Consumer 2018

Four steps to knowing your customers and how to be their go-to retailer in the new year and beyond

How well do you really know your customers?

For instance, did you know that:

- 45% of consumers plan to spend more in 2018 compared with this year

- 61% are happy to share personal information in exchange for a more tailored online shopping experience

- 57% feel less confident about the political situation in 2018 compared with this year

On the cusp of a new year and with Christmas trading in full swing, retail should be buzzing with optimism. However, in an environment of economic uncertainty and political unrest, reports of falling consumer confidence and decreased spending are rife.

With extra helpings of doom and gloom being served up this festive season, and shoppers increasingly cautious about what, how and where they spend, it is imperative for retailers to truly understand today’s consumer and ensure their wants and needs drive every business decision.

"It is imperative for retailers to truly understand today’s consumer and ensure their wants and needs drive every business decision"

But when faced with a barrage of data, news and speculation, can retailers decipher how today’s consumer really feels and plans to shop in 2018, and align their strategy accordingly?

This Retail Week guide – produced in association with Pure360, Oracle, Mastercard and Flixmedia – comprises four key steps, based on exclusive research of a nationally representative pool of 2,000 UK consumers, which will help retailers get to grips with the 2018 consumer and guarantee that when pennies are pinched, they will be the ones winning shoppers’ business.

Key steps to knowing the consumer

- Understand their mood

- How much do they plan to spend and on what?

- How do they want to shop?

- What will be the key trends in 2018?

STEP 1: UNDERSTANDING THE CONSUMER MOOD

Whether impulse buy or planned investment, emotions factor into every purchase. With political and economic uncertainty making consumers feel uneasy, retailers will benefit from rallying to support their customers.

- Respect the consumer mood – no matter how low – and respond accordingly

- Discounts, offers and fair prices go a long way when purse strings are tight

- Quality and variety are appreciated when money is a worry

Political uncertainty, returning inflation, economic instability and rising interest rates are taking their toll. According to GfK’s Consumer Confidence Barometer, consumer confidence fell two points to -12 in November, marking the 20th consecutive month of negative shopper sentiment.

Consumer moods are low and our research confirms that shoppers are struggling to feel positive about 2018.

Brexit fear factor

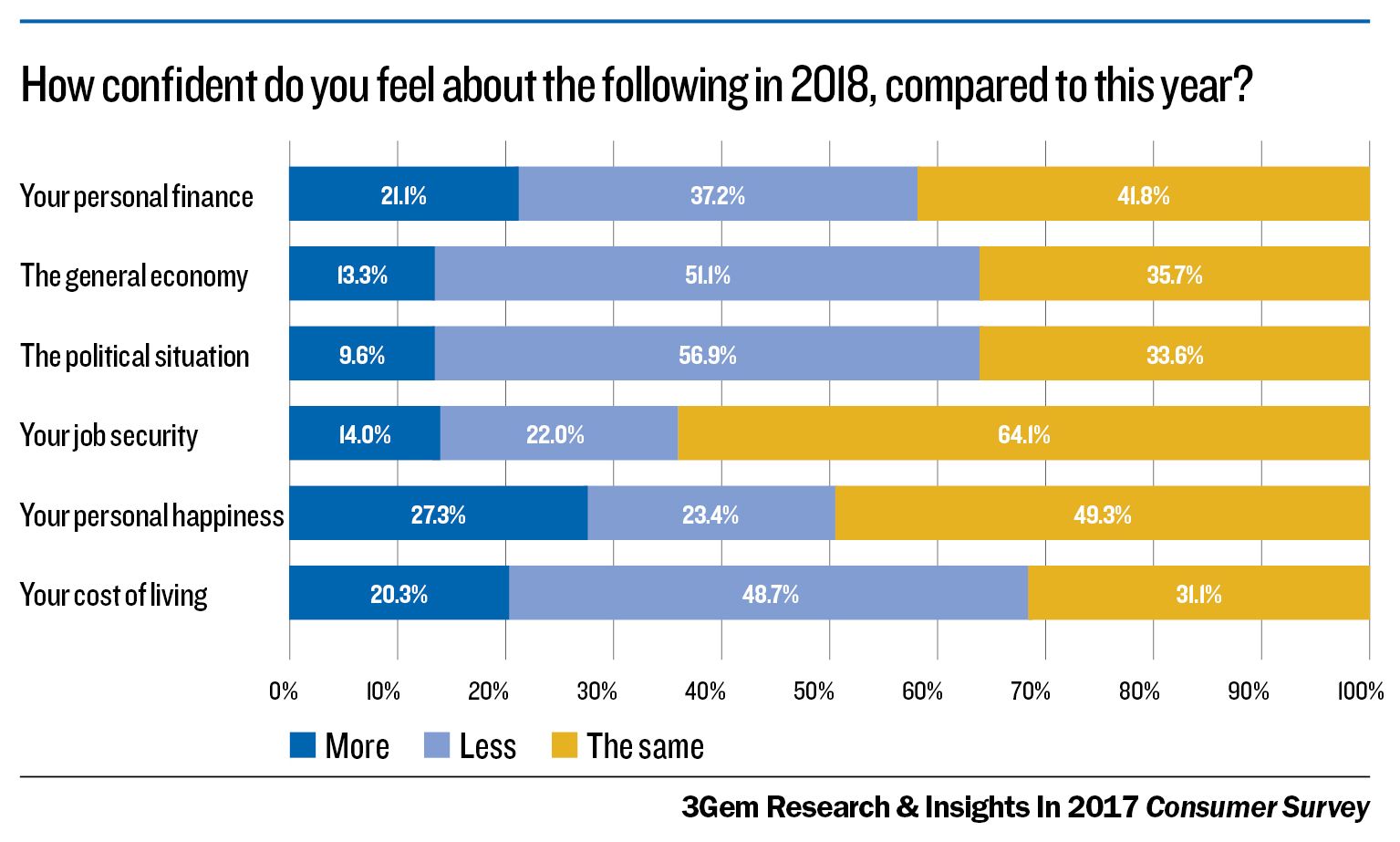

So what’s causing anxiety? Most notably, the political situation. Although Prime Minister Theresa May’s December Brexit negotiations with EU Commission president Jean-Claude Juncker may have helped quell some anxiety, our survey reveals that 57% of consumers feel less confident about the political situation in 2018 compared with 2017. A meagre 10% feel more confident.

Since the referendum in June 2016, compounded by the hung Parliament result and political infighting, Britain’s future has been unclear and retailers are feeling the strain. Sofa specialist DFS blamed uncertainty around the general election for its profit warning earlier this year.

DFS chief executive Ian Filby said at the time: “If you look at the election in 2015 or the Brexit vote, in a market like ours there tends to be some dampened demand until people are at least clear what’s happening.”

But how justified are retailers’ concerns?

Our research confirms that 18% of consumers have spent less following the Brexit vote, 13% have spent more and 70% have spent the same

Top of the troubles

Just behind political uncertainty for the factor causing the most worry is the general economy, which 51% feel less confident about in 2018, compared with the 13% who feel more certain.

Meanwhile, 49% feel less confident about the cost of living next year, compared with 20% who are more confident.

Job security is also worrying people with 22% feeling less secure about jobs next year, compared with 14% who feel more secure. This is despite unemployment reaching its lowest level earlier this year since the mid-1970s.

With real wages continuing to fall in the UK and subdued GDP growth prospects indicated in autumn’s Budget, consumers’ negative outlook is understandable, as is a desire to spend less, avoid borrowing and manage debt.

Softening the blow

Going forward the impetus is on retailers to help allay consumers’ fears by not only focusing on value for money and providing savings-boosting discounts and offers, but lifting dampened spirits.

“As consumers, we now shop in a culture of coupons, vouchers and special offers, however, [we] will also respond well to positive messages and anything that promises a brighter future,” says Joe Staton, head of market dynamics at GfK.

“Maybe now really is the time for a new ‘I’m backing Britain’ campaign to relaunch confidence in our homegrown produce and talent, get us to open our hearts, minds and wallets.”

When the mood is low, what influences consumers’ decisions about what they buy?

Key statistics at a glance:

- The highest number of people (68%) say quality impacts their decision to buy, followed by a low price (63%) and discounts (46%).

- When asked what is most important to them in store, the highest number of respondents (58%) say a wide selection of products. Just behind that was customer service (44%).

How to respond proactively:

- Fair prices, personalised discounts and offers help when incomes are stretched.

- Tough times turn the spotlight on to quality and variety of product.

- Exemplary customer service can help raise a smile.

STEP 2: HOW MUCH DO THEY WANT TO SPEND AND ON WHAT?

Food and other essentials will take less of a hit than discretionary spending as belts are tightened, but thinking creatively will help win consumer spend.

- People plan to spend more in 2018 compared with 2017

- Food will take the biggest share of people’s spending

- Experience matters

Heightened consumer anxiety is being felt. Almost directly after Prime Minister Theresa May lost her parliamentary majority in April’s general election, consumer spending dipped for the first time in nearly four years, down 0.8% year on year in May, according to the Visa UK Consumer Spending Index.

In October, overall spending fell by 2% year on year – the fastest rate in four years – Visa found through IHS Markit-compiled data.

Meanwhile, figures from the Office for Budget Responsibility, released with the Chancellor’s Budget, predicted declining real wages until 2022.

But according to our research, there is light at the end of the tunnel.

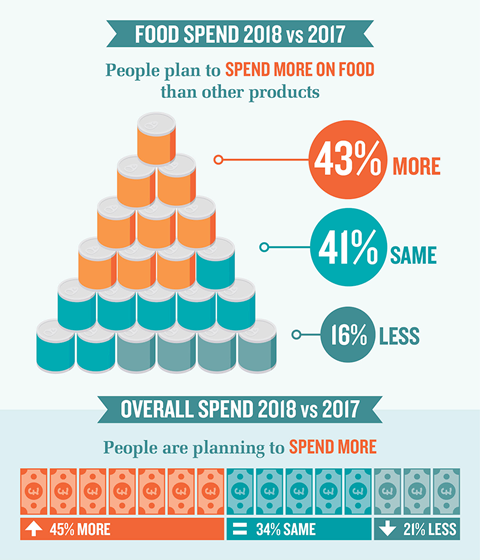

When asked how much they expect to spend in 2018 compared with 2017, 45% of shoppers say more and just 21% expect less.

Glorious food

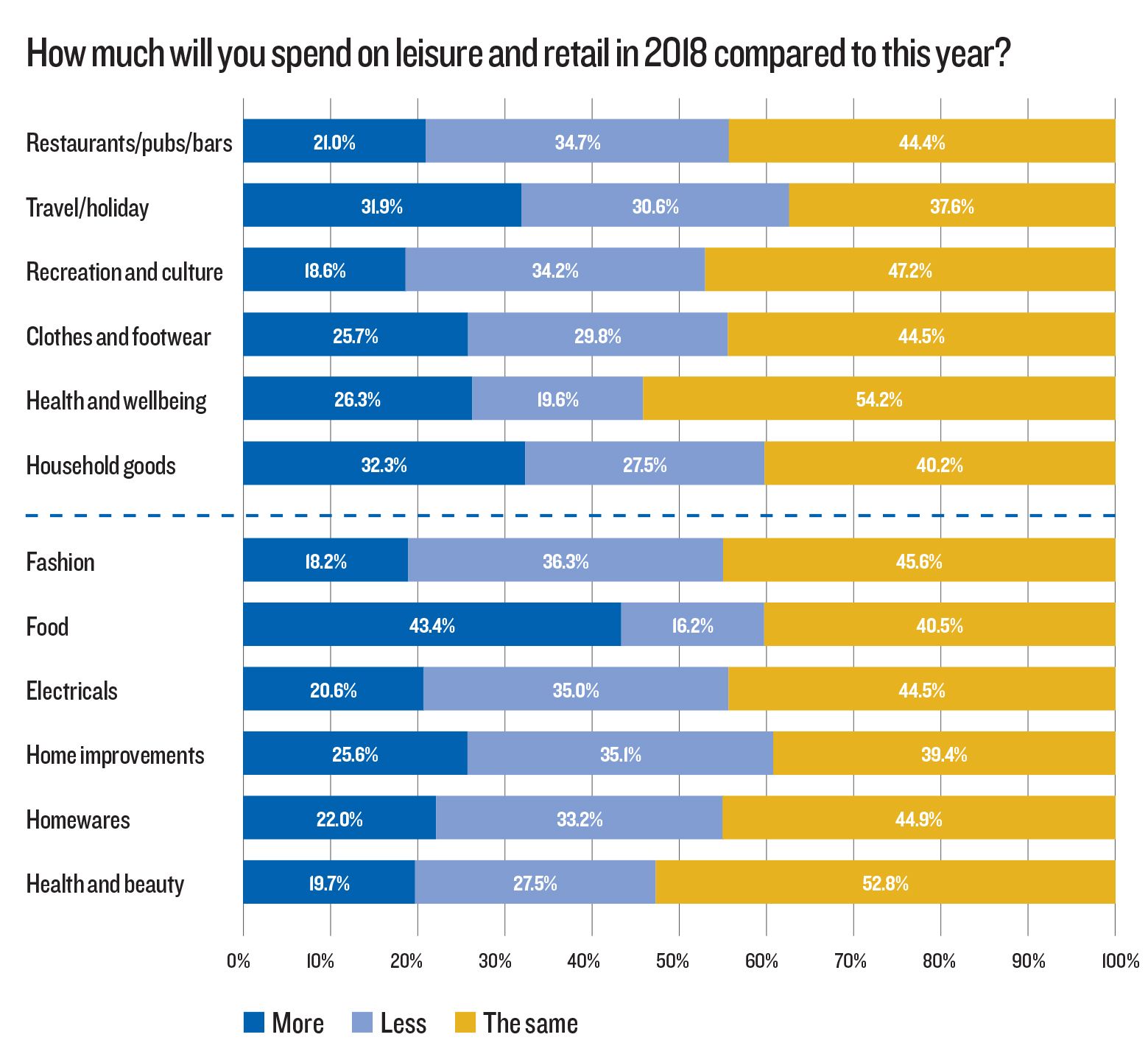

Prospects are most upbeat for grocers, with 43% planning to spend more on food in 2018 compared with 16% who plan to spend less.

“Grocery represents about 50% of retail sales and people need to eat,” says James Sawley, head of retail and leisure at HSBC’s UK corporate banking division.

“Food inflation has kept the numbers up despite Brexit uncertainty. More discretionary spending, such as clothing and furniture, has been hit harder.”

"Our research indicates that consumers will scrimp on fashion in 2018, with 36% intending to spend less on clothing, compared with 18% who will spend more"

Positive experiences

When incomes are stretched essentials are prioritised, but what about the mounting penchant for experience over product?

“Time with friends and family is becoming more important than household items and physical goods,” explains Paul Lockstone, managing director for corporate communications at Barclaycard.

Retailers should ignore the experience economy at their peril. Earlier this year, Next chief executive Lord Wolfson said: “The balance of increase in consumer spending is going into more experiential spending. That is the biggest single issue and the rest of the economy will compound or mitigate that issue.”

Instead of feeling the threat of experience, retailers are bringing experience in store.

Topshop’s experience to remember

In October, fashion retailer Topshop paid homage to hit Netflix show Stranger Things at its Oxford Circus flagship.

The store was decked out with Stranger Things décor and shoppers could interact with live window displays based on the series.

Inside, customers were met with Stranger Things clothing styled alongside Topshop’s existing range and a host of merchandise.

Building on the excitement around the cult show, Topshop created theatre that had shoppers stopping to spend.

GfK’s Staton says: “Retailers that build a better retail experience both on and offline will grow – simple ideas like bringing your website in store or building a strong sense of community and mutuality among customers.”

This ties into the significant 29% of consumers who say that when browsing a retail website customer reviews are most important to them.

When incomes are stretched what do people spend their money on and where?

Key statistics at a glance

- When asked what they will spend more, less or the same on in 2018, electricals (35%), home improvements (35%) and homewares (33%) were selected as something they will spend less on by approximately a third of people.

How to respond proactively

- Grocers and discounters can cash in on consumers’ focus on essential and value purchases, but customers still want quality so retailers in other product categories would do well to emphasise the value and quality of products.

STEP 3: HOW DO THEY WANT TO SHOP?

The high street will attract shoppers in 2018, but not at the expense of ecommerce. Retailers that combine their bricks and clicks to offer maximum convenience will boost bottom lines.

- Shoppers plan to spend more online in 2018

- Convenience and transparency will be in demand

Online marches on

In-store spending suffered in 2017 as people turned to the web. Visa’s October consumer spending research revealed that face-to-face transactions fell at the second-fastest rate since April 2012, falling 5% in a year.

Having said that, when asked where they are most likely to shop, the highest number of our survey respondents (31%) say in store.

But that doesn’t mean shoppers won’t be spending online. Indeed, 31% of shoppers expect to spend more online in 2018, compared with 20% who expect to spend less.

And for our surveyed consumers, desktop will be the preferred mode of online shopping in 2018, with 26% saying they plan to shop on a retailers’ website on a PC.

It’s a steep drop to the 10% who will be most likely to shop on a retailer’s website on a mobile phone, followed by 5% on a marketplace app and 3% through a retailer’s mobile app.

GfK’s Staton says shoppers expect to transition seamlessly from device to device, whether at home or on the move.

“Retailers must ensure any transaction is frictionless, personalised and fast irrespective of channel or location,” he says.

“Why prioritise one gadget over another when consumers expect and demand a seamless and similar experience however and wherever they choose to shop?”

"31% of shoppers expect to spend more online in 2018, compared with 20% who expect to spend less"

Give convenience credit

As well as demanding the convenience afforded by online shopping in 2018, consumers want transparency. When asked what was most important to them when browsing a retail website, the highest number of people (55%) say clear pricing information.

Behind pricing, 37% want lots of choices, 36% want clear delivery information and 35% want stock availability information.

And when it comes to being united with their purchases, for most people, click-and-collect from store is the preference. The service was selected by 30% as the delivery method they expect to use most in 2018.

Speed and precision also appeal, with 28% opting for next-day delivery and 23% choosing time-slot delivery.

With convenience dictating how consumers will shop, how significant will social media be to shoppers in 2018?

Key statistics at a glance

- When asked how they like retailers to engage with them on social media, 50% of people say they don’t want it at all, and 56% of people do not use any social media to browse or buy.

- For those who do use social media to browse and buy, Facebook is most popular with 31% using it. Among fans of social media, the highest percentage (27%) want retailers to use it to share offers and promotions.

How to respond proactively

- The significant number of people who want retailers to steer clear of their social media feeds tells retailers to tread respectfully when using the medium.

- Used wisely it proffers a real opportunity to complement and enhance shopping journeys, not only through offers and promotions, but also as an extension of in-store experiences.

STEP 4: WHAT WILL BE THE KEY TRENDS IN 2018?

Supporting the causes that matter to consumers will be imperative in 2018, and trust and transparency will be crucial at a time when confidence is wavering.

- Personalisation will continue to impress but be transparent and protect the consumer

- Show consumers you care with actions, not words

Today’s consumer wants retailers to care as much as they do about the causes that matter to them.

"When asked what guides their decision to purchase, 15% of respondents say sustainability"

The greater good

So what are some of the trends that we can expect to see in 2018?

When asked what guides their decision to purchase, 15% of respondents say sustainability – knowing that products are made in an ethical and sustainable way – while 9% say that provenance and knowing where products are made guides their decision to purchase.

When moods are subdued, consumers will thank retailers that help make them feel good. They want the businesses they spend money with to lend their support to making the world a brighter place.

Be positively sensitive

Among issues that retailers may want to support in 2018 is the body positivity movement.

Shoppers want retailers to care about their individual identities and fight back against unrealistic beauty ideals. Asos recently received a pat on the back for not airbrushing models’ stretch marks.

Asos is one of the fashion retailers fighting back against unrealistic beauty ideals by refusing to airbrush models’ stretch marks

Asos is one of the fashion retailers fighting back against unrealistic beauty ideals by refusing to airbrush models’ stretch marks

Meanwhile, retailers that lead and educate on sustainable products and ingredients are likely to resonate with shoppers whose concerns have been piqued by footage from BBC’s Blue Planet II surrounding the damage from plastics waste and a focus in Chancellor Philip Hammond’s Budget on conserving Britain’s beaches and oceans.

Retailers already getting involved include Co-op and Iceland, which have signed up to a plastic bottle deposit scheme.

As consumers shun post-truth politics and fake news, brands that embrace transparency, simplicity and evidence will do well, particularly in a climate where consumers are expected increasingly to cut out the middleman – whether that’s the media or retailers – and go direct to the source of products or stories.

Indeed, respecting what customers want will pay dividends because, while post-referendum uncertainty abounds, you can be sure that consumers must remain retail’s healthy obsession.

What else will consumers care about in 2018?

Data sharing

What we know: Consumers are aware that sharing data can personalise their shopping experience and 61% are happy to provide personal data when shopping online to receive a more individual shopping experience, compared with 39% who are not. But they also know about associated risks following high-profile data breaches.

Related statistics: We asked: What data would you be happy to give a retailer?

Results: Email 74% | Shopping habits and behaviour 27% | Income 9%

How to react: Incentivising customers to share data with discounts and offers will be key, as will ensuring data already held complies with new General Data Protection Regulation.

Shopping through their preferred platforms

What we know: Already a firm favourite for fashion inspiration, Instagram is poised to become a popular new shopping platform and, over the past year, has been testing its shopping capabilities for US users.

Related statistics: We asked: Which social networks do you use to browse and buy from retailers?

Results: None, I don’t use social media 56% | Facebook 31% | Instagram 13%

How to react: Instagram is the second most popular social network for browsing and buying. Don’t underestimate the importance of this platform to shoppers – particularly in the youth market – and ready your business to maximise the opportunity.

PARTNER COMMENTS

Komal Helyer, marketing director, Pure360

Pure360 helps retail brands to make more money from their ecommerce sites. We do so by providing the technology – and support – retailers need to build a better customer experience.

But this is just one part of the puzzle. The retail brands that make the best use of technology are the ones that truly understand how consumers think. This is why we have partnered with Retail Week on this guide.

We want to help retailers understand the mindset of consumers, so that they can connect with them in a meaningful way. With access to the right insight, retail marketers can use behavioural targeting and personalisation to build lucrative relationships with shoppers.

Once retailers understand how consumers think – and how they intend to spend – it is easier for them to predict behaviours and frame messages that resonate. This helps to reduce friction and ease the customer along in their journey to purchase.

Understanding trends and using these to curate collections of products consumers will want to be identified by in 2018 will be important. As will knowing which audience will respond to messages around quality, and which is most concerned with value.

Getting this level of insight will help retailers use technology to make personalised product recommendations at the moments that matter. Showing consumers items they genuinely want – at the times they want them – makes it easier for them to spend more.

What’s more, consumers will become loyal to the brands that understand them. By knowing how to navigate political instability and financial concerns in their messaging, retailers will be able to show consumers they care. That they aren’t thoughtless brands pushing products, but intelligent shopping partners that help make the customer experience more enjoyable.

"Understanding trends and using these to curate collections of products consumers will want to be identified by in 2018 will be important"

Antony Welfare, retail sales development manager, Oracle

This guide highlights a crucial goal for retailers that want to be successful in 2018, and beyond. Retailers need to ensure that consumers are in love with them.

Consumers today are driven by a desire to shop when, where and how they want. They want retailers to provide them not only with the goods that they desire, but also the experience.

With digital technologies now very much ingrained in most people’s lives, they want this replicated into every aspect – particularly in their retail experience.

For retailers this is no longer simply having a website. It’s about providing a 24-hour service and also integrating social media into the buying process so that people see shopping as part of their daily lives and something to share with friends and family, and ultimately an experience they enjoy.

Ensuring that people enjoy their buying experience is crucially important when you consider that consumer confidence is low, particularly with more than 20% of consumers today voicing concerns about personal finance.

By creating an experience that people enjoy or find convenient, consumers will feel an affinity with a certain retailer or brand, and are more likely to part with their hard-earned cash.

Ultimately, we can see that experience is now at the heart of the buying process. It is equally as important as the product. Retailers need to ensure they are putting as much focus on the experience as they are on their product or risk consumers keeping their wallets firmly closed.

"By creating an experience that people enjoy or find convenient, consumers will feel an affinity with a certain retailer or brand"

Scott Lester, chief executive, Flixmedia

Understanding what consumers want and how to deliver it is becoming an ever-more complex puzzle – and in a crowded retail industry the stakes are high.

This guide offers essential insight into what drives consumer demands, and what retailers must do to influence and capitalise on this in 2018.

Content is king, and with its endless virtual aisles, Amazon is its Queen. Yet in an environment of dizzying choice, retailers must remember that it is quality as well as quantity of content that consumers value.

Brands and retailers need a way to get the right message to the right people at the right time and in the right place. They must ensure content is engaging, timely and relevant, and that it is displayed in a clear and compelling way, helping to steer the shopper through a snag-free and enjoyable route from browse to basket.

The result is selling well, selling more and doing so in the most frictionless way possible.

Retailers should look to a partner that understands their consumers’ content demands and enables them to deliver on these.

What’s needed? Data analytics, automation, creativity, global reach, consumer insight and a firm finger on retail’s racing pulse.

"In an environment of dizzying choice, retailers must remember that it is quality as well as quantity of content that consumers value"

Consumer 2018

Four steps to knowing your customers

Produced by Kate Doherty, Dan Harder, Gemma Goldfingle,

Emily Kearns and Abigail O'Sullivan

Consumer research for Retail Week conducted by 3Gem Research

In association with Pure360, Oracle, Mastercard and Flixmedia