Exporting ecommerce

How to thrive online in Sweden

Sweden’s small population of 10 million is relatively wealthy, with an average monthly income of 33,305 SEK (€3,198).

That makes it an attractive proposition for UK retailers looking to expand, but understanding the nuances of the Swedish consumer is vital for any retailer looking to find success in the country.

For example, despite higher than average European monthly wages, Retail Week’s exclusive survey of 1,000 Swedish consumers found their purchasing decisions are still most likely to be guided by price.

Convenience is also key – a retailer failing to offer their preferred method of payment is the most-cited reason for consumers abandoning their basket.

Amazon does not currently operate in Sweden and, when it comes to payments, the country is a near cashless society, meaning it has a very different digital landscape to the UK.

"Amazon does not currently operate in Sweden and, when it comes to payments, the country is a near cashless society"

So what do retailers need to know in order to ensure successful expansion into Swedish ecommerce? What makes consumers in this part of the world unique? And what do they share in common with UK shoppers?

This digital guide and three-part Retail Week podcast series, produced in partnership with Exporting is Great, will identify the crucial points any retailer needs to consider when entering the Swedish online market.

We will analyse the results of our survey of Swedish consumers, learn from experts in ecommerce and hear from retailers that have already been successful at cracking the market.

Learn how to grow your business internationally with our digital guide, which includes:

- An interactive map of Sweden’s retail hotspots, making it easy to decide how and where to invest

- A three-part podcast series, including interviews with industry experts and retailer case studies

- Exclusive consumer research, granting you unrivalled access into the mind of the Swedish online shopper

Listen to episode 1 of the podcast

Episode 1 – The Swedish consumer

In this episode we will explore what consumers in Sweden are looking for from their ecommerce shopping experience. We will analyse how they behave online and what their expectations are when they visit a retail website.

Borders needn't be blockers

Interactive map: top retail hotspots in Sweden

When expanding internationally retailers need to be conscious of a country’s regional characteristics. Using findings from Retail Week research, in partnership with Exporting is Great, we have plotted a map through Sweden’s most economically exciting regions.

By examining the local economy and consumer behaviour, our interactive map provides a detailed overview of the 10 most interesting areas of Sweden from a retailer’s perspective.

For best results, view this map on your desktop computer.

The Swedish consumer

What do Swedish consumers really want?

To really get to know what the Swedish consumer is looking for from their online shopping experience, Retail Week carried out an in-depth study of 1,000 online shoppers in the country.

Our research will show you:

- How often Swedish shoppers are buying online and how much money they are parting with

- The tech they are looking to retailers to provide, particularly when shopping via mobile devices

- How to capture their attention with marketing

- Which delivery methods and fulfilment experience are most important to them

Online shopping habits

Swedish consumers are big mobile shoppers, with 60% spending on their devices at least once a month and only 11% saying they never shop this way.

Compare this with desktop and 31% say they never shop online using a computer, showing a clear leaning towards mobile shopping.

However, spending on these devices per month is near equal, indicating that it is well worth retailers putting in the effort to ensure they are offering a good experience on both devices.

From wish list to basket

Low prices are the number one thing most likely to make Swedish consumers part with their cash, with quality and discounts coming in second and third.

What motivates your purchases?

- Low prices

- Quality

- Discounts

- I like the brand

- Great customer service

When it comes to what they buy, there are clear differences in what men and women are shopping for. Men are more than twice as likely to be shopping for electrical goods, whereas women lean towards buying beauty products and fashion online.

Listen to episode 1 of the podcast

Episode 1 – The Swedish consumer

In this episode we will explore what consumers in Sweden are looking for from their ecommerce shopping experience. We will analyse how they behave online and what their expectations are when they visit a retail website.

Talking tech

With the research indicating a preference for mobile shopping, retailers must make this experience a priority.

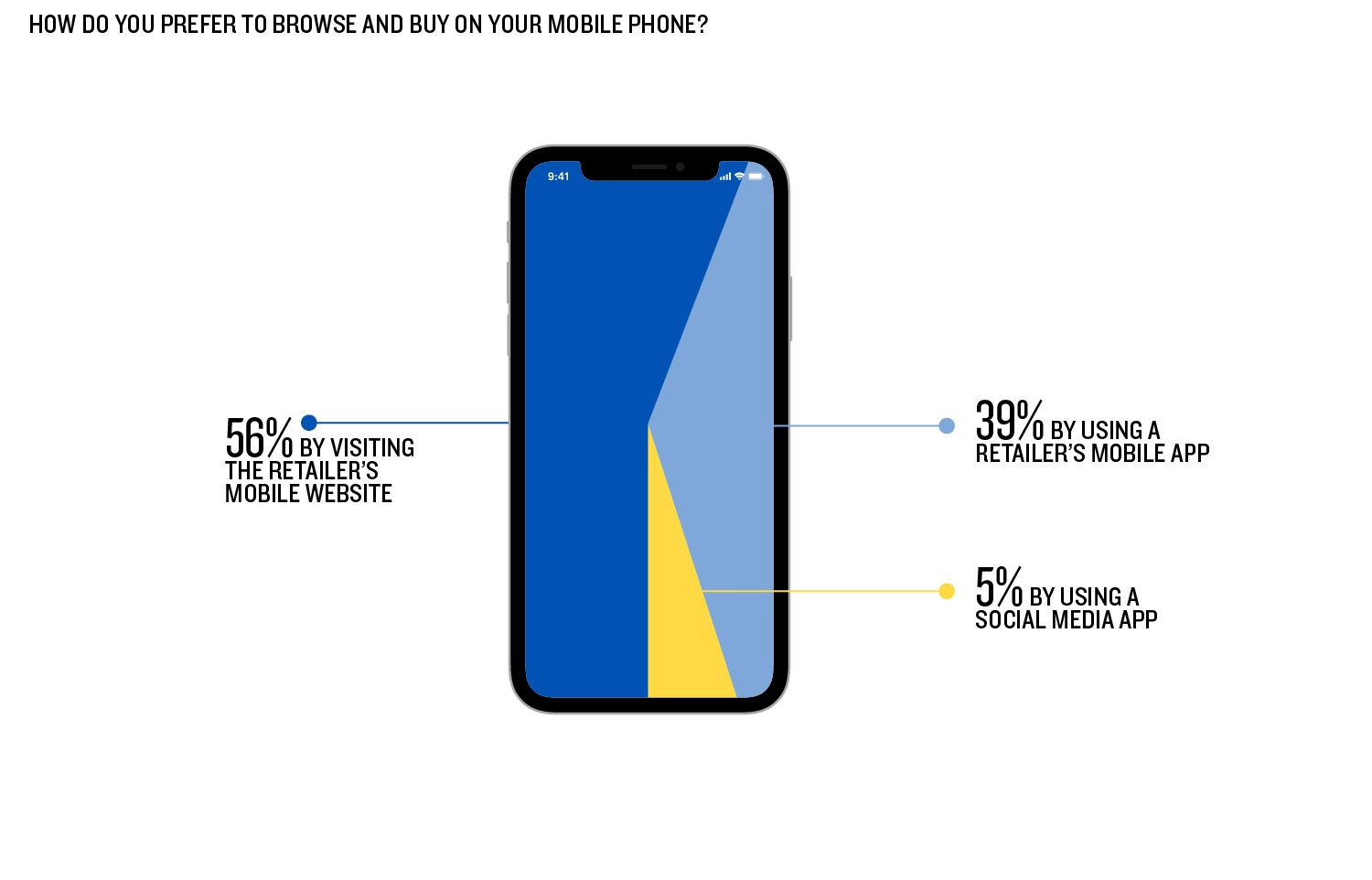

More than half (56%) of consumers say they prefer to use a retailer’s mobile website, while 39% say they prefer a mobile app and just 5% opt to shop via social media apps.

This suggests that even if a retailer decides not to invest in developing an app, having a mobile-optimised website will help provide Swedish consumers with a shopping experience to suit their needs.

Counting apps

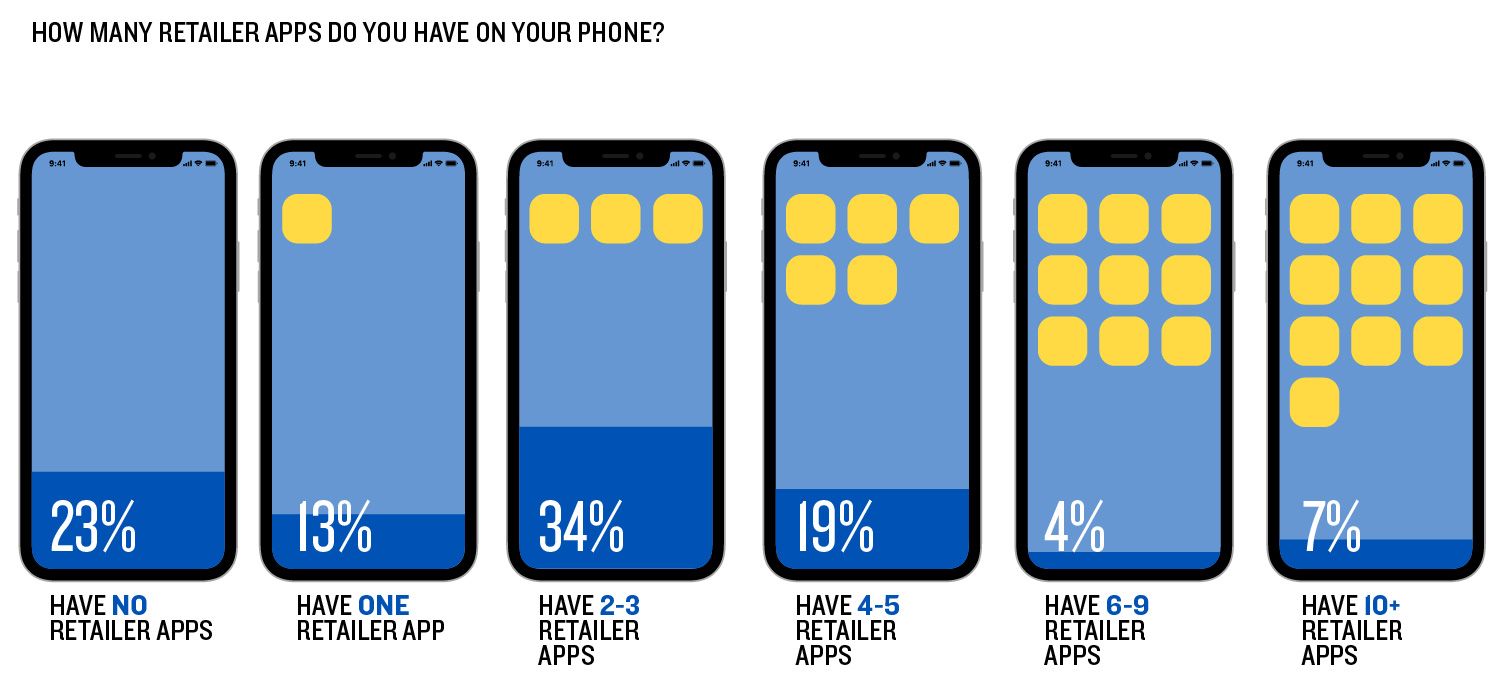

A huge 77% of Swedish consumers have at least one retailer app on their mobile phone, with 30% of these having more than four. Just 23% have none at all.

Payment pointers

Unlike many other European countries, PayPal doesn’t come out on top as the preferred payment method in Sweden, rather it’s in third place. Credit cards are number one, but interestingly, invoice-based payments come in as the second most popular method, an option not commonly offered on ecommerce sites in the UK.

Top five most popular payment methods with Swedish consumers

1. Credit card

2. Invoice

3. Debit card

4. PayPal

5. Buy now, pay later

Listen to episode 2 of the podcast

Episode 2 – Talking tech

In this episode we will get to grips with the technological advances in Sweden that are changing the way people shop online. In particular, we will look at what the Swedish consumer expects from payments and mobile shopping.

Marketing challenges

Social media is key when it comes to targeting Swedish consumers.

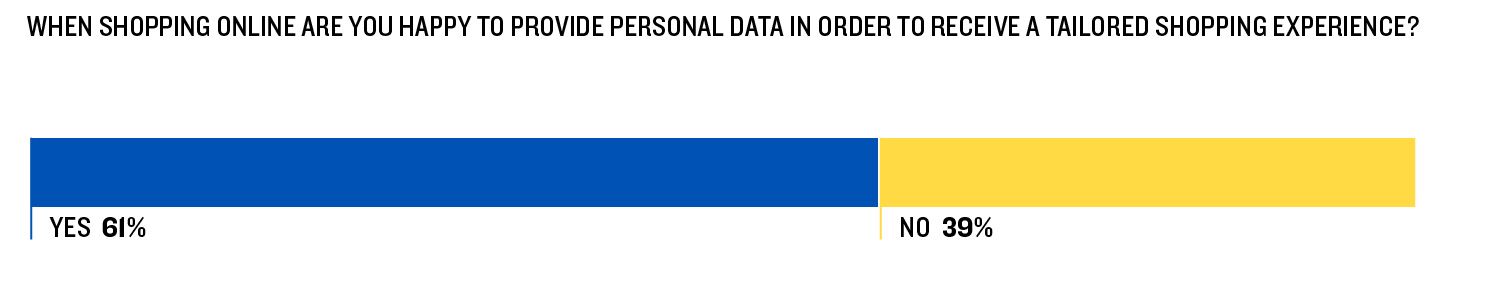

The majority of Swedish consumers are happy to share personal data – with 61% saying they would for a more personalised service. However, the remaining 39% present a challenge for retailers to market to as they do not want to provide this information.

Social life

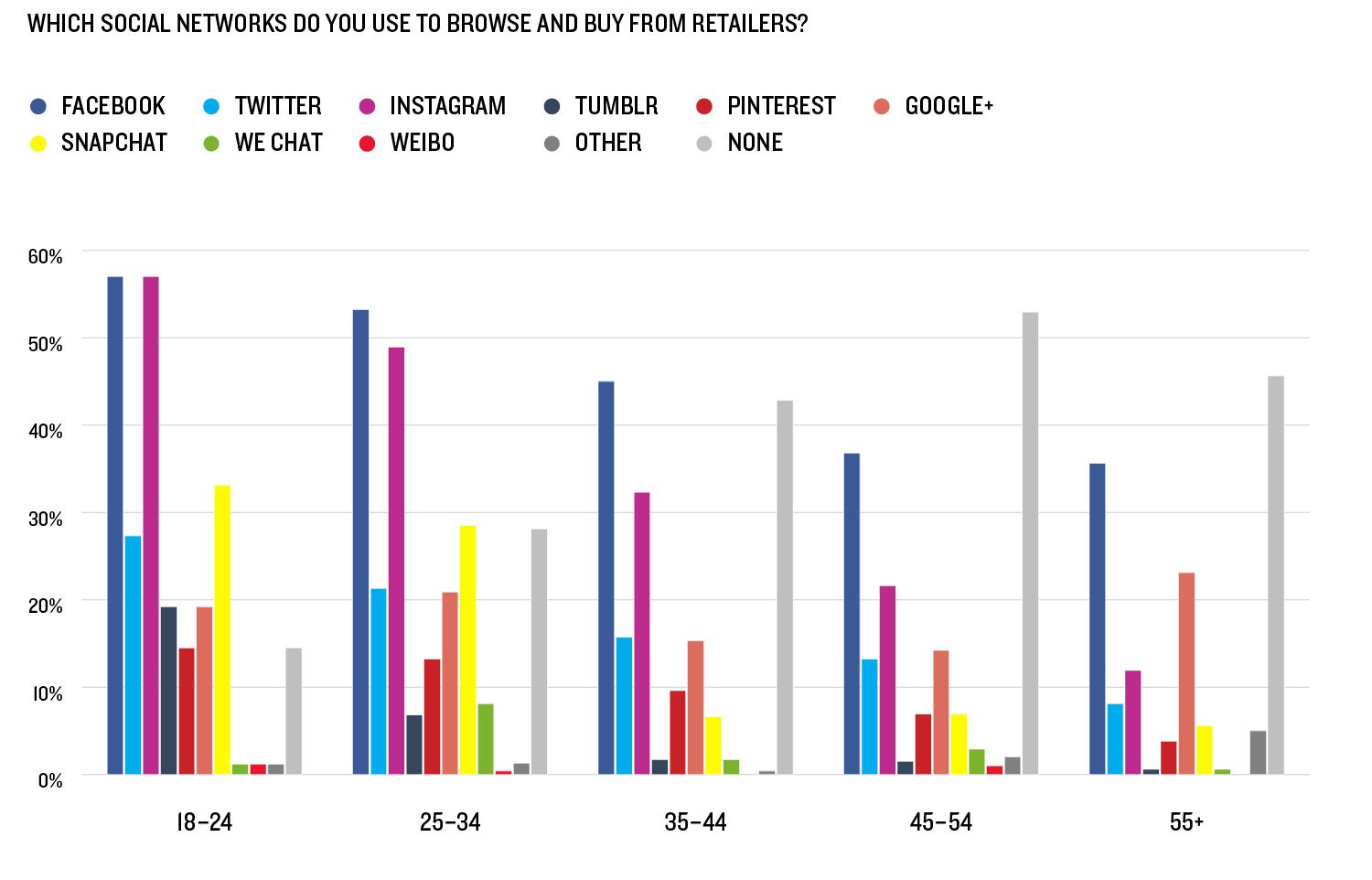

Social media is, as in most markets, widely used in Sweden. Most consumers are happy to hear from retailers on Facebook for instance, though over 45-year-olds would prefer not to hear from retailers on social media at all.

Instagram is also popular, particularly with younger age groups. This demographic also likes to use Snapchat as part of their online shopping experience, suggesting a highly visual approach to marketing might work in Sweden.

Influencing decisions

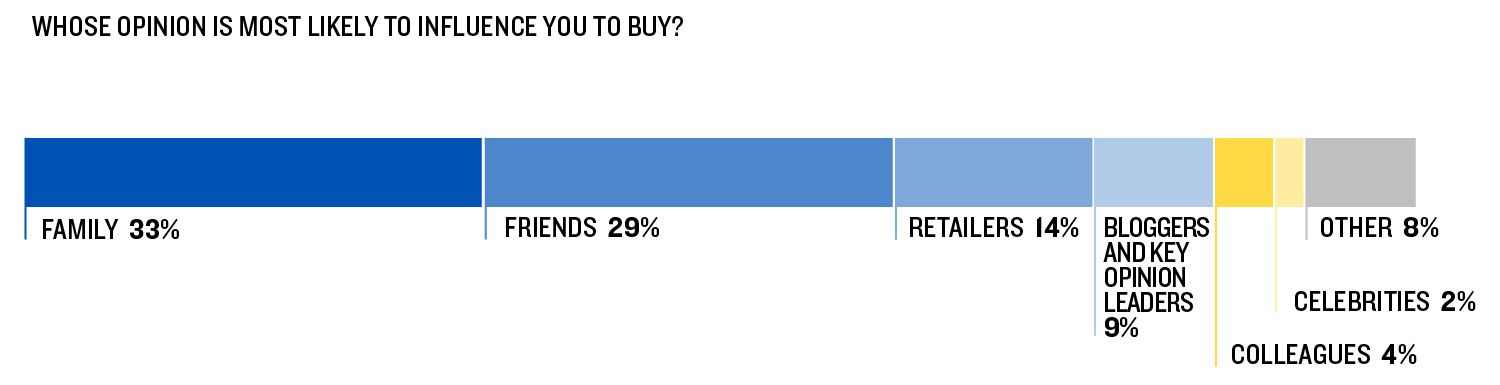

As in many other European countries, friends and family are the biggest influencers when it comes to purchasing decisions.

Retailers themselves come in as third most likely to influence shoppers, so there could still be scope for brands to act as thought leaders in their area of expertise.

Increasing reach through marketplaces

Marketplaces in Sweden can provide an opportunity for UK retailers to sell to an already established audience.

Many of these, including Fyndiq, which feature in our podcast series, span not only Sweden but many other economically strong Nordic countries encompassing a 25-million strong audience.

As such, marketplaces comprise an important part of many retailers’ expansion plans in Sweden.

Listen to episode 3 of the podcast

Episode 3 – Marketing challenges

In this episode we will delve into both the challenges and opportunities of marketing to the Swedish consumer, uncovering everything retailers need to know about the tactics that best resonate with this shopper.

We will speak to experts in online promotion, as well as listening to retailers share details of their marketing strategies. We will also explore the role of marketplaces when launching in Sweden and how they can provide a springboard for introducing a brand to other neighbouring countries with strong economies.

Delivery details

Above all, Swedish consumers are looking for convenience.

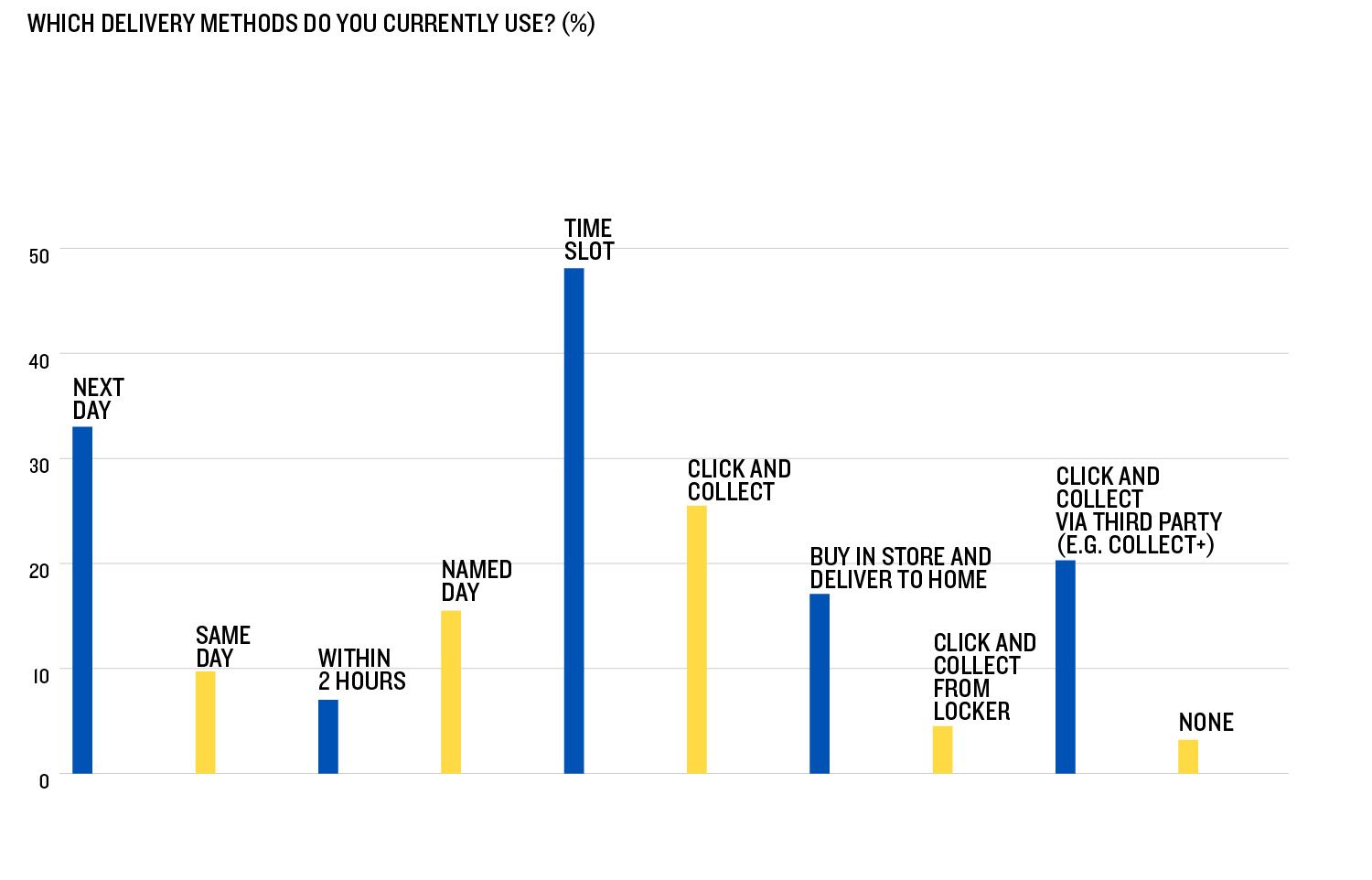

Time-slot and next-day delivery are top of the list when it comes to consumers’ preferred delivery methods, suggesting Swedish shoppers want their orders quickly.

Much like in the UK, there seems to be a low appetite for same-day delivery.

However, convenience is key. Different click-and-collect options account for 50% of the preferred delivery methods selected in our survey, indicating Swedish consumers appreciate the flexibility of being able to decide when and where they can pick up their parcel.

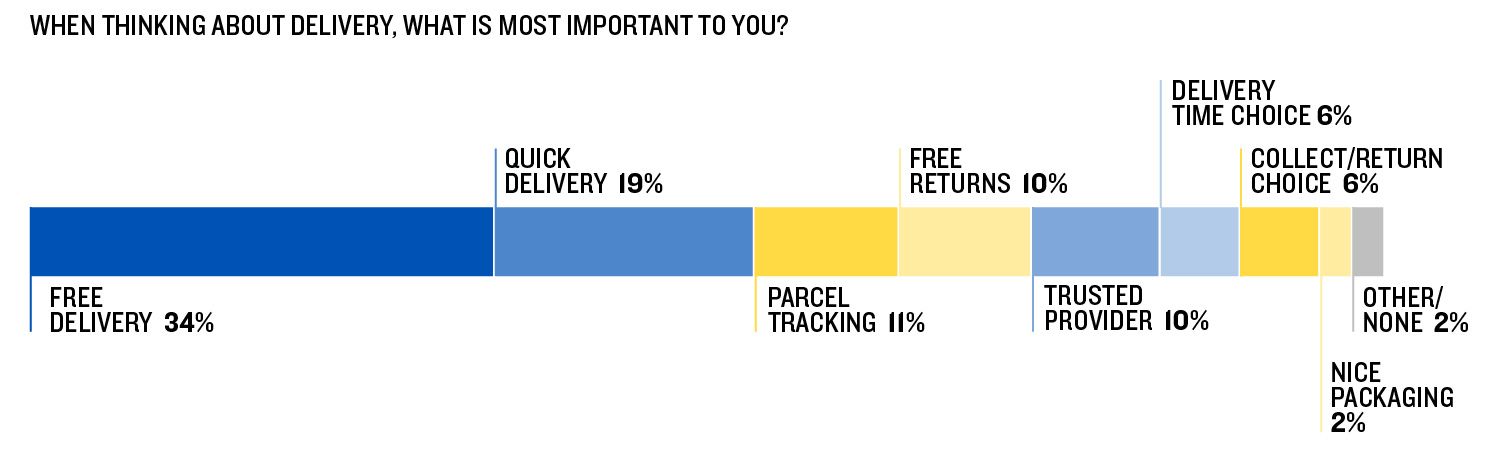

Similar to shoppers the world over, free delivery tops the logistics wish list for Swedish consumers, while nice packaging is least important to them.

Exporting ecommerce

How to thrive online in Sweden

Written by Jade O'Donoghue

Produced by Dan Harder/The Creativity Club

and Emily Kearns

In partnership with Exporting is Great