Can robots help run your business?

The rise of the machines should be embraced rather than feared

Robots are no longer science fiction. They’re here and they’re fast being adopted into the workforce.

In retail, robotics and automation are already being used to power warehouses, serve customers and deliver parcels and, in some cases, are unlocking real cost savings and valuable customer insight.

In this special report, Retail Week looks at the far-reaching impact of robotics across retail and looks at what retailers should be doing now to prepare for the new wave of automation.

Read on to find out how robots are being used in stores, warehouses and the delivery network and what lessons have been learned from the early adopters.

Join the conversation…

What does the future hold for robots in retail? Join the conversation on our social media platforms:

ROBOTICS – THE POTENTIAL FOR RETAIL

Robots make people nervous.

There is the well-trodden existential anxiety about whether they can be trusted, which has given science fiction ample material over the last century.

For every helpful C3PO-style droid gamely helping Luke Skywalker navigate the Death Star, there’s a hair-raising counterpart, from Arnold Schwarzenegger’s Terminator to the murderous android Ash in Alien.

But for the retail sector the hum of anxiety about what robotics and automation will mean for people, and specifically their jobs, is more than hypothetical.

Two years ago, Deloitte forecast that there were 2.1 million jobs across retail and wholesale that have a “high chance” of being automated over the next two decades.

Since then automation has continued to gain momentum.

“Sooner or later, our entire industry will be operated by AI and robots, not humans”

Retail bellwether and pacesetter Amazon has 100,000 robots working across its warehouses. Ocado has lured a clutch of international retail partners through its Smart Platform, which includes robot-powered fulfilment centres.

Earlier this year Shop Direct unveiled plans to develop a 500,000 sq ft, purpose-built automated warehouse to speed up the pace at which orders are processed and delivered to customers. This has led to 1,500 redundancies.

Speaking at World Retail Congress in April, Chinese etail giant JD.com’s chief executive Richard Liu said: “Sooner or later, our entire industry will be operated by AI and robots, not humans.”

So is the doomsday narrative that robots are taking over retail accurate?

The answer is yes – but that may not be such a bad thing.

Bruce Ackman, industry and energy commercial lead at Cambridge Consultants – the technology firm that partnered with Ocado to develop its robotics-enabled warehouses – says: “We’re trying to displace the fact that humans are no longer interested in certain kinds of work.”

Walmart has introduced shelf-scanning robots into 50 of its stores

Walmart has introduced shelf-scanning robots into 50 of its stores

Chief technologist of Amazon Robotics Tye Brady agrees: “When there are tens of thousands of orders going on [in our warehouses] simultaneously, you are getting beyond what a human can do.”

When deployed correctly, robotics and automation have the ability to gather vast amounts of data quickly and accurately, and can complete repetitive tasks more speedily and cheaply than humans are able to.

There are cases when that has worked for the staff employed directly alongside the robots as well as the retail leaders trying to drive cost efficiencies.

According to Forrester Research, empty shelves cost retailers 4% of their revenue globally each year – so an automated process that can alert staff to these issues efficiently could make a real impact to the top line.

Repetitive tasks and freeing up human resources

Robots are being designed and deployed across retailers to deal with a host of menial and repetitive tasks that businesses either cannot motivate or afford to pay staff to do.

From a customer-facing perspective, they are designed to augment the customer experience rather than replace staff altogether.

German retailer MediaMarktSaturn has deployed customer service robots in store since 2016. Chief innovation officer Martin Wild, who discussed how robots will transform retail at Retail Week’s Tech. event, says they are a valuable tool in the firm’s customer experience arsenal.

“Robots are a way to relieve our staff of routine tasks,” he says. “Our staff have more time to invest in giving personal advice and support to our customers.”

Waymo’s driverless car

Waymo’s driverless car

In the UK, where the government supports having “fully driverless cars” on the road by 2021, it is undeniably a case of when, not if, shoppers’ online orders are delivered by autonomous vehicles.

Academy of Robotics founder William Sachiti, who also spoke at Retail Week’s Tech. event, says: “Autonomous delivery will see necessary items such as bread and milk put in cars for delivery at the click of a button on an app.

“This is not done today because of the human expense, but an autonomous car that costs less than 1p per mile will revolutionise this space.”

This report delves into how robotics and automation will impact stores, warehouses, delivery and customer service, which sectors will be most affected and what retailers should do now.

Whether it’s freeing up stretched store staff’s time to answer customer queries or dealing with staffing issues in your fulfilment centre, the question might soon stop being whether you should use robots in your retail operation, but whether you can afford not to.

ROBOTICS AND THE STORE

The pressure on the UK retail industry has been well documented as national living wage hikes combine with business rates to make running a store more costly than ever.

In the last two years, redundancy rounds across retailers’ store staff have become commonplace, with customer-facing roles comprising the bulk of the 50,000 job cuts made across the sector so far this year.

Sainsbury’s, Tesco, Asda and Wilko are just a handful of the businesses to have axed shopfloor staff over the last 12 months.

Some retailers have turned to robotics and automation as a way to maintain the level of in-store service with fewer staff on the shop floor.

US grocery giant Walmart is one retailer that has deployed in-store robots in 50 of its shops.

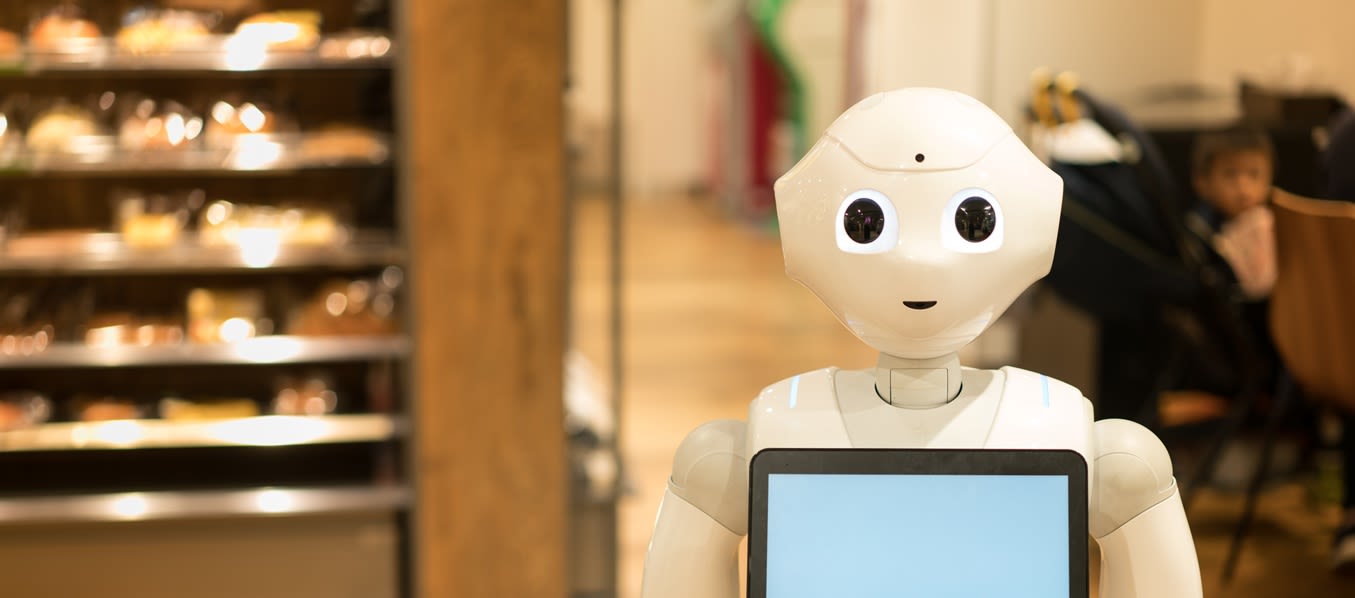

These robots, developed by San Francisco-based firm Bossa Nova, are not the hand-shaking, cartoon-like robots, such as SoftBank’s Pepper, which are more fodder for in-store selfies; instead they supercharge productivity.

The Bossa Nova robots are not designed for shopper – or employee – interaction. Instead, the machines scan supermarket shelves to pick up on a host of issues ranging from incorrect pricing of products, stock shortages and even the distance between products.

One UK grocery executive tells Retail Week there are “about 30 different reasons why a colleague might visit a shelf edge” in a supermarket store and this technology offered “all the back-end benefits of Amazon Go’s technology, which are just as impactful on the overall customer experience”.

“We’re seeing the technology emerge at a reasonable price point where we could start thinking about actually automating physical tasks in-store,” he adds.

Return on investment

As technology investments go, robotic shelf scanners are relatively lightweight because they do not involve infrastructural changes to the store.

Bossa Nova chief technology officer Sarjoun Skaff tells Retail Week: “This is an investment that allows [retailers] to restock a shelf faster, which leads to an increase in sales, which offers a very quick return on investment.

“The role of technology in retail is to pinpoint these centres of inefficiency and then inject data or automation to improve those efficiencies.

“Everybody wins – the employees get to do their job better and spend their time selling, the store is more efficient so there’s less inventory in the back room and the shopper finds what they’re looking for faster.

"Bossa Nova’s robots are 50% more productive than human store staff"

Walmart chief technology officer Jeremy King says Bossa Nova’s robots are 50% more productive than their human store associates and scan shelves up to three times faster, with a significantly higher level of accuracy.

US retailer Lowe’s shelf-scanning robot, called the Lowebot

US retailer Lowe’s shelf-scanning robot, called the Lowebot

Furthermore, the level of data collected by these robots could have tangible impacts on a store manager’s wider strategy.

One grocery executive says while some processes such as checking for out of stock products are currently carried out once a day, others, such as checking a shelf is planogram compliant, only take place every few months.

“Once you start getting that data two or three times a day it could be a real game changer,” says Cambridge Consultants industrial and energy lead Bruce Ackman.

He explains that getting accurate information on the stock on a retailer’s shelves could influence how a store manager lays out products, staffs the store for peak periods and reorders products, as well as increasing the relevance of promotional offers.

Doing the shopping for customers

Shelf scanning and price checking may drive efficiencies, however robotics could transform the customer’s shopping experience.

Javelin operations director Will Treasure says robotics could do the customers’ shopping in-store.

He explains that shoppers could enter a list of items into a machine upon entering the store – the household staples, or “the most boring part of the grocery shop” – to be fulfilled automatically while they’re shopping for fresh products.

However, Treasure says supermarkets would need to be reconfigured into two sections – ambient, uniform-sized products, and fresh – with the ambient produce auto-replenished at the back end of the store.

Treasure stresses that this model would require grocers to “rethink the whole role of the store” but believes it has “the potential to be as impactful as self-checkout has been on the grocery shopping experience”.

The Amazon Go store in Seattle, Washington

The Amazon Go store in Seattle, Washington

Amazon Go – the etail giant’s checkout-free shop – shows that if a store is purpose-built to be automated, it can dramatically improve the convenience of a shopping trip for customers.

But retailers will need to consider whether the costs associated with retro-fitting their existing store estate to add a greater level of automation to the shopping journey is a worthwhile investment.

One senior grocery executive warns that the costs associated with retro-fitting stores would be steep.

“Shelves and layout of goods have been done either with the idea of how people working there will do those tasks or with what makes sense for the customer in mind. The way to make it most efficient for automation purposes is unlikely to match up with either of those visions,” he says.

In the meantime, Skaff says there are less costly changes retailers can make to make the in-store shopping journey more convenient.

He explains that Bossa Nova is considering linking the data its robots collect while scanning shelves to Walmart’s mobile app, allowing customers to map the most efficient route of the store based on where the products on their shopping list are located.

The potential of automation to transform how shops are run is massive. The challenge for retailers lies in deciding whether they want to prioritise operational efficiencies, customer experience or both – and how much they can invest to make that vision a reality.

Are customer service robots just a gimmick?

Customer service robots, such as Softbank’s Pepper, have proliferated in recent years. However, many are not yet convinced of their efficacy, with one retail executive dismissing them as “broadly useless”.

These robots have been developed by a host of firms including Orchard Hardware, Softbank and Unity Robotics, and boast skills ranging from understanding and answering customer queries in multiple languages and guiding them to items in store – all while collecting data.

US homeware retailer Lowe’s rolled out a customer service and shelf-scanning robot in 2016 called the Lowebot.

Cambridge Consultants industry and energy commercial lead Bruce Ackman thinks the technology has intriguing implications for retail service more widely.

“In big-box stores there is a dearth of store staff – I have to go looking for sales staff to ask a question to. What the Lowebot does fills a function. It’s a bit of a novelty right now but every interaction with a consumer and transaction is captured,” he says.

“The value and game changer that these kinds of systems offer is in the rich data they will collect, which will then be imported into an analytics engine to constantly improve customer interactions with the Lowebot.

“It’s not the function of the robot itself but how the robot interface and data collection allows retailers to improve customer experience, inventory management and the efficiency of store operations.”

It’s worth noting that since the Lowebot was originally rolled out, its use has pivoted away from customer service to shelf scanning exclusively – indicating that to get the most benefit from a robot it is probably best not to ask it to multitask too much.

German electricals chain MediaMarktSaturn has deployed a host of robots across its stores, including Pepper and Paul the robots, developed by Unity Robotics – and chief innovation officer Martin Wild stresses that the technology fits perfectly into the firm’s wider strategy.

Paul the robot in Saturn stores

Paul the robot in Saturn stores

“In our view, it’s much more than just a gimmick”, he says.

“Saturn’s brand promise is ‘live and experience technology’ – and our robot assistants are helping us put it into action. Many of our customers see a robot or at least interact with one for the very first time in our stores. It’s a great experience which they associate with the brand. Furthermore, the robots will learn quickly and therefore will help our customers on many more occasions in the future.”

Wild adds that, as well as being a draw for first-time customers to visit MediaMarktSaturn (some customers are said to have travelled hundreds of miles to its stores just to see the robot) the machines are interacted with regularly by returning customers.

“This positive response shows we’re on the right track with our strategy regarding new technologies: test quickly, learn quickly and adapt even quicker,” he says.

Wild says it has encountered challenges such as speech recognition in a noisy environment but it is constantly improving the robots.

One of the key uses of customer-service robots is to take shoppers directly to the product they are looking for – which is an increasingly common source of frustration given shopfloor job cuts.

However, Bossa Nova chief technology officer Sarjoun Skaff is unconvinced this technology has tangible benefits.

“I’ve not seen any compelling reason why that automated shopping assistant makes sense,” he says.

“Do you really need a robot walking ahead of you [to locate a product]? In one day it reduces the friction of downloading an app, but on the other hand the interaction is still kind of broken because the maturity of technology is not sufficient to keep people engaged.”

Next steps

- Assess whether you should be using robots in your store. For retailers with a lot of uniform products, such as electrical, DIY and grocery chains, this technology can be quickly deployed. But for retailers without consistent RFID tagging, such as fashion businesses, shelf-scanning technology is not as scalable.

- Speak to US start-ups and UK tech firms now about deploying this technology in your store on a trial basis. Set-up costs will be low and major technology suppliers such as IBM, NCR and Microsoft are likely to be developing their own versions of shelf-scanning robots now.

Who to speak to:

Bossa Nova – The market leader in shelf-scanning robots, which is working with Walmart.

Fellow Robots – This robotics firm developed the Lowebot for US home and DIY chain Lowe’s. As well as shelf-scanning capabilities, this robot has customer-facing capabilities, can speak in multiple languages and take a shopper directly to the product they are looking to find.

ROBOTICS AND THE WAREHOUSE

There are myriad aspects of a retailer’s operation that will be impacted by robotics and automation. However, to date the supply chain – and warehouse specifically – is leading the race in terms of automation and innovation.

“There’s a massive spike in demand for robotics in distribution centres. The level of automation and sophistication going on inside the warehouse to improve performance is really quite staggering,” says Cambridge Consultants industry and energy commercial lead Bruce Ackman.

Ocado’s 4G-enabled fleet of warehouse robots navigate a grid the size of three football pitches

Ocado’s 4G-enabled fleet of warehouse robots navigate a grid the size of three football pitches

A handful of innovations in this space include autonomous ground drones that move towers holding products through a warehouse, robots that can climb shelves to collect out-of-reach items and Ocado’s 4G-enabled fleet of robots, which autonomously navigate a grid the size of three football pitches to assemble 65,000 orders a week.

One retail executive suggests one of the motivating factors behind the pace of innovation across retail warehouses is that their logistics networks are not visible to the public.

This means robotics solutions can be implemented without having to factor in customer reaction and uptake.

Cutting operational costs

Deploying robotics across a retailer warehouse is an undeniably effective means of cutting operational costs.

Hui Cheng, Chinese etail giant JD.com’s head of robotics research and former Amazon Go engineer, says that logistics is the most labour-intensive part of an ecommerce retailer’s operations, which means it is essential to keep a lid on costs.

Cheng says that JD.com has 30,000 warehouse workers across its 500 plus warehouses, and 40% of the costs incurred within its supply chain operation are associated with paying staff.

With the long-term aim of decreasing this expenditure, JD.com has developed 15 highly automated warehouses across China including one fully automated warehouse in Shanghai, which it claims is the first of its kind in the world.

JD.com is aiming to sell its automated warehouse solutions to third-party retailers in the future, like Ocado has successfully done to a tranche of retailers around the world.

The challenge of picking and packing

Robots are used to increase efficiencies in two main areas of a retail warehouse operation.

The first is mobility – moving a product from point A to B – and this technology is already deployed in a variety of retailers’ warehouses including Ocado, Amazon and Alibaba.

The other aspect is manipulation – the ability to identify a product and then handle and pack it correctly.

This is something that is entirely intuitive to the human hand and eye, but it is a crucial process that no technology firm has yet been able to replicate through robotics.

There are a variety of solutions out there including an electrostatic mop device that drapes itself over a product in order to move it without damaging it, to human-like robotic gripping hands with two, three or five digits.

But there is no robotic product available on the market that can manipulate products at the picking and packing stage faster and more accurately than a human can.

This is particularly pertinent to fresh food items, such as bananas, which can be easily damaged if handled incorrectly, or fashion items that can be creased or torn.

The subtle differences in sizes of clothing and fresh food products also present a challenge for robot hands to correctly identify and therefore handle in the right way.

Alibaba’s warehouse robots

Alibaba’s warehouse robots

Uniform products such as tinned food or smartphones can be picked and packed by robotic hands much more efficiently – but the fact that this sizing isn’t universal across all products means the final process of picking and packing before they are sent out to a customer still needs a human eye and hand in every retail warehouse.

Amazon hosts an annual ‘picking challenge’ with robotics start-ups in an effort to solve this problem. This is testament to the fact that the business that cracks it will have the silver bullet in automated warehouse technology on their hands.

“Human hand-eye coordination is still the best for doing that task because of the wide variety of objects that need to be grasped,” says Ackman.

Once a robot hand is developed that can pick and pack a variety of products with greater speed and accuracy than a human, the challenge for retailers will be ensuring the deliveries they receive from their suppliers are packed in a way that a robotic hand can unpack for individual customer orders.

Warehouse robots will also need to pack products destined for stores in a way that can be most efficiently unpacked by shopfloor staff who need to restock shelves.

“The way in which things are optimised for [unpacking to] the supermarket world isn’t necessarily the best way for an automated warehouse to receive them,” says Ocado chief technology officer Paul Clarke.

“There’s a tipping point we have to get to where the online world dictates the way in which things are packaged and put on pallets to make it easier to automate. I suppose for supermarkets and stores to become fully automated there will be common standards, but that’s a challenge between the old and the new world.”

Retail warehouses may be more highly automated than the rest of its operations, but the hurdles it faces for full automation are still significant.

However, as one retail executive pointed out, so are the rewards.

“There’s a lot of challenges there but every year we spend millions packing online orders, so the goal and the business benefit in terms of the amount of money you could save [by automating warehouses] is there,” he says.

Next steps

- Decide whether automation is suitable for the products in your warehouse. For electricals and grocery retailers with a high level of uniform products automation is straightforward. But for fashion retailers, the technology available to pick and pack products is not advanced enough yet.

- Make contact with the companies trying to make automation possible across all product types to enable speedy rollout when a solution is developed.

Who to speak to

Common Sense Robotics – This Israeli start-up raised $20m in a funding round at the beginning of this year and has combined AI and robotics to create a series of machines catered to different tasks around the warehouse, from store products to identifying and bringing the right ones to a human packer.

Right Hand Robotics – This hand-picking robotics firm has combined manipulation and mobility technology with 3D computer vision, machine learning and embedded sensors to create machines that understand how to handle different products better the more it processes them.

Locus Robotics – This robotics firm has designed a robot to work alongside human warehouse employees without the need to redesign a retailer’s existing warehouse. The firm claims its technology can speed up processing ecommerce orders by between three to five times. As there is still human involvement, this could be a good solution for a clothing retailer or one that wants a cost-effective way to make its warehouses more efficient.

ROBOTICS AND DELIVERY

The potential disruption of autonomous vehicles on retail deliveries has garnered its fair share of media attention, which has only increased since chancellor Philip Hammond unveiled an ambition for “genuinely driverless cars” to be on the UK’s roads by 2021.

Speaking on Radio 4’s Today programme last year, Hammond said: “[Autonomous driving] will happen, I can promise you. It is going to revolutionise our lives, it is going to revolutionise the way we work. And for some people this will be very challenging.”

Hammond even urged employers to retrain staff who drive for a living to take up new jobs in their business over the next two decades.

Retailers including Ocado, The Co-op and Tesco have been preparing for this with trials delivering grocery by robots through tie-ups with suppliers including Starship Technologies and Oxbotica.

These trials involve autonomous ground vehicles (AGVs), which vary in size but are smaller than a standard car, delivering small orders of convenience products. The AGVs are equipped with computer vision enabled cameras and AI capabilities that allow them to brake when they reach a crossing or cross path with a pedestrian.

They typically travel at the pace of a brisk jog (around 4mph) and deliver groceries to shoppers within a short radius of a store, from which orders are fulfilled.

Shoppers are then alerted when the AGV is outside their home and remove their order and take it inside themselves.

Another autonomous delivery option being deployed by retailers including Amazon and JD.com is drones, which fly from a retailer’s warehouse to a pre-determined destination to deliver a shopper’s order.

These self-driving drones fly on a pre-programmed flight path and are typically used to deliver products in relatively remote destinations – Amazon has delivered a bag of popcorn to a shopper’s large garden in Cambridge, while JD.com delivers via drone to a small mountainside town in rural China.

Drones could bolster the UK retail and wholesale economy to the tune of £7.7bn, the largest across all business sectors, according to a report by PwC released in May.

Meanwhile, AGVs have the potential to cut overheads for retailers as they do not have to pay for labour.

This might make it possible for retailers to scrap – or at least lower – minimum order values and delivery charges, which may encourage shoppers to make more online purchases.

Nevertheless, many are dubious that autonomous vehicles will revolutionise retail delivery.

Cambridge Consultants industry and energy commercial lead Bruce Ackman says: “I don’t think automated delivery systems will be as impactful as other means of human conveyance and piggybacking on the rideshare mentality, which has gained momentum in recent years.”

Pedestrians, potholes and policy

There is a lot of work to do make AGVs fit for purpose across all types of roads. They are currently only being trialled by grocers in flat, well-paved and heavily pedestrianised areas such as Milton Keynes and Greenwich, south London.

Navigating the realities of roads throughout the UK, from poorly displayed road signs to potholes, will be more difficult, which makes a wider rollout of delivery AGVs across the country unlikely in the next few years.

Reams of legislation need to be navigated before autonomous vehicles can share roads with traditional cars – ranging from liability in the event of an accident to ensuring vehicles powered by AI cannot be hacked.

All these issues, alongside public perception of sharing roads with self-driving vehicles, will prohibit mainstream adoption of this technology.

Cost savings

Despite these obstacles, Academy of Robotics founder William Sachiti says autonomous delivery will appeal to retailers because of the cost savings it will open.

"AGVs will cost retailers less than 1p per mile"

Sachiti claims that deliveries using an AGV will cost retailers less than 1p per mile, bolstered by the fact that they will not have to pay a delivery driver to fulfil the orders delivered using these devices.

One grocery executive concurs: “If you could do home delivery of shopping for under a pound, customers and retailers alike would bite your arm off for it.”

He adds that, unlike in the store and warehouse where the adoption of robotics inevitably leads to a difficult conversation about job losses or reduced recruitment drives, automating the last-mile opens up a new revenue stream without impacting a retailers’ existing employees.

“There’s nothing in the market that currently does that at the moment, unless you want to pay £8 for a man on a scooter to deliver you a pint of milk,” he says.

“It doesn’t feel like a bad news story in any way.”

Can robot delivery become mainstream?

It may not be a bad news story, but is it a feasible one?

Automated grocery delivery trials in Milton Keynes and Greenwich are one thing but, in order for last mile robot delivery to become mainstream, the technology needs to fit seamlessly into bustling streets across the country.

JD.com was navigating this challenge in China as it rolled out AGVs on a handful of the country’s roads and university campuses last year.

Its vehicles have accrued 17,000 hours of test drives on public roads to date – but JD.com’s head of robotics research Hui Cheng admits that there is much more work to be done.

Cheng says the technology needs to learn how to behave around humans in a polite way – such as not barging between two people in the street who are engaged in conversation just because it could fit between them.

“That’s a part of socially acceptable behaviour, so we are working to make sure our AGVs will deliver a product without making life difficult or inconvenient for anyone around it,” says Cheng.

JD.com is also rapidly developing air drone technology to deliver products to shoppers in remote areas of China. To date, it has seven different commercial delivery drone models and has completed 300,000 deliveries over a distance of up to 15 kilometres.

"300,000 – the number of drone deliveries JD.com has carried out in China"

The online retailer is also developing a drone model designed specifically to transport products between its 500 warehouses, which will be able to move as much as five tonnes at a time.

Disrupting the delivery status quo in the UK

For a retailer operating in a country as vast as China, investment in air drones may have real potential to change how shoppers living in remote areas receive products.

However, Sachiti thinks that in the UK, autonomous road vehicles have far more potential to transform the delivery status quo.

“Autonomous vehicles will disrupt the everyday purchases of low-cost items, which means you don’t need to go to the shop on your way home from work,” he says.

“Because we know what people buy and when, you can use algorithms to know what to stock in these self-driving vehicles.”

Sachiti says these vehicles will operate like Deliveroo and bring products shoppers want right now to their front door.

Ocado chief technology officer Paul Clarke points out that ensuring autonomous vehicles enhance a retailer’s delivery offer without clogging up busy roads or pavements will also be no mean feat.

“There is no doubt that the technological challenges we face would be reduced if overnight we could replace all vehicles with autonomous vehicles, whether that be on land, sea or in the air.

“They could communicate with one another, trust one another, be more predictable in their actions and adherence to navigation rules and be centrally orchestrated,” he says.

“But clearly that’s not going to happen. So autonomous vehicles are going to have to be smart enough to contend and co-exist with their human-driven counterparts and that means that as the percentage of autonomous vehicles increases, we will eventually reach a tipping point where, ironically, they can become more stupid again.

“To help us get over this tipping point, we need to consider what communication and sensing we may need to add to conventional vehicles in order to help them play nicely with autonomous vehicles and the supporting infrastructure.”

Clarke adds that multimodal autonomous vehicles that deliver products for multiple retailers or sectors simultaneously could be a good way of increasing the adoption of autonomous vehicles without overloading roads and delivery networks.

More than in any other part of the retail operation, retailers will have to collaborate to reap the rewards of automated deliveries – be it with legislators, technology suppliers or other retailers.

Whether it’s about eliminating the Friday night wine run for shoppers or dramatically reducing the costs of delivery, the benefits of getting it right speak for themselves.

Next steps

- Assess whether automated delivery could improve your existing delivery proposition. It is likely to impact sectors where regular repeat purchases are common most dramatically – so grocery is the most obvious sector that should be gearing up for it today.

- Consider cross-sector implications: are there other businesses with a similar reach and logistics network that could be collaborated with when developing or deploying automated deliveries?

- Reach out to automotive and ride-hailing power players. Businesses ranging from Mercedes Benz to Uber are developing autonomous vehicles, so fleshing out what their development means for the retail sector is vital.

Who to speak to

Starship Technologies – This firm was founded by two of Skype’s co-founders, Ahti Heinla and Janus Friis, in 2014. It develops AGVs designed to “revolutionise neighbourhood deliveries”. The firm has partnered with companies including The Co-op, Tesco and Just Eat and plans to roll out a 1,000-strong fleet of AGVs across 20 university campuses in the UK, US and Germany to deliver items to shoppers.

Oxbotica – This UK-based firm tied up with Ocado on its robot delivery trial in Greenwich. Its primary product is called Selenium, which is effectively the brain that allows a vehicle to reach a destination autonomously and can be applied to all things that move. The technology is designed to learn, so it can better navigate journeys the more miles it notches up.

Nuro – This company develops autonomous vehicles that are designed to drive on roads alongside other cars. The company was founded by two ex-Google engineers and has partnered with US grocery giant Kroger to develop its same-day grocery delivery proposition.

Can robots help run your business?

Written by Grace Bowden

Produced by John Beaumont