Artificial intelligence (AI) has been the technology on everyone’s lips over the past two years, skyrocketing in the past six months as generative platforms catapulted it from back-office assistance into front-page hype territory. But, beyond all the excitement, how is it being used in retail – and how might it change the industry in years to come?

As Beyond the Hype, produced in partnership with Braze, will explore, the answer to those questions is wide-ranging.

AI has the potential to change every part of retail, offering what feels like near-endless opportunities, but implementing it comes with its challenges, too. Many retailers have struggled for decades to find the skills they need when it comes to technology and data, and AI is no different.

It is crucial that retailers dive deep into the technology’s potential

For those eager to win the race to seamless AI integration, implementing at speed is often the first hurdle. While operational implementation cannot happen overnight, neither can the information-gathering process needed to feed AI models.

What you put in has a transformational impact on what you get out, making data quality another key piece of the puzzle for retailers keen to get ahead. As this report will explore, data must be comprehensive, accurate and relevant, and teams need clear plans in place to regularly audit and identify outliers and anomalies.

Data security and privacy must also be top of mind for retail’s legal teams. With regulation yet to catch up with the pace of change, ethical decision-making now is key to avoiding costly changes in the future.

There are other hurdles to contend with: a lack of trust in AI, fears around job losses and concerns about transparency, with data from shoppers and staff supporting these concerns. KPMG UK polled 3,000 UK consumers in May 2023, finding that 82% report a concern or barrier to using AI, with a third of them most worried about data privacy.

A Retail Week study earlier this year found that 19% of store staff are worried about the pace of digital change, with concerns that technology may put them out of a job or not help them to complete tasks more effectively.

But, as the experts we’ve spoken to throughout this report emphasise, such challenges are definitely surmountable – and the opportunities offered by AI make it worth the effort to do so.

As AI continues to change the retail sector, there are two key points to remember. First, retailers must keep a clear strategy in mind as they navigate the AI landscape, choosing investments wisely and picking those that will impact the bottom line by solving problems for customers or staff.

Second, they must keep people front of mind, with a need both in the UK and worldwide to prioritise the workforce as AI enters the mainstream.

Finding ways to use AI that combine human expertise with the technology’s far-reaching potential will enable retailers to make staff’s lives easier, solve customer pain points and operate more efficiently.

AI has moved beyond the hype, as this report will show, so it is crucial that retailers dive deep into the technology’s potential.

Few technologies have caused more excitable furore than AI. Having slowly gathered momentum in retail over the last decade, hype around the technology reached a new peak in 2022 with the launch of free-to-use generative AI platforms.

As everyone from businesses to consumers to journalists experimented, both excitement and scare stories reached a fever pitch. But hype is rarely an accurate indicator of a technology’s true impact.

So what actually is AI? How has it impacted retail to date and how is this impact expected to change in the near future?

As with many advanced technologies, the basic concept is simple.

“AI is the ability of computers to learn and generate outcomes from data inputs without direct human instruction”

Outgoing Ocado Solutions chief executive Luke Jensen, who has overseen major investment in AI as boss of the grocer’s tech innovation arm, puts it neatly: “When the tech industry talks about AI and generative AI, we’re talking mainly about machine learning.

“In essence, this is the ability of computers to learn and generate outcomes from data inputs without direct human instruction.”

Traditional AI includes solutions such as advanced data analytics, chatbots and warehouse robots. The technology can analyse vast amounts of information and make predictions or recommendations, problem-solve and/or make decisions.

Generative AI, meanwhile, “involves generating new content, such as images, text or videos, that is – in theory – indistinguishable from human-created content,” says Catriona Campbell, client technology and innovation officer at consultancy EY.

“One example is the creation of realistic product images for ecommerce websites, which can be used to showcase merchandise that hasn’t been physically produced yet.”

Wide range of uses

As AI becomes more advanced, more affordable and easier to use, it is impacting a growing range of areas in retail. Common industry applications in 2023 include marketing, customer engagement, warehousing and customer service.

A 2023 Gartner poll of more than 2,500 executives across industries found that 38% say customer experience and retention is their primary use of generative AI, followed by revenue growth (26%), cost optimisation (17%) and business continuity (7%).

A quick glance at some of retail’s recent uses of AI gives an idea of what this broad application looks like in practice.

At Kingfisher, AI is being used to provide a more personalised shopping experience at its brands Screwfix and B&Q, with a marketing automation platform launched in 2022 to tailor email communications, app notifications and in-app messaging.

The business partnered with customer engagement specialist Braze, commenting in its 2022-23 final-year results that the technology had helped accelerate progress in data capabilities and develop more “personalised customer interactions”.

Also focusing on customer experience is beauty brand Estée Lauder. Its Clinique Lab, launched in March 2023, takes a different approach entirely. It offers a metaverse space where customers’ avatars can access Skin School videos, chat with a consultant, purchase products and collect discounts. Through uploading a quick picture, customers can benefit from cosmetics recommendations for their skin through the brand’s AI-driven diagnostics tools Clinique Clinical Reality and Foundation Finder.

Kingfisher partnered with customer engagement specialist Braze, commenting in its 2022-23 results that the technology had helped accelerate progress in data capabilities and develop more “personalised customer interactions”

The lab was an expansion of the brand’s tech capabilities, with Estée Lauder having launched a “first-of-its-kind” AI-powered beauty app for visually impaired users in January.

In June 2022, Ikea also delved into at-home customer engagement, launching its AI-driven, digital home-design experience Ikea Kreativ. Using either its desktop site or the Ikea app, customers can create 3D replicas of their homes, which they can then add Ikea products to. All rooms are stored in the cloud and can also be accessed in store, with the aim being to bolster customer confidence and incentivise purchases.

And it’s not just online. Looking to bricks and mortar, Currys rolled out KettyBot robots in January 2023 that help customers navigate stores. Once a customer picks the item they are looking for on the robot’s screen, it guides them to it, enabling staff to spend time with customers who need more expert advice, improving their in-store experience.

AI’s impact reaches the supply chain, too, underpinning fashion pureplay Shein’s ability to offer a diverse range of styles for shoppers. Through analysing data such as web searches and social mentions, the brand gets an early sense of new trends to drive product design.

Employing a test-and-reorder model, the retailer orders small batches of items per style to then see how they perform before committing to the design, allowing it to offer a vast range of on-trend styles without creating excessive inventory waste.

According to Shein, employing this model means its unsold inventory level is now less than 10%, compared with an industry average of between 25% and 40%.

“AI has been around for ages, but a lot of it has been embedded in areas where consumers don’t see it. The real shift is AI being more visible and in the hands of consumers”

Ocado Solutions has instead focused on AI robotics to boost its supply chain efficiencies. The retail business uses robotic picking arms, which learn through AI how best to pick items up. The company says the tech will increase the productivity of its customer fulfilment centres by more than 50%.

Charlotte Byrne, AI product lead at PwC, says that, while it’s clear from these examples that AI itself is nothing new, what is growing is customers’ awareness of its applications.

“AI has been around for ages, but a lot of it has been embedded in areas where consumers don’t see it,” she says.

“They don’t experience, touch and feel it. The real shift is AI being more visible and in the hands of consumers in certain areas.”

38% of executives say customer experience and retention is their primary use of AI

38% of executives say customer experience and retention is their primary use of AI

Shein is one retailer already taking full advantage of AI algorithms

Shein is one retailer already taking full advantage of AI algorithms

Applications like ChatGPT have made AI accessible to the public

Applications like ChatGPT have made AI accessible to the public

An integrated approach, combining human and AI input, is the best plan of action

An integrated approach, combining human and AI input, is the best plan of action

Generative AI

Generative AI has been a significant driver of much of the recent hype around the impact of AI technologies. But, while the algorithms behind these services have clearly become more advanced, it’s not necessarily the complex, behind-the-scenes tech that has led to the recent leap in awareness and interest.

Instead, says Ocado’s Jensen, its success is related to how easy it is to use. “The single most important trigger behind AI in the news cycle is not even the tech behind apps like ChatGPT. It was the addition of a user-friendly interface to that tech, making it truly accessible to anyone.

“Suddenly, billions of people with no technology background have access to a toolkit that until now was solely the domain of machine-learning engineers. In retail terms, it’s the equivalent of adding a shop window.”

Generative AI use is already widespread. A global McKinsey & Company survey of 1,684 employees in April 2023 found that 40% of respondents working in the consumer goods and retail industries have tried it at least once, while a further 18% regularly use it in their work.

“Suddenly, billions of people with no technology background have access to a toolkit that until now was solely the domain of machine-learning engineers”

As with other industries, the most popular uses so far include marketing, product development and customer care.

Generative AI’s potential benefits include faster product development, enhanced customer experience and improved productivity. Its uses can even stretch to supporting store design and developing more creative ways to get closer to customers by inspiring new customer engagement strategies.

And its long-term impact shouldn’t be underestimated. Gartner predicts generative AI will have “an impact similar to that of the steam engine, electricity and the internet”.

Several global retailers, including ecommerce behemoth Amazon and fashion retailer Zalando, have implemented generative AI throughout their businesses. The former has invested heavily in large language models (LLMs) and generative AI, with the end goal to transform and improve “virtually every customer experience”.

Amazon also revealed in August 2023 that it would be using generative AI to produce summary paragraphs of product review sentiments and key themes, to help customers determine at a glance whether a product is right for them. In the testing phase at the time of writing, this use is set to be rolled out more broadly over the coming months if successful.

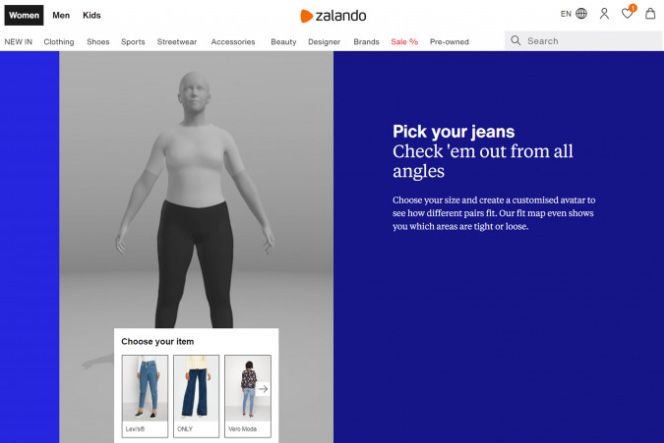

Zalando, meanwhile, rolled out AI-based, virtual fitting-room technology across all 25 of its markets in April 2023, with use of the fit tool becoming an expected part of the online shopping experience for its customers. Stacia Carr, vice-president of size and fit at Zalando, said: “We can already see that customer engagement with these campaigns increases and, in fact, around half of the customers try more than one size on the avatar”, showing clear benefits of the tool for its shoppers.

Zalando has rolled out an AI-powered virtual fitting room

Zalando has rolled out an AI-powered virtual fitting room

Customers create a 3D avatar by entering their height, weight and gender, and can then use this to see how different sizes from various brands would fit them. A combination of fitting models, machine learning, computer vision and other technologies predict if items will run big or small.

As usage of Zalando’s fit tool demonstrates, while the hype will die down as the intricacies and reality of AI implementation set in, we can expect increasingly innovative applications as people and businesses discover more ways to use it.

Getting the right tone

At the moment, generative AI does have some limits, showing best success when paired with individuals and used as the starting block for content outputs. Alone, its outputs run the risk of inaccuracy and bias, depending on the material it is fed to learn from.

With one of the biggest uses in retail so far being the creation of marketing or product content, can it be trained yet to produce content in the right tone and using the right brand guidelines? Is it possible for AI to get the subtleties of branding just right, applying the right level of humour, emotion and personality for any particular brand?

As the experts in this report discuss, it seems an integrated approach, using AI to bolster the work of retail colleagues, is currently the best one to take.

PwC’s Byrne says standard generative AI platforms that are publicly available, such as ChatGPT, are unlikely to be able to echo brand messaging accurately because they are not trained using the right inputs.

“They might be an efficient way to get started for idea generation, but you need to use your own data or build your own models to get your messaging, tone of voice, values and ways of thinking to create something that’s personalised to your brand,” she says.

None of this is easy and the right skills can be hard to recruit. As a result, third parties are playing a significant role in helping retailers to ease their way through.

The extent to which they help all depends on the use case, says Matt Moorut, director and analyst at insights provider Gartner’s Marketing Practice.

“For simple tasks such as building out copy for product page descriptions, third parties aren’t really needed, since marketers can use freely available tools to streamline their work,” he says. “For more advanced use cases like product design, or where core operations need to be adjusted, then third parties make more sense.”

Adoption rates for AI vary widely across the retail sector, depending on different brands’ business models and priorities – and many are already reaping the benefits.

So which retailers and brands are leading the charge when it comes to AI adoption and how is it helping them to drive return on investment?

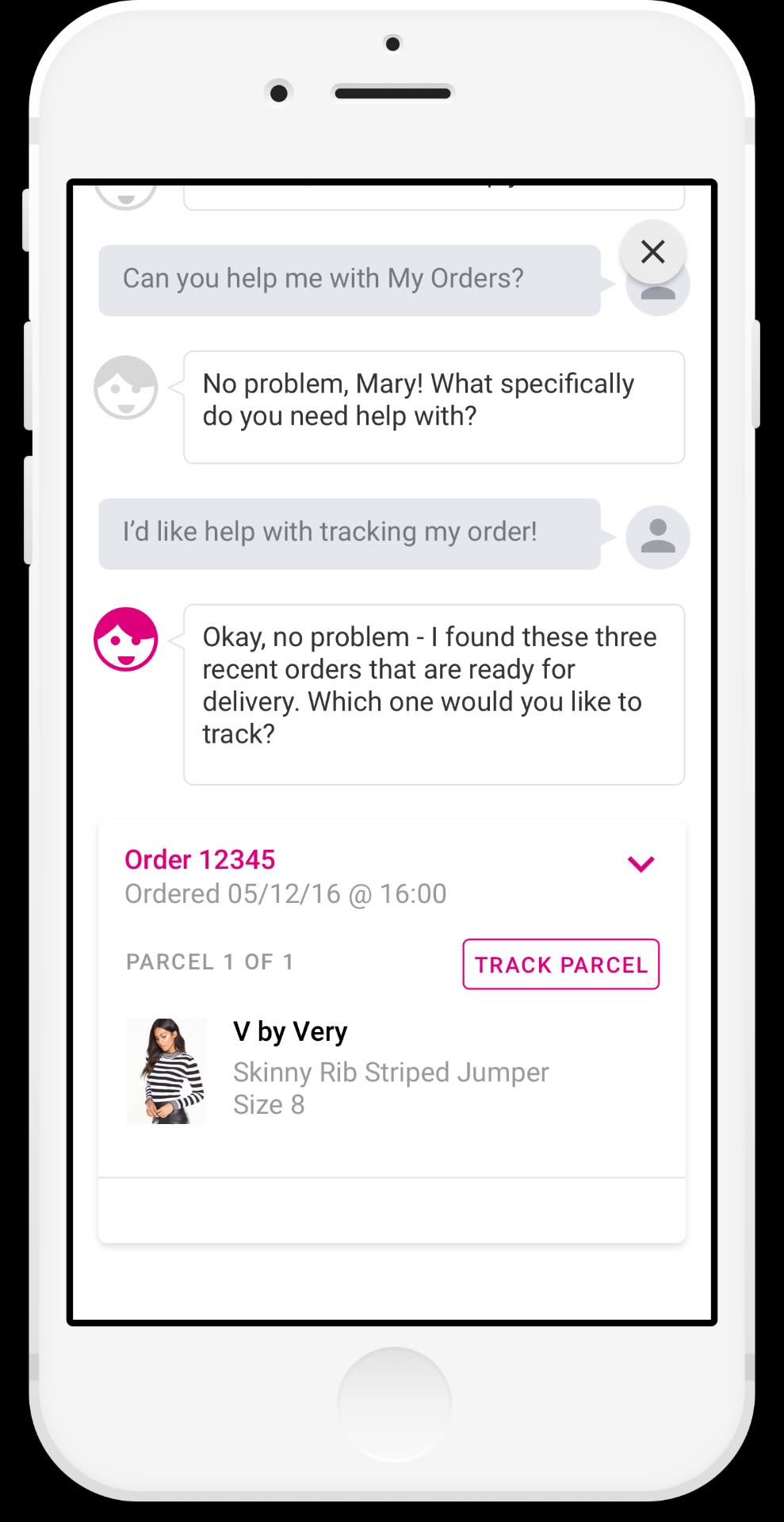

The Very Group launched its Very Assistant chatbot in 2017

The Very Group launched its Very Assistant chatbot in 2017

Very uses in-app ModiFace AR technology to allow customers to try out cosmetics virtually

Very uses in-app ModiFace AR technology to allow customers to try out cosmetics virtually

The Very Group

The Very Group has long been a leader when it comes to technology investment. Its strategy is to create long-term relationships with customers via personalised experiences and it has invested accordingly over the past decade. In 2015, it claimed to be the first in the sector to launch a fully personalised homepage.

The retailer started investing in AI in 2017 when it introduced its Very Assistant chatbot. Very now uses AI for a variety of tasks, including fraud prevention, deciding the ideal frequency of emails to send to each customer and dynamic pricing.

In recent years, the company has launched two relevant business-wide programmes.

In summer 2021, it started a three-year project to transform the technology and data that powers the business, with a goal to migrate its app and website to its new Skyscape ecommerce platform by 2024. The hope is that this platform will enable it to deliver customer experience changes more quickly and more frequently, through one dynamic content management platform.

In March 2022, the group announced plans to transform the technology behind its ecommerce platform through third-party partnership.

Very’s personalisation efforts are now driven by AI and it continues to work on improving areas such as marketing emails, the relevancy of ads and increasingly personalised homepage content. It has also trialled real-time and customer-specific offers via push notifications in its app, which generates 45% of its total sales.

Clothing shape and fit can be a barrier for online fashion shoppers and Very is using AI to tackle this as well, partnering with True Fit in May 2022 to provide personalised guidance across its 300 fashion brands. True Fit uses AI-powered machine learning to connect shoppers with items that fit, with the aim of reducing returns.

Very is also aiming to improve how customers discover new products on the site, using AI to learn from customer interactions and make better recommendations for products.

In its first phase, tech is being used to improve search and auto-suggest tools on the site; in the longer term, the retailer will roll out other functionality, such as a quiz that will help customers find the right products.

Speaking to Retail Week in June 2023, Very’s digital customer experience director Paul Hornby said the tech “will make it so much easier for customers to find the product they love”.

Other AI-related services from Very include in-app augmented reality (AR) that allows customers to try out new cosmetics products from L’Oréal, Maybelline and NYX digitally. It uses ModiFace AR technology, which relies on face, hair and nail tracking, analysis and rendering, and was launched in December 2022.

Charlotte Tilbury

In June 2023, beauty brand Charlotte Tilbury announced the launch of a mobile app that uses AI and deep learning to bolster customer experiences, delivering personalised beauty solutions, aiming to educate, inspire and provide incentives to new and existing customers.

Features within the app, which launched in 34 countries and is available in five languages, include shade matching of cosmetics, tutorial videos, personal consultations and exclusive product releases.

The app also offers exclusive content and confidence-boosting affirmations from Tilbury herself, who said: “My app brings me to your fingertips at all times, ensuring that beauty confidence is accessible to everyone, no matter where they are. It’s a pioneering beauty tech achievement, offering a comprehensive and empowering beauty experience exclusively within a single app.”

Shade matching leverages AI-powered beauty tech tools Pro Skin Analysis and Pro Shade Match. To use the former tool, customers answer three questions, upload a selfie and are provided with a personalised skincare routine and expert advice in under 60 seconds. The Pro Shade Match tool aims to help customers shop online for foundation and concealer, and uses an “expert skin algorithm” alongside AI to make shade matching easier and more accurate.

Beauty-tech engagement isn’t new to Charlotte Tilbury customers. The brand claimed to become the “first beauty brand to harness mixed-reality technology” in April 2022 with the launch of a 3D volumetric avatar of Tilbury. The avatar guides customers through a virtual journey, exploring virtual 3D products across a virtual store, which was launched in 2020.

Customers can also choose to “shop with friends” in the virtual space, with a video feature embedded allowing a group to engage with the tool and each other in an experience similar to a multiplayer video game.

Ocado uses AI throughout the customer journey, primarily through personalisation

Ocado uses AI throughout the customer journey, primarily through personalisation

Ocado

Ocado Group, which is made up of tech leader Ocado Solutions and grocer Ocado Retail, is another company leading the way with AI investment.

AI is used throughout the customer journey, primarily via personalisation – customers’ favourites and previously purchased items appear at the top of searches, and the company sends reminders for items they purchase regularly, such as their weekly milk.

Outside of direct customer engagement, another major focus in the grocery arm is reducing waste. The company says its AI-enabled forecasting leads to waste levels that are 50% lower than industry norms, achieving this via 20 million demand forecasts per day for what customers will order and when.

This forecasting technology also predicts future stock levels, leading to higher availability and lower substitutions for customers.

Ocado Solutions has been developing AI-powered robots to pick and pack groceries since 2015, which it offers to third parties and uses across its Ocado Retail warehouses.

Using an air-traffic-control-style system, items are picked in the best order for speed and accuracy. The company says a 50-item order can be picked in five minutes, compared with more than an hour in a physical store.

In 2022, Ocado announced its Orbit project, which splits an order across a number of smaller fulfilment centres, creating a “virtual distribution centre” powered by AI and machine learning. The service means a wider range can be offered with a shorter lead time to a higher number of UK households.

Learning from a global retailer:

Majid Al Futtaim

Majid Al Futtaim, a conglomerate based in Dubai, owns and operates shopping malls, hotels and retailers across the Middle East and North Africa. As the exclusive franchisee across 30 countries for Carrefour, the world’s second-largest hypermarket chain, and a partner with global retailers including Lego, AllSaints, Abercrombie & Fitch and Lululemon, customer engagement is high on Majid Al Futtaim’s priority list.

In 2021, it paired with Braze to implement a new communications tool with the goal of boosting the lifetime value of its customers and better engaging, retaining and growing its audience.

AI tools were used to bolster Majid Al Futtaim’s Share rewards programme, which had more than 3 million active users. Connected Content, a dynamic personalisation tool developed by Braze, was integrated into the rewards app to highlight relevant and personalised offers to members. Customer engagement was encouraged through the use of content-driven digital notifications, in-app polls and a ‘Spin the wheel’ gamified tool.

Through moving to the platform, Majid Al Futtaim reported engagement with more than 5.5 million of its customers each month, having executed more than 1,000 unique communications within its first year of using the new tool.

The key to the AI-powered tool’s success lay in the Majid Al Futtaim team’s ability to use it. Teams from across the business collaborated on the platform from its conception and, upon launch, extensive training was introduced.

Colleagues learned about the features, functionalities and data attributes of the platform, a data dictionary was created and teams continue to have quarterly refresher training to ensure they can most effectively integrate the tech, alongside their own creative expertise, to keep producing fresh content, introducing new and engaging features and sharing inspiring stories from across the company’s portfolio.

Ensuring that staff feel supported in tech transformations is no mean feat, especially for a large multinational organisation such as Majid Al Futtaim. This offers great food for thought for UK retailers who are at the start of their AI journeys.

AI is already making waves in the retail industry – but it is not without its challenges.

Trusting the data

As part of its digital transformation journey, fashion retail group N Brown turned to AI in 2019 to streamline its back-end processes and offer more personalised user experiences to customers, integrating an AI-driven size-and-fit solution in 2020, with continued investment in the tech to date.

Having been part of the retailer’s journey, Vlad Jiman, director of data at N Brown, says: “Navigating the AI landscape requires both pragmatism and empathy.”

One of the most common issues for both staff teams and consumer markets is trust, with outputs not always trusted if the inner workings of the technology can’t be seen.

“Data integrity is paramount. Retailers must regularly curate and cleanse their datasets to ensure information feeding into AI systems is accurate and relevant. Garbage in will always result in garbage out”

Jiman says there are two important parts to building trust, with data integrity being priority number one.

“First and foremost, data integrity is paramount,” he says. “Retailers must regularly curate and cleanse their datasets to ensure that the information feeding into AI systems is accurate and relevant. Garbage in will always result in garbage out.”

He adds that this will involve data validation, handling missing data and identifying outliers or anomalies. Comprehensive data audits can also help ensure that data used for training and testing AI models is of the highest quality.

Gareth Mitchell-Jones, digital solutions director at PwC, says data quality is a challenge for lots of retailers: “The big thing is that the data isn’t necessarily in the state that it needs to be, and a lot of work needs to be done to prepare this data for repeatable data processes that rely on good-quality data.

“And that is a challenge for every retailer I speak to. Understanding the attributes of a product, where it’s located, how many there are – they are traditional problems that haven’t been solved, and they’re still struggling with them after 30 years.”

The second part of building trust, says Jiman, is that retailers should always incorporate human oversight. “This can be achieved through a system of checks and balances where AI-generated insights are periodically reviewed by human experts for validity,” he says.

“This dual approach combines the computational power of AI with the nuanced understanding and contextual knowledge of humans.”

For some retailers, says Gartner’s Moorut, this will mean running AI models alongside traditional insight-generation processes until they are producing better insights than could otherwise be made. This iterative process, involving humans, will help build trust in AI projects as they grow.

Shiny object problem

One big question for retailers is where to invest. As discussed in previous chapters, AI is impacting every part of the value chain and has the potential to improve operational efficiencies and customer engagement across the board. So where should retailers set their priorities?

The answers differ significantly according to the business. For example, the likes of the Co-op are rolling out AI-powered robot deliveries, which use a mixture of cameras, GPS and sensor fusion to navigate. Meanwhile, brands such as L’Oréal are using AI to launch virtual try-on services to help customers make decisions when shopping online.

But do customers actually want these services? And how can retailers determine where to put their resources?

Beauty retailer Space NK brought this question to the fore when developing its store strategies. The retailer, which largely targets affluent shoppers with its premium range of beauty and wellbeing products, is limiting the impact of AI in stores, based on customer feedback from its currently successful model.

The business saw its revenues rise to “record-breaking” levels in the year ending March 2022 with sales of £119m, up 6.5% on the previous year.

Speaking to Retail Week in May 2023, Space NK chief executive Andy Lightfoot emphasised the importance of understanding customer wants and needs when creating engaging retail spaces.

“Experiential retail is one of these overused terms that could be engineered to mean absolutely anything,” he says. “For me, the experience that customers want when they go to a beauty retailer is to be able to touch the product, use it, play with it, feel it, smell it and have a really positive interaction with a member of staff should they wish.

“So you won’t see loads of screens in our stores. You won’t see loads of artificial reality experiences. We know that isn’t why our customers go into stores; they can do that on their phones.”

Following a £100m AI tie-up with Google, announced in August 2023, John Lewis Partnership (JLP) considered the potential of AI-driven, Just Walk Out-style checkouts – like those in Amazon Fresh stores – at Waitrose and how innovating this part of the shopping experience may not be right for the brand and its customers.

JLP chief technology officer Zak Mian said: “The jury’s out if customers want assisted service in a grocery shop or for it to be fully automated. A lot of our customers like our service of the fish, meat and cheese counter at the back of the shop – that makes a difference.”

“I don’t know a single customer who says: ‘That package better come by drone.’ You don’t really need it – that’s the shiny object problem. It’s interesting and it’s sexy, but are you really going to increase sales because of it?”

Brendan Witcher, vice-president and principal analyst at research firm Forrester, says the key to making AI applications a success is to ask whether they solve an actual problem for customers. AI-powered drone deliveries, for example – being trialled by Tesco in the UK, Walmart in the US and Coles in Australia – is one interesting idea to support customer convenience.

However, Witcher adds: “I don’t know a single customer who stands at their front door and says: ‘That package better come by drone or I’m never ordering from them again.’ You don’t really need it – that’s the shiny object problem.

“It’s interesting and it’s sexy, but are you really going to increase sales because of it? Are customers only going to order from drone delivery companies? We don’t care how the package gets to us.”

By contrast, virtual try-on services such as Zalando’s could help to tackle a real problem customers face when shopping online: knowing what something will look like on them. “That elevates the customer’s confidence in buying and AI is going to be most impactful when it removes pain points from the customer experience,” says Witcher.

The goal needs to be prioritising technologies that either reduce costs or increase revenue, he adds. The environmental and cost implications of returns also cannot be ignored here, with increasingly accurate virtual try-on solutions reducing another headache for retailers.

Space NK is limiting the use of AI in stores, based on customer feedback

Space NK is limiting the use of AI in stores, based on customer feedback

AI should be implemented to solve existing real-world problems, not just as a new shiny object

AI should be implemented to solve existing real-world problems, not just as a new shiny object

Consumer fears

Consumer fears and hesitations around AI are another hurdle for retailers. A KPMG UK study of 3,000 UK consumers in March 2023, for instance, found that 82% have concerns or challenges that prevent them from using it.

One of the biggest barriers is a preference for speaking to a human. More than half of those in the 55 to 64 and over-65 age groups said they would not use AI because of this – although this figure drops to less than a third for those aged 18 to 24.

But it’s not all negative. The best-received AI experiences are those that fit seamlessly into customer journeys, where the tech becomes a beneficial and natural part of engaging with a brand – Very’s chatbot, mentioned in Chapter 2, is a great example.

Another big sticking point is concerns around data privacy, with a third of KPMG survey respondents flagging this, rising to 37% for those aged 18 to 24.

Issues around data sharing in retail have been present for years, with consumers warily accepting that digital footprints and loyalty schemes mean a data exchange in return for promotional offers, a more personalised service or a stronger connection with a brand they like.

“Data security accreditation and transparent data policies are must-haves, but beyond that brands need to maintain a strong commitment to data ethics and communicate this as part of their brand strategy”

However, with AI likely to make data processing and collection easier and larger in scale, how will consumers feel about it – and how can retailers ensure they are comfortable?

Boris Revechkis, senior product manager, AI and machine learning at Braze, says: "Though the General Data Protection Regulation (GDPR) protects consumers in Europe, American businesses are left to navigate these issues themselves. By voluntarily adhering to the GDPR standard, Braze has set a high bar that should be the norm in the digital marketplace of the future. Consumers are often uncomfortable until they know what is being collected, what is being done with their data, and know they can withdraw it when they see fit."

For Gartner’s Moorut, the answer comes back to strong communication. He agrees that data security concerns have been growing and says communication around security and privacy needs to go well beyond formal policies.

“Data security accreditation and transparent data policies are must-haves, but beyond that brands need to maintain a strong commitment to data ethics and communicate this as part of their brand strategy,” he says. He adds that this needs to be communicated throughout the customer journey, rather than hidden in data privacy policies.

EY’s Campbell agrees that transparency is critical. “Transparency and trust are key to reassuring customers about data sharing. Retailers should be clear about their data collection practices, how data will be used and the security measures in place to protect customer information.

“Obtaining explicit consent and offering value in return for data sharing, such as personalised recommendations or exclusive offers, can further incentivise customers to share their data confidently.”

Legal scrutiny

With AI moving so quickly, regulation and legal scrutiny are racing to catch up. Gartner’s Moorut says the speed of development means lawmakers are lagging behind, but they are likely to catch up at some point.

“Retailers should work to make sure any decisions they make now are ethical, in the hope that investments won’t then need rolling back if laws are changed,” he says.

Data security and privacy are likely to be the first areas to be addressed. Forrester’s Witcher says retailers will be well served by a shift from covert ways of learning about consumers (such as cookies) to overt ways (such as consumers opting in to share data).

“Retailers have had to adopt a new culture of transparency and that will allow consumers to make the choice to share information, opt in and share data overtly,” he says. “It’s that strategy that will allow AI to become powerful. Without that strategy, you’re going to become handcuffed by the rules and regulations of security and privacy.”

Partnerships are becoming commonplace as retailers seek AI expertise to elevate and streamline their businesses. But while, in the past, the parameters and functions of static software could be promised, the constantly evolving nature of machine learning makes this harder to define, allowing for the possibility of contractual challenges.

As AI’s influence on retail increases, it could be expected that contractual provisions and service levels within contracts will flex, allowing for remedies and provisions in the case of any glitches that may occur.

The goal should be for AI to enhance working lives, rather than replace human workers

The goal should be for AI to enhance working lives, rather than replace human workers

Tesco’s AI-powered GetGo stores launched in 2021

Tesco’s AI-powered GetGo stores launched in 2021

As AI use increases in scale and depth across retail, staff in almost every department are watching. The likely question on many people’s lips is: will it take my job?

All the experts we spoke to are quick to reassure on this point: the universal goal should be for AI to enhance working lives, rather than replace human workers. But what this looks like in practice will, of course, be complicated. If, for example, AI can create dozens of images of a garment on multiple different types of AI models’ bodies and also write the product copy to go with it, would copywriters, photographers and models be out of work?

Not necessarily. It’s clear that many retailers are already taking a carefully balanced approach when it comes to rolling out strategies to stay ahead of the market.

Fashion retailer Levi’s, who announced its trial use of AI-generated models to “increase the diversity of models that shoppers see” in March 2023 emphasised in a statement that virtual models will “supplement” the use of human models, rather than replace them.

Tesco’s futuristic GetGo stores launched in 2021 and have seen ongoing success, expanding to three London stores and one Birmingham branch by the time of writing in 2023. The stores give customers a choice between AI-powered, app-based, tracked shopping, which requires no checkout, self-checkouts and manned checkouts.

Through trials, Tesco concluded that its AI-run checkouts only work for all customers if there is an option for human interaction alongside them. With the grocer looking set to roll out more GetGo stores soon, the hybrid approach is clearly working for them.

Retailers are proving that AI does not have to lead to job cuts and can work in favour of – rather than against – retail teams.

But the full story is more complex, says Forrester’s Witcher. “Retail has lost a lot of employees. It has had a huge exodus of people leaving and going to other industries that are higher-paying or because they don’t see a future in retail. It forces retailers to find ways to replace those individuals.”

The British Retail Consortium’s reported findings back up this sentiment. In a survey covering 550,000 workers employed in the retail sector during the first quarter of 2023, it found that roles in stores, warehouses and logistics are facing the biggest skills shortages, with 87.9% of retailers having difficulty hiring store managers or supervisors and 37.5% struggling to fill warehouse worker positions.

As Witcher suggests, AI could provide a solution to support shrinking teams in areas of staff exodus.

Job anxiety

In the longer term, most parts of retail businesses will be affected by AI, says Gartner’s Moorut. “Any roles that involve the creation of new assets should be able to lean further on generative AI to create, whether that’s lines of code, product designs or marketing collateral.”

He adds that data teams will be able to make use of more advanced AI to surface hard-to-find insights and that HR, operations and internal communications teams will be able to use it for employee-focused content. “I can think of few roles that won’t feasibly be able to use AI or generative AI.”

So how should retailers ensure that teams experience AI in a positive way, rather than just being wary of it?

PwC’s Byrne says that, where possible, staff should be involved in ideation and rollout. “Bring everyone on that journey. So it’s not just leadership ideating in a room; we’ve been ideating as an organisation and getting individuals to come up with potential opportunities of how they see these technologies applied in their roles, and then being part of tests and pilot scenarios.

“The technology isn’t forced upon them at the end; they’re part of helping us define what it does and how it works. That’s really shifted some internal fears to excitement – being part of it, feeding into what it can do. That’s been really successful for us as an organisation.”

Transparency and upskilling

N Brown’s Jiman says addressing job anxiety is crucial and agrees that the best way to alleviate fears is through transparency and upskilling.

“By being upfront about our AI goals and continuously reskilling and upskilling our workforce, we can transform potential displacement into opportunities for growth,” he says. “It’s essential to communicate that AI is an augmentative tool, designed to complement human capabilities, rather than replace them.

“Offering internal learning programmes (such as data academies) and clear pathways for role transitions can also instil confidence in our colleagues, ensuring they remain an integral part of our evolving business landscape.”

“We still need the human expertise of judgement and creativity. That’s never going to go”

N Brown is not the only retailer to emphasise the importance of human expertise while on an AI journey. Speaking at the AWS Summit in June 2023, Holland & Barrett chief data officer Dobo Radichkov said AI was allowing the retailer to “elevate the level of abstraction for employees so we can be more productive”.

However, he added: “But we still need the human expertise of judgement and creativity. That’s never going to go.” The retailer is using AI for demand forecasting, customer experience and internal operations.

AI also offers an opportunity to better arm retail staff with the information needed to assist customers, giving access to huge datasets of information and solutions to customer queries through handheld apps, enhancing the customer service store staff are able to offer.

This assistance function extends to other roles as well, from forecasting and planning to last-mile delivery via real-time visibility of goods, giving staff a head start when it comes to predicted delays and low inventory, and minimising any impact to the customer.

AI can open doors to data that human beings are currently unable to access

AI can open doors to data that human beings are currently unable to access

Powerful tool

It is also important to note that AI will increasingly be doing jobs that humans simply can’t. Forrester’s Witcher points to the analysis of unstructured data, such as customer emails or reviews, calls to service centres and social media comments.

“AI can help you uncover things that a human being really couldn’t get to,” he says. “A person isn’t going to sit there and read thousands of reviews and be able to assess what’s the trend, the pattern. You don’t want to pay an employee to do that for a week. AI can do it in seconds and can assess for you the way people are talking about things, the tone and tenor of that language, why people are saying certain things.”

Getting access to this insight could enable a business to do anything from gaining input into product design and the items customers want to see to changing the fit of items, to crafting product copy that better reflects how customers experience a product.

As mentioned earlier in this report, Shein is just one example of a retailer already taking full advantage of AI algorithms, scraping data from web searches and social media mentions to feedback to its design teams and influence the latest sketches.

For anyone still worried about their job, it’s important to remember that, while AI is likely to be transformative, it is also not quite there yet. Depending on the business, the timescale for some of this change could be relatively long-term.

“The good news is that AI is not good enough yet to count on, to walk on its own,” says Witcher. The experts we spoke to all agree that human supervision is critical.

This slow but steady pace is especially true in an industry like retail, which, for its fair share of innovative ideas and out-of-the-box thinkers, is often too low-margin to innovate at speed.

“Most retailers can’t afford to be innovation leaders,” says Witcher. “They just don’t have the balance sheet. If you start adding cost without return, that could be a big problem. So retailers are risk-averse and, in most cases, that’s wise.”

While full-scale AI transformation will take time, any retailer investing in it will also need to invest in its staff, whether this means hunting for new skills, upskilling teams or just ensuring that communication and collaboration are happening.

Get infrastructure in place first

The work that the likes of Ocado, John Lewis Partnership and Very are doing on their back-end systems is necessary for AI to have a positive impact on operations. This varies according to the business, but it can involve shifting to a cloud-based environment or working to get data into its most usable state.

Move quickly when the benefits are clear

There are a number of ways in which traditional and generative AI can make demonstrative differences to the way retailers operate. Starting with areas such as customer service and marketing emails will make a big difference quickly. Take Zalando’s launch of a generative AI-powered assistant: with fashion consumers often overwhelmed by choice, AI has the potential to help them cut through the noise.

Bring staff on the journey

Involve staff in coming up with ideas for using AI where possible and communicate transparently about where and why it will be used. Upskilling where necessary will help plug skills gaps and enable staff to evolve. As Currys has shown, AI can help staff by taking over basic queries and enabling them to focus on offering expert advice.

Focus on problem-solving

AI should be used to solve customer pain points, make life easier for staff, or in a way that reduces costs or increases revenue. While it’s easy to get carried away with shiny-looking or impressive projects, it’s best to stay laser-focused on business needs. Co-op’s AI-powered robot deliveries, for example, are a twofold solution, offering speedy grocery delivery to consumers and boosting high street store sales with online demand.

Boost consumer confidence

Many AI services in retail help consumers understand what items will look like in situ, whether it’s fit technology for fashion, try-on services for beauty or virtual design services such as Ikea’s Kreativ. Building services that will help them take that leap of imagination increases confidence in their decision.

Clean up your data

While easier said than done, continually working on data integrity, accuracy and relevancy will set businesses up to achieve what they want to with AI. Data forms the backbone of Shein’s new product development, for example, which allows the retailer to offer its extensive and ever-changing range of on-trend garments.

Weigh the costs and benefits openly

"With the technological landscape changing so rapidly, everyone must think carefully and on their feet in order to balance business needs and consumer protections. By having the above points covered, being transparent and deferring to consumers’ interests, retailers can maximise opportunities as they arise while avoiding negative outcomes or costly breaches of customer trust," says Braze's Boris Revechkis.

Boris Revechkis

Boris Revechkis

Partner insight

Partner commentary throughout this report provided by Boris Revechkis PhD, senior product manager at Braze

Beyond the hype: How AI in UK retail has moved to the mainstream

Rebecca Taylor

Commercial content manager and report lead

Rebecca Thomson

Writer

Alban Bizet

Senior graphic designer

Stephen Eddie

Managing editor

Rebecca Dyer

Production editor

Imogen Jones

Commercial partnerships director