How They'll Spend It 2024 equips retailers and brands with the insight into shoppers’ intentions needed to make critical decisions and investments to deliver the best customer experience and drive sales.

Featuring the exclusive findings of Retail Week’s survey of 1,000 UK consumers, we lift the lid on the major changes shoppers have already made to their spending habits and, crucially, which are likely to stick.

The report, produced in association with nShift, also delves into how shoppers are reprioritising spend by category and how retailers can reach different demographics, drawing on case studies of UK retailers already refocusing their strategies to reach the consumer of tomorrow.

Of course, there is no silver bullet for a successful retail customer strategy – particularly as external economic pressures outside of retailers’ control play havoc with trading – yet this report provides a much-needed foundation to shape retail’s thinking for 2024.

Methodology

On October 23, 2023, YouGov, in partnership with Retail Week and global parcel delivery management and shipping software leader nShift, surveyed 1,000 UK consumers across all age groups to determine where they are prioritising spending, where they are cutting back and which factors on the path to purchase are most important to them. The findings of the research are analysed throughout this report.

The demographics behind the research: We surveyed consumers aged 18 to 80 to find out how they are shopping. We will refer to their age classifications throughout the report, broken down by YouGov as the following:

- Gen Z (born 2000 and later)

- Millennial (born 1982-1999)

- Gen X (born 1965-1981)

- Baby boomer (born 1946-1964)

- Silent generation (born 1928-1945)

Retailers must understand what customers truly want to construct an effective consumer strategy fit for 2024, as they continue to trade against a complex backdrop of negative consumer confidence and subdued footfall.

Our research shows that 86% are worried – 38% very and 48% slightly – about the rise in living costs.

An ominous outlook

UK consumer confidence rose by six points in November, despite the “ongoing cost-of-living concerns” impacting many customers, but remains in negative figures.

The overall index score for consumer confidence saw an increase of six points to -24 in November, following a nine-point decline in October, according to the latest GfK Consumer Confidence Index. All five indexes of consumer confidence were up compared with last month as consumers appeared slightly more optimistic about their finances.

Continued uncertainty about the future and the UK economic situation is making 46% of consumers reconsider their spending

In our survey, almost half (46%) agree with the statement that “continued uncertainty about the future and the UK economic situation is making me reconsider my spending” and 43% agree they “would like to save money going forward”.

Although now on the decrease, inflation remains high; the consumer prices index rose by 4.6% in the 12 months to October 2023, less than the 6.7% figure for September, according to the Office for National Statistics (ONS).

On a monthly basis, the index did not change in October 2023, compared with a rise of 2% in October 2022. The largest downward contribution came from housing and household services, followed by food and non-alcoholic beverages, where the annual rate was the lowest since June 2022.

UK shop inflation eased to its lowest rate in more than a year in October, according to figures from the British Retail Consortium. This marked the fifth consecutive monthly decline and brought some relief to consumers.

Money-conscious consumers remain reluctant to visit physical shopping locations. Overall footfall increased in November by just 1% compared with October, despite a Black Friday boost in the final week, following a 0.2% decline from September to October, and was flat year on year, according to MRI Software data.

Breaking physical locations down, the data shows that high streets continue to suffer disproportionately, with footfall down 0.7% in November. However, things are looking up slightly at shopping centres and retail parks, where footfall grew by 1.5% and 0.1% respectively throughout November.

Time to take stock

It is possible that falling shop price inflation paired with strong wage growth could bolster household spending in time for Christmas.

As established retailers continue to fall while more disruptive brands are in growth, it's clear that retailers fostering innovation are most likely to succeed

But at the close of a year that saw established retailers Wilko and WiggleCRC fall into administration, while more disruptive brands such as Sephora and Marks Electrical are in growth, it is clear that retailers that foster innovation are most likely to succeed.

Retailers must prioritise getting under the skin of UK shoppers to understand both their short- and long-term priorities, and analyse their customer strategies to ensure they are fit for purpose. After all, game plans that were watertight two years ago are unlikely to win spend from the shoppers of 2024.

Sephora’s comeback

French beauty brand Sephora returned to the UK with a bang on March 8 – after a 17-year hiatus – with its flagship London store performing 300% better than expected during the first eight weeks of trading. Ahead of the store opening programme – its second London store opened on November 15 – it launched a UK website and app. The multinational retailer promises UK shoppers personalised “memorable experiences” via a CX strategy of blending technology with the human touch. It is likely to take inspiration from its Singapore store to achieve this, with customers able to attend classes at its beauty school, bookable via a mobile app, and build a personalised skincare regime drawing upon expert advice in its in-store skincare lounge. According to owner LVMH, Sephora’s full-year results for 2022 were its strongest ever, with record sales and profits.

Marks Electrical on the charge

Marks Electrical reported a 24.8% increase in revenue to £53.9m in the six months ending September 30, 2023, making it the UK’s fastest-growing electrical retailer. The brand, which was established in a Leicester garage in 1987, has positioned itself as a challenger to larger rivals such as Currys and AO through a strategy that has seen it generate robust aisles growth and build on its accelerated expansion during the pandemic. The pureplay retailer has made significant investments in technology and marketing, centralised operations at a multipurpose site, and runs a vertically integrated delivery model, with approximately 93% of orders delivered by its own fleet.

Shoppers may not be hitting the high street or splashing out on big-ticket items, but household spending has jumped sharply over the past year owing largely to price rises.

Almost half (48%) of consumers in our survey have seen monthly household spend increase significantly year on year, while 34% have seen a slight rise. Just 6% report no change.

As one respondent says, while their “spend is the same, I get less for my money… council tax plus gas and electricity equals half my monthly income now”.

The message is clear: in 2024, consumers will have less money to spare

The baby boomer generation appears hardest hit by the soaring cost of living, with 56% reporting monthly household spending increasing significantly as of October 2023, compared with the previous year. More than half of gen X (52%) note a significant rise in household spending, as do 44% of millennials.

The message is clear: in 2024, consumers will have less money to spare and so retailers must work harder to ensure that people are still coming to them with their spend.

Spending priorities

Many consumers are stripping shopping lists back to the essentials. Food and groceries are the number one priority among all age groups in our research when it comes to spending on new items, followed by general merchandise, and then entertainment and eating out. Of the nine categories, electricals and gadgets is the lowest priority.

While the results may seem positive for grocers, supermarkets still need to work to provide their shoppers with what they truly want to avoid losing custom to rivals. Change is already afoot; for instance, in October discounter Lidl overtook Asda to become the third-largest supermarket in London as its market share hit an all-time high of 9.1%, Kantar data for the 52 weeks to October 1, 2023, showed.

Trading down was a theme in our research, with more than half of consumers (54%) in the survey revealing they are buying cheaper or own-brand grocery items. This suggests significant opportunities for own-brand or value ranges that offer high quality at low prices, as well as loyalty schemes and compelling discounts.

Sainsbury’s boss Simon Roberts has recently credited the supermarket’s growth to investment in lowering prices. The grocer has rolled out discounted Nectar Prices to more than 6,000 products and reports that the vast majority of its customers are now shopping with Nectar, making savings of more than £450m since April 2023.

Sainsbury's Nectar Price scheme offers lower prices to members on more than 6,000 products

Sainsbury's Nectar Price scheme offers lower prices to members on more than 6,000 products

Speaking in November, Roberts said this work had helped the grocer gain market share “from other supermarkets” and that, for the first time, it was “taking back share from the limited choice discounter supermarkets, too”.

Not every shopper is intent on slashing their supermarket bill, however; in our research, almost a quarter (24%) say they have no plans to buy cheaper grocery items.

The oldest and youngest consumers are most likely to prioritise entertainment and eating out; 30% of the silent generation cite this as one of their top three spending priorities, as do 27% of gen Z and 25% of millennials.

Of all the groups, gen X is the most likely to prioritise big-ticket items (12%), while baby boomers are the most likely to buy general merchandise (39%). The generation likely to have the fewest financial responsibilities – gen Z – ranks fashion (17%) and health and beauty (17%) higher among their spending priorities than older age groups.

Where shoppers are cutting back

Despite it being the focus for generations at either end of the spectrum, the largest proportion of consumers (28%) say they are most likely to slash spending on entertainment and eating out over the next six months. As a result, retailers should be looking at more inventive ways to delight and surprise consumers who are spending more time at home.

“We are seeing a huge polarisation of wealth, which has been further accelerated by the cost-of-living crisis”

Fashion was the next category identified for cutbacks (16%) and then big-ticket items such as furniture and large appliances (14%). Gen X is most keen to tighten budgets around entertainment and eating out (30%), while gen Z is most likely to cut spending on fashion (25%) and toys and gifting (12%).

“We are seeing a huge polarisation of wealth, which has been further accelerated by the cost-of-living crisis,” says Lisa Byfield-Green, data and insights director at Retail Week.

“This means that around a quarter of consumers are heavily impacted and struggling, and just over 10% have been barely impacted by cost-of-living pressures. For this reason, growth in discretionary categories such as fashion is concentrated at the luxury and value end of the market. Our Retail Horizon Consumer report found that 55% of those shopping with the value retailers were buying fashion.

“For retailers serving customers in the mid-market, which is most fashion retailers, performances are polarised. Those bringing a strong brand strategy, innovation and differentiation are faring best.

“We have seen strong performances from Next and M&S, but pureplay brands such as Asos and Boohoo have seen sales decline. This is in part owing to tough competition from value retailers such as Shein and in part to customers reining in spend.

“As discretionary spend remains under pressure, consumers are also making sustainable choices to resell and buy fashion secondhand and/or reuse items that they already own.”

Time to surprise and delight

As the cost of living upends shoppers’ priorities, retailers need to be investing in innovative solutions.

”This research points to the next retail battlegrounds, which will be won by those that can surprise and delight their customers beyond the simple transaction,” says Lars Pedersen, chief executive of nShift. ”We are seeing that, as consumers become more sophisticated, so they are demanding more from the brands they buy from.

”In deliveries alone, they want more choices of when and how their items arrive. They want to enjoy the benefits of a smoother post-purchase experience, whether that’s easy returns, checkout badges, which highlight more sustainable options, or clearer communications. The delivery is the link between brands and their buyers, so it is central to the brand experience.”

Innovation is also needed to drive fashion sales. With customers not prioritising clothing expenditure, many brands are expanding into the resale market.

Marks & Spencer launched a pre-loved school uniform initiative in June, asking customers to donate garments in exchange for 20% off selected children’s clothing, thereby nudging customers back towards their shelves.

M&S provides Oxfam ‘Shwopping’ clothes drop-off points in stores, which reward customers with a discount

M&S provides Oxfam ‘Shwopping’ clothes drop-off points in stores, which reward customers with a discount

The donated uniforms were sold on a dedicated pre-loved school uniform shop on eBay and in Oxfam stores. As part of the long-standing M&S/Oxfam Shwopping collaboration, the retailer also awards a £5 voucher when a donation that includes at least one M&S-labelled item is made to Oxfam.

Another example, relevant to cutbacks in larger items, is Mamas & Papas’ circular resale service, launched in May.

One of several sustainability initiatives from the brand, the Loved for Life scheme sees shoppers rewarded for trading in a Mamas & Papas pushchair with a voucher worth up to £150. The pushchairs are then refurbished, deep cleaned and repaired before being sold in the retailer’s outlet stores.

Mamas & Papas offers vouchers for people trading in pushchairs, which get refurbished and resold

Mamas & Papas offers vouchers for people trading in pushchairs, which get refurbished and resold

This is a smart move from a brand within a sector currently relying heavily on millennial spend. With just 15% of millennials claiming they will not slash their spending, implementing creative sustainable solutions such as this will help capture the spend of the 85% who are planning to cut back.

Retailers catering predominantly to older demographics may not be as hard hit as those attempting to attract younger consumers. The silent generation is least likely to tighten their budget in the six months to April 2024, with 43% saying they won’t be doing so. For the baby boomers, 18% won’t be cutting back either.

How retailers can take action

With price clearly the biggest hurdle for shoppers, Sales and discounts that offer good value for money could be the first port of call for many retailers compiling their 2024 strategies. Flagship discounts and well-signposted sales, bolstered by targeted marketing campaigns, can attract new customers.

However, discounting is not a wise strategy for all retailers, fashion in particular, as customers can become reluctant to pay full price.

Food and grocery retailers especially are making customer grabs via price drops.

In November, Morrisons announced it was investing £4m in price cuts across its Christmas range – its 10th wave of cost-cutting in 2023 – to reduce the price of 58 popular items by an average of 20%.

Morrisons has reduced the price of almost 60 festive items well ahead of Christmas to help shoppers stock up early

Morrisons has reduced the price of almost 60 festive items well ahead of Christmas to help shoppers stock up early

Meanwhile, Aldi has slashed the cost of more than 150 goods across its stores over the past few months and in October was confirmed by Which? as the UK’s cheapest supermarket for the 16th month in a row. In September, Tesco locked more than 1,000 prices until 2024, cut costs on hundreds of products and applied its Aldi Price Match initiative to hundreds more.

Marks & Spencer reduced prices by 11% on average across 200 lines at the start of the golden quarter, while Waitrose embarked on its third cost-cutting mission of the year in September, dropping the prices of 250 everyday items by an average of 10%.

As for retaining existing customers, loyalty schemes that offer genuine savings and unique rewards put retailers head and shoulders above the competition.

For example, at the end of 2022, Ikea redesigned its loyalty scheme so that customers are rewarded for simply logging into and interacting with its app, as well as for making purchases.

They can then choose how to redeem their rewards – there are standard product discounts, of course, but they can also select interior design and skills workshops or furniture assembly assistance. The brand’s goal is to “add value into people’s lives when they shop with us”.

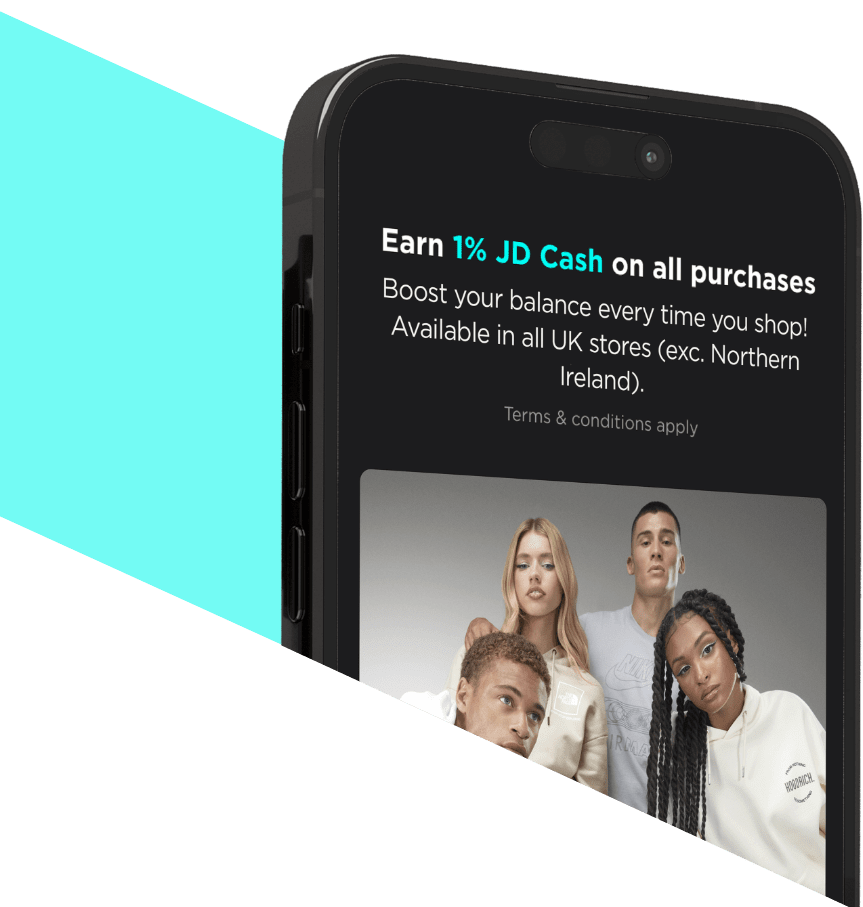

Meanwhile, JD Sports rolled out its new loyalty app, JD Status, across its store network in October.

Loyalty app JD Status offers users cashback as an incentive for shopping with the brand

Loyalty app JD Status offers users cashback as an incentive for shopping with the brand

As part of its ‘beyond physical retail’ customer experience approach, the app gives customers 10% cashback on their first purchase and 1% cashback on every additional transaction. The concept of rewarding customers with tangible cashback in store should strongly appeal to money-conscious shoppers, boosting sign-ups.

While the discourse around online customer experience dominates, our research indicates that bricks-and-mortar stores remain important to shoppers of all generations. Just 28% say they do the majority of their shopping online. This correlates with the latest ONS data that shows the proportion of UK online sales continues to fall, down from 26.9% in September 2023 to 26.6% in October 2023.

As with all surveys, though, we must keep in mind that there can be a say/do gap as sometimes sentiments and intentions do not necessarily lead to actions – for instance, the latest MRI Software data shows store footfall for November 2023 was flat year on year, despite a Black Friday boost in the final week.

Notwithstanding, our survey reveals that 36% of consumers now make most purchases in physical stores, while another 36% say they split their shopping between stores and online in equal measure.

Digging further into the data, millennials are the biggest online spenders, with 38% reporting they make most purchases online. Somewhat surprisingly, 38% of the digitally native gen Z say they prioritise shopping in stores, second only to baby boomers, 50% of whom shop mostly in stores.

Store resurgence

Stores must be a key part of retailers’ omnichannel strategies in the year ahead and many are already upping investment in their bricks-and-mortar networks.

Screwfix

Screwfix has been on a major store expansion drive. Despite the brand not opening its first physical shop until 2005, as of November it now operates 870 stores and 98% of people in the UK live within 30 minutes of one. The trade tool brand, which started as a mail-order catalogue business, is continuing apace on its store-opening programme, with plans to launch 60 new stores across the UK and Ireland by the end of 2024.

Majestic Wine

Drinks specialist Majestic Wine has a target to open one new store a month as part of its “commitment to innovating and investing in bricks and mortar”. In recent months, it has added outlets in Chippenham, Monmouth, Warwickshire and Nottinghamshire to its 200-plus estate and launched a new smaller-format outlet at London’s Crouch End in November. Majestic stores offer free wine-tasting sessions seven days a week, offering customers the chance to try before they buy with expert advice and tasting notes from the products sampled. Shoppers also benefit from free click-and-collect within four hours and a next-day delivery service.

Sosandar

Similarly, pureplay fashion retailer Sosandar has announced a move into omnichannel through the launch of its first-ever stores in spring 2024. While locations are yet to be announced, the retailer plans to target “affluent towns with thriving high streets”. The news comes after Sosandar saw revenues increase by 6% in the first half of its 2023 financial year, from £21m to £22.3m. It did, however, post a loss before tax of £1.3m for the period, but Sosandar co-chief executives Ali Hall and Julie Lavington (pictured) believe the debut store strategy will turn things around. The pair say the business is “perfectly placed” to open stores next spring following the success of its partnerships and the “growing strength” of the brand.

Wilko’s return?

Stores are also key to retail turnarounds. Despite the highly publicised winding down of Wilko stores after the value retailer fell into administration in September, its new owner CDS Superstores – owner of The Range – has announced five standalone Wilko stores will return to the high street before the year is out, ahead of an “aggressive rollout” in the new year.

Delivering success

Successful customer strategies for the close of 2023 and into 2024 will hinge on fulfilment. Our research shows that free delivery, unsurprisingly, is the most desirable option but also highlights that flexibility is paramount.

Drilling down, 69% of consumers prefer free delivery even if it takes longer, while 30% want the flexibility to choose different delivery options. Moreover, 24% cite the ability to choose a specific time and date among their top three delivery preferences.

Should retailers be striving to offer same-day delivery?

Significantly, our research shows that same-day delivery is not the be-all and end-all for consumers – same-day delivery was in the top three preferred delivery options for only 3% of respondents. On-demand delivery via services such as Uber Eats and Deliveroo was also not a widespread consumer preference, with just 6% rating this.

However, retailers targeting a younger demographic should certainly have these options on their radars. Same-day delivery and on-demand delivery are more important to gen Z consumers, with 6% and 14% respectively naming these in their top three delivery preferences. These options became progressively less important to consumers going up the age groups.

A same-day proposition is an investment priority for some of the biggest retailers. For instance, after success with its London pilot in July 2022, John Lewis expanded its same-day delivery options to Manchester, Leeds and Birmingham in July 2023. Reporting a “real appetite for same-day deliveries”, the retailer now offers the service – which currently costs £9.95 – to customers for items ordered before 10am.

Elsewhere, social commerce platform TikTok Shop launched Fulfilled by TikTok in August.

This new logistics programme offers same-day, automated fulfilment for all orders made by 7pm Monday to Friday, as well as a next-working-day premium delivery service, and improved customer feedback and ratings. There is no delivery cost for the consumer, but for the seller (the retailer), there are first item fees, picking fees and packaging costs per order. These vary depending on the price of the item and volume.

Screwfix has gone one step further for its customers, the majority of which are tradespeople, by introducing super-speedy deliveries. In 2021, it launched Screwfix Sprint, which provides delivery of 9,500 items direct to home or on site within an hour from 320 of its UK stores.

Screwfix Sprint's average delivery time is 47 minutes, while the fastest is just eight minutes

Screwfix Sprint's average delivery time is 47 minutes, while the fastest is just eight minutes

More than 30,000 customers have since utilised Sprint, which costs a flat £5 delivery fee. In May, the retailer aimed to increase awareness with a TV ad and influencer campaign – a first for Screwfix. Screwfix told Retail Week the average delivery time was 47 minutes, while the fastest was just eight minutes. The average number of products in a Sprint order is approximately 50% higher than a click-and-collect order.

Rising demand for click and collect

Click and collect appears to be gaining traction among consumers as retailers develop their omnichannel propositions. Click and collect from a retailer’s store ranked as the fourth preferred delivery option of the seven presented, followed by click and collect from a designated pick-up point, such as a third-party store, parcel box or locker.

Retailers have recognised the demand and are increasingly aiming to capitalise on this.

Aldi, which offers click and collect at more than 200 of its 990 UK supermarkets, has long been a champion of this fulfilment method as it aims to keep costs to a minimum and leverage its store estate.

In July, John Lewis extended its click-and-collect network with the launch of 72 collection points at Dobbies Garden Centres, taking the department store’s total number of collection points up to 5,700.

Primark, which had until last year eschewed ecommerce, has been making inroads in this area to cater to demand. The fashion retailer first launched click and collect in late 2022 with a pilot of children’s products in 25 of its stores across the North West of England. In July this year, it expanded the pilot to London, adding an additional 32 stores. In September, the service was expanded to include womenswear.

Happy delivery, happy customer

If retailers don’t maintain investment in improving delivery services, their bottom line will likely suffer. In our research, almost half (43%) of consumers say a lack of their preferred delivery option had stopped them from making a purchase with a retailer in the past six months.

Delivery is key to winning customer loyalty and advocacy:

- 58% of consumers agree with the statement ‘If something is delivered efficiently, I would be more likely to buy from the retailer again’.

- 56% agree with ‘I expect to be able to track the items I’ve bought while in transit’.

- 48% agree with ‘If I have a bad delivery experience, I am less likely to recommend the brand or retailer to friends and family’.

Part of the success of Amazon – which was named by most consumers as offering the best shopping experience (see chapter 4) – is thanks to its vast range of convenient delivery options, which include free standard, scheduled, one-day four-hour, same-day and overnight. And now the marketplace titan plans to go one step further and launch 60-minute drone deliveries in the UK and Italy in late 2024, following successful schemes in California and Texas. Amazon Prime customers will face no extra costs if they select the Prime Air delivery option at checkout.

“Half (48%) of consumers say that a bad delivery experience would make them less likely to recommend a brand or retailer. It is that important for the delivery to be seamless,” says nShift’s Pedersen. “For the consumer, it can be the first test of the brand they are buying from. If the delivery fails, so does the retailer.

“Customers expect deliveries on their terms, to be able to make choices in how and when something is delivered, often trading off cost, speed, location and carbon emissions. This is all part of a post-purchase experience, which among other things should make it easy for the customer to track the delivery and to return it easily if necessary.”

Return to sender

Easy and convenient returns are another priority for customers, particularly when it comes to online purchases, and getting this wrong can deter consumers from purchasing in the first place – 46% of consumers agree with the statement ‘I’m more likely to shop again with retailers with an easy returns policy’.

What’s more, 74% say having to pay a fee to return an item purchased online makes them less likely to shop with the retailer in the future.

We know that returns are often tricky and expensive for retailers. As of July 2022, the average cost per return for a retailer is £20, which accounts for around 10% of a retailer’s supply chain costs. It is reported that the end-to-end returns process is costing British retailers approximately £7bn annually.

“Charging shoppers to return items by post is relatively commonplace, but multichannel retailers should ensure that returns to store are always free as customers see brands, not channels”

“The best way for retailers to respond to the returns issue is to help customers make more informed choices,” says Retail Week’s Byfield-Green. “Providing accurate sizing information can help customers feel more confident, but beyond that, there are now plenty of technology tools available to retailers to help customers select the right size.

“We have seen avatars deployed on Zalando and also John Lewis’ fashion rental site that allow customers to visualise exactly how a garment will look on them so they can make better decisions. Since deploying avatars in the jeans category, Zalando reported that returns decreased by 10% and customers were less likely to order multiple sizes.

“When returns are necessary, retailers can incentivise customers by charging less for the preferred return option. Charging shoppers to return items by post is relatively commonplace for the sector, but multichannel retailers should ensure that returns to store are always free as customers see brands, not channels.”

Consumers want free, convenient returns, so should retailers seek to offer this or try to protect their margins and deter false returns?

Zara and New Look made headlines when they started charging for returns. Zara began charging shoppers £1.95 for postal returns in May 2022 and New Look introduced a trial fee of £1.99 for postal returns in February 2023, and has since increased the fee to £2.50. In September, H&M u-turned after it announced it would charge shoppers who returned online purchases in store, clarifying that customers would only be charged the £1.99 fee for online returns made to its warehouse.

While this approach may be expected to drive customers into the arms of competitors, AO credits its strategy of charging for delivery and returns as one of the main factors in its return to profitability in 2023. The retailer charges £24.99 for small items and £49.99 for large items to be returned via collection, while its drop-at-shop returns offer is free.

Chief executive John Roberts said that successfully making this move hinges on the quality of the service. “Our customer base understands there is value in the quality of the delivery service that we provide, and therefore that is not free.”

Elsewhere, The Very Group’s automated distribution centre at Skygate in East Midlands went live in March 2020. Skygate’s technology has delivered significant benefits for the brand and its customers, with returns processed in 30 minutes and faster refunds.

The Skygate centre can process returns within half an hour, which leads to faster refunds for Very customers

The Skygate centre can process returns within half an hour, which leads to faster refunds for Very customers

Sports Direct, meanwhile, teamed up with InPost in April 2023 to ditch print-at-home return labels in favour of a locker service. Customers returning an item can simply scan a QR code sent to their phone at their nearest InPost locker and leave the item in one of the compartments.

With plenty of innovation occurring in this area, it is apparent that retailers that fail to listen to what their consumers really want when it comes to flexible delivery options risk falling behind.

Christmas has come earlier than ever in 2023 as budget-conscious consumers map out their festive spending months ahead of the holiday season.

Almost half (45%) of the consumers in our survey (conducted October 23) were already planning their Christmas spending budget.

Many people are looking to tighten their belts this year – 47% say they plan to spend less this Christmas compared with last, 39% will match last year’s expenditure and just 4% intend to up their budget.

With less Christmas cash to go around overall, which retailers look set to gobble up the biggest slice of the festive market?

Christmas 2023: The forecast

Where consumers will be spending

Marketplaces and pureplay retailers appear best placed to capitalise this Christmas – 44% (the largest percentage of consumers surveyed) say they will be shopping with online-only brands, including marketplaces.

As Brits pull purse strings tighter, shoppers are likely hoping the ability to easily compare prices online will save them money. What’s more, ticking off the Christmas list from home is convenient and empowers shoppers to avoid the stress of packed high streets.

With the cost-of-living crisis rumbling on, 15% say they will rely on value variety retailers such as B&M and The Range, while a further 15% plan to fulfil their Christmas wish lists in supermarkets. Clothing stores and electrical retailers are forecast to struggle, however, with just 3.5% and 2% respectively planning to make use of these types of outlets. Health and beauty stores also only registered 3.5%. With consumers generally de-prioritising non-essentials and big-ticket items, they may also be avoiding gifting these often pricey products.

What’s on wish lists

It looks set to be a big year for food and alcohol, including hampers – which 41% of consumers say is the gift they are most likely to purchase this Christmas. Books and stationery ranked second with 29%, while toys came in third place with 26%.

Elsewhere, electricals and gadgets have slid to the bottom of Christmas lists, with just 13% of those surveyed planning to make a tech purchase.

Christmas case studies

Of course, retailers will have been thinking about their Christmas strategies well in advance, and from the initiatives launched over the past few months it would seem many are determined to go the extra mile to ensure the golden quarter shines.

We’ve seen investment in fresh loyalty programmes, in-store experiences and incentives, hiring drives, new products, a laser focus on flexible fulfilment and festive ranges available early.

Upping the ante across stores and supply chains

Department store John Lewis opened its online Christmas store in August, with the retailer’s Christmas buyer Lisa Cherry explaining: “Customers are definitely starting to shop earlier this year.”

John Lewis has opened Christmas emporiums at 10 locations across its estate, including London, Newcastle and Southampton

John Lewis has opened Christmas emporiums at 10 locations across its estate, including London, Newcastle and Southampton

Tapping into unseasonable festive demand while many retailers were still focused on beachwear has paid off, however. Sales of Christmas decorations are up 25% year on year and sales of Christmas lights are up tenfold since the launch. The retailer is also investing in more in-store experiences this year, including Christmas tree workshops, grottos and festive markets carrying local goods.

Selfridges also kicked off Christmas early, ramping up its store investment. It launched its first festive destination of 2023 in September, three weeks earlier than last year, to allow customers to “get ahead and make preparations”. The 4,000 sq ft shop, located within London’s Oxford Street branch, carries the brand’s extensive range of decorations, which it has expanded by 12% year on year.

Within the store, shoppers will find decorations celebrating diversity, locally sourced items, food-inspired decor and a dedicated personalisation desk. The department store’s strategy appears to be paying off, with online customer searches for its Christmas products increasing, and searches for decorations and advent calendars up 24% year on year.

WHSmith is offering gift cards in exchange for secondhand books, which are resold through Zeercle

WHSmith is offering gift cards in exchange for secondhand books, which are resold through Zeercle

One retailer taking an innovative approach to attracting custom this Christmas is WHSmith, which launched a new book buy-back service alongside resale partner Zeercle at the end of October.

The scheme allows customers to swap their used books for WHSmith e-gift cards. The majority of books will then be sold through Zeercle’s resale channels.

Pureplay grocer Ocado is hoping to attract custom by tackling two major festive pain points for consumers: price and fulfilment. It slashed the cost of autumn and winter favourites in October, marking the fourth Big Price Drop announcement since June, in a bid to “mitigate inflation for its customers”.

Same-day delivery options were expanded in August, with a focus on encouraging shoppers to order larger deliveries within these slots, and Christmas delivery slots were launched in September, allowing customers to plan ahead. The brand’s laser focus on its ‘perfect execution’ programme is reaping green shoots, with an increase in quarterly sales and a return to volume growth reported at the end of quarter three.

Leveraging loyalty

Some retailers are leaning on loyalty this Christmas.

Superdrug launched its loyalty app and VIP rewards scheme in October. New perks include stackable discounts and free delivery after hitting a spend threshold. More than 150,000 Superdrug Health & Beautycard members who have already spent £300 with the retailer will be granted automatic promotion to VIP membership. This gets them 12 months of offers, including an ‘always on’ 10% discount on own-brand products and beauty services.

Superdrug ecommerce director Matt Walburn said this marked the start of a move from a physical to a digital loyalty scheme, “enhancing our offline plus online initiative to engage and improve the customer experience”.

For the Co-op, loyalty is also a priority this Christmas. It has been implementing cheaper prices for its members on festive lines, including its all-new premium Irresistible party food range and new Christmas sandwiches.

The Co-op went for a German festive market-themed Christmas sandwich this year: currywurst pork sausage with cheddar, sauerkraut, mustard mayo and gherkins on rye bread

The Co-op went for a German festive market-themed Christmas sandwich this year: currywurst pork sausage with cheddar, sauerkraut, mustard mayo and gherkins on rye bread

Festive hires

A wide range of retailers are also on recruitment drives to meet customer demand this Christmas. The biggest recruiters include grocers Tesco, with 30,000 store colleague vacancies, and Sainsbury’s, which had 20,000 roles across stores and warehouses to fill.

John Lewis Partnership had 8,400 temporary positions to fill – 2,800 at Waitrose, 2,900 at John Lewis in sales and merchandising, and 2,700 in its supply chain.

Boots is also on a major drive. It has been looking to fill more than 1,000 customer assistant jobs, over 1,500 distribution centre roles, up to 600 in-store customer operations assistants and more than 200 customer support centre roles this golden quarter.

We asked 1,000 consumers, unprompted, to name the retailer – online, store-based or omnichannel – that they feel currently offers the best shopping experience. Amazon, rather unsurprisingly, came out top with nominations from 8.4%, way ahead of the rest of the top five, which was an interesting mix:

- Amazon

- Marks & Spencer

- John Lewis

- Asos

- eBay

In the same survey of 1,000 UK consumers conducted in October 2022, the top five retailers named for best shopping experiences were Amazon, Tesco, Asda, Aldi and Sainsbury’s – fewer grocers reign supreme this year.

Beyond Amazon, we have taken a deep dive into the strategies of the other four retailers in the top five, profiling how they are investing to offer great customer experience.

Marks & Spencer

- Group sales growth of 10% to £6.16bn for the half to end-September 23

- Profit before tax and adjusting items up 75% to £360.2m

- 1,064 UK stores

- Active app users increased 7% to 4.9 million from January to September 2023

Customers say…

“Very quick to shop with… good online experience”

An astute combination of technological investment, brand partnerships and structural innovation has reinstated Marks & Spencer as one of the UK’s most beloved brands. Under its transformative ‘reshaping for growth’ strategy, the retailer has put its digital-led customer experience in the spotlight and is forecast to overtake John Lewis in Retail Week’s ranking of the UK’s biggest retailers by 2026.

Marks & Spencer is hyper-aware of consumer demand for a seamless omnichannel experience and heavy personalisation. Innovations smoothing the path to purchase include its AI-powered Style Finder visual search feature, launched in 2019, which allows customers to upload a photo of an outfit to find similar products available at M&S. Its Scan & Shop feature, meanwhile, means users can cut the queues by scanning grocery items with their phones as they shop and pay via the app. Marks & Spencer also makes wins with its low-cost, rapid click-and-collect service.

The M&S mobile app has increasingly become a focal point as the brand realised its potential to act as an uber-personalised digital shopfront. It is targeting 10 million app customers – up from approximately 3.9 million as of October 2022 – over the next few years. The retailer is also aiming to be “more relevant, more often” through its prolific partnerships with third-party brands such as Nobody’s Child, Sweaty Betty and Adidas. Most recently, it added lingerie retailer Pour Moi in October. These partnerships plug gaps where M&S lacks dominance.

Marks and Spencer has also ploughed investment into its distribution centres over the past few years. Online availability now exceeds store availability and the retailer is keen to drive around 40% of clothing and home sales online over the next year or so.

Meanwhile, the brand’s Chester-based customer contact centre now deals with 5 million queries per year via live chat, email, social media, phone and post, while its CX platform streamlines the capture of customer feedback and analysis, leading to more customer-driven strategic decisions.

And customers are sitting up and taking notice. Group revenue rose 9.6% to £11.93bn in FY2022 and consumers in our survey describe the high street mainstay as “easy” and “very quick” to shop with, highlighting “good experiences” online.

John Lewis

- Partnership sales grew £5.8bn for the half to end-July 2023, up 2% year on year

- Losses before tax narrowed by 41% to £59m, with a 14% improvement in losses before tax and exceptional items to £57.3m

- Operates 34 John Lewis stores, one John Lewis outlet and 329 Waitrose stores

- 57% of JLP sales were made online in the year to October 2023

- In stores, personal styling appointments are up 27%, beauty services are up 23% and nursery consultations are up 17%

Customers say…

“Excellent delivery… easy shopping experience… premium delivery options”

Tech is at the top of the agenda for omnichannel retailer John Lewis. The brand is reaping the rewards of an ambitious programme of digital investment to craft a “very easy, quick and convenient” customer experience, with well over half of sales now generated online.

The use of mobile to bridge the gap between online and off is a cornerstone of John Lewis’ strategy. Its app includes a barcode scanner and store finder, while it has also trialled sending personalised, location-specific offers and promotions to mobiles while users are in stores.

Fresh customer experience innovations include improved shopping tools such as search and sort, heavier personalisation, upgrades to basket and checkout functions, and hand-held connected devices for sales staff in stores.

Renowned for its customer service, John Lewis’ business model means its 24,000 staff partners are highly incentivised to deliver positive customer service outcomes. As one survey respondent says: “John Lewis is a nice shop to visit."

The retailer is striving to provide the same quality of service online through its two customer service centres, expert partner consultations and range of virtual events.

Increasing convenience and ensuring delivery is wrapped around customers’ lifestyles is the retailer’s fulfilment mission. As the brand increasingly shifts online – 16 stores have been shuttered over the past few years – it is leaning on its vast 5,700-strong click-and-collect network to deliver this. Collection points can now be found in Waitrose, Booths, Co-op, CollectPlus and Dobbies Garden Centres, while Waitrose delivery drivers accept John Lewis returns. Recent fulfilment initiatives include two-hour delivery slots, online order tracking, the expansion of same-day delivery and the ability to see branch stock availability online.

John Lewis’ fulfilment capabilities are not going unnoticed by consumers. One respondent says: “The delivery has been excellent – I am notified of the one-hour window and then told when I can expect the next delivery. So practical.”

“The best [delivery] service has been with John Lewis,” another notes, while a third says they favour the retailer for its “easy shopping experience and premium delivery options”.

What’s next for John Lewis? The retailer says it is not “anywhere near the end of our omnichannel journey” and is aiming “to be very flexible and agile” in its approach to digital transformation. But with a cost-cutting programme under way and the planned 2025 exit of chair Dame Sharon White, who has spearheaded its digital-first approach, it must ensure it doesn’t lose its customer focus.

Nish Kankiwala – a non-executive director of the partnership since April 2021 – was hired as John Lewis Partnership’s first ever chief executive in March 2023. Kankiwala is tasked with driving performance and profitability day to day, while protecting the partnership’s ethos, and is expected to bring invaluable experience and stability to the business as it continues its transformation.

Asos

- Group sales dropped 10% to £3.54bn for the year to end-September 2023

- Reported a loss of £296.7m, deepening from a loss of £31.9m in the previous year

- Expects to return to growth by 2025 “with EBITDA margin around pre-Covid levels"

- Key focus for customer strategy is shift “back to fashion” with a focus on product curation

Customers say…

“Easy returns… pretty good delivery… easy to use”

Fulfilment, personalisation, engaging content and mobile experience top the development agenda at Asos. The disruptive pureplay retailer has been hit by a shift away from online shopping post-pandemic, posting in November an annual loss before tax of £296.7m and a 10% drop in group sales.

Our research, however, demonstrates that Asos remains influential with consumers, but it will need to protect its proposition while it rights this financial decline.

So what do shoppers love about Asos? Its returns policy is certainly high on the list. Asos offers free returns within 28 days of receiving an item and has no plans to charge for returns. It does, however, implement a serial returners policy, flagging accounts with customers returning large volumes of items, which it may block or withhold refunds to. In Asos’ words, this would apply to “returning loads – way, waaay more than even the most loyal Asos customer would order”.

Meanwhile, it has shored up its delivery and returns system through investment in infrastructure and tech to improve service levels.

While chief executive José Antonio Ramos Calamonte is scaling back investment in some areas – it was announced in September that the brand’s outlet department would close and that it was considering third-party partnerships to simplify its overstretched international presence – the retailer says it will continue to invest in delivering an engaging and seamless customer experience. To this end, it is developing cutting-edge capabilities, including voice shopping, visual search and AI-powered navigation.

CX highlights on its Microsoft-powered customer platform include the launch of ratings and reviews on the Asos app in 2020, a personalised spin on its ‘new in’ recommendations and a homepage countdown highlighting how long a discount will be active.

Meanwhile, the implementation of SecureTouch at checkout slashed the number of reCAPTCHA challenges by 98%, reducing friction on the user journey. In August, the brand partnered with ecommerce tech platform Rokt to serve customers better personalised post-purchase offers.

Rapid round-the-clock customer support is now available in nine languages, across email, social media, live chat and phone. The live chat routing feature determines the best available adviser based on a customer’s initial request.

Supply chain issues in 2022 led to increased markdowns to clear excess stock, severely impacting the retailer’s bottom line. The brand is now looking to simplify its supply chain, cut the amount of stock held in fulfilment centres and increase local sourcing. This, it believes, will boost agility to respond more quickly to trends. In July, for instance, it launched a pop-up sample Sale site with all old own-brand stock sold at £5 per item.

The retailer also expanded its Partner Fulfils initiative from two to 23 brands in February, following successful partnerships with Adidas and Reebok. Through the scheme, brands fulfil orders directly if the Asos warehouse is out of stock. The retailer has plans to add more brands to the scheme.

A decade ago, Asos was regarded as one of the UK’s most innovative retailers. Disrupting the fashion sector and doing new things quickly got the brand to its peak, so Ramos Calamonte’s vision of fostering innovation is an important one if it is to get back on track.

eBay

- Revenue increased 5% to $2.5bn (£2bn) for the quarter to end-September 2023

- Gross profit grew from $1.73bn (£1.39bn) to $1.79bn (£1.44bn)

- 50% of sales come from the US and 50% from international, including the UK

- 132 million active buyers worldwide (September 2023)

Customers say…

“Very convenient… best range and lowest price”

“Relevant, persistent and personalised experiences for consumers” is the goal at eBay, as the once-sprawling marketplace moves away from its previous acquisitional strategy and focuses on digital development.

eBay has constructed its highly personalised, relevant and inspiring path to purchase using AI and structured data. In recent years, it has trained a laser-sharp focus on two areas: enhancing the mobile experience and improving search results.

The marketplace aims to encourage social media-style ‘snacking’ behaviour among customers, incentivising them to return several times a day across various channels through frequently updated, highly personalised offers. AI-powered visual search technology allows customers to find similar items based on product images, while the ‘interests’ feature sends out personalised product recommendations.

And it’s paying off. In our survey, one consumer says they find the marketplace “very convenient” while another says it has the “best range and lowest price”. Another consumer cites its free delivery and order tracking as the reason they shop with eBay.

Customer service and trust are major pain points for online marketplaces. eBay addresses these through customer support via Facebook and X, as well as its call centre and resolution centre, where buyers and sellers are able to communicate directly should an issue arise.

With convenience often the deciding factor for online shoppers, eBay has ploughed resource into developing fulfilment services. Sellers and buyers can drop off and pick up items from Argos and Sainsbury’s, while its global shipping programme supports UK and US sellers with international logistics.

As consumer appetite for pre-loved items snowballs due to cost and environmental concerns, eBay has been tapping into this market. In December 2022, it partnered with clothing resale specialist ACS in a bid to tackle barriers to purchase for secondhand goods such as cleanliness, authenticity and condition. Its latest green innovation was the Circular Change Council, launched in October 2023, designed to tackle furniture waste.

Harvey Nichols

- Group net sales surged 58% to £191.7m in the year to April 2, 2022 (FY21)

- London flagship is central to growth: sales across the flagship store more than doubled in FY21 with net sales coming in at £57.8m (+112%)

- Making a name for itself in fashion: Retail Week’s analyst team ranks it among the top 30 fastest-growing UK fashion retailers – it continues to partner with burgeoning brands

- Retail Week forecasts that by FY26 group sales will come in at £275m

While not featured among our customer ranking, Retail Week spotlights Harvey Nichols – a retailer focused on making its strategy as customer-centric as possible, both online and in store.

Customer service and experiential shopping are paramount to its bricks-and-mortar strategy. Shoppers can book an appointment with a style adviser who will offer expert guidance on product size and fit, as well as styling tips and trend inspiration.

VIP customers at Knightsbridge, its London flagship, are treated to the “ultimate luxury personal shopping experience”, which includes a glass of champagne on arrival, private consultations with style advisers and a delivery service that transports shopping to the customer’s hotel or home. Customers receive “pampering treats and five-star dining” while personal shoppers assemble edits of different looks. Recent refurbishments have also included concierge departments to advise customers, with a huge focus on personalisation.

Elsewhere, Harvey Nichols’ partnership with online fashion portal Farfetch, which began in 2018, continues to enable the retailer to sell a range of accessories and clothing on the platform as it seeks to gain further traction online.

The department store chain has been investing in improving its delivery offering, too. It recently shifted from using a premium next-day delivery service to adopting nShift’s multicarrier shipping platform. The platform automates carrier allocations based on product dimensions – so that, for instance, single lipsticks are not shipped in a standardised box on their own – which has enabled the retailer to reduce costs and improve CX.

Harvey Nichols head of digital technology James Kothari-Henry explains: “For example, if the item fits in the envelope-sized packaging, we can then send it on a next-day track-to-letterbox service. That means there’s no need to wait in for the delivery. There’s no ‘Oh, I’ve missed my delivery, come back three days later.’”

Through the tie-up, Harvey Nichols has also sped up its delivery process by shipping products directly from stores rather than distribution centres – something the business was unable to do before using nShift’s service.

“And with approximately 20-30% of our parcel volume now via the new letterbox service, we have seen substantial savings that wouldn’t have been possible without nShift,” Kothari-Henry adds.

1. Invest in price and loyalty

The prevailing message is crystal clear. Consumers are incredibly concerned about their spending, and the cost-of-living crisis shows few signs of this sentiment changing. While convenience is important to shoppers, 69% say they would opt for free delivery, even if it took longer, and there are mixed views regarding same-day delivery.

While the outlook appears bleak, there are pockets of positivity and retailers can capitalise on consumer sentiment to grow market share. Launching discounts and sales that offer genuine value for money, backed by eye-catching marketing campaigns that target new demographics is a strategy that will pay off for many retailers. Deals that spark sign-up to loyalty apps will help retailers retain these new customers.

2. Invest in value

Budget supermarkets such as Aldi have enjoyed tremendous success with premium value ranges that attract customers who previously shopped in the luxury grocery sector but now have less cash to spare. With consumers more money-conscious than ever, a wide range of grocers, from Marks & Spencer and Waitrose to Tesco and Morrisons, are betting on severe price drops to retain customers and grab market share from rivals.

With the majority of shoppers prioritising essentials and more than half trading down, retailers must consider how they can tap into the value market. With incredibly competitive prices, value is no longer merely an option.

3. Think in omnichannel

Customers continue to interact with bricks-and-mortar stores, but they do so through a digital lens. The growing popularity of click and collect, the prioritisation of app features that engage with physical stores, and the success of true omnichannel brands such as Screwfix demonstrate that omnichannel is no longer merely a nice-to-have.

This means retailers must constantly think in terms of the omnichannel customer experience, whether rolling out a new line, offering a new deal or launching a digital feature. Consider the multitude of journeys that could bring customers to the point of sale and ensure there is engaging content at every step of the way, however the user chooses to interact with the brand. After purchase, analyse how to turn that shopper into a loyal repeat customer.

4. Wrap delivery around customers’ lives

If a shopper misses their delivery from a brand, the retailer is not necessarily to blame – but they will often reap the consequences of a lost customer. Our research shows that when delivery is efficient it builds loyalty, but when it goes wrong it can deter consumers from shopping with a retailer again.

This is why it’s worth investing in flexible delivery options; what works for one shopper won’t work for another. Offering a large range of both free and premium delivery options may cost a retailer more in the short term but will go a long way to building a loyal customer base.

5. Make returns as convenient as possible

Customer-first returns strategies are vital in the era of digital selling, with shoppers often investigating a brand’s policy before making their first purchase. A free, easy and paperless returns method makes the journey to purchase much smoother, as shoppers know that if a product doesn’t work for them they can simply reverse their purchasing decision. Consider taking a leaf out of John Lewis’ playbook and partnering with other brands to increase returns points while cutting costs.

Expert opinion

Lars Pedersen, chief executive, nShift

Our research with Retail Week shows cost-of-living concerns mean consumers have less money to spare, so retailers will have to do more to attract and retain their spend.

Cost-cutting alone will not be enough to win long term. The most successful retailers will be the ones that innovate to get closer to their customers. They will be the ones that think in terms of building ‘share of life’ relationships, rather than solely transactional ‘share of wallet’ goals.

Excellence in delivery management can give consumers reasons to buy and reasons to come back, time and again. Three-fifths (58%) of consumers say that if something is delivered efficiently they would be more likely to buy from that retailer again.

Getting the delivery right can no longer be taken for granted, though. Different consumers will have different attitudes and different needs, depending on what they are buying and when they need it.

That means retailers will want to be able to give customers choices about how their parcels are delivered. Two-fifths (40%) of consumers say they want that choice.

What could this look like in practice? Some customers may be willing to pay more for express delivery, while others may be willing to pay for zero-emissions options or might prefer a local pick-up. By offering options that customers like, retailers can increase their revenue and lower their costs. Being able to provide that choice means having access to a wide range of carriers, to cover all those options.

Many innovative retailers also use deliveries to build stronger customer relationships. The post-purchase experience is critical in building loyalty, for example, the ease with which returns can be processed or exchanged, the ability to track emissions or the use of communications about the delivery to engage customers with new marketing offers.

These are all key areas and the next retail battlegrounds in which to win customer spend in 2024. At nShift, we’re delighted to be able to help so many retailers rise to meet those challenges.

How They’ll Spend It 2024, produced by:

Megan Dunsby

Project lead and senior commercial content editor

Caroline Howley

Writer

Rachel Horner

Production editor

Stephen Eddie

Managing editor

Alex Hojbjerg

Account manager

Alban Bizet

Designer

Simon Mooney

Marketing lead