THE CHRISTMAS FORECAST

What to expect from golden quarter sales and the cost-of-living crisis

The industry’s focus begins to shift during the summer months as retailers start planning for the most lucrative period of the year – the golden quarter. Once again, this year retailers find they have a lot to consider. October to December is widely regarded as crunch time for retailers, but adding to that pressure is the fact that consumers are facing a financial squeeze of their own.

The rise in the energy price cap, increasing National Insurance contributions, a freeze on personal tax allowances, increasing inflation and the Russia–Ukraine conflict leading to a spike in commodity prices, are all combining to create a very real cost-of-living crisis, which is now sweeping the UK going into the second half of the year.

Spending on non-essential items is set to plummet by £12bn in the UK this year as consumers tighten their purse strings, according to findings from a report by Retail Economics and digital wallet HyperJar.

In May, consumer confidence plummeted to -40, the lowest ever recorded by data and research company GfK’s Consumer Confidence Barometer since its records began in 1974. It cited the causes as vacancies outnumbering job seekers for the first time and inflation peaking at a 40-year high, driven by soaring food and fuel bills.

According to Joe Staton, client strategy director for GfK, May’s result being one point lower than the previous record set in July 2008 signifies that “consumer confidence is now weaker than in the darkest days of the global banking crisis, the impact of Brexit on the economy, or the Covid shutdown”.

Expectations for the general economic situation over the coming year also declined by one point to -56, a 60-point drop compared with the same month in 2021.

The major purchase index also took a hit, decreasing by three points to -35, a 28-point drop from last year, as consumers keep their spending to essential categories.

So the collective sigh of relief expunged by UK retailers last Christmas has been replaced with a huge intake of breath as they face up to the latest challenge of trying to drive spending when consumers are struggling. How can retailers make sure they stay front of consumers’ minds and first on their shopping lists this golden quarter? And in an age of responsible retail, how can they square driving sales from cash-strapped consumers while at the same time supporting the communities they serve?

Winning strategies in this report

Retail Week has determined the five winning strategies all retailers should focus on in 2022 and beyond to succeed in a market transformed by technology and shifting consumer attitudes.

Inside the mind of the Christmas consumer

UK unemployment might be at its lowest level for almost 50 years, but the British Chamber of Commerce expects inflation to reach 10% in the final quarter of 2022, outpacing pay growth, which in turn puts household finances under increasing pressure.

In the region of £2.3bn of income for non-essentials was wiped off the economy throughout April, according to the research from Retail Economics and HyperJar. Data from their cost-of-living tracker shows that the fierce inflationary backdrop is curtailing discretionary income. How much the average household has left after paying for essentials is plummeting. According to the research, people had £83 less to spend on discretionary items in April versus the same month in 2021.

And it is likely the worst is yet to come, particularly as the energy price cap is due to rise again in the autumn.

The UK is experiencing some of the fastest price rises on essentials – such as energy and food – and inevitably this is hitting the least affluent households hardest. Lower-income households spend a disproportionate amount on staples, severely restricting the amount of spare cash they have to spend elsewhere.

Splitting out inflation and earnings by household is required to understand the true level of inequality. Retail Economics and HyperJar suggest the least affluent households are seeing inflation rates of 11.2% across their spending, compared with 8.3% for the most affluent families.

Income shock

A quarter of consumers say they currently “just about manage”, while 30% say they are “a little concerned” about their current financial situation.

HyperJar chief executive Mat Megens says: “Many of us have never lived through a period of high inflation – and it shows. Experts from ministers and markets to the Bank of England are getting cost-of-living predictions wrong, prices are rising and salaries aren’t keeping up. Individuals can’t control this surround-sound of uncertainty, but we can control what we spend and where – and try to make the most of every penny.”

Retail Economics chief executive Richard Lim agrees the UK is facing difficulties. “The country is experiencing an enormous income shock, with the least affluent families anchored at the epicentre. With inflation nearing double digits, life has turned extremely uncomfortable for many households.”

He predicts a “polarised Christmas” is on the cards.

Stepping (cautiously) into Christmas

Crunching the current spending and economic data, Retail Economics has produced a report exclusively for Retail Week predicting that retail sales by volume will be down year on year in the final quarter of 2022. However, with inflation currently around 9%, the value of retail sales is predicted to rise.

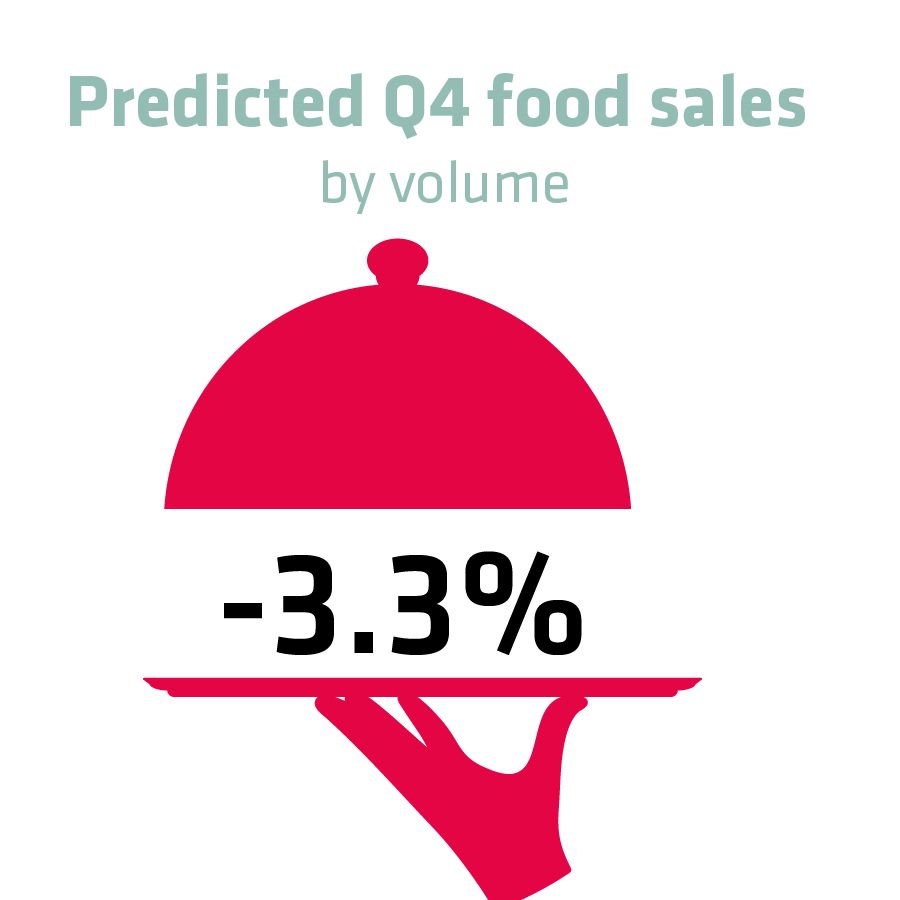

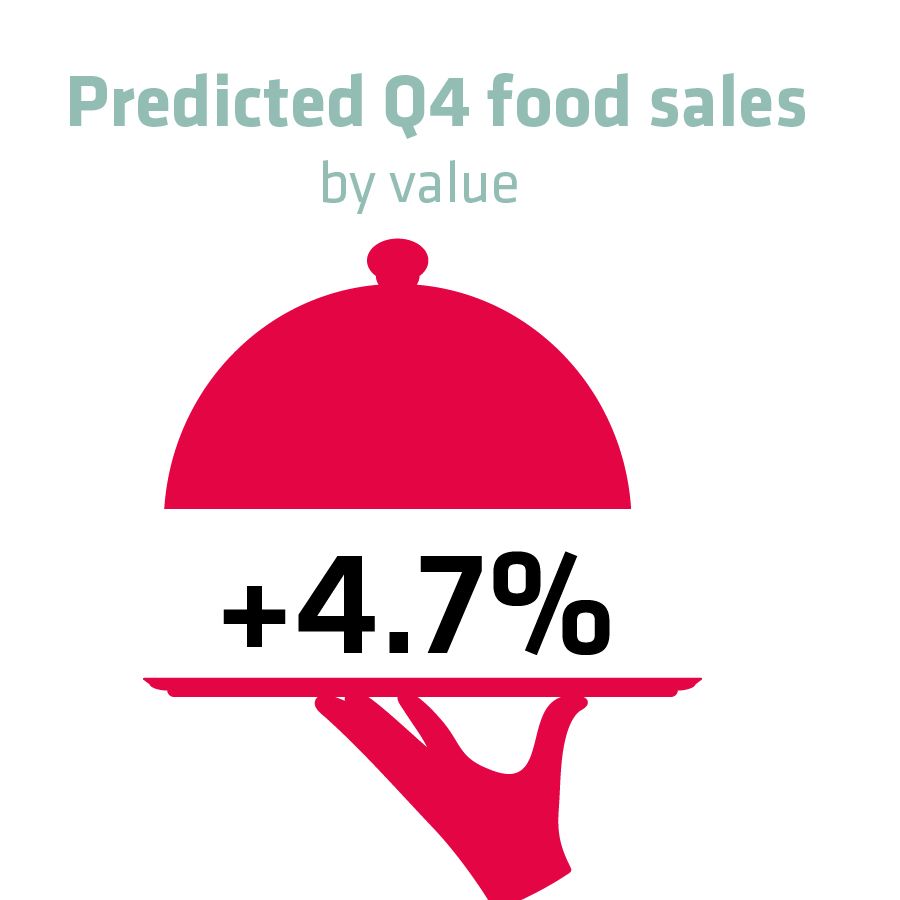

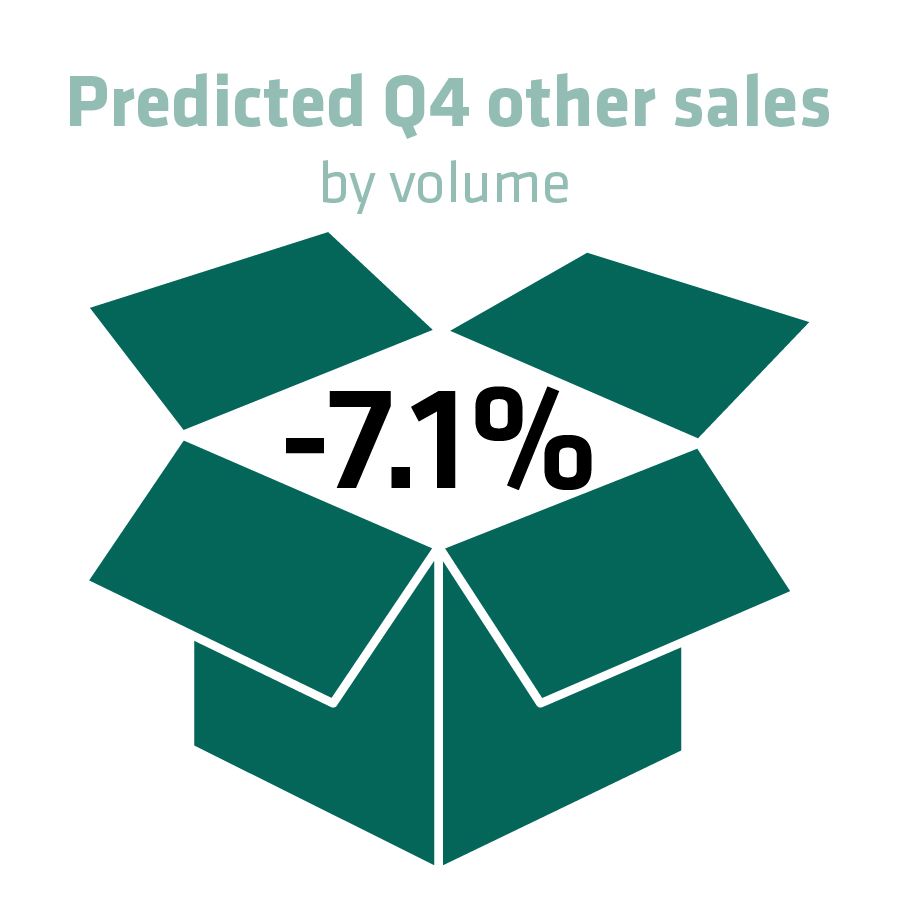

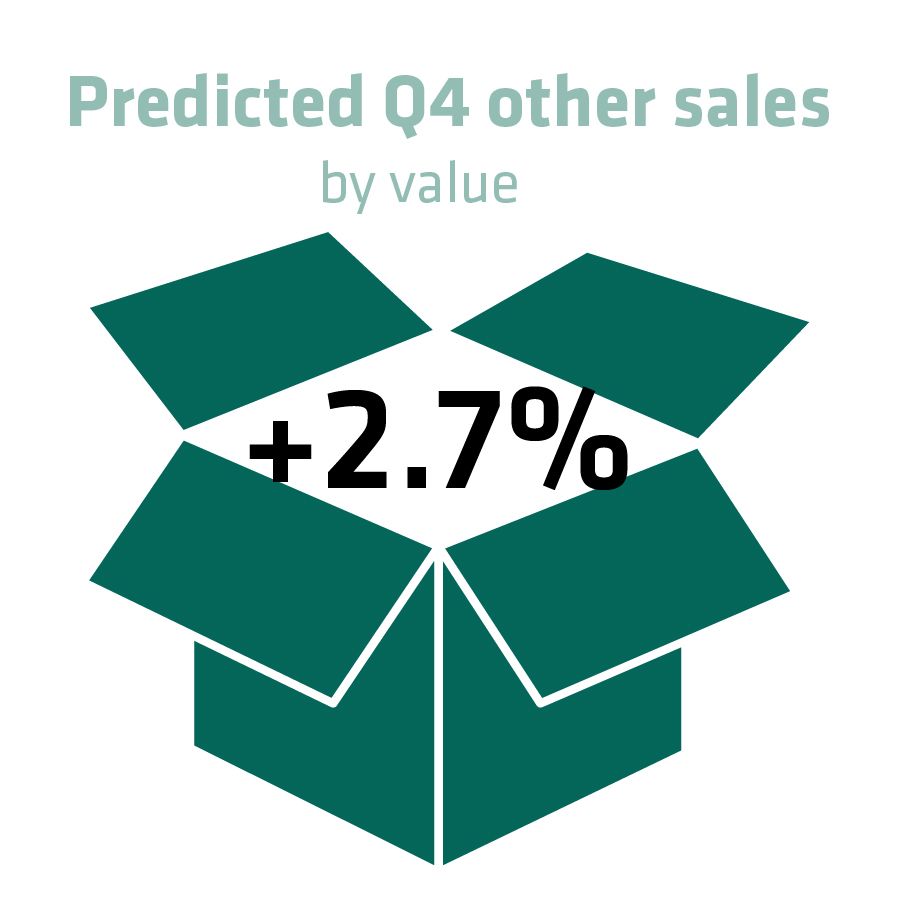

Food sales by value are expected to be up by 4.7% with sales volumes down by 3.3%, while in non-food those figures are predicted to be up by 2.7% and down by 7.1% respectively.

That will bring total retail sales by value and volume to +3.7% and -5.3% respectively.

Retail Economics says it estimates the proportion of retail sales online in the fourth quarter of 2022 to be 32.3%, which would represent value growth of 8% against the same period in 2021.

Something to consider about these estimates is that they not only come at a time of waning consumer spending power, but they are also in comparison with buoyant final-quarter sales figures from 2021.

Generally speaking, retailers had a strong Christmas period in 2021, with a raft of big names – including Tesco, Marks & Spencer, Asos and Halfords – updating the market with an upturn in sales and announcing greater profit forecasts.

Tesco, for example, recorded a 2.6% rise in group sales year on year in the 19 weeks to January 8, up 3.2% in the crucial six-week Christmas trading period. The “stronger-than-expected sales prompted the grocer to change its profit forecast to “slightly above” the top end of its previous guidance of £2.6bn.

Asos, meanwhile, reported a 5% rise in total sales year on year to £1.4bn in the four months to December 31, with the demand for party outfits driving an uptick in its UK sales during that time.

Sainsbury’s, JD Sports and Dunelm were among a long list of retailers reporting encouraging sales figures during the festive period, but analysts said at the time it was potentially a splurge before a tightening economic environment impacted consumer confidence.

And here we are, approaching the second half of 2022 in just that scenario.

“We tend to head into Christmas thinking it’s going to be tough, but come out the other end and it wasn’t too bad – this year the pockets of consumers are actually more impacted than previous years“

“Everything from a consumer perspective, in certain households at least, will be dominated by rising inflation,” explains Lim. “The cost-of-living crisis we expect to intensify throughout the year, as the ongoing impact of the cost of goods inflation, food inflation and energy price rises continues.

“What tends to happen is we head into Christmas thinking it’s going to be tough because of X, Y and Z, but we come out the other end and it wasn’t too bad. This year the pockets of consumers are actually more impacted than previous years, and that is so important because a third [of consumer spending] is spent in the retail sector.”

Stepping (cautiously) into Christmas

Crunching the current spending and economic data, Retail Economics has produced a report exclusively for Retail Week predicting that retail sales by volume will be down year on year in the final quarter of 2022. However, with inflation currently around 9%, the value of retail sales is predicted to rise.

Food sales by value are expected to be up by 4.7% with sales volumes down by 3.3%, while in non-food those figures are predicted to be up by 2.7% and down by 7.1% respectively.

That will bring total retail sales by value and volume to +3.7% and -5.3% respectively.

Retail Economics says it estimates the proportion of retail sales online in the fourth quarter of 2022 to be 32.3%, which would represent value growth of 8% against the same period in 2021.

Something to consider about these estimates is that they not only come at a time of waning consumer spending power, but they are also in comparison with buoyant final-quarter sales figures from 2021.

Generally speaking, retailers had a strong Christmas period in 2021, with a raft of big names – including Tesco, Marks & Spencer, Asos and Halfords – updating the market with an upturn in sales and announcing greater profit forecasts.

Tesco, for example, recorded a 2.6% rise in group sales year on year in the 19 weeks to January 8, up 3.2% in the crucial six-week Christmas trading period. The “stronger-than-expected sales prompted the grocer to change its profit forecast to “slightly above” the top end of its previous guidance of £2.6bn.

Asos, meanwhile, reported a 5% rise in total sales year on year to £1.4bn in the four months to December 31, with the demand for party outfits driving an uptick in its UK sales during that time.

Sainsbury’s, JD Sports and Dunelm were among a long list of retailers reporting encouraging sales figures during the festive period, but analysts said at the time it was potentially a splurge before a tightening economic environment impacted consumer confidence.

And here we are, approaching the second half of 2022 in just that scenario.

“We tend to head into Christmas thinking it’s going to be tough, but come out the other end and it wasn’t too bad – this year the pockets of consumers are actually more impacted than previous years“

“Everything from a consumer perspective, in certain households at least, will be dominated by rising inflation,” explains Lim. “The cost-of-living crisis we expect to intensify throughout the year, as the ongoing impact of the cost of goods inflation, food inflation and energy price rises continues.

“What tends to happen is we head into Christmas thinking it’s going to be tough because of X, Y and Z, but we come out the other end and it wasn’t too bad. This year the pockets of consumers are actually more impacted than previous years, and that is so important because a third [of consumer spending] is spent in the retail sector.”

Not roaring into the twenties

Although the impact of the cost-of-living crisis is not equal across the demographics, affluent consumers are still likely to be more considered in their spending, according to Retail Economics.

“Though people’s discretionary spending might not be squeezed as hard in the middle- to high-income households, there is still the psychological impact of ‘my money is not going as far as it used to’ [with] all the media talk about the crisis, so they will cut back spending.”

“We were expecting another roaring twenties, but it’s more like crawling twenties – people are nervous of spending“

Will Higham, consumer futurist and chief executive of trends analysis business Next Big Thing, agrees that macroeconomic factors are likely to affect spending this Christmas. The widely expected pent-up demand from the pandemic resulting in a 2022 sales splurge may have to be tempered owing to the current economic pressures, he says.

“Everybody is in a different place financially, but the overall trend is whatever situation people are in, there will be more carefulness around spending,” he explains. “We were expecting another roaring twenties, but it’s more like crawling twenties – people are nervous of spending.”

Get-togethers versus gifts

There are multiple additional factors to consider that will influence the shape of spending during the peak period, Higham notes. He suggests the demand for community, experience and spending time together will still be strong.

“Christmas post-lockdowns in 2021, retailers rightly focused on bringing people together, and that hasn’t gone away. Just because people have been able to spend time with one another over the past six months they aren’t going to be bored of it by Christmas – it will be another excuse to get together.”

As a result, food and entertainment will be a priority when people plan their spending, he says, adding that gifting may be more muted, with more family ‘secret Santas’ where each person at the get-together receives just one gift and a greater number of people who choose not to exchange gifts at all.

“[During] Covid we’ve become more authentic. People are admitting the truth about how they are not spending as much or if they are having tough times“

Delving into people’s psychology, he says: “We’re a bit more honest with each other as a nation. In Covid – both within friends and family circles, and the workplace – we’ve become more authentic. People are admitting the truth about how they are not spending as much or if they are having tough times, for example.”

Whether for economic or environmental reasons, Higham says people are also reconsidering their purchasing behaviour – and there are several factors he sees playing out over the coming months. Retailers should consider consumers’ inclination to thriftiness over the past few years – making their own wrapping paper, crackers and paraphernalia – and expect this behaviour to become more ingrained in our festive traditions, he adds.

“A few years ago, the return of the ‘spirit of the Blitz’ and idea of ‘make do and mend’ was trendy,” he says. “Over the next year, that will kick in for real for a lot of people. Make do and mend will be how you live your life not some kind of fun lifestyle choice.”

In preparing their golden quarter strategy, Higham advises: “Put yourselves in their shoes; you’re a consumer, too – they are not an alien species. All retailers will be considering their own personal situation and what to do this Christmas. Think how you feel, talk to your kids, partners and family and get a sense of people’s sentiment, and ask [yourself], ‘are you really going to be comfortable spending a lot of money on gifts this year?’”

As Elavon Europe head of retail Michael Bosshammer says: “Customers are definitely still interested in physical retail, but with digital touchpoints that enrich the shopping experience. Retailers need to embrace the lifestyle of their customers, and offer the convenience and fulfilment they demand.”

There is evidence of retailers adopting a consumer mindset, and there are several examples included in the sector-by-sector breakdown in the next chapter.

Not roaring into the twenties

Although the impact of the cost-of-living crisis is not equal across the demographics, affluent consumers are still likely to be more considered in their spending, according to Retail Economics.

“Though people’s discretionary spending might not be squeezed as hard in the middle- to high-income households, there is still the psychological impact of ‘my money is not going as far as it used to’ [with] all the media talk about the crisis, so they will cut back spending.”

“We were expecting another roaring twenties, but it’s more like crawling twenties – people are nervous of spending“

Will Higham, consumer futurist and chief executive of trends analysis business Next Big Thing, agrees that macroeconomic factors are likely to affect spending this Christmas. The widely expected pent-up demand from the pandemic resulting in a 2022 sales splurge may have to be tempered owing to the current economic pressures, he says.

“Everybody is in a different place financially, but the overall trend is whatever situation people are in, there will be more carefulness around spending,” he explains. “We were expecting another roaring twenties, but it’s more like crawling twenties – people are nervous of spending.”

Get-togethers versus gifts

There are multiple additional factors to consider that will influence the shape of spending during the peak period, Higham notes. He suggests the demand for community, experience and spending time together will still be strong.

“Christmas post-lockdowns in 2021, retailers rightly focused on bringing people together, and that hasn’t gone away. Just because people have been able to spend time with one another over the past six months they aren’t going to be bored of it by Christmas – it will be another excuse to get together.”

As a result, food and entertainment will be a priority when people plan their spending, he says, adding that gifting may be more muted, with more family ‘secret Santas’ where each person at the get-together receives just one gift and a greater number of people who choose not to exchange gifts at all.

“[During] Covid we’ve become more authentic. People are admitting the truth about how they are not spending as much or if they are having tough times“

Delving into people’s psychology, he says: “We’re a bit more honest with each other as a nation. In Covid – both within friends and family circles, and the workplace – we’ve become more authentic. People are admitting the truth about how they are not spending as much or if they are having tough times, for example.”

Whether for economic or environmental reasons, Higham says people are also reconsidering their purchasing behaviour – and there are several factors he sees playing out over the coming months. Retailers should consider consumers’ inclination to thriftiness over the past few years – making their own wrapping paper, crackers and paraphernalia – and expect this behaviour to become more ingrained in our festive traditions, he adds.

“A few years ago, the return of the ‘spirit of the Blitz’ and idea of ‘make do and mend’ was trendy,” he says. “Over the next year, that will kick in for real for a lot of people. Make do and mend will be how you live your life not some kind of fun lifestyle choice.”

In preparing their golden quarter strategy, Higham advises: “Put yourselves in their shoes; you’re a consumer, too – they are not an alien species. All retailers will be considering their own personal situation and what to do this Christmas. Think how you feel, talk to your kids, partners and family and get a sense of people’s sentiment, and ask [yourself], ‘are you really going to be comfortable spending a lot of money on gifts this year?’”

As Elavon Europe head of retail Michael Bosshammer says: “Customers are definitely still interested in physical retail, but with digital touchpoints that enrich the shopping experience. Retailers need to embrace the lifestyle of their customers, and offer the convenience and fulfilment they demand.”

There is evidence of retailers adopting a consumer mindset, and there are several examples included in the sector-by-sector breakdown in the next chapter.

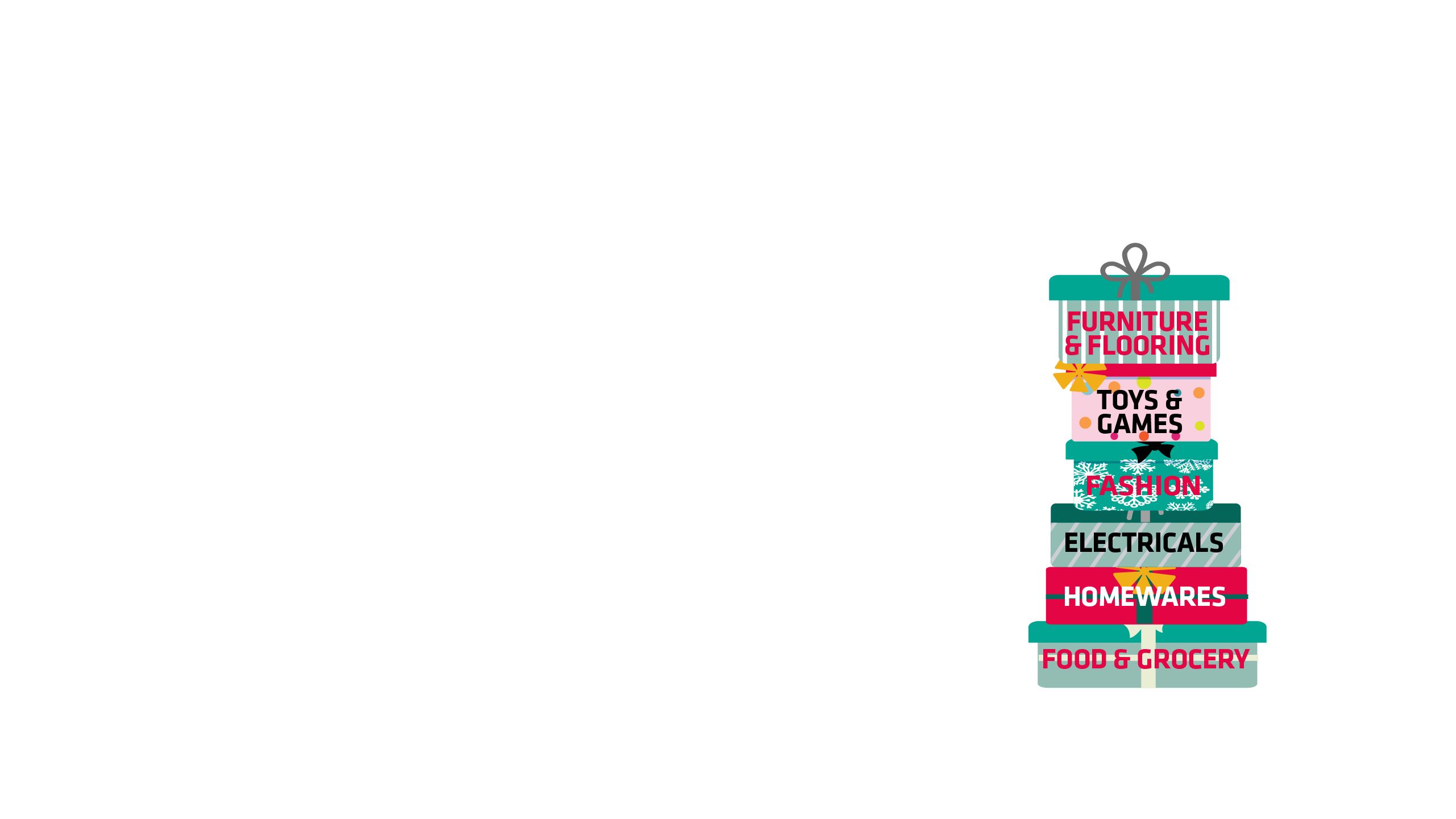

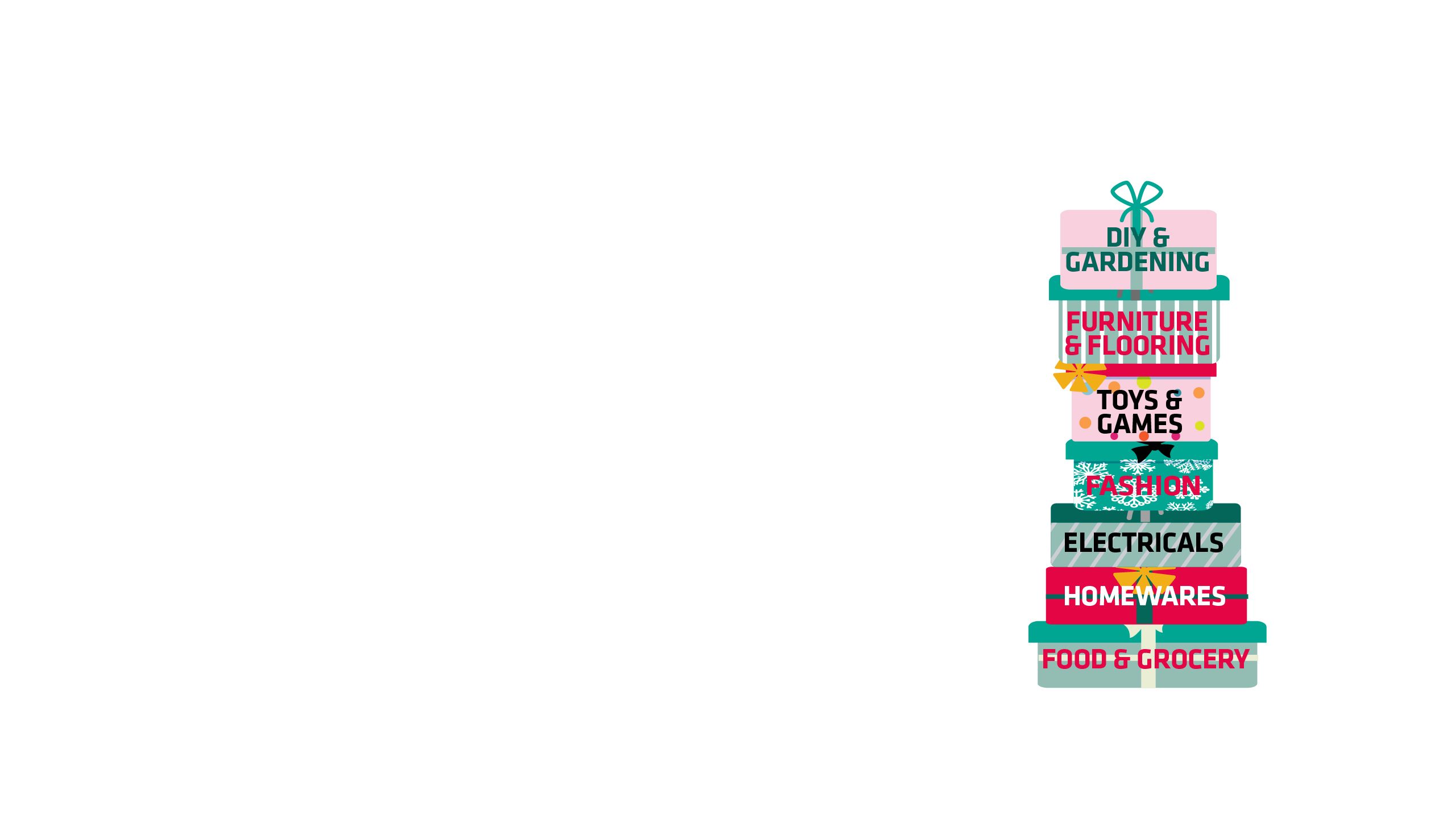

The outlook for retail's biggest sectors

There will be a big peak period ahead for several sectors, although in terms of value of sales Retail Economics suggests DIY and gardening along with electricals will be the two sectors that see sales decline. By volume, it’s a different story – only health and beauty is expected to see a rise – as the inflationary environment eats into people’s spending power.

Retail Week and Retail Economics have forecast Christmas sales performance by category, revealing which product areas retailers should be placing their bets.

Food and grocery

High levels of inflation are set to drive value growth across food and grocery, with sales predicated to be up by c.4.7% in Q4 2022 compared with one year before and implying a decline in volumes of 2%.

In 2020, the sector benefited from pandemic-induced lockdowns that closed many hospitality venues, but last year it still performed robustly in a more ‘normal’ environment.

The category will face greater competition from hospitality spending compared with Q4 2021, as many consumers avoided events and gatherings last year amid the emergence of the Omicron variant of Covid.

Overall this will act as a drag on sales comparisons, but there’s a lot at play here.

Faced with rising inflation, consumers are likely to adopt recessionary behaviours to stretch their budgets, and it will involve a mix of trading down to cheaper brands, sacrificing perceived quality for lower costs, shopping around and switching to the discounters.

Tesco chair John Allan told BBC Radio 4’s Today programme in May that the grocer had noticed customers rationing the amount of food they buy.

Describing how he felt the country was facing “real food poverty for the first time in a generation”, he criticised former chancellor Rishi Sunak for increasing national insurance: “It’s hitting people on modest incomes disproportionately and it’s absolutely the wrong time to do it.”

Retail Week expects grocers will continue to invest in lower prices. Iceland and The Food Warehouse have reduced the cost of products by 10% on Tuesdays for shoppers aged 60-plus, with no minimum spend. Iceland said it was reacting to research from Age UK that highlighted three-quarters of older people in the UK are worried about rising living costs.

Tesco has just launched its Better Baskets zones in stores to signpost healthier and more sustainable products at affordable prices, with the majority of the scheme's products at Clubcard Prices, Low Everyday Prices or in Aldi Price Match to help remove price as a barrier to making better choices.

Tesco chief customer officer Alessandra Bellini said on launch day in May: “At Tesco, we passionately believe that healthier food should be more accessible to everyone, no matter your budget – and today’s announcement is a key step towards that. With more than eight in 10 people reporting a rise in their cost of living, value is the number one factor that drives choice in our stores. We will always make sure our products are competitively priced.”

If last year’s trends continue, there will be more sales related to dietary trends and demand for own-brand goods. Kantar reported that plant-based foods proved particularly popular in the final 12 weeks of last year, with chilled vegetarian ranges up by 6% and the frozen equivalents growing by 4%.

Premium own-label sales broke records last Christmas, according to Kantar; shoppers spent £627m on supermarkets’ upmarket lines over the four weeks to 26 December, an increase of 6.8% compared with 2020.

There will also be a big focus on own-label value ranges and keeping prices down.

Anti-poverty campaigner and low-cost cookery writer Jack Monroe, who tweets as @BootstrapCook, drew attention to rising prices and the lack of availability of the cheapest lines in her local Asda branch. Her comments quickly went viral and Asda responded adeptly to Monroe’s concern – pledging to ensure its Smart Price and Farm Stores value ranges were available at all of its stores and online.

Homewares

Homewares sales are expected to rise by c.1.3% year on year in Q4 2022. However, growth will be entirely powered by inflation, which is expected to average 10.5% in the final quarter.

Volumes are therefore expected to fall c.9.2% against the previous year, with the squeeze on household finances holding back sales.

Momentum across interiors is beginning to wane after an industry-wide fillip during the earlier stages of the pandemic when many people refreshed their homes .

Recently DIY giant Kingfisher’s sales have declined against strong comparables in the past two years. The group, which owns B&Q and Screwfix as well as Castorama and Brico Depot in mainland Europe, recorded sales down 4.2% in constant currency in the three months to April 30.

Sales also declined 5.4% on a like-for-like basis over the same period. At B&Q, like-for-like sales dropped 18.3%, compared with last year, up 16.2% on a three-year basis, while Screwfix sales declined 10.9% but grew 18% compared with 2019.

Transactions across the housing market are also likely to slow compared with last year’s boost in activity driven by the Stamp Duty holiday, which will have an impact on home furnishings and related goods.

Nests tend to get feathered for Christmas hosting, but the predicted sales show this will be viewed as less important than food and toy purchases.

Electricals

Sales values in the electricals category are expected to decline by 2% in the final quarter of 2022 despite inflation of 11.2%, which suggests a volume decline of 13.2%.

Electricals inflation will accelerate aggressively as ongoing issues around supply chains and rising operating costs squeeze wafer-thin margins. As a particularly price-sensitive sector, retailers will find it difficult to pass on escalating costs against a backdrop of squeezed household incomes and lower consumer confidence.

However, the World Cup starts in November and overlaps with Black Friday, so this could provide a much-needed sales opportunity.

The last World Cup, Russia 2018, prompted a huge increase in TV sales, although it took place over the summer rather than this tournament's winter schedule. According to analyst group IHS Markit, the global TV market grew by 2.9% year on year in 2018, reaching 221 million units, owing to a sales surge in the first half of the year in preparation for the World Cup. Retailers are hoping for a repeat sales pattern this year.

Electricals as a category hasn’t been immune from the uptick in resales taking away market share, but it is responding. Currys, for instance, is ramping up its RepairLive service, which helps customers diagnose and fix tech issues with devices via a video call.

Fashion

Clothing is expected to see mild sales growth of 1.1% year on year in Q4 2022, against tough comparisons from last year when there was strong pent-up demand that rolled over from periods of lockdown. However, growth will be entirely driven by high levels of inflation, with volumes expected to decline by 8%.

For example, Primark posted a surge in sales and operating profits driven by the reopening of stores following Covid-enforced closures. For the 24-week period to March 5, Primark reported a 59% increase in sales year on year to £3.5bn and an 863% jump in adjusted operating profit to £414m.

Its competitive prices could see it continue to perform well through the golden quarter. It has, however, said it would be implementing “selective price increases” across some of its autumn/winter stock. The decision marks a change from the retailer’s stance in January when it cut 400 jobs but vowed to keep prices the same.

Weaker support from hospitality is expected compared with long-term averages, given the squeeze on household incomes will reduce the level of socialising, although there will be a polarisation in consumer spending in this area.

Polarisation will also be evident in luxury brands continuing to perform strongly, driven by demand from affluent households, but Retail Economics predicts many consumers will be trading down to cheaper brands to manage their finances.

Sustainable fashion, rental and resale will be big trends. Among many recent announcements are Asos' partnership with Thrift+, through which customers can send their unwanted clothes to the resale platform; and John Lewis is dipping its toe into clothing rental, trialling 51 products from its spring/summer collection with kidswear subscription rental platform Thelittleloop, joining the likes of brands Frugi, Kite, and Hunter and Boo.

All of these factors clearly have implications for how consumers shop for fashion at Christmas.

Toys and games

Toys and games sales are expected to rise by around 6.5% year on year in Q4 2022, driven by inflation of 8.2% over the same period. This implies that toy sales volumes will decline by 1.7% compared with the previous year.

Price is less likely to affect demand for toys during Christmas, with this category often the last area where households cut back on spending. If we saw a huge decline in this category it would indicate that the cost-of-living crisis was far more serious than anyone had predicted.

As the estimated figure shows, volume growth is likely to hold up relatively well compared with other categories. That said, ongoing disruption in supply chains, particularly in China, and rising operating costs from utilities, shipping costs, containers and labour are pushing costs higher and will be felt by all sectors.

Furniture and flooring

The value of furniture and flooring sales is likely to rise by around 2.5% year on year in the final quarter of 2022, which will imply a sharp fall in volumes of 10.5% compared with 2021.

There are several underlying factors leading to this prediction. Firstly, the furniture sector is likely to face continuing supply chain disruption into Q4 2022, stunting sales and causing delays. And with significant inflation across core materials, such as wood, fabric and rubber, further pressure is added to the mix.

With the housing market intrinsically tied to the performance of this category, it is worth noting the residential market is cooling compared with the highs of 2020/21 driven by temporary Stamp Duty relief, involuntary savings made during lockdowns and the pandemic-related ‘race for space’.

DIY and gardening

Overall sales values are expected to fall by 1.5% year on year in Q4 2022, with an even sharper fall of 8.7% in sales volumes.

This is largely because the intensity of DIY activity will wane in Q4 2022 compared with 2021, when the sector was still benefiting from the Stamp Duty holiday and pandemic-related home-development projects – exemplified by B&Q owner Kingfisher reporting record sales profit in 2021 of more than £1bn off the back of £13.2bn in revenues.

However, it is predicted the category will be supported by a wave of new DIYers. Wickes chief executive David Wood said in May that the chain was “confident of the opportunities available within the large and growing home-improvement market”, which has been swelled by the buoyant housing market and people spending more time at home owing to more flexible working practices.

On the flip side, at Christmas there will be greater competition from other discretionary spending categories such as gifts and entertainment.

In a first-quarter trading update delivered in May, Kingfisher chief executive Thierry Garnier gave an indication of the focus area for the DIY group going into the second half of 2022, hinting at a focus on own-brand and price-conscious retailing as the golden quarter arrives.

“We continue to effectively manage inflationary and supply chain pressures,” he announced. “As a result, our product availability is now very close to ‘normal’ levels across all our banners, and we continue to deliver value for our customers through our own exclusive brands and competitive prices,” he said.

Health and beauty

Overall sales in health and beauty are expected to rise by 4.2% year on year in the final quarter of 2022, with volumes also rising by 0.2% – the only sector where sales volumes are predicted to rise.

Health and beauty will be one of the strongest performing categories in the final quarter for several reasons, not least the continued shift back to the workplace. But the ongoing post-pandemic rebound in socialising – and therefore cosmetics being a more appropriate gifting choice again this year – is likely to give it a further boost.

There will be a big peak period ahead for several sectors, although in terms of value of sales Retail Economics suggests DIY and gardening along with electricals will be the two sectors that see sales decline. By volume, it’s a different story – only health and beauty is expected to see a rise – as the inflationary environment eats into people’s spending power.

Retail Week and Retail Economics have forecast Christmas sales performance by category, revealing which product areas retailers should be placing their bets.

Food and grocery

High levels of inflation are set to drive value growth across food and grocery, with sales predicated to be up by c.4.7% in Q4 2022 compared with one year before and implying a decline in volumes of 2%.

In 2020, the sector benefited from pandemic-induced lockdowns that closed many hospitality venues, but last year it still performed robustly in a more ‘normal’ environment.

The category will face greater competition from hospitality spending compared with Q4 2021, as many consumers avoided events and gatherings last year amid the emergence of the Omicron variant of Covid.

Overall this will act as a drag on sales comparisons, but there’s a lot at play here.

Faced with rising inflation, consumers are likely to adopt recessionary behaviours to stretch their budgets, and it will involve a mix of trading down to cheaper brands, sacrificing perceived quality for lower costs, shopping around and switching to the discounters.

Tesco chair John Allan told BBC Radio 4’s Today programme in May that the grocer had noticed customers rationing the amount of food they buy.

Describing how he felt the country was facing “real food poverty for the first time in a generation”, he criticised former chancellor Rishi Sunak for increasing national insurance: “It’s hitting people on modest incomes disproportionately and it’s absolutely the wrong time to do it.”

Retail Week expects grocers will continue to invest in lower prices. Iceland and The Food Warehouse have reduced the cost of products by 10% on Tuesdays for shoppers aged 60-plus, with no minimum spend. Iceland said it was reacting to research from Age UK that highlighted three-quarters of older people in the UK are worried about rising living costs.

Tesco has just launched its Better Baskets zones in stores to signpost healthier and more sustainable products at affordable prices, with the majority of the scheme's products at Clubcard Prices, Low Everyday Prices or in Aldi Price Match to help remove price as a barrier to making better choices.

Tesco chief customer officer Alessandra Bellini said on launch day in May: “At Tesco, we passionately believe that healthier food should be more accessible to everyone, no matter your budget – and today’s announcement is a key step towards that. With more than eight in 10 people reporting a rise in their cost of living, value is the number one factor that drives choice in our stores. We will always make sure our products are competitively priced.”

If last year’s trends continue, there will be more sales related to dietary trends and demand for own-brand goods. Kantar reported that plant-based foods proved particularly popular in the final 12 weeks of last year, with chilled vegetarian ranges up by 6% and the frozen equivalents growing by 4%.

Premium own-label sales broke records last Christmas, according to Kantar; shoppers spent £627m on supermarkets’ upmarket lines over the four weeks to 26 December, an increase of 6.8% compared with 2020.

There will also be a big focus on own-label value ranges and keeping prices down.

Anti-poverty campaigner and low-cost cookery writer Jack Monroe, who tweets as @BootstrapCook, drew attention to rising prices and the lack of availability of the cheapest lines in her local Asda branch. Her comments quickly went viral and Asda responded adeptly to Monroe’s concern – pledging to ensure its Smart Price and Farm Stores value ranges were available at all of its stores and online.

Homewares

Homewares sales are expected to rise by c.1.3% year on year in Q4 2022. However, growth will be entirely powered by inflation, which is expected to average 10.5% in the final quarter.

Volumes are therefore expected to fall c.9.2% against the previous year, with the squeeze on household finances holding back sales.

Momentum across interiors is beginning to wane after an industry-wide fillip during the earlier stages of the pandemic when many people refreshed their homes .

Recently DIY giant Kingfisher’s sales have declined against strong comparables in the past two years. The group, which owns B&Q and Screwfix as well as Castorama and Brico Depot in mainland Europe, recorded sales down 4.2% in constant currency in the three months to April 30.

Sales also declined 5.4% on a like-for-like basis over the same period. At B&Q, like-for-like sales dropped 18.3%, compared with last year, up 16.2% on a three-year basis, while Screwfix sales declined 10.9% but grew 18% compared with 2019.

Transactions across the housing market are also likely to slow compared with last year’s boost in activity driven by the Stamp Duty holiday, which will have an impact on home furnishings and related goods.

Nests tend to get feathered for Christmas hosting, but the predicted sales show this will be viewed as less important than food and toy purchases.

Electricals

Sales values in the electricals category are expected to decline by 2% in the final quarter of 2022 despite inflation of 11.2%, which suggests a volume decline of 13.2%.

Electricals inflation will accelerate aggressively as ongoing issues around supply chains and rising operating costs squeeze wafer-thin margins. As a particularly price-sensitive sector, retailers will find it difficult to pass on escalating costs against a backdrop of squeezed household incomes and lower consumer confidence.

However, the World Cup starts in November and overlaps with Black Friday, so this could provide a much-needed sales opportunity.

The last World Cup, Russia 2018, prompted a huge increase in TV sales, although it took place over the summer rather than this tournament's winter schedule. According to analyst group IHS Markit, the global TV market grew by 2.9% year on year in 2018, reaching 221 million units, owing to a sales surge in the first half of the year in preparation for the World Cup. Retailers are hoping for a repeat sales pattern this year.

Electricals as a category hasn’t been immune from the uptick in resales taking away market share, but it is responding. Currys, for instance, is ramping up its RepairLive service, which helps customers diagnose and fix tech issues with devices via a video call.

Fashion

Clothing is expected to see mild sales growth of 1.1% year on year in Q4 2022, against tough comparisons from last year when there was strong pent-up demand that rolled over from periods of lockdown. However, growth will be entirely driven by high levels of inflation, with volumes expected to decline by 8%.

For example, Primark posted a surge in sales and operating profits driven by the reopening of stores following Covid-enforced closures. For the 24-week period to March 5, Primark reported a 59% increase in sales year on year to £3.5bn and an 863% jump in adjusted operating profit to £414m.

Its competitive prices could see it continue to perform well through the golden quarter. It has, however, said it would be implementing “selective price increases” across some of its autumn/winter stock. The decision marks a change from the retailer’s stance in January when it cut 400 jobs but vowed to keep prices the same.

Weaker support from hospitality is expected compared with long-term averages, given the squeeze on household incomes will reduce the level of socialising, although there will be a polarisation in consumer spending in this area.

Polarisation will also be evident in luxury brands continuing to perform strongly, driven by demand from affluent households, but Retail Economics predicts many consumers will be trading down to cheaper brands to manage their finances.

Sustainable fashion, rental and resale will be big trends. Among many recent announcements are Asos' partnership with Thrift+, through which customers can send their unwanted clothes to the resale platform; and John Lewis is dipping its toe into clothing rental, trialling 51 products from its spring/summer collection with kidswear subscription rental platform Thelittleloop, joining the likes of brands Frugi, Kite, and Hunter and Boo.

All of these factors clearly have implications for how consumers shop for fashion at Christmas.

Toys and games

Toys and games sales are expected to rise by around 6.5% year on year in Q4 2022, driven by inflation of 8.2% over the same period. This implies that toy sales volumes will decline by 1.7% compared with the previous year.

Price is less likely to affect demand for toys during Christmas, with this category often the last area where households cut back on spending. If we saw a huge decline in this category it would indicate that the cost-of-living crisis was far more serious than anyone had predicted.

As the estimated figure shows, volume growth is likely to hold up relatively well compared with other categories. That said, ongoing disruption in supply chains, particularly in China, and rising operating costs from utilities, shipping costs, containers and labour are pushing costs higher and will be felt by all sectors.

Furniture and flooring

The value of furniture and flooring sales is likely to rise by around 2.5% year on year in the final quarter of 2022, which will imply a sharp fall in volumes of 10.5% compared with 2021.

There are several underlying factors leading to this prediction. Firstly, the furniture sector is likely to face continuing supply chain disruption into Q4 2022, stunting sales and causing delays. And with significant inflation across core materials, such as wood, fabric and rubber, further pressure is added to the mix.

With the housing market intrinsically tied to the performance of this category, it is worth noting the residential market is cooling compared with the highs of 2020/21 driven by temporary Stamp Duty relief, involuntary savings made during lockdowns and the pandemic-related ‘race for space’.

DIY and gardening

Overall sales values are expected to fall by 1.5% year on year in Q4 2022, with an even sharper fall of 8.7% in sales volumes.

This is largely because the intensity of DIY activity will wane in Q4 2022 compared with 2021, when the sector was still benefiting from the Stamp Duty holiday and pandemic-related home-development projects – exemplified by B&Q owner Kingfisher reporting record sales profit in 2021 of more than £1bn off the back of £13.2bn in revenues.

However, it is predicted the category will be supported by a wave of new DIYers. Wickes chief executive David Wood said in May that the chain was “confident of the opportunities available within the large and growing home-improvement market”, which has been swelled by the buoyant housing market and people spending more time at home owing to more flexible working practices.

On the flip side, at Christmas there will be greater competition from other discretionary spending categories such as gifts and entertainment.

In a first-quarter trading update delivered in May, Kingfisher chief executive Thierry Garnier gave an indication of the focus area for the DIY group going into the second half of 2022, hinting at a focus on own-brand and price-conscious retailing as the golden quarter arrives.

“We continue to effectively manage inflationary and supply chain pressures,” he announced. “As a result, our product availability is now very close to ‘normal’ levels across all our banners, and we continue to deliver value for our customers through our own exclusive brands and competitive prices,” he said.

Health and beauty

Overall sales in health and beauty are expected to rise by 4.2% year on year in the final quarter of 2022, with volumes also rising by 0.2% – the only sector where sales volumes are predicted to rise.

Health and beauty will be one of the strongest performing categories in the final quarter for several reasons, not least the continued shift back to the workplace. But the ongoing post-pandemic rebound in socialising – and therefore cosmetics being a more appropriate gifting choice again this year – is likely to give it a further boost.

How retailers are already capitalising on Christmas

Retailers start preparing for Christmas at different times, but it is fair to say their thoughts are never too far away from peak period and how to capitalise on it.

Retail Week caught up with three leading retailers and fast-growing brands whose final quarter is the busiest time of the year to find out how they are planning for the golden quarter in a challenging environment.

Co-op Food

According to Kantar’s research released in January, individual food retailers found it challenging to secure year-on-year growth over the Christmas period in 2021, following the highs of 2020 when the supermarkets were among the few shops permitted to stay open in the weeks leading up to Christmas.

However, every major grocer increased sales in the final weeks of 2021 compared with the same period in 2019. Co-op had a 5.8% share of the market, although Kantar data for the four weeks to 26 December showed sales at the grocer fell more dramatically (by 6.2% year on year) than any of its main market rivals.

So, how does the planning for this year look? Co-op Food head of product development and innovation Michelle Rowley says: “We’ll continue to ensure that great value remains at the heart of what we do for our members and customers.

“It’s a combination of ongoing investment in price, product, store layout and, more and more, our digital offer, which added together we are delivering a compelling and convenience-led offer for millions of people in the UK.”

Rowley says that work done in 2021 by Co-op’s development team was centred on getting core Christmas products “right on taste and price”.

“This worked well for products like our mince pies, and really drove repeat purchase and increased customer perception of the brand,” she explains. “This year we have looked to replicate this approach. For example, our festive ‘food to go’ offering where the development team have done really strong work on our flavours, quality and recipes to offer a really great range.”

Co-op is aware that product innovation is key to driving interest in its own-brand ranges and helping the retailer to stand out against competitors. Rowley notes: “This year, we’re focusing on the key categories that matter most to our convenience shoppers, which are in-store bakery, beers, wines and spirits (BWS), party food, food to go, and crisps, snacks and nuts.”

The ‘supersaver’ and ‘freezer filler’ promotions – the former is a meal deal and the latter enables consumers to pick up five big brands for £5 – performed well last Christmas, she adds, so the plan is to bring these back during the golden quarter period as they are “tailored to the customer mindset and shopping occasions this year”.

When Rowley talks about shopping occasions, she is also referencing the football World Cup.

“We’re expecting this to disrupt the usual shopping behaviour throughout the golden quarter, with an increased demand for game night snacks, party food lines, BWS and sharing meals, purchased both in our stores and through our convenience online platforms.”

The informal sharing occasion brought about by the World Cup and Christmas countdown in unison is “a key opportunity” identified by Co-op in the golden quarter.

“Our ranges this year need to deliver for both of these occasions and, as a result, we’ve looked cohesively across our ambient snacking and chilled and frozen sharing ranges to offer tasty, easy and quick solutions for shoppers at affordable price points,” Rowley says.

“We’ll be launching party food earlier, in time for World Cup celebrations, as well as festive parties. ‘Meals for tonight’ will also be an important area for us as shoppers get home to watch the football, so we’ve planned launches and ranges to fulfil these needs.”

In terms of the current economic environment, Co-op says ‘supersaver’ deals will be spread across November and ‘freezer fillers’ will be available in December. And Co-op has pledged to simplify the promotions strategy to “hit those key entry price points to help shoppers who want to spread the cost across a couple of months”.

On the green agenda, the retailer’s wrapping paper, crackers, cards and accessories have been amended to remove all unnecessary plastic. Festive finishing touches are 100% recyclable and the retailer’s luxury chocolate boxes have a new design with the plastic packaging removed.

Co-op Food

According to Kantar’s research released in January, individual food retailers found it challenging to secure year-on-year growth over the Christmas period in 2021, following the highs of 2020 when the supermarkets were among the few shops permitted to stay open in the weeks leading up to Christmas.

However, every major grocer increased sales in the final weeks of 2021 compared with the same period in 2019. Co-op had a 5.8% share of the market, although Kantar data for the four weeks to 26 December showed sales at the grocer fell more dramatically (by 6.2% year on year) than any of its main market rivals.

So, how does the planning for this year look? Co-op Food head of product development and innovation Michelle Rowley says: “We’ll continue to ensure that great value remains at the heart of what we do for our members and customers.

“It’s a combination of ongoing investment in price, product, store layout and, more and more, our digital offer, which added together we are delivering a compelling and convenience-led offer for millions of people in the UK.”

Rowley says that work done in 2021 by Co-op’s development team was centred on getting core Christmas products “right on taste and price”.

"Our festive ‘food to go’ offering – the development team have done really strong work on our flavours, quality and recipes to offer a really great range"

“This worked well for products like our mince pies, and really drove repeat purchase and increased customer perception of the brand,” she explains. “This year we have looked to replicate this approach. For example, our festive ‘food to go’ offering where the development team have done really strong work on our flavours, quality and recipes to offer a really great range.”

Co-op is aware that product innovation is key to driving interest in its own-brand ranges and helping the retailer to stand out against competitors. Rowley notes: “This year, we’re focusing on the key categories that matter most to our convenience shoppers, which are in-store bakery, beers, wines and spirits (BWS), party food, food to go, and crisps, snacks and nuts.”

The ‘supersaver’ and ‘freezer filler’ promotions – the former is a meal deal and the latter enables consumers to pick up five big brands for £5 – performed well last Christmas, she adds, so the plan is to bring these back during the golden quarter period as they are “tailored to the customer mindset and shopping occasions this year”.

“We’re expecting the World Cup to disrupt the usual shopping behaviour throughout the golden quarter, with an increased demand for game night snacks, party food lines, BWS and sharing meals"

When Rowley talks about shopping occasions, she is also referencing the football World Cup.

“We’re expecting this to disrupt the usual shopping behaviour throughout the golden quarter, with an increased demand for game night snacks, party food lines, BWS and sharing meals, purchased both in our stores and through our convenience online platforms.”

The informal sharing occasion brought about by the World Cup and Christmas countdown in unison is “a key opportunity” identified by Co-op in the golden quarter.

“Our ranges this year need to deliver for both of these occasions and, as a result, we’ve looked cohesively across our ambient snacking and chilled and frozen sharing ranges to offer tasty, easy and quick solutions for shoppers at affordable price points,” Rowley says.

“We’ll be launching party food earlier, in time for World Cup celebrations, as well as festive parties. ‘Meals for tonight’ will also be an important area for us as shoppers get home to watch the football, so we’ve planned launches and ranges to fulfil these needs.”

In terms of the current economic environment, Co-op says ‘supersaver’ deals will be spread across November and ‘freezer fillers’ will be available in December. And Co-op has pledged to simplify the promotions strategy to “hit those key entry price points to help shoppers who want to spread the cost across a couple of months”.

On the green agenda, the retailer’s wrapping paper, crackers, cards and accessories have been amended to remove all unnecessary plastic. Festive finishing touches are 100% recyclable and the retailer’s luxury chocolate boxes have a new design with the plastic packaging removed.

Liberty London

Liberty London is a retail destination long-associated with Christmas by many, and therefore a popular choice among festive shoppers from the UK and tourists visiting London.

Although the department store is looking to build business outside of peak, the importance attached to Christmas is such that planning for the period is effectively a year-long affair.

Flagship general manager Julian Beer says: “Orders were all placed in January and February, and we’re already talking about the booking-in stage at the warehouse.

“The stock will start arriving into us soon – it should already be on the seas if it’s coming from the Far East.”

Liberty likes Christmas stock ready and in place for August, as it comes out of the end of its spring/summer sales period, so it needs to be processed in the company’s warehouse in Derbyshire in early July.

In May, the retailer was scoping designs for the window and atrium installation, and by the start of August, festive props will be on order and contractors engaged.

“Christmas is a really big project for us and is [happening] right now as I talk to you on a fairly sunny day in May,” Beer explains, highlighting the planning process that goes into the golden quarter period.

Lessons were learned from last year, Beer says, when supply issues that impacted the wider retail industry meant Liberty worked with more UK manufacturers and distributors than usual. Some of those contracts have continued in 2022, but instead of being a strategy to fill a gap in stock it has been more thoroughly mapped out.

“The lesson we learnt [from last year] was let’s be bolder this year – let’s be brave and understand where the opportunity was last year,” Beer says.

“We have bought into the things we believed in in much greater depth already and at the same time we‘ve nurtured the relationships with other companies, such as the UK suppliers, which we can layer in on top.”

He notes that engaging with suppliers early in the year “ensures we get the taste levels right”, and can work new products into the business in a more profitable way.

Depth of range for key festive stock is important for Liberty, so consumers can expect a choice of about 250 baubles, for example. Beer says 50 will be bestsellers and 50 will not sell well, but the retailer needs to have them all in the range to bring a point of difference.

During the final quarter, Beer expects to see a greater-than-usual tourist spend on royal-related products, owing to the Queen's platinum jubilee.

“Anything royal and anything central London – an item with a corgi, a red post box, a black cab or a decoration with a crown on it – will resonate with the tourist market this year,” he says. “We’ve definitely backed that. It always does well, but I think even more so this year it’ll be relevant.”

Jewellery has been the overall winning category for Liberty in 2022 and that is expected to continue into the final quarter of the year, too.

And matching Retail Economics’ predictions of a buoyant beauty market, Beer says this sector continues to be a strong category for Liberty and will continue to be over the festive period.

Liberty tends to be a choice for the more affluent shopper but, aware of the wider economic environment, Beer says there is something for everyone on offer at the retailer all year round.

“We do very affordable decorations that make you feel you’ve indulged,” he says of the Christmas range. “Last year even when opening after the lockdowns, people were prepared to invest in things that made a memory and were lasting items. If you can move the dial to more sentiment or heirloom-like, then people are much more willing to invest in that.”

On how he thinks Liberty will perform during the crucial trading period, he says: “We’re optimistic the pre-pandemic numbers are in our sights – we’re being bold and brave about chasing that as we go into the final quarter.”

Liberty London

Liberty London is a retail destination long-associated with Christmas by many, and therefore a popular choice among festive shoppers from the UK and tourists visiting London.

Although the department store is looking to build business outside of peak, the importance attached to Christmas is such that planning for the period is effectively a year-long affair.

Flagship general manager Julian Beer says: “Orders were all placed in January and February, and we’re already talking about the booking-in stage at the warehouse.

“The stock will start arriving into us soon – it should already be on the seas if it’s coming from the Far East.”

Liberty likes Christmas stock ready and in place for August, as it comes out of the end of its spring/summer sales period, so it needs to be processed in the company’s warehouse in Derbyshire in early July.

In May, the retailer was scoping designs for the window and atrium installation, and by the start of August, festive props will be on order and contractors engaged.

“Christmas is a really big project for us and is [happening] right now as I talk to you on a fairly sunny day in May,” Beer explains, highlighting the planning process that goes into the golden quarter period.

Lessons were learned from last year, Beer says, when supply issues that impacted the wider retail industry meant Liberty worked with more UK manufacturers and distributors than usual. Some of those contracts have continued in 2022, but instead of being a strategy to fill a gap in stock it has been more thoroughly mapped out.

“The lesson we learnt [from last year] was let’s be bolder this year – let’s be brave and understand where the opportunity was last year,” Beer says.

“We have bought into the things we believed in in much greater depth already and at the same time we‘ve nurtured the relationships with other companies, such as the UK suppliers, which we can layer in on top.”

He notes that engaging with suppliers early in the year “ensures we get the taste levels right”, and can work new products into the business in a more profitable way.

Depth of range for key festive stock is important for Liberty, so consumers can expect a choice of about 250 baubles, for example. Beer says 50 will be bestsellers and 50 won’t be great, but the retailer needs to have them in the range to bring a point of difference. (James checking with Ben about this)

During the final quarter, Beer expects to see a greater-than-usual tourist spend on royal-related products, owing to the Queen's platinum jubilee.

“Anything royal and anything central London – an item with a corgi, a red post box, a black cab or a decoration with a crown on it – will resonate with the tourist market this year,” he says. “We’ve definitely backed that. It always does well, but I think even more so this year it’ll be relevant.”

Jewellery has been the overall winning category for Liberty in 2022 and that is expected to continue into the final quarter of the year, too.

And matching Retail Economics’ predictions of a buoyant beauty market, Beer says this sector continues to be a strong category for Liberty and will continue to be over the festive period.

Liberty tends to be a choice for the more affluent shopper but, aware of the wider economic environment, Beer says there is something for everyone on offer at the retailer all year round.

“We do very affordable decorations that make you feel you’ve indulged,” he says of the Christmas range. “Last year even when opening after the lockdowns, people were prepared to invest in things that made a memory and were lasting items. If you can move the dial to more sentiment or heirloom-like, then people are much more willing to invest in that.”

On how he thinks Liberty will perform during the crucial trading period, he says: “We’re optimistic the pre-pandemic numbers are in our sights – we’re being bold and brave about chasing that as we go into the final quarter.”

Sosandar

Online women's fashion brand Sosandar reported revenue of £8.85m in the three months to 31 December 2021, which represented an increase of 122% year on year and a record quarter for the business that launched in 2016.

It was the first EBITDA-positive quarter for Sosandar, with active customers increasing by 62% year on year to 213,715, as shoppers sought partywear from the retailer’s own channels as well its burgeoning presence with big-name third-parties M&S, Next and John Lewis.

Sosandar credited significant investment in stock depth and breadth (prices range from around £10 for accessories, up to £269 for a leather jacket), as well as its “high levels of customer engagement”, as key reasons for its success at the end of 2021.

Looking to build on that momentum, co-chief executives Ali Hall and Julie Lavington (pictured) say that some of the same trends seen in 2021 will expand this year.

“We saw a huge amount of interest in party clothes last November despite the growing Omicron variant concerns, and we expect occasionwear to be even more popular this year, particularly if restrictions remain fully relaxed,” Hall explains.

“Should the mood change again, we have a diverse range and are agile enough to respond quickly to ensure we continue selling what our customers want to buy.”

She added: “Fashion has moved quickly this year as people have shown a desire to restock their wardrobes, and have invested in clothing that feels very different to what they would have been wearing in lockdown. We are already seeing lots of bright colours, opulent prints and new shapes, and we expect that to continue.”

More formal tailoring for going back to work or social occasions has also been a trend, and Sosandar is expecting velvet, lace and sequins to be popular in the build-up to the party season.

Hall and Lavington, who both have fashion and lifestyle media backgrounds, are effectively the demographic their company is trying to target, so they have an understanding of the mechanics required to draw customers in and keep them happy.

“Listening to what consumers want is crucial to innovating successfully,” Lavington said. “We make sure we are in constant conversation with our customers, as well as of course staying tapped into wider fashion trends, and this helps us consistently create fantastic new products that sell through well.”

Commenting on the golden quarter prospects in light of the economic challenges in the UK, Lavington noted: “There is no doubt that rising costs are being felt across the entire population, however, alongside these headwinds we are seeing a clear desire from consumers to restock wardrobes with new fashion-forward clothing.

“While, as always, we don’t know exactly what will happen, we remain confident that Sosandar customers are continuing to spend on clothing.”

With Black Friday and various big Mega-Sale-day events now influencing consumer behaviour in the final quarter of each year, the shape of Christmas is different to the past when the beginning of December heralded the majority of spending. These Sales events create several peaks in consumer spending throughout the golden quarter and Sosandar has noticed the changes.

Hall commented: “We saw our customers buy partywear much earlier last year, driven – we believe – by a desire to invest in small treats during challenging times.

“We have seen a similar trend in the purchase of high-summer and holiday clothes, with people buying them earlier. We anticipate this trend of buying in advance to continue.”

Sosandar

Online women's fashion brand Sosandar reported revenue of £8.85m in the three months to 31 December 2021, which represented an increase of 122% year on year and a record quarter for the business that launched in 2016.

It was the first EBITDA-positive quarter for Sosandar, with active customers increasing by 62% year on year to 213,715, as shoppers sought partywear from the retailer’s own channels as well its burgeoning presence with big-name third-parties M&S, Next and John Lewis.

Sosandar credited significant investment in stock depth and breadth (prices range from around £10 for accessories, up to £269 for a leather jacket), as well as its “high levels of customer engagement”, as key reasons for its success at the end of 2021.

Looking to build on that momentum, co-chief executives Ali Hall and Julie Lavington (pictured) say that some of the same trends seen in 2021 will expand this year.

“We saw a huge amount of interest in party clothes last November despite the growing Omicron variant concerns, and we expect occasionwear to be even more popular this year, particularly if restrictions remain fully relaxed,” Hall explains.

“Should the mood change again, we have a diverse range and are agile enough to respond quickly to ensure we continue selling what our customers want to buy.”

She added: “Fashion has moved quickly this year as people have shown a desire to restock their wardrobes, and have invested in clothing that feels very different to what they would have been wearing in lockdown. We are already seeing lots of bright colours, opulent prints and new shapes, and we expect that to continue.”

More formal tailoring for going back to work or social occasions has also been a trend, and Sosandar is expecting velvet, lace and sequins to be popular in the build-up to the party season.

Hall and Lavington, who both have fashion and lifestyle media backgrounds, are effectively the demographic their company is trying to target, so they have an understanding of the mechanics required to draw customers in and keep them happy.

“Listening to what consumers want is crucial to innovating successfully,” Lavington said. “We make sure we are in constant conversation with our customers, as well as of course staying tapped into wider fashion trends, and this helps us consistently create fantastic new products that sell through well.”

“There is no doubt that rising costs are being felt across the entire population, however we are seeing a clear desire from consumers to restock wardrobes with new fashion-forward clothing"

Commenting on the golden quarter prospects in light of the economic challenges in the UK, Lavington noted: “There is no doubt that rising costs are being felt across the entire population, however, alongside these headwinds we are seeing a clear desire from consumers to restock wardrobes with new fashion-forward clothing.

“While, as always, we don’t know exactly what will happen, we remain confident that Sosandar customers are continuing to spend on clothing.”

With Black Friday and various big Mega-Sale-day events now influencing consumer behaviour in the final quarter of each year, the shape of Christmas is different to the past when the beginning of December heralded the majority of spending. These Sales events create several peaks in consumer spending throughout the golden quarter and Sosandar has noticed the changes.

“We saw our customers buy partywear much earlier last year, driven by a desire to invest in small treats during challenging times"

Hall commented: “We saw our customers buy partywear much earlier last year, driven – we believe – by a desire to invest in small treats during challenging times.

“We have seen a similar trend in the purchase of high-summer and holiday clothes, with people buying them earlier. We anticipate this trend of buying in advance to continue.”

The Christmas checklist

How to deck the halls and fill stockings

The message is clear from retailers already thinking about Christmas that consumer trends emerging at the start of the year are here to stay for the remainder of 2022 – so will therefore need to be considered for final-quarter planning.

From our interviews with the Co-op, Sosandar and Liberty, it is clear planning for the season is, and should be, well under way.

Having direct conversations with consumers and adopting the appropriate brand positioning based on their needs is going to be important as a general rule of thumb.

“Being able to offer your customers choice in the methods of how they want to pay is key to providing an exceptional customer experience,” says Elavon Europe's Bosshammer. “Customer demands and behaviours differ greatly among retail sectors so tailoring your payment strategy will be an essential part of the preparation for the golden quarter.”

In terms of timings, there has been a tendency for retailers to spread out the cost of Christmas – some of which has been driven by Mega-Sale-day events such as Black Friday playing a more prominent role in peak trading in recent years – but the cost-of-living crisis may elongate festive shopping even further in 2022.

“This year we’ll see festive sales pulling out into October – some driven by earlier promotions and perceived discounts,” explains Retail Economics' Lim. “But there’s going to be a lot around brand positioning and lots of work done by retailers and brands to make sure they get the tone right with consumers, given the cost-of-living crisis.

“For retailers with a wide customer base they’ll need to find the most compelling way to communicate in an authentic and relatable way – and that value proposition is going to be built around value for money.”

Consumers will be adopting the mantra of “making a little go a long way”

Christmas ads encouraging a splurge may be replaced with marketing of special offers in consideration of the wider economic climate, says Lim, who added that data analysis on whether consumers are willing to accept lower prices for lower quality, or higher prices for convenience or experience may be necessary.

“Understanding your core customers and how they will be looking at trading off different values for lower costs will be important,” he argues, adding there is a huge opportunity for retailers getting this right as people shop around and adopt a cost-conscious approach.

As Next Big Thing's Higham puts it, UK retailers will increasingly see people looking for bargains, and businesses need to look at how they are running sales events from now and into the peak shopping period.

Consumers will be adopting the mantra of “making a little go a long way”, he notes.

“Being able to offer your customers choice in the methods of how they want to pay is key to providing an exceptional customer experience,” adds Elavon Europe's Bosshammer. “Customer demands and behaviours differ greatly among retail sectors, so tailoring your payment strategy will be an essential part of the preparation for the golden quarter.”

And don’t forget, the World Cup brings unique opportunities in this golden quarter. The best retailers understand how major events impact consumer behaviour and will make this work to their advantage by starting their planning early.

Partner viewpoints

Michael Bosshammer, head of retail, Elavon Europe

Retail has been transformed, as public health restrictions sped up many trends already in flight. It is estimated the pandemic accelerated the shift from physical stores to digital shopping by roughly five years, with ripples across many other aspects of retail.

When it comes to offering an exceptional customer experience, how your customer pays must be front of mind. So, when planning your golden quarter strategies, here are some payment trends to consider:

Offer different ways to pay: Alongside the face-to-face experience, online, in-app and remote shopping are permanent features of the evolved retail landscape. A mix of both, known as omnicommerce, is the way forward. Behaviours we adopted in the pandemic, such as using BOPIS (buy online, pick-up in-store) and greater use of ecommerce, are here to stay.

Seamless online checkout: Almost one in five shoppers abandons a cart due to a “too long/complicated checkout process”. Think about implementing transaction risk analysis to apply exemptions to strong customer authentication for eligible transactions up to €500, or equivalent in other currencies.

Use your payment data: Analyse what your customers are buying, when they are buying and how they pay. You can use this to inform your offers to encourage upsells.

Loyalty: Forward-thinking retailers are future-proofing, finding innovative ways to build rewards programmes and inspire customer loyalty. Next-level loyalty schemes maximise in-app technology to reward repeat shoppers.

The future is now. The world is changing quickly, by talking and collaborating we can understand and address the opportunities and challenges facing the retail sector. Advanced payments innovation and technology mean you are always open – even when your shop doors are closed.

Whether you are welcoming local shoppers in-store or online customers from around the world using multiple currencies, we are the single expert payments partner you need.

Vihan Sharma, managing director Europe and senior vice-president global sales, LiveRamp

We might be basking in one of the balmier months of the year – but if you are in retail, you will know now is the time to get your house in order for the golden quarter. This Christmas retail period will no doubt be different as we navigate our way through the biggest cost-of-living crisis in decades.

But while there is plenty of uncertainty on the horizon, volatility also means there is a great deal of opportunity.

With consumers more likely to be tightening their purse strings, shopping needs to be more than just a transactional affair but an experience, too; seamless across multiple different touchpoints. Success with this will hinge on brands’ ability to implement robust data strategies.

It will be more important than ever to leverage first-party data in order to know, understand and anticipate what customers want, and how retail brands can be there to ensure people can engage in shopping experiences without any friction. As companies realise the treasure trove that is their data, measuring communications effectively and working safely with data partners will be key to driving supercharged Q4.

By using advanced capabilities to measure data consistently in a privacy-first, neutral environment, brands can harbour trust with consumers and optimise experiences across different channels quickly over the golden quarter.

Andrew Lawson, senior vice-president EMEA, Zendesk

Even with greater price sensitivity, consumers continue to value the service a brand provides – to the point that roughly half of customers would switch to a competitor after just one bad experience, according to our research.

In view of this, retailers need to start thinking about gaining consumers' confidence for the products and services they offer. Primary goods prices are on the rise – so, inevitably, consumers are going to carefully select the items they gift – and who they shop with this holiday season. It is no longer about quantity, it is about quality. What value are you offering to your customers? Are you aware of their needs, and are you making them feel understood? Cultivating empathy in your organisation has a major impact on your service and a ripple effect on the overall value that you offer to your customers. The Liberty example shows how a retailer can tap into that sentimental value by providing meaningful decoration options, making their customers feel like they are investing in goods linked to experiences and memories.

Your service teams hold the key to build stronger customer relationships that lead to long-term loyalty – and a difficult holiday season is an opportunity to show customers how you deliver on your values. Seasonal executions like pop-up shops are a great example of meeting customers where they are, to develop customer relationships and long-term loyalty, with a joined-up online and offline experience. But seasonal retail plans start well before the peak season. Retailers need to start early to collect their customer insights and invest in the right tools to be agile and flexible to their customer needs.

THE CHRISTMAS FORECAST: What to expect from golden quarter sales and the cost-of-living crisis

Produced in association with Elavon, LiveRamp and Zendesk

Editor and content lead: James Knowles, head of content innovation

Writer: Ben Sillitoe, journalist

Production: Stephen Eddie, production editor

Sub editor: Rachel Horner, multimedia journalist

Design: Helen Berry, graphic designer

Sales lead: Tom Jones, business development director