Retail leaders are permanently presented with endless shopping lists of potential investment opportunities. Winning strategies are a delicate balance between reaching for the immediate low-hanging fruit, while keeping one eye on what is on the horizon.

This coming year, retailers are splitting their budgets between core technology investment, opening new stores and refreshing existing shops, while staff recruitment and development are key focus areas, too.

There are also some intriguing changes from last year in terms of marketing spend – with a return to TV ads on the agenda for many.

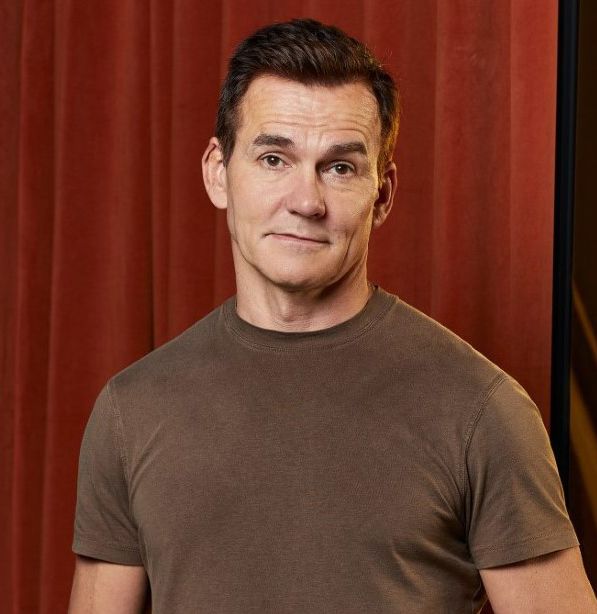

James Daunt says the four areas reinforce each other, so investing provides a “virtuous cycle”

James Daunt says the four areas reinforce each other, so investing provides a “virtuous cycle”

Waterstones’ four big investment priorities year by year

- IT and distribution infrastructure

- Automation

- New stores

- Staff pay

At Waterstones (pre-tax profit in the 52 weeks to April 2023 down £42m to £11.2m after a warehouse system glitch, as sales jumped from £399.9m in 2022 to £452.4m), there are generally always four central areas of investment every year, according to chief executive James Daunt, who provides a good template for what needs to be prioritised on an annual basis.

“We invest in our facilities, so the physical fabric of our existing store estate,” he says.

“We invest in our IT and distribution infrastructure, and that’s probably getting a bigger amount at the moment – particularly distribution. But it is a cyclical process of renewal and upgrading, and, at the moment, automation. We invest in new stores, and the fourth area is pay.”

Daunt adds that each reinforces the other and investing regularly provides a “virtuous cycle”, which will make a business more money to carry on investing. They are all necessary for a retailer that operates with physical selling space, he argues.

''Tech investment makes us more efficient, gives us better customer service and makes things easier for the stores''

''If we're going to spend £70m this year on technology, the best part of £55m of that is going to be in people doing programming all over the world''

''Customers are becoming more and more demanding about personalised products and experiences, so we see technology and data as a real opportunity''

Tech to enable sustainable growth

Tech investment is being directed towards infrastructure, fulfilment and core operations as retailers try to take advantage of the technology that is becoming a fundamental part of the modern IT stack, such as the cloud, AI and automation.

Graham Bell, UK chief executive of B&Q, sums up the power of technology, saying it represents the main investment area for the DIY chain in 2025 and that it “makes us more efficient, gives us better customer service, because there’s more efficiency for the customer, and it makes things easier for the stores”.

The tech investment is all about “doing things better”, he explains, with a key focus for B&Q on how to manage stock in the most optimal manner.

Matthew Moulding, chief executive of beauty and nutrition retailer THG, says “technology is where we're spending most of our investment” – which makes sense as the company runs the infrastructure for third parties with its Ingenuity platform.

“We do everything in-house so there are just countless projects all the time for ourselves and our clients,” he explains.

“We also do significant upgrades on the platform – we’ve got a major upgrade we’ve been delivering this year, and that will continue into next year where you’re basically going through evolutions of new technology, and you’re constantly updating them.”

Giving an example of investment levels, Moulding says: “If we’re going to spend £70m this year on technology, the best part of £55m of that’s going to be in people doing programming all over the world, developing and coming up with new solutions for us that then are released onto the platform.”

The Perfume Shop’s Smith says store and customer experience are key investments, but there will be a significant focus on technology and AI-powered automation.

“Investing in technology and automation to streamline tasks to enable staff to spend more time with the customer is essential to our business,” she explains.

“We are also thinking about ‘phygital’ stores, automation, personalisation, AI insights. Customers are becoming more and more demanding about personalised products and experiences, so we see technology and data as a real opportunity.”

Priority investment for Pets at Home includes its fulfilment network and new website and app, alongside physical stores and product development, expanding its accessories range and via more sustainable pet food options.

Speaking about the major investment the business is making in its supply chain, Madsen says the “big platform investments” are key, adding that they are “massive for the business” and will support the new digital offerings provided for customers such as rapid click-and-collect.

New stores and store refurbishments

A massive 87% of the retail leaders we interviewed whose businesses either already have stores or are planning to open them for the first time in 2024 or 2025 cited some kind of investment in bricks and mortar as a top-three priority for next year. There were 31 of these retailers in total.

Monthly retail footfall figures from the British Retail Consortium (BRC) show that in-store shopper traffic has only increased year on year once in the past 15 months (in July 2023). But still there are plans among retailers to invest in their physical spaces – with many retailers experimenting with bringing new experiences to their shops to drive custom.

The BRC has also called for planning reform as a priority for the new government – something prime minister Sir Keir Starmer has already set about tackling – saying “a fast-track planning system, which includes automatic approval in certain cases” is a way of giving retailers tools to invest up and down the country.

BRC chief executive Helen Dickinson comments: “Speeding up these processes, alongside reform of business rates, will help town and city centres to thrive. With our high streets undergoing transformation, as properties are used more often for wider purposes beyond retail, these reforms are essential for successful regeneration of local areas across the UK and ensuring footfall recovers in the medium and longer term.”

Interestingly, for what was an industry historically built on shops and physical selling space, some retailers now view stores as a point of differentiation in a market where lots of the noise and new development is happening online.

Stores as a strategic advantage

At fashion retailer U.S. Polo Assn. (which reported a record $2.4bn in global retail sales for 2023 – up from $2.3bn one year before), chief executive J. Michael Prince says store expansion is “very important” and hundreds of millions of dollars of investment will go into taking the company’s store estate from 1,200 to 2,000 in the coming years.

U.S. Polo Assn. is the official brand of the United States Polo Association and sells sports fashion in more than 190 countries. It has two designer outlet stores in the UK (at Cheshire Oaks and East Midlands), but more are expected in the years ahead as part of the expansion plans.

“We actually believe stores are a strategic advantage for us,” Prince notes. “A lot of the brands we compete with are closing stores and not actively opening them, and if they did it would cost hundreds of millions of dollars of capital investment.”

Sharon Meadows, managing director for commercial at EE, says her business is “definitely not dialling down” when it comes to shopping space. Indeed, the company is opening its Experience stores in flagship destinations across the UK as it looks to deliver retail, additional services and in-real-life interactions for shoppers.

“We see retail as key and we want to continue to offer the most personal customer-focused experience on the high street,” says Meadows, who is overseeing the rollout of interactive screens, mobile till points and in-store appointments at EE’s new shops such as the one at Westfield London, White City.

“To do this, we need to keep investing. We want to roll out more Experience stores across the UK, with these stores providing unique and exciting reasons for shoppers to visit the high street and come into our stores, time and time again.”

She continues: “We’ve upgraded our stores in terms of connectivity, so we can better showcase all of our services. We’ve introduced state-of-the-art tablets, so our guides can interact with customers in front of the products they're interested in.”

Store changes are afoot at BP, too, with Jo Hayward, vice president (MD) for mobility and convenience UK, saying convenience is “getting investment to grow” because it is deemed one of BP’s “growth engines”.

“By 2030, we aim to double the number of strategic convenience sites as well,” she states.

“We want to be the first choice on the roadside. We believe people stop for quality food and drink, and therefore we’re investing in Wild Bean Cafes, and we’re also continuing to invest with Marks & Spencer as we know that they drive differentiation to our forecourt.”

''Our overall property portfolio is our single biggest investment – we continue to invest in a depot strategy to support that bricks-and-mortar expansion''

''We know that 60% of clothing sales are transacted in physical stores, so it makes total sense to go after that large percentage of the clothing market''

''Stores always have been and always will be the lifeblood of our business and the main driver of sales''

Shop ‘pulling power’

For Primark (revenue up 17% to £9bn in the year to September 16, 2023), which only offers ecommerce through click-and-collect in its stores, investment in bricks and mortar will represent the largest share of overall investment in 2025 – but this will be the infrastructure around stores rather than the physical space per se.

“Our overall property portfolio is our single biggest investment – we continue to invest in a depot strategy to support that bricks-and-mortar expansion,” says chief executive Paul Marchant.

“We’re looking at new depots, but also the use of depot automation in certain locations. So, I would say logistics is another big area of investment, and then also technology – from customer-facing tech such as self-checkouts to logistics technology and our own in-house systems for people and merchandising.”

Womenswear retailer Sosandar (sales growth of 9% to £46.3m in the 12 months to March 31) is an online business but is opening its first two stores in Marlow, Buckinghamshire, and Chelmsford, Essex, in September, with more to follow. An online player opening bricks and mortar is a sure sign of physical retail’s power and pull when it comes to attracting customers to a brand.

Julie Lavington, co-chief executive, says: “We’ve reached a point where we’ve got a brilliant brand online and it makes sense for us now to move into the high street because we’ve been seeing such traction online.

“We know that circa 60% of clothing sales are transacted in physical stores, not online. So it makes total sense to us to start to go after that large percentage of the clothing market.”

THG, too, has branched into physical and opened its first store – in Altrincham – in September 2023, following several pop-up trials in recent years. Its beauty brand Lookfantastic’s shop opened its doors just before the peak period, hoping to bring “experiential” retailing to the Cheshire town.

In a world where the narrative is often about the growth of online, it can be forgotten that three-quarters of retail sales are still conducted in stores.

Indeed, The Works’ Peck describes stores in communities across the UK and Ireland as core to its operating model. “They always have been and always will be the lifeblood of our business and the main driver of sales,” he says.

“We will continue to invest in optimising our existing store estate through a mixture of refits and relocations if more favourable sites become available, as well as looking out for sites for new stores in desirable locations.”

Staff recruitment, training and development

Around 40% of interviewees said they are ploughing investment into hiring new staff and training and developing existing colleagues in order to drive new business areas and customer experience across the board.

This investment also comes against a battle to retain staff and find skilled customer-facing workers who are required to deliver some of the new concepts and experiences discussed above.

Staff bring the ‘magic’ to retail

One clothing retailer CEO says its top priority in 2025 is investing in colleagues and, more specifically, “attracting and retaining talent, looking to ensure that we can reward people who are working exceptionally hard and ensure that our colleague base tends to mirror our customer base quite closely, in terms of demographic”.

There was lots of talk in our interviews about the rising cost of staff, but generally there is a realisation that investment in people brings better results for businesses.

Dobbies’ Robinson recognises that a “careful balance between colleagues being more expensive and costs going up” needs to be considered.

“But, actually, in a garden centre business, that interaction with colleagues is part of the magic for customers,” he explains.

“We’re spending quite a lot, both on training and on our Dobbies’ culture, because that’s what customers really value, and then backing that up with technology. We’re spending over £1m on new handheld terminals that make their lives much easier, as well as speeding up basic tasks, so colleagues can spend more time with customers.”

Bensons for Beds’ boss Collard recognises the impact customer service has on store sales, so is rolling out appropriate training.

“If you’ve got someone who’s very, very good at going through a customer journey, helping people, giving them the right advice, that makes a dramatic difference in that store conversion,” he says.

“In a similar way that if you’ve got someone rocking up to your house with your bed delivery who brings it in with due care and attention, helps you assemble it and takes away the old one – that has a big impact on CX overall.”

John Colley, chief executive of wine specialist Majestic Wine, says the retailer has made “massive investment in colleagues and training”, which has seen the business roll out new management and performance-related schemes and invest “probably the highest amount we’ve ever spent on wine qualifications for our colleagues”.

Reflecting on that work in tandem with opening more stores, deploying an omnichannel system allowing online customers to view store stock in real time and having an “award-winning” buying team that is sourcing unique products, Colley says: “All of these things come together to help us attract thousands of new customers every year – and that’s how we continue to build our market share.”

Majestic’s revenue declined by 2.7% to £372.1m for the 53 weeks to April 3, 2023, but it reported its best Christmas ever in 2023, with trading up by 8.1% in the eight weeks to December 25.

Growing up fast

Some of the younger brands we spoke to highlighted specific roles they are seeking as they mature as businesses. Two businesses formed in 2015 have their eyes on key jobs they want to fill to take them to the next stage of development.

The CEO and founder of one womenswear retailer is on the hunt for a head of design, having just added a head of production and additional garment technologists.

“The design team is where we’re seeing a big increase in spend, when you look at our overall headcount, and also sampling sets as we look to become more of a global business,” she reveals.

At athleisure retailer Hera, there is a particular ambition to bring in someone to look after stock and accuracy management. Chief executive Holly Beadle says: “It’s not just from an inventory perspective in terms of fulfilment of that stock, but also then managing it so our customer gets the best experience as well.

“Obviously, if you’re consistently going out of stock of something, that’s not a good experience for the customer, so all ends of that stock management are going to be a real area of focus for us.”

Less than 10 years after launching, both of these growing fashion businesses are realising investment needs to be made in personnel to scale up.

The role of marketing in achieving share of voice

Of the 39 retailers we questioned, 64% said pay-per-click (PPC) was a top-five marketing spend area, while TV, Facebook and Messenger and Instagram were joint second at 41%. This represents a big shift against last year, when PPC (71%), email marketing (56%) and SEO (51%) were the big three, while TV was cited by just 22% as a top-five marketing channel.

“Promotional and product-led activity continues to drive traffic and conversion rates across channels such as search and Facebook for paid social,” explains The Works’ Peck, who talks of an evolving landscape in terms of successful marketing avenues.

“We have expanded activity on TikTok, having seen strong engagement and ROI within platform data, particularly for products such as books. We have reduced activity on discount code promotions, which have previously driven strong conversion but low profitability, and we have expanded activity with social and influencer affiliates that creates more user-generated content and promotion of our products, driving reach, engagement and conversion.”

Always-evolving market

Will Crumbie, chief executive of Fat Face, also talks of an ever-changing market. “Core digital PPC is definitely showing the best return.

“Although it’s really interesting because social media continues to be important, and while Instagram and Facebook are still our core focus, our customers are also using Pinterest and TikTok so we’ve got to be part of it. I think all these different touchpoints are going to continue to be used by people to buy products.”

Percival founder Gove says SEO work provides a particularly good return on investment and should be seen as a long-term business strategy.

“We did a piece, ’How to wear a Cuban collar shirt’, and once we created that article, the SEO just drives up and up and up over time, and we don‘t have to do anything else to it,” he explains.

“The more we put in, the more fruitful it becomes. We rank so highly on linen suits now because we did all the work three years ago. And we don‘t really do any more work on that and we don‘t really need to.”

Old and the new

Different channels work for individual retailers and brands.

Rothwell says Notonthehighstreet is seeing “really encouraging results from the influencer side of things”.

“We’re watching this with interest and really starting to think about how we can start to scale that, definitely because there is that deeper engagement that we see, but also just generally we‘ve seen triple-digit growth for products we‘ve had influencers getting behind – it’s all in the storytelling.”

Cotton Traders is returning to TV ads in the coming year, according to Hamblin, while Hinds says his jewellery retailer is “in the process of considering something for TV”, which underlines the trend for retailers to return to this marketing channel as email falls down the pecking order.

So, what’s behind the rise of TV ad spend? Part of it will be the growth in opportunity around connected television ads, where brands can be more tailored to their audience than in the past due to having more information about people’s viewing patterns.

U.S. Polo Assn. targets different audiences on live-streaming and linear TV, for example. “We do a lot in television,” chief executive Prince says.

“We do a lot around the world’s largest sports platform ESPN+ – it’s live-streaming and it is important to us.

“ESPN+ targets more of a young millennial, Gen Z consumer, while our linear TV advertising is for more of the Gen X and baby boomer audience. We are also investing in video and stories across social platforms such as Instagram and YouTube.”