Retail 100 2020

Retail Week’s ranking of the industry’s top 100 most influential individuals

You only need to look at the Retail 100 to understand what it means to be a retail leader in 2020.

Against a backdrop of the coronavirus pandemic and an impending recession, the Retail 100 – produced in association with Braze, ChannelAdvisor and Salesforce – highlights leaders who have prioritised people and purpose, those who have innovated, collaborated and operated with agility to meet unprecedented challenges.

With company culture shunted front and centre during Covid-19, it has become more important than ever for leaders to look after their workforce, maintain effective communication and to be a positive force, and voice, for the industry.

We’ve placed special emphasis on leaders who have stepped up to the plate in the face of the pandemic and made tough, but necessary, decisions in response

In last year’s Retail 100, we added criteria to reflect how traditional leadership styles had evolved. This year, in recognition of the extraordinary circumstances the sector finds itself in, we’ve placed special emphasis on leaders who have stepped up to the plate in the face of the pandemic and made tough, but necessary, decisions in response.

Unsurprisingly, leaders from grocery – forced to accelerate their supply chains and adopt new business models to meet demand – dominate the top 30, with Tesco boss Dave Lewis retaining the top spot.

While still featured for their influence, the likes of Mike Ashley and Sir Philip Green have dropped in the ranking considerably – both by 15 places – demonstrating the notable missteps they’ve made in leading their teams and managing their public profiles.

Representing the developing retail eco-system, there are 23 new faces in this year’s list, including those at the helm of emerging retailers and powerful DTC brands such as Glossier founder Emily Weiss and Nike CEO John Donahoe, to key players shaping grocery and fashion, including Sainsbury’s new chief executive Simon Roberts and H&M chief executive Helena Helmersson.

We’ve also made an exception by featuring Rishi Sunak, our highest placed new entry, following a busy few months where the chancellor has introduced measures showing he’s got retailers in mind.

And positively, the Retail 100 features more female leaders than ever before in the list’s history – 23 up from 18 last year – with Boohoo co-founder Carol Kane the highest placed woman in the list.

So, who are the sector’s most influential retail leaders? And what makes them so? Browse the Retail 100 to find out.

1. Dave Lewis

Chief executive, Tesco

▶ last year: 1

Tesco boss Dave Lewis holds on to the top spot in this year’s Retail 100 after a year in which Britain’s biggest retailer completed its turnaround and played a crucial role in feeding the nation during the coronavirus pandemic.

Lewis hailed Tesco’s turnaround as complete in April, after the supermarket giant delivered a 13.5% increase in full-year operating profit to £3bn before exceptional items.

But it was Tesco’s response to the health emergency that epitomised the culture and agility Lewis has been able to re-instil at the Welwyn Garden City head office.

Tesco has more than doubled its online capacity from around 600,000 orders a week to 1.5 million, allowing it to serve existing customers and target more vulnerable consumers.

The grocer also built pop-up stores at NHS Nightingale sites and was among the first food retailers to pay its shopfloor staff a bonus for their work during the crisis.

Winner of the 2020 Retail Week Awards Outstanding Contribution to Retail, Lewis will leave the grocer in a strong financial and cultural position for his successor Ken Murphy in October.

And, following the work he has overseen on food waste and sustainability, Lewis’ influence and involvement in the retail industry is unlikely to stop there.

Jeff Bezos

Jeff Bezos

2. Jeff Bezos

Founder and chief executive, Amazon

▶︎ last year: 2

Jeff Bezos cinches second place again after a watershed year for the online retailer.

Pace of innovation may have been slower than before, but the etailer has responded to intense operational pressure as coronavirus led shoppers to switch in their droves to online retail for day-to-day purchases.

Though Amazon has met customer expectations for speedy delivery, the business has come under scrutiny because of the pandemic. It hired 175,000 new staff in response to the crisis and suspended more than 10,000 selling accounts globally for price-gouging.

Nevertheless, criticism about the safety of its warehouses during the virus outbreak abounded. Senior executive Tim Bray broke rank in May, resigning over the treatment of staff who protested about the lack of virus safety measures in warehouses and called out “a vein of toxicity running through the company culture”.

Bezos has ploughed more than $4bn (£3.2bn) into Amazon to manage the impact of coronavirus, but the real cost may be to its reputation if he doesn’t tread carefully in the coming months.

3. Rishi Sunak

Chancellor of the exchequer

NEW ENTRY

The highest placed new entry in the list, chancellor of the exchequer and Conservative MP for Richmond Rishi Sunak is one of the few MPs across the political spectrum who can be considered to have had a ‘good pandemic’.

After being thrust into the role of chancellor in a hurried cabinet reshuffle in February 2020, Sunak has since unveiled a raft of spending measures designed to prop up UK businesses in the face of the coronavirus onslaught.

Among the most pertinent to the retail industry was Sunak’s decision to suspend business rates for 12 months to alleviate pressure on bricks-and-mortar retailers forced to close stores during the lockdown.

His coronavirus interruption loan scheme for small and big companies has also proved a boon for many retailers, as has his measure to pay up to 80% of furloughed staff salaries until the end of July.

While trade bodies such as the BRC have argued that more needs to done by Sunak in the long term to fix the broken business rates system, what the chancellor has achieved in the past four months will convince many that he has retailers' interests in mind.

Rishi Sunak

Rishi Sunak

David Potts

David Potts

4. David Potts

Chief executive, Morrisons

▲ last year: 10

David Potts surges into this year’s top five after leading what was arguably UK retail’s most significant and wide-ranging response to the coronavirus crisis – one that put customers, staff and suppliers at the heart.

The Bradford-based grocer was the first to launch 'easy to order' food parcels containing essential grocery items, producing 100,000 of them every week. It handed its shopfloor workers a three-fold increase in bonuses, meaning the average full-time employee would take home a £1,050 reward. And it led the grocery pack with its decision to pay small suppliers within two days rather than two weeks – a shift that was quickly followed by others such as Tesco and Sainsbury’s.

After a stellar turnaround, Potts and Morrisons have come under pressure in the past 18 months as sales in its core supermarket estate began to plateau.

But Potts has increased focus on capital-light growth through partnerships with Amazon and petrol forecourt operators and the expansion of wholesale.

Such initiatives have helped Morrisons increase pre-tax profits 3% to £408m in the year to February 2 – no mean feat in a challenging market – and growth has been maintained. In the 14-week period to May 10, the supermarket reported like-for-like sales excluding fuel up 6%, retail sales up 5% and wholesale 0.6%.

5. Lord Simon Wolfson

Chief executive, Next

▶︎ last year: 5

Lord Wolfson has developed a reputation as a retail oracle – his pronouncements and views typically seized upon by the industry as among the most perceptive.

He has provided some of the most thoughtful analysis of the retail landscape before and during the coronavirus pandemic – although he too was caught out by the ways in which the crisis developed.

Early on, Wolfson provided a detailed reading of the situation from a business perspective. The stress tests he elaborated were models as useful for others as they were to Next, but gloomy as they looked at the time, they proved too optimistic.

While Next is an online leader, it was among the first to shut its website because of concern about warehouse staff safety. However, online operations reopened within weeks, the retailer having made necessary changes to working practices.

Wolfson and Next continue to set standards for insights and executional excellence. As Wolfson said in April: “Our job is not to guess exactly how things will pan out but to prepare the company for all outcomes that seem reasonably possible.”

And, as they too consider future possibilities, retailers will continue to listen closely to Wolfson.

Lord Simon Wolfson

Lord Simon Wolfson

Steve Murrells

Steve Murrells

6. Steve Murrells

Chief executive, The Co-operative Group

▲ last year: 18

While the successes of Co-op's food business are well documented, Steve Murrells has played a critical role in steering the group and been a spokesperson for the wider industry this past year, which propels him from 18 to sixth place.

The group’s most recent annual results showed underlying pre-tax profit jumped 50% to £50m and total revenues were up 7% to £10.9bn.

Murrells’ decision to shift the food supply base to more UK producers has also paid off, putting it in a better position to withstand the wave of customer stockpiling in the early weeks of the lockdown that nearly crippled many other grocers.

Murrells has also kick-started a Members’ Coronavirus Fund – a scheme that enables members to spend unused rewards on food banks, supports frontline community causes and includes a funeral hardship fund.

Murrells has also stuck his head above the parapet to lobby for changes that would benefit retail. He has recently been a leading proponent within the industry for radical business rates reforms and for revitalising struggling UK communities.

7. Simon Roberts

Chief executive, Sainsbury's

NEW ENTRY

Sainsbury’s new boss Simon Roberts rockets into the Retail 100 top 10 just weeks after succeeding Mike Coupe as chief executive.

Roberts has already made his mark at the grocer, having spent three years as retail and operations director, and during which he won plaudits for his people-first approach. Also in that role, former Boots boss Roberts oversaw sweeping changes to Sainsbury’s store operating model and has been at the forefront of its bricks-and-mortar response to the coronavirus pandemic.

Sainsbury’s was among the first supermarket chains to introduce regular shopping hours for NHS staff, elderly and vulnerable people, and Roberts pressed ahead with moves to redeploy Argos staff into Sainsbury’s stores to cope with the spike in demand. Sainsbury's also leveraged its store portfolio to increase online collection points across the UK, including car-park collections, in its bid to help “feed the nation”.

Roberts might have a tough act to follow in the Sainsbury’s hot seat, but his pedigree and groundswell of internal support within the business will provide him a firm foundation.

Simon Roberts

Simon Roberts

Peter Cowgill

Peter Cowgill

8. Peter Cowgill

Executive chair, JD Sports

▼ last year: 7

It has been a year of two halves for Peter Cowgill.

His business performance has been outstanding, with sales up 47% at the half-year mark to £2.7bn and pre-tax profit up 7% to £130m. The retailer’s international expansion has also continued at pace with expansion across the US, Asia and Australia.

However, growth ambitions have been punctured somewhat by the Competition and Markets Authority, which blocked JD’s acquisition of struggling sports fashion retailer Footasylum in May following a lengthy deliberation. Cowgill slammed the decision as “reckless” and said an appeal was being considered.

As JD Sports closed stores during the coronavirus outbreak, Cowgill has taken a voluntary 75% pay cut to reduce business costs.

Despite the CMA’s verdict, Cowgill’s business looks likely to be one of the more resilient to the vagaries of consumer confidence throughout the pandemic and beyond.

And Cowgill appears undeterred. In May, it was revealed that he was among the prospective bidders, alongside Mike Ashley, for footwear chain Office.

9. Mahmud Kamani and Carol Kane

Founders, Boohoo

▲ last year: 27

Rising from 27th place to feature among the Retail 100 top 10, Mahmud Kamani and Carol Kane have overseen a vintage year at Boohoo, supported by new chief executive John Lyttle (who ranks at 43).

Boohoo reported a 54% jump in pre-tax profit to £92m in its last financial year and a 44% revenue increase to £1.2bn.

Under Kamani and Kane, Boohoo has made bold moves to broaden its appeal with the acquisition of the online businesses of Karen Millen and Coast in September 2019.

Such deals support their ambition for the group to lead the fashion ecommerce market, fuelling international expansion and brand awareness, and significantly increasing scale in the process.

Despite challenging times for the fashion market amid the coronavirus pandemic, conditions have demonstrated the inherent strengths of Boohoo’s businesses, particularly across its supply chain which, despite holding some 80,000 styles, has provided the flexibility to move production around and make orders at a moment’s notice.

After an initial drop in sales as the UK entered lockdown, Boohoo reported that performance subsequently bounced back and there was “improved year-on-year growth of group sales during April”.

With the coronavirus playing to Boohoo’s advantage, Kamani and Kane will no doubt oversee another stellar year for the business.

We can also expect Kamani to play a role in helping to control the virus itself as he prepares to launch an at-home Covid-19 testing kit through his separate business venture Medusa19.

Mahmud Kamani and Carol Kane

Mahmud Kamani and Carol Kane

Nick Beighton. Photo credit: Peter Searle

Nick Beighton. Photo credit: Peter Searle

10. Nick Beighton

Chief executive, Asos

▼ last year: 9

After a record-breaking first half for Asos, chief executive Nick Beighton was forced to put celebrations on hold as a result of the pandemic.

Asos had posted a “record” uplift in interim pre-tax profit to £30m from £4m the previous year. Group revenues had jumped 21% during the first half to £1.6bn, up 20% in the UK to £577m. Total order numbers rose 19% year on year to 41 million.

Following the outbreak, the fashion retailer reported in March that sales had since plummeted between 20% and 25%. One month later, Beighton revealed the business was launching a £200m equity share to protect its business from disrupted trading.

Yet there have been positive signs. In April, Beighton revealed that the pandemic had prompted interest from a raft of fashion brands on its “target list” to sell through its marketplace. Asos’ outlet team had also been working with high street partners to help find solutions to clear excess stock.

With its agility, international strength and social media prowess, Asos continues to set the benchmark that other businesses look to for inspiration so, while its short-term outlook may be uncertain, under Beighton Asos looks set to emerge as a stronger business post Covid-19.

11. Paul Marchant

Chief executive, Primark

▼ last year: 4

For Primark chief executive Paul Marchant, this has been his toughest year.

Little more than 12 months ago, as Primark opened a Birmingham flagship, Marchant was proving once again that great value, great product and a great store environment could draw shoppers in droves. Primark does not trade online so its success was testament to the enduring appeal of consummate bricks-and-mortar retail.

A year on, however, and Primark’s reliance on stores made it one of the most high-profile casualties of lockdown – sales disappeared at the rate of £650m a week.

The retailer was protected by the financial strength of owner ABF, but nevertheless had to negotiate with landlords over rent.

After some initial criticism of its treatment of suppliers during the outbreak, Primark acted generously towards the overseas manufacturers that make its clothing and, in the end, set a good example.

With its stores reopening from June 15, Primark has promised to “come back with a bang”. That’s a pledge rivals can’t afford to take lightly. Whether it also decides finally to introduce an online proposition will be closely watched by the whole of fashion retail.

12. Archie Norman

Chair, Marks & Spencer

▼ last year: 11

When Marks & Spencer chair Archie Norman famously described the retailer as a burning platform back in 2018, he had no idea that all of retail would be engulfed in a bigger conflagration – the coronavirus pandemic.

Lockdown has meant M&S’ core fashion business has been effectively closed. Along with its peers, M&S had to secure liquidity to tide it over in the short term and work out how to rebuild business in the medium and longer terms.

This is a colossal challenge to add to those Norman and the M&S leadership were also attempting to navigate as part of the turnaround programme.

Norman has clearly encountered some inertia at M&S, and urging a culture shift he said the efforts of coalface staff were not always mirrored among elements of management.

He can look forward to one big achievement though – the launch of a joint venture with online grocer and tech platform Ocado, finally enabling M&S to sell its food online.

The partnership will go live in September and the hope is it will be transformational.

13. Doug Gurr

UK country manager, Amazon

► last year: 13

Doug Gurr has had a busy 12 months.

Industry speculation that Amazon would open its first Go store in the UK seemed to be proved right earlier this year, when plans to open a checkout-free shop in west London emerged.

The online titan’s stake in takeaway firm Deliveroo also secured hard won approval after undergoing intense scrutiny by the Competition and Markets Authority, and the business is gearing up to launch a UK grocery delivery service called Ultra Fast Fresh later this year.

However, these developments pale into insignificance in the face of Amazon’s response to the coronavirus crisis in the UK.

The ability to maintain ranges and delivery timeframes have impressed shoppers but arguably this has come at a price, with the safety of warehouse staff amid the outbreak in question.

In the coming months, Gurr’s role in managing Amazon’s UK reputation while fulfilling customer expectations may become more of a challenge.

14. Steve Rowe

Chief executive, Marks & Spencer

► last year: 14

Marks & Spencer chief executive Steve Rowe, along with chairman Archie Norman (ranked 12), was already engaged upon a programme to turn around the bellwether retailer when coronavirus struck.

The scale of disruption was evident when the pandemic prompted a further strategic rethink at M&S, with its ‘never the same again’ programme unveiled alongside full-year results in May. For the 52 weeks ending March 28, M&S reported that pre-tax profit fell by 21% down to £403m, while group revenues slipped 2% to £10bn.

Rowe seems determined to turn crisis into opportunity. Covid-19 has galvanised the retailer’s efforts to be relevant, evident in everything from its support for suppliers to staff pay during the outbreak and initiatives to support the NHS.

The sense of urgency may help M&S power-charge its wider transformation. Although some progress has been made, there is a long way still to go – particularly at the long-underperforming clothing division. Its revival is seen by many observers as vital in restoring M&S' fortunes.

Rowe famously described the turnaround as a marathon challenge, prompting wags to continually ask whether he "can see the Cutty Sark yet".

Coronavirus has not helped, but the launch of M&S food online with Ocado later this year will be a significant milestone.

15. Giles Hurley

UK and Ireland chief executive, Aldi

▶︎ last year: 15

Media-shy Aldi boss Giles Hurley has quietly gone about his job of growing the discounter’s UK market share.

Aldi achieved UK sales growth of 9% in April as shoppers continued to stockpile during the cornavirus outbreak, while a raft of new initiatives gave the supermarket extra appeal.

In a bid to better serve vulnerable and elderly customers, Aldi launched its first foray into online grocery delivery – offering ambient food parcels to such customers available from its website.

While Aldi had previously sold wine and some general merchandise lines online, its ability to scale up to offer more food deliveries during the virus is testament to the agility built into the organisation by Hurley. Since lockdown, Aldi has recruited an extra 9,000 staff.

Prior to the outbreak, Aldi had been pushing ahead with its store expansion programme, targeting 1,200 UK stores by the end of 2025. At the end of last year, it had significantly ramped up the rollout of its convenience format Aldi Local.

With a 2020 Retail Week Awards win for Best Grocer under his belt, Hurley will continue to steer Aldi in its disruption of the established UK grocers this year.

16. Tim Steiner

Chief executive, Ocado Group

▼ last year: 6

Ocado’s co-founder and chief executive Tim Steiner has certainly had a year to remember, both highs and lows.

In many ways, 2019 saw Ocado complete what Steiner has often called its “20-year overnight success”, securing a £750m joint venture with Marks & Spencer and embarking on ambitious international deals with Coles in Australia and Aeon in Japan.

However, for all its successes, Ocado’s full-year results showed losses before tax spiralled to more than £215m, while EBITDA also slumped 27% to £43m, affected by factors including accounting changes, share scheme costs and the fire at its Andover depot last year.

Despite its profitability issues, Ocado remains a darling of the City and is one of the few innovative UK businesses that could be considered a global leader in its field.

Steiner’s relentless entrepreneurial ethic and boundless vision for the business saw him honoured as the Retail Leader of the Year at the 2020 Retail Week Awards.

During the coronavirus pandemic, Ocado ramped up capacity by about 40% domestically to meet the surge in demand for its home grocery delivery service and served more than 150,000 vulnerable customers from March to May.

With its first international customer fulfilment centres going live earlier this year, 2020 looks to be another year of growth for Ocado under Steiner’s tenure.

17. Dame Sharon White

Chair, John Lewis Partnership

NEW ENTRY

Dame Sharon White has had a baptism of fire since becoming chair of the John Lewis Partnership in February.

Her predecessor, Sir Charlie Mayfield, was widely seen as having delivered a hospital pass on his way out, after unveiling radical restructuring at the department store and Waitrose grocery group that resulted in the departures of some of its most experienced leaders.

White has played a deft hand, focusing primarily on listening to partners and getting under the bonnet of the retailer but making clear that change is to come.

Such change might include abandoning key elements of the Mayfield plan, such as giving each business more autonomy than envisaged by her predecessor who was determined to wring out synergies from the pair under a unified structure.

On top of needing to sort out what many in retail believe to be a bit of a mess, White joined just as the pandemic was about to bring Britain to a near stop and must address its impact.

White, who formerly ran regulator Ofcom, has accelerated a strategic review at the partnership. The findings will be revealed later this year, no doubt influenced by former McKinsey partner Nina Bhatia, who also joined the retailer in February as strategy and commercial development director, and who is mentioned in this year's 'ones to watch' section.

18. Mike Ashley

Chief executive, Frasers Group

▼ last year: 3

It has not been a vintage year for notorious retail entrepreneur Mike Ashley, who has fallen 15 places in the ranking.

Ashley is known for his outspoken nature, but several missteps have invoked ire from many quarters. These have included Sports Direct’s recent plea to keep stores open during the pandemic despite being classified as a non-essential retailer by the government and accusations by some store managers that they were being made to work despite being furloughed.

Ashley apologised for the former but, nevertheless, such moves put him out of step with the public mood.

Ashley has faced scrambling to find a new auditor and a Belgian tax bombshell during the year and, while both issues have been rectified, they are perhaps indicators of a less than slick operation.

The group posted a 22% rise in underlying EBITDA to £181m at the half-year mark in December and is still pursuing its elevation strategy. However, it has flagged that progress on that front is slower than anticipated because of an unenthusiastic response from some big-name brands.

Ashley’s bombastic style is legendary, but he will need business sense and an understanding of public sentiment if he is to regain ground.

19. Alex Baldock

Chief executive, Dixons Carphone

▼ last year: 16

After two years at the helm of Dixons Carphone, Alex Baldock’s strategy overhaul is beginning to take shape, but it still has a way to go.

Group sales were down 0.9% to £10.4bn and pre-tax profits down 22% from £382m to £298m last year, on the back of challenging conditions in the UK across electricals and mobile, particularly the latter.

In March 2020, the business announced the closure of all Carphone Warehouse stores in a bid to streamline its store estate and focus on a three-in-one concept.

Speaking of the decision, Baldock admitted the changes made for “a painful and difficult day for the business”, particularly amid the coronavirus situation, but insisted that the strategic shift was “an essential one to set us up for long-term success”.

Baldock has also continued to merge online and offline worlds in response to changing customer behaviours in lockdown. With stores reopening from June 15, it will feature a zero-contact model including a drive-thru concept and ShopLive, a video shopping service.

While Dixons Carphone has managed to recover two thirds of its lost store sales online, Baldock needs a solid post-pandemic strategy to keep the business on track.

20. Richard Walker

Managing director, Iceland

▲ last year: 23

While the past year hasn’t been without challenges for Iceland, it has marked the period in which Richard Walker – son of Iceland founder Malcolm – stepped out from his father’s shadow and became the face of the frozen food specialist.

His articulate views on Brexit on BBC’s Question Time in March 2020 won national press coverage and Walker has used his platform to bring attention to Iceland’s goals around the use of palm oil and its sustainability efforts – in July 2019, Iceland became the first grocer to ban the use of plastic bags outright.

During the pandemic, Walker has continued to be a voice for the industry and praised retail staff for their efforts, commenting that “coronavirus has brought out the best in retail”. Iceland was the first retailer to implement dedicated store hours to help elderly and vulnerable shoppers, a practice that has since been replicated by all the grocers.

Last year Iceland also expanded its store estate under Walker’s direction, with a focus on its Food Warehouse fascia. It opened its 100th store in Blackpool and continues to be one of the UK’s fastest growing retailers by number of new store openings.

Paul Marchant. Photo credit: Anthony Woods

Paul Marchant. Photo credit: Anthony Woods

Archie Norman

Archie Norman

Doug Gurr

Doug Gurr

Steve Rowe

Steve Rowe

Giles Hurley

Giles Hurley

Tim Steiner. Photo credit: Peter Searle

Tim Steiner

Dame Sharon White

Dame Sharon White

Mike Ashley

Mike Ashley

Alex Baldock

Alex Baldock

Richard Walker

Richard Walker

Christian Hartnagel

Christian Hartnagel

Seb James

Seb James

Luke Jensen

Luke Jensen

Jason Tarry

Jason Tarry

Charles Wilson

Charles Wilson

Roger Burnley

Roger Burnley

Helena Helmersson

Helena Helmersson

Thierry Garnier

Thierry Garnier

John Donahoe

John Donahoe

21. Christian Hartnagel

UK chief executive, Lidl

▼ last year: 20

Under Christian Hartnagel’s leadership Lidl has enjoyed another stellar year of growth.

In February, the German discounter pledged more than £1bn investment in new stores as it looks to reach a target of 1,000 UK stores by 2023. That same month, it opened its 800th UK store – its 50th of the past year.

Because of continued expansion, Lidl has increased its overall grocery market share and sales soared over the all important Christmas period – up 11% year on year.

Under Hartnagel’s watch, Lidl has also sought to bolster its UK supply chain, committing £15bn of investment over the next five years for British growers and suppliers.

Since the onset of the coronavirus crisis Lidl has played its part in the wider grocery sector’s combined efforts to feed the nation, with plans to hire 2,500 new staff.

Looking to the year ahead, Hartnagel’s role in disrupting the one-time hegemony of the big four supermarkets shows few signs of abating. Post-lockdown, consumer caution may make Lidl’s low-cost groceries even more appetising to shoppers.

22. Seb James

Senior vice-president, president and managing director, Boots

▲ last year: 26

As Boots' ebullient UK boss, Seb James has helmed the health and beauty chain through a challenging year.

UK sales and profits declined amid speculation that owner Stefano Pessina is seeking to take the chain and its US stablemate Walgreens private.

The retailer took the decision to shutter 200 stores last year to cut costs and suffered a cybersecurity attack on its loyalty card programme earlier this year, which resulted in 150,000 accounts being hacked.

But James has delivered some bright spots, unveiling further store overhauls and introducing new brands and product categories, including wellness and sex toy products.

Its health proposition meant Boots continued to operate during the pandemic and the business won praise for its coronavirus response, which included offering testing kits for NHS workers.

James’ plans to spruce up the store estate have been put on ice as the retailer cuts costs during the outbreak. However, he has the opportunity to build upon Boots’ vital place as a UK health specialist over the coming months.

23. Luke Jensen

Chief executive, Ocado Solutions

▲ last year: 24

The past year has been busy for Ocado Solutions boss Luke Jensen as he delivered on several new international partnerships.

Under Jensen’s stewardship, Ocado Solutions bookended 2019 by striking new deals with Australian grocery giant Coles in March and then with Japanese supermarket chain Aeon in late November.

The business now has agreements with grocery clients worldwide, including Kroger in the US.

Jensen has been at the forefront of bringing to completion the first of the technology business’ international customer fulfilment centres (CFC).

In March 2020, Ocado’s first international CFC went live for French supermarket giant Casino at Fleury-Mérogis, near Paris. That was followed in April by the opening of its first North American automated warehouse with Sobeys in Canada.

The coronavirus pandemic has opened new doors for Jensen and Ocado Solutions. In May, the retailer said that Ocado Solutions had drawn increased interest from potential overseas customers and it hinted that existing customers might also seek to increase CFC orders in the near future.

24. Jason Tarry

UK and Ireland chief executive, Tesco

▲ last year: 33

Tesco’s core UK and Ireland division continues to go from strength to strength under the leadership of 30-year veteran Jason Tarry.

Last year the grocer’s British business delivered a 17% jump in operating profit to £2.2bn on flat sales of £45bn. Bottom line improvements were delivered because of margin gains that, at 4%, are now the envy of many of Tesco’s mainstream competitors.

Tarry has overseen those efforts and delivered strong improvements in Tesco’s net promoter score and value perception among shoppers – further enhanced in March with the launch of its Aldi price-matching scheme.

Tesco has won plaudits for the part it has played during the coronavirus crisis. Tarry drove much of the strategic change implemented.

Fresh food counters were closed so that staff could be redeployed on to the shopfloor, payment terms for small suppliers were shifted from 14 days to five and it set the bar with social distancing measures in stores.

As a sense of normality begins to appear on the horizon, Tesco and Tarry are well placed to deliver another fruitful year.

25. Charles Wilson

Chief executive, Booker

▶︎ last year: 25

He may not have taken centre stage in front of the media and analysts during the coronavirus pandemic, but the man known across the industry as “Two Brains” will have been pulling strings behind the scenes as Tesco responded to the crisis.

Wilson, who leads the grocer’s Booker wholesale division, has spearheaded an impressive period of growth.

Last year Booker delivered a 5% uplift in sales to £6bn and it has since completed the acquisition of Best Food Logistics to further its presence in the growing wholesale market.

Even at a time when Booker has come under pressure – sales to its bar and restaurant customers plummeted 60% since lockdown measures came into force – Wilson and his team have played a crucial role in feeding the nation.

Sales to convenience store partners have jumped 30% during the pandemic as smaller, local shops grapple to maintain availability.

Wilson has provided a valuable sounding board for Tesco chief executive Dave Lewis throughout his six-year tenure and will continue to offer vital expertise when Ken Murphy takes the helm in October – a role that emphasises his huge importance to Britain’s biggest retailer.

26. Roger Burnley

Chief executive, Asda

▲ last year: 31

Roger Burnley climbs the Retail 100 after overseeing a solid year and the ongoing response to the coronavirus crisis at Asda.

Owner Walmart has paused efforts to sell a majority stake in the supermarket giant during the health emergency, giving Burnley the headspace to push forward with his strategy.

The grocer has closed the gap with the discounters on price after investing about £80m over the past 12 months and continued to improve its own-brand ranges. Although sales started to come under pressure towards the end of 2019, Burnley has laid strong foundations from which Asda can build.

During lockdown, Asda was one of the first to launch ‘volunteer shopping cards’, which could be topped up by elderly, vulnerable or self-isolating customers for a volunteer to do their shopping.

The grocer has donated £5m to food banks and community charities, and in May it launched an electric vehicle fleet to help ramp up its online delivery capacity.

Asda may possibly be under new ownership in a year’s time, but in Burnley the business has a safe pair of hands on the tiller.

27. Simon Arora

Owner and chief executive, B&M

▼ last year: 22

With Simon Arora at the helm since 2004, B&M is generally recognised as one of the value sector’s more resilient operators, but Arora has faced some obstacles over the past year.

The general merchandise powerhouse posted a rare decline in sales at the beginning of the year after a difficult November trading period and pre-tax profits slumped at the half-year mark as its German division Jawoll dragged down the group’s overall performance. In contrast, UK sales were up 14%.

Arora has taken swift strategic action. In March he confirmed the sale of Jawoll for £11m, hired a new chief financial officer – former Wilko CFO Alex Russo – and he is now focused on the recent acquisition of French value chain Babou to deliver international growth.

Arora has also faced a smoother period than most retailers during the pandemic, with B&M stores deemed essential and allowed to remain open during the crisis.

While Arora’s international ambitions have had to be readjusted, he has presided over a period of spectacular transformation at B&M and he’ll be using his track record to return the group business to strong financial health.

28. Helena Helmersson

Chief executive, H&M

NEW ENTRY

Helena Helmersson debuts in the Retail 100 after becoming the first woman to lead H&M.

Made chief executive in January following Karl-Johan Persson’s move to the chair’s role, Swedish-born Helmersson had spent more than 20 years working her way up at H&M. She held senior roles overseeing operations and sustainability, and her promotion confirmed her status as one of the most powerful women in retail.

Helmersson told Retail Week that she was “fortunate to lead several of our important group functions and have been part of the plans around supply chain and logistics and production, but also in the digital space with IT and AI and I have also worked on the expansion".

At the time of her promotion, H&M set out a plan to integrate the physical and digital offers, invest in technology and secure the best product assortment – all areas which Helmersson will lead.

With a presence across 72 markets, H&M was hit hard by the pandemic and more than 4,900 of its stores were shuttered. However, Helmersson is confident she can overcome its impact.

She says she believes the crisis will accelerate the pace of digitalisation in general in the fashion industry, which will work in H&M’s favour.

29. Thierry Garnier

Group chief executive, Kingfisher

NEW ENTRY

A veteran of French retail giant Carrefour, Thierry Garnier succeeded Véronique Laury at Kingfisher in September last year – and hopes rest on him to get the business into better shape.

Garnier faces various challenges at the DIY giant. In the three months to April 30, total sales fell 24% to £2.2bn, while in the UK and Ireland sales fell 15% to £1.1bn.

Kingfisher was hit hard by the enforced closure of its stores during the start of lockdown, but the shift to online plays to Garnier’s expertise.

During his time at Carrefour China, he launched the retailer’s online business in 2014, increased digital sales penetration from 0.6% in 2016 to 7% in 2019, and launched an app that was downloaded 60 million times within six months.

While it was previously thought Garnier would modify Laury’s One Kingfisher strategy, recent financial performance has led to a rethink. Garnier is now being given the “opportunity to review everything that’s going on with the business”.

Whether this will see him rip up the One plan in its fourth year remains to be seen, and all eyes will be on Garnier as he makes his battle plan.

30. John Donahoe

Chief executive, Nike

NEW ENTRY

PayPal chair and former eBay chief executive John Donahoe replaced long-term Nike boss Mark Parker as chief executive in January this year, when Parker became executive chair.

Donahoe’s appointment is part of the brand’s plan to pivot its business towards digital.

Parker said that Donahoe’s “expertise in digital commerce, technology, global strategy and leadership combined with his strong relationship with the brand, made him ideally suited to accelerate our digital transformation and build on the positive impact of our 'Consumer Direct Offense'.”

The ‘Offense’ referred to is Nike’s move into selling more direct to consumer, having recently cut ties with Amazon on its third-party programme, while scaling back its wholesale business by as much as 50% over the next five years.

Five months on from his appointment, Donahoe has already made bold moves, including a leadership reshuffle with a new chief operating officer and chief financial officer, alongside the decisive move to shut all stores across the US and Western Europe during the pandemic before lockdown measures were implemented.

With form in powering a retailer’s business model forward – he was the driving force behind eBay’s push to mobile-compatible tech and expansion of its ecommerce offering – Donahoe appears primed to take Nike on its next iteration, which is likely to further change the traditional retail landscape.

31. Peter Jelkeby

Country manager UK and Ireland, Ikea

NEW ENTRY

Peter Jelkeby was appointed to head Ikea’s UK and Ireland arm in May 2019, following Javier Quinones' move to lead the US division.

Jelkeby has spent more than 20 years with Ikea, working for the retailer in Sweden, Russia and Vietnam, as well as the UK and Ireland.

On his appointment, Jelkeby said he was ready to “respond to the changing needs of our customers to secure an Ikea that is affordable, reaches more people, delivers excellent customer experience and is truly people and planet positive”.

With UK sales up at £2.1bn for 2018/19 driven by its stores and online propositions (accounting for 19% of sales), Jelkeby has been tasked with developing the retailer’s multichannel capabilities and improving in-store experiences.

While the pandemic shuttered its store estate, the crisis has helped the retailer accelerate transformation plans. In April, Ikea acquired AR start-up Geomagical Labs in a bid to drive shoppers to purchase more big-ticket items without visiting a store.

Promoted from 'one to watch' in the Retail 100 2019, the coming year will see Jelkeby put his years of experience into play.

32. Theo Paphitis

Chief executive, Theo Paphitis Retail Group

▶︎ last year: 32

It has been a mixed bag for Theo Paphitis and his trio of brands – Ryman, Robert Dyas, and Boux Avenue – over the past year.

During the six weeks to December 24, the group’s like-for-likes slipped 1.3%. There was a positive performance at Robert Dyas, Ryman was flat and Boux Avenue was down.

In February, Paphitis appointed advisers from Deloitte to discuss a potential restructuring process for Boux Avenue that would result in store closures. This followed a trading update in January when Paphitis said Boux Avenue was paying “above-average” rents while other retailers had been able to “completely realign their rental cost base, often through CVAs”.

At the time, Paphitis said he was focused on addressing Boux Avenue’s “cost base, in particular our rents, as well as addressing the appropriate mix of channels to match the changing needs of our customers”.

The pandemic shuttering Boux’s store estate will have brought these areas into even greater focus for Paphitis, but there may be a silver lining – while its latest results are yet to be published, general UK lingerie sales were reported to be up 66% during lockdown.

33. Jo Whitfield

Chief executive, Co-op Food

▲ last year: 37

The Co-op’s food business continues to be the pillar on which the wider business can rely for growth.

In April, the Co-op enjoyed the biggest overall growth of all the grocers in terms of sales – up 20% – while its market share growth topped out at 7%.

Before the coronavirus crisis struck, Whitfield’s convenience store empire had been growing steadily and she had led the retailer into burgeoning food trends, including launching the Co-op’s own-brand Gro vegan range in January.

During the pandemic, the Co-op has been focused on increasing its online delivery capacity, spearheading tie-ups with delivery app Deliveroo, as well as experimenting with its own Co-op.com delivery services.

To meet demand, the Co-op has bought on around 5,000 new employees and has focused its recruitment on people whose previous jobs in the food and beverage and hospitality sectors were decimated by the outbreak.

Showing community retail at its best, the Co-op ploughed £600,000 into local food banks across the UK and has donated £1.5m worth of food to charity FareShare.

Awarded the prestigious Veuve Clicquot Business Woman Award in 2019 in recognition of her contribution, Whitfield has led the grocer skilfully.

34. John Roberts

Founder and chief executive, AO.com

▶︎ last year: 34

Returning to lead AO.com in February 2019 after a two-year hiatus, John Roberts is keenly focused on developing the retailer’s product ecosystem and fleshing out its offering.

Group sales growth remained solid over 2018/19 with an increase of 13% to £903m, but AO’s profit struggles have deepened recently. Group pre-tax losses for 2018/19 increased to £19m, impacted by driver legislation changes in Germany and lower product margins in Europe.

However, Roberts has played his part in improving AO’s UK arm with pre-tax profits up £400,000 to £14m in 2018/19 and Roberts is overseeing new launches to improve performance.

In the past year, the AO boss has piloted a white goods rental scheme and launched a mobile division – AO-mobile.com – throwing down the gauntlet to the likes of Dixons Carphone.

Roberts has also been giving back to local communities and his commitment as chair of Onside Youth Zones – safe, affordable and inspiring places for young people – saw him crowned Retail Activist at the 2020 Retail Week Awards.

While he’s asserted that his comeback “is not the John Roberts roadshow”, his leadership is certainly helping to breathe new life into AO.

In May, Roberts commented: “In terms of online shopping behaviour, I believe we have seen five years accelerate into only five weeks and we will plan to cement that change” – and even if this statement is somewhat exaggerated, Roberts’ business stands to be a big beneficiary from the crisis.

35. John Allan

Chair, Tesco

▶︎ last year: 35

Tesco chair John Allan this year shouldered responsibility for the biggest decision at Britain’s biggest retailer – who should succeed Dave Lewis as chief executive.

The surprise departure of Lewis, who was lauded for restoring Tesco’s fortunes in the wake of a profit warning of titanic dimensions and an accounting scandal, was unwelcome news to Tesco investors. And it was ultimately Allan’s role to ensure a smooth succession, in contrast to the wrong choice made by his predecessor, which was a big contributor to the crisis at Tesco.

Allan gave his approval to the appointment of former Walgreens Boots Alliance director Ken Murphy, who will start later this year.

As well as overseeing Tesco’s governance and changing of the guard, Allan has been busy in his role as president of business body the CBI. He has frequently appeared in the media to discuss wider business concerns such as Brexit.

36. Trevor Strain

Chief operating officer, Morrisons

NEW ENTRY

A new entry, Trevor Strain has surged into the Retail 100 following a year in which his influence at Morrisons has grown.

A former Tesco director, he was promoted from his previous Morrisons role as chief finance officer to chief operating officer last December, with an extensive remit that includes commercial, manufacturing, supply chain, logistics, operations development, online and wholesale.

Strain has played a central role in Morrisons’ turnaround and has led in building £1bn wholesale business from scratch, by making better use of the grocer's unique vertically integrated model.

Strain has also been at the heart of the supermarket chain’s impressive coronavirus response. The Bradford-based grocer was the first to introduce food parcels and rolled out a click-and-collect food box service from hospital car parks to give NHS staff easy access to essential groceries at the height of the pandemic.

In another first, Morrisons launched a telesales grocery shopping service for elderly and vulnerable customers who may have struggled to shop online in the traditional way.

The heir apparent to Morrisons boss David Potts, it might not be too long before Strain bags himself another promotion.

37. Carlos Crespo

Chief executive, Inditex

NEW ENTRY

Carlos Crespo makes his Retail 100 debut after being promoted from chief operations officer to chief executive last May by executive chairman Pablo Isla.

Crespo originally joined Inditex – owner of Zara, Pull & Bear, Bershka and Stradivarius – in 2001 in auditing. His background and knowledge will help uphold the business’ standing as the world’s largest fashion company with 7,420 stores in 96 countries.

While Isla has handed responsibility of Inditex’s technology, data, logistics and sustainability over to Crespo, the pair are now jointly responsible for defining the company’s global strategy.

Already the new strongman has overseen a solid performance. In March 2020, the retailer generated an 8% rise in net sales to $28bn (£22bn) and like-for-likes climbed 6.5%. Inditex said it had decided to recognise an inventory provision of €287m (£256m) in the wake of coronavirus. That meant that net profit was up 6% to €3.6bn (£3.2bn). Without the provision, profits would have climbed 12% to €3.8bn (£3.4bn).

Crespo was also set to be putting the wheels in motion for Inditex’s digital store strategy, but these plans have been paused after the pandemic shuttered the group’s estates.

As shops gradually reopen, Inditex’s global footprint should help it cope better than some and Crespo’s years of experience will make him an asset in getting operations back to normal capacity.

38. Roger Whiteside OBE

Chief executive, Greggs

▲ last year: 64

Up 26 places on 2019, Roger Whiteside has achieved another highly successful year at the helm of Greggs and, perhaps buoyed by the triumph of the baker’s vegan products, he has embarked on a meat-free diet.

Greggs reported a strong rise in full-year profits, with a 27% jump in pre-tax profit excluding exceptional items to £114m in the 52 weeks to December 28, 2019, as sales rose 14% to £1.2bn. The food-on-the-go specialist also launched 97 new stores during 2019, bringing its total to 2,050.

Greggs’ six-year transformation is now almost complete, and Whiteside – who has proven his ability to see where consumer trends are going and to move with the times – is now looking to push through his 'Next Generation Greggs' strategy. This includes partnerships, drive-thrus, seats in-store, click and collect and customisable food.

Whiteside had begun to action this by rolling out Greggs’ delivery partnership with Just Eat, but orders had to be halted owing to coronavirus and, in April, the brand was forced to access £150m in new finances through the government’s corporate financing scheme.

Whiteside shouldn’t have trouble getting the baker back on its feet. Demand has remained high; Iceland reported sales up 42% of its Greggs branded products during Covid-19 crisis.

39. Carl Cowling

Chief executive, WHSmith

NEW ENTRY

Carl Cowling took the group helm at WHSmith in November 2019 after long-term boss Steve Clarke stepped down.

Cowling is steering the business at a time when sales and profits are on the ascent – overall sales were up by 11% to £1.4bn in the 2018/19 financial year, with group profits up 3% to £135m.

Cowling knows WHSmith inside out, having spent the past four years heading up the retailer’s buoyant travel division and more recently its high street operation.

Cowling has extensive knowledge of the wider retail sector, too, having held several senior roles at major retailers including Dixons Retail and Carphone Warehouse.

It remains to be seen whether Cowling’s appointment marks a change in the retailer’s cost-cutting strategy, which has been the order of the day at WHSmith for as long as can be remembered. This strategy involves putting “creating value for our shareholders” at the top of its priority list by improving profitability and cash flow and delivering sustainable returns.

However, in the short term, the coronavirus outbreak has forced Cowling to focus on shoring up its balance sheet with the business, particularly its travel arm, having experienced a “significant impact” from coronavirus. The majority of WHSmith’s high street shops have also been closed temporarily, with only the 203 stores that house Post Offices and its 140 stores inside UK hospitals remaining open.

To steady the business through the ongoing crisis, Cowling announced in April that the business had raised £165m through share-placing. Cowling himself bought more than 7,000 shares.

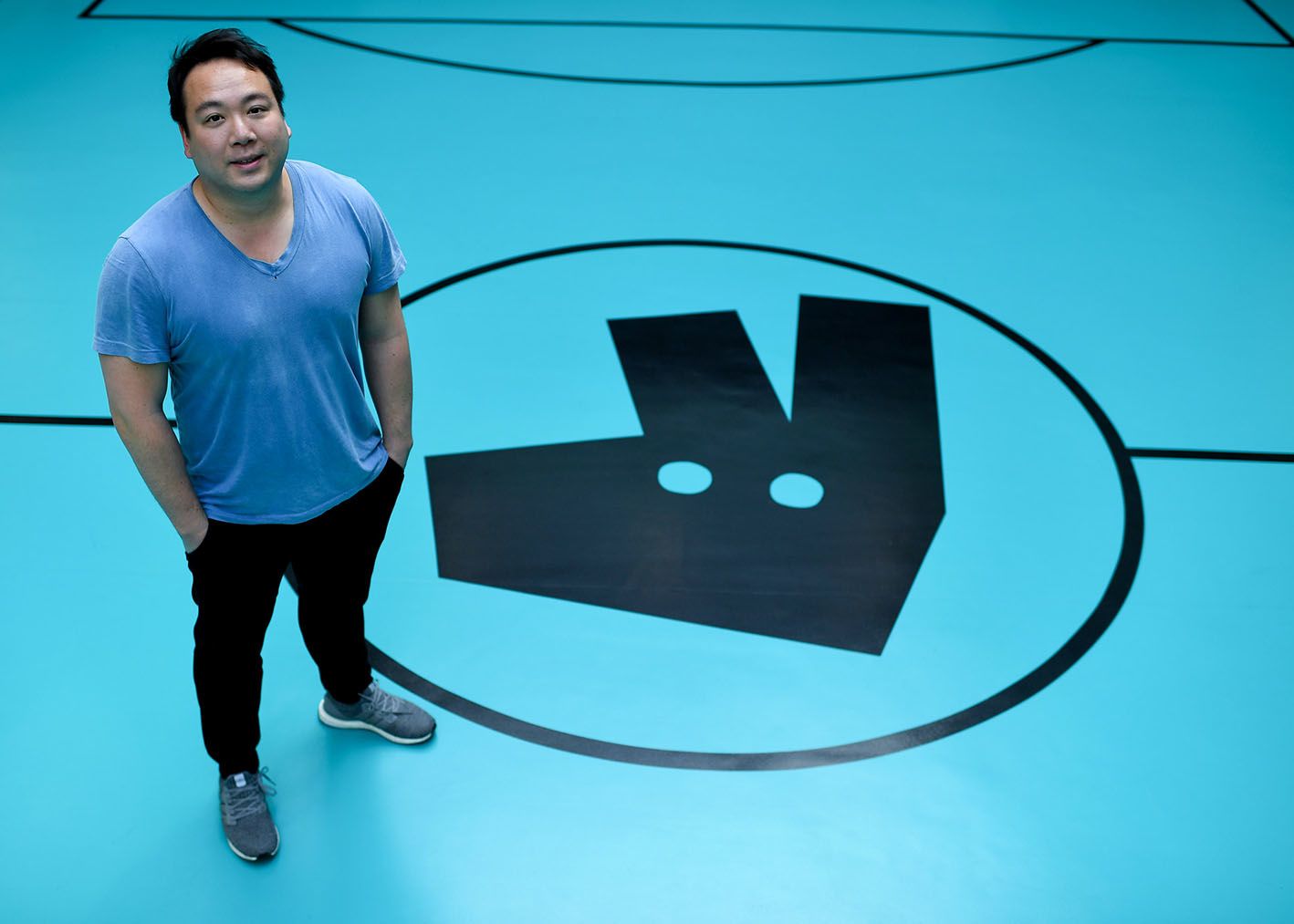

40. Will Shu

Founder, Deliveroo

▲ last year: 56

Tech titan Will Shu has endured a tumultuous year.

Under his leadership, the food delivery specialist has evolved its model from simply partnering with restaurants to collaborating with retailers. In the past year or so, Deliveroo has inked deals with retailers such as Morrisons, McColl’s and Marks & Spencer, and has deepened its existing ties with names such as Co-op on grocery home delivery.

Such partnerships are yet to benefit the bottom line, but the tide could be about to change after Shu led a tie-up with Amazon through Competition and Markets Authority scrutiny earlier this year.

In April, the CMA passed the deal after concluding that Deliveroo, despite being “a highly successful company”, would “not be able to meet its financial commitments and would have to exit the market” without Amazon’s investment.

The verdict highlighted how Deliveroo, a highly innovative business, could have gone, in the blink of an eye and through no fault of its own, amid the coronavirus crisis.

Now, with the financial backing of one of the world’s biggest retailers behind it, Shu has allayed fears of going bust and will be using the £450m investment to fund better service for customers, develop new innovations and offer customers greater choice.

Peter Jelkeby

Peter Jelkeby

Theo Paphitis

Theo Paphitis

Jo Whitfield

Jo Whitfield

John Roberts

John Roberts

John Allan

John Allan

Trevor Strain

Trevor Strain

Carlos Crespo

Carlos Crespo

Roger Whiteside OBE

Roger Whiteside OBE

Carl Cowling

Carl Cowling

Will Shu

Will Shu

Kevin O'Byrne

Kevin O'Byrne

Michael Ward

Michael Ward

John Lyttle

John Lyttle

Andy Bond

Andy Bond

Clare Clough

Clare Clough

Nick Wilkinson

Nick Wilkinson

Peter Pritchard

Peter Pritchard

Alannah Weston

Alannah Weston

Judith McKenna

Judith McKenna

Rob Hattrell

Rob Hattrell

41. Kevin O'Byrne

Chief financial officer, Sainsbury’s

NEW ENTRY

Sainsbury’s finance chief Kevin O’Byrne re-enters the Retail 100 at a time when his influence is likely to grow following the departure of boss Mike Coupe.

Having sat alongside Coupe at investor and media briefings for the past three and a half years, O’Byrne will offer an intelligent, calm and charismatic foil for new chief executive Simon Roberts as he settles into the hot seat.

O’Byrne’s number-crunching and strategic nous have played a huge role once again in Sainsbury’s year. He has been a central figure in the drive to knit together the Sainsbury’s and Argos businesses, particularly in the reconfiguration of their respective store portfolios.

And, as the shift to online grocery shopping has ramped up amid the coronavirus pandemic, O’Byrne will be tasked with ensuring that the numbers stack up in what is a notoriously challenging operation to return a profit.

Roberts will need a strong team around him to fill the sizeable void left by Coupe and O’Byrne will be a crucial cog in that machine during the coming year.

42. Michael Ward

Managing director, Harrods

▶︎ last year: 42

Over the past year Michael Ward had been setting grand plans in motion to support Harrods’ growth, including the launch of a global ecommerce platform in April, in partnership with Farfetch. However, the opening of a permanent store in China has been put on pause owing to the pandemic.

With its famous Knightsbridge store shut since March and unable to take advantage of its usual tourist demand, the luxury department store star is relying solely on ecommerce and that will be having a detrimental impact to its bottom line.

As of the 2018/19 financial year, Harrods’ online sales accounted for less than 13% of total group sales and its flagship made up the bulk of sales and profits.

However, Ward isn't one to give up easily. In 2017 he announced he was leaving Harrods, but reversed his decision later the same year to “ensure that Harrods continued to thrive and remained ahead of the competition”.

The reopening of Harrods once permitted will be welcome, not just for the retailer but for the London economy in which it plays a vital part as a landmark destination.

43. John Lyttle

Chief executive, Boohoo

▲ last year: 62

John Lyttle has delivered an exceptional first year at the helm of fast-fashion darling Boohoo since joining from Primark.

The brand’s unstoppable growth meant Boohoo posted a strong rise in its 2019/20 preliminary sales and profits. It reported a 54% hike in pre-tax profit to £92m in the year to February 29, as revenue soared 44% to £1.2bn. That marked a substantial increase on its previous range of 33% to 38% growth .

As Boohoo has taken tentative steps towards entering the 25+ trend-led market, it snapped up the online businesses of Karen Millen and Coast for £18m in August 2019. Lyttle has since commented that both brands are “showing great promise” under Boohoo’s steer.

Analysts at Bank of America described Boohoo as the “best placed online retailer” to cope with the coronavirus pandemic, because of its agile supply chain and relatively high margins.

Lyttle’s remit enables him to focus on the day-to-day running of the business, making him pivotal to the brand’s pandemic response. Having claimed the crisis has highlighted Boohoo’s “key strengths”, the fast-fashion boss is clearly confident the business will continue to triumph even in these uncertain times.

44. Andy Bond

Chief executive, PepCo

▼ last year: 36

As chief executive of PepCo, the European parent of discount chains Poundland and Pep&Co, Andy Bond has settled into a strategic role this past year by leading on new collaborations and expansion.

After an incredibly successful 2016/17, group sales dropped off sharply to £1.5bn in 2017/18. To help shore up profits in an increasingly competitive discount landscape, Bond has focused on widening the scope of Poundland’s product range to include fresh and frozen foods. He has also driven the cross-fertilisation of the two sister brands, with Pep&Co products currently on shelves in 200 Poundland stores.

New hires have also been on his agenda and, in October, “to further strengthen PepCo’s position” Trevor Masters, the former chief executive of Tesco International, was appointed as PepCo managing director.

In recent months, the coronavirus crisis has put a slight spanner in the works for Bond with “temporary hibernation” of approximately 100 stores and the furloughing of 250 staff.

However, with the pandemic leading to increased demand in value products and a recession on the horizon, Bond’s business is positioned to benefit from the fallout.

45. Clare Clough

UK managing director, Pret a Manger

NEW ENTRY

Named head of Pret a Manger’s UK business in September 2019, Clare Clough has helped take it from strength to strength.

Having led on the retailer’s allergy plan following the tragic death of a customer in 2016, Clough has recently spearheaded the growth of the brand’s Veggie Pret business – the close of 2019 there were four standalone UK Veggie Pret stores – and she played a role in the acquisition of rival brand Eat with an eye to turning many of its former locations into vegetarian eateries.

Alongside new chief executive Pano Christou, who replaced former boss Clive Schlee last year, Clough has been instrumental in pushing the brand into new sales channels during the coronavirus outbreak.

In April, the brand launched its first coffee range in supermarkets, expediting the process by more than a year. Pret has since begun reopening stores on a trial basis, offering takeaway coffee and food services, with a focus on catering to NHS hospitals.

Clough’s leadership in crisis mode demonstrates agility and quick thinking – skills that will her serve her well over the coming year.

46. Nick Wilkinson

Chief executive, Dunelm

▲ last year: 79

Since securing the top job at Dunelm in 2018, Nick Wilkinson has steered the wave of digital transformation triggered by the furniture retailer’s 2016 acquisition of the Worldstores group.

The £8.5m acquisition more than doubled the size of its online business, but the primary benefit of the move was the access to technology and digital development capabilities.

In December 2019, the retailer confirmed completion of its three-year technology transformation plan, allowing Dunelm to launch click and collect and boost delivery options.

With Wilkinson at the helm, Dunelm remains one of the most profitable retailers in the home sector, with total sales rising 5% to £1.1bn in 2018/19 and like-for-like growth up 8%.

While the retailer drew down a £165m revolving credit facility in April, it’s unlikely Dunelm will be derailed by Covid-19. After reopening its online business in April, Wilkinson reported “significantly higher” orders than before the crisis.

Wilkinson has expressed confidence that Dunelm “will emerge from this crisis as a stronger business ready to return to sustainable and profitable growth” and, as proof of this confidence, he’s taken a 90% pay cut.

47. Peter Pritchard

Chief executive, Pets at Home

▲ last year: 83

Pets at Home top dog Peter Pritchard is our highest riser in the Retail 100 – up 36 places on 2019 – having overseen a very strong period at the retailer this past year.

Group revenue increased 7% to £961m over the year to March 2019, with the retailer’s snowballing veterinary arm largely to thank. Pritchard has set a goal of generating 50% of revenues through veterinary services by 2024.

Omnichannel sales rocketed 43% to £74m during the year, driven by recent customer experience investment.

Next up on Pritchard’s agenda is rolling out its pet centre format, touted for this year, which is designed to make the brand feel like a special alternative to online marketplaces, alongside further omnichannel investment.

Pets at Home has reported “exceptional levels of demand” during the coronavirus crisis. As an essential retailer, its stores are open but non-essential services such as Groom Rooms aren’t operating.

Under Pritchard, the retailer donated £100,000 in April to the industry’s CaRe20 fund, while the Pets at Home boss’ approach to leading his team through the crisis has been admirable, with the launch of a buddy network to support staff communication, initiatives to support mental and physical wellbeing, and the introduction of a £1m colleague support package.

In a column for Retail Week in May, Pritchard said that having a sense of purpose and belonging, “a reason which is greater than just taking sales”, has motivated staff throughout the pandemic.

At a time when the current situation presents retail leaders with the opportunity to do the right thing by their people, Pritchard is doing exactly that.

48. Alannah Weston

Chair, Selfridges Group

▼ last year: 47

Chair of the department store group since May 2019, Alannah Weston has made sustainability top of her agenda since taking the reins from her father.

With Selfridges already well ahead of the pack in removing items such as single-use plastic bottles, plastic straws and carrier bags from its stores, Weston has been ramping up the retailer’s commitment to sustainable products and business models this past year.

In late 2019, the retailer launched six new labelling categories including responsible leather, vegan and forest friendly, while at the start of 2020 it launched a pop-up for luxury fashion items at its Oxford Street flagship in partnership with wardrobe rental platform Hurr. The aim was to help reduce the impact fashion has on the environment.

However, Weston’s sustainability initiatives have had to take a backseat amid Covid-19. Having shut its stores on March 18, the retailer has since reopened its food hall.

Some industry observers have questioned the future of the department store as a retail format – Debenhams fell again into administration recently and big US department store businesses have also collapsed. However, Selfridges has been a beacon for the department stores sector and Weston will be determined to ensure that continues.

49. Judith McKenna

Chief executive, Walmart International

▼ last year: 41

One of the most powerful women in the retail world, Walmart International boss Judith McKenna retains her place in this year’s Retail 100, despite not managing to finalise a sale or float of its Asda business.

Talks with interested parties were in progress but had to be canned amid the coronavirus pandemic.

McKenna will clearly have a huge say in the fate of Asda – as a key ally of boss Roger Burnley she has already helped the business get back on a firmer footing after a prolonged period in the doldrums – but her influence extends far beyond the UK.

Named Woman of the Year by World Retail Congress in 2019, McKenna has reshaped Walmart’s sprawling overseas portfolio, which spans some 26 markets, 6,000 stores and 800,000 workers.

The US titan is scaling back in countries such as Brazil to focus on high-growth markets including India, China and Japan, where McKenna has helped establish partnerships with Flipkart, JD.com and Rakuten.

Walmart is positioning itself to emerge as an even stronger global force following the health emergency and McKenna will have a central role to play in leading that charge.

50. Rob Hattrell

UK vice-president, eBay

NEW ENTRY

Rob Hattrell makes his inaugural entry in the Retail 100 among the top 50, after a busy few months during the pandemic.

Under Hattrell, who joined eBay in February 2017 after a long stint at Tesco, the online marketplace has offered to defer seller fees to support cashflow, given eBay Shop subscribers up to 100,000 free listings, and has cracked down on profiteering on products such as toilet roll and hand sanitiser.

He has also worked with the NHS to build a dedicated portal from which healthcare workers across the UK can order personal protective equipment.

With the UK a key international market for the eBay group, alongside Germany, Hattrell’s recent efforts to maintain the brand’s reputation and online demand during the crisis will likely ensure another strong financial performance.

Results for the 2018 financial year showed UK sales up by approximately £50m to £1.1bn and the group reported in April 2020 that “since mid-March, our marketplace platforms have experienced strength in key metrics – traffic, buyer acquisition, conversion, sold items and gross merchandise value".

51. Matt Moulding

Chief executive, The Hut Group

▼ last year: 50

It has been a stellar year at The Hut Group for chief executive and executive chair Matt Moulding.

The entrepreneur has led the business at pace, including delivering a 31% boost in EBITDA to £91m in the year to December 31, 2018, driven by a 24% surge in group sales to £916m. The highly acquisitive online retail group has wooed investors with its expansion ambitions and technological prowess and secured £1bn in its latest funding round in December.

The Hut Group was set to open its first bricks-and-mortar store in Manchester this year, but it is likely that coronavirus will have put those plans on hold for now.

Not one to be deterred from innovating, Moulding has instead responded to the global pandemic by snapping up two cargo planes for the launch of ‘THG Air’ to better facilitate its global distribution networks amid supply chain disruption.

Moulding also launched a £10m coronavirus aid package to support vulnerable communities, key workers and emergency services. Moulding said that The Hut Group “has an obligation to support those in need, not only as a major regional employer but because we have the ability to do so".

52. Stuart Machin

Managing director, M&S Food

▲ last year: 54

In the past year, Marks & Spencer food supremo Stuart Machin has overseen a raft of initiatives that have helped the retailer stoke shopper appetite for its famous fare.

While maintaining a reputation for quality, Machin has gone some way to countering perceptions that were a drag on performance, such as 'expensive' or 'limited range'.

Better communication on price and assortment has been accompanied by, and built upon, pilot food hall formats with in-store theatre and other innovations, such as a vertical farm in Clapham and a specialist fresh pasta concession in Southampton’s Hedge End.

Later this year Machin will hope to make a similar impact on ecommerce, as M&S’s joint venture with Ocado will at last enable the retailer to sell its food range online. Machin will be preparing for a showdown with Waitrose, Ocado’s former partner, which is determined to further build its own online operations in response.

53. Tracey Clements

Chief operating officer, Boots

NEW ENTRY

Tesco veteran Tracey Clements joined Boots in the newly created role of chief operating officer in March 2019, taking responsibility for UK store operations and supply chain, as well as P&L for the Boots business in the Republic of Ireland.

Clements brings a vast array of experience to the health and beauty retailer. She started her Tesco career as operations development manager in 2002, before working her way up through roles including operations development director and customer strategy and insight director.

Her knowledge and skillset will no doubt have proved invaluable in supporting Boots managing director Seb James in driving UK strategy forward and, most recently, navigating the coronavirus pandemic.

Prior to the outbreak, Boots had been increasing its technology investments and revamping store formats with new beauty halls and brands but, amid the coronavirus crisis, the retailer announced it was “proactively deferring certain activities”.

Instead, Boots has focused its operations on supporting the country’s efforts, including joining forces with the government for its testing drive for frontline NHS staff and recruiting 500 additional delivery staff to meet prescription demands.

As the retailer plans for its post-pandemic future, Clements will be a key influence.

54. Anne Pitcher

Managing director, Selfridges Group and Selfridges UK

▼ last year: 52

Anne Pitcher will be leaning on her wealth of experience in the department store sector to help weather the storm facing retailers as a result of the pandemic.

Having worked for various arms of the business since 2004 – and made managing director of the wider group in February 2019 – Pitcher has been a key figure in the transformation of the department store chain into a luxury fashion and beauty-led business.

With UK boss Simon Forster unexpectedly exiting in February this year, Pitcher has taken over his responsibilities until a permanent successor can be found.

Based on sales density figures corroborated by the retailer, Retail Week Prospect estimates that recent online sales accounted for 12% of total group sales.

Having invested heavily in its stores in the past year, including opening the world’s first permanent department store cinema at its Oxford Street flagship, the coming months will be crucial for Pitcher’s legacy.

55. Julian Richer

Founder, Richer Sounds

▼ last year: 39

Last year’s winner of Outstanding Contribution to Retail at the Retail Week Awards, entrepreneur Julian Richer has continued to push the importance of ethical business this year.

However, having stepped back from the day-to-day running of the business, Richer drops down in the Retail 100 ranking.

He has thrown his weight behind Zero Hours Justice, a campaign and advice service with the aim of "ending the enforced imposition of controversial zero hours contracts". He believes they are bad for business and society and is working with the TUC to consign them to history.

It is the latest initiative from a retail leader who has consistently argued that treating people well sits at the heart of business success, and whose influence has been brought to bear on other retailers, including Marks & Spencer where he is an advisor. Last year Richer handed control of his business to its employees, through a workers' ownership trust.

As ethics and reputation rise up retail’s agenda, Richer has blazed a trail for others to follow.

56. Alessandra Bellini

Chief customer officer, Tesco

▲ last year: 70

Alessandra Bellini has played a substantial role in Tesco’s recently completed five-year turnaround, since joining as chief customer officer in 2017.

With her customer-centric remit, she has spearheaded a series of initiatives, including the overhaul of own-brand and the launch of Clubcard Prices promotions to mark the grocer’s centenary in 2019.

Speaking to Marketing Week in February 2020 Bellini told the publication that keeping things simple had been at the heart of her success.

She said: “I love the fact I work on simple products that seemingly don’t matter; the everyday things that impact people’s lives.”

Bellini’s fascination with consumer essentials and proven intuition for customer sentiment should serve Tesco well during the pandemic, when shoppers have little time for luxuries.

Indeed, the grocer’s agile response to Covid-19 has focused on what the country most needs – from feeding people nationwide, to pop-up shops at NHS Nightingale sites and a £30m charitable pledge.

57. Peter Macnab

Chief executive, AS Watson Health and Beauty UK

▲ last year: 71

Having spent 13 years in senior roles for AS Watson UK – owner of Superdrug and Savers – Peter Macnab is cementing his tenure this year.

Under his leadership, AS Watson Health and Beauty UK has accelerated innovation and taken action to support its staff.

The retailer ramped up its introduction of cloud technology for ecommerce – initially due in late 2020 – and by April had implemented it across the business to meet online demand. That same month, it reported that implementation at Superdrug had enabled the business to facilitate 50% more orders per day.

The health and beauty giant also launched a £40m coronavirus staff support package to ensure full pay for parents unable to work remotely or in another business position and full pay for anyone unable to work owing to sickness or self-isolation.

Macnab said the support package gave financial reassurance to staff “working very hard to keep our stores open and to ensure customers’ online purchases are delivered”.

Pre-Covid-19, Macnab was credited for transforming the Superdrug business with solid like-for-like growth restored and strengthened margins. Post-pandemic, he will no doubt be credited for his effective crisis management.

58. Henry Birch

Chief executive, Shop Direct

▼ last year: 53

It’s been a bracing year for Henry Birch as chief executive of online retailer Shop Direct.

On one hand, he has made strides in building his executive team after a deluge of management exits prior to his arrival in 2018 – poaching Clarks finance boss Ben Fletcher for the chief financial officer role and snapping up Boots own-brand boss Guy Farmer as trading director.

But on the other, Shop Direct owners the Barclay brothers were understood to be exploring a possible sale of the business late last year amid a consolidation of their eclectic asset pile. The online retailer ended up securing increased financing from its owners after a mooted sale never materialised and it unveiled a rebrand as Very Group in January.

Plans to unveil a new state-of-the-art warehouse and ramp up operations following the rebrand appear to have taken a back seat during the coronavirus disruption, but the year ahead could be critical for Birch.

The industry will watch to see how he makes good on his plan to drive business growth in a new post-pandemic environment.

59. Mark Constantine

Chief executive, Lush

▼ last year: 58

Lush’s co-founder and chief executive Mark Constantine has had an industrious year.

Under his guidance, the ethical beauty retailer has been hailed for its eye-catching and experiential stores, and over the past year has innovated at a breakneck pace.

Shortly after unveiling its biggest ever store in Liverpool, the retailer opened a state-of-the-art tech-fuelled Tokyo flagship. New format stores include a perfume library in Italy and a florist-inspired fresh cosmetics emporium in Paris shortly followed.

Lush has also rolled out its Naked store concept – which only sells zero-packaging products – and unveiled a corresponding Lens app that allows shoppers to check the ingredients of products by scanning them with their smartphone.