What this report will tell you

This report is based on extensive research conducted by both Royal Mail Marketreach and Retail Week.

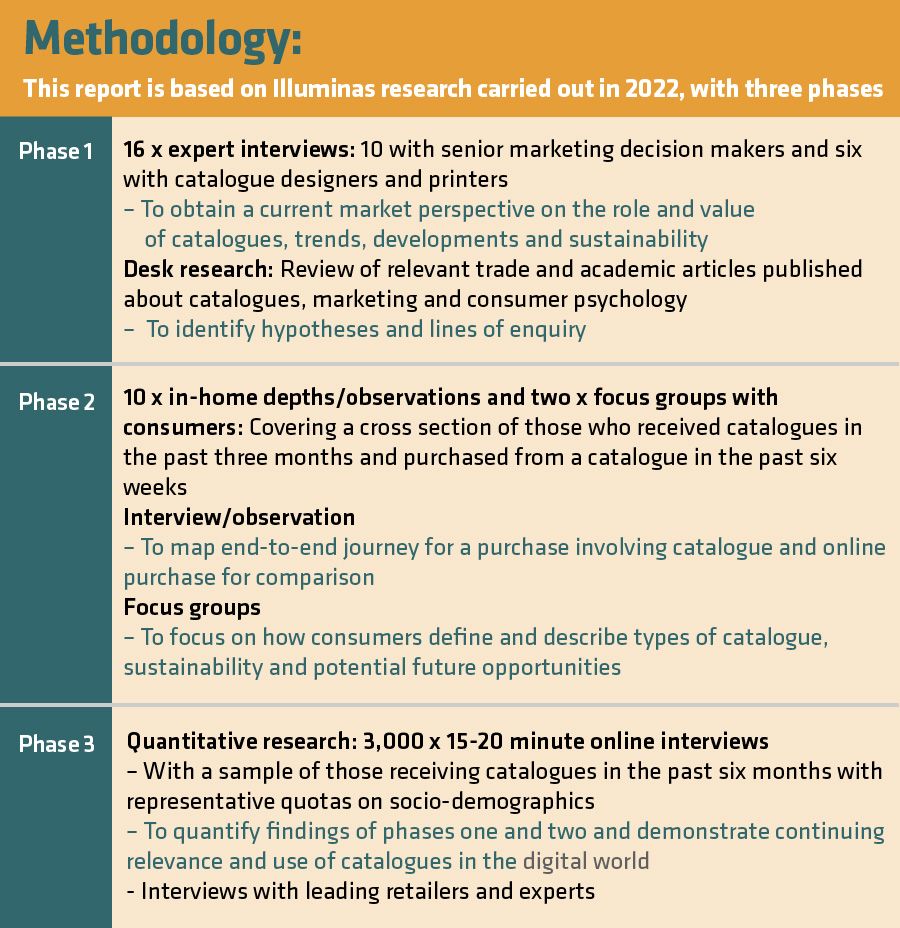

As shown in the methodology (below) Marketreach commissioned 16 expert interviews, in-depth at home interviews and observations with 10 UK households, two focus groups and a survey of 3,000 UK consumers, through independent research agency Illuminas.

Retail Week then analysed the findings in depth, conducted extensive market research and interviewed eight retailers, from businesses including Matalan, Seasalt and Wickes (full list opposite).

The result is a detailed account of how consumers view and use catalogues, as well as the strategies that retailers are deploying to make direct mail a success and drive return on investment.

This report reveals that catalogues deliver physical, sensory experiences with positive cognitive and emotional impacts on consumers. They are an effective complementary marketing and sales channel working alongside ecommerce.

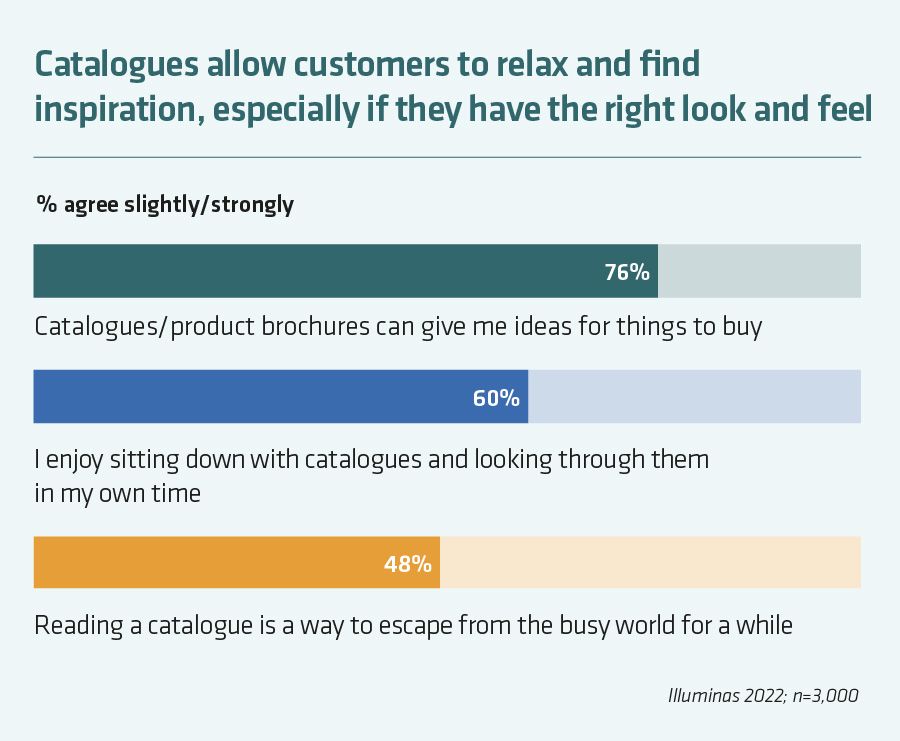

Consumers value catalogues’ relaxing and inspirational qualities. The research reveals shoppers are likely to reach for a catalogue when they want to unwind at home. On average, they will spend 15 minutes browsing a toys or books catalogue, 12 minutes on electricals or health and beauty, and 11 minutes leafing through a fashion catalogue; 53% did something of commercial value after receiving a catalogue. Meanwhile, 48% of consumers agree catalogues provide a “way to escape from the busy world for a while” and 76% agree they give them ideas for things to buy. As a result, the commercial appeal for retailers is clear.

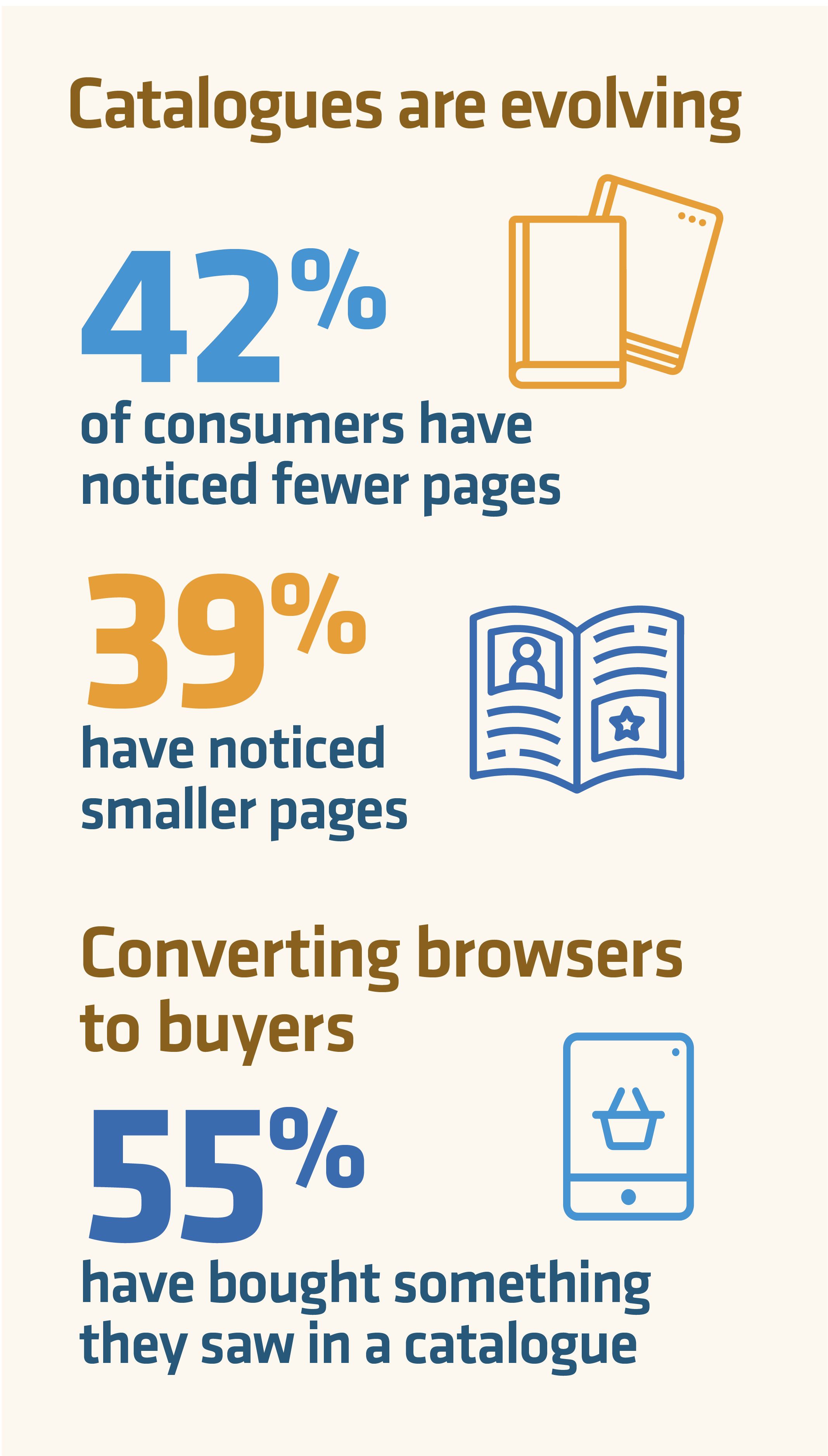

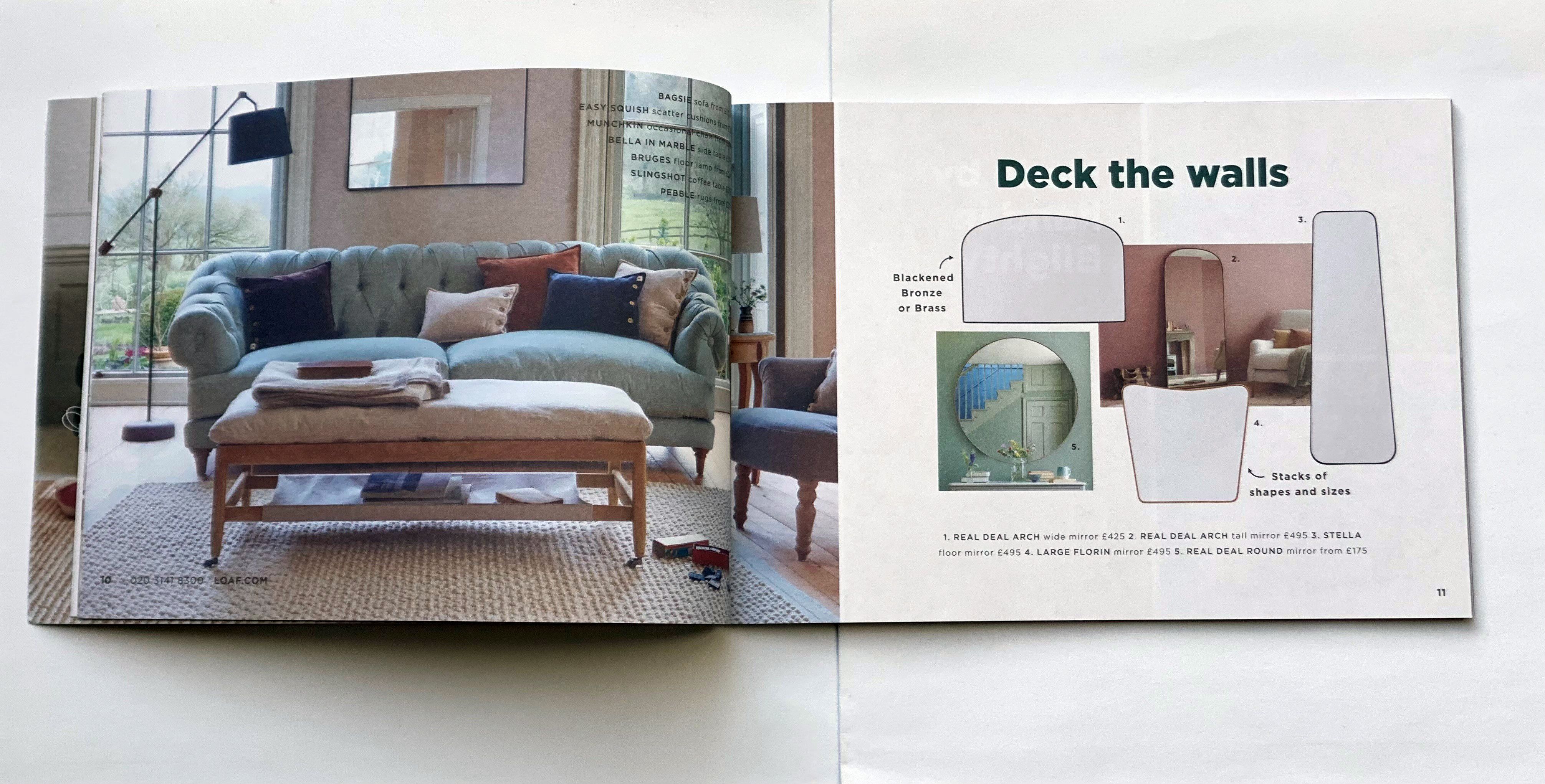

Catalogues have evolved to become slimmer and more experiential. In the same way that retailers are focused on fewer but more experiential stores and ecommerce retailers look to recreate the same wow factor digitally, the catalogue has also moved forward from being a large listing to delivering a strong brand and customer experience. In chapter two, we reveal how this step-change has not gone unnoticed by consumers; 42% note fewer pages in catalogues and 39% have spotted smaller pages being used.

The White Company, Seasalt, Wayfair, Majestic Wine and Hotel Chocolat are just a selection of the retailers taking advantage of the opportunity that catalogues provide. In chapter three, we take a deeper dive into their strategies.

QR, AR and VR technologies are increasingly integrating catalogues into the wider shopping journey. Retailers can still display their full ranges to consumers through a slimmed-down catalogue that contains a QR code to direct them to the products online, where they can complete purchases and arrange for delivery. Beyond this, AR and VR technology are being used to create more of an in-store experience, removing the drawback of not being able to touch and feel products.

Meet the experts: Who Retail Week spoke to

Jeff Howarth,

marketing director,

Matalan

Angela Porter,

chief marketing officer, ProCook

Miranda Hammond,

senior customer relationship manager,

Seasalt

Mark Winstanley,

chief creative officer,

The White Company

Mandy Minichiello,

head of marketing, showroom, Wickes

Jack Merrylees,

head of brand, content and PR, Majestic Wine

Carly Czuba,

marketing director,

Go Outdoors

Carl Rogberg,

industry expert and former

CFO Avon International,

interim CFO Intersport Sweden, and finance director at Tesco

Gary Howard,

chief digital officer,

Precision

Catherine Shuttleworth, founder,

Savvy

Jonathan Chippindale,

chief executive,

Holition

Eve Stansell,

senior communications planner, Marketreach

Lisa Byfield-Green,

data and insights director, Retail Week

- Chapter 1: Maximising retail's brand-building opportunity

- Chapter 2: The evolution of the catalogue

- Chapter 3: Why QR, AR and VR mean big things

- Chapter 4: How different sectors are approaching catalogues

- Chapter 5: A Christmas snapshot

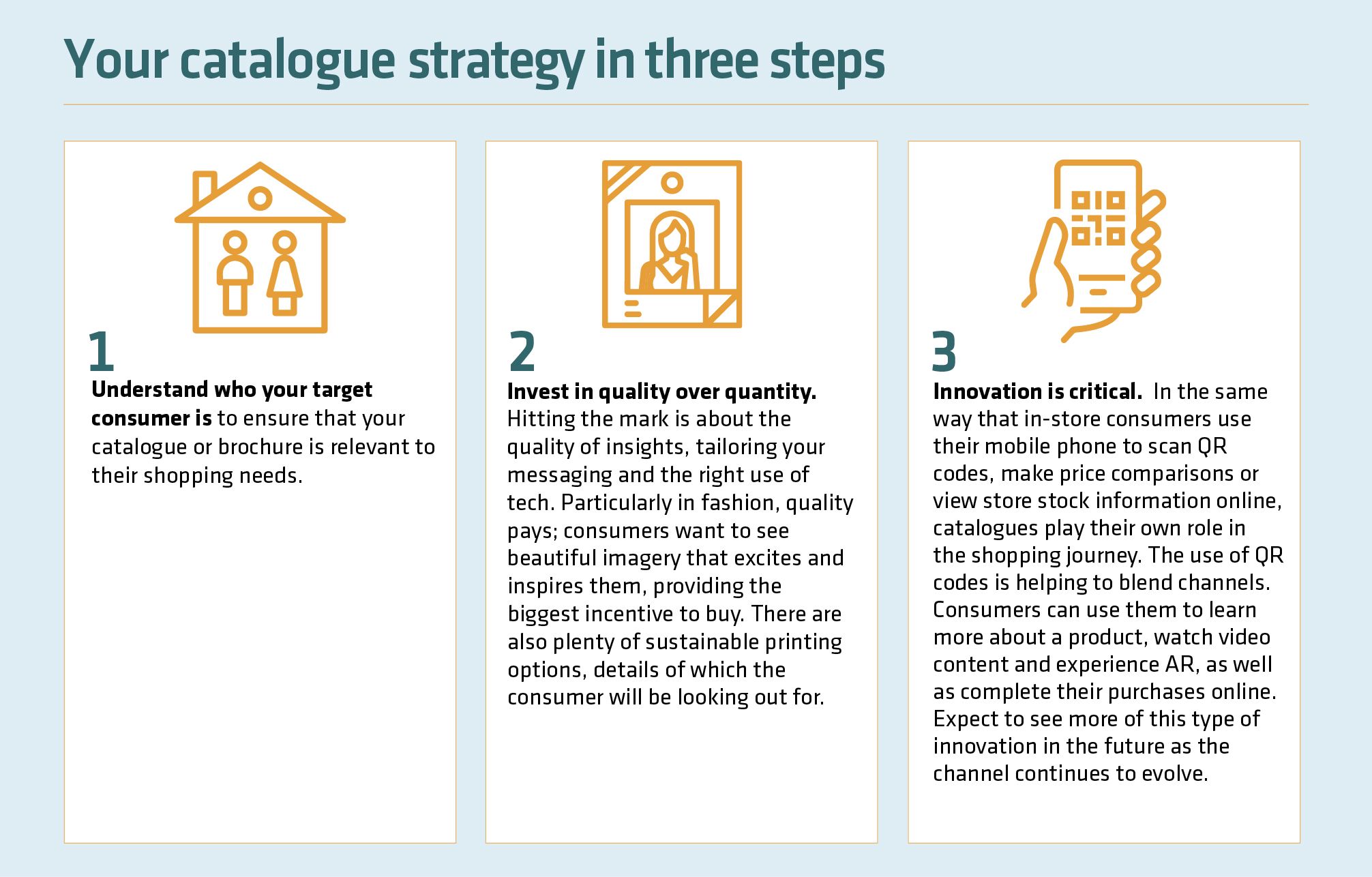

- Conclusion: Your catalogue strategy

- Partner viewpoint: by Eve Stansell, senior communcations planner

Ploughing investment into digital marketing may seem the natural conclusion to draw from the past two years, but the situation is more nuanced. This swell of consumers online has escalated the digital noise level and made online advertising as competitive – and expensive – as it has ever been.

Research by advertising technology company AdSkate in June 2022 found: Meta’s CPM (cost per thousand impressions) has increased 61% year on year, averaging at $17.60 (£15.57); while TikTok’s has increased 185% year on year, averaging at $9.40 (£8.32); and Google’s programmatic display cost has increased 75% year on year. Instagram’s has increased 23% year on year.

The logic is there are more eyeballs to target digitally. That is true, of course, and digital ad spending was estimated to see growth of 11.9% in 2022, according to analyst group eMarketer, following what it calls a “remarkable” 36% surge in 2021. That means increased competition and greater costs. Retail – at £5.2bn – is the sector set to spend most on digital ads in 2022, highlighting the clamour for share of voice and visibility in the industry.

The average cost per click (CPC) worldwide was $0.52 (£0.46) at the beginning of 2021 compared to $0.62 (£0.55) at the beginning of 2022, with evidence pointing towards continuing CPC inflation, markets and consumer data expert Statista says.

Gary Howard, chief digital officer at marketing agency Precision, says: “Retailers need to think more creatively and look at data acquisition. First-party data is needed so you can engage with consumers over and over again – and catalogues will come into their own here.”

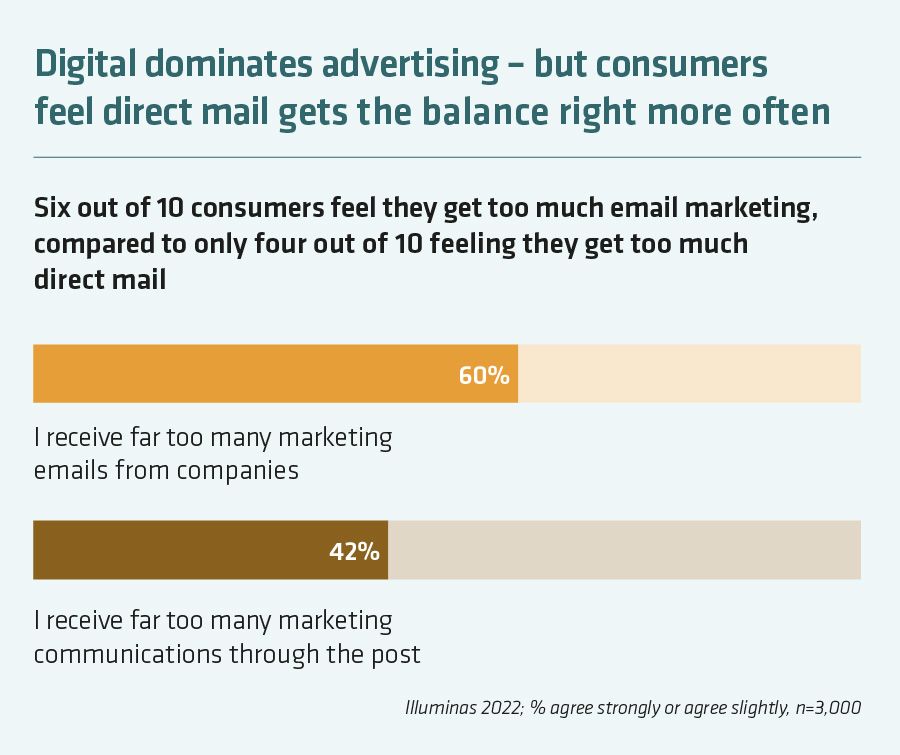

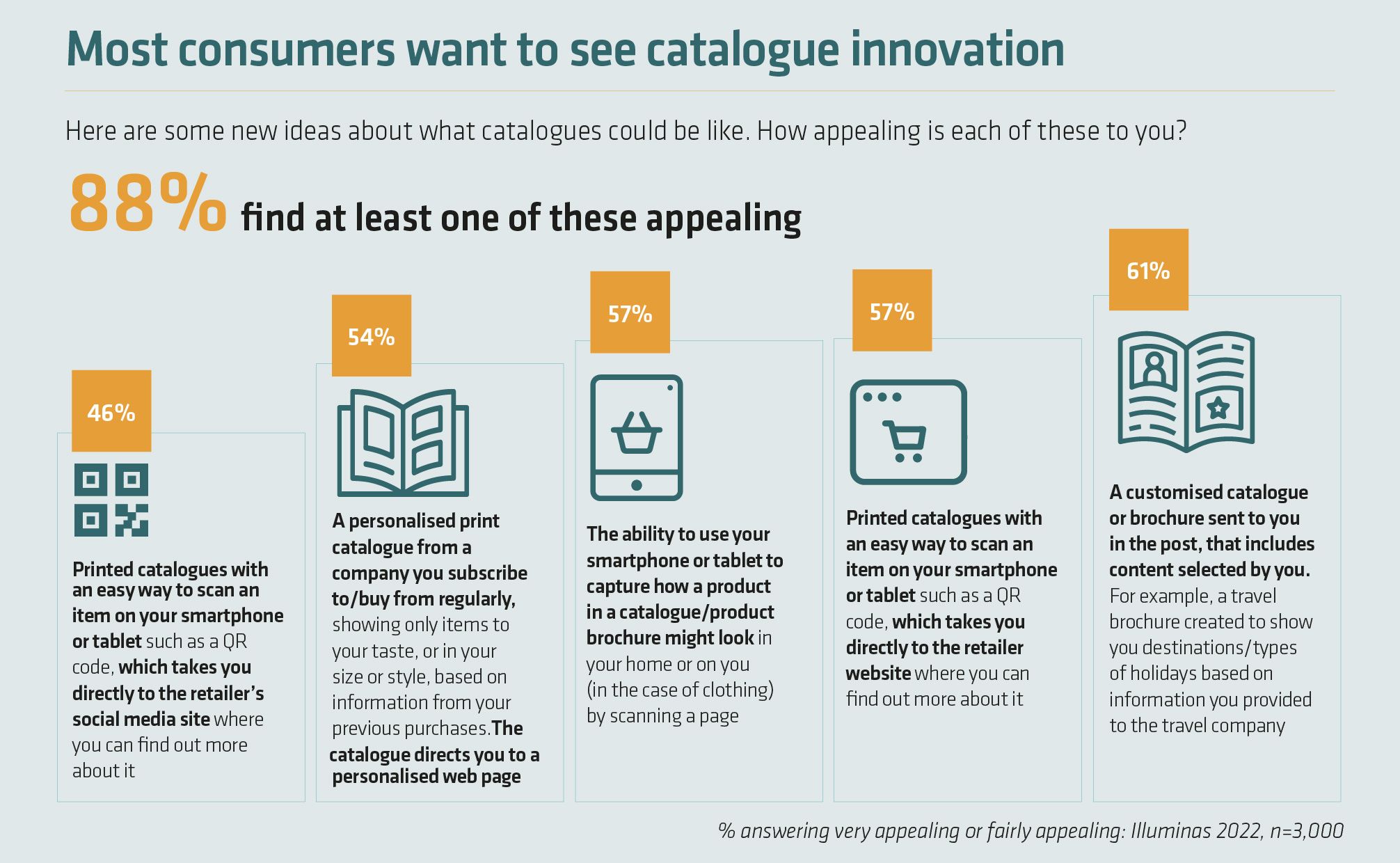

Catalogues cut through digital overload as consumers are more accepting of physical marketing: 60% of the consumers surveyed by Illuminas agreed that they received too many marketing messages via email. Only 42% said the same thing about marketing communications through the post.

Retail Week’s recent Retail 2023 report surveyed 57 CEOs and found that 82% plan to spend on email marketing next year, behind search engine marketing first and Instagram second.

Although digital ad spend is significant and remains critical, in reality customer journeys are not linear so rather than relying on one channel brands should look to create an integrated approach that can touch consumers wherever they are and whatever they are doing, be that on- or offline.

One 36-year-old female consumer from Essex who took part in the research explained the value of catalogues to her: “I think generally it’s a positive communication. They remind you of the brands themselves, they remind you of the products and just keep it sort of fresh in your mind.”

Investing in the catalogue channel

As digital costs and investment has increased, some brands looked to make cost savings in their use of print marketing. These include Argos, The Very Group-owned Littlewoods, and Ikea. Brands had traditionally used big books to show their full range, but this has now changed because digital proved a cheaper option. However, other retailers are ramping up investment and seeing catalogue marketing as a way to stand out from the digital crowd. The pandemic and ensuing changes in the way consumers shop acted as a step-change for many retailers.

“As a direct marketer with 30 years’ experience, there’s nothing like a data-driven, fully-curated catalogue to drive people to spend when they hadn’t intended to,” says Sarah Kujawiak, letter specialist at Marketreach. “You have to take the goods to them, don’t flatter yourself to think they will come looking for you. When you find them you will find that your catalogue stimulates impulse spend, higher basket values and more frequent shops.”

Those making strides in the catalogue space have moved away from the ‘big book’ of old – more on that later – to produce and distribute magazine-style and easily digestible print formats that consumers want to keep. Catalogues are material consumers want to keep, and pick up when they want to switch off and relax.

Catherine Shuttleworth, owner of retail and shopper marketing agency Savvy, says: “The digitisation of society hasn’t made catalogues redundant, it has meant they have to be used in a more tactical fashion than ever before. “It’s no surprise the big catalogues of old don’t have the place they once did, but there is a really good place for tactical use of magazines and ‘magalogues’.”

One 30-year-old male from London who took part in the research said: “I think in the catalogues, you do tend to have a lot more photographs and images, which can be good. So clothing catalogues, for instance; I had five weddings last year and I did look through and was thinking what do you wear to a wedding in May/June and the sort of outfits and trying to get up to date with what’s in fashion and what looks good.”

He added: “It’s just a lot more sort of absorbable, such as the Howden’s catalogue, if you were going to go into a builder’s merchant, these massive warehouses, it could take you half an hour to walk around and find everything. It can be useful to have things concentrated into a catalogue, so you know what you’re looking for.”

Tapping into consumers’ emotions

The physical, sensory nature of catalogues means they are kept for long periods of time in consumers’ homes and provide a significant sales opportunity. They are likely to trigger consumer search and purchase. A catalogue’s physicality gives it a certain value in consumers’ minds.

“Because everything is online it can make you blind to what’s actually available, so the ideal move by catalogues is to a more curated collection,” adds Shuttleworth.

Some experts say the use of personalisation online, whereby browsing history dictates what you see, is reducing the excitement of the ‘discovery’ element of shopping.

Carl Rogberg, who left his role as chief financial officer at Avon International earlier in 2022, says: “If you’re in a rush and need to buy something, having access to the internet is obviously good and useful. If you just want to browse a little bit, then the physical catalogue is not completely based on your browsing history and preferences – it is full of unfiltered ideas. I believe the filtering you see online is creating a kind of tiredness.”

He says catalogues sit alongside digital and other channels as a key part of the marketing mix for many companies, but he argues the catalogue can help consumers find something new they have not considered before.

Matalan marketing director Jeff Howarth says: “On average, we send out five mailers a year to over 2 million customers, so they continue to be a key part of Matalan’s omnichannel strategy.

“We know our customers respond really well to our seasonal catalogues, as they give them a great snapshot of the latest offers and ranges available in-store and online, driving incremental sales from our large Matalan Me loyalty programme membership.”

A new phase of retail

What became clear in the process of producing this report is that retailers have recognised that consumers are increasingly shopping at different touchpoints of the shopping journey, with their shopping experiences weaving across online and offline.

As a result, the retailers we spoke to were all looking for new ways to draw customers in with new and exciting immersive experiences. Catalogues are playing a key role in that, bringing their brands into consumers’ homes, allowing them to touch the brand and make it a part of their home-life experience.

The Retail Week view

Hybrid consumers are a trend that we are seeing, which means people are far more tech-savvy post-pandemic and expect to use technology such as mobiles online and in-store to remove friction from the customer journey.

It is important to serve these customers the right information at the right time to suit their needs and shopping mission.

However, these shoppers are also looking for the best of both worlds and that includes the ability to switch off from the digital world to make the most of in-person and physical experiences.

It is important to also consider the needs of shoppers who may prefer to browse a catalogue or brochure.

This audience may or may not have access to in-store shopping and may struggle to find what they are looking for online.

If customers love a brand and have opted in to receive marketing from them, a personalised offer or a carefully curated assortment of items is likely to inspire them to revisit the brand, online or in person.

Catalogues still do what they always have done, bringing the brand and product selection into people’s homes, allowing them to shop as they choose. They also provide a more considered, but impactful, alternative to the ‘shout-out-loud’ marketing messages following people around the internet.

Precision’s Howard says of the catalogue: “It’s a great call to action – for example, you’ll only go online to buy if you know the item exists. If you Google something, you already know what you are looking for, but print can sell you something you didn’t know you wanted yet, which is absolutely key to retail.”

According to Marketreach’s research, print is now differentiating itself from digital through the use of taster catalogues and the adoption of long-term, brand-building tactics. Catalogues provide consumers with tactile experiences and they are increasingly vivid and targeted.

“There is a value in something you pick up and hold,” Holition’s Chippindale argues. “It is important that a campaign has good quality and enticing imagery – the quality of the creative is a big consideration in how well a campaign performs and how it influences product desirability.”

The journey of the catalogue in the home

Sixty per cent of consumers said they enjoy sitting down with catalogues and looking through them in their own time, while 48% said reading a catalogue is a way to escape.

“The catalogue is very tangible,” says Rogberg. “As an example, an Avon representative who is also a hairdresser started bringing people to her house to cut their hair during the pandemic. She left the Avon catalogue in the ‘waiting room’ and her sales took off.”

He adds: “People were sitting there, so they picked up the catalogue and then they placed orders through it. Rather than fiddling with your phone, the catalogue is there and is an attractive option.”

One 70-year-old woman from Manchester said: “When they first come through the door, I would make myself a cup of tea and sit down and, and just glance through them and then put them to one side for possibly when I’ve got a bit more time to have a proper look at them.”

This was echoed by a 59-year-old male from London, who said: “If they’re around, when I’ve got downtime, so if I’ve cooked dinner and I’m sitting down to eat, usually it’d be on my own. So if there’s anything like that, I would flick through it.”

Inspiring purchases

The consumers interviewed revealed how catalogues encourage then to make purchases.

One 42-year-old woman from Essex said: “If I’ve seen something which I think might make a good birthday present I’ll hang on to it to look further down the line.” Another woman, aged 29 and from Essex, talked about receiving a JoJo communication in the post and said: “I did flick through that catalogue and I saw something that was quite sweet actually. I went online and I did buy that for a friend of mine. It was her daughter’s birthday, so I bought that and sent it directly to her.”

A 41-year-old woman from London added: “If you get a really nice catalogue from a brand like Selfridges or Liberty, I love it. It makes me feel I’m part of something and they’re saying ‘you may like this’. It’s not something that I’d thought of buying but because it’s such a beautiful catalogue, I love looking through it.”

Most importantly from a commercial retail perspective, 76% of consumers said catalogues or product brochures give them ideas for things to buy, according to Marketreach, and 55% bought something they saw in a catalogue within the past year.

Offering a personal example, but one that supports the study’s statistics, Savvy’s Shuttleworth says: “I recently received a magalogue from The White Company with all its Christmas goods in it; there was a 15% voucher and a list for me to rip out and write what I want from it. I read it cover to cover and I will now go on The White Company website. I might have avoided it otherwise.”

Timeliness is key to catalogue success, she adds, saying they can work particularly well when sent ahead of peak events such as Mother’s Day, Father’s Day, Christmas, and – in the case of garden centres, for example – ahead of the summer.

Size matters

Many retailers and brands across the UK are still using approaches with a lot of product, however these are slimmer than the classic big books, Marketreach suggests. It adds that the ‘taster’ technique, whereby customers are encouraged by catalogues to explore the brand further by heading online or to stores, is well received by consumers.

As Marketreach’s senior communications planner Eve Stansell says: “A critical development in the evolution of the catalogue is how they are inherently more streamlined and focused on driving that website visit and sale. They are no longer a replication of the entire product line as the shopping journey continues online; catalogues offer that initial taste and encourage people to either purchase or engage further with your brand.”

A change in visual appeal and quality of catalogues has been noted by consumers, too.

Thirty-two per cent of them said they had received more visually appealing catalogues than five years ago, while 23% noted “higher quality” publications over the same time period. In addition: 42% of consumers said they had seen catalogues containing fewer pages than they did five years ago, while 39% commented on the size of pages being smaller

All of this speaks to the evolution of the printed marketing message – with brands learning from digital in adopting shorter, sharper messaging while realising the need to offer customers value at every touchpoint.

Rogberg says that finding the right balance for printed marketing material has become more difficult in the digital age, but if it is achieved it can be hugely powerful.

“Catalogues are the trigger to find the full range online or in the store where you can explore more,” he explains. “What you put in the catalogue is a smaller version of the range.”

Digital players want in

Etailers are using catalogues to reach wider audiences and drive purchases. In fact, such is the appeal of catalogues as a medium, even digital behemoth Amazon wants in.

For Christmas 2021, the retailer launched a Christmas Toy catalogue, complete with blank space for lists towards the front of the 70-page mailer.

It featured QR codes in the place of prices, encouraging parents to head online to complete their purchases. (For more on how QR codes are being used to innovate the catalogue experience, see chapter 5).

The idea, quite simply, is that physical catalogues stay in the home for long periods of time and present yet another way for Amazon to reach into the lives of consumers.

The sustainability consideration

A survey of 3,500 consumers by supply chain software provider Manhattan Associates released in October showed that 51% consider a brand’s environmental efforts important when choosing whether to shop with them.

That statistic suggests half of customers will have sustainability or the environment on their mind when shopping, making it crucial that retailers have the right processes and messaging in place to give the consumer the transparency they require.

In the wider context of shopping – particularly ecommerce — consumers view catalogues as one of the less damaging elements in terms of environmental footprint, Marketreach says. Instead, shoppers tend to consider the real offenders as excess/plastic packaging, unnecessary over-ordering and the related returns that accompany that consumption. Most catalogues are perceived to be recyclable with the ability to recycle more important than being made from recycled material.

Many businesses are now sending brochures ‘naked’ or with a compostable wrap – the National Trust is an example of the latter – while reduced size and pagination, as well as carbon-friendly inks, using data effectively to target mailings to the key audiences and more prominent reminders to recycle are advised if a brand wants to be considered eco-conscious.

Shuttleworth says retailers need to be aware of consumers’ growing sustainability concerns in their catalogue marketing strategy: “If you send them out too big or too glossy, you’ll be questioned.”

A 29-year-old woman from Essex explained why, for her, catalogues feel like a good choice: “It’s difficult, isn’t it? It’s not just about sustainability. Is it better for you to look through this and then put it into a recycling bin or is it better for you to be constantly glued to your phone? It feels a little bit more acceptable to flick through something like this.

“For example, I can sit here and look at this catalogue while my children are there, and they won’t think I’m ignoring them, but if I’m on the phone all the time, it’s not good for your mental health to just be glued to the phone all the time.”

The Retail Week view

When shopping online, often we need to know what we want in advance and search for that item.

A visually appealing catalogue can be inspiring, presenting a curated assortment to us that catches the eye and makes decision making easier.

Sustainability is a key consideration when sending printed communications to customers.

It is important to use sustainable materials, include messaging on how to recycle catalogues, and allow people to opt out if they prefer not to receive these.

The rapid pace of retail technology developments means big – and new – advances for catalogues. From augmented reality (AR) to virtual reality (VR), and the revival of QR codes, there are various ways new tech is combining with traditional print to compelling effect for the consumer and therefore the brands embracing these new techniques.

QR codes – for example – were one of the winning technologies in helping us through the pandemic. They found their use case in different scenarios, having been around for years without widespread take-up in retail.

From helping people to purchase goods from store windows, to their use as menus on pub and restaurant tables when social distancing was in place, QR codes now provide brands and retailers with a chance to help consumers ‘buy off the page’ in a more seamless way.

Crucially, they are presenting the opportunity for companies to better understand customers by tracking the end-to-end marketing to conversion journey. Howard says QR codes provide “a quick, deep link into digital communications” and, paraphrasing marketing strategist Mark Pollard, he says: “Covid did for QR codes what Pulp Fiction did for John Travolta.”

Zappar’s Stahel adds: “Printed catalogues drive a significant proportion of online sales, and mobile-friendly QR codes are increasingly appearing in catalogues to help consumers navigate more easily to the online listing and point of sale and tell brand stories behind the products that cannot be covered in the limited space in traditional printed catalogues.

"More excitingly, QR codes are being used to help consumers link quickly to immersive AR content and visualise products in their homes and overcome the ‘imagination gap’ helping them make a purchase with more confidence.”

ProCook chief marketing officer Angela Porter says the homewares retailer sees a tangible benefit from its marketing strategy to blend its catalogue and online channels: “In a world that is ever increasingly digital, catalogues and direct mail still have their place in the mix and manage to cut through. Recent testing showed us that customers who receive our catalogue along with emails are more likely to purchase, so for us it’s about sharing our range in the right way for the customer.”

She adds: “It’s important to us to share helpful content like recipes, how-to’s and videos with as many of our customers as we can. We’ve seen an increase in the demand for simple ways to access digital content from print such as QR codes, and we have made our digital online catalogue fully shoppable.

"Again focusing our marketing activity on making it easy for customers to access our content and shop our range how they want to."

TUI used QR codes to reach customers that prefer print to inform them of the latest travel advice during the pandemic

TUI used QR codes to reach customers that prefer print to inform them of the latest travel advice during the pandemic

What’s the reality?

As with ecommerce, catalogues face the challenge of consumers wanting to ascertain a product’s true quality and suitability. With the use of AR, catalogues can help solve this consumer knowledge gap.

Fifty-seven per cent of consumers asked by Marketreach said they would find it appealing if a brand or retailer offered them the ability to use their smartphone or tablet to scan and capture how a product in a catalogue might look in their home or when worn.

Consumers said the technology should be used for bringing the information in the catalogue into a space to confirm the decision, supported by further research if needed, and to see the latest deals and prices.

Such deployment would need to be seamless, they said, with many believing there is still some distance to travel to replicate in-person shopping via AR and VR.

Chippindale agrees that the digital capabilities do not exist yet for AR experiences to be offered for every product in a retailer’s catalogue, meaning if it is used today it is typically for “hero” or showcase products. “There’s some tech that needs to be invented and then there needs to be a conversation on how it’s applied so consumers get the benefit through a catalogue,” he says.

“Every year improvements are made but the development in this space is slower than I thought it would be. I thought it’d be commonplace five years ago.”

However, Chippindale predicts the use of AR will become “a hygiene factor” in retail, becoming a natural part of how the industry engages with consumers, but its rise in prominence may require it falling into the merchandiser’s budget rather than the marketer’s.

“If merchandisers see it is driving revenue, they’ll use it; the problem with AR being part of the marketing budget is this department is always looking at what’s new, so they’ll experiment in some catalogues rather than rolling it out.”

Research by Holition showed consumers want AR – for example, to try on several looks digitally while they are on the train home after work – but it is not at the level of adoption yet where it becomes a truly influencing factor in why they select a particular brand over another.

“It’s not that consumers don’t know about AR, it’s just not out there in enough scale for consumers to get on with it, understand it and expect it,” Chippindale argues. “AR in conjunction with a catalogue can be the last-minute check. [When the technology is at the suitable level] consumers will be able to use it to check if the product they propose to buy looks right.”

Further development in this field could feed into sustainability strategies; if a consumer can be more sure of the look, feel and fit of a product they are much more likely to buy the right thing the first time, which in turn leads to fewer returns.

Future innovation

As an alternative to AR, Chippindale suggests visual recognition technology is now at such a level of sophistication that it could be used by marketers via catalogues (see chapter four).

“Improvements in image recognition mean you don’t necessarily need QR codes all over the page – your mobile will relatively easily recognise images on a page whether it’s a product, a look, a gender, an ethnicity or an age demographic,” he says. “It’s getting quite sophisticated now, offering catalogue readers lots of trigger points to enter a digital world. All of that can be delivered using browsers rather than native apps.”

For Howard, brands should use the technology at their disposal to gain as much data about their target audience as they can. This is particularly important as third-party online cookie depreciation continues in the coming years.

He also suggests the next iteration of direct mail marketing could be combining the mini-catalogue or voucher booklet with a mobile app.

“Mailers could become menus and become a big part of the ordering pattern,” he explains, though he says even with sophisticated use of technology, the fundamentals of marketing must still be considered.

“Even if you use data science to make the campaign successful, there has to be a value exchange. People won’t scan codes or provide their data unless there is something for them. That might be a free gift, for example, and the price point has to be relevant too.”

The Retail Week view

Offering a quicker and better shopping experience is important to consumers. We have become very comfortable with QR codes since the pandemic.

They can be used effectively to take us to a product on a website to find out more detailed information, place an order or check whether an item is in stock.

This is a valuable way to bring together the online and offline experiences.

Technology enablement is hugely important, but retailers must also take into consideration less tech-savvy customers and those with disabilities

Ikea abandoned its catalogue in 2022 for sustainability reasons but it has encouraged customers to switch to using its app. Its latest app, Ikea Place, allows shoppers to see exactly how an item will look in their own homes.

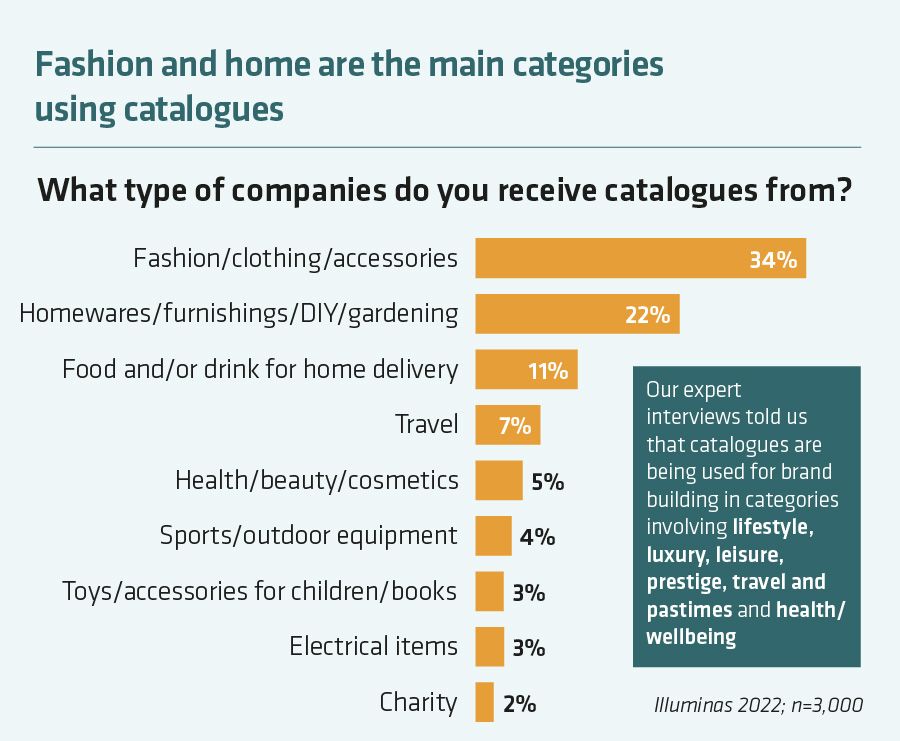

Multiple retail sectors are embracing catalogues to deepen their relationship with existing customers and to win new ones.

Fashion/clothing and homewares/lifestyle are the two categories using catalogues the most based on what consumers say they have received, according to Marketreach.

Thirty-four per cent said they had received marketing material from fashion or clothing companies and 22% said they had received homewares/lifestyle catalogues.

Despite the general state of the economy, many retailers reported a positive 2022 Christmas trading period. Several retailers exceeded downbeat expectations to report strong sales, encouraging momentum and — in some cases, including fashion and homeware retailer Next –

profit increases.

Sainsbury’s CEO Simon Roberts said “customers went all out for the big Christmas dinner this year after two years of less-than-normal Christmases”, while elsewhere in grocery Marks & Spencer reported its highest ever Christmas sales of £80m and Lidl attracted 1.3 million new food customers during the festive period.

Home shopping group N Brown, which owns brands such as Jacamo, Simply Be, and JD Williams, said sales were down but it added that customers were “more intentional in their spend during the period, buying what they need or what they love, with a greater focus towards either the value or premium end of our ranges”.

Majestic Wine’s sales rose 21.1% over the eight weeks to December 26, compared to pre-Covid levels in 2019, with the wine retailer achieving record market share. Meanwhile, Hotel Chocolat reported 10% like-for-like sales growth in the nine weeks to Christmas Day and Cornish fashion brand Seasalt hailed record in-store trading over Christmas. Overall sales across shops, online and marketplaces were up 15% in the five weeks to December 31.

Fashion retailer Sosandar also saw its sales surge across every product category and through its third-party collaborators, including John Lewis, Next and Very, with a 30% year-on-year increase for the three months to December 31.

Black Friday feeling extended to Christmas

Promotional activity was rife in the final quarter of the year, and financially-pressured consumers sought bargain deals in their numbers. It all kicked off with Black Friday in November, which was tipped to reach £1.7bn worth of sales, boosted by an extra £269m relating to the delayed World Cup being held at the same time.

There was a sense that with the triple whammy of Black Friday, the World Cup and the first proper Christmas since Covid, retail had the opportunity to create momentum for the golden quarter, even taking into consideration the cost of living crisis. Combining marketing and messaging was a good way to kick off the period.

The likes of Aldi and Sports Direct even managed to focus on football for their Christmas campaigns: Sports Direct featured only football players in its usually more diverse sporting stars advertising. Aldi released its Feast of Football advert with football-themed characters Ron-Aldi, Macarooney, Marrow-dona and Roy Bean alongside Christmas character Kevin the Carrot, and the World Cup and Christmas themes were carried through into the special buys catalogues.

Boots recorded its biggest Black Friday ever, taking over three orders per second for 14 hours straight online. A spokesperson for the retailer said that many consumers were using Black Friday to purchase much of what they needed for Christmas at lower prices and so Boots was offering its most affordable festive season ever. They added that the demand on Black Friday was fuelled by “customers wanting to buy presents for friends and family, but wanting to do it on a budget”.

Furniture and homeware retailer Dunelm, online fashion player Shein, and footwear specialist Schuh all recorded website traffic increases of more than 10% year on year during the annual sales event.

Retailers agreed this activity at the end of November created a halo effect that carried excitement into the build up to Christmas. For example, Roberts said that Sainsbury’s stablemate Argos’ Black Friday campaign, which drove 15,000 orders per hour on the day itself, stimulated bumper technology sales during the November period that then held through to Christmas.

Call it the last hurrah before a quieter 2023 as the cost of living crisis continues or proof of retail’s resilience in tough times; either way, the inflationary environment the industry is operating in means the cost of doing business is still greater than it has been for some time, which will bring ongoing challenges as the year draws on.

And that will call for clever tactics throughout the 12 months ahead, where a range of marketing triggers will be required. As we have seen from the success stories of the Christmas period from the likes of Argos, Hotel

Chocolat and Sosander, catalogue marketing can really help brands remain front of consumers’ minds and nurture good customer experiences to maintain growth in challenging times.

Print sets the scene for Christmas campaigns

Catalogues as a marketing tool probably reach their peak efficacy during the Christmas period as many shoppers are looking for gift and home decoration inspiration, and they perhaps remind some of their younger days when the toy catalogue through the door meant the festive period was coming.

As we learned in chapter two, two-thirds of consumers use catalogues or product brochures to give them ideas for things to buy and more than half bought something they saw in a catalogue within the past year.

Offering a personal example that supports the study’s statistics, Savvy’s Shuttleworth says: “I recently received a magalogue from The White Company with all its Christmas goods in it; there was a 15% voucher and a list for me to rip out and write what I want from it. I read it cover to cover and I will now go on The White Company website. I might have avoided it otherwise.”

Retailers and brands using catalogues to drive interest in their products in the run-up to Christmas included JD Williams and Emma Bridgewater, which both distributed enhanced festive publications.

Added extras

Innovation to entice and direct people from print to online was also seen for the festive period. Liberty, for example, included QR codes to take customers to products on its website where they could see more images and product information, with beautiful photoshoots to really make sure the items were seen in enhanced detail, as well as curated gift guides.

Argos also used this tool, often to take consumers to commercial videos of the products, and also included discounts and vouchers to engage browsers.

Enhancing the editorial value of its catalogue, and perhaps also tapping into the nostalgic sentiments of bygone Christmases, Loaf included wordplays on well-known festive themes and also a wordsearch puzzle.

Tailored for the times

Catalogues going out as the build-up to the festive season got under way, were tailored by some companies to fit the times. Robert Dyas, for instance, showed empathy with the embattled consumer by labelling its festive catalogue “Cut the cost this Christmas”, which played to the discount and value demands of UK shoppers in 2022.

Lakeland, which at the time of writing had not released its Christmas trading figures for 2022, used omnichannel marketing to its full potential by combining its annual Christmas catalogue with the marketing activity it undertook in store and online.

It was an example of a retailer placing the print arm of its marketing at the centre of its messaging, as it looked to capitalise on people buying homeware gifts at Christmas. The same branding, including colour tone and specific messages emphasising “The joy of Christmas” used in the catalogue were also present in its stores. Completing the consistent multichannel messaging triangle, Lakeland also included videos and images of people using the catalogue to plan their Christmas shopping in social media posts during the festive run-in.

Such a joined-up approach to marketing highlights, again, how it is not a case of either/or when it comes to digital or print material. A combination of both — supported by a store presence if a brand has one — is essential for promoting the right message during the all-important festive trading period.

This report shows overwhelming evidence that catalogues deliver powerful brand and sales success for retailers, even in an increasingly digital world.

Let’s take a moment to recap some of the key findings from the research. First, the physical nature of catalogues means that by virtue of living in a consumer’s home, the medium has a far greater chance of influencing purchase compared to online, where the message can be fleeting or overlooked and the competition is just one click away.

Secondly, catalogues have a cognitive and emotional impact, providing consumers with greater brand connection than the frenetic nature of the digital space.

Sixty per cent of consumers believe they receive too many emails but just 42% feel the same way about catalogues. This is a notable difference in the world of marketing. Once they have a catalogue, consumers spend on average 10 minutes reading it. The research found 76% of consumers say catalogues provide inspiration for things to buy.

As shown within the case studies in this report, many retailers are using data insights to make their catalogue content more relevant to customers.

Consumers find 69% of the catalogues they receive are relevant to them. However, particularly in today’s fraught market —in which retailers are coping with numerous headwinds from the pandemic fallout, the cost of living crisis and the increasing pace of digital innovation — ROI is critical.

The third key takeaway from this research is that catalogues are delivering tangible results.

In the fashion category, 68% of respondents took action after receiving a catalogue, while 35% looked at the sender’s website. Others spoke to family and friends about it, searched online or went into a store. In beauty, 66% of consumers acted after receiving a catalogue.

Catalogues are increasingly playing an immersive role in marketing strategies.

The buying experience is not linear and consumers crave both on and offline experiences. Retailers that understand this know that digital and catalogues can complement each other to drive short-term activation and longer-term brand building, providing a mix that maximises results.

QR codes are one example of how catalogues fit into the bigger picture, giving consumers that targeted but personal one-to-one offline experience but also gently directing them to the website to learn more about products, see the full range, make a purchase, or find a store to visit.

Marketers are faced with one of the greatest cost-of-living crises in a generation, where customer retention and loyalty will become critical. Tangible and trusted channels like direct mail and catalogues rightly earn their place in the mix to meet these challenges.

Partner viewpoint

Eve Stansell,

senior communications planner

Catalogues — the offline influencer

Mail Order. Magalogues. Look books. Catalogues. The channel has evolved but how does print impact your customers today and your business tomorrow?

As UK online retail sales have more than tripled in the past decade, brands must be front of mind to convert that search into a sale.

Catalogues and digital go hand in hand — in the past year, two in three catalogue recipients visited the brand website after receiving a catalogue.

We are proud to be partnering with Retail Week to bring an insight-based look at how, what and why catalogues powerfully deliver value for consumers and retailers in this highly competitive omnichannel world.

And while buying remains the critical measure for most marketers, there’s incredible value beyond the purchase. Catalogues have a positive brand effect, too, with 60% of consumers saying that they enjoy sitting down with catalogues and reading them in their own time.

This is a connection which supersedes the immediate sale. It’s a relationship which means your investment has longevity — catalogues improve ROI and generate more meaningful customer engagement. They are not a one-hit wonder, as most catalogues that are kept are revisited at least two to three times.

A powerful quote at the beating heart of this research: “Print powerfully brings the consumer into the retailer’s world. Digital paths allow the retailer to continue the conversation through the lens of the consumer's own world — on and off the retailer site.”

So, if print is the gateway, then QR codes have given marketers a key — unlocking both virtual doors and digital journeys.

With the potential of virtual reality and augmented reality largely untapped, today’s retailers have many creative ways to use catalogues to deepen the customer experience through more real-world visualisation. And the more real the experience, the less likely the return of a purchase.

This brings us to our planet and the challenges and many misperceptions for print. With sustainability at the core of our collective strategies, we’ve delved into attitudes to print, paper, recycling and general wastefulness. And the findings might surprise you.

Catalogues by their very nature are data driven and targeted so inherently less wasteful. They are also more streamlined and sustainable thanks to product innovation with an increased focus on paper biodiversity.

These more environmentally friendly materials, however, don’t compromise creativity or quality, which is a clear win for the double bottom line.

Whatever their name or guise, the evidence is compelling — catalogues make a powerful impact in today’s world. And retailers can deliver this rich experience into the very homes of the customers who make an impact on them and their businesses.

Royal Mail and the cruciform are trade marks of Royal Mail Group Limited. © Royal Mail Group Limited 2023. All rights reserved. Royal Mail Group Limited, registered in England and Wales, number 4138203, registered office: 185 Farringdon Road, London, EC1A 1AA

Report produced by:

James Knowles

Report editor and head of content innovation, Retail Week

Ben Sillitoe

Writer

Stephen Eddie

Production editor, Retail Week

Rachel Horner

Subeditor

Sam Millard

Designer

Matt Macdonald

Business development director, Retail Week