For retailers to truly understand how to transform their distribution, fulfilment, sourcing and warehousing, we need to hear from the supply chain decision-makers.

This new report lifts the lid on the motivations, concerns and aspirations of 50 retail supply chain and IT leaders during one of the industry’s most turbulent periods.

Over the following chapters, we will tackle the big questions:

- How are those working at the forefront of supply chain, IT and technology feeling?

- What challenges and pressures are they facing?

- What investments do they want prioritised?

- Do they have a seat at the boardroom table?

- And what opportunities do they see for the sector?

The insights gathered will enable retailers to understand what their supply chain strategies must look like going forward, the new thinking required and, crucially, the technology to invest in to stay ahead of disruption.

Methodology

Retail Week surveyed 50 UK retail supply chain and IT leaders in February 2022, who remain anonymous, to understand how they feel about their role and their leadership team, their investment priorities and challenges, and what they believe is required for the successful retail supply chains of the future.

Winning strategies in this report

Retail Week has determined the five key strategies all retailers should focus on in 2022 and beyond in order to succeed in a market transformed by technology and shifting consumer attitudes.

It would be an understatement to say the retail supply chain is in disarray

Close to 60% of those surveyed have considered leaving their jobs in the past 12 months, which tells the story about the challenges faced in the retail supply chain, while a quarter of respondents said policymakers are not doing enough to alleviate their burden

It would be an understatement to say the retail supply chain is in disarray.

At the time of writing, Russia is waging war with Ukraine. Some of the world’s largest shipping companies have suspended operations in and out of Russia, effectively cutting the country out of much of the global supply chain.

Meanwhile, some of the largest brands and retailers – including H&M, Asos and Boohoo – have cut off sales and operations in and out of Russia, as part of a wider world move to stop doing business with the country.

As well as the devastation and human displacement caused by the war, there are seismic economic and supply chain repercussions to contend with. Food, wheat and oil supplies are among the commodities set to be most impacted, and certain international relationships will never be the same again.

This all comes against the backdrop of an already embattled global supply chain, following Brexit and a two-year pandemic that has made getting goods from A to B and across borders increasingly difficult and expensive.

In the past six months, Ikea, Nike and several other retailers and brands have announced price hikes on key product lines as a result of rising supply chain costs.

In January Currys chief executive Alex Baldock warned of further shortages across 2022 due to supply chain constraints, and in February Joules posted a profit fall tied to supply chain challenges and terminated some EU stockist wholesale agreements citing Brexit costs. That same month Studio Retail entered administration – primarily due to problems getting goods where they needed to be.

Closed factories in Vietnam and increased freight costs were, respectively, cited by furniture retailer Made.com as reasons why its revenue was stemmed and margin erosion was reported for the 12 months ending December 31.

And that’s just a small sample of what is going on.

These are turbulent times for retail, with some headlines marking this period as the end of the era of globalisation – or at least prompting companies to rethink their global strategies if they hadn’t done so already due to Brexit and geopolitical unease.

Retail Week’s survey of the current situation, interviewing 50 UK retail supply chain and IT leaders, makes it clear that more needs to be done across industry and within government to help supply chain bosses and their teams deal with the pressure they are under.

Some 56% of those surveyed have considered leaving their jobs in the past 12 months, which tells the story about the challenges faced in the retail supply chain, while a quarter of respondents said policymakers are not doing enough to alleviate their burden.

Lifting the lid: how supply chain leaders really feel

Once upon a time, supply chain staff operated in the background of retail organisations, but their role has come under the spotlight with the acceleration of online retail and global disruption – the ‘back end’ of retail has become more and more critical.

So, what is the sentiment among the increasingly important supply chain and IT leaders in retail, and – in their eyes – what can businesses do to better invest in and support them?

Positively, 88% of the supply chain and IT leaders surveyed say they feel supported in their role by those in leadership and 64% feel more supported than they did two years ago.

Positively, 88% of the supply chain and IT leaders surveyed say they feel supported in their role by those in leadership and 64% feel more supported than they did two years ago

However, as cited earlier, 56% have considered leaving their jobs between February 2021 and February 2022.

The inclination to leave may be specifically related to supply chain pressures, but it may also be a symptom of the Great Resignation – over the past two years a high volume of people have quit their jobs, seeking a career change. This has impacted retail more than most industries.

Retail has a problem generally when it comes to retaining, recruiting and motivating staff, it seems, with just two companies from the industry included in employer review website Glassdoor’s 50 best companies to work for in the UK – voted for by the employees themselves.

While 88% feel supported in their roles, the 56% of supply chain leaders considering quitting their jobs shows that there is unrest and willingness to consider alternative employment among supply chain and IT departments.

Time for c-suite to step up?

There doesn’t seem to be widespread feeling that the c-suite and boards have simply left supply chain teams to deal with the problems they face, yet a not-insignificant 10% of those surveyed say they do not feel supported and 12% complain that the chief executive and executive board do not understand the pressures they are under.

10% of retail supply chain professionals do not feel supported by c-suite

In the pandemic, changing consumer purchasing patterns have caused different sectors to feel the supply chain squeeze at different times and the disgruntled 10% now could become the disgruntled 20% in the coming months – things really are changing that quickly.

For instance, the product supply issues cited by retailers in the early stages of the pandemic in 2020 were in the grocery and FMCG space – toilet rolls and cleaning equipment, for example – but this then moved on to toys in 2021 and then, judging by comments made in 2022 from Ikea, Made and Studio Retail, furniture and homeware.

… and the government too?

The majority (62%) of supply chain and IT executives surveyed say they are ‘very positive’ or ‘somewhat positive’ about the state of their own business’ supply chain. However, less can be said about their view of UK retail supply chains more generally.

Some 24% of retailers are negative about the overall UK retail supply chain, compared with 16% saying the same thing about their own company’s supply chain.

And while 28% of supply chain leaders are ‘very positive’ about their retailers’ supply chain and operations, only 8% say the same thing about the industry as a whole.

Those negative about the wider retail supply chain blame the government for not doing enough, but the fact that issues are not localised and are – in the words of one retailer – “a global problem” means if one company is struggling everyone is.

“I think most people [in retail] are holding on by a thread,” said one supply chain leader, which tallies with research released by corporate restructuring firm Begbies Traynor in January 2022.

“I think most people [in retail] are holding on by a thread”

Begbies Traynor, which publishes a regular business health check report, said the number of UK retailers in financial distress rose by 2% in the final three months of 2021, with inflation and supply chain challenges indicating this was about to get worse as 2022 progresses.

Many retailers were on the brink of collapse, it said, with 35,775 retailers – including both online and high street-focused businesses – under “significant financial distress” as the new year dawned.

Retailers that are “very negative” about their own business’ supply chains in the Retail Week research blamed Brexit above all else, while other negative responses related to staff shortages, including a lack of lorry drivers and hauliers reneging on contracts, and the uncertainty over the procurement of goods at a time when the business is “questioning everything about the supply chain”.

Meanwhile, many of those who were positive about the status quo cite recent improvements after the pandemic storm, and others say supply chains are “slowly getting back to normal” or “settling down”. One respondent who was “very positive” about their company’s supply chain says “the vast majority of our products don’t have to be imported so we've been affected less by things like Brexit and Covid. Also, our stock isn’t short-life so small delays aren't an issue”.

All of this suggests a mixed picture, and is indicative of an industry where clear winners and losers are being defined. Those with robust supply chains, and those sourcing closer to home, have an advantage in the current climate, but there are some organisations that seem stronger than others when dealing with the existing turbulence.

More investment and teamwork required

Of the 50 supply chain leaders surveyed, 52% say their retail businesses increased investment and budget for supply chain IT and technology by between 11-20% in the 12 months to February 2022.

Yet almost a quarter (22%) say they don’t feel the budget allocated to them to optimise retail supply chain technology and IT is adequate – and it’s not just marginal increases that leaders feel are necessary.

Some 27% of our respondents say an additional 31-40% of budget is required to meet their current retail supply chain technology and IT needs, while 9% say an increase in budget of 50% or more is necessary.

Some 27% of retailers say an additional 31-40% of budget is required to meet their current retail supply chain technology and IT needs, while 9% say an increase in budget of 50% or more is necessary

There appears to be a gap in what those working at the heart of retail supply chains want and what is actually being offered by decision-makers – the size of the gap paints a picture of ongoing discord.

One solution could be bringing different departments closer together. Over the pandemic years, retailers have got better at getting departments to work more collaboratively.

Pets at Home trialled home delivery from store stock for online orders in July 2021, making greater use of its store estate as a distribution network. By the end of the year 130 stores could be leveraged for online orders, helping the business speed up delivery by localising fulfilment.

Dovetailing with a one-hour click-and-collect service, the remodelling of this system, which involves store staff getting directly involved in the online fulfilment process, enables the retailer to fulfil approximately a third of online orders through its store network.

In a trading statement in January 2022, Pets at Home said working in this way was “generating operational efficiencies relative to a fully centralised model”, whereby management oversees the design, development and implementation, and departments are then responsible for rolling out and relaying feedback.

Fulfilment patterns at Sainsbury’s highlight how the supply chain needs to continually evolve. The grocer relaunched its same-day delivery service in September 2021, having paused it during the pandemic, and to support it 100 new stores and 100 new click-and-collect locations compared with pre-pandemic levels were added to the online distribution network.

With Deliveroo and UberEats now established delivery partners for Sainsbury’s, in addition to its in-house Chop Chop bike delivery service, those working on the front line at the supermarket chain are getting more and more familiar with wider supply chain operations.

In 2021, Sainsbury's added 100 new click-and-collect locations to its store network

In 2021, Sainsbury's added 100 new click-and-collect locations to its store network

Our research supports the anecdotal evidence that cross-collaboration in retail has improved, with 56% of supply chain leaders saying they are now working more closely with store staff on fulfilment than they did two years ago.

However, in the eyes of retail staff, there is still much room for improvement here, as 64% of those surveyed say they feel store staff either aren’t fully equipped or need greater training in order to fulfil orders and support on fulfilment.

Some 16% of the retailers surveyed say the solution for positive impact on a company’s supply chain transformation is upskilling and reskilling frontline store staff to support on fulfilment.

However, collaborating with more third parties, including tech platforms, retailers and industry experts (30%), is seen as the most popular way forward for retailers in terms of having a positive impact on supply chain transformation.

Pets at Home has sped up localised fulfilment by leveraging all of its stores for online orders

Pets at Home has sped up localised fulfilment by leveraging all of its stores for online orders

Collaborating with more third parties, including tech platforms, retailers and industry experts (30%), is seen as the most popular way forward for retailers in terms of having a positive impact on supply chain transformation

Tech transformation: where retailers should be betting

Third-party collaboration is seen as crucial for supply chain transformation, but where specifically should the focus be?

Data analytics and real-time supply chain visibility (42%), accurate stock levels (36%), and improving warehouse and factory working conditions (30%) were the top supply chain and IT investment priorities among the leaders surveyed and the areas where investment is currently being targeted at their retailers.

Looking ahead, however, the largest volume of leaders surveyed (50%) perceived on-demand delivery services to be the most transformative technology for the future of supply chains, followed by warehouse robotics automation (42%) and predictive data analytics (42%).

However, there is a gap in short-term supply chain strategies and long-term planning.

For example, on-demand delivery is only a current priority for 22% of the 50 retail organisations represented in the survey, and the implementation of artificial intelligence (AI)-driven robotics automation within the warehouse is highest on the agenda for just 18% of supply chain leaders currently.

General warehouse automation, such as robotic conveyor belts, labels and scanning, is a current priority investment for only 14% of retailers questioned.

These figures suggest the most transformative tech investments for future-proofing the supply chain are not currently met by the majority of the industry and retailers need to start expanding their focus.

As GreyOrange EMEA director James Newman highlights: “Delivery choices and immediacy have become a major differentiator for consumers. Brands whose supply chain systems prevent them from offering choice and immediacy will see their consumers move away. Fulfilment is becoming a cornerstone in winning and retaining consumers.”

“Fulfilment is becoming a cornerstone in winning and retaining consumers”

Superior supply chains

To understand what the 50 supply chain and IT professionals want their own operations to look like and how they want the c-suite to support them, Retail Week asked them to share the retailers and brands they rate the most highly for supply chain excellence – and why.

We look at some examples of Amazon’s supply chain automation ability in the next chapter. With its significant budget capacity, Amazon is often seen by traditional retailers as an outlier rather than a company to replicate.

Therefore, we’ve analysed Ocado, Tesco and Zara – three more comparable companies that ranked among the top rated – on their work and supply chain investments. It is worth noting that Ocado is now just as much a tech provider as it is a retailer, which we address in our analysis.

Supply chain excellence, according to the professionals surveyed, is defined by having “very advanced supply chain management that is also extremely quick and efficient”, a “fully automated warehouse” and a business that “seems further ahead than the competition”.

“They are – ultimately – a powerhouse and a standard setter,” explained another respondent.

Tesco

Tesco chief executive Ken Murphy has talked up the retailer’s supply chain capability. During a half-year results announcement in November 2021, Murphy said: “With various different challenges currently affecting the industry, the resilience of our supply chain and the depth of our supplier partnerships has once again been shown to be a key asset.”

He added: “As industry supply chains came under increasing pressure, we were able to leverage our strong supplier relationships and distribution capability to maintain good levels of availability for customers, contributing to our market outperformance.”

“With various different challenges currently affecting the industry, the resilience of our supply chain and the depth of our supplier partnerships has once again been shown to be a key asset”

Over the past few years, Tesco has invested in improved storage technology, giving it the option of cutting the food packaging stage from parts of its supply chain and allowing it to ship directly from produce suppliers to its stores. The objective here is fresher food for its customers and less waste, which is a key aim for all the major UK grocers as sustainability and efficiency sit high up on the boardroom agenda.

Tesco also used a higher proportion of rail networks to distribute its products than any other food retailer in the UK, with a dedicated train service bringing produce to its distribution network from Spain – a move that is also greener than many of the alternatives, such as lorries on the roads, as the trains mostly run on electricity.

Not only is this greener but, according to Tesco’s UK head of primary distribution John Steventon, it “will add a whole extra day to shelf-life and reduce food waste” when, with track improvements, the route from Spain to the UK is cut from four days to three; in comparison, lorries currently take four days.

Murphy said the company planned to expand the 65,000 containers it transports by rail each year to 90,000 in the near future. Tesco is also aiming to have a fully electric home-delivery UK fleet by 2028, and is among the leading businesses in trialling and developing alternatively fuelled vehicles in efforts to reduce its carbon footprint.

Tesco used a higher proportion of rail networks to distribute its products than any other food retailer in the UK, with a dedicated train service bringing produce to its distribution network from Spain – a move that is also greener than many of the alternatives

Outside of sustainability moves, Tesco has invested in equipment that improves storage density and brings more automation into the warehouse, but it is in the on-demand delivery space where the company has made great strides in the last 12 months.

Since the launch of its Whoosh delivery option in May 2021, Tesco is enabling customers in certain areas of the UK to get deliveries to their door in under 60 minutes – with goods fulfilled by a fleet of bikes. The grocer also partnered with on-demand delivery intermediary Gorillas in October 2021, with the two businesses establishing co-located warehouses within Tesco stores – or micro-fulfilment centres – to enable delivery of groceries within minutes for customers in the initial areas of operation.

The partnership allows Tesco to enhance speedy delivery capacity, while Gorillas’ app users gain access to an extensive selection of Tesco’s products. Supply chain collaborations like this demonstrate how retailers are focusing on their strengths and turning to specialist partners to fill gaps in their business model.

Ocado

With multiple third-party companies now paying Ocado to use its intellectual property and technological systems, it’s fair to say the business should be recognised for its supply chain clout.

Ocado’s technology arm supports retailers such as Casino Groupe in France, Loblaws in Canada and ICA in Sweden, which use the Ocado Smart Platform (OSP) infrastructure to run their online operations and support supply chains.

Sophisticated warehousing featuring robotics and cutting-edge picking and packing automation is all part of the OSP, and Ocado continues to hold conversations with other global grocers about supporting their operations. Finding a partner in Italy is among its current ambitions.

Closer to home, Ocado created a joint venture with M&S in 2019, in which Ocado sells its partner’s food online and M&S benefits from the latest in automation and supply technology to help its online business.

The innovation continues at pace, with Ocado announcing in January 2022 several new OSP modernisations that make it more robust and attractive to potential new partners.

Among the new tech changes was the launch of a 600 Series bot, which Ocado chief executive Tim Steiner said was the “lightest and most efficient” grocery fulfilment robot in the world, meaning the grids these picking and sorting robots run on can be built quicker.

Currently, the design and fit-out of an Ocado fulfilment centre can take up to two years, but the new tech could make it possible to achieve the build in six months.

Ocado has also announced a new AI technology, “automate frameloads”, which automate the physical packing of picked orders from the grids and prepare them for delivery. Additionally, new robotic picking arms can help the existing robots to pick directly from the grid, which Ocado said will reduce labour costs and boost general efficiency.

Alongside these developments, Ocado unveiled capabilities that will allow it to provide same-day and – potentially – on-demand grocery delivery using the same vans that already offer next-day fulfilment. New software that lets Ocado partners integrate their existing websites and apps into OSP technology was also revealed, as was Ocado Orbit – “the world’s first virtual distribution centre”.

Ocado Orbit is a system whereby smaller warehouses share a virtual DC, which uses AI and machine-learning software within a supply ecosystem. Each warehouse acts as a primary supply hub for a fraction of the stock but they all have access to the combined range. Ocado has said that customer fulfilment centres currently need to be a certain minimum size to “achieve the necessary economics for suppliers” and that the new virtual warehouse will address this issue.

Ocado Technology chief product officer Hannah Gibson described Ocado Orbit as: “Bringing together the efficiencies, large ranges and higher-order accuracy of large warehouses, but for a network of smaller sites. This allows all sites to offer the entire combined range of the network, allowing consumers to have access to tens of thousands of products, but with shorter lead times.”

Ocado’s earnings have slipped due to recent investments, with the grocer warning in February that increased spending to fund international expansion – including the investment in tech – would dent profits.

Capital expenditure this financial year is expected to hit £800m, with £30m more than analysts originally expected allocated for its global technology business. Analysts, like Ocado itself, view this strategy as one of long-term growth, as it looks to add more partners and territories to its OSP network in the months ahead, which will boost annual revenue in the future.

Zara

Inditex-owned Zara has frequently been used as an example of best practice supply chain management.

The logistics and supply chain set-up at Inditex includes making products close to home, known as proximity sourcing, meaning more than half of the group’s products are made in Spain, Portugal, Morocco and Turkey – rather than in Asia, where other fast fashion businesses tend to manufacture the bulk of their goods.

In times of disruption, as was experienced during the pandemic, such a model provides more stability – even though it is more expensive to run a greater number of operations in these countries. The warehouses also have capacity built in that can be ramped up in an agile manner when demand necessitates.

Inditex has invested significantly in supply chain IT and technology in the past few years as the business has evolved to keep up with rising ecommerce sales and a growing customer demand for speedy orders. Central to that has been a project to ensure stores and ecommerce are as integrated as they can be – a project that began in 2012.

Inditex calls this a “single, digitally integrated stockroom” and it entails a full deployment of an RFID system across the group’s global territories, which acts as the platform for a fully integrated stock management system.

The RFID system encodes each garment at the manufacturing stage. Due to this, the group’s brands are able to identify where each item is during all the stages of the supply chain, ensuring live, real-time inventory management.

As of the end of the 2020-21 fiscal year, the system was active in 5,777 stores across 89 markets; it helped enable Inditex to fulfil 46 million online orders worth €1.2bn (£1bn) from its stores – bringing with it the added bonus of “more precise and efficient” stock management.

The group has invested over €11bn (£9.3bn) in technological integration, digitalisation, transformation and store adaptation since 2012, and the rate of investment is not yet being reined in. Why would they when they are supporting 77% growth in online sales?

The group has invested over €11bn (£9.3bn) in technological integration, digitalisation, transformation and store adaptation since 2012

“At the heart of the integrated sales system is the Inditex Open Platform (IOP), a hybrid cloud-based digital replication of every phase in Inditex’s business model,” Inditex said in its full-year results statement last year.

“A virtual building adapted for each department and its needs, which integrates the entire product life cycle and enables constant interaction, feedback and adaptation.”

This entire complex architecture is being developed internally by multidisciplinary teams, according to Inditex, and is expected to be fully deployed across the group’s global operations by the end of 2022.

“Thanks to its open and modular nature, it allows all areas of the company to adapt their processes for customer demands in real time and react to their preferences,” the company explained.

“That customer-driven responsiveness has always been the inspiration for Inditex’s model. As a result, the IOP has the ability to constantly generate technological solutions by means of microservices adapted for each phase of the business process, bringing extraordinary agility and versatility in a purely digital environment.”

If automation, RFID, robotics and new on-demand delivery partners represent what retailers can invest in now to manage their supply chains and get ahead of disruption, then the future might be drones or driverless vehicles.

Boots is trialling delivering medicines to the Isle of Wight, which entails using unmanned aerial vehicles to take goods across the Solent, which can take off from both helipads and airfields. It is early days for this type of technology, but Boots’ work follows other drone trials by the likes of Amazon, which were conducted privately and in test mode, and Icelandic drone delivery service AHA, which is already using the tech commercially in northern Europe.

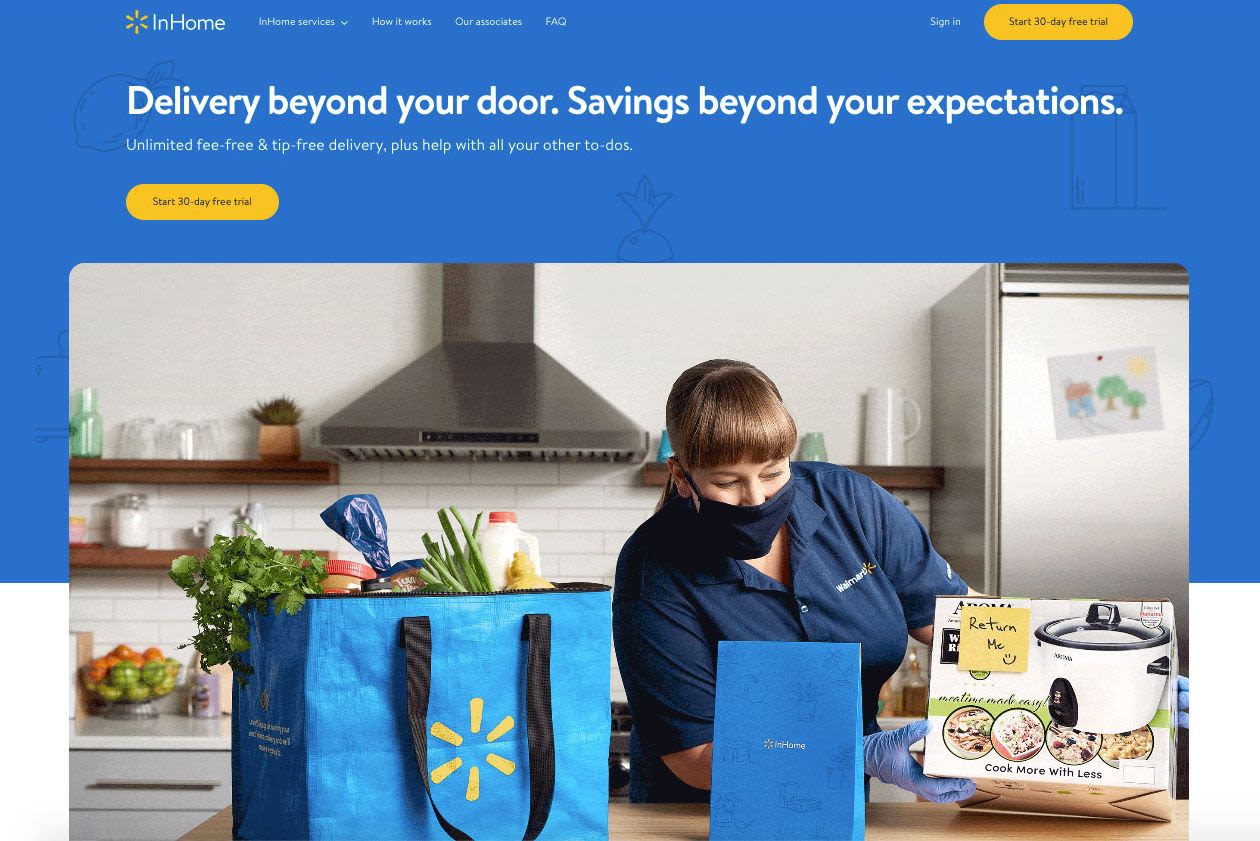

Elsewhere, Walmart in the US is increasingly rolling out its ability to deliver into a person’s home when they are not there, which represents a notable evolution in final-mile fulfilment.

Walmart InHome enables grocery deliveries while the shopper is out

Walmart InHome enables grocery deliveries while the shopper is out

In January 2022, Walmart announced its InHome service will be made available to 30 million US households by the end of the year. Currently accessible to 6 million homes, the service involves staff delivering groceries straight into consumers’ kitchens or garage refrigerators if the customer is not at home.

By pairing the InHome app with smart lock technology, delivery drivers can gain access to empty households and unpack items.

This level of personalisation and convenience is part of a new frontier in retail delivery, but it needs a sophisticated and robust supply chain to support its success – as well as willing consumers.

How AI can help

We’ve talked about the role of technology in future-proofing supply chains more generally, but – going deeper – it is AI technology, machine-learning software and AI-driven automation in particular that are helping retailers to optimise their supply chains.

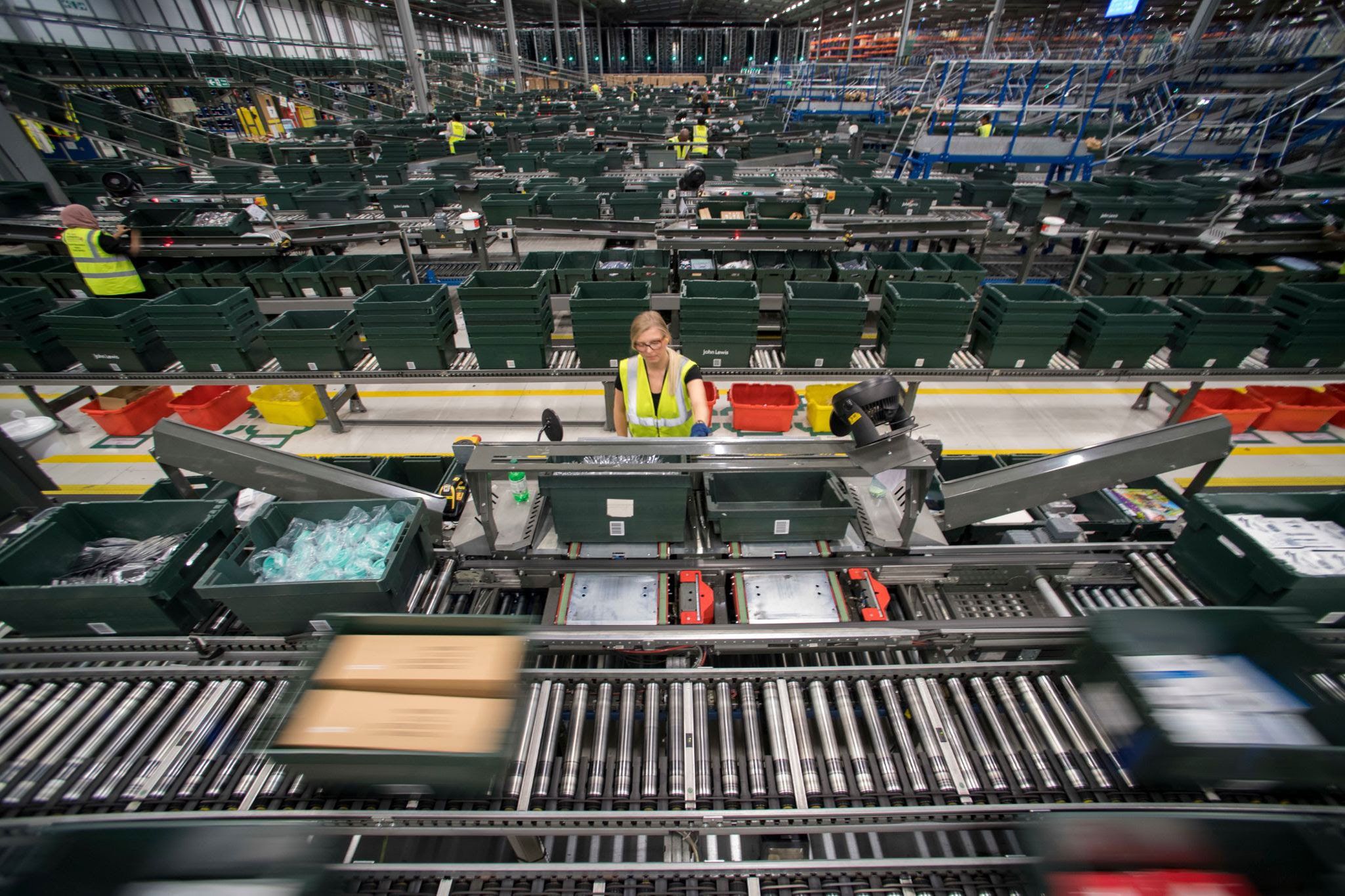

Inevitably, many of the big players are at the forefront of this, with Amazon, Walmart and Alibaba displaying their prowess in this space, but more traditional retailers such as The Very Group, John Lewis and JD Sports are all placing their bets on automation too.

John Lewis is among the big names in retail investing in automation

John Lewis is among the big names in retail investing in automation

GreyOrange powers AI-driven fulfilment solutions and Newman says the expansion of ecommerce and the fulfilling of individual item orders is contributing to the need for faster and more automated supply chain operations.

“As this area of business continues to accelerate in growth, the ability to operate efficiently in a single pick, single return, back into inventory stock model will be needed to protect future margins and remain competitive in the markets,” he adds.

This is especially evident in warehouses and navigating first mile: “Demand for automation in the warehouse has changed dramatically in the past couple of years and all the indicators suggest that this is going to accelerate even more rapidly in the next two.”

“As this area of business continues to accelerate in growth, the ability to operate in a single pick, single return, back into inventory stock efficiently will be needed to protect future margins and remain competitive in the markets”

Newman lists “three drivers of this need for speed”: firstly, the increasing shortage of labour, which he says is a growing problem that is compounded by “the Amazon people effect whereby Amazon is scooping up resources that are available in the job market”.

Secondly, the pandemic and the fact “social distancing is and will be a factor in the future of warehousing and how a business provides more space for operatives” is contributing to more automation. But, thirdly and “most significantly”, it is consumers’ growing expectations of fulfilment and returns that is the key factor driving change.

“Fulfilling orders and accepting returns was always seen as important but nonetheless an operational aspect of the supply chain,” explains Newman. “In more recent years, retailers have woken up to the understanding that these factors can be a competitive differentiator and, moving forward, these are absolutely embedded aspects of ‘customer experience’.”

Below are examples of AI automation in action that retailers can learn from.

Amazon

Kevin Keck, worldwide director of advanced technology at Amazon, blogged in June 2021 about the company’s use of robotics and AI in its warehouses to give a picture of how the technology aids its supply chain processes and helps “make employees’ jobs safer”.

Amazon introduced a robot called “Ernie” in 2021 to take totes (warehouse storage boxes) off a robotic shelf and use a robotic arm to deliver them to employees, rather than making employees reach down into what it described as non-ergonomically friendly positions.

Amazon uses robotics to smooth out supply chain operations (Credit: F4D Studio)

Amazon uses robotics to smooth out supply chain operations (Credit: F4D Studio)

“The innovation with a robot like Ernie is interesting because, while it doesn’t make the process go any faster, we’re optimistic, based on our testing, that it can make our facilities safer for employees,” explained Kevin Keck, worldwide director of advanced technology at Amazon.

Meanwhile, “Bert” – one of Amazon’s first autonomous mobile robots, which is there to be summoned by staff to help with tasks – might at some point be able to move larger, heavier items or carts that are used to transport multiple packages through the retailer’s facilities.

Two additional robots, with the code names “Scooter” and “Kermit”, also operate autonomously, but they transport carts carrying empty totes and packages through Amazon’s facilities. The aim of this automation, Amazon says, is to make facilities safer and “enable employees to focus on jobs that require their critical thinking skills”.

Walmart

Joe Metzger, executive vice-president of supply chain operations at Walmart US, announced in July 2021 “an industry-leading technology system poised to transform our supply chain and make warehouse work easier for our associates”.

Having had automation in its warehouses for several years to more accurately sort, store, retrieve and pack freight on to pallets, Walmart is now rolling out a new system to its regional network – in 25 of its 42 regional distribution centres (RDCs).

Walmart has said the move will transform how its products get to stores and make the process more efficient and less labour-intensive. The new system uses a complex algorithm to store totes using high-speed mobile robots, rather than humans, and operates with precision to speed the intake process. Walmart added that the system increases the accuracy of freight being stored for future orders.

“By using dense modular storage, it also expands building capacity. And by using high-speed palletising robotics to organise and optimise freight, it creates custom store- and aisle-ready pallets, which take the guesswork out of unloading trucks,” says Metzger.

Unloading palletised trucks is faster and simpler as a result, he added, allowing staff to spend more time with Walmart shoppers and focus on customer service.

John Lewis

John Lewis’ supply chain strategy is focused on continued investment in automation of its DCs as a priority to increase capacity and improve ecommerce efficiency. This automation investment extends to its new 1 million sq ft DC at Fenny Lock in Milton Keynes, which will become fully operational in the summer of 2022.

Leased for 11 years from Tesco, the site will become the retailer’s second-largest distribution centre after its 2 million sq ft campus just four miles away, at Magna Park.

Describing plans for Fenny Lock, Andrew Murphy, partner and executive director of operations for the John Lewis Partnership, said it would be a “one-of-a-kind distribution centre” and that John Lewis “will invest in the site’s automation capability to support future growth”. The site will be used to fulfil customer orders specifically for fashion, small home furnishing items and tech products.

This keen automation focus and proximity to its Magna Park campus, Murphy says, will enable John Lewis to combine more customer orders – in turn reducing the number of packages the business creates by “approximately 1 million per year”, while reducing the number of lorries on the road.

The Very Group

Another example of modern supply chain technology in action is The Very Group’s highly automated warehouse in the East Midlands, which opened in 2020.

Supported by robots collecting products for dispatch or integrating returned items back into stock, the facility features a “pocket sorter”, which keeps popular products easily accessible and enables dispatch in as fast as 18 minutes thanks to the automation.

Launched on the day the UK went into its first lockdown caused by the Covid-19 pandemic in March 2020, the 850,000 sq ft facility has secured a number of benefits for the online retailer and its customers.

This includes greater product availability, faster refunds and enhanced ability to handle peak trading periods.

Matt Grest, chief information officer at The Very Group, says: “We’re significantly investing in our tech stack, data analytics capabilities and, most importantly, the digital customer experience to be the first port of call for UK consumers.”

So far, this report has only scratched the surface on the perception among supply chain and IT supply chain leaders of what the future of the industry looks like. Here we explore the areas in which supply chain leaders want change and are anticipating challenges.

Supply chain leaders want… policymakers to alleviate the burden

In the early stages of the pandemic, the UK government made the unprecedented move to enable retail supply chains to better work together to support the nation in a crisis.

The government temporarily relaxed elements of competition law as part of a package of measures to allow supermarkets, in particular, to work together to ‘feed the nation’. It allowed grocers to share data with each other on stock levels, cooperate to keep shops open, and share distribution depots and delivery vans.

The government also temporarily relaxed rules around drivers’ hours, so retailers could deliver more food to stores.

It was at the demand of supermarket bosses and helped the grocery industry serve customers while many other retailers were forced to close their doors until Covid infection levels dropped.

“[Policymakers] have forgotten the struggles we are facing. They should be offering advice and guidance to companies to help us work together to quickly find a solution”

But perhaps there is a need for more permanent change in how supply chains operate.

Some 25% of retail supply chain and IT professionals questioned say they don’t feel policymakers are doing enough to alleviate the burden on retail supply chains that has been building up over recent years and has been accentuated by the ongoing pandemic.

These retail leaders want the government to invest more in this area, with supply chain bosses saying there is “too much red tape”, “not enough government guidance”, “not enough investment in driver/HGV training” and “not enough pressure on manufacturers to become more sustainable”.

One supply chain executive said policymakers “have forgotten the struggles we are facing – they should be offering advice and guidance to companies to help us work together to quickly find a solution”.

Supply chain leaders want… greater investment in automation

As highlighted in chapter two, supply chain leaders see robotics automation as the main transformative tech for retail supply chains. Only 6% of those surveyed say they don’t see the benefits of robotics automation and think retailers shouldn’t be investing in it.

However, they are divided on who should be leading that automation within businesses.

30% believe retailers should be hiring chief robotics officers or chief automation officers to drive the change

Some 34% believe it should be the supply chain leader’s responsibility; however, a significant 30% believe retailers should be hiring chief robotics officers or chief automation officers to drive the change.

On the drive for supply chain automation, 24% of respondents say they are being retrained and reskilled to support the future of the business.

24% of respondents say they are being retrained and reskilled to support the future of the business

This tallies up with work being undertaken by some retailers to bring about greater automation.

Walmart’s Metzger, for instance, has said the increased automation under way in the US grocer’s distribution facilities is coming with more training for staff. Last year, when announcing the new investments in tech and planned roll-out, he said: “Along with saving time, limiting out-of-stocks and increasing the speed of stocking and unloading, we’ll also have the chance to train associates on how to use the new equipment, creating new skills and preparing them for jobs in the future.”

He added: “And because the technology decreases the need for our associates to handle freight, it removes one of the toughest aspects of supply chain work in material handling.”

In short, Walmart says it is aiming for automation to provide better jobs for its staff.

Training data ‘superusers’

Official statistics show that the retail workforce in the UK is getting smaller, so to maximise on the workforce they currently have retailers will need to focus on training and developing existing staff for the new world.

The British Retail Consortium (BRC) is among the organisations helping the industry move in this direction. Teaming up with education tech company Cambridge Spark, the BRC has launched a Master’s level apprenticeship in data science and machine learning – funded by the Apprenticeship Levy.

The Level 7 apprenticeship aims to provide a fast-track programme for upskilling retail staff into machine learning engineer roles, providing the skills that customer data analysts need to discover and identify areas in which AI solutions can be used to develop new business opportunities.

Lucy Crowther, director of the BRC Learning division, says: “It is one thing to have the data, but to truly use it to drive business decisions, our retailers need the skills to mine it, sort it, make sense of it and critically turn it into insight.

“It is one thing to have the data, but to truly use it to drive business decisions, our retailers need the skills to mine it, sort it, make sense of it and critically turn it into insight”

“The ability to be a data 'superuser' only comes with considerable learning that includes a deep understanding of all aspects of data science and AI.”

Other retailers, including M&S, are developing their own programmes to boost talent in these increasingly competitive areas, and the most successful ones of the future will continue to do this and ensure they are working with the specialists in this field.

Supply chain leaders want… a greener supply chain

The environmental awakening under way in society – and therefore in retail – is leading many retailers to start tackling carbon emissions in their supply chain. It fits part of the wider environmental, social and governance (ESG) agenda that is providing the building blocks to much of the corporate world’s current strategy.

Retailers ranging from Tesco and Sainsbury’s to Burberry and Etsy are looking to address not just emissions associated with their own operations but also so-called Scope 3 emissions that are related to their suppliers and their activities.

The Science Based Targets initiative advises retailers to break their carbon emissions into Scope 1, 2 and 3. The former two are related to a retailer’s own operations, while Scope 3 – and where there are apparently huge improvements that can be made – are related to emissions from partners and suppliers up and down a retailer’s value chain.

As attention grows in this area, and retailers continue to invest in the technology and systems to boost transparency and traceability, it is going to have a radical impact on how supply chains operate, the companies retailers work with and the standards adhered to.

Certainly, the leaders surveyed believe sustainability is a vital strategy for their retail businesses – with 94% saying it is important to their role within IT and the supply chain.

The leaders surveyed believe sustainability is a vital strategy for their retail businesses – with 94% saying it is important to their role within IT and the supply chain

Some 60% of those surveyed are looking at reducing the volume of packaging and plastic as a top priority, 52% say they are investing in electric vehicles including electric HGVs, 48% say they are going to manufacture more items in the UK, 46% say a key supply chain focus is investing in green energy such as solar power and 40% are investing in automation to reduce waste.

Overall, 48% agree retail supply chains can become truly sustainable in the future – this is a more positive outlook compared with critics who have argued retail supply chains can never be fully sustainable because of the nature of the business model.

For the 8% of supply chain professionals who say their businesses are not investing to become more sustainable there should be concerns.

Consumers are voting with their wallets and increasingly seeking companies that have a bonafide greener retailing philosophy, which suggests retailers looking to build back better and greener following this difficult period for supply chains are going to be well placed to drive future business.

New policies – not to mention the very real threat of the climate crisis – are also making it difficult for retailers to justify not investing in sustainability. For instance, the government is calling on retailers to take back old electronics from consumers, the plastic packaging tax was introduced on April 1 and there is tightening legislation around reporting greenhouse gas emissions.

Next steps

James Newman, EMEA director, GreyOrange

If the past two years have taught us anything, it is that the current model of supply chains and supply chain management is no longer fit for purpose.

Supply chains as we know them are a 20th-century construct borne from a manufacturing premise for the movement of materials from origin to use in production. The model nicely overlaid on to the retail sector when the store was effectively the manufacturing plant and consumers all came to the store to buy goods.

Ecommerce, omnichannel, mobile, sustainable and ethical goods manufactured nearshore rather than offshore, pandemics, wars and labour shortages have all exposed the old model as inadequate.

The emerging model of the supply chain is one of a network of nodes, or a supply network, where anywhere in the network can be a fulfilment node. Empty stores can be turned into mini distribution centres. The back of a shop can be used as a micro-fulfilment centre. Orders are fulfilled much closer to the consumer. Delivery journeys are reduced, choices are increased, more orders can be met and almost immediate delivery can be offered.

The thinking is new; the technology driving this is different. It isn’t going to be a labour-driven model, it will be a tech-driven model and the technology will not be massive ERP-like systems but agile, AI and machine learning guided platforms capable of orchestrating fleets of robotic agents and human agents across a network of fulfilment points. Flexible, agile, adaptable and consumer-driven.

Chain Reaction, published in association with GreyOrange

Content lead: Megan Dunsby, senior commercial content editor, Retail Week

Report author: Ben Sillitoe

Sales lead: Caroline Londono

Production: Emily Kearns and Stephen Eddie

Designer: Helen Berry