At a glance – what this report will tell you

Ongoing digital transformation, Brexit-related disruption, a global pandemic, war in Ukraine, pressure across the supply chain and now the fiercest cost-of-living crisis in generations – managing through chaos has become the norm for retailers.

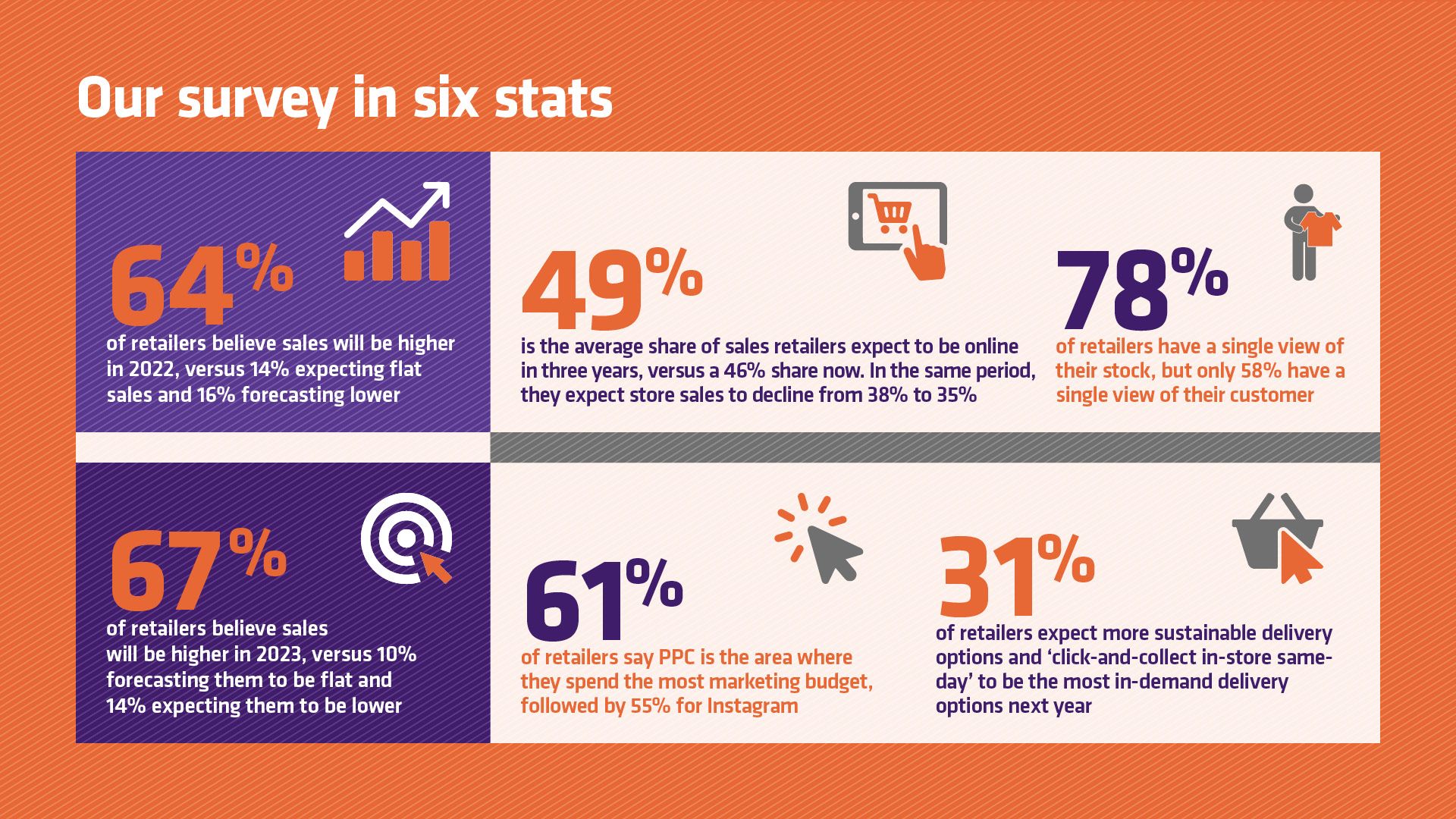

When Retail Week published Retail 2022 – our 10th annual in-depth state-of-the-industry report featuring interviews with leaders across sectors – there was confidence in how the 12 months ahead would pan out. Last year, 88% of retailers expected sales to be up in 2022. However, although different retailers were interviewed for this edition, it seems sales for 2022 have been flatter than hoped for, with that figure dropping to 64%.

But the word on everyone’s lips is inflation. How that impacts retailers’ abilities to grow profit and convince shoppers to part with their money in the first place is a major factor in how the industry is mapping out its plans for 2023.

We interviewed the leaders of 54 businesses for Retail 2023 and it is clear, as another new year appears on the horizon, that balancing increasing costs in the supply chain with a world-class customer proposition is central to many strategies. Sustainability and ensuring diversity, inclusion and engagement among staff are key focus areas for the industry, too.

The interviews were conducted between June 23 and August 4, before new chancellor Kwasi Kwateng's 'mini-budget', but at a time when the cost-of-living crisis was already biting, war was raging in Ukraine and inflation was rocketing.

Confidence about growth and general progress with digital development remain, though. And 67% of retailers expect 2023 to result in sales growth for their businesses.

While the shift to more hybrid ways of working was a hot topic last year, that appears more settled in 2022 – and lots of investment is being directed at the collaboration tools required to keep staff connected whether working at home, in-store or at the office.

Digital transformation of the industry shows no sign of slowing down and – like 12 months ago – pay-per-click (PPC), Instagram, email marketing, Facebook and SEO dominate as the marketing channels of choice for now and the year ahead.

Stores remain a central focus for those developing multichannel strategies, but the shortfall in potential employees to work in them presents a challenge for the industry.

As ever, those running retail are optimistic and laser-focused on how to move their businesses forward. It is all to play for and those who can build agility into their strategies and get a grip on what they can control, in what will continue to be a volatile and unpredictable trading environment, have a real chance to progress.

Winning strategies in this report

Retail Week has determined the five winning strategies all retailers should focus on in 2023 and beyond to succeed in a market transformed by technology and shifting consumer attitudes.

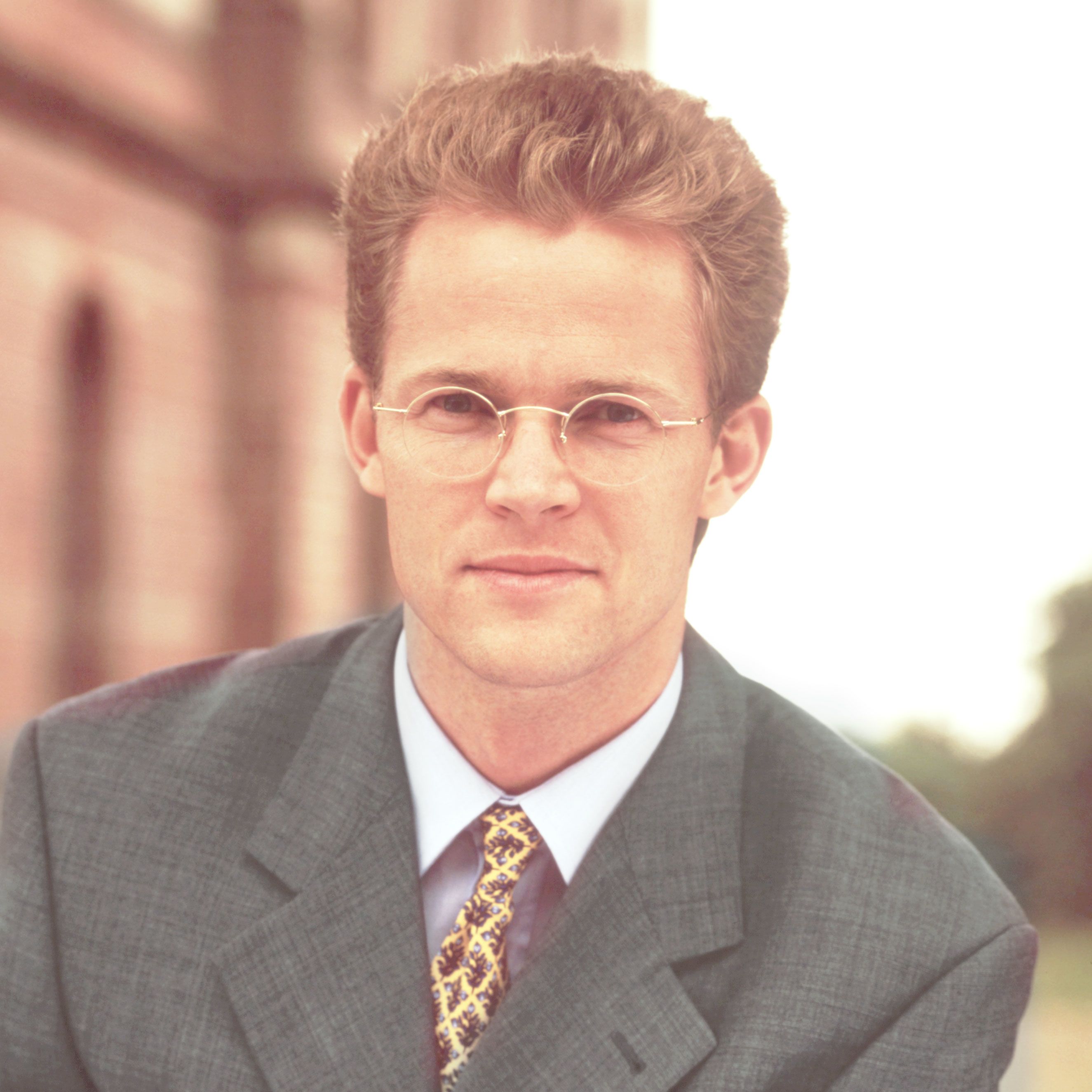

Partner viewpoint

Mark Thomson, director of retail and hospitality for EMEA, Zebra Technologies

When I introduced our report on what UK retail leaders expected 2022 to look like, none of us thought we would have to contend with a cost-of-living crisis brought on by inflation, war and political uncertainty, all on top of a hangover from the pandemic that continues to affect the supply chain and recruitment.

Fortunately, however, we can at least rely on retailers’ patience, courage and persistence in confronting these challenges that, taken all together, can seem overwhelming. And we can also rely on the technology industry to maintain its pace of innovation to help retailers continue to transform their businesses in store and online.

At Zebra Technologies, we are focused on a key area of investment for these retailers – enabling them to provide their staff with the collaboration tools they need to stay connected, whether working at home, in store or at the office. In this way, they will be even better placed to serve a demanding customer that is now shopping almost seamlessly across channels.

As our report looking ahead to 2023 shows, the 54 retailers we interviewed across all sectors are still bullish about their prospects for growth. In tough times, their focus is on being lean, efficient and customer-focused in order to manage rising costs, demonstrate sustainability, stay continuously tuned into customers and keep on building the store of the future.

Let me conclude by saying we are proud to collaborate with Retail Week on this report, which I know you will find invaluable as you continue to build your strategies for 2023 and beyond.

Who we spoke to

Retail Week conducted a series of in-depth strategy interviews with the leaders of 54 of the UK’s most prominent retailers between June 21 and August 9. This included 48 on-record interviews and six off-record interviews.

Paul Kraftman

Chief executive, Gift Universe, and owner, Menkind

Alessandro Savelli

Co-founder and managing director, Pasta Evangelists

James Daunt

Managing director, Waterstones

Doug Putman

Owner, Putman Investments and HMV

Chief executive

Footwear retailer

Sean Ashby

Managing director, AussieBum

Andrew Hood

Co-founder and managing director, Amara

Andy Lightfoot

Chief executive, Space NK

Orlagh McCloskey

Co-founder, Rixo

Henrietta Rix

Co-founder, Rixo

George Graham

Chief executive, Wolf & Badger

Aron Gelbard

Chief executive, Bloom & Wild

Mark Suddards

Global retail director and general manager for northern Europe, Ganni

Graeme Jenkins

Chief executive, Dobbies

Peter Jelkeby

Country manager for UK and Ireland, Ikea

Luca Donnini

Chief executive, Temperley London

Tracey Clements

Chief executive of convenience for Europe, BP

Andy McGeoch

Chief executive, M&Co

John Colley

Executive chair and chief executive, Majestic Wine

Paul Marshall

Managing director for Europe, Specsavers

Peter Bainbridge

General manager for optics, Specsavers

Michael Thomson

Chief executive and founder, Pour Moi

Marketing and corporate responsibility director

Fashion and home retailer

Maria Hollins

Managing director, Ann Summers

Paul Marchant

Chief executive, Primark

Huw Crwys-Williams

Chief executive, WiggleCRC

Ali Hall

Co-chief executive, Sosandar

Julie Lavington

Co-chief executive, Sosandar

Managing director

Grocery chain

J. Michael Prince

President and chief executive, USPA Global Licensing (U.S. Polo Assn.)

Mark Saunders

Chief executive, Mamas & Papas

Debbie Bond

Chief commercial officer, Lovehoney

Paul Hayes

Chief executive, Seasalt

Rachel Sheridan

Chief commercial officer, Thread

Alex Loizou

Co-founder and chief executive, Trouva

Daniel O’Neill

Chief executive and founder, ProCook

Chief executive

Sports equipment retailer

Rasmus Brix

General manager for UK, Pandora

Will Kernan

Chief executive, River Island

Markus Naewie

Head of EMEA, Victorinox

Michael Fletcher

Former chief executive, Nisa

Vanessa Masliah

Vice-president of marketing and branding, Vestiaire Collective

Chris Gaffney

Chief executive, Johnstons of Elgin

Managing director

Jewellery retailer

Gavin Peck

Chief executive, The Works

Kara Trent

Managing director for EMEA, Under Armour

Bridget Lea

Managing director of commercial, BT

Elizabeth Spaulding

Chief executive, Stitch Fix

Amy Heather

Director of strategic accounts, Just Eat

Kumaran Adithyan

UK trading director, eBay

James Bailey

Executive director, Waitrose

Natalie Knoll

Co-founder and creative director, Bird & Knoll

Chief executive

Fashion retailer

Chirag Patel

Chief executive, Pentland Brands

Penny Grivea

Managing director for UK and Ireland, Rituals Cosmetics

Gareth Pearson

Senior vice-president and chief operations officer for UK and Ireland, McDonald’s

David Robinson

Chief operating officer, Pets at Home

Retail 2023, in association with Zebra, produced by: