Marketplaces deciphered

Your guide to unlocking global potential

In 2018, 59% of global ecommerce transactions occurred on marketplaces, and retail analyst Forrester predicts that figure will rise to 67% by 2022.

Estimates from global payments firm WorldFirst and the Centre for Economics & Business Research also suggest that marketplace sellers will contribute £21.3bn to the British economy by 2020 – up from £11bn in 2016.

Big names such as Amazon, Alibaba and ebay are the dominant global marketplaces, but as the popularity of this retail medium has grown, so too has the number of platforms launching in niche areas or new markets, or offering new and improved seller fees.

Marketplaces act as third-party sellers for products, allowing retailers to reach a wider audience and enter global markets that may otherwise have been out of reach.

Appealing to consumers owing to their wide variety of products, stringent delivery standards and often lower prices, marketplaces offer another channel for shoppers to access products online, multiplying brand exposure and driving new growth.

This Retail Week report, produced in association with ChannelAdvisor, provides a comprehensive overview of how retailers can capitalise on marketplace opportunities.

"As the popularity of this retail medium has grown, so too has the number of platforms launching in niche areas or new markets"

GROWTH OF MARKETPLACES

Marketplaces have evolved considerably since Amazon launched in 1994, as the activities of today’s ‘big four’ demonstrate.

The history of marketplace ecommerce began in the US with Amazon in 1994 and ebay in 1995 – now two of the biggest online marketplaces in the world.

Closely followed by Chinese competitor Alibaba in 1999, and later fellow US firm Google Shopping Actions in 2018, these now form the big four of the marketplace industry.

Below, we provide an insight into the incredible growth stories of these marketplace titans.

Amazon

- Launched in 1994

- Net global revenue of more than $232bn in 2018

- 300 million global users

Amazon’s 4-star store in New York

Amazon’s 4-star store in New York

Globally recognised as the world’s first and largest marketplace, as well as one of the biggest technology companies, Amazon began its life as an online bookstore in 1994.

Founder Jeff Bezos has since created an empire, with products ranging from the Kindle e-reader to the Fire TV Stick streaming media device, as well as cloud platform Amazon Web Services and tech-driven voice assistant Alexa.

Amazon uses the US market as its test-bed for innovations. Significantly, it has even branched out into bricks and mortar, launching its checkout-free Amazon Go stores and Amazon 4-star stores (which sell a curated selection of the highest-rated products on the website) since 2018. It plans to up its Amazon Go store count – currently at 17 – to 3,000 by 2021. The online giant also acquired food retailer Whole Foods in 2017.

Amazon operates dedicated websites for the UK, Australia, France, China, Germany, Singapore, UAE, Turkey, India, Italy, Canada, Japan, Mexico, the Netherlands, Spain and Brazil, as well as its original US website.

The UK, Germany and Japan are its core overseas markets, accounting for nearly 80% of its international sales. Due to competition with Chinese titans Alibaba and JD.com, Amazon Marketplace (its platform for third-party sellers) withdrew from China earlier this year, but it will continue to operate Kindle and Amazon Web Services in the Chinese market.

To sell on Amazon is simple – a pro-merchant seller account costs £28.50 per month to access all five European marketplaces (Germany, France, Spain, Italy and the UK).

Amazon’s obvious attraction is its vast customer base – it has more than 300 million global users.

Despite reports earlier this year that Amazon was being flooded by fake reviews, the retailer’s review system has also built trust between its buyers and sellers.

Earlier this year, Business Insider reported that 66% of US consumers begin their product search on Amazon. Moreover, 82% price-check on Amazon and 79% read Amazon reviews before purchasing.

Amazon should, in theory, be the first port of call when expanding into marketplace selling. However, one thing to be aware of is the growing inventory of its own products.

Ebay

- Launched in 1995

- Group sales of £8.1bn in 2018

- 182 million active buyers

Ebay has launched an image search tool

Ebay has launched an image search tool

Ebay began life as auction-only website AuctionWeb, with its first sale a broken laser pointer that went for $14.83.

Fast-forward to 2019 and ebay has 182 million active buyers across 23 international websites in Europe, the US, Asia and Australia, reaching more than 100 countries.

Ebay is yet to gain popularity in Africa and South America, but it does have a branded store on Latin American marketplace Mercado Libre’s Chilean website as of 2017. However, as 58% of sales are cross-border trade, ebay is the perfect springboard for an international ecommerce strategy.

The auction site offers its global shipping programme, allowing retailers to simply send products to its UK shipping centre while it takes care of factors such as customs, clearance and tracking.

Ebay shops work on three subscription levels – basic, featured and anchor. In general, the criteria for opening an ebay store is straightforward: a retailer must be PayPal-verified, register as a business seller and maintain an average score of 4.4 (for featured) or 4.6 (for anchor) or more for a 12-month average.

Shop owners are also in charge of their own online design, and new retailers should not underestimate the importance of achieving the right look.

The marketplace recently launched its Retail Revival scheme, a 12-month partnership with the City of Wolverhampton, designed to help small businesses launch online with dedicated support from a web team.

Ebay UK vice-president Rob Hattrell says: “Fast-forward 10 months and the 64 businesses on the programme have surpassed £4m in sales, a phenomenal growth of 40% year on year. Many of these have also expanded their premises and taken on new staff to cope with increased sales.”

Ebay is also innovating in AI. It launched an image search tool on its app last year, allowing customers to upload a photo of an item to generate similar product results.

Alibaba

- Launched in 1999

- Revenue of $54.5bn to the year ended March 2019

- 552 million customers

VR headsets at the Alibaba Singles’ Day shopping festival

VR headsets at the Alibaba Singles’ Day shopping festival

Chinese goliath Alibaba is the one of the world’s largest retailers and ecommerce companies. It comprises three main marketplaces – B2B Alibaba.com, C2C Taobao and B2C Tmall.

Named after the character Ali Baba from the Middle Eastern folk tale collection One Thousand and One Nights, founder Jack Ma chose the name due to its famous association with the phrase “Open Sesame” – aiming to open doors from Chinese retailers to the global market.

Since its inception, Alibaba has grown to boast a 60% share of the Chinese ecommerce market – reaching more than 552 million shoppers and 634 million monthly active mobile app users as of October 2018.

Alibaba’s primary sales event, Singles’ Day, generated $30.8bn last year – more than double 2018’s Black Friday and Cyber Monday online sales in the US combined, which amassed $6.2bn and $7.9bn respectively.

While not a recognised national holiday, Singles’ Day occurs on November 11 (so named for the fact that its numeric date, 11/11, represents four singles). During the 24-hour event, Alibaba.com and its other marketplaces offer massive discounts on products. In 2018, the marketplace made its first $1bn in just one minute and 25 seconds.

Singles’ Day is not just a sales event, though. Alibaba also hosts a countdown to midnight gala, broadcast on television and streamed online, featuring a host of celebrities and performances, with last year’s event including Mariah Carey, model Miranda Kerr and Cirque du Soleil.

This combination of “content, community and entertainment” shows the “interactive future of shopping”, according to David Lloyd, Alibaba’s managing director for UK, Ireland & Nordics.

Alibaba dubs this integration of online and offline commerce ‘New Retail’.

For UK retailers, Alibaba’s Tmall Global is the best way to enter the Chinese market. Launched in 2014, it allows European and US businesses to sell products to Chinese consumers and receive payment in their own currency.

Retailers must pay a refundable $25,000 deposit upon opening their online store, with an additional fixed yearly fee of $5,000 to $10,000 depending on their product category. Tmall also charges a product commission of 2% to 4% calculated using the product price and freight cost.

While somewhat expensive, Tmall Global allows UK retailers to ship from their own factories without a Chinese business licence or bank account, allowing them to test the waters in Asia.

Established this year, the Tmall Innovation Center (TMIC) conducts market research and uses consumer insights to help brands design and market new products specifically to the Chinese consumer.

An Alibaba representative explained that L’Oréal was able to identify five groups of male consumers in China, each with its own distinctive consumption patterns and beauty rituals.

“By understanding the touchpoints that matter to these individual audiences, TMIC has been a powerful tool for the beauty giant to be able to specifically target male consumers.”

Alibaba is also investing in technology, recently updating its online storefront. Customers’ suggested products can be viewed on the homepage, which also caters to individual preferences – for example, shoppers who love viewing content about products will be presented with live-streamed video content.

However, before entering this lucrative market, retailers should learn lessons from Marks & Spencer, which withdrew from China altogether in 2018 after a 10-year venture. The British veteran brand released its clothing line to Chinese consumers both in physical stores and on Alibaba’s Tmall.

M&S retreated from China citing “cost and complexity” after it struggled to compete with the “highly promotional online Chinese market”. M&S also failed to adapt its clothing to the Chinese consumer, according to Bloomberg, with label sizes that were hard to understand and poorly translated product names.

Before choosing to enter the Chinese market via Alibaba, therefore, retailers must consider both the hefty price tag and how to cater to a different type of consumer.

Google Shopping Actions

- Launched in 2018

- Google Express recorded 33% growth from Q4 2017 to Q1 2018

- 2 billion Google users

VR headsets at the Alibaba Singles’ Day shopping festival

VR headsets at the Alibaba Singles’ Day shopping festival

While Google has existed since 1998, Google Shopping Actions only launched in 2018.

Google Shopping Actions is a collection of major retailers and brands whose products appear on multiple Google subsidiaries – for example, Google Assistant, Google Home and the Google Express app.

The purchasing process then goes directly through Google, rather than sending the consumer on to a brand’s own website. Coupled with a universal shopping cart, Google Shopping Actions offers complete ease of transaction for customers.

For retailers, there is a pay-per-sale model – depending on the category, a commission of between 5% to 20% is taken, averaging at 12%.

Customer support and returns are also handled by Google, reducing the running costs of listing on the marketplace.

Currently, Shopping Actions is only available in the US and France. However, UK retailers can join the marketplace as long as they have a US or French bank account and the ability to meet local fulfilment within those countries.

For this reason, Google Shopping Actions is perhaps better kept in mind for a later date for smaller retailers that can still use Google Shopping.

Google Shopping uses a pay-per-click model, where retailers pay a chosen amount each time a customer clicks on an ad (the more they pay, the higher Google places it), which then carries them to their own website – the higher the cost-per-click, the higher the visibility of the shopping ad.

Product focus

While these are considered to be the big four platforms, in recent years there has been an explosion of marketplaces specialising in product categories – from general merchandise and DIY to clothing and beauty.

According to Tony Preedy, chief commercial officer for European marketplace Fruugo, marketplaces offer retailers a chance to extend their digital footfall without investing much capital.

This is especially true for SMEs looking for new sources of growth and wishing to break into foreign markets that are otherwise inaccessible.

Marketplaces are a good way to test new territories and many offer personalised marketing services, translation services and fraud protection, bringing ROI on the costs of listing with both a pay-per-sale or a subscription-based model.

"Marketplaces offer retailers a chance to extend their digital footfall without investing much capital"

Forrester retail analyst Michelle Beeson attributes the popularity of marketplaces to consumers’ desire for ease of purchase, with the ability to access thousands of products in one place with personalised shopping experiences.

Beeson also notes the “hyper-focus” of marketplaces as an attractive proposition, such as Zalando for clothing, Beauty Bay for beauty, or Etsy for handicrafts – all destinations for people seeking a certain type of product.

While some are worried about the dominance of Amazon, Beeson claims the retailer’s growth has propelled the proliferation of marketplaces, which both compete with and complement Amazon’s retail proposition.

Marketplaces act as the gateway for retailers wishing to expand their international ecommerce strategy in a controlled, low-cost and relatively risk-free way.

BEYOND THE BIG FOUR

Who are the emerging marketplace players? We profile eight of the best.

Before listing products on one or more marketplaces, retailers must first consider which ones are most appropriate for their needs, what the requirements are for entry and how to use them to the greatest advantage.

The number of marketplaces globally has grown over the past few years, and it can be difficult to decide which one to use. Below, we outline the most established and fastest-growing marketplaces worldwide.

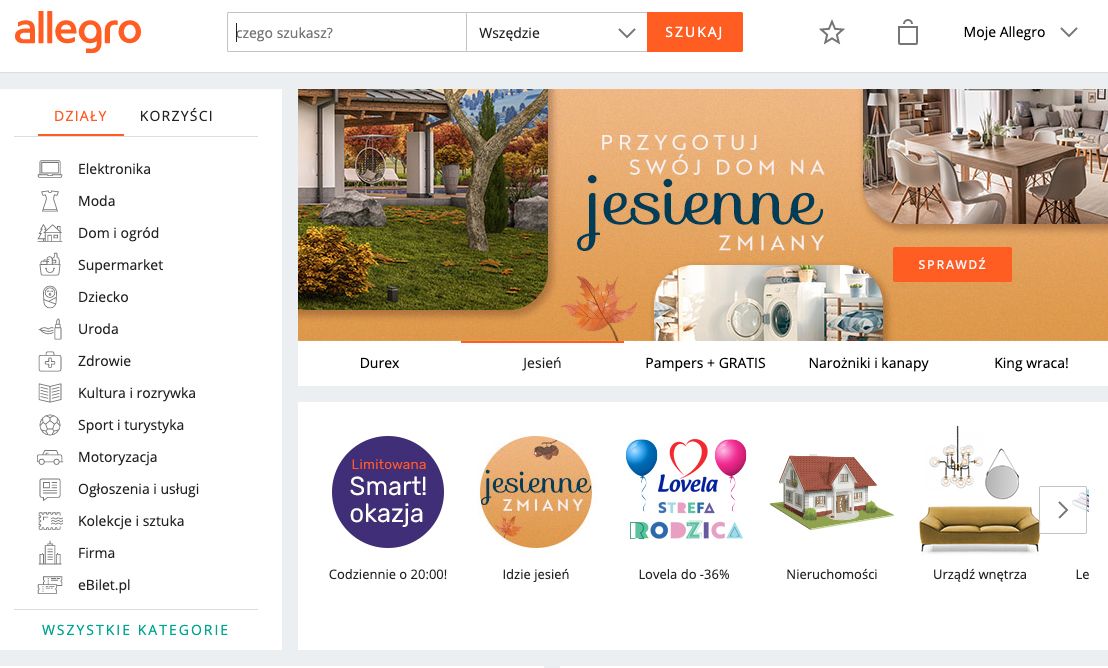

Allegro

- Launched in 1999

- Revenue growth of 13.6% in 2018

- 14 million active users

Central and Eastern European marketplace Allegro is Poland’s biggest ecommerce marketplace and search engine, holding 80% of market share. Polish ecommerce overall is outpacing the rest of the EU, registering 23% year-on-year growth, as opposed to the 18% average. This makes Poland a great market to trial.

There is no requirement for a Polish bank account or Polish returns address on Allegro, although the latter is recommended. It is also recommended to have a Polish speaker to help list items and provide customer service, as language is the biggest barrier retailers experience when selling on the marketplace.

Allegro charges commission of between 2% and 10%, depending on the product category, making it cheaper than most marketplaces. It also boasts a 97% retention rate for its 14 million active users.

Cdiscount

- Launched in 1998

- Revenue of €1.96bn in 2018 (registering the highest growth in its parent company Casino Group, despite overall group losses)

- 9 million active customers

Cdiscount is a major French marketplace, known for its discounted technology offerings. It charges a monthly subscription fee of €39.99, plus a commission on the total transaction amount, ranging from between 5% and 20%, depending on the product category.

Cdiscount also requires sellers to offer French-language customer service via email and provide either a French returns address or a prepaid shipping label to pay for international returns. For shipping, sellers decide their own costs, with the ability to set a sliding scale if more than one product is bought.

An additional option Cdiscount offers is moving the entire fulfilment process to the marketplace – including storage, packing and shipping – with rates varying, depending on the length of storage time and the weight of the product.

Cdiscount is actively seeking foreign sellers to round out its product categories, particularly in home furnishing, jewellery and luggage. Its key focus is price, so retailers must be willing to be competitive.

Flipkart

- Launched in 2007 (now owned by Walmart)

- Revenue growth of 50% in 2018 financial year (but losses increased fivefold)

- 100 million registered users

Flipkart is India’s biggest online marketplace, reaching more than 100 million active users. In order to list on Flipkart, UK retailers must partner with an Indian representative to act as the registered seller and handle operations in India, including product listings, customer service, shipping and returns.

Flipkart gives standard, one-day or same-day guaranteed deliveries and returns within 10 or 30 days depending on the category. Deliveries are fulfilled by Flipkart, so either the retailer or the representative must send products to the marketplace fulfilment centres. Sellers then need a local address for returns.

In India, cash on delivery is the preferred payment method, with more than 50% of online sales paid to the delivery driver. Flipkart charges a 5% to 25% commission rate per sale, depending on the product category, but no other fees.

It has also introduced a Hindi interface to appeal to the growing customer base of Indian internet users, which is expected to rise from 251 million to 290 million by the end of the year.

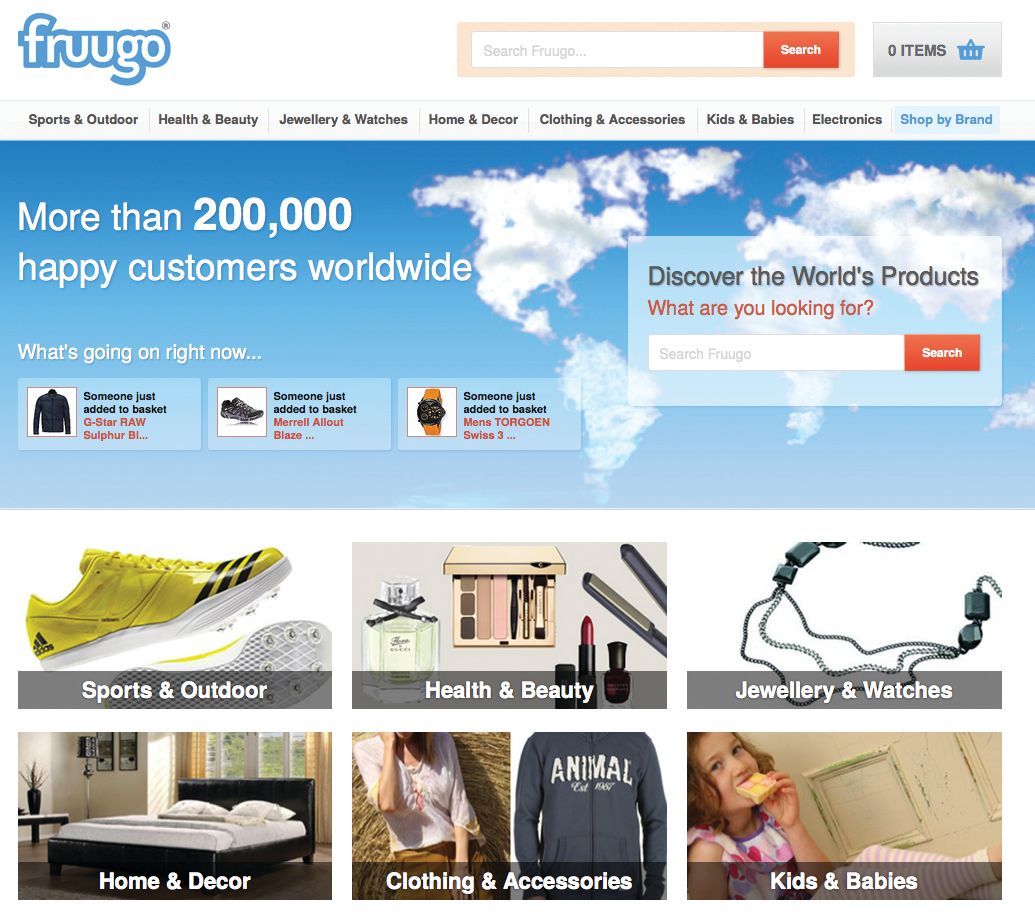

Fruugo

- Launched in 2010

- Four consecutive years of triple-digit growth up to 2018

- 25 million active users

Fruugo was set up to specialise in internationalisation by connecting British sellers with buyers around the globe, according to chief commercial officer Tony Preedy.

Fruugo offers in-house translation services, uses localised payment services for each country and provides localised customer service. It also offers a no-sale, no-fee model and retailers can benefit from its partnerships with global comparison search engines.

While its commission is slightly higher, at around 15%, the services Fruugo offers outweigh the higher cost.

JD.com

- Launched in 2004

- Revenue of $67.2bn in 2018 – a 28% increase from 2017

- 352 million active users

JD.com is pioneering tech such as delivery drones

JD.com is pioneering tech such as delivery drones

While Alibaba’s Tmall is the reigning Chinese marketplace, JD.com is its big competitor and known for its artificial intelligence technology, from delivery drones to driverless delivery vehicles.

The marketplace runs a JD Worldwide initiative to encourage cross-border trade (CBT), similar to Tmall Global. JD.com has also partnered with logistics services such as DHL to help with delivery.

One stipulation UK retailers should note is that they must have a USD bank account to apply to the marketplace. JD.com also requires a deposit of $15,000 and charges a yearly fee of $1,000 plus 2% to 8% commission per product. While this is still not a low-cost option, JD.com charges less than Tmall, so could be a more achievable way to enter the Chinese market.

Miya Knights, head of industry insight at software-as-a-service company Eagle Eye, also noted that both JD.com and Alibaba’s Tmall have overtaken Amazon in popularity in Russia and India.

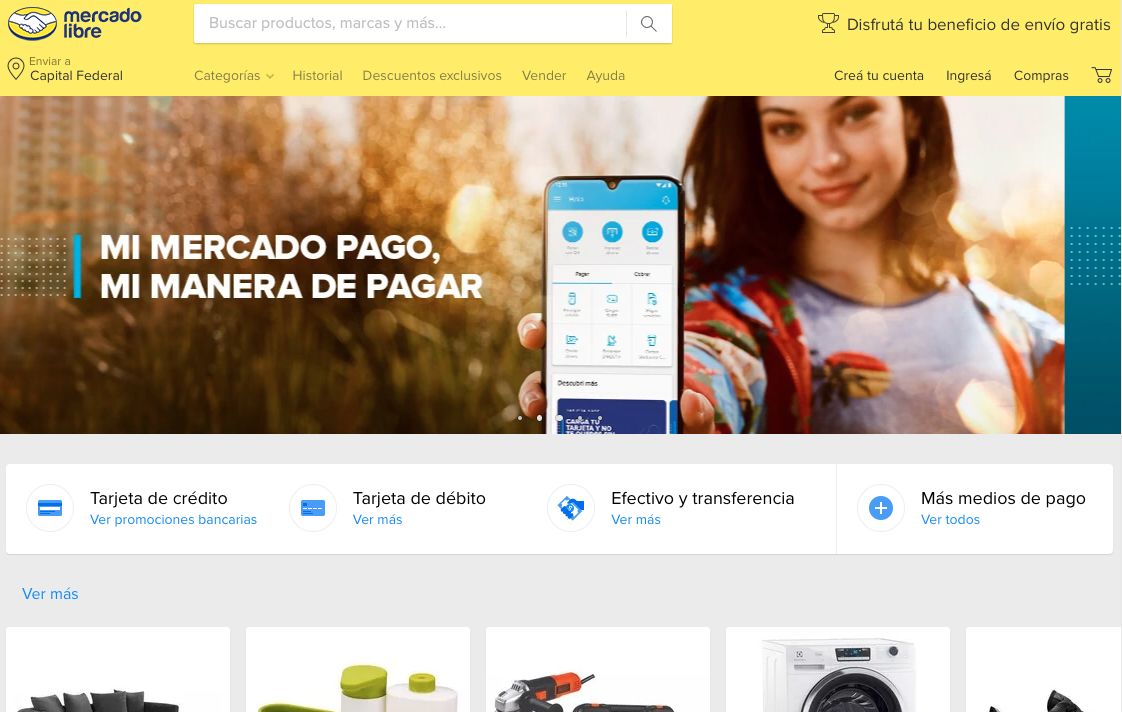

Mercado Libre

- Launched in 1999

- Revenue of $1.4bn in 2018

- 280 million registered users

Mercado Libre is the largest retail marketplace in Latin America, operating across 18 countries within the region. Like ebay, the marketplace offers either auction or fixed-price product listings.

It also operates a CBT programme, encouraging international sellers to list on the website as long as they can run operations in the US. As of August 2019, CBT is only available for buyers in Brazil, Mexico, Argentina and Chile. As a UK retailer, logistics and finances would therefore need to be handled in the US. Products must be sent to Mercado Libre distribution centres, which will then be delivered to the buyer.

To account for expenses such as translation services, importation taxes and customs, Mercado Libre presents buyers with a total landed cost, meaning they pay the total product price, including such fees. Like Flipkart, UK retailers wishing to sell on Mercado Libre must weigh up the costs of running operations abroad. Retailers are charged a commission after sale – 17.5% if selling in Mexico and 16% elsewhere.

OnBuy

- Launched in 2016

- Year-on-year growth of 1,300% in the year to March 2019

- 8 million customers

OnBuy chief executive Cas Paton says that his marketplace aims to look after both the buyer and the seller, encouraging them to list all products as it does not carry its own competing inventory.

Paton describes OnBuy as a hybrid between ebay and Amazon – a catalogue marketplace that lists multiple sellers for each individual product. The business is developing its own fulfilment service, but retailers are currently responsible for this aspect.

It operates in 51 countries and charges commission fees of up to 9%, so it is a low-cost option. Describing itself as the number-one UK-owned marketplace by traffic, OnBuy also offers extensive marketing campaigns in all its countries to help drive sales.

Zalando

- Launched in 2008

- Revenue growth up 20% in 2018 to €5.4bn

- 26.4 million customers

German marketplace Zalando wants to be “the starting point for fashion”, with ambitions to hold a 5% share of Europe’s fashion market, which is forecast to grow to €450bn within the next five to 10 years.

Currently holding 1.5%, Zalando is still Europe’s largest fashion retailer. Operating in 17 countries, it reaches 26.4 million customers. Its main draw for shoppers is its free delivery and 100-day free returns policy, the feasibility of which retailers will need to consider before listing on the marketplace.

To help with this, like Fruugo, Zalando offers localised fulfilment, payment and customer service. While the marketplace does hold its own inventory, it plans to focus more efforts on its partner programme, with fashion brands selling in-season products that do not have to compete on price with end-of-stock or unbranded goods, as they would on Amazon.

Zalando primarily sells apparel and shoes, but it has now ventured into the beauty sector, including a partnership with beauty retailer and marketplace Feelunique, announced in August.

Making the most of marketplaces

There are a number of ways that marketplaces can be used. OnBuy’s Paton says they should be a supplement to a traditional multichannel strategy, to drive exposure and growth.

Paton says retailers would be prudent to list on multiple appropriate marketplaces, but to price pragmatically.

As a trusted global marketplace, products listed on Amazon could be priced higher, versus a newer or niche marketplace where a lower price might drive conversion rates.

Choosing which products to list on marketplaces is down to a retailer’s discretion; some may choose to list all products to increase sales.

"As a trusted global marketplace, products listed on Amazon could be priced higher, versus a newer or niche marketplace where a lower price might drive conversion rates "

However, alternative strategies could include listing only new products to trial them; listing bestselling products to establish a presence in a foreign market; listing end-of-season products to clear old lines; or listing products in only one colour, for example, to drive customers to the retailer’s own store for alternatives.

The key for retailers using marketplaces is not to compete too much on price with their own websites.

Forrester retail analyst Michelle Beeson warns of the grey market, in which unauthorised products or copies can be sold on marketplaces at reduced prices. She says few marketplaces have stringent enough restrictions on the authenticity of goods sold on their websites, therefore brands must put safeguards in place themselves.

Forrester suggests retailers establish a “minimum advertised price” policy, review their supply chain to check for any weak links and educate their customers on the benefits of buying legitimate products.

One marketplace that has attempted to combat counterfeiting amid global backlash is Alibaba’s Tmall.

Last year, in the run-up to Singles’ Day, Tmall began to introduce blockchain technology for all the items in its Luxury Pavilion. This records the origin, raw materials and processes behind each luxury item. Customers can then trace the data on the website or scan a product’s QR code, reducing the chance for counterfeit goods to be sold.

Tmall also announced a commitment to swiftly remove fraudulent listings, which all customers have the ability to report via its AliProtect system.

The Brexit effect

Of course, one thing retailers should also consider regarding marketplaces is the impact of the UK’s eventual exit from the EU.

Fruugo’s Preedy argues that a no-deal Brexit will provide similar – or greater – opportunities for retailers wishing to sell on marketplaces.

“Analysts predict a depreciation in the pound following Brexit, therefore British products will appear cheaper and could potentially sell better consequently,” Preedy says.

“It is useful for UK retailers to appear on marketplaces outside the EU because, even with no deal, new tariffs should be offset by the depreciation.”

Paton agrees that marketplaces are a low-risk option, even with Brexit, as many of them work on a no-sale, no-fee basis.

"Analysts predict a depreciation in the pound following Brexit, therefore British products will appear cheaper and could potentially sell better consequently"

NICHE MARKETPLACES TO WATCH

These specialist examples have carved out their own distinctive offering to corner a particular section of the market.

While Forrester’s Beeson predicts that established marketplaces will continue to grow, she also foresees a proliferation of marketplaces with a specific value proposition or niche product range.

Beeson particularly points to the popularity of sustainable, vegan and ethically sourced products as a springboard for new marketplace ideas.

Eagle Eye’s Miya Knights also says she is “keeping an eye on marketplaces built on blockchain technology, like Forra.io or Russian grocery specialist INS”.

For marketplaces, blockchain would assist with issues such as payment security, fraud and the grey market, as the transparency of all processes holds both sellers and buyers accountable.

There is already evidence of these specialised marketplaces within the retail ecosystem, as these examples demonstrate.

Etsy

- Launched in 2005

- Revenue of $603.7m in 2018

- 39.4 million customers

Etsy is a marketplace for handmade and vintage goods, which makes it suitable for smaller retail enterprises wishing to grow their exposure and sales.

Since 2013, Etsy’s rules allow retailers to outsource production of goods and still class them as handmade, as long as the original idea for the product comes from its respective seller.

To list on Etsy, sellers are charged $0.20 per product listing and 5% commission per sale.

Farfetch

- Launched in 2007

- $602m revenue in 2018

- 2.8 million active customers

Farfetch brings together luxury apparel from both famous brands and emerging boutiques in one marketplace, shipping to 190 countries. However, it also positions itself as a technology business that “exists for the love of fashion”.

The marketplace’s key focus is bringing global customers to retailers that would never normally encounter each other. Farfetch’s director of marketplace strategy Simon Domone says: “We look for boutique and brand partners that can enhance our offering and give our customers access to the most exciting and wide-ranging fashion.

“We also look for partners that share our values around outstanding customer service and will uphold our high standards, quickly delivering beautifully packaged products to our customers.”

So, to appear on the marketplace, retailers will have to impress as a brand.

Farfetch is also looking for cutting-edge retailers to work with and aims to share its tech to leverage a better ecommerce strategy. Earlier this year, the marketplace announced a partnership with JD.com to launch its luxury products in the Chinese market.

Feelunique

- Launched in 2005

- Annual sales of $100m in 2018

- 65% of customer base is aged under 35

Feelunique is a hybrid beauty retailer and marketplace. Chief operating officer Jim Buckle explains that it carries most well-known beauty brands on a wholesale basis, but operates a marketplace model for: small brands to work with on a trial basis; brands in supplementary categories, for example, health products; and more individual or luxury brands that have a strong presence in terms of packaging.

For UK retailers, Feelunique is an attractive proposition because of its dual nature and customer base spanning more than 100 countries. Unlike most marketplaces, however, to be listed on Feelunique retailers and brands will have to first get noticed by the marketplace’s buyer, so they must ensure their offer is both innovative and exciting.

ManoMano

- Launched in 2013

- Reported 85% increase in revenue in 2018

- 2.5 million active clients

ManoMano is a DIY marketplace operating in Western Europe. New UK sellers on ManoMano will initially be launched on the UK website only, with the option to enter different markets once they have built up a good reputation.

ManoMano’s focus is on the quality and reliability of services, so retailers must adhere to strict principles and will be put through a screening process to be accepted as a partner on the marketplace. Once accepted, prices must be in line with the retailer’s own website and any other marketplace they list on. Commissions are negotiated on a case-by-case basis.

Notonthehighstreet

- Launched in 2006

- Recorded £40.7m revenue in 2017

- More than 39 million unique visitors annually

A hub for creatives, Notonthehighstreet is a marketplace that specialises in innovative, crafted and personalised products. Like Etsy, the marketplace is perfect for small retail businesses looking to expand their customer base.

Retailers must pay a one-off joining fee of £199 and 25% commission on each product.

Key to retail landscape

Knights says that this proliferation of marketplaces can only be good news.

“For the customer, more competition will drive prices down and choices up,” she says.

“For retailers and brands, it forces marketplaces to offer more attractive warehousing, fulfilment, and product price and listing capabilities, as well as develop more compelling advertising and data analytics services.”

Ebay’s Rob Hattrell believes that marketplaces are a key part of the retail landscape.

He says: “They are proven to be attractive to buyers, and with consumer shopping habits moving increasingly online, their place in the world of retail is here to stay.

“Retailers that succeed will be the ones that increasingly take advantage of these opportunities.”

"Marketplaces are proven to be attractive to buyers, and with consumer shopping habits moving increasingly online, their place in the world of retail is here to stay"

THE FUTURE OF MARKETPLACES

Drone delivery, automation and immersive technologies – the sky’s the limit.

As the number of marketplaces grows, each one will need to innovate to stand out from the crowd – to attract both retailers as sellers and consumers as buyers.

“There is always room for new or existing marketplaces to use technology to offer both sellers and buyers some kind of competitive differentiation,” says Eagle Eye’s Knights.

Spurred on by Amazon’s next-day, same-day and two-hour offerings, marketplaces will need to streamline their fulfilment services to offer faster and more efficient delivery.

"Marketplaces will need to streamline their fulfilment services to offer faster and more efficient delivery"

Time to fly higher

To dial up their delivery, marketplaces and retailers will have to invest in innovations including robotics and automation.

Following in the footsteps of Chinese marketplace JD.com, delivery drones could be used to dispatch items to customers in a matter of hours or even minutes.

Since 2016, JD.com has piloted drone delivery across China. The service has focused on reaching customers in remote locations, such as those living in mountainous areas that would be difficult to access otherwise.

Earlier this year, the Chinese tech titan expanded its drone service with a government-approved test delivery in Indonesia.

This drive towards fast, frictionless service can also be achieved with autonomous delivery vehicles, factories and distribution centres. Such systems can reduce packing time and staff costs, and lead to improved delivery success.

One to watch: blockchain

Blockchain can be used to eliminate uncertainties in the supply chain. For marketplaces, this means reducing the risk of payment fraud, as both sellers and buyers are connected directly in a transaction.

As in the case of Alibaba’s Tmall, blockchain can also be used to verify the authenticity of goods.

This could be applied to the sustainability trend that Forrester’s Beeson predicts will become a popular focus in the future, as mentioned in the previous chapter.

Using blockchain, customers will be able to see the journey of their product from farm to table to guarantee its sustainable credentials (this could include information such as origin, transportation and packing).

The shopping experience

Technology could also be used to change how customers shop on marketplaces.

Knights suggests: “For customers, marketplaces could target the use of more immersive technologies, such as AR and VR, to bridge the gap between browsing online and being able to physically touch the products on sale as you can in a store.”

AR has begun to gain some traction in retail. US beauty retailer Sephora launched an AR tool on its app in 2017. Customers can take a selfie and use the tool to visualise different make-up looks before purchasing products.

Both Amazon and Alibaba offer AR functions that allow customers to drop virtual products into their homes, viewing them through their smartphone camera to decide if they fit in with the room.

"Marketplaces could leverage AR to allow customers to virtually try on clothing, take a picture and share the look on social media"

And ebay uses AR in the packaging process with a tool that allows sellers to select different-sized boxes to virtually check if a product will fit inside them.

The possibilities for AR in the marketplace world are vast, especially in allowing customers to try before they buy.

For example, to capitalise on the Instagram generation, marketplaces could leverage AR to allow customers to virtually try on clothing, take a picture and share the look on social media.

Deploying AR in this way could reduce delivery and returns expenses, while still allowing customers to spread awareness of the brand with this shared content.

Amazon is in the process of developing AR technology to expand on this. By analysing a customer’s social media photographs, the tool will create an AR double that can then virtually try on clothes.

The analysis will also establish a person’s job, lifestyle and personal preferences to suggest potential outfits. This sort of AI has a place in the future of marketplace ecommerce.

Most notably, ebay introduced a visual search tool last year. As marketplaces carry multiple similar products, this tool will become essential for reducing customer frustration by helping to select the closest product to the one that is being searched for.

Powering personalisation with technology

Personalisation is key to customer satisfaction. Alibaba’s Tmall website, which displays video or written content depending on customer preference, is a great example of this.

Speaking about the Tmall marketplace concept Flagship Store 2.0, which launched earlier this year, Alibaba’s Lloyd explained: “Each retailer’s storefront on Tmall has been designed to feature more personalised experiences for consumers. Likely purchases are placed on a store’s first page, rather than making shoppers search for the things they want.

Retailer storefronts on Tmall feature personalised experiences

Retailer storefronts on Tmall feature personalised experiences

“In addition, algorithms collect and compare vouchers and cashback promotions, calculating the best prices after discount available.

“The updated stores also cater content offerings to individual preferences. Users who love watching videos will see more short-form video content than those who enjoy shopping via livestream.”

The retail landscape

It’s evident that the number of marketplaces will accelerate over the next few years. So, longer term, what does this mean for retailers’ own websites? Will retailers instead focus their energies on listing products on marketplaces?

This depends on the size and scope of the retailer in question. As a way to enter new territories, marketplaces are a cost-effective and risk-free way for all types of retailers to take products to international consumers.

"Retailers that do not use marketplaces as part of their multichannel offering are likely to miss out"

While marketplaces will probably not replace retailer websites completely, retailers that do not use marketplaces as part of their multichannel offering are likely to miss out.

The growth of marketplaces will ultimately drive innovation and lead to greater competition to offer the best proposition for retailers and customers alike.

Farfetch’s Domone summarises: “The emergence and increasing popularity of marketplaces is a positive thing for retail, given the innovation and customer focus brought by these new models.”

PARTNER COMMENT

The explosion in marketplaces is also an opportunity for brands and retailers to expand.

With nearly half of all product searches beginning on marketplaces,[1] these channels have become an essential strategy for multichannel success. Consumers now use multiple marketplaces in their buying journey, exploring an endless aisle of products, comparing prices and reading reviews. And it’s not just browsing. By 2022, 67% of global transactions will take place on marketplaces.[2]

If you look at the mindset of the modern consumer, many of their expectations have evolved from their experiences on marketplaces: endless choices; low, competitive prices; easy checkout; fast, free and convenient delivery.

With customers across the world choosing to shop on marketplaces over direct channels, we’ve seen an explosion in choice. From the expansion of behemoth generalists such as Amazon and ebay to specialised offerings across niche verticals, there’s no shortage of marketplace opportunities vying for your customers’ attention.

Quicker and safer way to go international

For brands and retailers, this means opportunity. Expanding to new marketplaces is considered one of the safest and quickest ways to enter new territories and expand internationally. But with so many channels to choose from, you need to become an expert at spotting the best destinations for your products – and then learning how to maximise your impact once you’re there.

"Consumers are using multiple marketplaces, across multiple regions, using multiple devices. It’s time for brands and retailers to tap into this opportunity"

From the start, focus on the unique audience of each marketplace, make sure your listings are optimised and ensure you are compliant with each marketplace’s listing requirements. Then, consider how you will maximise marketing spend and drive more traffic to your listings.

Finally, optimise your fulfilment strategy to provide a fast, efficient delivery every time. To be successful, brands and retailers need to put today’s consumers at the centre of their efforts and develop advanced strategies across the entire buying cycle – from marketing, to selling, to fulfiling.

Consumers are using marketplaces more than ever – multiple marketplaces, across multiple regions, using multiple devices. It’s time for brands and retailers to tap into this opportunity by expanding to more marketplaces, in more countries, in less time.

[1]https://www.emarketer.com/content/more-product-searches-start-on-amazon

[2]Forrester

Jon Maury

Jon Maury

Jon Maury is managing director EMEA at ChannelAdvisor, a leading ecommerce cloud platform whose mission is to connect and optimise the world’s commerce.

Since joining ChannelAdvisor in 2017, Maury has been responsible for developing the company’s local strategy and direction for growth.

He has more than 15 years’ experience of management and sales leadership, including roles at Automic, BMC and Identify Software.

Marketplaces deciphered

Your guide to unlocking global potential

Written by Rosie Shepard

Produced by James Knowles, Emily Kearns and Rebecca Dyer

In partnership with ChannelAdvisor