Ecommerce 2021

Four steps to engagement, conversion and loyalty online

At a glance

With online penetration rising faster than ever due to the pandemic, it's vital for retailers to be present in the digital spaces where consumers are now shopping.

Analysing exclusive consumer research, RWRC, ChannelAdvisor and Webgains' Ecommerce 2021 digital report maps out the new online shopper journey, uncovering how retailers and brands can use savvy search, data and personalisation tactics to reach and retain customers online.

This in-depth report will serve as the ecommerce blueprint to win consumer attention, convert them into paying customers and keep them coming back for more.

This report forms part of RWRC’s inaugural Accelerating Ecommerce Week of virtual events, which will delve into the report findings and drive discussions to help retailers, with often limited resources, redefine their online strategies to take advantage of the explosion in digital sales.

| Winning strategies in this report | |

|---|---|

| ✔ | Brand relevance and evolution |

| ✔ | Agility and partnerships |

| ✔ | CX |

| ✔ | Innovation and investment |

| ✔ | Culture and purpose |

2020 was the year in which ecommerce exploded. AO founder and chief executive John Roberts said in May that the coronavirus crisis had accelerated five years of online shopping behaviour changes “into only five weeks”.

Asda boss Roger Burnley, meanwhile, noted in August that the grocer expanded online capacity early in the pandemic “to meet levels we had anticipated reaching in eight years”.

John Lewis Partnership chair Dame Sharon White unveiled a new strategy in October for the John Lewis and Waitrose parent group, saying “five years of change in the past five months” was key to a more digital-led operational structure.

“Ecommerce operations aged three years in three weeks”

Hobbycraft head of digital experience Jennifer North told attendees at trade association IMRG’s virtual Data Week event that the retailer’s “ecommerce operations aged three years in three weeks” in March 2020, adding the retailer's “feet haven’t touched the ground since”.

While in December Waitrose executive director James Bailey highlighted just how rapidly the grocer’s digital footprint had changed over a nine-month period. Sharing results from its Food and Drink Report 2021, Bailey revealed Waitrose’s online grocery business was on track to be worth 20% of total sales by December 31 – a dramatic uplift from the 5% of total sales it generated pre-Covid.

Online is predicted to provide 57% of global sales growth by 2025

The picture is clear and the trend looks set to continue into 2021.

So how can retailers make online their advantage this year?

It will require investment in new teams and technology, and a fresh set of tactics – all the while ensuring that the economics of a more digital proposition add up.

While traditional online marketing methods such as PPC and banner advertising will still play a crucial role in helping retailers maximise the consumer shift towards digital, there are plenty of new and emerging approaches to consider. These approaches, explored throughout this report, include everything from deep data-driven personalisation and discovery commerce to optimised website UX and mobilisation of new digital channels.

Retailers must stay one step ahead during this period of rapid change – this report will show you how.

Digital by numbers

- 46% - year-on-year uplift in ecommerce sales from December 2019 to December 2020, according to ONS data published in January

- 31% - online penetration totalled 31% in December, 5% down from the online peak in November but up significantly on the pre-pandemic figure of 20%, according to the ONS

- 57% - online will provide 57% of global sales growth by 2025, with more brands going DTC through ecommerce and most retail categories becoming increasingly digital, Edge by Ascential predicts

- 100% - the year-on-year increase in organisations looking to fill roles in 2020, according to digital jobs agency Beringer Tame, which specialises in recruiting for roles such as digital trading manager, marketplace manager, and heads of digital marketing in retail and FMCG businesses

- 45% - of consumers are now making online purchases one to three times a week, while the average monthly spend is just under £150, RWRC research from November surveying 1,000 UK consumers found

STEP 1:

Understanding the new breed of online shopper

Online shopping is on the rise, but how consumer behaviour will look year by year is less black and white. No longer linear, the online path to purchase is rapidly evolving, with consumers able to discover products via marketplaces, search engines and home assistants, as well as make purchases in just a few clicks from social media.

Transactions often only occur once consumers have visited multiple retail, review and lifestyle websites, as savvier shoppers conduct comprehensive research prior to purchase.

The coronavirus pandemic has resulted in demographics that previously only shopped in stores, generally older consumers, becoming digitally literate and enjoying the benefits ecommerce provides, thus expanding its reach.

RWRC's study reveals 51% of consumers are now spending on average more than £100 online every month, with 11% spending between £251 and £400, indicating it is now the primary shopping channel for many.

So, through what online channels are consumers shopping?

The role of marketplaces in the new ecommerce

Marketplaces matter, with 34% of consumers surveyed starting the majority of their online shopping journeys on the larger marketplaces, such as Amazon and eBay.

Moreover, 40% of consumers are spending more than 40% of their online outlay via Amazon; another 24% spend between 21% and 40%. On average, 36% of people’s monthly ecommerce outgoings are spent via Amazon, highlighting the importance of having a presence on the platform. Only 3.6% say they don't shop on Amazon at all.

While marketplaces are no silver bullet, for retailers without the scope and budgets of retailers like Nike – which recently cut ties with Amazon to take more control of its sales and to drive its own DTC operation – there is greater reward versus risk.

Giving up margin to third parties is never a preferred option for retailers, but Amazon’s popularity might be used by retailers as one method of attracting consumers to their brands before they engage them with a wider collection via their own channels.

Including independent and smaller platforms, such as Notonthehighstreet.com, Trouva and Etsy, 73% of consumers shop via online marketplaces, and 46% of consumers say they are less likely to shop with a retailer if its products are not available to buy on these channels. This can’t be ignored and the right marketplace strategy seems vital to brand success.

Where social media fits in

Social media discovery is still in its infancy, but a channel for retailers to consider nonetheless, especially as sites such as YouTube, Snapchat, Instagram and TikTok have never been so popular.

Ofcom research from June shows nine in 10 online adults, and almost all older children aged eight to 15, used at least one of these websites and apps in the past year, with many watching videos from them several times a day. One-third of online adults now spend more time viewing video-sharing services than broadcast television, according to the study.

RWRC's survey found that just 1.5% of consumers start their online shopping journey on social media, however 35% say they have purchased an item after seeing it on social media. This chasm just goes to highlight how unpredictable today’s shopping journeys have become, and may even highlight that there is often a gap between what consumers say they do and how they actually act.

Founder and chief executive of social media engagement and insight tool Maybe* Polly Barnfield says that “the fact our own research shows consumers are now spending on average three hours a day on social media but don’t think they’re being influenced to buy is very interesting”.

She continues: “Consumers don’t think of themselves as starting their shopping journeys on social media, but it’s a signalling process and often they may purchase something not realising they’ve previously seen it on social media and that this had reinforced their spending intent.”

To harness the power of social media, Barnfield recommends retailers invest in retargeting ads, specifically across Facebook and Instagram.

“A number of our retail clients are now doing retargeting campaigns where they hadn’t before – it just brings in cash like you wouldn’t believe. By retargeting existing people that have engaged with a post organically you can capture and convert them to spend,” she says.

“My advice: make sure that the organic engagement you drive through Facebook and Instagram is retargeted through ads.”

Outside of driving investment in social media, Barnfield says retailers can learn a thing or two from Primark’s social media strategy.

“Primark is a retailer with no ecommerce, but they stack up next to Asos and Boohoo in terms of social media engagement. Looking at our data about Primark, customers were talking about them as much on social when they were shut during the UK lockdowns [in2020] as they were when stores were open," she says.

“How? Primark has used its social media channels to own the audience, they understand that social media is about good communication and not using it simply as a customer service tool.”

When asked about the importance of a retailer or brand having a presence on a social media channel such as Instagram or Facebook, a sizeable 29% said they would be less inclined to make a purchase if they didn't.

It might not yet be consumers’ go-to shopping channel, but it is an increasingly vital way to drive sales, meaning now is the time for retailers and brands to ensure their social media sites are not only positioned for commercial needs but act as a medium to communicate and build relationships with the target audience.

"The fact that consumers are now spending on average three hours a day on social media but don’t think they’re being influenced to buy is very interesting"

“Make sure that the organic engagement you drive through Facebook and Instagram is retargeted through ads”

The pulling power behind your website

A retailer’s own website is still the most important channel for appealing to shoppers at the beginning of their purchase journeys.

More than a third of shoppers (39%) say they start their online shopping journeys via a retailer’s own website, compared with the next most popular, marketplaces at 34%, suggesting online consumers often have in mind a specific retailer they would prefer to purchase an item from when they begin their path to purchase.

With the ecommerce market becoming ever more crowded, retailers' websites must offer great user experience, product range and have conversion tactics in place to ensure shoppers don’t transact elsewhere. We’ll come to this in Step 2.

What’s motivating online shoppers?

We’ve uncovered top-level insights about consumer behaviour in the new digitised world, but what is driving these actions?

Gifting and treats

In 2020 gifting was a key trend for online shopping and retailers should plan for this in their ecommerce strategies this year. Some 41% of consumers revealed that the majority of their online purchases had been gifts for others or treats for themselves. Retailers could leverage this trend by adding ‘gift idea’ category descriptions to their websites, and prioritising placement of gift items in product searches and on social channels, for instance.

Grocery and home items in high demand

The acceleration of online has occurred as many non-essential shops shut their doors temporarily in 2020, or consumers deemed visiting shops unsafe at the height of the pandemic.

So it's no surprise that grocery and household essentials were high up the list of sought-after categories for shoppers, with 20% and 28% respectively citing these sectors as where they purchased the most items online in 2020 – setting a precedent for what will be important this year if Covid-19 disruption persists.

Out of fashion

Whereas grocery, gifts, homewares and furniture have effectively been gateway categories to the online world for many, and are likely to endure this year, the same cannot be said for fashion. Just 10% of respondents said that most of their online purchases were essential clothing or footwear.

IMRG statistics support this finding, showing in the first 10 months of 2020 online sales of products for the home were up by 70% year on year, while clothing including footwear and accessories was down by 1.2%. With people largely confined to their homes and events cancelled, clothing was the only category where online sales declined during 2020.

These figures will be expected to improve this year with the vaccine rollout helping the health crisis to subside. Equally, strong trading reported by Asos, Boohoo and Zalando throughout 2020 proves the market’s potential, but retailers in this space must work doubly hard to attract customers during such challenging times.

Discounts, delivery and word of mouth matter

Discounts and free delivery/returns are the best ways to capture new customers online that haven’t shopped with a retailer before, according to the research, with 38% and 30% respectively citing these as their top reason.

A recommendation from a friend or family member is the main purchase trigger for 14% of people, so the value of word-of-mouth marketing for ecommerce cannot be overlooked. Interestingly, the over-65s are most swayed to shop with a new retailer offering free delivery and returns, with 36% of those in this demographic choosing this option.

Demographic differences

What device?

At first look there seems to be little difference, in general, between which device a consumer prefers to use for an online transaction, with 46% preferring laptop or desktop and 42% choosing a mobile phone.

However, it becomes stark when assessing consumers’ ages. While 25% of 17- to 24-year-olds prefer using desktops and laptops, 67% of this age group prefer to use their phone. And for over-65s that is turned on its head, with 74% preferring to use desktops and laptops and just 7% choosing mobile.

Tablet devices appear to be the big loser, proving less popular across all age groups. However, the link between age and device type preference suggests retailers should be optimising size of font and text depending on the device to capture as large an audience as possible.

Which social media platform?

When it comes to social media, Facebook is the platform most likely to influence a purchasing decision for all age groups, apart from 17- to 24-year-olds who are more likely to be swayed by Instagram.

TikTok and Pinterest had no key purchasing influence on anyone over the age of 55, but TikTok was the most influential platform for 8% of 17- to 24-year-olds.

Since retailers cannot target all consumers online, they must define, identify and understand their social media target audience to communicate with them effectively.

Understanding where target audiences are, and where they are most active, will help to prioritise which social media platforms to focus on and retailers should then adjust and adapt as they go. TikTok, for instance, has become an active marketing channel for Gymshark to reach the platform’s 16-24 demographic.

Gymshark: proof that it’s time to TikTok?

Gymshark is one brand ahead of the curve in terms of its TikTok usage. Head of social content Elfried Samba says the company posts a new video daily, with people often enacting a challenge or dance, always while wearing Gymshark clothing.

“We soon realised that, instead of trying to push out hardcore fitness content, we needed to pay close attention to what the users like, creating entertaining videos but with a fitness twist,” he says.

“By doing this, we’re staying true to our DNA while adapting to the platform.”

Gymshark has a team of in-house staff who take part in their posts, as well as collaborating with TikTok-specific influencers. This is helpful as the TikTok algorithm recognises when videos feature the same people and faces, and consequently places the content higher up the app’s main feed.

Gymshark has received high engagement on TikTok, according to Samba, who says some posts will receive 20 million views and eight million likes. This dwarfs engagement it receives on its Instagram account, for instance, where the majority of posts average 50,000 to 60,000 likes. Its TikTok following is also growing at pace: by May 1, 2020, it had 1.8 million followers and by January 12, 2021 had grown this following to 2.3 million.

Targeting Gen Z

RWRC’s study confirms that younger shoppers in the UK are far more likely to shop online more regularly and to use social media to start their online purchase journey than older demographics. In fact, 7% – the highest proportion of those surveyed – aged 17-24 reported making online purchases on a daily basis.

The purchasing power of 16- to 24-year-olds, also known as Generation Z, is undeniable. They account for 24% of the global population and are the most likely demographic to shop, compare prices and research purchases online, according to Retail Week’s Retail Horizon 2021 strategic toolkit.

Socially and environmentally aware, they balance strong values and fast-moving lifestyles, meaning they seek authenticity and brands with purpose.

Gen Z-ers are digitally native and big consumers of media, and they expect to interact online with retailers and brands. Often, this generation will shop for, and influence, older family members’ purchasing decisions, making them an important audience to impress.

STEP 2:

Reaching consumers with great digital UX

Online shopping may have rocketed in the last 12 months but so too has competition. In order to truly take advantage of the ecommerce opportunity retailers must, more than ever, offer consumers compelling reasons to shop with them, and central to this is web UX.

One retailer that already achieves highly in this regard is global ecommerce behemoth Amazon.

49% of consumers named Amazon as the retailer that delivers the best digital UX

According to RWRC's research, the company dominates when it comes to the best online user experience (UX). When asked, with zero prompts, to name the retailer that currently delivers the best online shopping experience, almost 50% of consumers said Amazon.

They cited reasons such as “it’s secure and I feel safe buying from them”, “the option to have Prime next-day delivery on some items”, “extensive customer reviews”, “great selection of products” and “a fast checkout process”.

In the words of retail analyst and NBK Retail founder Natalie Berg: ”Covid has cemented Amazon’s status as the indispensable route to market and will accelerate its transition to become the rails that the retail sector runs on.

”Covid has cemented Amazon’s status as the indispensable route to market and will accelerate its transition to become the rails that the retail sector runs on”

”The company has spent the past decade embedding itself in our homes and the pandemic has offered a once-in-a-lifetime opportunity to deepen engagement with consumers beyond its core retail offering.”

So what can the wider retail sector do to keep up with Amazon? What else does our survey tell us about what retailers' ecommerce investment priorities should be? And what actions would improve their UX?

Measuring up to the UX of Amazon

Firstly, a strong online UX is non-negotiable, with the survey findings highlighting how the majority of shoppers (39%) still start their ecommerce journey on an individual retailer’s website as opposed to a marketplace (34% for the larger ones, 4% smaller independents), search engine (20%), or social media platform (1.5%).

Amazon dominates our research when it comes to the best online user experience (UX)

Amazon dominates our research when it comes to the best online user experience (UX)

The element of a retailer’s website that consumers believe is most important in providing the best experience is secure shopping and payment gateways, meaning it is crucial for retailers to offer familiarity and a choice of options at the point of purchase. Some 31% of survey respondents say it is the most important factor.

Not only does the point of sale online have to be highly secure, but it also has to provide an easy checkout process, according to consumers, who rate this, alongside high-quality product images and branding, as vital to creating a positive UX. Some 11% and 18% of respondents, respectively, choose these as the most crucial elements for good UX.

Fast loading speeds and mobile responsiveness are not as crucial in terms of providing the ultimate UX, but this differs markedly by age range – with 25- to 34-year-olds ranking both as much more important factors than older shoppers.

On the flip side, over-45s are far more likely to be highly concerned about online shopping security than millennials.

It goes to show retailers with a targeted demographic may not have to provide winning UX in every aspect to convert shoppers, but those trying to appeal to multiple generations – including department stores and general merchandise retailers – must be consistently good across the board to avoid disappointing their audience.

Pick of the best online retailers by UX

Although Amazon was deemed to have the best online UX by 487 of the 1,000 shoppers, many other retailers received positive feedback in the survey for the online shopping experiences they provide.

Online marketplace eBay was commended for its choice of products and low prices, and was regularly marked highly because it is “easy to use” in the eyes of consumers.

The same term was used frequently by survey respondents to describe another pureplay, Asos, which was also talked up for its speed and range of delivery options, and because it is “updated often".

Multichannel retailers John Lewis Partnership and Tesco received credit for “a slick interface” and “good pictures of products”, respectively, highlighting online consumers’ keenness for good functionality combined with a nice look and feel.

Despite the positive comments, John Lewis Partnership acknowledged in October that “it’s not always been as easy as it should be to shop with us”, and said it was investing £1bn over the next five years to accelerate the capabilities of both John Lewis and Waitrose online businesses and to transform the stores that are to remain open.

That investment covers improvements to websites, apps and general customer service operations. Early signs of progress are encouraging, with the launch of John Lewis’ first virtual Christmas shop, which allowed consumers to navigate the retailer’s London Oxford Street store via their computer screens or mobiles, click on products for information and pay for desired items – supported by Matterport 3D technology.

Learning from retailers turning online to their advantage

Outside of respondents’ top picks, Littlewoods and Very.co.uk parent The Very Group has emerged as one of the ecommerce winners in a year plagued by business disruption and consumer uncertainty.

Following 2019’s loss before tax, it returned to profit in 2020 as its full-year sales surpassed £2bn for the first time, driven by an 11% boost in customer numbers to 4.5 million.

The retailer’s growth has continued to surge. It posted a 25.5% uplift in sales in the seven weeks up to and including December 25, its strongest Christmas sales performance on record. The group’s sales momentum was bolstered by 46.2% and 44.8% jumps for home and electricals sales respectively, alongside a 49.7% jump in site visits over the festive period to 139 million.

The addition of 100 new brand partnerships, the company’s mobile-friendly platform, its access to and use of customer data for personalisation, and a new automated distribution centre that speeds up orders and returns processing have been listed by chief executive Henry Birch as key factors in the business’ improvement performance and UX.

“The digital transformation that Covid-19 has brought on, whether it’s been sped up by three years or five years, puts us in exactly the right place and we are firing on all cylinders,” he explains.

“The digital transformation that Covid-19 has brought on, whether it’s been sped up by three years or five years, puts us in exactly the right place and we are firing on all cylinders”

Retailers should also be optimising UX to target global consumers. Fashion retailer Boohoo’s approach to designing a customer-centric online strategy is one that businesses can learn from.

Boohoo has been rolling out dedicated mobile shopping apps for international markets with localised currencies and languages, and this strategy has been bearing fruit. Its US sales for the six months to August 31 surged 83%, while international sales grew 55%, compared to 37% growth in the UK for the same period.

Overseas, grocery chain Carrefour has been honing its ecommerce presence. Its Brazilian operation replatformed its website in 2020 with the aim of giving consumers a more personalised grocery shopping service.

Bandwidth (the amount of data that can be downloaded and transmitted across the site) automatically scales at peak times to meet increased customer demand, while product and category listings are personalised to users based on their preferences and previous shopping behaviour.

The move is part of a comprehensive digital project conducted alongside software company VTEX, aimed at modernising the ecommerce experience in line with growing online grocery shopper numbers in South America.

Collaborating to build online communities

Instead of going it alone, many retailers and brands are looking to experts already established in the space to fast-track their ecommerce propositions.

One company that has invested in its proprietary technology to ensure it capitalises on this trend is The Hut Group (THG). The company, which owns a host of brands such as Lookfantastic and Myprotein, sells its THG Ingenuity tech infrastructure to third parties.

In the second half of 2020 it established partnerships with Warner Bros to allow the entertainment conglomerate to sell its consumer products direct to consumers (DTC) around the world; coconut water company Vita Coco to launch DTC in the UK, Germany and France; and British clothing brand Jack Wills to offer a full ecommerce proposition, including fulfilment and digital brand building, across the US, Australia and Asia-Pacific region.

Homebase is also now working with THG to overhaul its ecommerce operations. In September, the home and DIY retailer penned a 10-year partnership with the Ingenuity platform to transform its transactional website, including payments and fulfilment infrastructure, alongside support on web development.

For Homebase chief executive Damian McGloughlin, the tie-up offers a means to marry the business’ online and offline presence: “We’ll combine the best of bricks and mortar with THG's world-class expertise, to advise, excite and inspire our customers with new ways of shopping we know they’ll love.”

Influencers and tech converge

Some 23% of consumers surveyed say they have purchased an item online because of an influencer’s review or testimonial. Meanwhile 7% say a positive review on social media or from an online influencer would convince them to transact with a retailer they have never bought from before.

And there are several retailers tapping into this trend, building businesses on this type of consumer behaviour and using technology in novel ways to keep audiences engaged.

Il Makiage, for example, launched in the US in 2018 to allow consumers to shop trending beauty brands via on-site video testimonials featuring social influencers. It utilises influencer content to link inspiration, education, trial and purchase experiences within a single platform.

The company arrived in the UK and Germany in 2020, as consumers in Europe became increasingly digital, and through its in-house tech expertise, comprehensive industry dataset and its acquisition of data science start-ups, it uses algorithms to match consumers with the compatible products.

Trinny London, meanwhile, which has made a name for itself on social media, has created a burgeoning online community by integrating innovative digital tools such as Match2Me.

Match2Me allows consumers to scroll through different looks, hair colours and complexions, choosing those that best match them, which then prompts tailored product recommendations. It launched in 2020 when many in-store beauty counters were closed due to Covid-19, offering virtual consultations with professional makeup artists.

Voice-assisted shopping – the future’s not here just yet

Although an array of new systems and digital thinking is required to help retailers get the right ecommerce strategies in place for the new world of retail, it seems voice-enabled technology shouldn’t be a priority in the short term.

Shopping via virtual home assistant is still somewhat in its infancy, with just 18% of consumers surveyed having used a voice home assistant, such as a Google Home or Amazon Alexa, to purchase a product in the past year. Some 30% of those questioned don’t own a device of this nature.

With so many retailers making such radical changes online and introducing new technology for the first time, it is important not to forgo the fundamental due diligence needed when securing new supplier partnerships and deploying new software.

STEP 3:

Using search to get in front of customers

It’s important for retailers to have a neatly designed website with a strong UX, multiple digital channels, and a wide and appealing product inventory, but none of this will matter if people can't find the business online in the first place.

Search engine optimisation (SEO), search ads and ensuring link-building across relevant content is all part of the modern marketing mix – and it requires hiring dedicated professionals in this field.

RWRC's research highlights why it is so important, with a fifth of consumers surveyed indicating they now start the majority of their online shopping journeys by searching for a product or term on a search engine such as Google. Millennials (those aged between 25 and 34) are more likely to start their online shopping journeys via a search engine than other demographics.

How retailers are investing to win in search

Individual retailers have adopted their own tactics to ensure they are doing all they can to get their products in front of shoppers in the right place at the right time, as more consumers migrate online.

During the first national lockdown in 2020, Marks & Spencer established a dedicated 'SEO working party’ to improve search rankings, and position its online channel “to reflect rapidly changing customer behaviours, including trading our site with refreshed architecture focused on the goods most searched for by customers such as kidswear, bedding, towels and loungewear”.

Learning from emerging brands, UK homewares retailer Cox & Cox ramped up its paid social and paid search activity in the long lockdown period in spring 2020 as it too benefited from consumers staying at home, going online more and looking for items to improve their surroundings.

“It was a case of moving quicker, being dynamic and testing campaigns, promotions and media,” explains Cox & Cox director of ecommerce Aynsley Peet.

Speaking in September, Peet explained that this focus, as part of its wider ecommerce strategy, had driven huge return-on-investment for the pureplay business: “In May and June, we were up 100% year on year in terms of orders. We did slow down because of stock demands; we sold out of all of our outdoor furniture by June, for example, whereas previously we would still be selling it in July and August. But we are continuing to see that trend continue, we are seeing a 60% uplift in terms of revenue in August.

“We are a lean business, we only have 60 staff full-time. This year we will generate £23m in revenue.”

Talking in 2019, Heal’s ecommerce and marketing director David Kohn highlighted the importance of SEO strategy and setting up websites in the most optimal way for Google.

“Whether it’s organic or paid, Google generates 70-75% of traffic, so keeping Google happy is arguably more important than keeping my customers happy,” he explained.

“It’s incredibly important. For us, Google is god, if you’re not keeping Google happy, you’re not keeping your shareholders happy.”

Google generates 70-75% of Heal’s website traffic

Speaking in June 2020 at IMRG’s Customer Week, Kohn again was open about Heal's online marketing strategy. He said the furniture retailer’s pay-per-click (PPC) marketing investment in the first lockdown period was “far more cost-effective” than usual.

This was mainly because more shoppers were online, and homeware and furniture turned out to be one of the most in-demand categories, he said, but it highlights the importance of putting digital marketing building blocks in place in order to capitalise on rising online shopper numbers.

Google said that its search results indicate more people spending greater amounts of time at home during the pandemic has influenced search behaviour.

“They are also shopping locally as they spend more time at home, and searches containing 'available near me' have doubled around the world,” the search engine provider revealed in a blog update in September. “In the first half of 2020, searches for local services, like home improvement or maintenance, increased by over 25% in a year across a range of European countries.”

“In the first half of 2020, searches for local services, like home improvement or maintenance, increased by over 25% in a year across a range of European countries”

For those retailers looking to get the most out of Google, the business launched free listings for European retailers on its shopping tab in the run up to Christmas.

In addition, Google launched free online business-planning tools on its Google for Small Business site to help firms pivot online during a challenging year. Covering France, Germany, Italy, Spain and the UK, the toolkit provides personalised plans including guidance on which digital options are most suitable based on the type of business.

As ecommerce continues to grow in demand in 2021 and beyond, having a clear Google search strategy will be critical, and UK retailers will be seeking all the support they can in the months ahead, especially following the Brexit transition process when new rules apply.

With so many survey respondents saying they start the majority of their online shopping journeys on a retailer’s website (as discussed in Step 2) on-site search listings should not be neglected either.

On-site search optimisation

In January 2021, Heal's revealed it had seen a huge transformation in its website traffic and said growth had mostly "come from higher visibility on, and better rankings with Google". In the first quarter of 2020 natural search traffic had been down on the previous year by as much as 40%. Just six months later and this position was completely reversed with growth over 50%, representing a positive swing of more than 90%.

According to SimilarWeb, almost 55% of all Heal’s traffic now originates from search, where paid advertising makes up the rest. The company is now ranking in top positions for more keywords than ever before.

In June, Kohn said online traffic during the first national lockdown had been “unprecedented” and he was thankful for putting new site search functionality in place at the start of the year enabling the business to optimise conversions at such a busy time.

Encouragingly, improving on-site SEO strategy as part of wider digital trading activity is very much top of mind for some of the industry’s largest players. In October 2020, M&S poached Next’s head of digital trading Gemma Lumsden as its head of optimisation and analytics to build on the search work already under way at the company.

Lumsden is responsible for leading the analytics, website optimisation and SEO teams, and is charged with ensuring the M&S website offers “a cohesive and consistent” experience for its customers.

Investment in search is underway at Asos, too. Chief executive Nick Beighton reported in October’s full-year trading statement that the company had experimented with geo-targeting, prospecting, retargeting, new social media channels and deepened its understanding of pay-per-click in 2019-20.

“This [combined approach] drove efficiency through our marketing spend and a clearer understanding of the incrementality generated by investment through different channels allowing us to redirect our investment as appropriate,” he explained, as Asos' worldwide sales jumped by 19% year on year.

“We adopted a more dynamic approach this year – with shorter, sharper, more targeted events. This has allowed us to improve the return on these events, drive incremental traffic from our existing consumers, as well as increased levels of customer acquisition.”

He added: “Looking forward, we will continue with further experimentation and a data-led approach to ensure we are continually optimising and building greater agility into the way we deploy spend.”

Discovery commerce: the new frontier?

Discovery commerce is an online marketing method based on guiding the buyer towards a product. It builds on the concept of strolling through a store, browsing shelves without intention to buy until the perfect product catches your eye.

Facebook head of industry for retail and ecommerce Stefano Pardi has talked up the concept of discovery commerce as a more successful way for marketers to target online shoppers. The social media giant has created its own business tool of the same name that adopts discovery commerce. It is powered by data and machine learning that claims to have the capability to anticipate customer needs and match products to them, based on their online behaviour. The social media company says it allows brands to “dig deeper than demographics”.

“Ecommerce is still going to be there but discovery commerce is taking it a step further by allowing brands and products to be discovered by customers''

Pardi says: “In ecommerce, [the] customer might be looking for a particular dress or brand and they go and search for it, with the website and shop playing a crucial role for a product or brand.

“Ecommerce is still going to be there but discovery commerce is taking it a step further by allowing brands and products to be discovered by customers.”

The system leverages what is known about consumers and feeds it into an algorithm, therefore letting the machine identify audiences a brand might not be targeting and helping them place ads accordingly.

Pardi adds: “It sounds like a small change but it’s actually massive.”

STEP 4:

Becoming a data-driven ecommerce player

Successful retailers already monitor online shopping behaviour and use web analytics to improve CX, retain customers and increase customer lifetime value.

This data-driven strategy is one to pursue, says personalisation platform True Fit Corporation EMEA managing director Sarah Curran-Usher. True Fit uses data and machine learning to optimise shopping experiences. Curran-Usher says: “Brands and retailers have an opportunity to pause and listen to what their customers want before blindly marketing products at them.

“Brands and retailers have an opportunity to pause and listen to what their customers want before blindly marketing products at them”

“If your customers seem happy to fit into the box you designed for them, then you are making the false assumption that they will be happy next time.”

The cost of customer acquisition through marketing can add up quickly – Maybe*'s Barnfield says it’s the most expensive part of operating online and it’s not surprising that emerging brands such as Sosandar and Eve Sleep list customer retention as a key performance indicator in their trading updates.

Converting fickle shoppers into repeat customers

According to RWRC's survey, the best way to convert new customers into loyal shoppers is to offer them access to a rewards or membership scheme entitling them to discounts, freebies and exclusive offers. The highest proportion of consumers surveyed (39%) suggest this would be most effective in getting them to spend again.

This makes sense. If consumers provide consent for rewards and offers via such programmes, retailers will have a direct line to them, an opportunity to understand their shoppers’ individual conversion triggers and the option to act accordingly.

The study also indicates that half of consumers are happy for retailers to have access to their basic data – full name and email address – if it means they will get a better online shopping experience. Additionally, 29% say they would provide access to additional data, such as gender, location and age, to support receiving a better online UX.

A mutually beneficial data exchange between retailer and consumer can be extremely powerful – let’s look at some examples.

Data and personalisation best practice

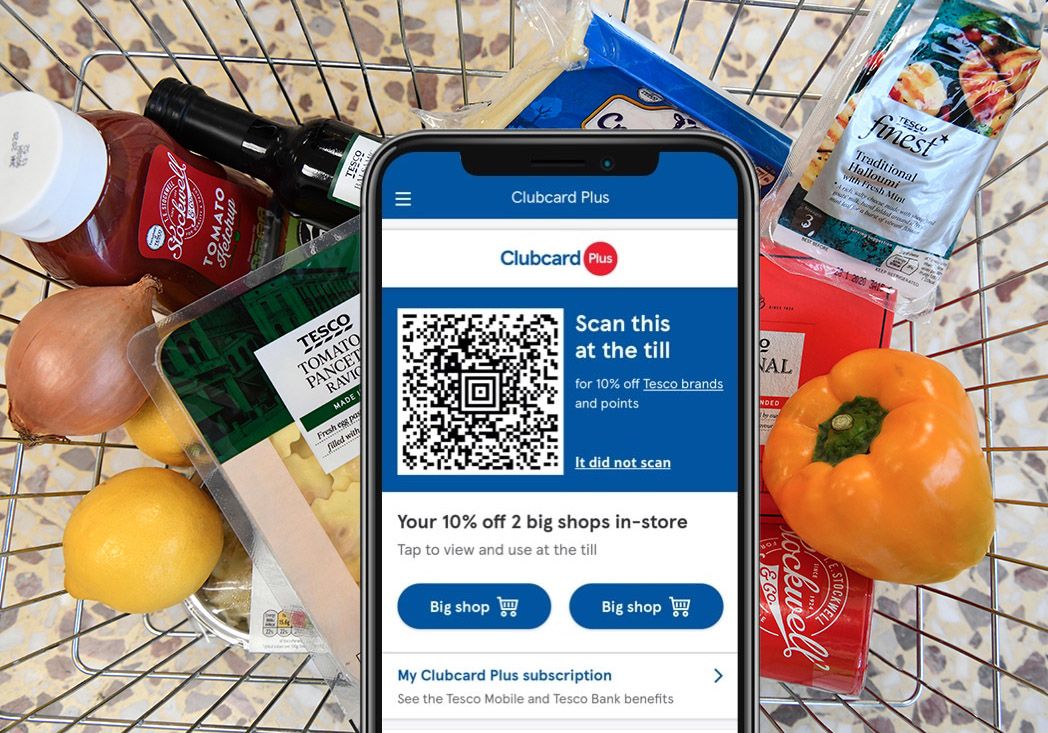

The UK’s largest retailer Tesco reinvented its loyalty programme by launching a Clubcard Plus subscription service at the end of 2019. For a £7.99 monthly fee participating customers get cheaper groceries and offers related to the wider Tesco group, including its mobile, F&F clothing and banking arms.

Tesco acknowledged it did not seek to accelerate take-up in 2020 due to Covid-19-related distractions, but said subscribers were on the up, with basket size uplift of those using it three times what was originally expected. More than 1 million customers signed up to the service in the first half of the 2020-21 financial year alone.

In September, Walmart launched its Walmart+ membership programme which, for a $98 annual fee, gives customers unlimited free deliveries, fuel discounts and access to the scan-and-go functionality on the existing Walmart app.

It is part of the US-based grocer’s long-running battle for market dominance with Amazon, which has experienced huge success with Prime, and speaks to Walmart’s commitment to get closer to its customers.

Back in the UK, sandwich chain Pret a Manger has launched its first loyalty scheme, offering consumers up to five coffees a day for a set £20 per month subscription fee.

Although a move to drive store traffic after Covid-19-related trading challenges, the mobile app loyalty scheme brings together in-store customer behavioural and transactional data, and is viewed by Pret as a key future customer engagement facilitator.

Google is looking to phase out third-party cookies by 2022, which allow digital marketers to plan, measure and attribute online sales, which might further strengthen the case for subscriptions as a key platform for customer engagement.

That said, although Tesco, Walmart and Pret are part of a wave of retailers adopting paid-for subscription services to tie customers into their ecosystems, good use of data and personalisation doesn’t have to cost consumers a dedicated fee.

M&S, for example, overhauled its Sparks loyalty app last summer and now has more than 8 million members in total. Customers’ usage of the app and the M&S website was analysed by the retailer’s data team to dictate which one of 10 different Christmas ads they would see – in the hope of providing relevant marketing.

Farfetch, meanwhile, continues to maintain a healthy share price despite being unprofitable and this is partly to do with investors’ understanding of the luxury fashion etailer’s customer loyalty.

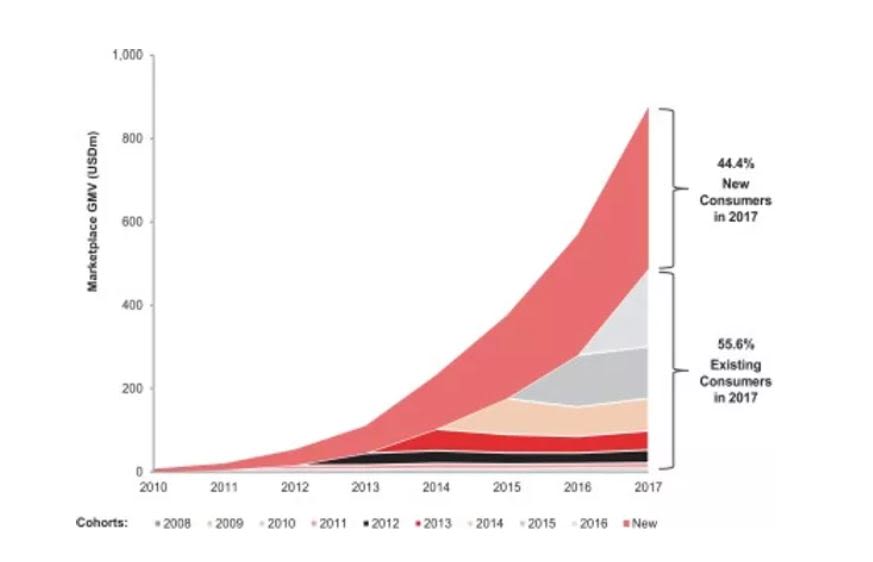

Ahead of its stock market flotation in 2018, Farfetch disclosed its customer cohort chart (known as the C3), displaying revenue by acquisition cohort over time and indicating how total customer spending changes as each cohort ages.

Farfetch disclosed its customer cohort chart before floating in 2018

Farfetch disclosed its customer cohort chart before floating in 2018

From the C3 evidence, Farfetch’s investors can tell customers stick with the retailer in a way more akin to a subscription business than a retailer, therefore expecting future sales success.

What these case studies all show is that good use of data and personalisation is helping retailers attract customers, and improve marketing messaging and UX, while keeping investors happy.

Key takeaways to tap into growth

We’ve covered the four steps to engagement, conversion and loyalty but what next? As online continues to grow as a percentage of total retail sales, here are the factors brands must consider to give themselves the best chances of ecommerce success this year.

Deliver deals

Discounts and free delivery/returns are the best ways to capture new customers online in the current environment. Once an audience is captured they are keen to share more of their personal data in return for additional offers and value.

Tick every box

Payments security is a key issue for consumers when shopping online but consumers also demand speedy transactions and a great looking site. Consumers expect a lot from retailers so ecommerce investment must be comprehensive.

Know your audience

Different age groups have contrasting views on what makes for a good online experience, highlighting the need for strong data and personalisation strategies to enable a tailored approach to consumer engagement.

Keep an eye on the new

New online brands established themselves quickly in 2020, as stores experienced coronavirus disruption. Retailers will need to continue to evolve and explore new tech to stay in the game or should look to partnerships and collaborations as we’ve seen with THG, for example.

Get savvy with social

With over a third of today’s online shoppers having purchased an item after seeing it on social media, the influence of social platforms cannot be ignored. However, as RWRC’s study shows, breaking through the noise in the crowded online market requires a targeted approach. Retailers targeting Gen Z should be taking to TikTok as a marketing channel while businesses should be optimising posts and retargeting ads on Facebook to reach older demographics.

Cautionary tales

RWRC's survey shows social media posts and ads were the least effective at building online brand loyalty, with just 2% of consumers saying this activity would be likely to prompt repeat spend.

As discussed earlier in the report, social media still has a huge part to play in the ecommerce discovery process and can help capture new customers, but it seems retailers cannot rely on these channels to drive repeat revenue.

Being careful with data and privacy for personalisation is paramount, too – 15% of consumers say they are not comfortable with a retailer having access to their data. Familiarity with the online world, ie: those who have shopped via the web for longer, and a more relaxed attitude to personal data do not go hand in hand, suggesting there will always be a section of a retailer’s audience cautious about sharing personal information.

Partner viewpoints

Vladi Shlesman, managing director EMEA, ChannelAdvisor

Last year was one of remarkable change for the retail industry. Digital transformation plans were accelerated as brands and retailers scrambled to adapt to the changing conditions.

Consumer behaviour also radically changed – an acceleration of the shift to online that was already well underway. Consumers have more confidence in shopping online than ever before and that new confidence results in more experimentation and fragmentation across multiple channels and platforms.

Retailers must continue to be agile during this time of rapid change. The brands that will thrive in this new landscape will be those that can embrace a digital-first mindset; keep connected to changing consumer behaviours; and provide a seamless, multichannel and personalised experience for their customers.

Alona Malinovska, managing director, Webgains

While 2020 was a stormy year for many brands, it uncovered a lot of hidden opportunities. From well-established names to SMEs to start-ups, many retailers with a solid online presence significantly grew their client base and improved their trading position.

Those brands that reacted to the sudden market changes quickly deployed a multitude of affordable and relatively easy to implement ecommerce initiatives. From upgrading the on-site experience to releasing tailored, event-specific deals. By scaling activity on less explored acquisition channels, these retailers have seen a significant increase in interest and secured a whole new segment of customers.

To build on the experience of last year, companies should continue to invest in the digitalisation of their brand and commit to exploring various tactics to attract and sustain customer engagement.

When it comes to expanding the buyer mix, retailers should be willing to test and scale channels such as affiliates, partnerships and influencer marketing. By launching these extra campaigns, brands decrease their dependency on paid search and marketplaces while widening the audience scope and, more often than not, noticeably reducing the cost of sale.

Love this report? Why not book in one of our experts to present the findings to your team, examining what they mean for you and your business. Contact Isobel Chillman at isobel.chillman@ascential.com

Ecommerce 2021

Written by Ben Sillitoe

Produced by Megan Dunsby, Rachel Horner, Emily Kearns and Laura Reid

In association with ChannelAdvisor and Webgains