Exporting ecommerce

How to thrive online in Spain

With GDP forecast to grow by 2.6% in 2018, Spain is a country with spending power and a growing ecommerce market.

Though there are many similarities with the UK market, there are also differences that make understanding the Spanish consumer vital for any retailer looking to expand online there.

The high number of rural areas can make delivery a challenge, while payment methods that are less commonly used in the UK, such as cash on delivery, are more popular.

The use of mobile phones to shop is growing, with 20% of Spanish consumers saying they make daily purchases this way and 90% having at least one retail app on their device.

“The high number of rural areas can make delivery a challenge, while payment methods that are less commonly used in the UK, such as cash on delivery, are more popular“

So how does an online retailer find success in Spain? And what exactly do you need to know in order to attract the Spanish consumer – and keep them coming back for more?

Learn how to grow your business internationally with our digital guide, which includes:

- An interactive map pinpointing Spain’s retail hotspots, making it easy to decide where (and how) to invest

- A four-part podcast series including interviews with industry experts and retailer case studies

- Exclusive consumer research granting you unrivalled access into the mind of the Spanish online shopper.

This Retail Week digital guide and podcast series, in partnership with Exporting is Great, will look at the key things retailers need to know about the Spanish ecommerce market.

We will present the findings from our nationally representative survey of 1,000 Spanish consumers, speak to experts in the sector and discover retailers that have already been victorious in Spain in order to help other businesses enter the online market.

Listen to episode 1 of the podcast

Episode 1 – What do Spanish consumers really want?

In this episode we will take a deep dive into exactly how consumers are behaving in Spain and how they like to shop online. We will learn which devices they are using and what customer experience they are looking for when they land on a retailer’s website.

Borders needn’t be blockers

Interactive map: top retail hotspots in Spain

When expanding internationally, you need to be conscious of a country’s regional characteristics.

Using findings from Retail Week research, in partnership with Exporting is Great, we’ve plotted a map through Spain’s most economically exciting regions.

By examining the local economy and buyer behaviour, our interactive map provides a detailed overview of the 10 most interesting regions in Spain from a retailer’s perspective.

For best results, view this map on your desktop computer.

Consumer spending behaviour

What do Spanish consumers really want?

In 2018, Retail Week conducted an exclusive survey of 1,000 Spanish online shoppers to understand what they are looking for from an ecommerce experience.

Using their responses, we have been able to paint a comprehensive picture of the Spanish consumer, highlighting the key information UK retailers need if they hope to enter and succeed in this market.

Our research will show you:

- How often Spanish consumers shop online, which devices they’re using to browse and what they are spending their money on

- Which payment options they want etailers to offer and how much they are spending online

- The delivery methods they prefer and what is important to them when it comes to fulfilment

- How to market to Spanish consumers, including which social networks they use and who influences them most to buy.

“For daily purchases, mobile shopping narrowly wins; 20% do so daily compared with 18% who shop daily on their desktops“

Shopping on the go

While 27% of Spanish consumers surveyed say they never shop online using a mobile, only 3% say they never shop on a desktop computer.

In terms of frequency of online shopping, 43% of the Spanish consumers we spoke to shop on a desktop at least once a week and 36% say the same for mobile.

For daily purchases, mobile shopping narrowly wins; 20% do so daily compared with 18% who shop daily on their desktops.

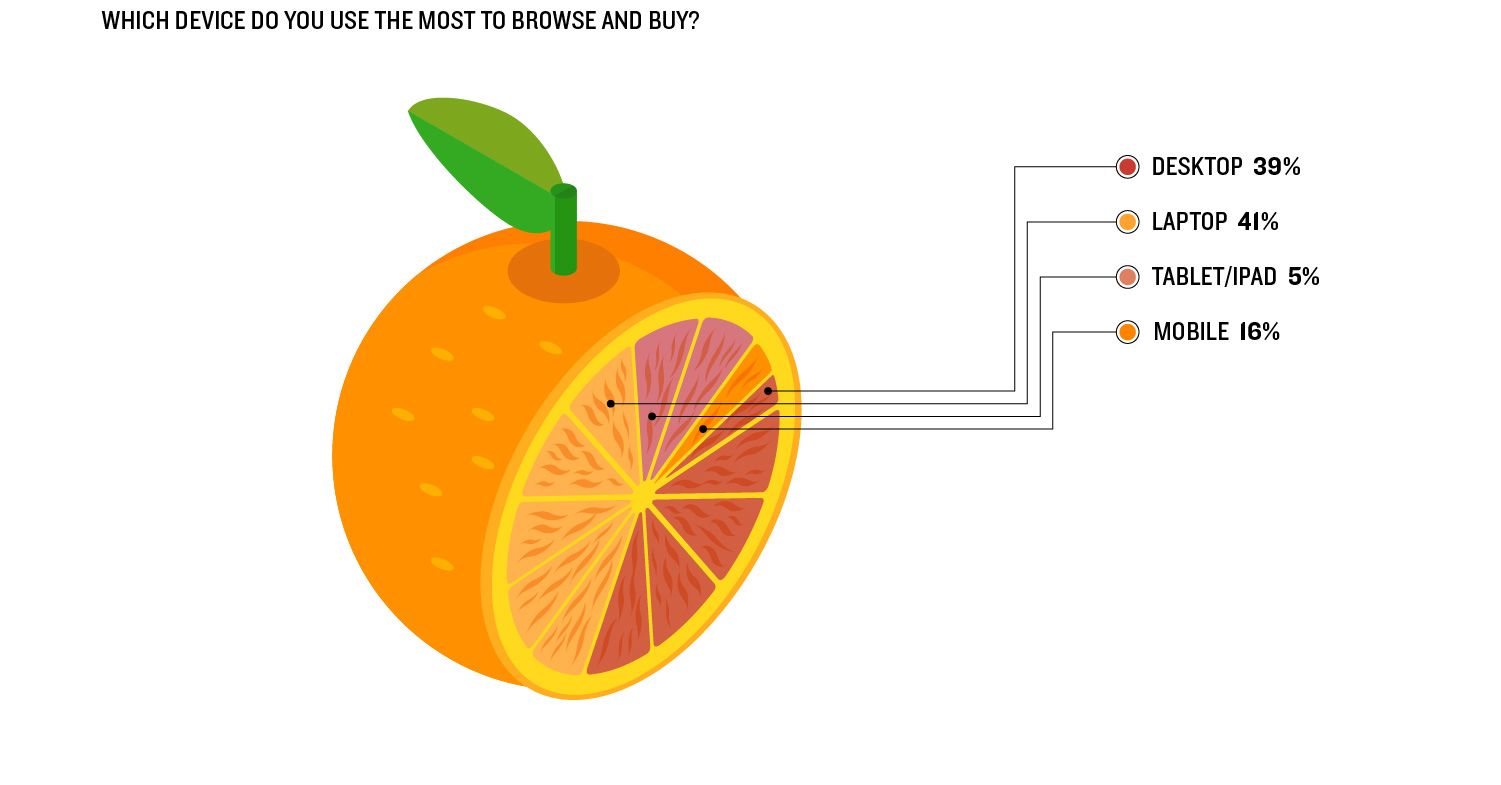

Which devices are they using to browse and buy?

Despite Spanish consumers frequently shopping on mobile, only 15% say this is the device they use most to browse and buy.

Desktop computers and laptops prove more popular, with 39% and 41% respectively citing these as their most used devices for shopping.

This suggests it is important to have an ecommerce offer that is optimised across each device.

In the Spanish shopping basket

So what are consumers buying on their desktops and mobiles once they are logged on?

In Spain, this differs according to gender, with male shoppers most frequently buying electricals online and women preferring to purchase fashion – information which may prove key to a UK retailer’s marketing strategy.

Listen to episode 1 of the podcast

Episode 1 – What do Spanish consumers really want?

In this episode we will take a deep dive into exactly how consumers are behaving in Spain and how they like to shop online. We will learn which devices they are using and what customer experience they are looking for when they land on a retailer’s website.

Providing the right payments

Ensuring the journey through the website is as seamless as possible is vital.

After all, not providing a payment method of choice and adding extra charges for payment are listed as the top two reasons for Spanish consumers abandoning their baskets at checkout.

Top four reasons for basket abandonment:

- Retailer charged extra fees for my payment method of choice.

- Retailer didn’t provide my payment method of choice.

- I didn’t trust the site’s payment security.

- Unexpected delivery charges were applied.

Favourite payments

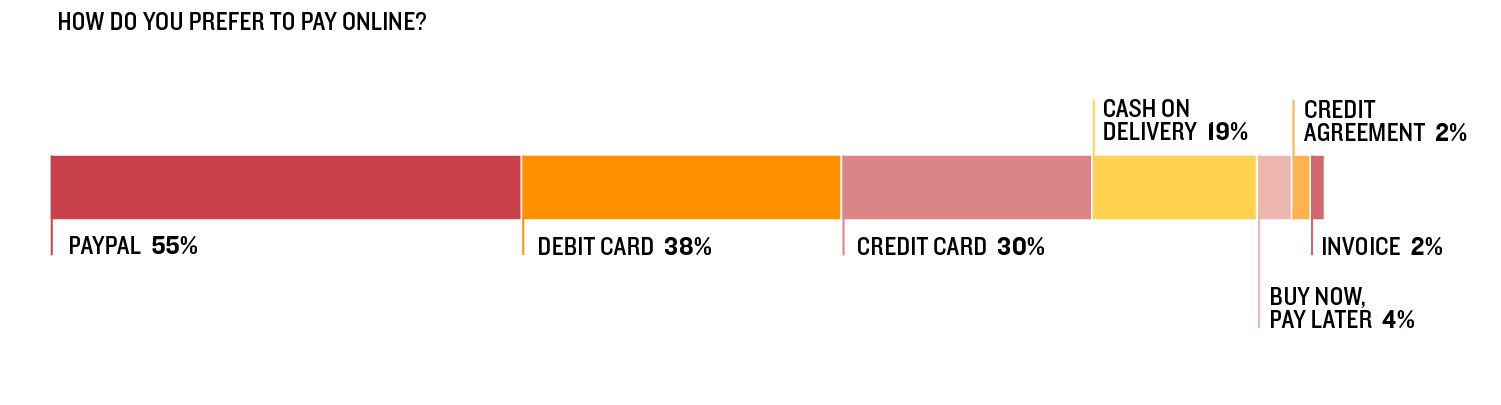

So how do Spanish consumers prefer to pay online?

PayPal came out on top in our research, selected by 55% of consumers as their preferred option. This choice perhaps reflects the Spanish consumer’s desire to be sure of payment security, with 33% of people saying a lack of trust in a website would cause them to abandon their basket.

“PayPal came out on top in our research, selected by 55%. This perhaps reflects the Spanish consumer’s desire to be sure of security“

Credit and debit cards were also popular payment methods, while cash on delivery is preferred by 19% of consumers. This is a more commonly used way of paying for goods in Europe than it is in the UK.

How much are they spending?

Before investing a large amount of money in different online payment options, retailers must first determine how big the prize is – how much money do Spanish consumers spend online?

The research suggests that smaller purchases are more likely to be completed on mobile, with 80% saying they spend between zero and £100 a month on their mobile, compared with 73% saying they spend this amount on their desktop.

Listen to episode 2 of the podcast

Episode 2 – Providing the right payments

This episode will take a look at the payment methods available in Spain and which ones consumers prefer to use. We’ll talk to retailers already operating in the Spanish ecommerce market and find out which payment methods they offer and why.

Delivering the goods

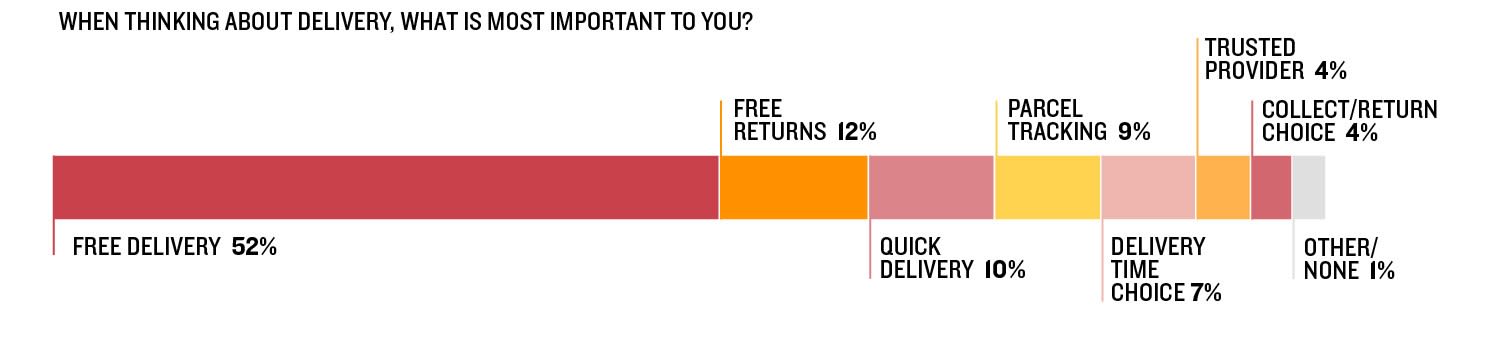

Free delivery is just as important in Spain as it is in the UK, with 52% of Spanish consumers expecting it.

When it comes to click and collect, 26% want to collect from a store.

However, only 6% are happy to pick up from a locker and the same small percentage are willing to go to a third-party location such as a convenience store, perhaps indicating that this way of receiving goods hasn’t fully taken off in Spain yet.

“Overwhelmingly, the Spanish want their deliveries to be free"

What’s important when it comes to delivery?

Overwhelmingly, the Spanish want their deliveries to be free. More than half select this response, suggesting they are looking for value online.

Free returns are less vital though; only 12% of consumers cite this as most important to them, suggesting that, once they have purchased, shoppers are generally set on their decision.

Listen to episode 3 of the podcast

Episode 3 – Delivering the goods

This episode will examine consumer expectations of deliveries and returns, and look at what retailers are doing in Spain in order to achieve this. We’ll look at which delivery options are preferred in Spain and gain a better understanding of how to succeed in fulfilment without it costing the earth.

Mastering your marketing

In any market, getting your website viewed by the right customers is vital to success.

So understanding which marketing tactics will appeal to the Spanish consumer is critical.

Sharing information

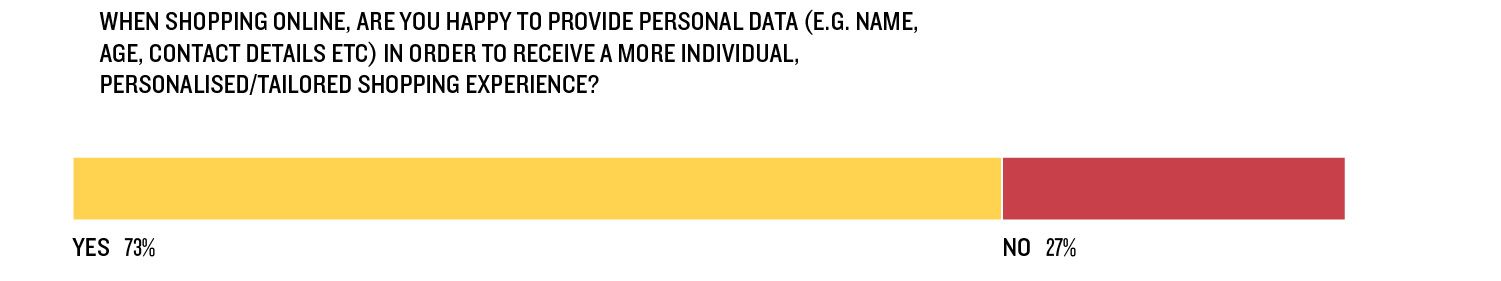

Targeted marketing often requires personal information from consumers and the Spanish shopper is generally very happy to give this up: 73% say they will provide their details in order to get a more tailored experience.

Name, email address and gender are the three pieces of information Spanish consumers are most happy to share, with financial status and income the details they are least prepared to give up to retailers.

“If you are going to use social media to speak to your consumers, it is worth understanding who influences their purchases“

Getting social in Spain

With this kind of information, retailers can begin to build a view of their audience in Spain.

One area they may wish to channel marketing efforts into is social media.

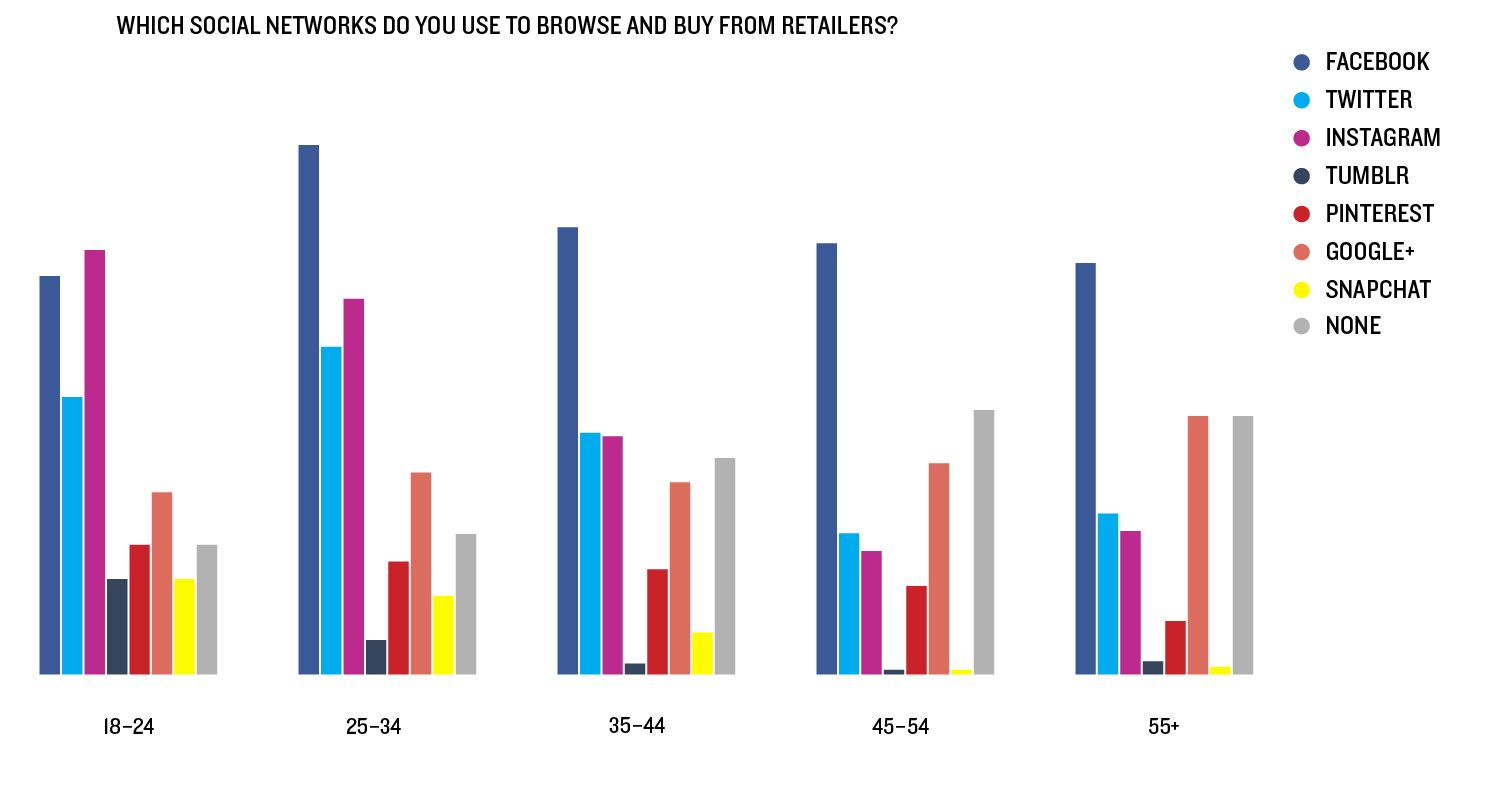

When it comes to Facebook, 59% of Spanish consumers say they browse and buy this way, with this number climbing to 70% for the 25- to 34-year-old age bracket.

Instagram is most popular with 18- to 24-year-olds, with 56% of them browsing and shopping through the photo-sharing platform.

Being a good influence on your consumer

If you are going to use social media to speak to your consumers, it is worth understanding who influences their purchases.

Our results show 35% of Spanish consumers say family members have the biggest impact on their purchasing decisions, with 29% saying friends do.

This suggests that using the ‘social’ aspect of social media could help with brand recognition – perhaps encouraging people to share discount codes or invite friends and family to register for updates.

Celebrities have long been used to promote products and brands, but less than 1% of Spanish consumers say they would be influenced by them.

On the other hand, 9% say bloggers or key opinion leaders would sway them.

In addition, 19% say retailers themselves influence their purchasing decisions on these platforms.

This suggests that establishing yourself as an authority and an expert in your area may help persuade the Spanish to part with their cash online.

Listen to episode 4 of the podcast

Episode 4 – Mastering your marketing

In this episode we get to grips with the methods of marketing that are most welcomed by Spanish consumers and look at which are less likely to work. We discuss social media use in relation to shopping, and examine how marketplaces can help brands reach shoppers in Spain.

Exporting ecommerce

How to thrive online in Spain

Written by Jade O'Donoghue

Produced by Dan Harder/The Creativity Club

and Emily Kearns

In partnership with Exporting is Great