Money makers

The top 20 retailers driving profits and their winning strategies

It is telling that only a third of the UK’s largest retailers achieved any profit growth at all in their most recent annual results.

When compiling the data for this digital guide, which charts profit growth across UK retailers, just 60 of the 180 retailers covered by Retail Week Prospect could boast a rise in yearly earnings.

The sector is facing a new reality. While achieving sales growth in this environment is tricky enough, driving profits is proving nigh on impossible.

Margins for most retailers have been obliterated in recent years; a result of the downturn and the need to stay on top of ever-changing shopping habits.

Keeping up with consumer demands is a costly business and retailers are ploughing huge amounts into customer-facing capabilities such as improved fulfilment options and in-store technology.

And this investment comes on top of rising costs associated with the living wage, business rates and rents, not to mention rising sourcing costs due to Brexit.

Protecting and growing profit margins is as hard as it has ever been.

So which retailers are growing profits at the strongest rate and how are they doing it?

"Retailers are facing a new reality. While achieving sales growth in this environment is tricky enough, for many retailers driving profits is proving nigh on impossible"

This digital guide uncovers strategies to drive profit growth by examining winning formulas from the top 20 retailers leading the way. We lift the lid on inventive initiatives from smaller companies facing structural decline as well as larger businesses exploring entirely new profit avenues.

However, with Amazon prioritising market share so successfully over earnings, the guide also examines whether profit is still considered the key indicator when it comes to business health and longevity.

Methodology

Retailers were ranked based on operating profit figures – UK focused where available and otherwise group operating figures – from the latest posted data as of July 2018.

The ranking is based on profit growth rather than absolute earnings in pounds in order to provide useful takeaways from retailers of all sizes.

AT A GLANCE

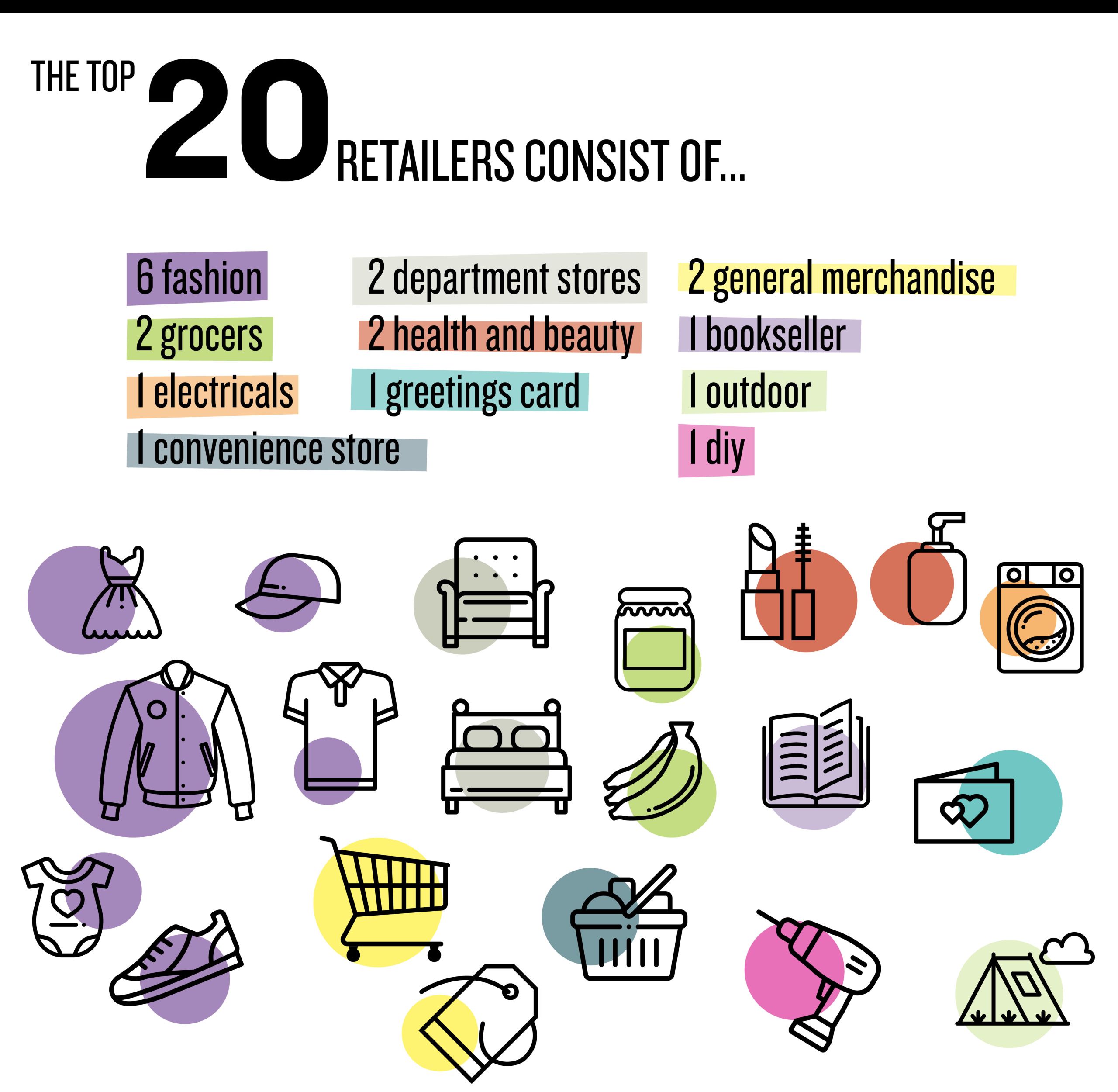

Our ranking illustrates that a diverse range of retailers have significantly boosted profits by playing to the strengths of their largely unique propositions.

The top 20 retailers driving profits

| Position | Retailer | Latest year results | Growth | UK operating profit |

|---|---|---|---|---|

| 1 | Apple | 2016/17 | 65% | £32m |

| 2 | Lush | 2016/17 | 57% | £13m |

| 3 | Matchesfashion.com | 2017/18 | 44% | £23m* |

| 4 | Waterstones | 2016/17 | 44% | £25m |

| 5 | Harrods | 2016/17 | 42% | £253m* |

| 6 | Boohoo | 2017/18 | 41% | £43m* |

| 7 | Screwfix | 2016/17 | 31% | £118m |

| 8 | Mountain Warehouse | 2016/17 | 30% | £21m* |

| 9 | Tesco | 2017/18 | 28% | £1.2bn |

| 10 | Asos | 2016/17 | 26% | £80m* |

| 11 | The Body Shop | 2017 | 26% | £29m* |

| 12 | JD Sports | 2017/18 | 23% | £296m* |

| 13 | Home Bargains | 2016/17 | 23% | £168m |

| 14 | McColl’s | 2016/17 | 22% | £25m |

| 15 | B&M | 2017/18 | 21% | £194m |

| 16 | Selfridges | 2016/17 | 16% | £109m* |

| 17 | Sainsbury’s | 2017/18 | 14% | £694m |

| 18 | Ted Baker | 2017/18 | 13% | £71m* |

| 19 | Superdry | 2017/18 | 12% | £100m* |

| 20 | Moonpig | 2016/17 | 10% | £16m* |

* Group operating profit

The top five comprises an electricals giant, a handmade cosmetics brand, a multichannel fashion retailer, a high street bookseller and a renowned department store, demonstrating that there is no one guaranteed approach to maximising profits in contemporary retail. However, one trait ties them together: retailers must be more flexible than ever to maintain success.

For instance, table topper Apple’s profits have clearly been boosted by its high-value, high-margin-generating products. Operating profit rose 65% in 2016/17. However, it does not rely solely on product to drive earnings; it has refreshed its store estate to drive growth rather than overinvest in new stores, thus keeping an eye on costs (see Chapter 2).

Launched in the UK in 2016, its new store design includes its ‘Forum’ area that hosts community events such as game nights, learning events and workshops, as well as offering free Wi-Fi.

Such investments drive footfall and bolster sales throughout the year, not just when new products are released.

Apple has also adapted its multichannel approach, unifying the stores and online business into a single unit to offer a more seamless shopping journey, and a more streamlined approach to generating sales.

For example, by arming staff with transactional tablets, customers are able to order in store as they can online but with the additional draw of Genius support and services such as set-up guides for newly purchased devices.

Again, this increases footfall and opportunities to upsell on these high-margin products, thus boosting profits.

Commanding cost control

For second-placed Lush, surging sales have accelerated profit growth. UK sales grew 12% to £139.9m in the year to June 2017, lifted by product innovation, its blossoming online business and its strong ethics-focused brand appeal.

Lush’s vertically integrated model – meaning it manufactures its own products – ensures it can tightly control sourcing and product development costs.

It should be noted here, though, that despite its rapid profit growth, Lush’s UK operating margin was just 9.2% in 2016/17. This is relatively low for a retailer that owns its own supply chain. For instance, Moonpig – 20th in our ranking – generated a group operating margin of 18.3% in 2016/17.

Lush’s constrained margins reflect intensifying competition in the beauty sector, as well as rising property costs. The group opened a large flagship store in London in 2015 and has continued to focus on relocations to bigger, prime sites, inflating its rent bill. This has partially offset its inherent supply chain advantages.

Still, along with Apple, Lush is among the few retailers that have produced vibrant profit growth while still improving the customer experience.

However, achieving this is not confined to retailers with the financial clout of Apple or the supply chain advantages of Lush.

Ted Baker is another one. It posted group operating profit growth of 13% in 2017/18 despite investing in expanding its operations into China and Japan, launching more localised payment options for European websites and investing in a raft of in-store technology. Its group sales rose 11%.

Ted Baker has a leading customer experience proposition among premium fashion retailers. Differentiating itself through its distinct brand – with every store being entirely unique in design – has enabled it to grow demand both domestically and internationally.

Focusing on full-price sales has bolstered profit at a time when other fashion groups are suffering because of rife discounting.

It has also protected its bottom line through its store estate model, whereby around half of its UK stores are rented on turnover leases. This has afforded it more control over the costs of its store estate expansion and protected it from difficult trading conditions.

However, it should be noted that heavy investment in a new European distribution centre in the UK in 2016/17 meant profit grew from a lower base than usual in 2017/18.

Lush, which manufactures its own products, is able to tightly control sourcing and development costs

Lush, which manufactures its own products, is able to tightly control sourcing and development costs

Fulfilment weighs on bottom line

Much of Amazon’s strength lies in heavy investment in meeting customer expectations of delivery speed, convenience and accuracy – and it famously forgoes profits to do it.

Matchesfashion.com, Boohoo, Asos and Sainsbury’s all invest to varying degrees in their own fulfilment offer and are managing to increase profits while they do it.

Argos’ fulfilment capabilities were central to Sainsbury’s decision to spend £1.4bn to acquire it in 2016. Its Fast Track delivery service enables stores to act as fulfilment centres, facilitating same-day delivery to most of the country in a low-cost way.

While fulfilment is critical to customer experience, expensive delivery innovations are eroding retailer margins. This is particularly relevant in the grocery sector where delivery of fresh and frozen food incurs heavy costs associated with multi-temperature-controlled vehicles, in addition to the usual wage, fuel and transportation costs.

This partly explains why only two grocers and one convenience-store format, McColl’s, feature in the top 20.

For instance, Ocado claims to be profitable on every order but to maintain its high level of convenience it reinvests most of its profits into technology development, such as warehouse automation to improve delivery speed. In 2013/14 the group reported its first pre-tax profit, 15 years after being founded, but earnings growth has since remained subdued.

The success of its leading fulfilment offer and its deals with international grocers – such as French giant Casino and America’s second-biggest supermarket chain Kroger – may have vindicated Ocado’s years of loss-making, but ensuring future confidence in its model is dependent on further profit growth.

Focusing on what is deemed pivotal to the customer experience is crucial for sales growth, but having a considered plan for the return on investment is key to long-term success and profitability.

Brother UK partner viewpoint

The variety of businesses and operating models appearing on the fastest growing list is fascinating. It challenges any simplistic reading of the direction of travel for retail in terms of the relationship between bricks and clicks along with consumer behaviour.

Of course, a one-year view of profit growth cannot tell the whole story, but it certainly demonstrates that there are still big opportunities for well established high street retailers.

Adaptability is clearly the watchword for those looking to succeed in today’s retail landscape, and those that have been able to move quickly to match changing customer expectations are coming out ahead.

MULTICHANNEL STRATEGIES

Existing store estates and own-brand products are just some areas in which multichannel retailers are investing to protect their bottom line.

Adjusting to the digital age has required established retailers to innovate and invest. Doing this while remaining profitable is challenging. As can be seen from those topping our table, playing to the strengths of the individual retailer’s proposition and adding customer-centric capabilities to existing stores – rather than significantly downsizing or expanding – has proved fruitful.

Case study: Apple

Pack leader Apple’s success is undoubtedly driven by its dominance in developing must-have, trendsetting, innovative devices, such as the globally prolific iPhone and iPad. However, the tech giant has boosted profit growth by augmenting its existing store estate with new technologies and experiences, rather than expanding or contracting outlets. Its UK store estate has remained at 39 outlets since 2014/15.

As well as unifying store and ecommerce operations, Apple launched a new store design in 2016 offering an even greater focus on community, excellent customer service and more retail theatre than before.

As well as its highly sought-after products, it is these experiences that enable it to offer such high price points and still retain extraordinary levels of footfall.

Its decision not to open new stores helps to limit the amount it pays in rent and rates along with wage costs. During 2016/17, staff costs rose by just 5.8%, compared with over 15% a year earlier. Its staff-costs-to-sales ratio dropped from 16.3% to 14.5% as a result, bolstering profit.

Apple has also increased profit by developing a single view of stock. Sales through its retail stores, website and third-party retailers are carefully monitored in order to allocate stock to where it is most needed.

Additionally, the tech retailer is able to leverage its ability to design and develop its own operating systems, hardware, application software and services. Like Lush’s vertically integrated supply chain, bringing these operations in house offers Apple more control over costs and bolsters efficiency.

Store estate optimisation

For multichannel retailers no longer in the rampant growth phase of their journeys, optimising existing stores is essential to competing with pureplays, as evidenced by Apple and Lush.

With an even bigger store network, albeit with smaller shops than most retailers in the ranking, Kingfisher-owned Screwfix drove UK operating profit growth of 31% in 2016/17 by focusing on differentiation from other DIY retailers through specialist customer service and a targeted product range.

Kingfisher is working on a more unified product offer across its businesses to reduce the number of suppliers it deals with for improved efficiency.

Unlike others, Screwfix has focused on physical expansion while maintaining profitability. It opened 60 branches alone in 2017/18.

Its vast network has been leveraged to offer a leading click-and-collect service and a third of online orders are picked up within an hour.

By combining this product approach with a focus on its target demographic’s needs, Screwfix has the potential to maintain strong margins while expanding.

While Screwfix can fulfil click-and-collect orders relatively cheaply due to its large stockholding in the back of its stores, for other retailers it’s a costly business due to the costs associated with fulfilling from central distribution centres. Since 2015, Tesco has charged for click-and-collect orders under £40, indicating it has not been willing to chase sales at the expense of margins.

Indeed, Tesco has aggressively cut costs in an effort to protect margins. It closed its non-food Tesco Direct website in 2018, citing “no route to profitability”. Although actioned after the financial year examined in this report, it is a good example of retailers making bold decisions in the fight to protect their bottom lines. The grocery giant also cut 1,200 head office jobs in 2017 to mitigate rising wage and rent costs.

It also axed around 1,700 deputy manager roles across its Express estate, replacing them with more than 3,300 shift leader roles, which demand a lower salary. It has also focused on increasing its share of freehold property to reduce its rent bill.

Grocers seeking efficiencies

Alongside Tesco, the other grocer in our table, Sainsbury’s, and convenience store chain McColl’s are battling to maintain margins as the market continues to shift towards smaller urban grocery stores. These shops incur higher costs per square foot as they are often located in city centres, hiking up rent expenditure.

Both retailers have addressed this through supply chain efficiencies, pricing strategies and product mix.

For instance, McColl’s wholesale partnership with Morrisons from 2018 allows it to leverage Morrisons’ manufacturing and sourcing capabilities, enabling it to have more stock delivered to a larger number of stores more quickly. As such, it can respond promptly to shoppers’ behaviours and tailor its product range to local areas, potentially reducing wasted stock.

McColl’s model means suppliers deliver their stock directly to stores and all stock owned by the convenience chain is held on site, removing the overheads associated with maintaining a warehousing and distribution network.

It is also reducing its network of underperforming newsagents, shifting the portfolio towards its premium convenience and food and wine formats to sell a greater volume of higher-margin products.

"Value and quality-driven own-brand ranges have become a key differentiator in the competitive grocery sector and allow more control over input costs, bolstering margins"

Sainsbury’s has also built profitable advantages around convenience and online fulfilment. The grocer is able to fulfil online orders from stores, unlike many of its rivals.

For instance, Asda and Tesco use ‘dark stores’, which are dedicated to online orders, are very space efficient and ordered in such a way to suit online picking. However, these are still additional physical stores that require hefty investment.

By using its existing stores to pick online orders, Sainsbury’s has avoided creating dedicated stores with sunk costs. This improves short-term profitability by minimising the costs associated with online delivery.

Sainsbury’s has also made a big push to promote its Taste the Difference and Basics own brands.

Value and quality-driven own-brand ranges have become a key differentiator in the competitive grocery sector and allow more control over input costs, bolstering margins.

Going forward, the use of dynamic pricing models, already trialled by Sainsbury’s and Tesco, is set to grow in popularity. This technology allows retailers to adjust prices throughout the day to react to changes in demand and footfall.

This has the potential to drive greater volume sales and reduce wasted stock, a vital gain in the march toward profit growth among grocers in particular.

Case study: Waterstones

Ranking fourth, last remaining national high street bookseller Waterstones has pulled off a surprising turnaround after facing closure in 2011. Its UK operating profit soared by 43.7% in 2017/18, although this was from a relatively low base of £17m.

Since 2011, the retailer, which operates 269 UK outlets comprising approximately 91% of its sales (according to Prospect), has adapted its product mix to cater to local areas and promote higher-margin goods, enabling it to ride out competition from Kindle products. It has shifted away from selling academic course books into more profitable products such as stationery and toys.

By tailoring stores to local markets, the new management has significantly reduced the return rates of unsold books, which were weighing heavily on profitability.

Meanwhile, Café W eateries have been introduced in some shops, encouraging dwell time and adding theatre. These coffee shops replaced previous branches of Costa Coffee and again reflect the benefits of own-branded ventures, which protect costs and support the bottom line.

Waterstones also streamlined staff to control costs, reducing its headcount by more than 25% to just under 3,000 over the three years to 2015/16, before expanding it in 2016/17 to almost 3,200.

Waterstones’ flexible approach, product choices and features such as coffee shops focus on improving the customer experience, which is a must if high street operators are to compete with Amazon.

Key takeaways

- Refreshing store estates in favour of downsizing or expanding can be a profitable strategy.

- Multichannel retailers can leverage their existing store estate with services such as click and collect to compete with pureplays.

- Be ruthless in focusing on higher-margin products and channels where possible.

- Cost cutting is necessary if businesses are to continue reshaping in the digital era.

Brother UK partner viewpoint

For all the complexity involved in a successful multichannel retail operation, there is one goal at the centre, which is to understand what customers want and then to deliver this quickly and in a relevant way.

Whether that means focusing on keeping products at the forefront of technology as Apple has, backing up a core offer with extensive customer support as in the case of Screwfix, or catering to highly localised demand such as Waterstones – putting the customer at the heart of the strategy will always be key.

LEARNING FROM THE UPSTARTS

Although pureplay retailers don’t have to contend with store overheads, the need to invest in the technology required to support digitally led customer experiences can weigh heavily on margins.

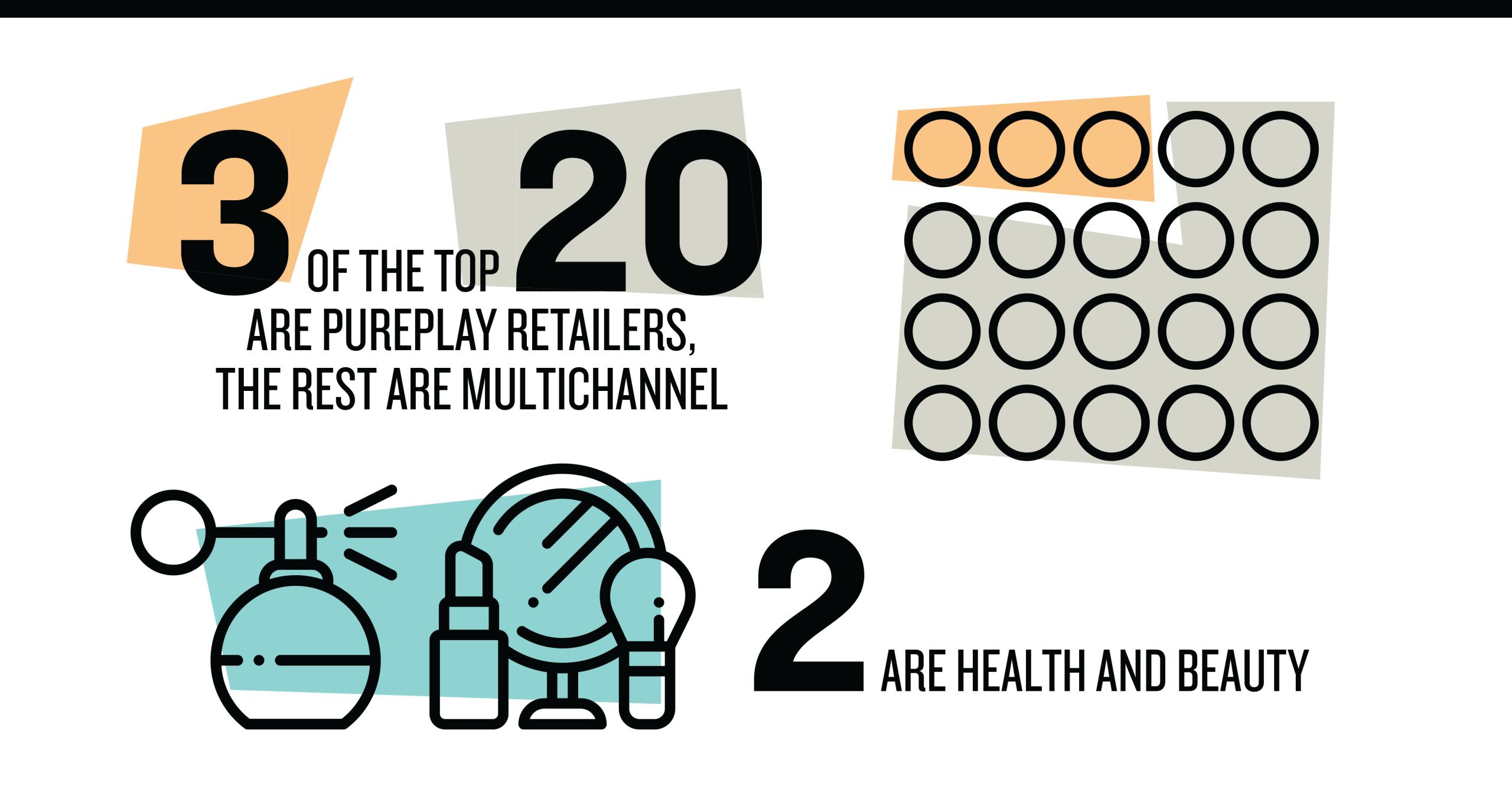

Indeed, just three of the top 20 are strictly pureplays – Boohoo, Asos and Moonpig – while in its modern guise following a 2013 rebrand, Matchesfashion.com generates some 95% of sales through its online channel. Despite outpacing most traditional retailers in terms of sales growth, these upstarts generally have lower profit margins.

However, one key area where these businesses have proven adept at maximising return on investment is marketing. For instance, Asos utilises social media and in-house editorial content to engage with its core millennial audience.

Using localised Snapchat and Instagram channels, whereby content and ads are tailored across different regions, its marketing strategy has propelled its global reach at relatively low cost compared with some fashion rivals that spend huge sums of money on expensive TV campaigns that are difficult to measure.

"The likes of Apple, Lush and Harrods have also benefited from immersive content and theatrics either online or offline. Embracing consumers’ desire for authenticity and inspiration can bring high rewards at low cost"

Effective online content boosts traffic and dwell time, and is increasingly crucial for fashion etailers such as Asos, Matchesfashion.com and Boohoo, often generating a high return on investment.

The likes of Apple, Lush and Harrods have also benefited from immersive content and theatrics either online or offline. More multichannel retailers could learn a lesson here. Embracing consumers’ desire for authenticity and inspiration can bring high rewards at low cost.

Mindful marketing

Moonpig has prioritised improving its customer segmentation to ensure marketing is relevant and engaging.

This personalised approach helps bolster average order values and the etailer is afforded such investments due to its vertically integrated business model, which has allowed it to develop its entire production and management IT systems, driving efficiency throughout the business.

Etailers often utilise more digitally savvy marketing strategies to gain a profitable advantage over traditional retailers, but more and more are also leaning on small physical store networks as powerful branding tools.

Despite the large capital outlay physical stores require, luxury etailers are increasingly attempting to offer some of the interactive and unique physical experiences devised by the likes of Apple and Lush, as a way of understanding customers better.

This can enable upselling opportunities and can support online growth. Having a physical location can generate more organic web traffic and thereby lower customer acquisition costs.

Matchesfashion.com currently has three stores and one discount outlet around London that serve to bolster brand awareness and drive increased web traffic.

These stores also provide an additional avenue of sales growth but the retailer generated 95% of sales online in 2017/18. It is also using a small physical presence to generate brand awareness overseas, opening a New York pop-up in 2016.

Pop-ups should enable the group to continue improving profitability, as it can reach a wider international audience, boosting sales growth without a large capital outlay on stores.

Matchesfashion.com comes third in our ranking with 44% growth in 2017/18, although its profit base was relatively low – operating profit increased from £16m to £23m.

It has only just begun to reap the benefits of heavy investment in its digital platform and logistics, which had led to five straight years of pre-tax losses until 2016/17. This strategy has paid off with the group no longer needing to reinvest so much of its turnover into technology and supply chain operations, allowing profit to soar over the past two years.

The retailer has also benefited from a focus on improving productivity. Its staff-costs-to-sales ratio has decreased consistently in recent years, falling from 18% in 2014/15 to 12% in 2017/18. And, like Apple and Lush, Matchesfashion.com benefits from the appeal of its luxury high-margin products.

Etailers still face difficulty in conquering growth and profitability. Many have been satisfied to forgo profit for sales growth in the short to medium term. The likes of mattress etailer Eve Sleep, which operates local sites in 15 countries and gains 40% of its sales from overseas, and fashion portal Farfetch have seen their global popularity soar as they have reinvested aggressively, but both have yet to make a profit.

It is therefore groups such as Machesfashion.com, Moonpig, Boohoo and Asos that are the truly distinctive success stories of the digital retail age.

They have proven that digital retailers can eventually reach a high level of profitability after scaling up over a prolonged period, a strategy that some may still question.

As online sales continue to take up a greater share of overall sales, traditional retailers may need to follow their lead to maintain profitability and success.

Moonpig has focused on targeted and personalised marketing, which has helped boost average order values

Moonpig has focused on targeted and personalised marketing, which has helped boost average order values

Etailers such as Eve have enjoyed soaring global popularity thanks to heavy reinvestment, but have yet to make a profit

Etailers such as Eve have enjoyed soaring global popularity thanks to heavy reinvestment, but have yet to make a profit

Key takeaways

- Smaller marketing budgets have encouraged a fresh approach from younger retailers.

- Social media and editorial content provide a low-cost route to marketing.

- Pop-ups provide a relatively cheap way to expand and boost brand awareness.

Brother UK partner viewpoint

There are so many more ways to reach a target audience today than there were 10 years ago, and it is clear that overall, younger brands are better placed to exploit these opportunities.

Using these approaches effectively can be a triple win for brands. They can reach more potential customers across a wide age range, give shoppers unprecedented access in a way that feels authentic and unfiltered, and often costs a lot less to execute than traditional marketing.

PROFITS POST-BREXIT

Uncertainty may be dominating the horizon but digitally led international expansion could be key to future growth.

The future of UK retail is fraught with doubt and uncertainty, therefore unsurprisingly many are looking overseas for sales growth.

However, traditional players may struggle to maintain profits once they take into account the cost of investing in physical stores overseas, while the upstarts can leverage their technological prowess and ecommerce to propel growth across borders more profitably.

Multichannel retailers can of course expand overseas through ecommerce models rather than physical stores, but pureplays arguably have advantages given their expertise and sole focus on the online channel.

The likes of Boohoo, Asos, Moonpig – and others that just missed out on the top 20 this year such as Burberry – are prioritising international expansion by embracing digital investment.

Profitable partnerships

While the rapid pace of technological change may force retailers to accept thinner margins, by developing effective partnerships retailers can open new avenues for growth abroad and make their businesses more margin efficient.

Retailers including Sainsbury’s and Aldi have launched in China on Alibaba’s Tmall marketplace

Retailers including Sainsbury’s and Aldi have launched in China on Alibaba’s Tmall marketplace

For instance, Burberry recently revealed a global tie-up with Farfetch meaning it can now sell on the fashion marketplace. Its entire inventory is now available on the platform across some 150 countries, allowing it to expand globally at a lower cost than investing in its own stores and ecommerce platform.

Burberry can also leverage Farfetch’s economies of scale to negotiate lower costs for the likes of shipping, further protecting its bottom line.

The use of online marketplaces is a more profitable strategy for international expansion that retailers could benefit greatly from in the next decade. Retailers such as Sainsbury’s and Aldi have already launched in China on Alibaba’s Tmall marketplace as they realise they can extend their global reach without the need for upfront stock investment. Aldi entered the Chinese market via Tmall in 2017, while in August 2016, after initial success, Sainsbury’s ramped up its trial with Tmall by doubling the number of products it sells in China.

However, Marks & Spencer failed to prosper via this approach and recently withdrew from the marketplace – illustrating the need for caution and considered planning in this area.

Operating post-Brexit

Costs associated with the supply chain could rise significantly as a Brexit-induced weak pound threatens to further derail UK retail profit growth. As such, supply chain efficiencies and ways to mitigate higher sourcing costs will be increasingly sought after.

Asos has also stolen a march in this area. As far back as 2013 it began rationalising its supplier base to drive gross margin efficiency and reduce lead times, while enhancing fashionability and quality of its ranges.

It also recently commenced a global fulfilment programme to optimise its stock management capabilities and provide greater flexibility to efficiently move stock around its global warehousing network.

This has included introducing a warehouse control system to support automation, reducing the cost of labour per product and bolstering its mechanised picking technology.

However, the etailer is by no means entirely focused on shoring up margins. In mid-2017 it insisted that it would not raise prices as inflation bites but instead absorb costs to continue growing its global audience.

John Lewis also recently unveiled a 10-year plan to invest in the likes of in-store personalisation, customer service and unique product offers at the expense of margins in order to grow share.

However, growing its own-brand and exclusive products from 30% of sales to 50% is a move in the right direction in terms of bolstering long-term profitability without raising prices.

Although there are clear opportunities to drive margin growth, such as own-brand development, there is no escaping the fact that profits will continue to come under pressure in the coming years.

"As globalisation takes priority for many, balancing marketing, logistics and cross-channel investment with profitability will become even harder"

As globalisation takes priority for many, balancing marketing, logistics and cross-channel investment with profitability will become even harder.

It seems that pureplay etailers are in pole position to make this work and, while their margins may not end up being as rounded as traditional retail leaders such as Marks & Spencer in their heyday, their potential to scale up should make our ranking look very different over the next 10 years.

Despite some of the upstarts of today’s digitally driven retail climate continuing to prioritise sales growth, earnings will arguably remain the strongest indicator of underlying retailer success. Against a backdrop of uncertainty, profit growth needs to be viewed with more reverence for retailers looking to secure future success.

Key takeaways

- Overseas growth is increasingly attractive amid Brexit uncertainty.

- Marketplaces can provide a more profitable strategy for international expansion.

- Making the supply chain more efficient is a way to help mitigate rising sourcing costs.

PARTNER COMMENT

A combination of current political uncertainty and the race to keep up with rapid changes in buyers’ habits has created extremely trying times for retailers.

Phil Jones, managing director, Brother UK

Phil Jones, managing director, Brother UK

What this report shows, however, is that far from being all doom and gloom, there are many opportunities for those that can adapt to changes and set the agenda.

This applies as much to more traditional high street retailers as it does to digital-only operations.

The need to drive cost efficiencies to get the right business model without impacting the customer experience is a key priority.

The back office IT systems available to retailers have evolved quickly in recent years and have the potential to significantly reduce overheads. But integrating them into existing systems will be an ongoing challenge and one that we frequently see retailers we speak to struggle with.

I look forward to seeing how the race for growth among retailers develops in the years to come.

Money makers

The top 20 retailers driving profits and their winning strategies

Written by Ryan Doherty

Produced by The Creativity Club and Emily Kearns

In partnership with Brother UK

RW Guides brought to you by RW