls iD Cloud, to its North American stores by September 2022. The retailer is now rolling out that strategy across Europe, the Middle East, Africa and Asia Pacific in 2023 – work began at the start of the year.

The retailer has been a long-term advocate of product lifecycle management (PLM) software, which tech retailers use to ensure the journey products take from idea stage to creation and development is tracked in one central place across different territories and departments.

Implementation of RFID technology allows store staff to leverage “real-time, accurate data” when serving customers, while also supporting the company’s fulfilment offerings such as buy online, pick-up in store

Lululemon continues to invest in the latest technology available. Speaking in 2022 about the new user experience in its PLM provider’s latest tools, Lululemon director of product development Leith Irvine said it was going to “revolutionise the lives of our product developers” and provide greater transparency of supply chain.

When it comes to supply chain sustainability, in June last year Lululemon joined H&M Group as one of the backers of a $250m (£198.7m) fund aimed at accelerating efforts to cut carbon emissions in the fashion industry's supply chain. The fund will help finance expanding the use of renewable energy, ending the use of coal in manufacturing and improving energy efficiency, as well as developing next-generation materials and other initiatives.

Lululemon is an investor in the Fashion Climate Fund to reduce carbon emissions

Lululemon is an investor in the Fashion Climate Fund to reduce carbon emissions

No results have yet been shared by the Apparel Impact Institute, running the fund, but US department store chain Target joined the mission in November last year. The idea is to build momentum behind greener fashion by pooling resources and funds for research and good causes that can help the wider industry reduce its impact on the environment.

With estimated sales of £6.6bn in 2022/23 and an expected five-year CAGR rate of 10.5%, total sales at Lululemon look set to hit £12.5bn in 2027/28.

Marks & Spencer

- Now owns its food logistics sourcing following Gist acquisition

- ‘Autobagger’ machines having a marked impact at its distribution centre

- Seeking out sustainable solutions to transform supply chain

In a novel move, M&S purchased its food logistics provider Gist in July 2022 to take control of its end-to-end food supply chain. Gist operated eight primary and 10 secondary distribution centres for the retailer, providing most M&S Food logistics services. M&S made an initial cash offer of £145m and a further £110m plus interest to be payable on certain conditions including the ability to retain the brand’s freehold properties.

M&S chief executive Stuart Machin’s comments at the time of the deal indicated it was a prudent step economically. “M&S has been tied to a higher-cost legacy contract, limiting both our incentive to invest and our growth,” he said.

Elsewhere, M&S is building automation into its infrastructure with the latest equipment to support the back end of its food business. Much of this work, which includes modernising forecasting processes, is tied up under the retailer’s Vangarde programme, which aims to reduce waste and enhance the customer experience through improved processes.

M&S has restructured most aspects of its business in the past five years, much of which is under the ‘Never the same again’ transformation programme. Managing stock flow across the clothing and home division has been a key priority, with reducing the size of and automating the UK DC network part of that.

Like many multichannel retailers, M&S is also ramping up its pick-from-store capabilities, using the store network for product flow rather than product holding. This includes returns, a growing area of focus for all fashion retailers, which M&S wants to be able to incorporate back into store inventory as soon as possible rather than always heading back to a central returns warehouse.

At its Castle Donington distribution centre, M&S is also using ‘autobagger’ machines, which can each pack 2,000 items per hour, and IT mapping. The latter tool enables staff to pick 15% more product without needing to walk any further, according to the retailer.

M&S refreshed its long-running Plan A strategy in October 2021, including the return of its ’Look Behind the Label’ campaign which shines a light on its planet-positive work and highlights stories behind responsibly sourced products. It established a new Look Behind the Label online hub to hold this information, but it also appears in email messaging to customers.

In February it introduced a bring-your-own-bag policy for click-and-collect customers, to reduce the need for plastic bags in its stores and smooth operations at the pick-up points. Meanwhile, last June it launched a start-up accelerator to find sustainable solutions it can implement – showing it is looking to be greener across all areas of its business operations.

Total sales at M&S are expected to hit £11.9bn in 2022/23 and rise at a five-year CAGR rate of 3.1% to reach £14.4bn in 2027/28.

Natura & Co

- The Body Shop owner recognises and rewards suppliers that supports its ESG agenda

- Reducing use of air freight within its transportation network

- Supply chain and sustainability heavily linked with recent investments in circular packaging and project to protect the Amazon

The Body Shop and Avon parent Natura & Co’s supply chain is centred around sustainability and tackling biodiversity loss, and it runs a continuous assessment of its suppliers – using its own substantial standards criteria.

To highlight its commitment to using suppliers that support its eco goals, Natura & Co operates a programme to reward and recognise them across the different facets of its business. The aim of the organisation, it says, is to “strengthen ties, boost innovation and cooperation, and reward distinguished achievements in quality, resilience and positive impact on society”.

For its business within France, Natura & Co favours sea transportation rather than air freight due to its perceived reduced environmental footprint and in the UK it looks to optimise its distribution network by consolidating some of The Body Shop’s activities at Avon’s Corby facility.

It is looking to lead from a greener retailing perspective by developing circular packaging solutions, setting up a hub to develop new ideas and with the mission to “create platforms, partnerships and provide intelligence” to support its four brands.

It is looking to lead from a greener retailing perspective by developing circular packaging solutions

From a technology perspective, the Natura & Co 2022 Annual Report suggested the group is outsourcing the technology development at its Avon brand. And much of the tech investment is being ploughed into its supply chain and sustainability work, which are intrinsically linked.

The group announced a significant structural reorganisation in June 2022 to bring down operating costs, and give each of its brands more autonomy and accountability. Alongside that, it has accelerated the integration of the Avon and Natura businesses in Latin America, starting this year with Peru and Colombia, quickly followed by Brazil.

Focus for the group will turn to The Body Shop and Avon now that it has sold Aesop to L’Oréal for $2.5bn (£2.02bn). That deal was announced in April 2022 and with a “deleveraged balance sheet” investment in strategic changes at its remaining brands, such as supply chain optimisation, can be expected in the coming years.

From a sustainability perspective, in 2020, Natura &Co launched a broad sustainability campaign that included supporting PlenaMata, a project in partnership with collaborative climate network MapBiomas and InfoAmazônia; the news organisation covering the endangered Amazon region.

One of Natura’s goals is to protect the Amazon and this initiative is expected to create a centralised database to inform initiatives for the conservation and regeneration of the Amazon biome. It is being developed in recognition that current data about the health of the Amazon is disparate and hard to use, but Natura & Co is looking to change that, and boost transparency and drive improvements in relation to deforestation.

It does all this work against the backdrop of a predicted five-year CAGR rate of 2.7%, which will take its total sales from £5.7bn in 2022/23 to £6.1bn in 2027/28.

Next

- Total Platform gives the retailer an edge in the market, supporting other brands’ infrastructure and online presence

- Major investments to increase warehouse capacity underway

- Focused on shifting sourcing, with Turkey a key market focus

As the UK’s largest clothing retailer by sales, investment in technology and supply chain optimisation are behind Next’s rise to power in recent years.

Like Amazon, Next’s supply chain expertise can be gauged by others’ willingness to piggyback on it. Through its Total Platform, which launched in April 2020 and comprises IT systems, warehousing and general logistics, Next is increasingly providing the infrastructure to other retailers’ ecommerce and fulfilment operations, meaning they don’t have to build their own.

Gap and Reiss joined the platform in 2022, and Joules – which was acquired out of administration on December 1 last year via a joint venture between Next and the company’s founder Tom Joules – will be fully set up on the Total Platform by October 2023.

In March 2023, Next also bought Cath Kidston out of administration and will be supporting its relaunch later in 2023 using its continually evolving tech and fulfilment capabilities.

Warehouse investment totalled £117m in the 2021/22 financial year, following a £124m investment the year before, as part of a long-term programme to increase capacity. Next has eight UK warehouses, seven UK depots and two international hubs that provide fulfilment to customers’ homes or retail stores.

The site in South Elmsall will introduce automation in a phased programme of development over the next two years to ultimately provide an estimated increase in boxed capacity of 50%

Indeed, a new 780,000 sq ft online facility is becoming operational in 2023, as Next continues to ramp up its distribution power. The site in South Elmsall will introduce automation in a phased programme of development over the next two years to ultimately provide an estimated increase in boxed capacity of 50%, with marginal labour cost per unit expected to be around 40% down on the present level.

Next’s chief executive Lord Wolfson recognised early, compared with other multichannel retailers, that working with its competitors in fashion can have multiple benefits. Many retailers are adopting the marketplace model that Next effectively established for itself in 2014 with the launch of its Label proposition.

As part of that strategy, Next selects various fashion brands to sell through its website, while allowing these companies to deliver to the customer directly.

From a sourcing perspective, product development improvement in Turkey is a current focus – with Next having identified the country as best placed to respond to emerging trends. The Next Sourcing division operates as a standalone business that competes with the retailer’s other 500 third-party suppliers, but gives the wider organisation an element of sourcing control via the factories it owns.

In mid 2021 Next was part of a pioneering group trialling a new supply chain platform created by the UK Fashion & Textile Association. In partnership with Tech Data, IBM and the Future Fashion Factory, the aim was to drive transparency in the supply chain – thanks to the use of blockchain and other tech. More recently, Next joined the US Cotton Trust Protocol as part of a journey to source all cotton from responsible sources by 2025.

Next is forecast to hit £5bn in sales for FY 2022/23 and tracking on a five-year CAGR rate of 3% that should see total sales reach £5.8bn by 2027/28.

Nike

- Investing in single view of stock

- Roll-out of automated machines in its factories has reduced lead times from 60 to 10 days

- Downsized distribution network to gain greater supply chain control

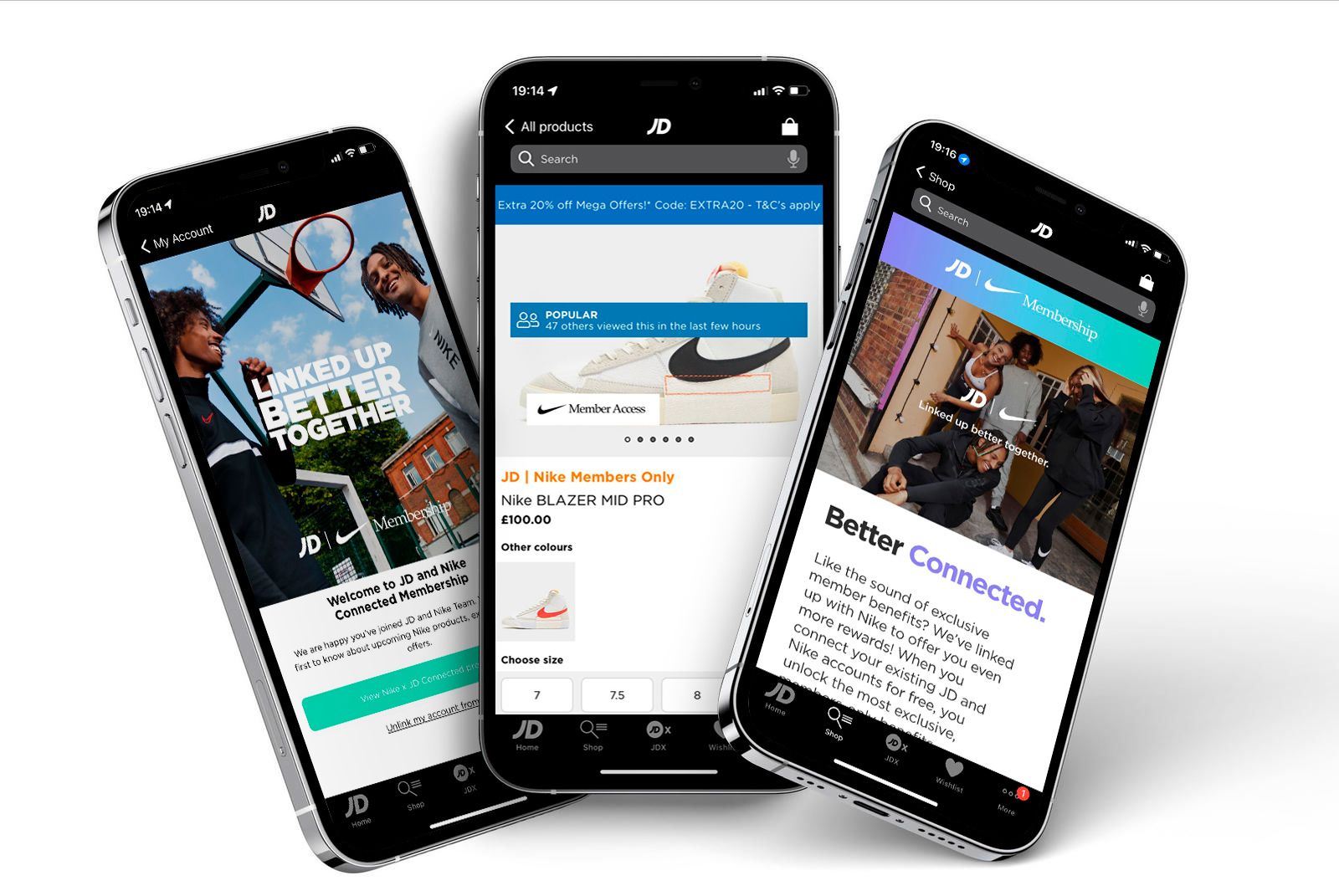

DTC giant Nike was relatively late to bring technology into its supply chain operations, but this has rapidly become essential to its strategy and has therefore become a key focus area.

The brand adopted RFID and QR code technologies in June 2019 as it moved to create a single view of stock across its global operations, helping boost inventory visibility across its organisation. Shortly after, in August that year, Nike acquired data firm Celect, as part of a strategy to bring in the expertise of start-up tech firms – and it has used Celect’s predictive analytics to forecast stock demand and anticipate where product will be needed in its supply chain.

Nike has also reduced lead times for orders from 60 days to just 10 days by installing 1,200 new automated machines at the factories of its Asian suppliers to handle cutting, cementing, shoe assembly and making soles. Nike has also developed methods to produce footwear with 30% fewer production steps involved and 50% less labour – all done with better supply chain responsiveness in mind.

Nike has reduced order lead times from 60 days to 10 days by installing automating machines at its factories

Influencing much of the supply chain technology investment and distribution improvement at Nike is its now five-year old Consumer Direct Offense strategy – which is underpinned by a plan to innovate twice as much, at twice the speed as it once was.

With that switch to more digital-led direct-to-consumer transactions, Nike is gaining tighter control of its supply chain, with product distribution centred around 40 retail partners compared with 30,000 at its peak.

Nike has aspirations to compete with Amazon’s delivery model by speeding up delivery times and at Nike’s Annual Meeting in 2022 chief executive John Donahoe spoke of the concept of “connected inventory”. The premise is of consolidating inventory from stores, retail partners and warehouses – meaning, for example, if a retail partner does not have stock it could connect with a Nike store nearby that does – more details about this are sure to emerge in due course.

While that represents the potential future for Nike, its total sales for FY2022/23 are estimated to be £37.7bn. With a predicted 4.5% CAGR over the next five years that figure should reach £50.8bn by 2027/28.

Ocado

- Ocado Solutions arm is at centre of supply chain innovation with imminent roll-out of ‘Re-Imagined’ technologies

- Investing in power of robotics to achieve operational gains

- Micro-fulfilment on the cards with plans to establish 14 mini CFCs

Ocado is not simply a retailer, it is a technology company too. It runs a grocery business supported by a joint venture with M&S Food, while its Ocado Solutions business comprises tech and warehouse infrastructure that is adopted by international supermarket chains.

The Ocado Solutions arm International Solutions saw revenue more than double in FY2022 compared with the previous 12 months as the number of live sites using the tech trebled.

Ocado said it had strengthened its balance sheet after a June equity raise of £578m, meaning it had £1.3bn gross liquidity by the end of the 2022 financial year. In the next four to six years the group expects to be “cash-flow positive”, with cash flows from its existing tech deployments and fulfilment centres financing future investments.

So much tech investment sits behind Ocado’s work. It is designing ’Re:Imagined’ technologies that are set to be ready for roll-out to partners by the end of FY23 – these are expected to reduce capex and operating costs for Ocado and its partners. Re:Imagined is the next iteration of picking and sorting bots, and grid systems for storing and organising products in the warehouse, all fuelled by advancements in AI and machine learning capability.

Re:Imagined is the next iteration of picking and sorting bots, and grid systems for storing and organising products in the warehouse, all fuelled by advancements in AI and machine learning capability

Ocado said the tech might be able to apply outside the grocery sector, potentially broadening its partner base and bringing new revenue opportunities based on its supply chain capability.

The Ocado Smart Platform is a key USP for the organisation that gives it a unique end-to-end operating system and highly automated customer fulfilment centres (CFCs). That model is then white labelled for and used by other companies, including Kroger in North America, Casino in Europe and Coles in Australia.

Ocado applies proprietary technology, software and algorithms to create a platform that provides the front-end user interface through to the warehouse operations and the routing systems that optimises delivery routes. This structure is used to run its own ecommerce business, but also that of others.

In its own business, Ocado runs five large customer fulfilment centres (CFC) in the UK that include this technology and it is consistently upgrading the tech as it adds new sites. So much so that the original site in Hatfield is closing this summer as it moves to what it has described as a “next-generation infrastructure solution” relying on more robotics power that will allow it to pick more than 200 units per labour hour.

There are also plans to have around 14 mini CFCs that are built closer to the communities they serve, as Ocado looks to reach more customers and drive operational efficiency. They are scaled-down versions of the larger premises and will help the business fulfil grocery items at an even greater speed.

With £2.5bn in sales in 2022/23 and a forecast CAGR rate of 3.1% over the next five years set to take that figure to £3bn in 2027/28, it is a supply chain supporting a big business.

Analysts have always questioned Ocado’s ability to drive profitability though. And with the company reporting a pre-tax loss of £500m for its 2022/23 financial year, it is putting much faith in its Solutions arm getting it back into profit in the long term.

Tesco

- Strategic supply chain investments supporting profitability

- Focused on expansion of rapid delivery service Whoosh to fulfil customer demand

- Electric vehicle home-delivery roll-out set to be achieved across UK by 2028

While Ocado has a huge technology innovation agenda and continues to break down barriers in terms of robotics capability in grocery, it operates at a significant loss. Tesco, meanwhile, is investing less in supply chain technology but reported profit of £753m in the 12 months to February 25, 2023.

There is an argument that both strategies can work, with Tesco’s 100-year history requiring a more considered evolution of back-end systems compared with the revolutionary changes deployed by the legacy-light 20-year-old Ocado.

Tesco is no laggard in the supply chain tech space though. Indeed, Tesco is seen as a world leader in supply chain technology. It uses advanced analytics systems to help predict what customers are buying, and modelling tools provided by computing software firm MathWorks that are used to simulate the performance of distribution depots based on four years of sales data. This can keep costs down in the supply chain.

Ongoing improvements are being made to its distribution network, and in 2018/19 the retailer implemented an online grocery transport planning algorithm that management said saved its fleet of vans more than 11.2 million miles over a 12-month period. Routing software is used in its Central European operations too, optimising vehicle journeys in its network.

And from a home-delivery perspective, in March Tesco surpassed its own target for the roll-out of its rapid-delivery service Whoosh – which can get products to people’s homes in as little as 30 minutes – and has made it available from 1,000 Express stores.

In March Tesco surpassed its own target for the roll-out of its rapid-delivery service Whoosh – which can get products to people’s homes in as little as 30 minutes

The online service first launched in May 2021 and is now available from half of Tesco’s estate of Express convenience stores across the UK, which the retailer said represents 55% of UK households. Whoosh is in recognition that customers want a multitude of services from retailers, including rapid delivery they are willing to pay a premium for. Whoosh costs £2.99 for orders that are worth at least £15.

Tesco merged with wholesale giant Booker in March 2018 and that opened up significant opportunities to share resources that continue to emerge five years after the deal. In particular, Tesco is considering broadening fulfilment options by pooling the delivery fleet for both wholesale and home-delivery customers.

Indeed, efficiency like this is what has helped Tesco build a strong reputation within the industry for its sustainability work. More evidence of Tesco’s commitment to being more environmentally friendly in its supply chain comes in the form of its electric vehicle home-delivery roll-out, which covered two stores in Scotland and three in England in 2022, with plans for this to be replicated across the rest of the UK by 2028.

Sales of £65.8bn in 2022/23 are expected to rise to £79.2bn by 2027/28, tracking a CAGR of 2.9% over the next five years.

The Very Group

- New automated distribution centre generating impressive results

- Brand partnerships a focus to increase product assortment

- Prioirity to offset carbon emissions from its inbound logistics

The story of The Very Group’s supply chain strategy in the past decade has been one of consolidation, optimisation and increasing automation.

From a total of nine warehouses and seven customer contact centres in 2009, the company had consolidated its operations into four and two sites respectively by 2017.

In the years since it has closed three fulfilment centres in favour of developing a new 850,000 sq ft automated distribution centre at East Midlands Gateway called Skygate, which opened in March 2021 and now supports the business’ same-day delivery and midnight cut-off for next-day delivery due to its enhanced order-processing and robotics-supported capabilities.

The new network has built-in flexibility, and The Very Group has found that investment in the space means it can extend its product ranges and stockholding capabilities when operating during peak periods. As an example, the group continues to break its own records for daily orders processed each year.

The fastest order during Christmas 2022 was reportedly processed and despatched in 10 minutes and 30 seconds

Some 16,000 items were processed on November 22, 2022, the busiest day of Very's peak period that year, according to the business. The fastest order during Christmas 2022 was reportedly processed and despatched in 10 minutes and 30 seconds, breaking the 2021 record of 16 minutes.

In October 2021 a new partnership model was developed with Adidas, which involves the brand fulfilling some orders to Very.co.uk customers and in turn allows the online retailer to increase its product assortment. The Very Group has said that there are plans to ”scale up this stockless fulfilment model” and retailers and brands such as Quiz, Lacoste, Kickers, Berghaus, Speedo and Ann Summers are on board with it.

Elsewhere, working in partnership with supply chain management firm Damco, The Very Group has created a portal showing real-time stock movement and availability that can be accessed by all stakeholders – booking agents, shipping lines, forwarders, the distribution centre, trading and finance. Such transparency in the back end clearly helps aid communication and drives efficiencies in its operations that can be used to enhance the experience it offers customers.

The Very Group has taken an off-setting approach to sustainability. Through a partnership with shipping company Kuehne+Nagel it offsets all carbon emissions from its inbound logistics. Beginning with sea freight, The Very Group said it had offset 1,300 tonnes of CO2 within a few months. Essentially, emissions that can't be reduced to zero are compensated by investing in nature-based projects aligned with the United Nations' Sustainable Development Goals.

Estimated sales of £2.1bn in FY2022/23 are expected to grow on a five-year CAGR rate of 2.9% to hit £2.5bn by 2027/28.

Lessons from the world leaders

Evidently the Retail Changemakers have their own ways of running their supply chains with different focus areas based on their business and customer needs.

Yet there are commonalities for the wider industry to follow. In a similar way to how these organisations have gone about their supply chain transformation in recent years, we have mapped out the important areas to focus on.

Retailers must:

Automate where they can: From Amazon to The Very Group, and many in between, leading retailers have embedded automation into their warehouses to speed up product pick time, which allows them to support growing customer demand for rapid fulfilment.

Take control of distribution: There will always be third-party partnerships in supply chains – that will increase as the marketplace model develops in the industry and this is no bad thing. However, notably, many of the Changemakers have taken ownership of specific parts of the distribution, including M&S. Ownership brings an element of control in an ongoing disruptive space.

Be agile with inventory: The past few years of Brexit- and pandemic-induced supply chain pain has meant many retailers have learnt the hard way that inventory is crucial to maintain strong business flow. Having the option, as many of the changemakers do, to pivot to other brands’ inventory or add new ranges via a marketplace model is a modern retail winning formula for B&Q, Decathlon and others.

Take environmental concerns seriously: While there are worries in certain business quarters that adopting a green agenda will be a costly affair, many of the changemakers, including Ikea, are among the retailers at the forefront of finding supply chain efficiencies that can help the planet while also bringing cost benefits or new revenue streams to their organisations.

Maximise stores for supply chain success: As we’ve seen from the examples Ikea’s stores that double up as fulfilment centres and Inditex turning its stores into microfulfilment centres at night, bricks and mortar have an integral role to play in retail supply chains of the future. With warehouse space increasingly limited, retailers and brands should make their stores work harder for them.

Use data to your advantage: Data has long been the holy grail for retailers but, against the current trading landscape, having access to key data – to support everything from managing and tracking inventory to customer forecasting – is more crucial than ever. Lululemon’s use of RFID to leverage data to aid its fulfilment and Nike’s investment in predictive analytics technology show that data is the differentiator between retail’s winners and losers.

Build agile and sustainable supply chains: Inventory management to ensure shelf availability across all channels was the lynchpin of retailers’ supply chains over the past few years. From a service provider perspective, the models on how to collaborate and enable retailers to hold inventory in an agile fashion – with visibility across locations and modes – is evolving fast.

Maersk's Hainz says most manufacturers have committed to net-zero targets, while it is growing fast in the retail space. What is important, though, is that the Scope 3 level of carbon emissions is so much larger for retailers than for other industries and therefore requires a stronger collaborative approach within the full supply chain ecosystem to make a significant reduction happen. Both visibility and clarity around measurements, as well as the choice of a global partner, such as Maersk, with a consistent agenda, can be a game-changer in making progress realistic.

Partner viewpoints

Scott Jennings, Chief Strategist, Retail and Consumer Products, Informatica

The era of unbridled ecommerce demand has been replaced by an uncertain economy and a more cautious consumer.

In response to these economic headwinds, retailers must get closer to the consumer and deliver exceptional shopping experiences that promote long-term customer relationships and grow customer lifetime value.

The blueprint that supports these outcomes is buried in the data spread across a company's systems, its key trading partners and third-party vendors.

Informatica has a long and proven track record of enabling retailers to get ahead of constantly changing consumer preferences using clean and trusted data rather than intuition or business as usual.

Bringing together curated and fit-for-purpose data from local systems and hybrid and multi-cloud environments, we help to differentiate the retail shopping experience to bring loyal shoppers back – again and again – using AI-powered, cloud-native, data-management solutions based on the Informatica® Intelligent Data Management Cloud™ (IDMC) for Retail.

This approach can empower resource-constrained retailers to reduce risk, speed time to value and deliver transformational outcomes with data.

Johanna Hainz, Global Head of Retail, Maersk

The profiles of the Retail Changemakers clearly show there is now a distinct set of supply chain strategies to win in the market.

While retailers must beef up their emergency supply chain measures to be prepared for all eventualities and invest in solutions for resilience, they also must adapt quickly to changing consumer demands.

This means connecting online and physical availability of products and the customer experience end to end, facilitated by an always-on agile supply chain.

Yet this requires work. Ensuring smooth deliveries and returns is increasing the complexity of retail supply chains. For instance, we've seen that some products have a reverse logistics cost of as much as 6% of the total value. Not to mention that retailers are battling market volatility, labour pressures and other supply chain constraints.

Effective forecasting and inventory management – a priority for many of the 15 retailers highlighted in this report – are areas we see as essential for retailers to reduce the complexity and future-proof their strategies.

Everyone acknowledges the difficulties in forecasting demand, particularly with the unusual consumption trends that peaked a year ago and have now flatlined. Getting the right number of seasonal products and getting them at the right time are challenging in the retail world and we can help retailers to overcome this.

I hope retailers find this report to be a useful guide to benchmark their supply chain strategies and explore how it’s possible to achieve growth amid challenging times.

”Retailers must get closer to the consumer and deliver exceptional shopping experiences that grow customer lifetime value”

”Effective forecasting and inventory management are areas we see as essential for retailers to reduce the complexity and future-proof their strategies”

Retail changemakers: 15 global brands revolutionising the supply chain

Megan Dunsby

Senior commercial content editor

Ben Sillitoe

Writer

Matt Macdonald

Account director

Hannah Buckley

Account director

Simon Mooney

Senior marketing manager

Alban Bizet

Senior designer

Stephen Eddie

Managing editor

Emily Kearns

Production

Sam Millard

Designer

Leslie Kimona

Digital marketing operations executive

Jed Adkins

Marketing executive