The UK’s top 30 most productive retailers of 2020

At a glance

At the start of the year, against a tense backdrop of Brexit-fuelled uncertainty, rising costs and changing consumer expectations, UK productivity growth had fallen to pre-Industrial Revolution levels.

Research from academics at Sussex University and Loughborough University, published in February 2020, found that productivity growth was at its lowest in 250 years. This, the research said, was the result of a nationwide failure to solve the UK’s productivity puzzle: a trend triggered when the 2008 financial crisis crippled the British economy.

In February, the Bank of England’s chief economist Andy Haldane had called productivity the “single most pressing issue” for the UK economy.

And all this before a global pandemic that would hit just one month later and drag productivity levels down even further.

Findings from online data platform Trading Economics, published in May, found that UK labour productivity - as measured by output per hour - fell by 1.1% quarter on quarter in the first three months of 2020, following a 0.3% rise in the previous period. Trading Economics said this was “the biggest plunge in productivity since 1974” and was largely “due to the coronavirus pandemic and restrictive measures imposed”.

As such, retailers across the board have been forced to re-examine their operations and pivot their business models to adapt to the new reality.

A key focus for many is exploring ways to maximise their workforces and increase employee engagement to drive greater ROI.

As Simon Hedaux, founder of productivity consultancy ReThink Productivity, asserts: “The retail revolution in productivity has been long overdue, but Covid has forced retailers to be more agile and to fast-forward their thinking.”

This report, in association with Catapult and Rotageek, shines a spotlight on those retailers already ahead of the game when it comes to productivity.

We reveal the UK’s top 30 most productive retailers of 2020, spanning bricks and mortar, multichannel and pureplay. Retailers’ staff-cost-to-sales ratios and sales value per employee have been revealed and analysed to find out what has powered their productivity.

It should be noted that while these 30 retailers are mitigating an extremely tough trading environment with higher levels of staff productivity, not all are necessarily enjoying sales and profit growth – Superdry and N Brown being cases in point.

So, how have the top 30 retailers achieved productivity gains? Which tech solutions are feeding greater employee engagement? And what are the practical steps businesses can take to help solve the productivity puzzle in the post-pandemic landscape?

Here are the top 10 productive retailers – click here for the full top 30 ranking:

| 1. | BrandAlley |

| 2. | Victorian Plumbing |

| 3. | Asos |

| 4. | The Very Group |

| 5. | Birchbox |

| 6. | WiggleCRC |

| 7. | Missguided |

| 8. | Aldi |

| 9. | N Brown |

| 10. | Boohoo |

Methodology

The productivity rankings in this report are based on retailers that have the lowest global staff-costs-to-sales ratios combined with the largest sales value per employee – key performance indicators for productivity.

Retail Week’s in-house intelligence service Prospect analysed 180 UK retailers, with data compiled using the latest available financial year for which retailers had filed their annual reports or accounts at Companies House.

NB: This productivity ranking was compiled in March prior to the coronavirus outbreak. It has not been updated as the majority of the 180 retailers have not provided financial updates in the months since the pandemic.

The UK’s productivity puzzle

Even before the UK entered lockdown as a result of the coronavirus outbreak, the country had a major productivity problem.

For the fourth quarter of 2019, the Office for National Statistics (ONS) reported that productivity – defined as the economic output of work – was 0.3% higher when compared with the quarter a year ago.

However, the ONS confirmed that “in historical terms 0.3% is still a very low productivity growth rate, significantly below the post-2008 economic downturn median and less than a seventh of the pre-downturn median growth rate”.

“The takeaway story is the continued weakness of the UK’s productivity growth since the economic downturn,” the ONS concluded.

The UK has also been performing badly against its global peers. The latest ONS data on the G7 leading economies found the average British worker produced 16% less on average than their counterparts.

ONS data on the G7 found that the average British worker produced 16% less on average than their counterparts

In the Covid-19 influenced world, productivity has taken on a new meaning as many businesses battle against fresh obstacles including closed stores, new customer demands and macroeconomic pressures.

The retail industry, in particular, needs to jumpstart productivity to halt the erosion of profits. Data from accounting firm Sage, published in June 2020, found that retailers have faced a far greater financial hit from the pandemic than other sectors.

For retail, sales were down 88% in early April on what retailers expected, improving to a drop of 32% in late May. By contrast, the study found that businesses in healthcare, technology and media expect an increase in revenue of between 9% and 12%.

So how can retailers bounce back and turn the tables on the productivity slowdown?

Time to solve the puzzle

Industry experts believe businesses that use this period to overhaul their operations will fare better in the post-Covid-19 world.

Retail Economics chief executive Richard Lim believes that retailers must necessitate change and says those who don’t will be unlikely to survive.

“Many retailers will be unable to adapt business models quickly enough, tied to antiquated business practices. This is likely to involve fewer shops, fewer staff and greater automation across supply chains and distribution centres that service a high volume of online orders.

“The retail sector that emerges will be leaner, more productive and adaptable to the challenges that lie ahead,” Lim concludes.

With fewer staff and high levels of UK unemployment on the horizon, employee engagement will be crucial in driving productivity.

The retail sector that emerges [post-pandemic] will be leaner, more productive and adaptable to the challenges that lie ahead

While few retailers can throw cash at staff engagement at the moment, now is the time to think about aligning employee needs more closely with business productivity.

Michael Frank, head of retail at business advisory firm BDO, says “competitive gains can be achieved without necessarily making huge investments”.

He says: “There is a real opportunity for those retailers who can convert employees into brand ambassadors.

“If retailers can build buy-in and engagement from their workforce, this can be a real differentiator, and ensure that customers can get a feel for the brand at every touchpoint and at every interaction – both online and offline”, he asserts.

To achieve this buy-in, Suzi Bentley-Tanner, strategy director at consultancy ENGINE Transformation, advises retailers must “understand staff and what motivates them as individuals.” By doing this, Bentley-Tanner says retailers will “free up retail staff to focus on their primary role of customer service”.

Global studies reinforce this thinking, and show that employee engagement is heavily linked to productivity.

Research conducted in 2018 by the Chartered Institute of Personnel and Development (CIPD) found that UK workers were less likely to quit when their organisation offered higher levels of health and wellbeing, a better work-life balance and better work relationships – key elements of employee engagement.

The CIPD study found that businesses with the most engaged employees saw 15% greater productivity, along with 26% less staff turnover and 20% less absenteeism.

Businesses with the most engaged employees saw 15% greater employee productivity, along with 26% less employee turnover and 20% less absenteeism

However, employee engagement isn’t an area the majority of UK businesses appear to excel in. For instance, software firm Unit4’s 2020 report Decision Making for the Future Business found 57% of UK employees felt they had no say in the direction of their organisation. Furthermore, they felt their chief executives were distant in their approach to employee engagement.

So, who is getting productivity right?

Improving productivity will help UK businesses. Economists believe an upward swing is needed to boost GDP and wages.

So, which UK retailers are winning at productivity? And how have they achieved this in such turbulent economic conditions?

This guide exclusively reveals the top 30 most productive retailers in the UK and takes a look at their strategies.

Who are the top 30 most productive retailers?

RWRC, together with Catapult and Rotageek, has analysed retailers’ group staff-costs-to-sales ratios and the value of sales per employee to identify Britain’s 30 most productive retailers.

| Rank | Retailer | Productivity score |

| 1. | BrandAlley | 220 |

| 2. | Victorian Plumbing | 215 |

| 3. | Asos | 212 |

| 4. | The Very Group | 211 |

| 5. | Birchbox | 210 |

| 6. | WiggleCRC | 205 |

| 7. | Missguided | 204 |

| 8. | Aldi | 203 |

| 9. | N Brown | 202 |

| 10. | Boohoo | 201 |

| 11. | Made | 200 |

| 12. | Lovehoney | 196 |

| 13. | Matchesfashion | 195 |

| 14. | MandM Direct | 190 |

| 15. | Majestic Wine | 185 |

| 16. | Loaf | 182 |

| 17. | Boden | 181 |

| 18. | Farfetch | 180 |

| 19. | Dixons Carphone | 176 |

| 20. | Green Man Gaming | 175 |

| 21. | Morrisons | 173 |

| 22. | Childrensalon | 172 |

| 23. | Superdry | 171 |

| 24. | Superdrug | 170 |

| 25. | Argos | 167 |

| 26. | Sainsbury’s | 166 |

| 27. | Screwfix | 165 |

| 28. | Selfridges | 164 |

| 29. | JD Sports | 160 |

| 30. | Asda | 155 |

Learnings from the most productive retailers

Emerging vs legacy retailers

Younger brands, established after the internet boom, were often set up with current consumer expectations of technology and omnichannel retail in mind, and are more productive as a result.

Even discarding rebrands and restructures, the top five retailers were established an average of 16 years ago, while the bottom five from the top 30 were established an average of 83 years ago.

The productivity trend among younger retailers could explain the rapid success of emerging brands such as Loaf, which placed 16th.

Omnichannel retailer Loaf (originally called The Sleep Room) was established in 2008 – far later than the majority of its counterparts in the productivity ranking – and has quickly expanded its offering from a limited range of beds to furniture and accessories for the whole house.

The top five retailers were established an average of 16 years ago, while the bottom five were established an average of 83 years ago

In 2018/19, Loaf’s sales grew 16% to £48m, following growth of 20% the previous year. Prior to the coronavirus outbreak shuttering Loaf’s bricks-and-mortar operations, sales had been partly driven by its showrooms. Dubbed ‘Loaf Shacks’, the physical stores are designed to help shoppers better interact with products and open up the brand to a wider consumer base.

In order to improve its operational efficiency, the retailer has been making big changes to its supply chain strategy.

The retailer consolidated its warehouses to a single facility in 2018 and has recently invested in data warehousing to get better insights into its business performance, stock levels and customer behaviour.

In the five years to 2018/19, the retailer has more than tripled its headcount to over 180 staff. To drive employee engagement, and therefore productivity levels, Loaf has placed emphasis on staff communication and increased investment into training as its team grows.

The retailer has said it is committed to offering “better customer service than its competitors” and has “stepped up its commitment to staff training” to make sure this remains true.

Pureplay often equals productivity

It’s no secret that pureplay brands have a head start when it comes to productivity. These retailers typically have fewer employees and arguably a bigger consumer reach than bricks-and-mortar brands, not to mention lower overheads.

Our analysis confirmed this trend: four of the top five most productive retailers in the ranking are pureplay brands.

While four of the top 10 retailers operate bricks-and-mortar stores, this includes Missguided whose physical store network is secondary to its gargantuan online presence.

By contrast, nearly all retailers ranked from 20 to 30 (excluding Green Man Gaming and Childrensalon) are well known for their bricks-and-mortar operations, with online supporting offline sales.

Significantly, pureplay brands haven’t had to navigate the same challenges during the pandemic as their bricks-and-mortar counterparts that were forced to close stores for a considerable period.

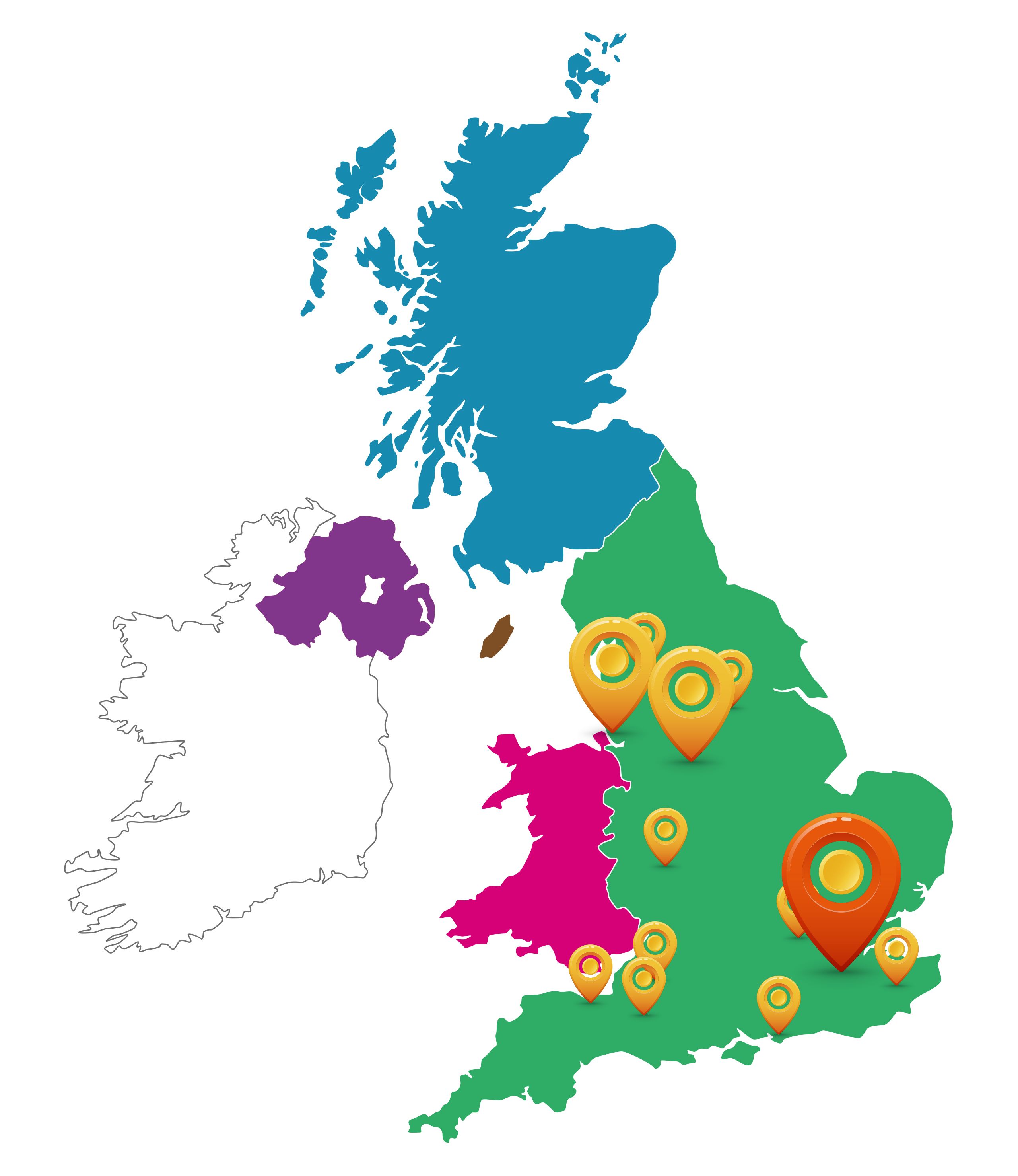

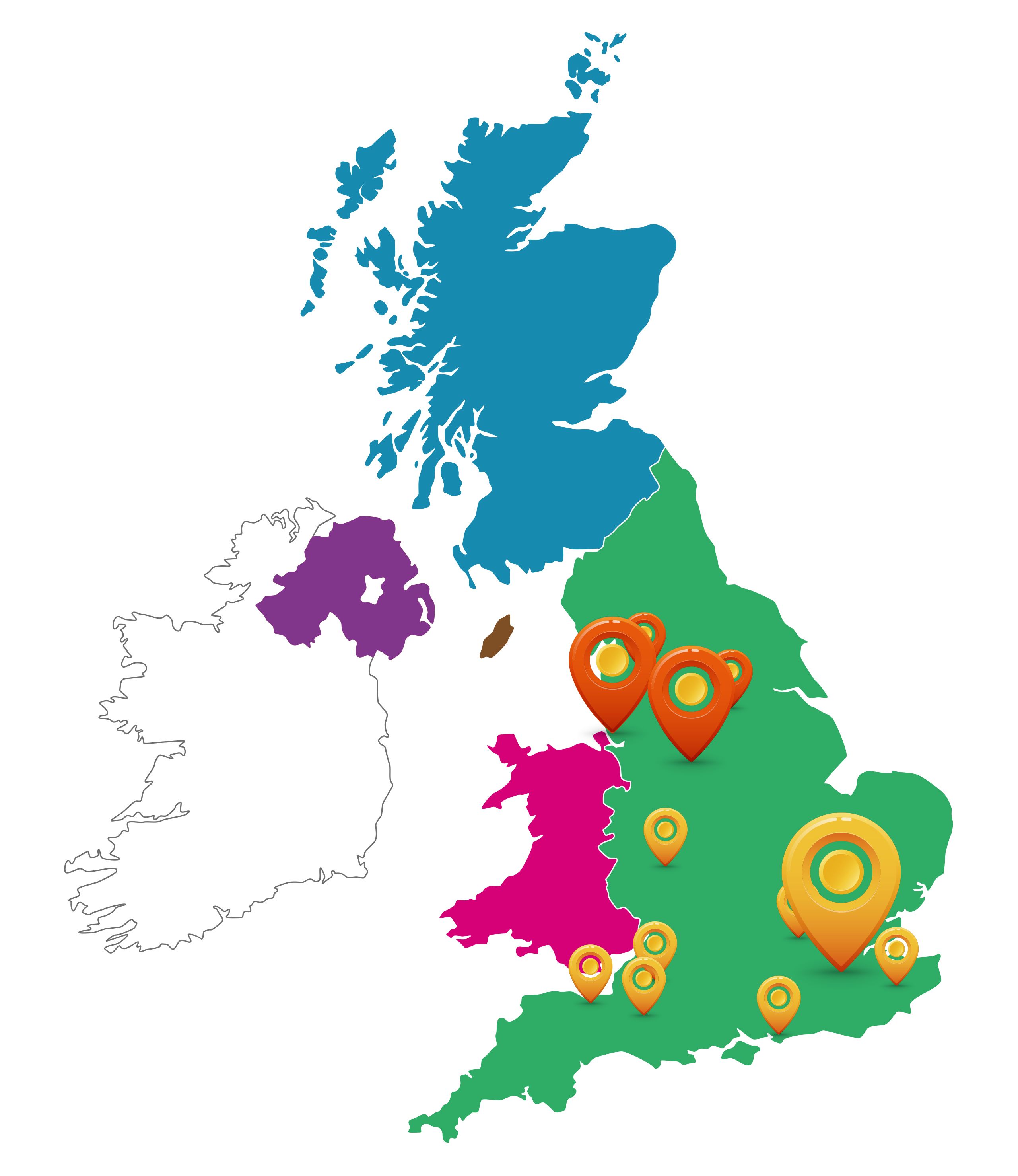

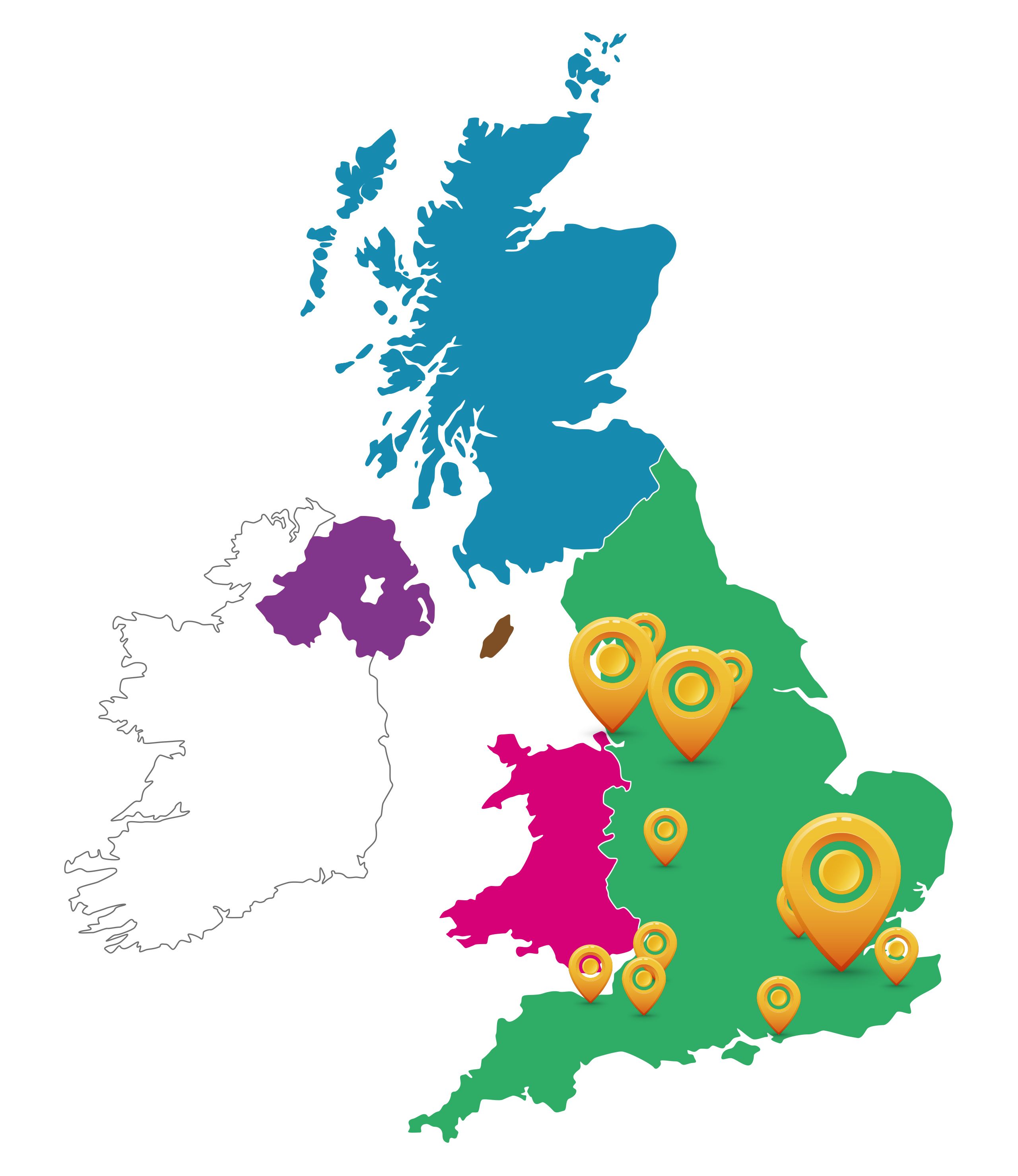

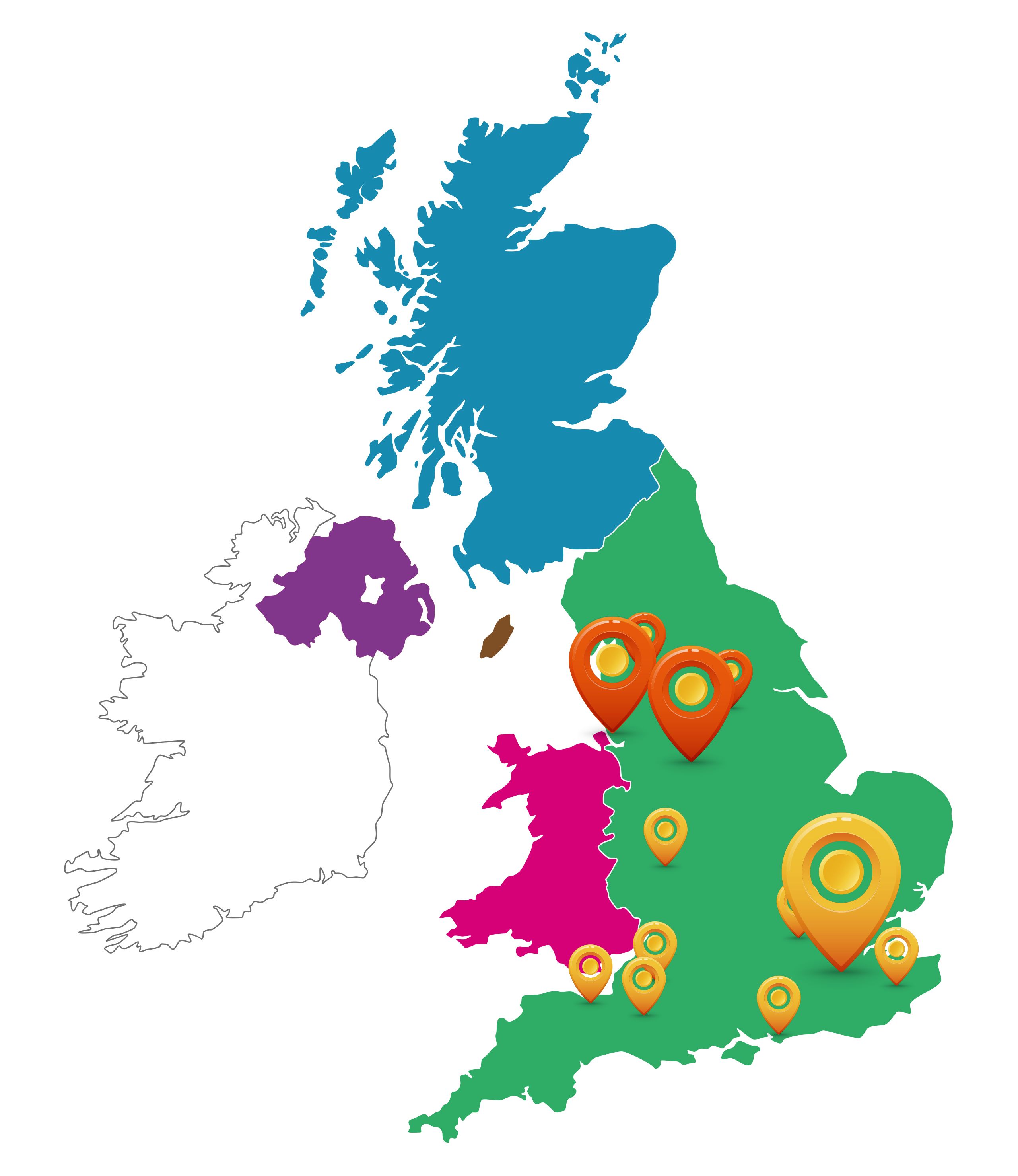

Northern brands dominate the top 10

While there are 13 London-based retailers in our top 30, only three made the top 10, which includes five brands located in Manchester and Liverpool.

While retaining a London HQ clearly doesn’t mean a brand can’t achieve greater productivity per employee, access to the cheaper overheads and lower staff costs of the North can give retailers that extra edge.

ONS data for 2019 found that weekly earnings in London are £152 higher than the UK average. In addition, a 2018 analysis by ABC Finance confirmed that the capital is the most expensive UK city in which to live and indeed seven of the top 10 cities for highest cost of living are all found in the South. By contrast, Manchester placed 11th and Liverpool 24th.

ONS data for 2019 found that weekly earnings in London are £152 higher than the UK average

With the cost of living lower outside of London and overheads such as rent and transport likely to be cheaper for retailers, establishing a northern base could boost the bottom line.

As remote working has become the norm during UK lockdown, with most retail offices closed until recently, post-pandemic retailers could make productivity gains by scaling down head offices or replacing them with regional hubs as more staff choose to work from home on a permanent basis.

Speaking to Retail Week in June, Harper Dennis Hobbs property advisor Jonathan De Mello also suggested that the recent shift will help retailers to cast their nets wider when recruiting talent, with flexible and remote working enabling candidates from other locations to be considered.

“Ten years ago, if you were interviewing someone for a role outside of where they lived, one of the conditions would be the need to relocate. Over the last decade, and five years particularly, that has already lessened substantially.

“Coronavirus is only going to further enhance that. If you only need to be in head office one or two days a week, that will actually increase and improve the potential level of talent that certain organisations can attract,” he said.

Employee engagement is key

As we’ve already seen, there’s a clear correlation between employee engagement and productivity.

Dr Heiner Evanschitzky, marketing professor at Alliance Manchester Business School, told us that: “A way to increase productivity is to invest in staff. This will lead to quicker and more satisfactory solutions and better outcomes for the business.”

“We have the most efficient and productive workforce, and this is why they earn the highest rates of pay in the grocery sector”

At number eight in our productivity ranking, Aldi highlights how efficiency is closely tied to employee engagement.

Back in January 2020, the supermarket announced market-leading pay rises for its employees that bust the recommended National Living Wage of £8.21 an hour for those aged 25 and over. Aldi staff around the country saw their hourly pay rise to £9.40, while those working in London now take home £10.90 per hour.

Speaking at the time, Aldi UK boss Giles Hurley explained that employee productivity is the very reason the supermarket chain can afford to pay staff more. He said: “We have the most efficient and productive workforce, and this is why they earn the highest rates of pay in the grocery sector.”

Kantar Worldpanel data for the 12 weeks ending 14 June 2020 shows Aldi now has a 7.5% share of the market – way above competitors such as Lidl (5.8%) and Iceland (2.5%) – as shoppers continued to stockpile during the coronavirus outbreak.

The grocer’s ability to scale up to offer more food deliveries during the coronavirus pandemic is testament to the agility and productivity built into the organisation. Since the crisis began in March, Aldi has recruited an extra 9,000 staff.

A retail productivity one to watch?

Outside the top 30, Marks & Spencer fell short at 40th place.

However, M&S has taken bold actions of late. In February 2020, it warned landlords it would shut underperforming stores and, in the same month, announced it would be closing two distribution centres in the Midlands, putting nearly 700 jobs on the line in a bid to save money.

The pandemic prompted a further strategic rethink at M&S, with its ‘never the same again’ programme unveiled alongside full-year results in May. For the 52 weeks ending March 28, M&S reported that pre-tax profit fell by 21% down to £403m, while group revenues slipped 2% to £10bn.

Covid-19 has galvanised the retailer’s efforts to be relevant, evident in everything from its support for suppliers to staff pay during the outbreak and initiatives to support the NHS.

What this tells us is that retailers looking to drive productivity need to ensure they are where their customers are. EY UK and Ireland’s head of retail Julie Carlyle agrees and says that “retailers must look to truly integrate their channels”.

Otherwise, Carlyle says “they will end up running two parallel business models with reduced productivity across both and split capital and overall investment activity”.

Meet the top three retailers

by productivity

Whether they are boldly focusing on growth in a bid to amplify profits or analysing their operations to see where roles can be created or cut, these are the UK’s three most productive retailers.

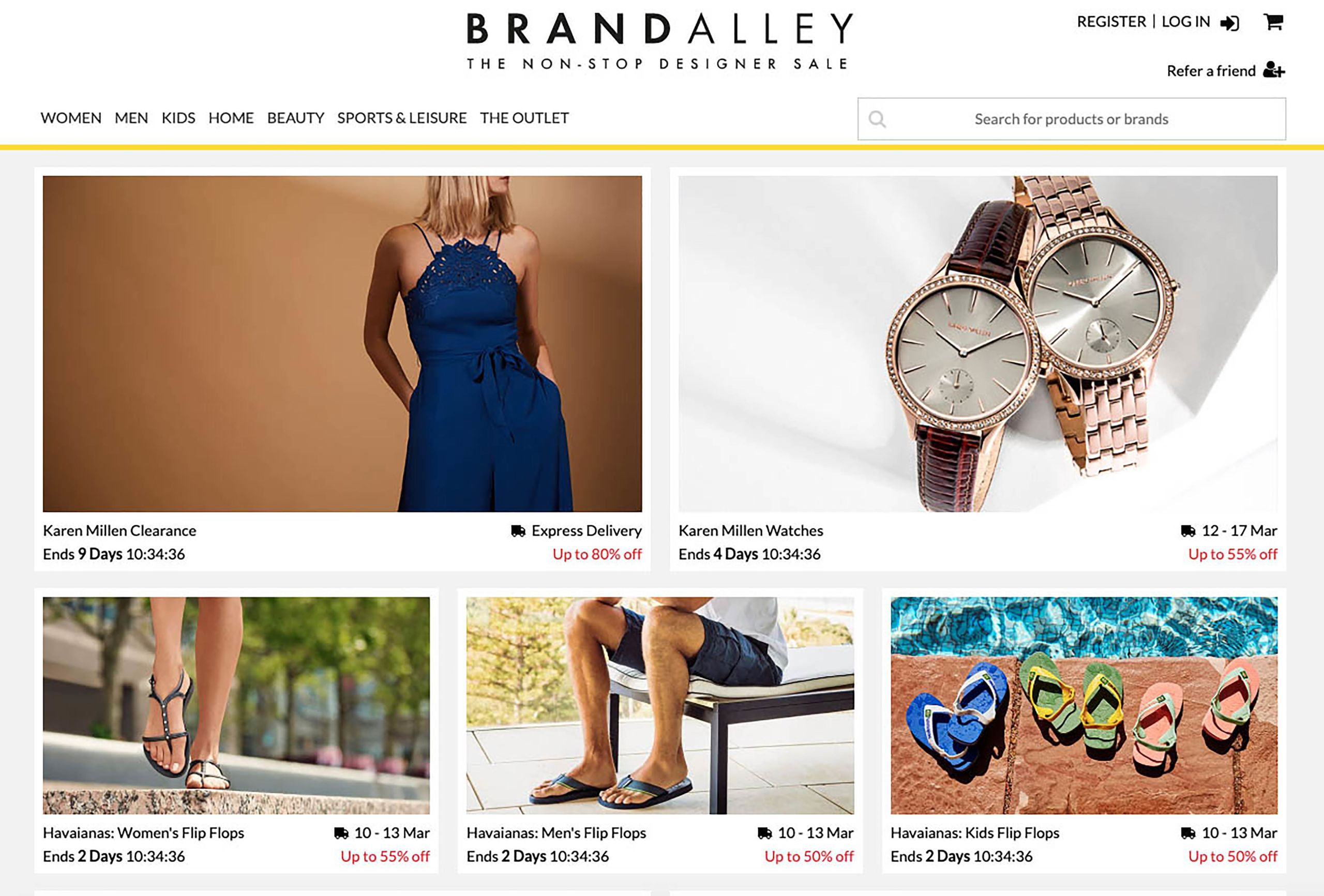

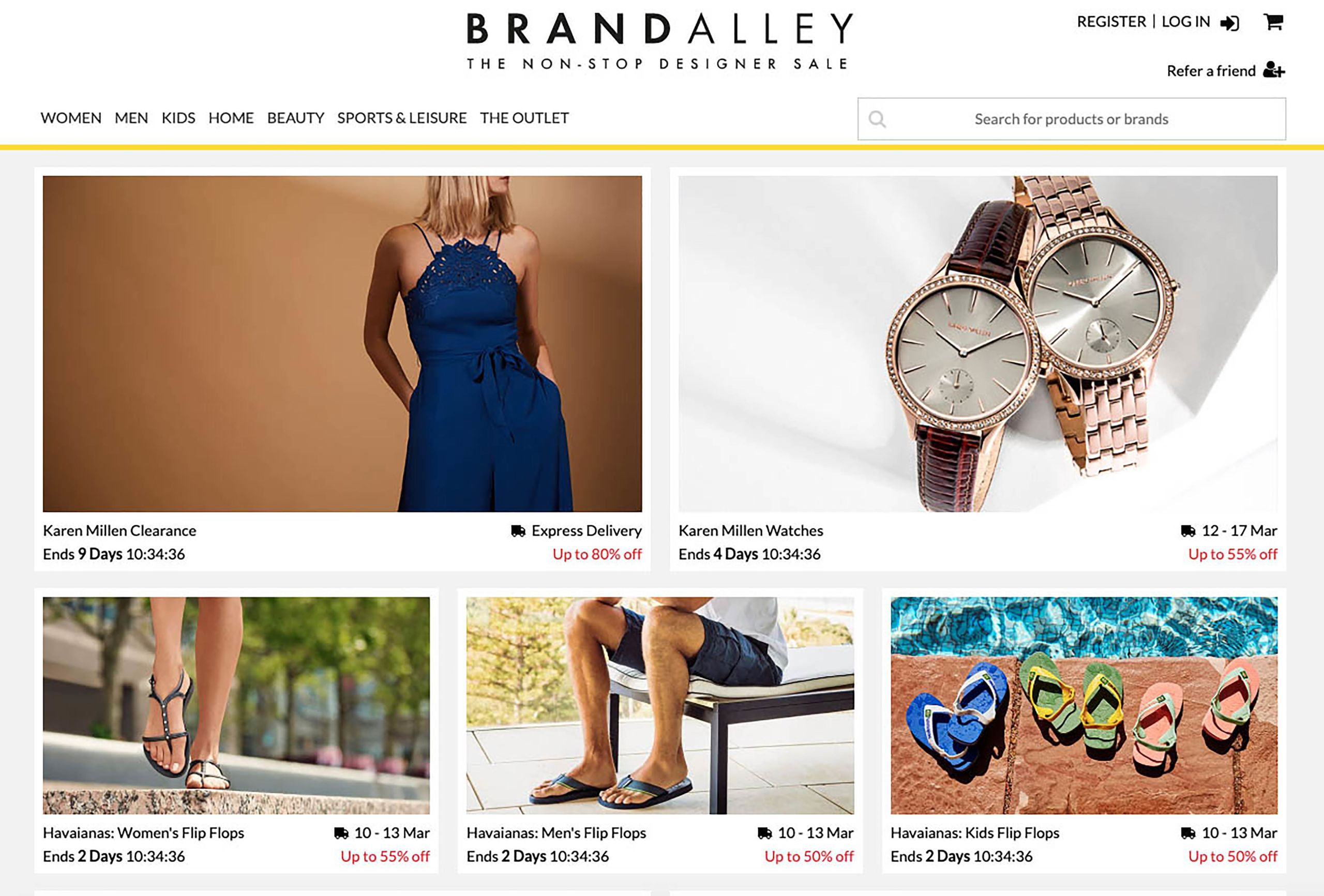

1. BrandAlley

Launched: 2008

Employees: 72

Group sales: £46m

Productivity score: 220

Sales value per employee: £636,667

Staff-costs-to-sales ratio: 6.28

- Acquisitions as part of growth strategy a priority

- Investing in staff and employee engagement

- Supply chain supports efficiency

Flash-sales retailer BrandAlley takes the top spot in our productivity ranking following a year of business wins.

BrandAlley reported a sales rise of 122% to £46m during 2018, and a group pre-tax profit of £1.4m. This is especially notable given that the brand only became profitable in 2017 following its 2013 buyout.

The retailer has a clear growth strategy. It has made a string of acquisitions recently, including homeware and beauty etailer Achica from the Dunelm Group in 2018 – which contributed approximately £7m to sales in 2018 – and members-only shopping club Cocosa from MySale Group in 2019.

BrandAlley said growth was also powered organically, citing a combination of strong product, effective digital marketing and customer relationship management (CRM), a sound IT platform, and “excellent” logistics and customer service.

Its supply chain strategy also supports operational efficiency; the brand largely buys the exact number of products it has already sold, rather than stocking up in a warehouse.

Rob Feldmann, chief executive, BrandAlley

It reserves stock with its brand partners and then runs a Sale on its website, usually lasting four to eight days. After the Sale concludes, orders are placed with its brands and goods are then delivered to its warehouse and shipped out to customers.

Valuing staff

Significantly, the retailer has placed a renewed emphasis on employee engagement through wellness and mental health initiatives.

Speaking to Retail Week in October last year, chief executive Rob Feldmann explained how, after encountering two members of staff suffering from anxiety, he has introduced quarterly training surrounding tackling mental health – including relaxation and breathing techniques.

Feldmann explained that such an approach emphasises “loyalty and makes [employees] feel very valued – they could see we did it because we were concerned about them”.

Rob Feldmann, chief executive, BrandAlley

Rob Feldmann, chief executive, BrandAlley

Mark Radcliffe, chief executive, Victorian Plumbing

Mark Radcliffe, chief executive, Victorian Plumbing

2. Victorian Plumbing

Launched: 1999

Employees: 298

Group sales: £152m

Productivity score: 215

Sales per employee: £509,289

Staff-costs-to-sales ratio: 4.24

- Innovative internal talent and people investment

- Modest staffing increases result in soaring profits

- Recent AI and tech rollouts offer productivity boost

Soaring sales have seen Victorian Plumbing celebrate its most profitable year to date, rewarding a pureplay strategy comprising a hefty marketing budget and investment in staff and new technologies.

Annual sales surged 29% to £152m in the year to September 30, 2019, while pre-tax profit rose fourfold to £10m. The online bathroom retailer posted a pre-tax profit margin of 6.7%, well ahead of rival brands.

Interestingly, Victorian Plumbing increased its staff numbers from 266 in 2017/18 to 298 in 2018/19, while group staff costs have risen from £5.2m to £6.4m. However, thanks to rising sales, the retailer has become more productive over the year, with its staff-costs-to-sales ratio dropping from 4.38 to 4.24.

This demonstrates that it is possible for retailers to grow headcount without seeing an initial drop in profits or productivity.

“Members of each team are encouraged to take on responsibility in areas that might fall outside their role, not restricting their contributions because of a job title”

Mark Radcliffe, chief executive, Victorian Plumbing

Victorian Plumbing founder and chief executive Mark Radcliffe has underlined the retailer’s agile strategy when it comes to getting the best out of employees: “The approach is always to look internally and promote ownership of new initiatives and projects.

“Members of each team are encouraged to take on responsibility in areas that might traditionally fall outside their role, utilising their strengths to positive effect for Victorian Plumbing and not restricting their contributions because of a job title.”

Outside of direct staff investment, Victorian Plumbing also understands the importance of technology in supporting efficiency.

Its agile custom-built handheld warehouse management system, designed to cater to fluctuations in demand, has meant the brand has been able to continue operating from its 109,000 sq ft Skelmersdale warehouse, despite significant growth.

The retailer has reported that the system has helped “improve efficiencies in a number of areas” and is allowing the business to “reduce stock holdings and increase capacity”.

Furthermore, the brand has also invested in AI in the form of a virtual assistant to maximise its customer service team’s productivity.

3. Asos

Launched: 2000

Employees: 4,755

Group sales: £2.73bn

Productivity score: 212

Sales per employee: £574,869

Staff-costs-to-sales ratio: 6.58

- Core values defined as the 'Asos way’

- Investment in logistics and technology reduced significantly to cut costs

- Chief executive has used coronavirus crisis to drive productivity

One of the world’s best-known and most successful pureplay retailers, Asos had celebrated what chief executive Nick Beighton called an “encouraging start to the year” with UK retail sales up 18% and EU sales up 22% for the four months to December 31, 2019.

Beighton had partly attributed this growth to a “robust operational performance” and noted the brand was well positioned to “capture the substantial opportunity ahead”.

Nick Beighton, chief executive, Asos. Credit: Peter Searle

Celebrations had to be momentarily paused during the coronavirus pandemic as the retailer tackled the impact on customer traffic and sales, with Asos reporting a decline in group sales of 20-25% for the three weeks to April 9. However, Beighton has used the crisis to control costs and drive productivity.

Speaking in April, Beighton said that “in two weeks, we have reorganised our workforce so that 98% of all tasks can be done at home. Take sample management – this is done digitally or they are shipped to buyers’ homes, who then accept them electronically and place an order.”

Asos’ logistics strategy is also being overhauled. Investment was reduced to £221.6m for the 2018/19 financial year and will be reined in further to £150m for 2019/20.

The ‘Asos way’

As a relatively young company, Asos’ approach to employee engagement reflects its entrepreneurial spirit and drive. It says it expects its employees to be high performers “so that they thrive in our fast-paced environment”.

Its core values are defined as the ‘Asos way’ and include striving to be:

- Restlessly innovative – “we don’t stand still, we give it a go”

- Collaborative and respectful – working together to get the job done and making things happen from within

- Passionate – “proud to be part of Asos”

Nick Beighton, chief executive, Asos. Credit: Peter Searle

Nick Beighton, chief executive, Asos. Credit: Peter Searle

The evolution of bricks and mortar

While the top three most productive UK retailers are pureplay brands (although Victorian Plumbing operates a showroom from its Merseyside office), 18 of the 30 businesses in the ranking have a bricks-and-mortar presence.

This majority is significant given that it is reasonable to assume that retailers with store networks – typically with higher overheads, leases and inventory costs – would struggle to achieve comparable productivity to online brands, which tend to have fewer physical assets and staffing costs.

Bricks-and-mortar retailers have been among the hardest hit by the coronavirus pandemic, with many having to shutter their stores during lockdown. However, with lockdown easing, one positive trend has emerged.

Retail Week editor Luke Tugby reported in June that “the majority of consumers who ventured to retail locations on [the first day of store reopenings] did so with purpose – they knew what they wanted to buy and which shop they needed to visit. Although shopper numbers were down year on year, as you would expect, many retailers told us that conversion rates and average transaction values were up.”

With many retailers grappling with how to replicate the human connection and interaction enjoyed in store, those retailers that will win in the productivity stakes will be those adapting their strategies to create the right online and offline mix to cater to the changing consumer.

Below we’ve explored how three bricks-and-mortar retailers in the ranking have sought to drive productivity.

Superdrug

Superdrug, the UK’s second largest health and beauty retailer, has driven sales increases of late, with revenue up 3.3% to £1.3bn for June 2018 to June 2019.

Deemed an essential retailer, Superdrug was able to continue trading during the pandemic and it has used the crisis to accelerate innovation and support staff.

The retailer ramped up its introduction of cloud technology for ecommerce – initially due in late 2020 – and by April had implemented it across the business to meet online demand. As a result, it reported that same month, Superdrug was able to process 50% more orders per day – highlighting the power of technology in supporting productivity.

The health and beauty giant also launched a £40m coronavirus staff support package to ensure full pay for parents unable to work remotely or in store and full pay for anyone unable to work owing to sickness or self-isolation.

As a Retail Week Be Inspired partner, Superdrug has also supported the learning and development of its staff, with access to workshops and training on areas such as leadership, retail skills and managing work-life balance. In 2019, the retailer also made a commitment to social mobility and diversity and inclusion by signing the government’s Social Mobility Pledge.

JD Sports

Named as one of the six store brands “Amazon can’t touch” by Retail Week in 2019, JD Sports has managed to hold its own in the ferociously competitive environment of 2020.

The retailer achieved group sales of £4.7bn for the financial year 2018/19, of which £2.1bn was attributed to its UK operations. With JD Sports stores closed during the coronavirus outbreak, executive chair Peter Cowgill took a voluntary 75% pay cut to reduce business costs.

Taking 29th place in our productivity ranking, JD Sports has been committed to in-store experiences and has said it believes great stores are fundamental to its ability to showcase products because of the “theatre” offered to customers. This commitment will remain post-Covid and to support its team in showcasing products, the retailer has a long-established training programme for all levels of retail staff.

Supply chain is another area where JD Sports is focusing on making productivity gains. In 2019, it revealed it would be investing in “operational capacity and flexibility” in its UK and overseas warehousing as its capital expenditure had risen to £191m in 2018/19 – significantly higher than than the £160m it had expected.

Selfridges

While some industry observers have long questioned the future of the department store as a retail format, Selfridges has been a beacon for the sector and the retailer is determined to ensure that continues.

Comprising its Oxford Street flagship and three stores in Manchester and Birmingham, Selfridges comes in at 28th on our list following a year when it invested £300m in a major store overhaul. This was arguably good timing given the new battle that retailers face in attracting consumers back to the high street amid a pandemic.

The innovation and enhancement of its London flagship, which was completed in 2019, was intended to modernise the store with a focus on drawing in younger customers, and creating experiential retail and “authoritative category destinations”. The overhaul featured the world’s first department store cinema, a permanent second-hand resale space and more restaurants and VIP meeting areas.

To help get the best out of its teams and support productivity, Selfridges has been integrating tech innovations to help staff manage customer queries and drive sales.

For instance, over the past few years, Selfridges has been using software from social media monitoring and engagement firm Synthesio to enable its marketing and customer service staff to better respond to customers, and analyse their online and offline experiences to find areas for improvement.

Empower your workforce

An effective tech stack is another part of solving the productivity puzzle.

Efficiencies can be generated through automating and/or standardising basic repeatable tasks, easing communication and collaboration between employees, and collecting and analysing business data to improve existing work systems and processes.

The tools and functions of these technologies vary, but their purpose is ultimately the same: to empower employees to work more productively by making it faster and easier to perform key elements of their role.

Evanschitzky says that technology – automation being one example – tends to increase productivity

“One way to increase productivity is to incentivise the use of technology in retailing. The post-Covid world provides a golden opportunity for that,” he says.

“Technology can help businesses respond more flexibly to customer needs by helping to create a customised, personalised service without massive increased costs.”

Here are some of the areas where retailers can use technology to empower staff and, therefore, improve productivity levels.

Communication and collaboration

Tools such as Slack, Fuze, Google Chat, Yammer and Trello are designed to improve collaboration across businesses – particularly those with remote or geographically diverse workforces – by removing barriers to communication.

Business adoption of these tools may have accelerated during the pandemic as remote working has become the standard but, as Hedaux highlights, “retailers can’t afford to drop the ball on communications”.

He says: “Some retailers have already established great digital mediums of communicating with colleagues, whereas many others haven’t and have been caught short during the coronavirus. Most of the time staff being informed and kept up to date trumps pay and other financial incentives. Engagement is going to be key for productivity now and that’s going to be driven by tech.”

At 26 in the ranking, Sainsbury’s has been using the internal social network Yammer to help its colleagues communicate across stores, depots and head offices. It has been using the tool since 2015 and other supermarkets such as Tesco have since followed suit.

While platforms like these are highly effective all-rounders, others have been created with retailers in mind. For instance, Convo replaces corporate email with a social feed aimed at non-desk employees.

It’s capable of handling in-depth discussions and providing visual feedback – which is useful in retail-specific tasks such as managing the installation of new displays across a network of stores.

Workforce planning for demand

The coronavirus outbreak has forced many essential retailers to run recruitment drives to meet demand. This is especially true for the grocers in our ranking, with Aldi, Sainsbury’s and Asda having recruited thousands of temporary colleagues to work in store, as drivers and in warehouses.

Many non-essential retailers, on the other hand, have had no choice but to furlough staff in the short term and are now considering restructuring to control costs in the long term.

Managing workforces is going to be just as challenging post-Covid as retailers look to ensure all shifts are covered with enough staff to balance customer demand with their bottom line.

Automated staff scheduling and optimisation platform Rotageek frees up managers for more value-adding work by creating rotas that better match team members' shifts to customer demand while improving employee experience too.

Rotageek optimises schedules by creating and assigning shifts in tandem, generating millions of combinations of schedules and only proposing a final schedule where every shift is assigned to a worker. Recently deployed with global retailer Gap in the UK and Europe, Rotageek has contributed to an uplift in sales through increases in average basket size and conversion as well as delivering a 7% increase in customer satisfaction in store.

Shared workforce platforms such as Catapult aim to address staffing challenges by offering retailers access to a network of flexible workers.

Catapult creates efficiencies by reducing the time retailers spend on administration, hiring and staff planning. For instance, it has worked with bakery brand Paul to help the chain achieve an 8% uplift in sales and reduce its staff turnover within four weeks.

Partner up to provide credit at point of sale

Many of the UK’s biggest retailers now offer credit facilities.

The advantages are clear: customers can spread costs over an extended period, allowing them to buy at a time that’s convenient for them, therefore enabling retailers to make sales that they may not otherwise have made.

With experts predicting the country is heading into a recession, these payment solutions can help cautious customers budget responsibly in this new landscape.

However, launching and running a credit service can be a significant undertaking for retailers, potentially distracting from their core focus and harming productivity.

Some tools – such as Divido – aim to remove barriers to entry for retailers looking to provide customer credit at point of sale. Shoppers can pay for their items over several months, while retailers (whether online brands or bricks-and-mortar stores) are paid in full upfront.

‘Buy now, pay later’ businesses Klarna, Openpay and Clearpay are similar services that enable customers to pay in instalments. These have proved popular among the retailers in our ranking, with Asos, Missguided and Boohoo all recent customers.

Invoicing and expenses

Invoicing and expenses are classic examples of business tasks that benefit from automation. They are simple and repeatable, but also time-consuming and vulnerable to human error.

Invoice Ninja, Sage and QuickBooks are three of many tools in the market aiming to save businesses time on their invoicing and expenses processes. Recurring invoices and auto-bills can be set up, as can late-payment reminders, reducing or eradicating the need for finance teams to send countless emails requesting and chasing up payments.

Earnings, expenses, clients and vendors can be stored and managed from a single system, saving time and money.

Your path to productivity

What learnings can businesses take from our ranking of the retailers beating the odds and getting productivity right?

Adept retailers adapt

With mounting economic challenges, retail workforces need to meet the demands of today, not cater to retail conditions that existed five or 10 years ago.

The pandemic has shown how rapidly consumer demand can evolve and how retailers must regularly review the make-up of their workforce in order to deploy staff where they’re needed.

Hedaux advises that retailers have “an intrinsic knowledge of how much work there is to do” and says that “while this may seem simple enough”, he’s seen many retailers struggle, with “customer service and staff training the first areas to suffer” when retailers look to cut costs to boost productivity.

“There are other ways productivity can be gained without cutting customer service and employee training – you’ve got to look hard at your business and consider what’s working commercially and what the risks are.”

Hedaux continues: “We’ve seen lots of retailers forced to drop things during Covid that they were previously very precious about and their business hasn’t fallen apart. For instance, to manage its inventory a retailer we work with was getting staff to monitor and track the performance of 500 SKUs a week and they’ve had to drop to 50 SKUs and this hasn’t impacted ROI.”

Where demand fluctuates, workforce-planning technology and the adoption of a shared workforce strategy can be used to maximise profits and productivity.

Prioritise employee engagement

In testing times such as these, staff are often the first to pay the price, with measures such as pay freezes, training cuts and often redundancies commonly implemented.

However, as this report has highlighted, employee engagement is inexorably linked to productivity. Failing to invest in staff could compound business problems.

If people costs need to be reduced, retailers should consider finding cheaper methods of employee engagement, such as perks, on-the-job training and a focus on communication and collaboration.

Shared workforce solutions can also help retailers save money while improving productivity. For example, data from Catapult shows businesses using its platform benefited from a reduction of more than 50% in core staff turnover.

Use tech to maximise productivity

When it comes to productivity, technology could save the day.

Invest in the right technology for your business and you’ll amplify your team’s efforts for a fraction of the cost of the number of employees needed to get such results.

However, there’s always room for improvement as Hedaux concludes:

“If you can become more productive, what will you do with the time you’ve saved? During Covid-19, we’ve seen a real desire among businesses to save costs and the big dilemma is do you save that money or reinvest it to drive customer service and experience? The best retailers will reinvest for long-term gain.”

Partner comments

Be a future-fit retailer – productivity through empowerment, integration and automation

Chris McCullough, chief executive at Rotageek

In this day and age when looking to improve productivity, after countless marginal gains have already been made and online retail is squeezing bricks-and-mortar stores harder than ever, retailers have to be even smarter to realise those much needed gains.

Working across the retail and healthcare Industries, we see that embracing automation and integration are key drivers of productivity gains.

While Covid-19 may have kick-started the digital transformation in the healthcare industry only recently, we see that retailers have been on this path for some time and are seeing the benefits of automation and integration in areas such as logistics, online and customer experience.

We know that scheduling, for example, is complex when it comes to matching up the competing elements of customer demand, business operating rules and employee needs and so is a prime task for automation and optimisation while freeing management across the store estate for more value-adding work.

During a recent trial with a global retailer, Rotageek has proven that we can make rotas that are not only 13% more accurately matched to demand than store management, but also provide the technology to ‘revolutionise’ the employee experience of being a shift worker.

Similarly, our integration with Catapult, which provides on-demand staffing, will enable further productivity gains by allowing the advertisement and assignment of shifts to trained and vetted workers from within the rota.

We all know that the happier your shift-working teams on the ground are, the better the store performance will be.

Giving employees a way to see their schedule, submit their preference for shifts, and swap and pick up extra shifts where desired, helps to empower and engage them. Giving staff input and control over their schedules will not only impact their happiness, but has seen businesses reap the financial benefits, now and in the long term.

Workforce 2.0: Reaping the rewards of a shared workforce

Oli Johnson, co-founder of Catapult

While always important, in recent times, productivity gains have become crucial to retail’s very survival.

But doing more with less doesn’t mean blindly demanding greater output from frontline employees. Rather, every effort should be made to alleviate pressure on store staff, eliminating unproductive tasks from their routine and allowing them to focus on the customer.

Stores tend to have two different groups working within them. The first group is made up of store management and tenured workers on more than 20 hours per week. The second, group is workers on shorter contracts intended to give the business flexibility. Average staff turnover and tenure figures mask the fact that the second group turns over two to four times as often as the first.

Why is this important? Instead of focusing their efforts on the customer, store management and top performers are caught in a continuous cycle of rehiring the second group, which is the most transient part of the workforce. This practice is an enormous and hidden productivity sink.

It’s also expensive. The second group costs retailers between £2-£6 per hour in addition to salary costs, depending on the cost of hiring and training workers to competency, and how long they end up staying with the business.

No wonder then that so many retailers are moving towards Workforce 2.0 – a staffing model consisting of a smaller core staff with flexible support from a shared labour market.

With Workforce 2.0, stores can rely on an extension to their workforce; a marketplace of vetted regulars (and even store alumni), that show up with smiles on their faces, at the click

of a button. The benefits:

- Increased productivity through freeing up top performers to focus on customers

- Reduced costs on the expensive rehiring of transient workers

- Increased productivity through having a truly flexible staffing model

The last point is particularly important as we head into the most uncertain Christmas peak in recent memory. Having access to a large flexible workforce can be the difference between managing peak effectively or having to close stores due to Covid-related absences, or even being overstaffed when faced with lacklustre consumer demand.

These are uncertain times, but we’re already seeing positive steps taken by retailers to put themselves on a stronger footing for the future. Catapult is here to support.

Chris McCullough, chief executive, Rotageek

Chris McCullough, chief executive, Rotageek

Chris McCullough, chief executive, Rotageek

Chris McCullough, chief executive, Rotageek

Oli Johnson, co-founder, Catapult

Oli Johnson, co-founder, Catapult

Oli Johnson, co-founder, Catapult

Oli Johnson, co-founder, Catapult

Love this report?

Why not book in one of our experts to present the findings to your team, examining what they mean for you and your business.

Contact Isobel Chillman on: isobel.chillman@ascential.com

The UK’s top 30 most productive

retailers of 2020

Written by Caroline Howley

Produced by Helen Berry, Megan Dunsby,

Rebecca Dyer and Eleanor Smith

In partnership with Catapult and Rotageek

Rob Feldmann photo: Andrew Parsons/i-Images

Nick Beighton photo: Peter Searle

Selfridges photo: Andrew Meredith