The big picture: What you need to know

A new year is about to dawn, but with the UK chancellor’s autumn Budget provoking cries of disappointment from the industry and – in the case of Lord Stuart Rose – talk of retail being “clobbered” by tax hikes, 2025 looks set to be another rollercoaster ride for businesses and consumers alike.

Retailers face considerable sums being wiped off their bottom line due to the rate employers pay in National Insurance contributions rising from 13.8% to 15% on a worker's earnings from April 2025 and the threshold at which they start paying the tax on each employee’s salary coming down from £9,100 to £5,000 per year. How this manifests itself remains to be seen, but price hikes for consumers certainly cannot be ruled out to cover new levies and the ongoing transformational work so many in the industry are embroiled in.

Most retailers are on a perpetual drive to improve customer experiences online and in their stores – if they have them – and many are doing so with already tight margins. They also know consumers will continue to expect good service and choice when it comes to price and convenience, whatever internal challenges they face.

Retail sales and consumer confidence

In 2024, retail sales and consumer confidence have been creeping up on a year-on-year comparison basis – and the IMRG suggests online sales edged up 3.2% in September, the first time any annual growth had been achieved since April 2021.

The growth is certainly fragile, though. The British Retail Consortium-KPMG retail sales monitor shows retail sales jumped by 2% year on year in the five weeks to September 28, 2024, which is slower than the 2.7% growth for the same period one year before. This is also versus three-month average growth of 1.2% and 12-month average growth of 1.1%.

The build-up to the Budget on October 30 resulted in consumers reining in spending as they awaited to hear new fiscal measures, according to the BRC. Raw from the post-pandemic cost-of-living crisis featuring high utility bills and inflation, consumers are still cautious about spending in light of the recurring economic ups and downs.

Aspirations and basket inflation

Research house Retail Economics talks about the worst of the cost-of-living crisis being over but warns of a particularly squeezed “aspirational millennial” consumer demographic, which is balancing multiple borrowings with much higher interest rates than they have ever experienced in adulthood.

Retail Economics chief executive Richard Lim says at the height of the crisis, there were 18 consecutive months when inflation was outpacing earnings growth and it is estimated this eroded around £50bn of spending power in the UK. Inflation has finally dropped (2.3% in October compared with 4% in January), but Retail Economics estimates that a typical basket of goods and services that cost £111 in 2021 would now cost £134.

After cutting interest rates from 5% to 4.75% in November, the Bank of England said forecast inflation would stay above its 2% target until early 2027. One of the reasons given was the government's first Budget and a higher minimum wage.

The following report, produced in partnership with SheerID and Vypr, highlights consumer spending intentions for the all-important Christmas period – one that makes and breaks many retailers – and sets the scene for the new year ahead. Read on to understand the hotspots for spend among 1,000 UK consumers and where retailers will require more effort to encourage people to part with their hard-earned pounds.

Research methodology: The findings in this report are based on research conducted by Vypr in October 2024. Vypr conducted the research using a nationally representative sample of 1,000 consumers. This means that proportionate weightings, aligned to the most recent Office for National Statistics (ONS) population data (2024), were used to ensure proportional representation associated with age and gender. The research helps to understand consumer shopping habits and priorities, painting a picture of where retailers should be focusing their attention and investment.

Shutterstock/Laura Reid

Shutterstock/Laura Reid

BRC chief executive Helen Dickinson said in November that “a good start to autumn” was followed by “disappointing” October sales growth. The BRC’s Black Friday report for 2024 showed non-food sales climbed 5.5%, which will come as a welcome relief to retailers that endured tough trading during November.

In more positive news, in-store sales were up 4.1% over the period, while footfall jumped 4.8% on Black Friday and 10.6% on Cyber Monday – usually a day when shoppers look online to find last-minute deals. Online sales jumped 7.2% on Black Friday, while the overall online penetration rate of sales was 45.5%.

“Uncertainty during the run-up to the Budget coupled with rising energy bills also spooked some consumers,” she explained.

“Fashion sales took the biggest hit as the mild weather delayed winter purchases. Health and beauty sales remained buoyant, with beauty advent calendars flying off the shelves. After a painful budget for retailers, the hope is it will be less painful for households in the immediate term and consumer appetite will pick up.”

Dickinson’s comments serve as a warning to retailers that nothing can be taken for granted. A period of retail sales improvement can quickly be disrupted by external events and the macroeconomic environment.

Inflation jumping back up to 2.3% in October (it was 1.7% in September), reversing the pattern of month-by-month annual inflation declines throughout the year, is another warning that the economy remains far from settled.

Consumer spending influences

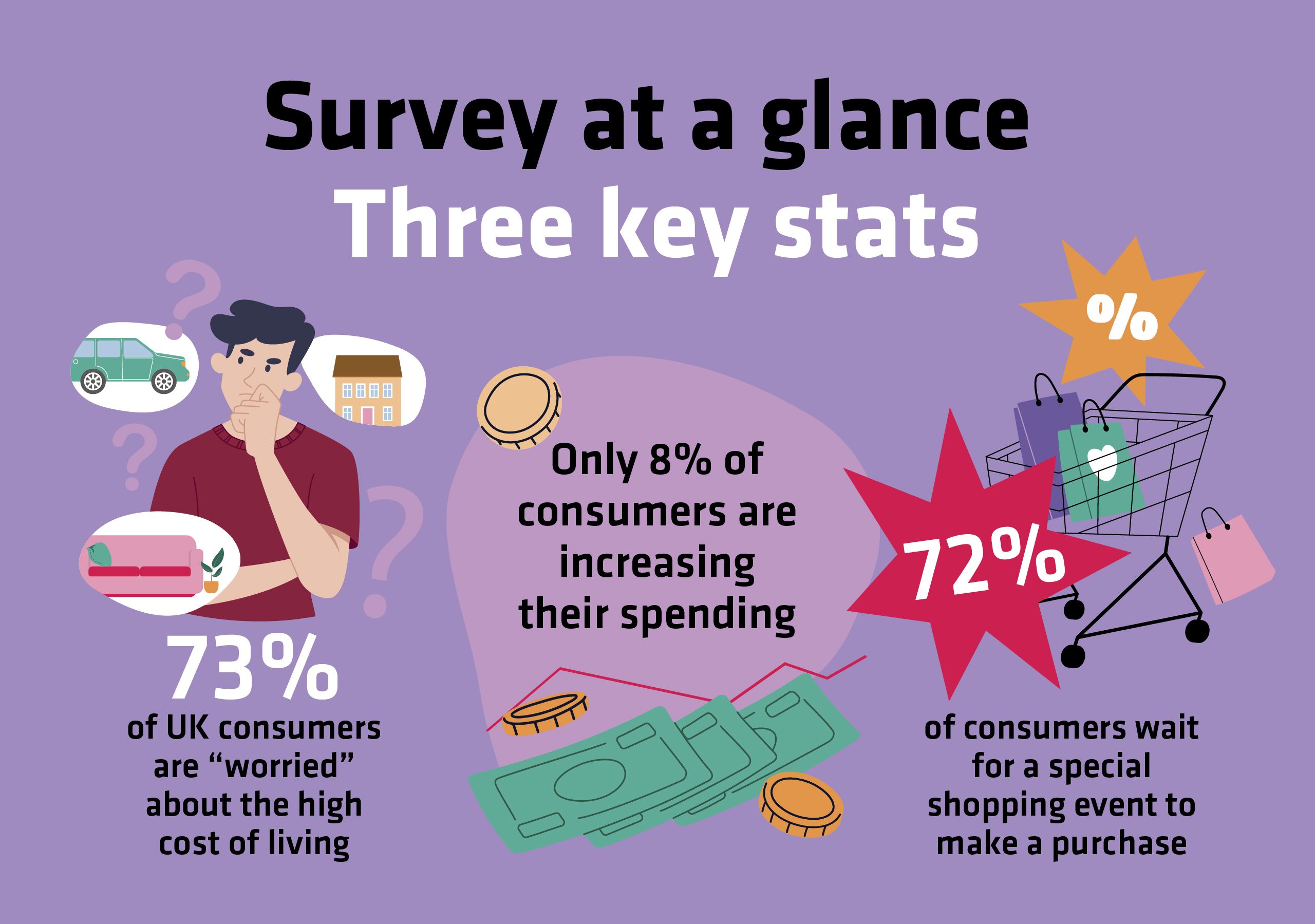

Some 73% of UK consumers are “worried” about the high cost of living and the impact on their rent or mortgage, council tax, utility bills and ability to spend on essentials such as food shopping. A significant 34% say they are “very worried”, underling how consumers are still feeling the pinch despite the economic situation looking more favourable than it was going into Christmas 2023.

GfK data shows that while consumers are cautious going into festive season 2024 (consumer confidence was at -18 in November, and thoughts about their personal finance situation were rated -9), this is a stark improvement on November 2023, when those metrics were -24 and -16, respectively.

Over-65s are the least worried about the high cost of living – with 25% of that cohort not that worried or concerned at all about the economic landscape. On the other hand, 39% of 55- to 64-year-olds and the same percentage of 25- to 34-year-olds are “very worried” about the current state of affairs.

In terms of the cost of living and its impact on people’s purchasing habits, our survey uncovered more negative sentiment than positive. “I have not got the same purchasing power I had not long ago, so certain cut-backs have to be made,” one respondent explained, showing the rapid change some people have seen in their discretionary income.

Ben Davies, founder of product intelligence platform Vypr, commented: “Consumer sentiment reveals a stark contrast in how households are navigating the cost-of-living crisis, particularly when juggling income levels and family responsibilities. Our research found that over 39% of households with children report being ‘very worried’ about their financial situation.

“However, this figure drops significantly to 25% in households earning over £65,000, compared to 44% in lower-income brackets. These findings highlight the urgent need for retailers to deliver affordability without compromising quality. As discretionary spending tightens, retailers have a vital opportunity and responsibility to build trust by offering clear and better options that address the real challenges consumers face in today’s market.”

Another suggested things are “getting worse”, while others spoke of an “exhausting” environment, particularly in relation to the cost of food, and how it is harder to make ends meet the older they get.

“The cost of living is a real problem,” said another. “I work and am not on a very low income but need to carefully think about what I buy and, after paying essentials, don't have much spare.”

They suggested it is “a huge issue, and limits planning for the future as well as living now”.

Some 79% of respondents told us their monthly household spend has gone up this year compared to the previous 12 months, with 55- to 64-year-olds reporting this more than others (82%), and 35- to 44-year-olds (79%) also experiencing this more than most.

This period has coincided with a significant level of fixed-year mortgage deals – secured during the house sales boom at the end of the pandemic – coming to an end, only to be renewed at much higher than recent history averages. Between March 2009 and April 2022, the Bank of England's base rate was below 1%, but at the time of writing it was 4.75%, so it is therefore no surprise the middle-aged demographic, which includes the aspirational millennial, is feeling squeezed.

Private renters are not immune from the crunch either, as landlords hike rents to pay their mortgages. According to the ONS, the average cost of residential rent in the UK increased by 8.7% in the 12 months to October 2024 – up to £1,348 a month (+8.8%) in England specifically.

London renters saw costs go up the most in the 12 months to October 2024, by 10.6%, while annual rent inflation was lowest in Yorkshire and the Humber, at 5.9%. Rent rises, however, have been evident across all regions of the UK.

There is a substantial section of society that has had its financial wings clipped.

Only 8% of survey respondents across all age groups said they are increasing their spending, while 37% said they are reducing their spending, and 36% said they need to be more careful with their spending. The cautious consumer outlook is also supported by the 18% saying uncertainty about the future and economic situation is making them reconsider their spending.

The age group most likely to be increasing their spending is the 25- to 34-year-olds (15%), but a much higher number (41%) of that cohort are already reducing their spending. Retailers will need to market to this audience with care, tempting them with deals and digging deeper into personalisation strategies to ensure they talk to individual customers in the right way.

"There's a critical shift in marketing occurring," says Rebecca Grimes, chief revenue officer at SheerID. "Brands are recognising the power of authentically understanding their customers in an effort to build trust, personalise experiences and drive growth. By leveraging verified customer data, brands can create more meaningful connections and foster lasting loyalty."

Some 42% of 55- to 64-year-olds are reducing their spending, which should trigger some alarm bells for retailers, as this boomer generation have typically been reliable consumers in the past and willing to splurge even during downturns.

One-fifth of consumers say they would like to save more money going forward, and that feeling is particularly strong in the 35- to 44-year-old group (26%). It is a generation that has generally only known cheap borrowing in adulthood, and the rise in interest rates combined with the spike in inflation, which topped 11.1% in October 2022, would have made many reconsider their financial management practices.

Encouragingly for retailers, footfall rose for the first time in more than a year in September 2024 as consumers flocked to the shops during the back-to-school rush. Total UK shopper visitors jumped by 3.3% year-on-year, according to the BRC, overriding the 0.4% decline in August – with retail parks seeing the biggest boost (7.3%) in footfall.

This was echoed by data from real estate and investment management software provider MRI Software, which forecasts a 5% rise in footfall in physical locations in December due to experience-led visits.

Retail parks and shopping centres are also expected to perform well in December, with MRI predicting a 2.2% footfall rise in shopping centres and a 1.1% rise in retail parks.

Social media is playing an increasingly important role, and data from MRI shows that around 47% of retailers have seen a boost in in-store sales as a result of promoting on social media platforms such as TikTok and Instagram.

All four of the UK nations experienced an increase in footfall year-on-year in September, with Wales reporting an increase of 5.4% and England seeing a 3.6% hike. Although these numbers are against favourable comparatives in 2023, when the late summer heatwave meant many people stayed at home, they show there is life in shoppers yet – particularly around traditional peak periods.

There is every chance that despite the overriding caution, the worries about spending power and consumers still feeling squeezed, retailers can still convince them to come out in their droves throughout the golden quarter. However, it will take a dedicated value-based approach.

Although it is approaching five years since the Covid-19 pandemic shut down much of the world and turned the retail industry upside down overnight, some of the patterns in spending that emerged in those extraordinary circumstances have yet to shift.

A feature of the latter stages of the pandemic and the subsequent cost-of-living crisis was consumers prioritising food and essentials and cutting back on fashion items and other discretionary purchases. A flurry of big-ticket domestic spending occurred as people, finding themselves marooned at home, fuelled a DIY and homeware boom. The growth in these sectors has been far harder to maintain since.

With consumers saying they are cautious about splashing the cash in the months ahead, these patterns continue to play out – albeit there is hope for the fashion sector.

Unsurprisingly, when asked to rank the top three areas of spending they are prioritising, 70% of survey respondents said food and grocery. A quarter ticked the entertainment and eating-out box, while 21% said fashion, which just edged out health and beauty (19%) to make the top three.

Success at Primark, where adjusted operating profit rose 51% to £1.1bn in the year to September 14, 2024, off the back of sales growth of 6% to £9.45bn, highlights positive movement in the fashion sector. Meanwhile, highlighting the strength of health and beauty, Superdrug reported a 43% surge in pre-tax profits to £111.6m for the full 2023 financial year, alongside an 11.8% rise in revenue to £1.5bn.

At the opposite end of the list were big-ticket items such as furniture and white goods (11%), toys and gifting (12%), and sports and leisure (14%).

Clearly this differs by age group, and those categories that have been deprioritised should look to target specific demographics. For instance, 35- to 44-year-olds (15%) were far more likely to prioritise big-ticket items than others, and this group (21%) also provides the most fertile ground for toys and gifting retailers looking for active buyers.

The latter point reflects the fact that this age group are more likely to have young families they intend to buy for this festive period, but nevertheless it is worth toys and gifting retailers remembering who their real target market is in the coming months.

Although electricals and gadgets sit midway up the list of important spending areas for consumers, retailers in this space might be interested in honing their offering to 25- to 44-year-olds, who are their most likely customers right now.

At present, over-45s are far more likely to prioritise pet care than those below that age, while 35- to 44-year-olds (31%) are set to prioritise health and beauty. That latter figure is significantly higher than for any other demographic, and underlines the importance for beauty and wellness brands of capturing the attention of the middle-age market.

The growth of Trinny London is a case in point. The beauty business targets the middle-aged market – and to double down on that focus, in October it secured a partnership with John Lewis that will result in its products appearing in seven of the department store chain’s shops and on its website. This move came a month after Trinny opened its first standalone flagship store on King’s Road in Chelsea, highlighting its ongoing evolution from digital to multichannel player.

To eat out or not to eat out

Consumer sentiment around entertainment and eating out is polarised. It is one of the three main priorities for spending, but at the same time it is also the leading selection (21%) when people were asked where they would cut back in the next six months.

Several consumers described eating out and entertainment in general as a “luxury” that needs to go as the cost of living remains challenging. Many respondents to the survey suggested restaurants are more expensive than they were, are often overpriced, and are “treats” that can be parked in more difficult economic times.

“We have less excess income now with all the increased cost of everything, so the usual treats like eating out and entertainment have to take a cut,” said one consumer.

Another said they were dropping entertainment and eating out simply so they could afford to buy Christmas presents.

And herein lies an opportunity for retailers. It is no secret that the rise of fast food, quick-service restaurants and greater food and entertainment facilities in shopping centres have dented retail’s share of wallet over the past couple of years. The rise of coffee culture and food on the go means more of people’s disposable income has gone on these and taken share from retail.

Greggs’ growth is a case in point, with the company reporting on October 1 that it had experienced a 10.6% year-on-year increase in sales for the 13 weeks to September 28, 2024. The business attributed its sales growth to its ongoing menu development, which includes new pizza and doughnut options, as well as pizza sharing boxes and over-ice drinks.

There are many people looking to replace the expenditure with cheaper options. Consumers cutting back on going out gave statements about what they would do instead, which should provide an incentive for the retail industry.

From “watch more films at home and buy takeaway meals from supermarket”, and “entertain at home more”, to “buying store food to cook at home” and “just stay in more”, the selection of answers given show there is a gap to fill for quick-thinking food and entertainment retailers. That is, those that can find creative and cost-effective ways of getting their goods into the hands of more home-anchored consumers.

“We plan on spending less on meals out and more on making better-quality meals at home,” said one consumer. “We plan on spending less on nights out and fewer trips to the cinema too due to the increasing cost of living.”

Sainsbury’s is already looking to take advantage of this situation, and in May it extended the range of products under its partnership with meal kit provider SimplyCook, while also tying up with Gousto to sell food ingredients boxes.

And those retailers and brands that can convince consumers they are more than discretionary – and which can capture hearts and minds over the festive period – may find they are able to attract more long-term customers well into the new year.

Trading places

As of October – in some categories – consumers are saying they are likely to trade down, buy cheaper, or purchase own brands.

Food and grocery (42%), fashion (24%) and health and beauty (22%) are the areas where this is most likely to happen, according to the research.

Retailers often major on own-brand development in tough economic times to better manage margins themselves, so this could be a hot area of development in the coming months.

Examples of catering for own-brand demand are Waitrose – which in June doubled down on its premium own-label by adding 130 new products, as well as new branding and packaging for its No.1 range – and Marks & Spencer, which in the same month listed 15 new premium own-label spirits, including gin, rum and vodka.

In May, Asda launched ‘Exceptional by Asda’, a premium own-brand offering which it said “aims to champion taste whilst providing shoppers with the very best quality” and will cover 500 products.

Holland & Barrett relaunched its entire food and drink category in September 2023, and said in November it was upping its in-house food development capabilities ahead of further own-label launches.

These retailers are looking to shift their propositions in ways intended to help both theirs and their customers’ balance sheets in the medium term.

In a squeezed market, there is more at stake when it comes to customer experience (CX) strategy.

Retailers and brands need to give people a reason to spend, and they must serve shoppers across all channels and be active where the consumer is.

“Consumers today expect brands to truly know them,” says SheerID's Grimes. “To excel, marketers must go beyond surface-level interactions and deliver value with content, products and promotions that improve customers' lives. Brands doing this well are combining consent-based consumer attributes with their behavioral data to unlock deeper personalisation, fostering authentic connections that drive loyalty and growth.”

This is perhaps never truer than around peak trading, when there is an annual clamour from retailers to grab customers’ attention.

Where shoppers are spending their money

Our research shows that in-store (42%) is where the majority of consumers spend most of their money – with 23% saying they make the majority of their purchases online. The key stat to keep in mind, though, is that 35% of consumers split their spend equally between the digital and physical realms of retail.

Although over-65s (58%) are far more likely than 18- to 24-year-olds (37%) to do the majority of their shopping in-store, there are not huge differences between the age groups in terms of the channels on which they are directing their spend. One point worth underlining, however, is that it is the particularly time-poor 35- to 44-year-olds (31%) who are most likely to make the majority of their purchases online, which should be a consideration for retailers targeting this demographic.

Survey respondents favouring online shopping referenced what they described as greater levels of “convenience” than in-store shopping. There was also a perception that people do not have enough time to go to physical shops or shopping centres and that ecommerce is cheaper than visiting a store in real life.

“Like most people, I started to shop more online during the pandemic,” explained one consumer. “It is extremely convenient and the options to shop online increase all the time. It has become much easier to return most goods too, if required.”

Another spoke about wanting to avoid “rude” staff and other customers, in another reminder to retailers how shoppers have long memories and won’t easily forget their bad experiences of retail environments.

That said, most of the consumers who cited in-store shopping as their preference reported that the ability to “touch and feel” items was crucial to their purchase journey. Retired consumers said things such as “we’ve got time on our hands”, so they would prefer to visit shops.

Another said: “I’m retired so like to go to shopping centres like the 02 or Westfield at Stratford or Shepherd’s Bush, as you can browse, buy and have a meal, so a good day out with my partner.”

ProCook chief executive Lee Tappenden is one of the retail leaders who understands the need for stores, telling Retail Week the company is looking to open an “average of 10 stores per year” in the next few years to move from 60 to 100 shops.

“We’re not in Sheffield, we’re not in Leeds, we’re not in Nottingham and we’re not very present in Birmingham,” he says. “There’s a lot of big cities and some affluent market towns we’re not in.”

The focus will be on “underserved areas” across the UK, initially looking at “larger store locations with much higher traffic”, which Tappenden says is a format that has met and exceeded expectations to date. With more electrical items in the range and coffee machines and additional kitchen goods being added to the mix soon, he moots the idea of more experiential store spaces in the future.

All of our findings underline the need for retailers to stay hot on all channels and cultivate a mix of tactics that appeal to all tastes and preferences.

Consumer viewpoints

The responses to our survey further fuel the narrative that consumers are more empowered and astute than they have ever been. With a wealth of information available to them on the web and – often – in their hands in the form of a smartphone, consumers are well versed on what is on offer to them across the retail landscape.

Shoppers said they go online to research products and find the best prices, and to purchase commodities, while they visit stores when they need to touch and feel an item or – in the case of food – when they want the freshest goods available to them.

One comment neatly highlights how shoppers cannot easily be shoehorned into one demographic or type; it strengthens the view that retailers must double down on their personalisation strategies to truly understand their audience. “I work office hours Monday-Friday and don’t want to spend my leisure time after work going out to do any shopping, so I have home deliveries during the week,” one person said. “At the weekend I don’t like to tie myself down to definitely being at home at a particular time for a delivery, so I prefer to go out to physical stores at a time that suits me.”

In the year ahead, price and convenience – and easier, cheaper parking near to the shops – look set to drive people to stores. In an age of online when all options are available at the click of a button, consumers say that more variety in-store or special in-store-only discounts would be motivating factors for them to hit the shops.

H&M is thinking this way, illustrated by its revamped store at Westfield Stratford, which opened on November 21. Replicating flagship renovations in Seoul, South Korea, and in Stockholm, Sweden, the shop puts omnichannel at the heart of the shopping experience.

As well as ranges for men, women and kids, there is a dedicated home offering too. The new store houses mobile checkouts and interactive fitting rooms – the latter include screens that recognise the size and colour of products and offer tailored styling tips, and provide an option to order online via the H&M website from the fitting room.

Secondhand shopping on the rise

The research reveals that 62% of consumers say they are likely to explore the secondhand marketplaces or resale sections of retailers for their purchases. This suggests that retailers such as Decathlon, Asos and Selfridges, which have all upped their second-hand choices for consumers in the past year, are on trend and making themselves attractive to a growing audience.

Decathlon, for example, introduced a bicycle buyback service in October 2023 to allow consumers to sell their old bikes to the retailer for the business to sell on second-hand. In April this year it extended that commitment to sporting equipment, including racquets, fitness gear and paddleboards, which Decathlon is able to refurbish before placing on the resale market in the name of keeping items in circulation and finding alternatives to using virgin materials in production.

Swedish childrenswear retailer Polarn O. Pyret has been running resale for four years, and in 2023 it nearly doubled its preloved sales year-on-year, with 94,000 items sold through the initiative.

Launching an in-store version in the UK this year has also been well received. The retailer said 10% of sales units in February 2024 were from second-hand items and 40% of second-hand customers were first-time buyers, highlighting how the scheme opens up the brand to new customer acquisition.

Supporting the trend for second-hand is a Vinted and Retail Economics study, published in November, suggesting £2.05bn will be spent on preloved gifts over the 2024 festive season. Second-hand is expected to account for 10.2% of UK Christmas gift sales, and with Similarweb research suggesting eBay and Etsy were among the most-visited sites last Christmas, all the signs point to it as a growth market.

The importance of social

Some 44% of consumers said influencers “sometimes” or “very often” impact their purchasing decisions, and the power of people with high follower accounts in retail marketing has been recognised by businesses such as Gymshark, which built its brand in the early days by using global fitness figures as advocates. In our research, one-fifth of men said influencers “very often” impact their purchasing decisions, while only 7% of women said they ‘used’ influencers so regularly.

Gymshark took its influencer strategy to the next level in August when it named global fitness athlete Whitney Simmons, who has more than four million followers on Instagram, as the first creative director for its Adapt range. The collaboration will help the creative team bring goods to market with expert guidance and greater marketing power, and it follows 18 months on from Gymshark’s appointment of influential bodybuilder David Laid as its first creative director for lifting.

36%

Another interesting social ecommerce finding is that 45% of respondents said they sometimes or often watch unboxing videos before making a purchase. A quarter of those aged between 18 and 44 said they “very often” watched them, while older demographics were far more likely to say they never watched these videos.

These findings suggest there is power in using influencers and significant potential to attract audiences with unboxing videos, making this a worthwhile investment for retailers to make, or at least test.

36%

A forward-thinking retailer in this space is Boohoo which, in July, introduced The Boohoo Collective, giving creators a chance to operate their own storefront on the company's main website. Participants can use their page to showcase favourite products and gain rewards for their influence on sales. Boohoo said it wants to “accelerate the value of social traffic” as it looks to find ways to grow against a tough backdrop for fast fashion.

Reframing returns

Boohoo, H&M and Zara are among the retailers to have placed fees on returning items in the past two years, as they look to reduce the financial and environmental costs associated with processing reverse logistics. The three retailers' fees are £1.99, £1.99 and £2.95, respectively.

Customers deemed ‘serial returners’, who are typically younger shoppers who buy and return frequently, often over-order and plan returns before a purchase is completed, are costing retailers millions of pounds. These serial returners are expected to account for £6.6bn worth of online returns in the UK in 2024, according to a study by Retail Economics and ZigZag.

Asos said in September that it was clamping down on serial returners, warning those who regularly send back most of their orders that charges will be faced.

Although implemented for the good of the business, these initiatives may come with a consumer cost.

Some 45% of survey respondents said imposing a returns fee would make them less likely to shop with a retailer. However, 23% said it would make them more likely to only shop in-store with that retailer. Only 15% said it would have no impact on their purchasing behaviour whatsoever.

This is clearly an area where retailers need to treat consumers sensitively. Those that communicate these developments and are open and transparent with why they are making these decisions should be in a better position to appease shoppers.

But for multichannel retailers, there is also an opportunity to engage with customers online and in-store. And that is exactly what Next and Zara do – returns are free for shoppers who bring items back into a shop, because the logistical burden is somewhat alleviated as this removes the initial collection and transport costs.

Those consumer price sensitivities around fulfilment play out in terms of online delivery too – with 43% of respondents saying they prefer free delivery even if an item takes longer to arrive at their home.

Black Friday has pulled peak trading from December into November (Image: Shutterstock)

Black Friday has pulled peak trading from December into November (Image: Shutterstock)

Amazon was the most popular website between Black Friday and Christmas Eve in 2023 (Image: Amazon)

Amazon was the most popular website between Black Friday and Christmas Eve in 2023 (Image: Amazon)

Health and beauty is the most popular Christmas gifting category (Image: Sephora)

Health and beauty is the most popular Christmas gifting category (Image: Sephora)

The shape of peak trading has changed considerably in the past decade, and it is largely to do with the arrival on these shores of the US-driven phenomenon that is Black Friday.

Black Friday has also morphed into a month-long extravaganza of offers and discounts in the past five years as retailers look to capture consumer spending in the build-up to Christmas. IMRG says December used to be the premium online shopping period, but that is now the mantle of November, with Black Friday’s presence pulling peak trading forward by a month.

Ho ho… how much?

The consumers we surveyed confirmed the purchasing-power influence of Black Friday, with 18% saying they now “always” wait to make a purchase based on seasonal promotions such as Black Friday and January Sales; 54% said they “sometimes” wait for such events before making a purchase – meaning that 72% of consumers wait for these times to make a purchase.

The retail industry’s regularity with promotions has trained consumers when to expect money off, but the best retailers will be carefully curating these offers to preserve margins and avoid driving top-line growth at the expense of bottom-line profit.

At the same time, the pre-Christmas discounting period presents opportunities. Some 23% of consumers would “always” switch brands if promotions became available on an alternative product, meaning if the money-off tactic is used at the right time by a retailer, it could help them capture market share.

This report’s research was conducted during the last week of October 2024, and 65% of survey respondents said they had started to plan their spending and budget for the festive season. Nearly half (47%) of those we questioned said they intend to spend the same on Christmas as last year, while 28% said they are likely to spend less – only 17% said they are looking like spending more than 12 months ago.

Sales data from Nationwide showed a 16% increase in online card transactions compared to 2023 at the end of Black Friday 2024 – covering a total of 7.39 million transactions through that bank alone.

Where the Christmas spend is taking place

When shopping for gifts this Christmas, consumers are prioritising online-only retailers and marketplaces, with 20% saying this is where they will head as a first port of call. Indeed, last year, Amazon was the most popular website between Black Friday and Christmas Eve. Even though this list did not include app traffic, Amazon pulled in circa 90 million visits in the key shopping period to its .co.uk site and a further 6.7 million visits from Brits to the US domain Amazon.com.

Some 16% said supermarkets were the priority for gifts, while 14% listed value variety retailers such as The Range and B&M, underlining the pressured personal financial situation in the UK to seek out discounts.

Despite the rising popularity of preloved goods, only 6% said they will prioritise recommerce this Christmas, which suggests the circular economy movement has some way to go before it is a key consideration for gifting. But those who are planning to prioritise it talked up the sustainability and cost benefits, with many keen to make purchases that help stop items going to landfill sites.

Proving the growing awareness of retail and its impact on the environment, one survey respondent said they were prioritising recommerce because it “means that I am doing my bit to cut down on virgin material use in retail”.

Petcare and electricals retailers look like they have got their work cut out this Christmas, with only 2% and 4% of shoppers, respectively, prioritising these sectors in the peak period. It may be why Currys, for example, went early on its festive-related advertising; it recruited celebrity chef Marco Pierre White to promote a “White” Christmas via the marketing of its white Ninja Double Stack XL air fryer as a potential game-changer for preparing dinner on the big day.

Those prioritising online-only retailers this Christmas said these are quicker and “easier” than facing the shops, and they cut out the “hassle” of crowded streets and town centres. Others cited the benefits of being able to get presents delivered rather than carrying them around shops and shopping centres.

In a stark warning to retailers and highlighting what they are up against as consumers seek ultra-convenience, one shopper said they would prioritise online-only shopping this Christmas “because I can get pretty much everything on Amazon”.

Multichannel retailers that want consumers to head to their stores may want to take this feedback on board and consider options to buy in-store but deliver to home. They could also find other ways that take the stress out of in-person shopping at Christmas time.

IMRG data released on November 21 suggested that ‘Black November’ got off to a poor start, with sales dipping markedly in the first two weeks. IMRG’s Online Retail Index, which tracks the online sales performance of 200+ retailers, reported a 5.9% annual decline for the week commencing October 28, 2024.

The week commencing November 3 was also down – 3.9% year-on-year – but with Black Friday falling five days later than last year, the hope at the time of writing is that the best is yet to come. As of the week commencing November 17, just under half of the retailers that IMRG tracked were yet to launch their campaigns, which was down on 2023.

IMRG said health and beauty was the star performer at the start of November, with the fragrance and haircare subcategories reporting online sales up 67% and 66%, respectively, compared to the previous year. Furniture retailers were also up, by 12.3%.

Gift of giving

The IMRG data tallies with this report’s consumer survey. When shopping this Christmas, the presents that consumers are most likely to purchase for others are in the health and beauty category (40%), with food and alcohol gifts (38%) and fashion (35%) next on the list.

John Lewis, Marks & Spencer and Boots are increasing their share of products offered in the beauty space as consumer interest in this category persists. Jenna Whittingham-Ward, head of gift transformation and strategic brand partnerships at Boots, says “beauty is having a real moment” and argues that other retailers playing in this space is good for the retailer.

Boots has put beauty front and centre of its festive marketing campaign and rolled out a stronger-than-ever category offering for Christmas 2024. “We’re betting, in a big way, on beauty,” Whittingham-Ward notes.

“This is the biggest beauty Christmas we’ve ever had. For us, beauty gifts feel really personal. We’re going big on beauty across all price points. We’ve got skincare gifts and brands like Bubble and Byoma, which we know are trending. Especially for teens, we know that they’re on everyone’s gift list, and they’re actually flying out.

“We’ve got really limited buys, so they’re kind of the hottest brands on social media, and when they’re gone, they’re gone, and they’re online-only.”

Reflecting on consumers tightening their purse strings, she adds: “For the last few years, we’ve definitely seen a really big trend in people gifting more carefully. So, for example, half of our range is under £10 [and] 80% of our range is under £20.

“In our core range, we work hard to keep Christmas as affordable for everyone as we can.”

Toys (32%), home decor (30%) and books and stationery (28%) are next up. While health and beauty over-indexes compared to other categories, it does appear that consumers are looking to spread their spending on gifts across multiple categories in 2024.

With food and toys key parts of the Christmas gifting mix in 2024, the decision by Aldi to introduce its biggest-ever range of wooden toys from October 10 looks like being a strong play. More than 50 toys – with prices starting from £2.99 – were added to the ‘Special Buys’ selection in stores, including a wooden kettle, coffee and hot chocolate maker and a double easel.

Customers want convenience and ease when it comes to Christmas shopping, and having multiple categories together on one site should be an attractive proposition for them – and we go into that in more detail in the section below.

The top four retailers that our 1,000 UK consumers named for providing the best shopping experiences are Amazon, John Lewis, Asda and Tesco.

At a time when cost, value and convenience are so imperative, these businesses are obviously getting closest to delivering this holy trinity.

Amazon

- Amazon's UK sales climbed 11.7% to $35.6bn (£27bn) in FY2022

- Same-day delivery expansion in 2024

- £500m-plus investment in AI and robotics across European supply chain

What can one say about Amazon that has not been said many times before? The tech titan continues to move the goalposts in terms of what consumers expect from a retailer, particularly around speed and convenience, and it was the clear CX leader in our survey of consumers for this report.

Evidence of the company’s continued commitment to the above came in October when it expanded its same-day delivery service to more than 80 towns and cities across the UK, including Middlesbrough, Aberdeen and Plymouth. The move followed Amazon reporting that the number of items being ordered by customers for same-day delivery had more than doubled compared to 2023.

The company gave an example of its capabilities, saying a customer in Leeds who ordered silicone chocolate bar moulds and pistachio spread at 8.30pm received them at 10pm the same day.

So much of what Amazon can offer at the front end is supported by significant supply chain – or back-end – investment. Earlier in the year, the company said it would have invested “more than €700m” (£582.3m) in robotics and artificial-intelligence-powered technology in its European fulfilment centre network between 2019 and the end of 2024 – and these enhancements, it argues, support the customer proposition and the experience of its employees.

Amazon has leveraged Vypr’s product intelligence platform to refine its private-label products, understanding how consumers place importance on provenance, especially in its own-brand food lines sourced from the UK. Staying ahead of shifting consumer expectations is essential for Amazon, enabling it to align to demand with an optimised supply chain.

In October, Amazon also relaunched its second-hand division as Amazon Resale. This is a service that is helping to keep customer returns in circulation, so it supports the business’s sustainability targets – but it also ensures more products are available to customers at lower prices, which is essential in these fragile economic times.

John Lewis

- John Lewis' sales were £4.8bn, down 4%, in the full year to January 27, 2024

- Never Knowingly Undersold return has fuelled online traffic

- Store upgrades freshening up CX

John Lewis has its mojo back after a period of post-pandemic transformation that saw the department store chain report a sales decline and huge losses. The revival has much to do with focusing on what it originally built its strong reputation on: customer service.

The headline example of this return to customer centricity was bringing back the Never Knowingly Undersold (NKU) proposition in September, giving consumers confidence that the price of the goods they are buying from the department store are unmatched. In the 10 days after an ad launched with news of NKU’s return, the John Lewis website was reportedly drawing an extra 89,000 visits per day through natural traffic.

Bringing back its former fashion boss, Peter Ruis, as executive director in January is helping drive the changes at John Lewis. He has reshaped the buying and merchandising teams to give them enhanced resource and focus, and the plan in-store is to free up staff to spend more time with customers.

Indeed, as much as John Lewis is experiencing an increase in online traffic, its stores have always been the anchor of its operations. And its flagship Oxford Street shop has undergone a £6.5m makeover to increase relevancy and improve the CX, which includes increasing the beauty hall by 25% and adding a selection of new brands such as a Waterstones bookshop. Its Peter Jones outlet in Chelsea is next in line for a major refurb, with the retailer adamant that a revived store experience is key to its ongoing recovery.

John Lewis is combining a return to tradition with a modern twist, and the launch of buy now, pay later on its website in November, which allows consumers to purchase goods in three instalments made over 60 days, is a budgeting enabler for its customers.

Asda

- Asda's adjusted EBITDA after rent was up by 24% to £1.08bn in the year to December 31, 2023 as like-for-like sales grew by 5.4%

- New leadership team in place to drive company forward

- Rewards app and in-store partnerships to help build momentum

Despite a spate of layoffs, unsettling senior management changes and a dip in market share, there is still hope of a quick turnaround for Asda – because consumers rate the shopping experience they get from the supermarket chain. And with Lord Rose now leading the business and former chief Allan Leighton in place as executive chairman, there is confidence that the retailer can return to its growth trajectory.

One of the services made available for the first time this festive season that could trigger a return to growth at the grocer is a link-up with fellow CX star Amazon. Thanks to a new strategic partnership between the businesses announced in November, Amazon customers can now pick up eligible orders from most Asda stores across the UK.

Asda said providing Amazon pick-up and drop-off (PUDO) will make shopping at the supermarket “even more convenient”, as customers can do their weekly shopping and parcel collection or returns in one trip. It builds on an already strong PUDO proposition at Asda, which comprises its own To You service and allows consumers to processes packages from third-party retailers and brands.

The collaboration is convenient for shoppers as it reduces the need for extra shipping boxes because customers can return an item in the original manufacturer’s packaging. On announcing the tie-up, Asda vice president of logistics Chris Hall explained: “By bringing essential services like Amazon parcel pick-up and return drop-offs closer to where our customers live and work, we’re able to provide greater convenience to more of the communities we serve across the UK.”

In a bid to get back to sales and market share growth, Asda said in August it is laser-focused on improving customer satisfaction and enhancing product availability, supported by a £30m commitment to invest in more staff hours and £50m for a wide-ranging store refurbishment programme.

Consumers’ positive sentiment towards Asda in 2024 could also have been aided by the £70m it said it has spent on reducing the prices of 120 core products, as well as the Asda Rewards app, which the retailer says is focused on shopping missions and has been well received.

Tesco

- Tesco reported pre-tax profit of £2.29bn (versus £0.88bn the year before) in the year to February 24, 2024. Group sales climbed by 7.4% to £61.48bn

- In-store partnerships driving traffic

- Close eye on consumer behaviour shaping online strategy

As a trailblazer in customer loyalty programmes in the 1990s with its Clubcard, Tesco has long been able to follow the data to shape its proposition in a way that suits consumers.

It has continued to keep a close eye on consumer behaviour in 2024 to ensure it has the right offering, and that led to the June launch of an online marketplace to give consumers access to a broader range of goods and more of the items they were searching for. And a recent tap into customer insights resulted in the supermarket bringing its F&F clothing brand back online in October because, as chief executive Ken Murphy told Retail Week, “between 80% and 85% of all clothing searches now start online”.

At most UK supermarkets, price reductions have been a feature of the year in light of the continued financial pressures consumers are facing. Tesco argues its “unique” customer offer of the Aldi Price Match, Low Everyday Prices and Clubcard deals has kept it as the “cheapest full-line grocer” for the best part of two years.

Elsewhere, Tesco knows that to maintain in-store footfall, it has to bring variety to its spaces and embrace partnerships with third parties. In October, The Entertainer revealed it had introduced more than 850 toy shops within Tesco stores – and strategic tie-ups such as this will keep the supermarket experience fresh and attractive to shoppers.

Ikea lockers are now at three Tesco shops too, meaning the flatpack furniture retailer’s customers can collect their purchases as part of their food shop. There are already 100 Ikea lockers at Tesco stores across the UK, but the extension of the partnership highlights the success both parties see in working closely together in the name of customer convenience.

1. Develop a flexible pricing strategy: Yes, the costs are mounting for retailers in the forms of tax hikes and business rates, but consumers will seek to spend away from stores and websites if retailers mess around too much with price.

Today’s shoppers are easily influenced by discounts and don’t necessarily stay loyal to a brand if there is a cheaper option elsewhere. Despite wage rises outpacing inflation, they are fundamentally poorer than they have been for some time in terms of discretionary spend – and that means all retailers need to offer a strong value proposition and affordable ranges to stimulate repeat spend.

2.Ringfence the ‘aspirational millennial’: The millennial demographic is an interesting one. Many of those in this category are particularly squeezed financially and time-pressed, but they are typically making purchasing decisions for others, i.e. their children.

They have a propensity to spend online due to the perceived ease it offers and to navigate time constraints, and they are the most likely to be purchasing goods from the sectors that other age groups have deprioritised spending in, such as big-ticket items and toys. Key to success for retailers in the year ahead will be meeting the ever-varying and slightly unpredictable demands of this group as they navigate what is expected to be a continued turbulent time for them in 2025.

3.Discount events pay: UK retailers have trained shoppers to look out for dedicated sales events when they can get hold of discounts and special offers, and many consumers hold off their spending until these times.

Most retailers need to be active in these events but without damaging their margins too heavily, or if they are not going to get involved, they need to understand this shopper mindset and make sure their everyday offering appeals to the growing raft of bargain-hunters residing in UK households.

4.Consider strategic partnerships: As Asda and Amazon, and Tesco and The Entertainer, have shown, there is power in the partnership. Sometimes the solution to what your consumers are looking for already exists but is simply offered by someone else.

The most astute retailers will identify what these gaps are and team up with those who can fill them to deliver the products or the convenience and ease of shopping experiences that consumers demand today.

5.Stay strategically proactive: Although the general assumption is that the worst of the cost-of-living crisis is over, inflation is not settling in a downwards direction. October’s inflation rise reversed the pattern of month-by-month declines following the 2024 high of 4% in January, and the Bank of England does not expect the UK to return to its target rate of inflation until early 2027.

This – along with expected rises in energy bills in the new year and mortgage-holders coming off fixed-rate deals having to navigate significantly higher interest rates than before – means consumers are far from feeling rich. The consumer continues to be cautious, and retailers must remember that splurges in spending remain an exception to the norm.

Partner comments

Rebecca Grimes, chief revenue officer, SheerID

Sophisticated marketers recognise the value of treating customers as individuals – embracing customer-centric approaches that prioritise trust, privacy and a deeper understanding of their needs and preferences (while also keeping an eye on their margins). This not only enhances the customer experience but fuels growth by allowing brands to personalize marketing messages and foster stronger customer relationships. Furthermore, zero-party data is increasingly seen as a valuable resource for building direct customer relationships and creating personalised campaigns that resonate with target audiences.

While the How They’ll Spend It report paints a somewhat bleak picture of the current economic landscape, it highlights the significant opportunity for retailers to grow market share by truly knowing their customers and engaging authentically.

SheerID believes there's a fundamental shift occurring in how brands are connecting with their customers. With real-time verification of consent-based consumer attributes, you can personalise marketing messages, foster stronger relationships and create a thriving community of loyal advocates. Is your brand ready to embark on this evolution?

Here are a few questions to consider if you’re ready to move to a customer-centric approach to driving growth for your brand:

- Are we looking to increase customer acquisition, improve retention or drive loyalty for our brand?

- Do we have a clearly defined target audience that would qualify for discounts or special offers (eg: students, teachers, first responders, partner programmes)?

- Would personalised offers and gated experiences incentivise this audience to provide zero-party data and/or to join our loyalty programme?

- Could we use zero-party data collected through verification to improve our marketing segmentation and personalisation efforts?

- Are we looking to improve the customer experience by providing a seamless and personalised verification process?

- Are we effectively mitigating the risk of fraud and ensuring data privacy with our current verification methods?

By adopting a customer-centric approach, prioritising zero-party data and creating personalised experiences, SheerID helps brands forge deeper connections with their customers and drive growth.

Connect with SheerID to learn about our solutions.

Ben Davies, founder Vypr

Our research with Retail Week highlights how cautious consumer spending is redefining the retail landscape. With rising living costs squeezing discretionary income, retailers must go beyond discounts to build trust and loyalty with their consumers.

As many consumers choose to trade down or opt for more affordable retailer-owned brands that still meet their needs, a significant opportunity emerges. Vypr customers such as Marks & Spencer, Waitrose and Holland & Barrett are seizing this by leveraging the consumer voice to shape their own-brand product development.

“The ability to hear context on big trends driving product development but in the consumer's own words has been hugely valuable”

Innovation in consumer experience is also key. For instance, three-quarters of consumers say they prioritise value and convenience in their purchasing decisions. Retailers who anticipate these needs and tailor their offerings, whether through personalised discounts, omnichannel experiences or loyalty schemes, stand to gain the competitive edge.

Being agile will also play a crucial role. Different demographics have different priorities, and retailers must adapt. While younger consumers may seek sustainability-focused options, such as secondhand and re-commerce marketplaces or eco-friendly delivery methods, older shoppers often prioritise convenience and reliability. This might mean offering a range of fulfilment choices: flexible delivery windows, local pick-up options or even bundled services for cost savings.

In this turbulent economic climate, where political pressures and the rising cost of living weigh heavily on consumers, developing a flexible pricing strategy has never been more important. While tax hikes and business rates burden retailers, consumers are quick to turn away if prices shift too dramatically. Balancing affordability with value will be key, as retailers must find ways to maintain margins without alienating price-sensitive shoppers. Retailers that embrace this flexibility are more likely to build trust and keep shoppers engaged, even amid economic challenges.

Understanding shopper price sensitivity is critical for retailers aiming to balance affordability and value in 2025. Tools like Vypr’s pricing capabilities enable retailers to explore price sensitivity, helping them optimise pricing strategies while protecting margins. As consumers become more discerning, these insights are essential for staying competitive and building trust.

Ultimately, the retailers that thrive will listen to their consumers and adapt their strategies to meet evolving needs. Not just for today but for the long haul.

How They'll Spend It 2025 was produced by

James Knowles

Head of content innovation and report editor

Ben Silitoe

Writer

Hannah Buckley

Account manager

Sophie Nevin

Account manager

Chris Young

Subeditor

Stephen Eddie

Managing editor

Laura Reid

Designer