Exporting ecommerce

How to thrive online in the US

American consumers spent an estimated $340bn (£245bn) online in 2017.

With online sales of physical goods projected to surpass $600bn (£432bn) in 2021, the US is clearly an important market for overseas investment and growth; it has been the world’s largest single recipient of foreign direct investment since 2006.

And Americans love to shop; an estimated two-thirds of the US GDP comes from retail consumption, making it an exciting opportunity for any UK brand.

“Customer expectation has risen in the US, but retailers haven’t necessarily kept up”

British retailers including Primark and Topshop have managed to reap the rewards of transatlantic expansion, and online retail provides a relatively low-cost entry point into the US market.

In this interactive guide and podcast series, in association with Exporting is Great, retailers can learn how to successfully navigate the US ecommerce market, from understanding the consumer mindset to how to tackle sales tax.

Learn how to grow your business internationally with our digital guide, which includes:

- An interactive map pinpointing America’s retail hotspots, making it easy to decide where (and how) to invest

- A five-part podcast series including interviews with industry experts and real-life retailer case studies

- Exclusive consumer research granting you unrivalled access inside the mind of the American online shopper.

In this five-part Retail Week podcast series we’re looking at the nuances of the US consumer and its etail market in comparison with the UK, in order to help you plan your expansion into the world of American ecommerce.

Listen to episode 1 of the podcast

Episode 1 – The land of the free, and the home of the loyal consumer

Episode 1 of our exclusive podcast series takes a closer look at what drives the American consumer’s decision to purchase, helping you understand how to balance their love of brands with their loyalty to value.

Borders needn’t be blockers

Interactive map: top retail hotspots in the US

When expanding internationally, you need to be conscious of a country’s regional characteristics.

Using findings from exclusive Retail Week research, in partnership with Exporting is Great, we’ve plotted a map through America’s most economically exciting states.

By examining the local economy and buyer behaviour, our interactive map provides a detailed overview of the US from a retailer’s perspective.

For best results, view this map on your desktop computer.

Consumer spending behaviour

How do American consumers prefer to shop online?

As part of exclusive new Retail Week research, we surveyed 1,000 online shoppers to provide a comprehensive analysis of consumer behaviour in the US.

With a nationally representative split across gender, the findings have been broken down into regions (as found in Chapter 1’s interactive map) and age demographics, as seen in the charts throughout this guide.

Uncovering the nuances of the American online shopper, our research uncovers:

- The devices and platforms consumers favour when shopping online

- What guides their decision to purchase and influences them to buy

- Why they would leave a retailer’s website without completing a purchase

- What is most important for a retailer to provide, from product choice to preferred payment methods and fulfilment options.

“Gen Z are the most concerned with the security of their personal data online, but also the most open to sharing it. Essentially, they’re deal making”

How do consumers spend online in the US?

US consumers are more likely to shop on a regular basis via their mobile than on desktop, with 15% of those surveyed saying they shop on their smartphone on a daily basis.

Breaking the data down into different demographics, men are almost twice as likely to shop daily via a laptop or computer than women, and there is clearly a generational divide when it comes to shopping online.

|

Online shopping frequency via desktop

|

Male | Female | 18-24 | 25-34 | 35-44 | 45-54 | 55+ |

|---|---|---|---|---|---|---|---|

|

Daily |

13% |

7% |

17% |

14% |

19% |

5% |

3% |

|

Never |

10% |

16% |

21% |

20% |

13% |

Consumers over the age of 45 are significantly less likely to shop online daily than those aged 44 and under, with only 3% of those aged 55-plus saying they do so via desktop and 4% via mobile.

Smartphone penetration in retail ecommerce clearly dominates with the younger generations; only 2% of 18- to 24-year-olds say they never shop online via their mobile, while 15 times as many consumers aged 55-plus (almost a third of those surveyed) avoid mobile shopping.

| Online shopping frequency via mobile | Male | Female | 18-24 | 25-34 | 35-44 | 45-54 | 55+ |

|---|---|---|---|---|---|---|---|

|

Daily |

18% |

12% |

26% |

22% |

27% |

8% |

4% |

|

Never |

2% |

7% |

5% |

13% |

30% |

To learn more about the spending behaviour of the American online shopper, and how to exceed their (already high) expectations of customer service, listen to episode 1 of our five-part podcast.

Listen to episode 2 of the podcast

Episode 2 – Making a splash: promoting your product across the pond

Talking to Allyson Stewart-Allen, author of best-selling book Working with Americans, in this episode we’ll discover how UK retailers can successfully build brand awareness in the US.

Entering the market

How do American consumers prefer to pay online?

Smartphone penetration in retail ecommerce is clearly high in the US, with 43% of consumers surveyed saying they prefer to shop online via their mobile.

A further 13% of consumers prefer to shop via a tablet device or iPad, meaning that just under half of American consumers (44%) still choose to shop via a desktop or laptop computer.

Americans named credit and debit cards as the most popular ways to pay when shopping online.

PayPal sits in third place, with a quarter of shoppers preferring to use the online payment provider over any other method.

These results reflect the traditional approach to payments by US consumers, with the adoption of contactless cards and mobile payments being much slower to catch on compared with the UK.

Payments on public transport in New York and London (each country’s largest city) provide a compelling narrative of payment evolution.

Transport for London launched contactless payments on all its services in 2014, whereas New York’s Metropolitan Transportation Authority is hoping to roll-out a contactless ticketing system for the subway by 2021.

“We created a marketplace that’s empowering for sellers”

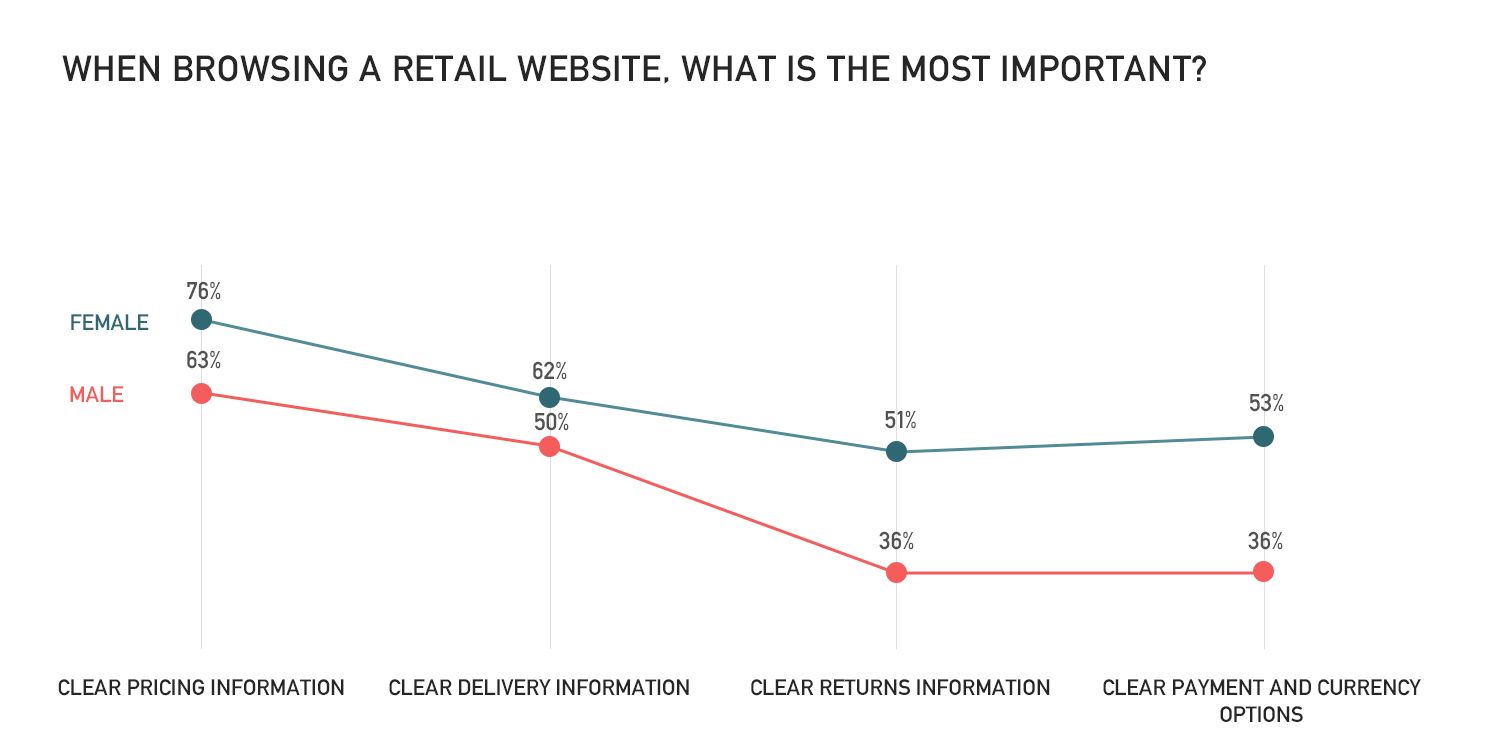

When consumers were asked for the most important factor of a retailer’s website, four out of the five top answers were around payments and fulfilment, showing that providing customers with clear pricing and delivery information is vital to creating a strong ecommerce offering.

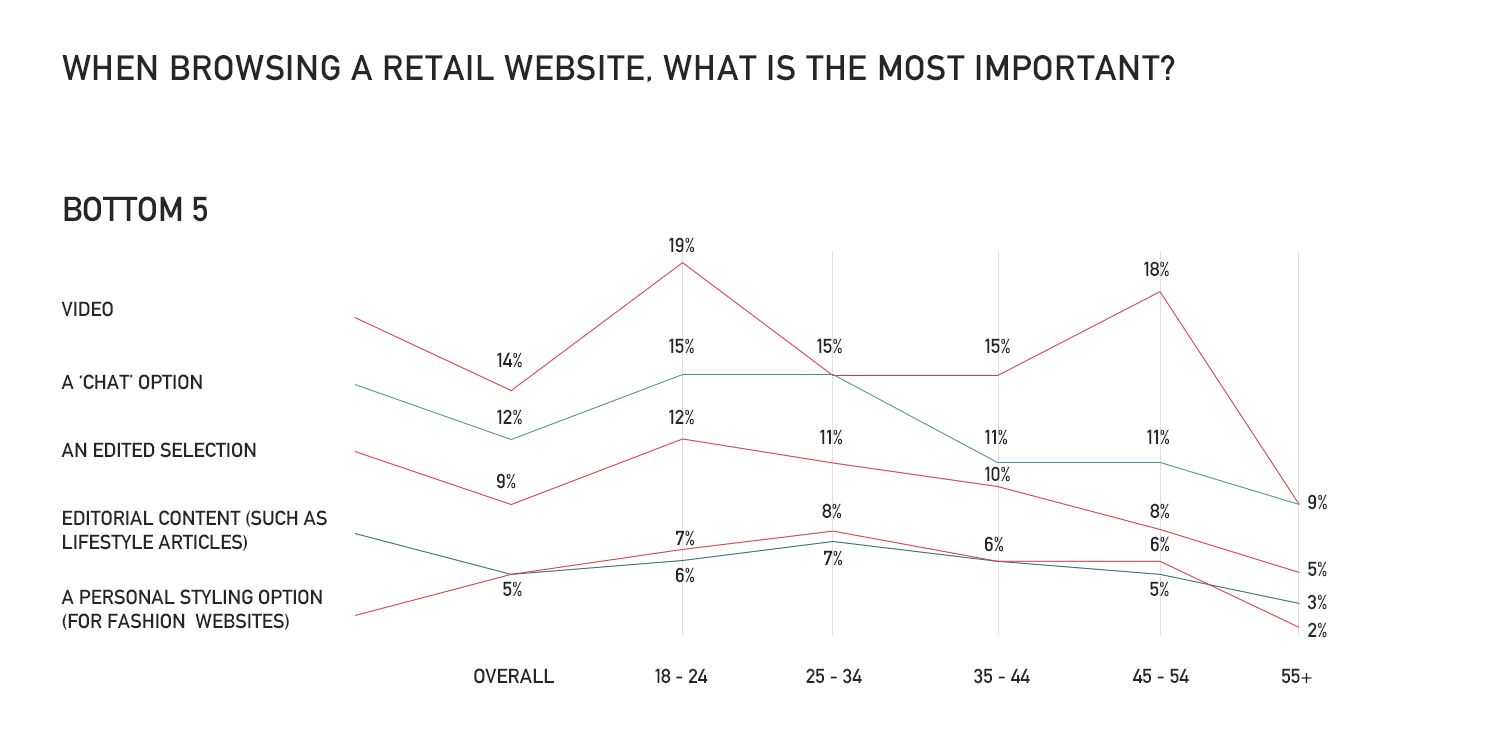

The five least essential requirements of a retailer website included video, a chat option and personal styling, showing that American consumers still view these features as a ‘nice-to-have’ rather than a necessary addition to their online experience.

As the consumer of the future becomes more intrinsically tech-focused, it’s no surprise that the younger shoppers are, on average, the most interested in such options, with those aged 18 to 24 showing higher levels of interest than the nationwide average in four out of five of the lowest-ranked categories.

When looking at the results based on gender, women are more likely to place importance on pricing and fulfilment information than men. More than three-quarters of women view clear pricing information as essential.

Listen to episode 3 of the podcast

Episode 3 – Amazon and beyond – mastering marketplaces

In this episode we’ll help you choose which platform will best suit your business, and speak to retailers that are already reaping the benefits of America’s digital mall.

The motivation to buy

What motivates their purchases?

Home goods and clothing are the most popular products to buy online in the US, with only a quarter of online shoppers choosing to buy their groceries this way.

In comparison, the UK is forecasted to become the second largest online grocery market worldwide after China by 2020.

Gender stereotypes come into play when looking at the types of products consumers shop for online; more than two-thirds of men buy electricals online compared with only 37% of women, who are more than twice as likely to buy cosmetics than their male counterparts.

American consumers are viewed as being extremely brand-loyal, but our research found that, although brand is important (with 49% naming it as a leading reason to purchase), a low price (79%), quality (64%) and a discount (52%) were deemed more influential.

“Americans are flooded with options, which makes us promiscuous consumers. We live in an economy of abundance”

More than a quarter of consumers (27%) say they would leave a retailer’s website if they didn’t trust its payment security, showing a focus on the safety of their personal details.

27% of consumers would leave a retailer’s website if they didn’t trust its payment security

And yet (on average) 10% of consumers have abandoned checkout because they have been redirected to a security filter, with male consumers and shoppers aged 18 to 24 most likely to do so.

Listen to episode 4 of the podcast

Episode 4 – Becoming a legal (bald) eagle

In this episode we’ll hear from sales tax experts Tax Jar and Avalara, on how to get your products safely – and legally – into the hands of your US customer.

Conquering the last mile

Free delivery is the most important aspect of the fulfilment process for American consumers, with 59% of those surveyed naming it as such.

With ‘quick delivery’ ranking third, at a substanially smaller 11%, it’s clear that US online shoppers would rather wait for their product – as long as it’s coming for free – than pay for it to arrive faster.

“Amazon has served as a catalyst for the rest of retail to increase their investment in innovation”

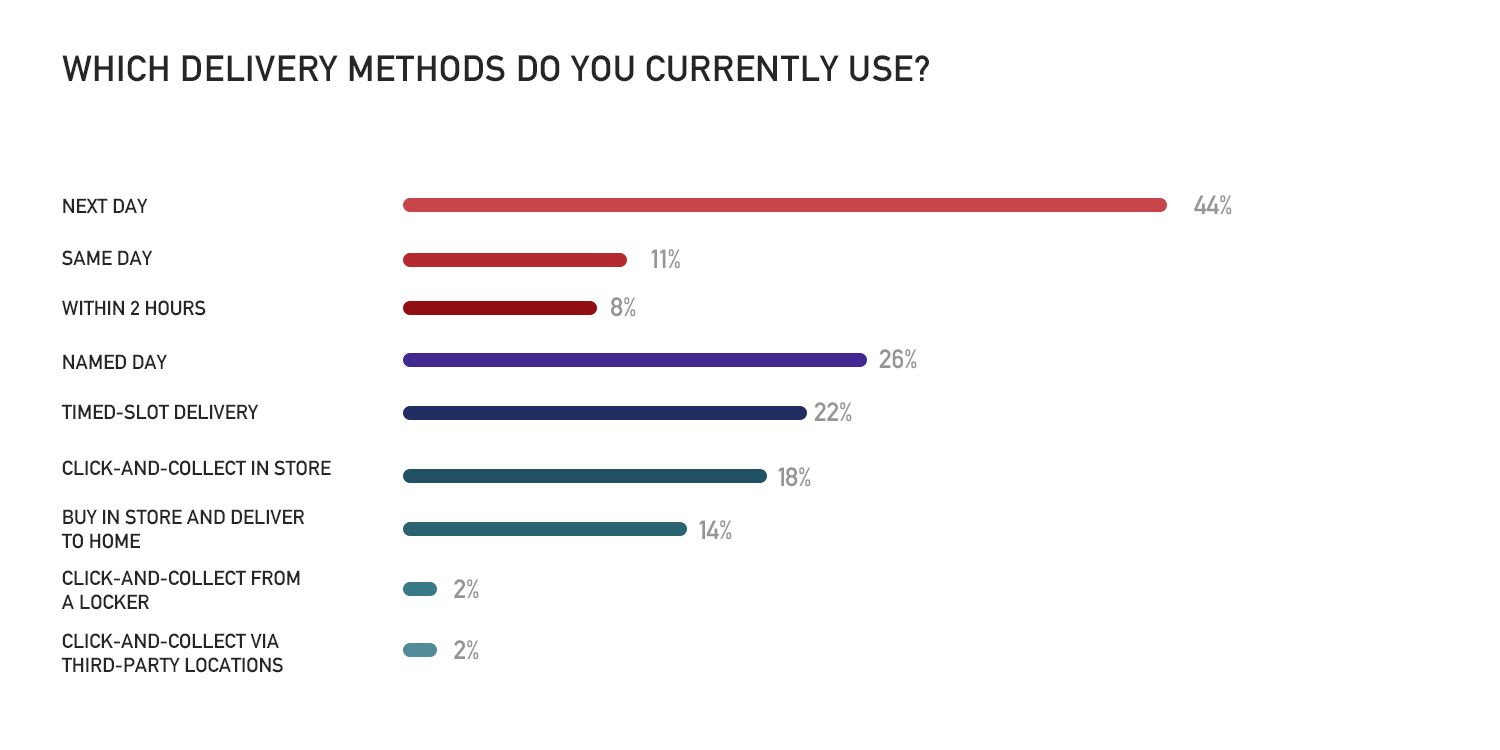

However, this preference for low cost rather than speed of delivery doesn’t match up with the types of delivery methods US consumers currently use.

Next-day delivery came out as the most popular form of delivery method with American online shoppers, with 44% of those surveyed saying they currently use it.

Consumer interest in click-and-collect has been growing slowly over the years, but it still isn’t yet widely recognised by US consumers.

Only 2% of consumers currently pick up packages from a click-and-collect locker or via a third party location.

But with Amazon dominating retail ecommerce, online retailers in the US may need to further the growth of click-and-collect in order to compete with consumer expectations on speed of delivery that the Prime model has created.

When breaking the data down into age demographics, 25- to 34-year-olds are the most likely to want their product to arrive the same day they make the purchase, with 21% of consumers in that age bracket using same-day delivery.

That statistic drops significantly as the age of the consumer increases, with only 4% of those aged 55-plus using the speedy delivery method.

Listen to episode 5 of the podcast

Episode 5 – Navigating the delivery landscape

In this episode we’ll discuss how to tackle fulfilment in a country 40 times the size of the UK, to help you discover which route would best suit your business and customers.

Thank you to our contributors

Exporting ecommerce

How to thrive online in the US

Written by Isobel Chillman

Produced by Red Apple and Abigail O'Sullivan

In partnership with Exporting is Great