Exporting ecommerce

How to thrive online in France

France is the sixth biggest online market worldwide.

The French ecommerce market grew 14% in 2017 and the French E-commerce Federation (Fevad) predicts it will be worth €100bn (£89bn) in 2019.

Like many other major European ecommerce markets, Amazon has good penetration in the country.

But with local players such as Cdiscount and La Redoute holding their own against the US giant, the French retail market still boasts a sea of opportunities for online retailers looking to expand their business internationally.

In this interactive guide and podcast series, produced in association with Exporting is Great, retailers can learn how to successfully navigate the French ecommerce market.

We will tell you how to grow your business internationally with our digital guide, which includes:

- An interactive map pinpointing France’s retail hotspots, making it easy to decide where (and how) to invest

- A three-part podcast series including interviews with industry experts and real-life retailer case studies

- Exclusive consumer research granting you unrivalled access inside the mind of the French online shopper

In this Retail Week podcast series we’re looking at the nuances of the French etail market and its consumer in comparison with the UK, in order to help retailers plan their digital expansion into France.

Listen to episode 1 of the podcast

Episode 1 – Understanding the French consumer

Episode 1 of our podcast series helps you get inside the mind of the French online shopper, with exclusive interviews with Made and Feelunique.

Borders needn’t be blockers

Interactive map: top retail hotspots in France

When growing globally, businesses need to be conscious of a country’s regional characteristics.

Using findings from exclusive Retail Week research, in partnership with Exporting is Great, we’ve plotted a map through the most economically exciting French regions.

By examining the local economy and buyer behaviour, our interactive map provides a detailed overview of France from a retailer’s perspective.

“The French ecommerce market is a huge opportunity for UK brands”

For best results, view this map on your desktop computer.

Consumer spending behaviour

How do French consumers prefer to shop online?

As part of exclusive new Retail Week research, we surveyed 1,000 online shoppers to provide a comprehensive analysis of consumer behaviour in France.

With a nationally representative split across gender, the findings have been broken down into regions (as found in Chapter 1’s interactive map) and age demographics, as seen in the charts throughout this digital guide.

Uncovering the nuances of the French online shopper, our research reveals:

- The devices and platforms consumers favour when shopping online

- What guides their decision to purchase and influences them to buy

- What is most important for a retailer to provide, from product choice to preferred payment methods and fulfilment options

“The French consumer is known to be nationalistic, but there is a growing appetite for discovering new brands”

How do French consumers spend online?

French consumers may be less likely to shop online via their mobile than their British or American counterparts, but building a comprehensive mcommerce platform is still critical to engage younger shoppers.

Three quarters of consumers (75%) surveyed say they prefer to shop via their laptop or desktop, but the influence of modern technology on younger generations is clearly prevalent.

Consumers aged 18 to 24 years old are 30% more likely to shop via their mobile than shoppers aged 55 and over, and laptop use decreases along with the age of the consumer demographic, from 91% for the eldest age bracket down to 58% for the youngest.

This shift towards mobile shopping is unsurprising, as 2017 showed continued accelerated growth in the French mcommerce market.

According to national ecommerce association Fevad, in 2017 there was a 38% increase in the mobile commerce index (which measures mobile sales on smartphones, tablets and mobile websites), following 30% growth in 2016.

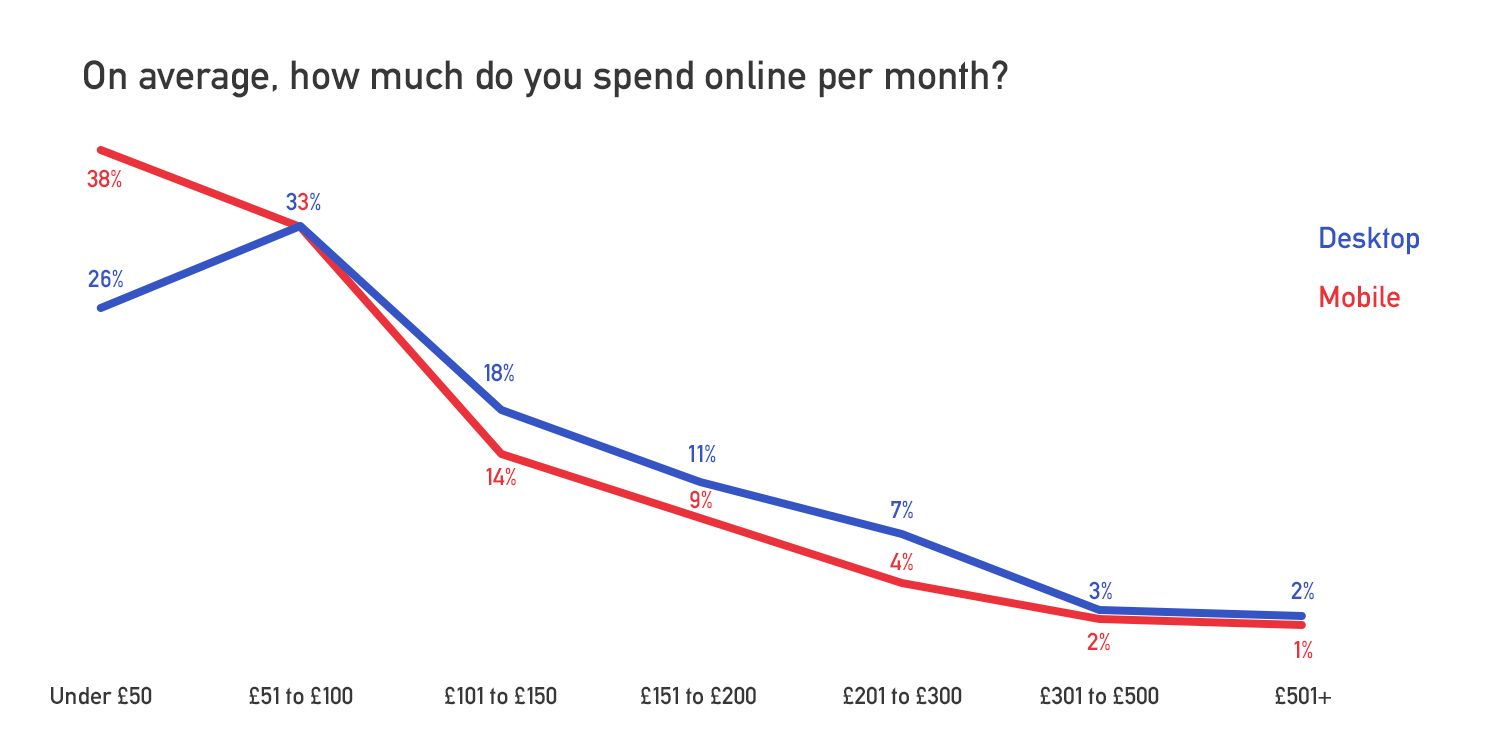

The effortless ease provided by mobile shopping has meant that French consumers are now more likely to make smaller purchases via their mobile phones than via a desktop (value of £50 or less), and equally as likely to make purchases of £51-£100 via both types of device.

Creating a strong mobile offering is clearly essential when entering the French etail market, in order to capture a share of a market predicted by Fevad to exceed €90bn (£80bn) in 2018.

To learn more about how French consumers like to shop, and discover how two retailers successfully navigated the French ecommerce market, listen below to episode one of our ‘How to thrive online in France’ podcast series.

Listen to episode 1 of the podcast

Episode 1 – Understanding the French consumer

Episode 1 of our podcast series helps you get inside the mind of the French online shopper, with exclusive interviews with Made and Feelunique.

Entering the market

What do French consumers expect from an etail offering?

UK retailers may want to consider launching a French ecommerce app as part of their expansion strategy, as Retail Week research found that almost half of all online shoppers (47%) prefer to browse and buy via a retailer app, and 72% of consumers have more than two retailer apps on their phone.

Providing plenty of product choice is essential, with 71% of consumers we surveyed rating it as the first thing they look for in a retailer’s online offering.

Similar to other European markets, consumers also want to see clear information regarding their purchase, from pricing and stock availability to deliveries and returns.

Providing transparency around your products and delivery capabilities allows the consumer to not only trust your brand, but to feel empowered throughout their shopping journey too.

How do French consumers prefer to pay online?

With French credit card Cartes Bancaires the most widely used payment method in France, it’s unsurprising that credit cards are the most popular online payment method; more than 95% of French payment cards are Cartes Bancaires, co-branded with Visa and Mastercard.

PayPal is a close second though, showing that consumers are willing to change their long-standing habits regarding payments, and utilise technology in order to create simplicity in their online transactions.

“The French consumer is very demanding in regards to quality; a brand name alone won’t make it”

What delivery options do French online shoppers prefer?

Free delivery is the most important fulfilment provision a retailer can provide for French shoppers, with more than half of respondents naming it as more important than their product arriving quickly.

Convenience and receiving goods on time are of higher importance to the French consumer than speed.

Only 15% of respondents name quick delivery as the most important aspect of a retailer’s fulfilment proposition, and just 9% say they currently use same-day delivery.

However, 35% of respondents report currently using next-day delivery and 34% use named-day delivery, with click-and-collect from store and time-slot delivery coming closely behind, showing a strong demand for flexibility around the time and place a product is delivered.

Listen to episode 2 of the podcast

Episode 2 – Entering the French market

Episode 2 focuses on how UK brands can create a localised offering without necessarily setting up a local team, including an exclusive interview with Feelunique CEO, Joel Palix, about their expansion into France and acquisition of The Beautyist.

Purchasing decisions

What motivates French consumers’ purchases?

Arguably the home of the luxury goods industry, globally recognised French brands include Louis Vuitton, Chanel and Cartier.

With luxury intrinsically part of the culture, it is therefore logical that French consumers say that quality of product is the main driver behind their purchasing decisions, unlike their German and British counterparts whose focus is mainly on price.

With Euromonitor reporting that France is the number one luxury shopping destination in the world, the country should be seen as a key market for UK retailers with a high-quality product that are looking to expand internationally.

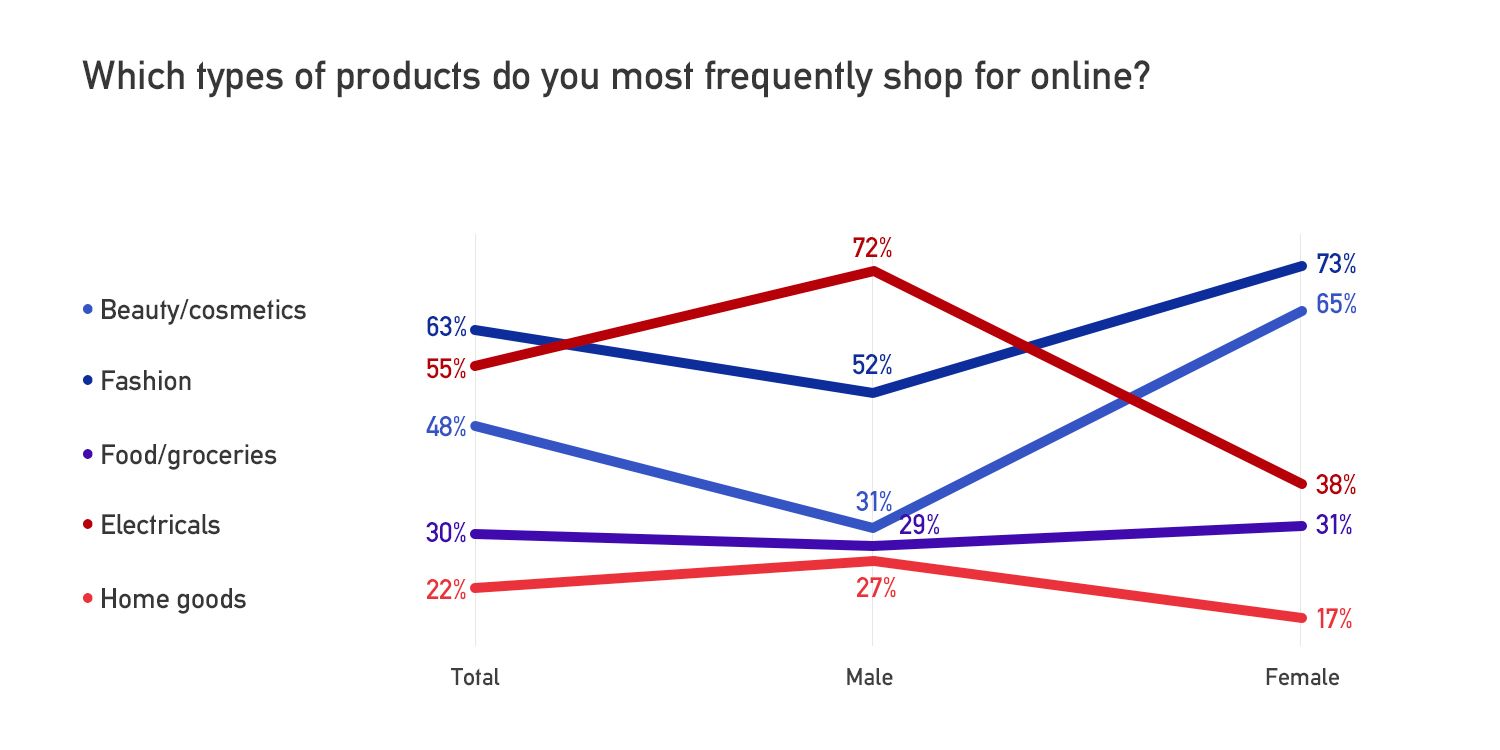

What products are they most likely to buy online?

Fashion is the most purchased product type online. Similar to most other global etail markets, almost three quarters of female French consumers buy clothing, shoes and accessories online (73%).

Currently less than one-third of French consumers buy their groceries online (30%) but that shouldn’t be seen as a negative to British food and drink retailers.

In 2017 Kantar named France as having the second highest online basket spend for groceries globally, at €55.47 (£49.36), behind only the UK at €68.24 (£60.72), suggesting that there is significant headroom for ecommerce to grow in this sector.

Listen to episode 3 of the podcast

Episode 3 – ‘Free from’ to fromage: French product trends

Episode 3 in our series looks at food and drink product trends in France, and our team of retail experts provide their top tips for expansion across the Channel.

Thank you to our contributors

Exporting ecommerce

How to thrive online in France

Written by Isobel Chillman

Produced by Red Apple and Abigail O'Sullivan

In partnership with Exporting is Great