Brand loyalty is now hard won, difficult to maintain and easily lost. Consumers are hyper-sensitive to price, crave authenticity and have retailers queuing up to give it to them.

The cost-of-living crisis has thrust this delicate balance into the spotlight. Discretionary spending in particular has been hit hard as UK inflation, while having reduced from a 40-year high of 9.6% in October 2022 to 6.3% in August 2023, still sits at the highest rate since November 1991, according to the Office for National Statistics (ONS).

However, there are some positive economic tailwinds that make for a more promising outlook.

UK consumer confidence continues to increase – it rose to -21 in September, the best recorded showing since January 2022, according to the latest GfK Index. As of August 2023, total retail sales are now 17.3% higher in value terms than they were in February 2020, according to the latest ONS figures.

Green shoots are all well and good, but how do retailers set them flourishing?

In the summer of 2023, Retail Week – in partnership with American Express – brought together a group of UK retail executives, industry leaders and a consumer behavioural expert to help answer this question.

All agreed that retailers and brands will only succeed if they can turn their customers into brand advocates. Therefore we’ve created a guide with actionable takeways on how to make that shift.

We were also granted access to findings from interviews with 2,000 UK consumers, conducted by our partner American Express, revealing their loyalty drivers and what factors turn them on to – and off – brands.

The insights have been shared throughout this guide to help retailers inform their customer strategies for the remainder of 2023 and into 2024.

WHAT ARE ADVOCATES?

These are customers that, over time, protect your brand and act as guardians of it. It requires long-term relationship development

Who we spoke to

Value – what you get as opposed to what you pay – is increasingly what matters to shoppers and is closely linked to loyalty.

In fact, the research from American Express shows 51% of shoppers today see value as being more important than customer service. If retailers get it right, there are rewards to be won with 21% of consumers asserting that they are more loyal to retailers than they were this time last year.

The Very Group chief marketing officer Jess Myers highlights that, while the cost of living has “of course increased customer demand for value, this doesn’t just mean price”.

For Myers inspiring loyalty beyond cost requires “structuring the shopping experience, diversifying products and ranges, and offering flexible ways to pay to add real value for customers”.

With £2.1bn revenue for the year to 2 July, 2022, and 4 million customers as of June 2023, The Very Group has evolved its offering to combine price with value. In February, it expanded its low-cost value range Everyday – with prices 20% less than standard – by 900 products following strong demand.

In December 2022 The Very Group launched its virtual try-on AR cosmetics tool

In December 2022 The Very Group launched its virtual try-on AR cosmetics tool

That same month it launched AI product discovery on its website and app to enhance the customer shopping experience. This followed the December 2022 launch of its virtual try-on AR cosmetics tool to provide a more immersive experience to customers shopping with makeup brands such as L’Oréal Paris, Maybelline and NYX – enabling them to make better purchasing decisions, and therefore derive greater value.

Fighting for discretionary spend

There is a marked difference between what value now means to customers in non-discretionary and discretionary retail.

FSB chair of retail Michael Weedon explains: “Looking at latest ONS revenue figures, for the first time we’re seeing mainly food stores overtake expenditure on the discretionary side and for years this hasn’t been the case. Most of our [160,000] members are trading in discretionary and they’re finding it hard.”

For BIRA chief executive Andrew Goodacre, representing the organisation’s 4,000 retail members, this is a “real problem” with customers focused on “essential spending, whether that’s food, energy and mortgages, and that not only stops people spending on discretionary items but is changing the volumes in which they’re purchasing”.

He says his retailers are seeing “fewer impulse purchases being made” and that “customers still want more value”. For his retailers, this is being achieved through offering “product bundles, greater convenience and increased levels of customer service”.

BRC director of insight Kris Hamer points to the positives with “the economy is more robust than anticipated, and sales values are ticking up”. However, he echoes Goodacre’s comment that “volumes are falling” and notes “this is even the case for food retailers that, on the surface appear to be doing really well, but are not seeing the same volumes they used to”.

Evolving loyalty schemes

Loyalty is being impacted by generational differences. Retail Week analyst Beth Bloomfield says Gen Z are more “protected” from the cost-of living crisis and therefore have been “lining the pockets of retailers such as JD Sports [which topped £1bn in sales in May]”, but she also says this group are falling more into a “want-it-now mentality”.

This is translating into evolving loyalty schemes, according to Bloomfield, with retailers such as Boots adapting its loyalty Advantage Card with new ‘Price Advantage Deals’ to cater for customers who “don’t want to save up their points, but would prefer to spend their money now”.

The research backs this up; 53% of shoppers said they now prefer instant savings over accumulated points. Boots’ approach is paying off – in July it reported customers with an Advantage Card had saved almost £50m through Price Advantage deals since January 2022.

Boots says customers have saved almost £50m through its loyalty card scheme since January 2022

Boots says customers have saved almost £50m through its loyalty card scheme since January 2022

UK consumers are embracing loyalty schemes, with 94% of the consumers surveyed signed up to at least one loyalty scheme and 59% saying they would now consider using a retailer’s loyalty scheme amid the cost-of-living crisis.

Retailers would be advised to invest in a scheme – indeed many already are. In July alone, the Co-op started offering rewards for members and their communities through its online grocery partnership with Uber Eats, OnBuy became the first marketplace to offer cashback loyalty rewards, and Selfridges launched its Selfridges Unlocked membership scheme to offer shoppers access to “the best product launches, events, news and free shipping”.

Retailers must invest in their stores as a tool for customer loyalty and merge this with online activity.

Consumers are looking for richer experiences in store with the American Express research indicating 37% are more likely to make a purchase if they are shopping at a store with special products or features, jumping to 62% among millennials (18- to 34-year-olds). Pop-up events, use of augmented reality (AR) technology, in-store hospitality services and entertainment are popular requests of what consumers want to see, according to the research.

Hackett UK retail director Ramon Zevallos has been with the luxury menswear retailer for four years. With Hackett reporting EBITDA of £4.06m in the year to March 2022, a swing from a loss of £8.55m in the previous period, Zevallos credits the growth – the best under his tenure – to “surprising and delighting customers”.

Customers want VIP treatment

“We offer customers experiences money can’t buy,” says Zevallos. “In store we do a lot of servicing, so if customers want to bring in their shoes for polishing or resoling, if they want in-house tailoring or if they want to have a gin and tonic while they shop, then we offer it.”

Hackett has invested in making its stores, such as Savile Row (pictured), more immersive with relaxation areas and cocktails

Hackett has invested in making its stores, such as Savile Row (pictured), more immersive with relaxation areas and cocktails

Of course, not all retailers can offer premium services as Hackett does, yet Zevallos says the emphasis should be on “making customers feel like VIPs”.

“I’ve taken some of our customers to the British Grand Prix through our collaboration with Aston Martin; we’ve taken couples to an exclusive vineyard trip with executive chefs; and we frequently hold business lunches for our corporate customers."

LK Bennett digital and marketing director Zoe Donovan agrees and says value is “not simply about price for us as our shoppers are happy to be rewarded in other ways”. This extends to inviting customers to experiences.

“We run lots of competitions where customers can engage with us, and they get excited. Having their photo taken at Royal Ascot and it then being shared on LK Bennett’s Instagram is something that they appreciate and enjoy. Top feedback we’ve received – and this is from women who are maybe in their 50s and not necessarily that active on social media – is about how special they felt.”

LK Bennett competition winners having their photo taken at Royal Ascot and then shared on the retailer's Instagram feed

LK Bennett competition winners having their photo taken at Royal Ascot and then shared on the retailer's Instagram feed

LK Bennett has seen sales soar with revenue in the year to 31 January up 30% on the previous year to £49m and EBITDA hitting £4m – three times that of last year. The fashion retailer’s strategy, according to Donovan, is centred around making the customer “feel really special”. She adds: “This is either in person or in digital communications through competitions, PR evenings that customers can attend, and co-creation such as creating shoes with bespoke dates on for your wedding or birthday.”

“It’s about the little bits of added value we can do as a brand to offer something different to customers and make it clear as to why that value is there.”

Avoiding pigeonholing consumers

HMV UK is also doubling-down on loyalty to revive its fortunes and its strategy is paying off. For the 2021/22 financial year, the retailer recorded 66.8% revenue growth to £150.8m while gross profits increased 64% to £65.4m. It now operates 119 UK stores with a flagship Oxford Street store (pictured) set to reopen by the end of 2023.

Its chief marketing officer Patrizia Leighton, who has been with the retailer since 2013, says the company’s restructuring has been focused on understanding customer differences.

“We’ve got various ‘fandoms’ that we recognise and that are important to our brand DNA. It really is about how you surprise and delight those fans.”

Leighton’s approach to driving loyalty is a combination of listening to customers, embracing local communities, and creating authentic relationships: “We closely review what customers say on the ground, what they’re looking for and what they need, and that’s the overall insights piece that we keep an eye on. Beyond that there’s the strategic direction of the business and where those customer insights fit to inform where we need to go.

“We’ve also opened more of our shops to become ‘local community experience destinations’’. These are stores which, every weekend, host live and local acts in the community. This brings authenticity when it comes to building customer relationships – you need face-to-face interaction.”

Customers are increasingly expecting frictionless shopping experiences. But what does ‘frictionless’ really mean?

BIRA’s Goodacre says, on entering an “Amazon Fresh store a couple of months ago, I walked in and out and didn’t talk to anyone. It was a soulless experience in many ways”.

Chief behavioural officer at Humanising Brands Kate Nightingale chimes with this view and says “frictionless is actually meaningless as it’s a non-memorable experience and doesn’t drive loyalty”.

HMV’s Leighton says customers are “happy to have a level of friction and engagement”, while the FSB’s Weedon says for non-essential purchases, he believes customers want “more interaction and a level of human service” due to there being more consideration involved. So with mixed opinions, how should retailers get CX-driven loyalty right?

What customers want

Online, customers seek out the following for a valuable experience, according to the research from American Express:

- Clear shipping and delivery information (38%)

- Being able to use preferred payment methods (29%)

- Flexibility to make changes to an order/go back (28%)

- An easy-to-use website (21%)

- Good delivery service (18%)

- Smooth checkout process (14%)

In store, checkout is absolutely crucial to driving consumer loyalty, with 42% of consumers surveyed stating they haven’t returned to a store due to slow checkouts, while 28% haven’t returned due to a lack of payment options. The most important factors for a valuable experience in store were cited as:

- Friendly staff (50%)

- Well-managed queues (40%)

- Self-checkouts (31%)

Emotional engagement

Nightingale advises retailers to avoid falling into the trap of a “one size fits all” approach to CX-driven loyalty. Some customers, as the research indicates, want to use self-checkouts, while she notes that Sephora has rolled out colour-coded shopping baskets that indicate whether or not customers would like to be assisted in store.

She says: “Retailers should be focused on elevating every tiny moment and interaction that customers have.”

American Express vice president and UK general manager of merchant services Dan Edelman notes that, while the research shows “customers say they’ll always go for price, [but] when something goes wrong, they always prioritise service”.

To this point, The Very Group’s Myers advises “not to get buried in the functional as purchases are often very emotional”.

“When a customer gets in touch, most of the time it’s because there’s a problem. Therefore, we’ve increased service through our online AI chatbot, and we’ve seen a real increase in our NPS (net promoter score). When we get customer queries answered quickly and they engage with our customer care team, they have that emotional response.”

Flexible ways to pay

Edelman reveals that, for American Express, the vast majority of in-person payments are now contactless and a significant amount are made via mobile such as Apple Pay and Android Pay. Where frictionless can work well, according to Edelman, is in retailers marrying payments and loyalty schemes, and offering multiple payment options.

He says: “A lot of people only use Apple Pay in person and only have their mobile; one place a lot of retailers go wrong is giving customers a physical loyalty card that they’re not going to use in store if they’re only paying with their phone.”

He adds: “Tesco is getting it right as they have the QR code in your mobile wallet, which you can scan on payment and that’s what retailers need to be looking at. Online payments have been a difficult space because of new regulation with two-factor authentication, but that doesn’t mean frictionless payments shouldn’t be prioritised.”

BNPL (buy now, pay later) should be considered too; for Very, most customers come to its site or app on flexible payment options and tend to shop eight out of the 10 categories available.

User-generated content (UGC)

Nightingale says: “UGC is extremely valuable in building brand advocacy.” This is a particular focus for LK Bennett and HMV.

LK Bennett has been investing in building its community so that its customers self-moderate and create their own posts.

According to LK Bennett's Donovan: “We now have customers dropping a question or comment on a social post and then another customer will reply with a great response before our own customer care team has got to it! We’re invested in creating a two-way conversation between the brand and the customer.”

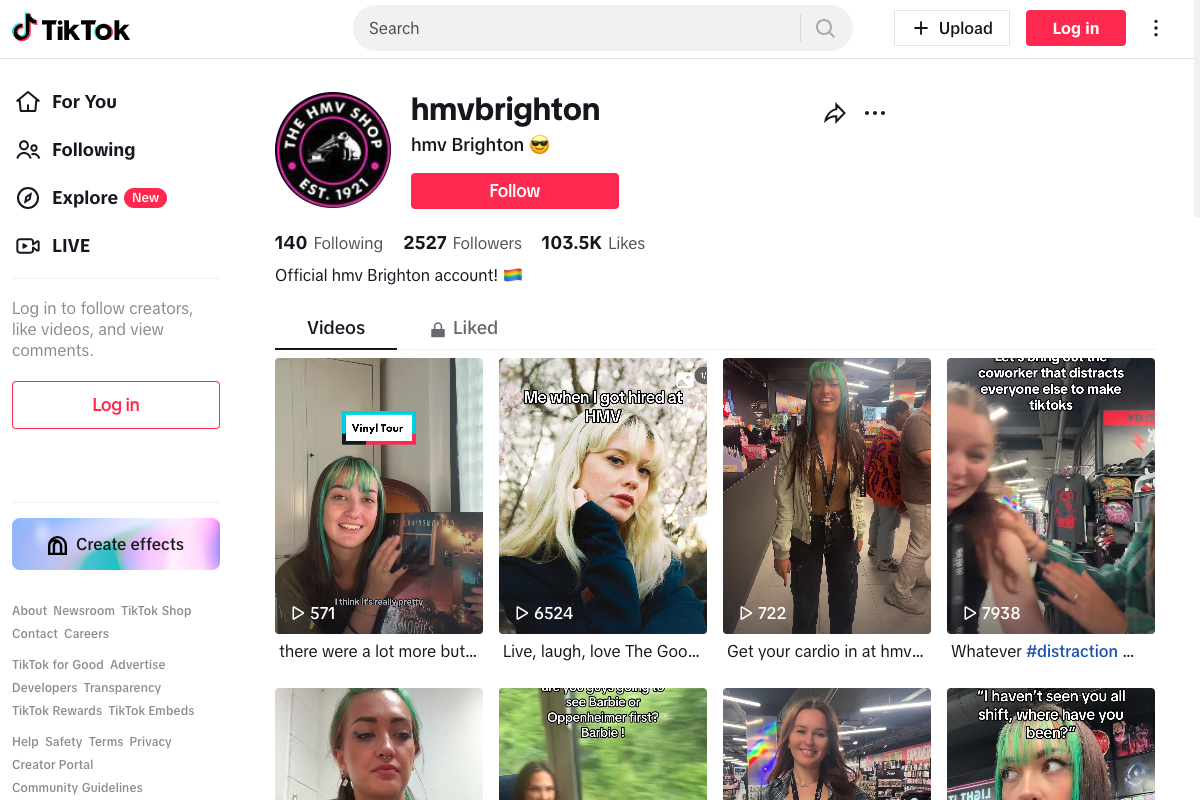

At HMV, each store manages its own TikTok account to promote the business. Leighton says staff members running the accounts have become its “biggest influencers and advocates”.

He says: “With UGC, you’re giving communities a voice and we allow flexibility around our voice. Staff get creativity in the content – provided it’s positive – and this helps build authenticity.”

Amazon Fresh: Is frictionless retail able to drive loyalty?

Amazon Fresh: Is frictionless retail able to drive loyalty?

Sephora has introduced colour-coded shopping baskets that indicate whether or not customers would like to be assisted

Sephora has introduced colour-coded shopping baskets that indicate whether or not customers would like to be assisted

Retailers must insure loyalty cards are available digitally in order to capture customers who rely on mobile payments

Retailers must insure loyalty cards are available digitally in order to capture customers who rely on mobile payments

Each HMV store manages its own TikTok account in order to reach customers in its local area

Each HMV store manages its own TikTok account in order to reach customers in its local area

One of the biggest challenges for retailers is how to best use data to build loyalty. The American Express research revealed that the largest proportion of UK consumers surveyed (43%) say they expect to receive only personalised emails and adverts from retailers, not generic promotions, and 40% are open to sharing their personal data.

Yet there is a fine line with targeting. Some 58% of consumers say they get frustrated when brands contact them too frequently; the most, 27%, want only weekly communications with personalised messaging about the latest/offers and products; and 54% say they unsubscribe to emails if the content is too personalised as they feel their data is being exploited.

Finding the balance

The Very Group’s Myers says the balance is in being “convenient but not creepy”: “Brands have this duty of care and immense amount of data that they are sitting on so they must use that data for a seamless experience.

“There’s a value exchange in customers saying, ’I’m giving you my data, you’ve just made me tick and sign a disclaimer and you now have so much data on me, I’m expecting you to use it carefully and to see that in the quality of service provided.’ The retailers and brands that don’t use data in the right way are the ones that will get left behind.”

AI has a role to play in improving personalisation too, as Amex's Edelman notes in this example: “My Alexa alerted me the other day that a present on my daughter’s birthday Amazon wish list was 25% off. It saved me £35.

When it comes to customer data use, the trick is to find the balance between "creepy" and "helpful"

When it comes to customer data use, the trick is to find the balance between "creepy" and "helpful"

“It was great that Amazon knew it was my daughter’s birthday, knew it was on the list and the personalisation served me perfectly. AI is going to be very powerful with revolutionising personalisation.”

For personalisation to work, FSB’s Weedon says retailers must acknowledge customers but cannot go “over the creepy line”: “I think this is where AI can help because sometimes personalisation conducted by humans can be heavy handed.”

Steps to greater personalisation

Having helped several retailers and brands, Nightingale has identified three levels of personalisatoin retailers should aspire to – relevancy, intimacy and inspiration.

1. RELEVANCY: using customer data to understand purchasing behaviours. “A lot of retailers are already doing this, or at least attempting to do this, and are predicting future purchasing decisions – i.e., we know if customer X does this, they’ll do that.”

2. INTIMACY: using data such as personality profiles to get closer to consumers. “For instance, for one of our homeware clients, we got them to run personality tests for their consumers and it really helped them. Hardly any retailers are using personality to understand consumers.”

3. INSPIRATION: building a data-driven relationship where the customer develops with you and you tell them how to grow. “It’s about making the customer realise they need this product that they didn’t internally know they were ready for.”

Customer loyalty now goes hand in hand with employee engagement. According to the research from American Express the majority (51%) of UK consumers surveyed say they have stopped shopping with a retailer recently due to unhelpful staff. Moreover, 27% of shoppers report that good in-store service has increased their loyalty to a retailer, shifting to a not insignificant 19% online.

Hackett has a “very high” staff retention rate and Zevallos says this is down to investing in pay, training, communication, transparency and, even, uniforms.

He says: “We have an ongoing project where we’re checking our salaries against other brands to make sure we’re paying appropriately. We offer suits to our male staff and we’re introducing female uniforms with tailoring as we know they value feeling good and being acknowledged.

“Conferences and training are vital too, especially for our store managers. We run seasonal training where we bring all store managers together for product updates. Our view is staff cannot sell [the product] unless they really know what factories, mills, quality and manufacturing has gone into it.”

“We have an ongoing project where we’re checking our salaries against other brands to make sure we’re paying appropriately“

Zevallos adds that Hackett “also recently launched a communication platform. Before it was very email-driven staff communication, and through this new platform our head office people are ensuring our store staff are up to date on what’s going on across the company and have access to opportunities for growth and career development.”

Marks & Spencer is another retailer investing in staff communication to enhance customer relationships. In July 2022, M&S launched its Straight to Stuart initiative; a platform for staff to share ideas, feedback and recommendations to drive change. As of 21 July, 2023 the retailer’s 65,000 colleagues had used the platform to make 10,000 recommendations with more than 600 implemented.

An update from M&S on its Straight from Stuart initiative five months ago, since this was posted it has reached 10,000 recommendations

Pay vs purpose

A combination of wage shortages and inflationary increases are severely impacting talent – and retail’s access to it. This year, the BRC introduced a quarterly HR Benchmark report, inviting 30 retailers to provide labour data to support its market intelligence.

The results of its first HR Benchmark for Q1 2023, reported in June, found that pay growth in retail was at 11.2% compared with 7.6% across the UK, while average staff turnover across the retail workforce was 50.8%. Turnover is highest in store workers (46%), low in warehouses and distribution (3.3%) and lowest in head-office roles at 1.5%.

For BRC's Hamer, “what is most surprising is the pay increases among retail teams and minimum wage increases”.

“Average earnings on the base rate have gone up 12% so there’s a lot of catching-up retailers have to do to ensure they remain competitive in what is now a tight labour market. Retailers must think carefully about how to absorb the costs,” he concludes.

With every retailer fighting for talent, Amex's Edelman believes retailers – much like Hackett’s approach – cannot focus on pay in isolation: “Retailers today must go beyond pay and create a real sense of purpose and wellbeing.”

Based on our expert panel’s insights and the consumer research, these nine steps – while some may appear obvious – are essential to a successful loyalty strategy that converts customers into advocates:

✓ Do not confuse price with value

Value must move beyond cost alone and recompense shoppers in other ways, such as immersive experiences, new ranges, co-creation and exclusive access.

✓ Launch or adapt loyalty schemes

More consumers are embracing loyalty initiatives and want to be able to control how they use rewards. However, keep in mind that customer loyalty is a relationship, not just a scheme.

✓ Prioritise ‘special’

Customers want to be surprised, delighted and treated like VIPs.

✓ Offer flexible ways to pay

The Very Group example shows that prospective customers who are offered payment options, such as BNPL, are more likely to browse for longer and across a higher volume of categories.

✓ Utilise customer data to offer personalised rewards

Customers expect more personalised offers rather than generic promotions.

✓ Honour the data exchange

While customers want personalisation, they also expect a duty of care. “Convenient not creepy” personalisation is key.

✓ Leverage staff

Investing in product training, giving store staff autonomy with social media accounts and customer dealings, and listening to staff feedback are proven ways our retail panel have generated greater loyalty.

✓ Incorporate UGC into your customer strategy

As the examples from LK Bennett and HMV show, UGC is an effective tool for brand advocacy.

✓ Perfect the checkout experience

Whether online or in store, the checkout is now the moment in the path to purchase. Make delivery and returns information transparent, give customers flexibility, offer recommendations and ensure the process is quick.

✓ Partnering for prosperity

American Express supports large and small retailers to drive best-in-class customer experience through targeted offers, personalised insights and valuable rewards. Discover more about how American Express can help build and nurture a loyal customer base.

Lessons in loyalty: How to turn customers into advocates

Megan Dunsby

Senior commercial content editor and report author

Caroline Londoño

Business development director

Stephen Eddie

Managing editor

Emily Kearns

Production editor

Sam Millard

Designer